|

市场调查报告书

商品编码

1851562

可再生能源:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

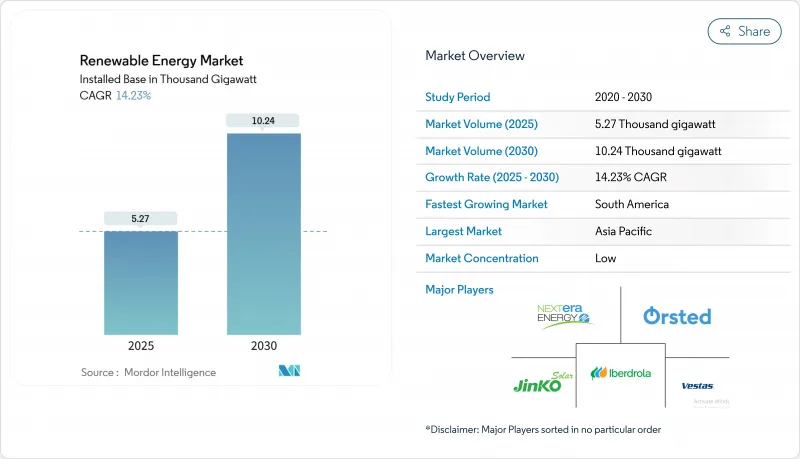

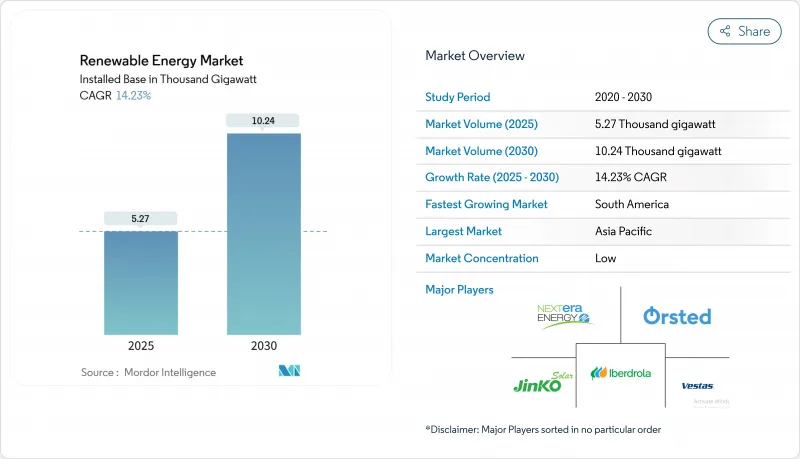

预计可再生能源市场规模将从 2025 年的 5,080 吉瓦扩大到 2030 年的 7,040 吉瓦,在预测期(2025-2030 年)内实现 8.94% 的复合年增长率。

技术成本暴跌、政府扶持政策以及企业需求不断增长,共同推动了这项扩张。 2024年,太阳能光电发电将引领可再生能源市场,占总装置容量的42%,预计到2030年将以13%的复合年增长率成长。儘管公共产业事业规模的计划仍然是成长的支柱,但随着企业对冲石化燃料价格波动风险并加强永续性目标,工商业(C&I)光电发电专案也正在加速发展。亚太地区占最大份额,但南美洲的成长速度最快,这得益于有利于投资的改革以及丰富的风能和太阳能资源。

全球可再生能源市场趋势与洞察

在北美和欧洲,根据购电协议建造的大型发电厂正在加速。

企业购电协议 (CPPA) 如今已成为可再生能源采购的核心,科技公司和製造商需要为其人工智慧、云端运算和重工业营运获取绿能。例如,ENGIE 已签署 85 份 CPPA,涵盖 4.3 吉瓦的装置容量,有效期至 2024 年,相当于 136 太瓦时的电力供应。自愿性企业购电协议已为美国近一半的新建电力项目提供支持,为开发商提供可观的收入并降低资本成本。灵活的「虚拟」购电协议允许买家在无需实际交割的情况下对冲价格风险,但不断上涨的电网电价和复杂的合约仍然是中小企业面临的障碍。

对超大规模资料中心的需求推动了北欧和爱尔兰的太阳能和风能采购。

预计资料中心用电需求将从2024年的415太瓦时成长到2030年的945太瓦时。业者选择北欧国家和爱尔兰,是因为这些地区气候凉爽且再生能源丰富。 2024年5月,微软签署了一项长期电力采购协议(CPPA),将从爱尔兰的莱纳利亚风电场采购30兆瓦的风力发电。工作负载转移使资料中心能够作为灵活负载吸收多余的风力发电,从而减少弃风弃光,并提高可再生能源市场的併网容量。

