|

市场调查报告书

商品编码

1851526

增稠剂:市占率分析、产业趋势、统计、成长预测(2025-2030)Tackifier - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

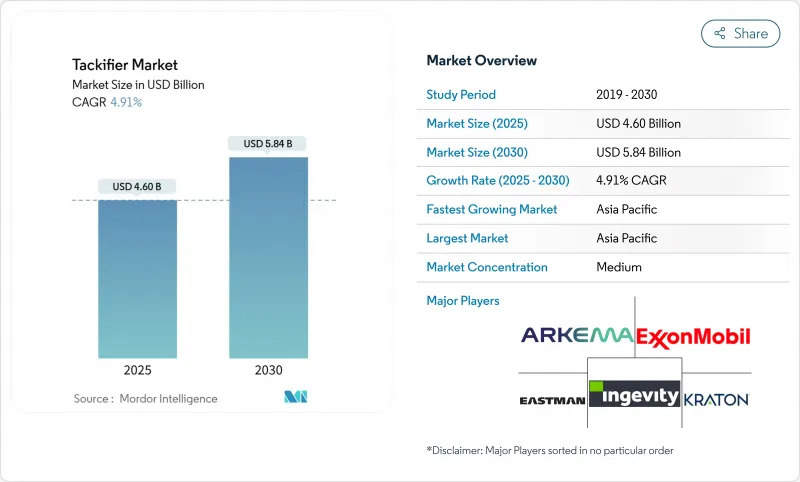

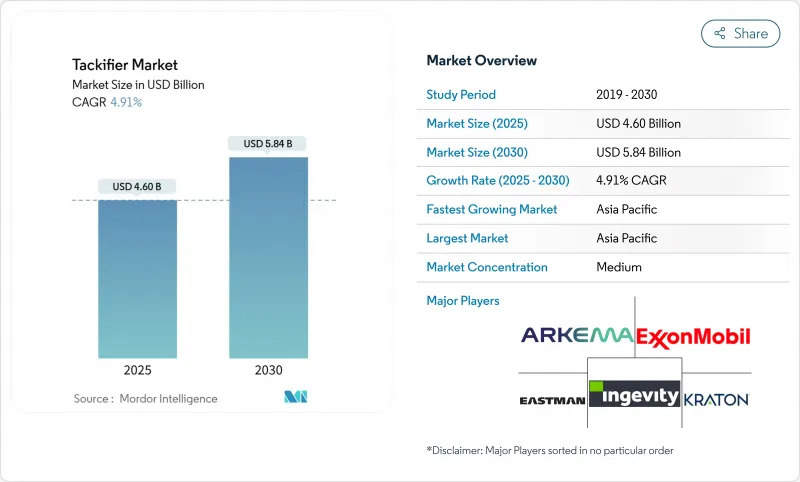

2025 年增黏剂市场规模预估为 46 亿美元,预计到 2030 年将达到 58.4 亿美元,预测期(2025-2030 年)复合年增长率为 4.91%。

包装和卫生用品领域对压敏黏着剂和热熔胶的持续需求支撑着当前的收入,而电动车电池组装、特殊建筑和低VOC食品包装等领域的日益广泛应用则开闢了未来的成长途径。亚太地区基础设施的快速投资、北美和欧洲日益严格的排放法规以及品牌所有者对生物基材料的承诺,都在推动市场发展。超低VOC等级、耐高温烃类树脂和松香衍生分散体等创新技术,使供应商能够在不牺牲黏合性能的前提下,满足日益严格的食品接触和环境法规要求。技术朝向无增黏剂反应型热熔胶和动态聚氨酯化学的转变,以及原油价格的波动,仍然是可能降低盈利但同时也促进研发多元化的主要风险。

全球增粘剂市场趋势与洞察

包装和卫生用品行业对热熔胶和压敏胶的需求不断增长

电子商务小包裹量和高端卫生用品的需求持续增长,推动了热熔胶和压敏黏着剂的消费量增加。增粘树脂为这些高速生产线提供了至关重要的初始黏合力和持久剥离强度。 HB Fuller 的 Full-Care 6217 表明,透过配方调整,可以在提高脱模性能的同时,减少 20% 的胶合剂用量。可生物降解的松香树脂在纸基胶带中越来越受欢迎,这与品牌的永续性承诺相契合。女性垫片的吸湿排汗性能促使供应商寻求能够耐受高湿度并减少异味的胶合剂。埃克森美孚的 Escorez 产品组合表明,透明包装薄膜需要浅色、耐热的胶粘剂,因为透明度至关重要。这些需求共同表明,到 2030 年,增黏剂市场将与消费品产业的成长紧密相连。

亚太地区城市基础建设热潮带动建筑黏合剂需求

中国、印度和东南亚国协的公共交通线、机场和经济适用房计画支撑着对地板材料、屋顶和板材黏合剂的长期需求。湿固化系统在热带潮湿环境下表现优异,其对增粘树脂早期润湿的依赖推动了销售量。凭藉这些产品,Master Builders Solutions的目标是到2028年在印度实现50亿印度卢比的销售额。建筑规范鼓励使用轻质复合材料建筑幕墙和夹芯板,这拓宽了具有热稳定性的合成烃基黏合剂的性能范围。中国胶带协会报告称,建筑胶带的销售成长显着,凸显了基础设施和耐用消费品产业的交叉作用。这些投资巩固了公司在亚太地区增黏剂市场成长的领先地位。

石油和原料价格的波动对烃类树脂利润率带来压力。

烃类增黏剂生产线受原油价格波动的影响,因为C5和C9馏分是石脑油裂解产物。价格上涨会损害利润率,抑制资本投资,并限制研发预算。 2021年欧洲物流危机期间,黏合剂需求下降了5%,凸显了其对供应中断的脆弱性。特种化学品规划人员目前正专注于避险和灵活的定价措施,但小型独立树脂生产商仍面临风险。石油基树脂占市场份额的65.45%,价格波动加剧可能重塑竞争格局,并促使买家转向生物基树脂。

细分市场分析

2024年,石油树脂将占销售额的65.45%,凭藉其可靠的品质和性价比,为增黏剂市场提供支撑。 C5-C9混合树脂可确保汽车内装和工业胶带的黏性和耐热性。同时,随着加工商为获得环保标章和认证可堆肥包装袋而追求可再生成分,松香树脂的年复合成长率将达到5.15%。由于生质燃料精炼商也使用相同的原料,妥尔油松香的供应紧张,预计到2030年将出现8%的供不应求。成功的供应商正在烃类和松香体系之间进行多元化配置,以对冲价格波动风险,同时实现品牌永续性目标。萜烯树脂虽然应用范围较小,但其极性优势可提高对天然橡胶和弹性体基材的黏合力。增粘剂市场受益于此混合原料策略,使配方师能够平衡成本、性能和环保成分。

石油生产商寻求长期合约以维持稳定,但当客户强调生物基含量时,此类合约会降低灵活性。另一方面,松香创新者正利用氢化改质来满足透明包装薄膜所需的颜色和气味标准。成本波动与永续性法规之间的相互作用将决定未来十年的原料策略。

2024年,固态切片和颗粒占总销售额的81.56%,这主要归功于加工商对其易于供应、粉尘含量低以及与现有热熔设备的兼容性的青睐。它们对于纸箱封口和木工生产线至关重要,因为它们能够承受超过150°C的熔化峰值而不会发生氧化劣化。树脂分散体将以5.32%的复合年增长率 (CAGR) 实现成长,推动水性黏合剂在标籤和柔性复合材料领域的应用。这些分散体能够减少VOC排放并简化生产线清洁。液体型产品用于需要常温黏度的色带涂层和溶剂体系,但由于溶剂成本的降低,其市场份额已停滞不前。对于製造商而言,提供多种形式的产品组合可以提高转换门槛,并确保在需要客製化黏度特性的专业终端应用领域占据市场份额。

区域分析

亚太地区预计到2024年将占全球收入的36.25%,复合年增长率达5.50%,这主要得益于基础设施投资、商业的蓬勃发展以及一次性尿布使用量的增加。中国胶带产量将实现强劲的个位数成长,这与建筑和电子产业对差异化黏合剂的需求相符。印度建筑化学品市场预计到2025年将达到2,000亿卢比,凸显了该地区对能够加速建筑週期的黏合剂的需求。政府鼓励可生物降解包装的政策将提振对松香基材料的需求,而不稳定的妥尔油供应则给当地复合材料生产商带来了确保原材料稳定供应的挑战。