美国ERCOT和中国内蒙古的电网拥塞和限流风险

到2024年,ERCOT的太阳能和风能弃光量将增加29%,达到340万兆瓦时。德克萨斯州的资源匮乏和输电线路不畅是限制因素,这与中国内蒙古的情况类似,后者也面临类似的限制,阻碍了可再生能源市场的发展。电池储能和电网增强装置是可行的解决方案,但部署速度落后于新增装置容量,损害了开发商的利润,并阻碍了未来的计划。

细分市场分析

到2024年,太阳能光电发电将占总发电量的42%,到2030年将以13%的复合年增长率成长。在许多国家,公用事业规模的太阳能光电发电目前是最经济的新型发电方式。随着钙钛矿-硅串联电池的实验室效率达到31.6%,预计2030年,可再生能源市场将成长80%。然而,组件供应过剩正在挤压生产商的净利率,促使他们转向在美国和欧洲等地进行国内生产,以减少对中国进口的依赖。

中国的沙漠太阳能发电厂和印度的超大型太阳能发电园区等大型计画展现了规模经济效应,使其成本与传统电力持平。随着第三方所有权和虚拟净计量技术的引入,住宅屋顶太阳能发电的部署也在不断改进,降低了家庭用户的前期成本。这些趋势正在巩固太阳能作为可再生能源市场容量重要贡献者的地位。

陆上和离岸风电使可再生能源市场更加多元化,并以每年约8%的速度成长。离岸风力发电涡轮机的额定功率现已超过18兆瓦,提高了单位面积的能源捕获量。然而,通膨和供应链压力导致成本高于竞标水平,迫使购电协议重新谈判甚至终止。预计到2025年,离岸风力发电可再生能源市场规模将翻倍,但营运商正在寻求更可预测的政策来降低资本配置风险。

欧洲强制回收旧叶片和印度限製本地化含量的政策表明,如果供应链放缓,这些政策会如何推高成本。来自亚洲低成本风力涡轮机的竞争正迫使西方製造商专注于服务合约、数位优化和模组化设计,以保持市场竞争力。

可再生能源市场报告按技术(太阳能、风力发电、水力发电、生质能源、地热能和海洋能)、终端用户(公共产业、商业和工业以及住宅用户)以及地区(北美、亚太、欧洲、南美以及中东和非洲)进行细分。市场规模和预测以装置容量(吉瓦)为单位。

区域分析

亚太地区将占全球可再生能源市场装置容量的55%,其中中国在2024年将占全球新增装置容量的64%。由于奖励,印度的可再生能源市场规模到2030年将成长四倍,达到62吉瓦,而东南亚国家则致力于解决储能和电网瓶颈问题。 2024年,外国直接投资将超过580亿美元,凸显了投资者对再生能源市场的信心,儘管各国政策不尽相同。

南美洲将迎来最快成长,复合年增长率将达16%。巴西预计2024年太阳能和风能装置容量将有所成长,但不断上涨的输电成本和授权延误令投资人望而却步。智利和哥伦比亚也在扩大商业太阳能发电工程,这得益于现货市场流动性的增加。

北美正受惠于美国《通膨降低法案》中的税额扣抵。到2025年,太阳能发电装置容量将成长35%,但电网拥塞正在运作计划的併网进程。在德克萨斯州和中西部地区,企业购电协议(PPA)正成为将资料中心需求与丰富的风能和太阳能资源相匹配的主要采购方式。

欧洲透过「再生能源电力计画」(REPowerEU)设定目标,到2030年实现12吉瓦的再生能源装置容量。儘管面临电网瓶颈,西班牙仍在努力将其可再生能源装置容量翻番;义大利则在试行推行容量市场改革,以奖励电力弹性。欧洲风电产业面临中国低成本製造商的供应链竞争,但授权规则的调整正在缩短前置作业时间。

中东和北非地区在开发以廉价太阳能为动力的绿色氢能方面取得了进展。沙乌地阿拉伯已将3.7吉瓦的太阳能发电计画列入2024年竞标的候选名单,其中包括2吉瓦的萨达维(Al Saadawi)计划。埃及的本班(Benban)综合设施和阿联酋的达夫拉(Al Dhafra)工厂是重要的建设项目,旨在为国家电网供氢,并成为未来的氢气出口中心。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 2024年可再生能源结构

- 市场驱动因素

- 企业购电协议加速了北美和欧洲的电力扩张。

- 超大规模资料中心的需求推动了北欧和爱尔兰的太阳能和风能采购。

- 吉瓦级绿色氢能管道将