北美在创新方面保持主导,严格的挥发性有机化合物 (VOC) 法规和美国食品药物管理局 (FDA) 的食品接触规则推动了超低气味等级产品的采购。美国和墨西哥汽车电气化程度的不断提高,推动了对耐高温合成树脂的需求,以保护电池组。欧洲专注于循环经济目标和 REACH 法规合规,儘管成本不断上升,但仍在转向生物基增黏剂。欧洲建筑黏合剂市场预计在 2025 年復苏,这表明监管方面的阻力可以与永续的替代机会并存。

南美洲和中东及非洲地区虽然规模较小,但凭藉着物流走廊、消费品成长以及製造业领域的外国直接投资,蕴藏着巨大的发展潜力。圣戈班斥资10.25亿美元收购福斯罗克,巩固了其在海湾合作委员会国家和印度的建筑胶粘剂分销渠道,这正是全球企业对新兴需求中心进行战略性押注的例证。儘管外汇波动和当地树脂产能有限会限制短期成长,但逐步推进的工业化将为未来十年增黏剂的市场渗透奠定基础。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 包装和卫生用品行业对热熔胶和压敏胶的需求不断增长。

- 亚太地区城市基础建设热潮带动建筑黏合剂需求

- 电子商务的成长将加速胶带和标籤的消耗。

- 超低VOC、食品接触相容的树脂等级将成为首选。

- 电动车电池和轻量化汽车组件需要高耐热黏合剂

- 市场限制

- 石油原料价格波动会损害烃类树脂的利润率。

- 无增黏剂反应型热熔体系的出现。

- 永续性认证限制了妥尔油和松香的供应。

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 按原料

- 松香树脂

- 石油树脂

- 萜烯树脂

- 按形式

- 固体的

- 液体

- 树脂分散体

- 按类型

- 合成

- 自然的

- 透过使用

- 胶带和标籤

- 组装

- 书籍装订

- 鞋类、皮革、橡胶

- 其他用途

- 按最终用户行业划分

- 包裹

- 建筑/施工

- 车

- 不织布

- 鞋类

- 其他终端用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Arakawa Chemical Industries, Ltd.

- Arkema

- Eastman Chemical Company

- Exxon Mobil Corporation

- Henkel AG & Co. KGaA

- Ingevity Corporation

- Kolon Industries, Inc.

- Kraton Corporation

- Lawter, a Harima Chemicals, Inc. Company

- Natrochem, Inc.

- SI Group, Inc.

- Teckrez, Inc.

- TWC Group

- Yasuhara Chemical Co., Ltd.

第七章 市场机会与未来展望

The Tackifier Market size is estimated at USD 4.60 billion in 2025, and is expected to reach USD 5.84 billion by 2030, at a CAGR of 4.91% during the forecast period (2025-2030).

Sustained demand for pressure-sensitive and hot-melt adhesives in packaging and hygiene products anchors current revenue, while widening use in electric vehicle battery assembly, specialty construction, and low-VOC food packaging broadens future growth pathways. Rapid infrastructure spending across Asia Pacific, stringent emission norms in North America and Europe, and brand owner commitments to bio-based materials collectively reinforce market momentum. Innovation in ultra-low-VOC grades, high-heat hydrocarbon resins, and rosin-derived dispersions allows suppliers to address tightening food-contact and environmental regulations without sacrificing bond performance. Technology shifts toward tackifier-free reactive hot melts and dynamic polyurethane chemistries, alongside crude-oil price swings, remain overarching risks that could temper profitability yet also spur R&D diversification.

Global Tackifier Market Trends and Insights

Rising Demand for Hot-Melt & PSA Adhesives in Packaging and Hygiene

E-commerce parcel volume, combined with premium hygiene products, continues to lift hot-melt and pressure-sensitive adhesive consumption. Tackifier resins provide the critical early-grab and sustained peel strength these fast-running production lines require. H.B. Fuller's Full-Care 6217 shows how formulation tweaks can cut adhesive usage by 20% while improving peel, a direct cost-and-performance benefit to diaper makers. Biodegradable rosin resins gain traction in paper-backed tapes, aligning with brand sustainability pledges. Moisture-management features in feminine care pads push suppliers toward tackifiers that tolerate high humidity yet keep odor low. ExxonMobil's Escorez portfolio illustrates the push for light-color, thermally stable grades serving transparent packaging films where clarity is paramount. These combined needs ensure that the tackifier market remains firmly linked to consumer goods growth through 2030.

Urban Infrastructure Boom in APAC Spurring Construction Adhesives

Mass transit lines, airports, and affordable housing programs across China, India, and ASEAN nations underpin long-run demand for flooring, roofing, and panel bonding adhesives. Moisture-cure systems excel in tropical humidity, and their reliance on tackifier resins for initial wet-out drives incremental volumes. Master Builders Solutions targets INR 500 crore turnover in India by 2028 on the strength of such products. Building codes pushing lightweight composite facades and sandwich panels widen the performance window for synthetic hydrocarbon tackifiers that deliver thermal stability. The China Adhesive Tape Council reports volume gains in building tapes, highlighting how infrastructure and consumer durables intersect. These investments sustain APAC's leadership in tackifier market growth.

Petroleum-Feedstock Price Volatility Hurting Hydrocarbon Resin Margins

Hydrocarbon tackifier lines mirror crude-oil price swings because C5 and C9 streams are co-products of naphtha crackers. Spikes erode margins, stall expansion CAPEX, and constrain R&D budgets. During the 2021 European logistics crunch, adhesive demand slipped 5%, underscoring vulnerability to supply disruptions. Specialty chemical planners now emphasize hedging and agile pricing tools, yet smaller independent resin houses remain exposed. With petroleum resins occupying 65.45% share, extended volatility could redirect buyers toward bio-based grades, reshaping the competitive landscape.

Other drivers and restraints analyzed in the detailed report include:

- E-commerce Growth Accelerating Tape & Label Consumption

- Ultra-Low-VOC, Food-Contact Compliant Resin Grades Gain Preference

- Emergence of Tackifier-Free Reactive Hot-Melt Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Petroleum resins delivered 65.45% of 2024 revenue, anchoring the tackifier market with a reliable quality and price-performance balance. C5-C9 hybrids secure tack and heat resistance for automotive interiors and industrial tapes. Meanwhile, rosin grades expand at a 5.15% CAGR as converters pursue renewable content for eco-labels and certified compostable pouches. Tall-oil rosin supply tightens because biofuel refiners draw from the same feed pool, leading to a projected 8% deficit by 2030. Successful suppliers diversify between hydrocarbon and rosin lines, hedging price swings while meeting brand sustainability targets. Terpene resins, though niche, add polarity advantages that improve adhesion to natural rubber and elastic substrates. The tackifier market benefits from this blended feedstock approach, ensuring formulators can balance cost, performance, and green content.

Petroleum producers aim to lock in long-term contracts to preserve stability, but such commitments reduce flexibility when customers pivot to bio-content mandates. Conversely, rosin innovators exploit hydrogenated modifications to match color and odor standards demanded in transparent packaging films. The interplay between cost volatility and sustainability legislation defines feedstock strategy for the decade ahead.

Solid chips and pellets held 81.56% of 2024 sales because converters prefer easy feeding, low dust, and compatibility with established hot-melt equipment. They withstand melting peaks above 150 °C without oxidative degradation, making them indispensable for carton-sealing and woodworking lines. Resin dispersions outpace with 5.32% CAGR, meeting waterborne adhesive growth in labels and flexible laminations. These dispersions reduce VOC output and simplify line cleanup, critical under tighter plant-emission audits. Liquid forms serve ribbon-coating and solvent systems where room-temperature viscosity is needed, yet their market share lags amid solvent abatement costs. For manufacturers, offering multi-form portfolios elevates switching barriers and secures share in specialty end uses that demand customized viscosity profiles.

The Tackifier Market Report is Segmented by Feedstock (Rosin Resins, Petroleum Resins, Terpene Resins), Form (Solid, Liquid, Resin Dispersion), Type (Synthetic, Natural), Application (Tapes and Labels, Assembly, Bookbinding, and More), End-User Industry (Packaging, Building and Construction, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific commanded 36.25% of 2024 revenue and rises at 5.50% CAGR, underpinned by infrastructure investment, surging e-commerce, and expanding diaper penetration. China's adhesive tape production grew at high single digits, aligned with construction and electronics verticals that specify differentiated tackifiers. India's construction chemicals market, sized at INR 20,000 crore in 2025, underscores regional appetite for adhesives that accelerate build cycles. Government policies favoring biodegradable packaging boost rosin-based demand, while volatile tall-oil supply challenges local formulators to secure consistent feedstock.

North America retains innovation leadership through tight VOC caps and FDA food-contact rules steering purchases toward ultra-low-odor grades. Automotive electrification in the United States and Mexico triggers demand for high-heat synthetic resins that secure battery cell stacks. Europe emphasizes circular economy targets and REACH compliance, prompting a pivot to bio-content tackifiers despite higher costs. The 2025 rebound in European construction adhesives signals that regulatory headwinds can coexist with sustainable substitution opportunities.

South America and Middle East & Africa, though smaller, offer upside tied to logistics corridors, consumer goods growth, and foreign direct investment in manufacturing. Saint-Gobain's USD 1.025 billion purchase of FOSROC bolsters distribution of construction adhesives in GCC states and India, an example of global firms placing strategic bets on emerging demand centers. Exchange-rate swings and limited local resin capacity temper immediate growth, but gradual industrialization sets a foundation for tackifier uptake over the next decade.

- Arakawa Chemical Industries, Ltd.

- Arkema

- Eastman Chemical Company

- Exxon Mobil Corporation

- Henkel AG & Co. KGaA

- Ingevity Corporation

- Kolon Industries, Inc.

- Kraton Corporation

- Lawter, a Harima Chemicals, Inc. Company

- Natrochem, Inc.

- SI Group, Inc.

- Teckrez, Inc.

- TWC Group

- Yasuhara Chemical Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for hot-melt and PSA adhesives in packaging and hygiene

- 4.2.2 Urban infrastructure boom in APAC spurring construction adhesives

- 4.2.3 E-commerce growth accelerating tape and label consumption

- 4.2.4 Ultra-low-VOC, food-contact compliant resin grades gain preference

- 4.2.5 EV battery and lightweight automotive assembly needing high-heat tackifiers

- 4.3 Market Restraints

- 4.3.1 Petroleum-feedstock price volatility hurting hydrocarbon resin margins

- 4.3.2 Emergence of tackifier-free reactive hot-melt systems

- 4.3.3 Sustainability certifications constraining tall-oil and gum-rosin supply

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 Feedstock

- 5.1.1 Rosin Resins

- 5.1.2 Petroleum Resins

- 5.1.3 Terpene Resins

- 5.2 Form

- 5.2.1 Solid

- 5.2.2 Liquid

- 5.2.3 Resin Dispersion

- 5.3 Type

- 5.3.1 Synthetic

- 5.3.2 Natural

- 5.4 Application

- 5.4.1 Tapes and Labels

- 5.4.2 Assembly

- 5.4.3 Bookbinding

- 5.4.4 Footwear, Leather and Rubber

- 5.4.5 Other Applications

- 5.5 End-user Industry

- 5.5.1 Packaging

- 5.5.2 Building and Construction

- 5.5.3 Automotive

- 5.5.4 Non-wovens

- 5.5.5 Footwear

- 5.5.6 Other End-user Industries

- 5.6 Geography

- 5.6.1 Asia-Pacific

- 5.6.1.1 China

- 5.6.1.2 India

- 5.6.1.3 Japan

- 5.6.1.4 South Korea

- 5.6.1.5 Rest of Asia-Pacific

- 5.6.2 North America

- 5.6.2.1 United States

- 5.6.2.2 Canada

- 5.6.2.3 Mexico

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Rest of Europe

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 South Africa

- 5.6.5.3 Rest of Middle East and Africa

- 5.6.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Arakawa Chemical Industries, Ltd.

- 6.4.2 Arkema

- 6.4.3 Eastman Chemical Company

- 6.4.4 Exxon Mobil Corporation

- 6.4.5 Henkel AG & Co. KGaA

- 6.4.6 Ingevity Corporation

- 6.4.7 Kolon Industries, Inc.

- 6.4.8 Kraton Corporation

- 6.4.9 Lawter, a Harima Chemicals, Inc. Company

- 6.4.10 Natrochem, Inc.

- 6.4.11 SI Group, Inc.

- 6.4.12 Teckrez, Inc.

- 6.4.13 TWC Group

- 6.4.14 Yasuhara Chemical Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment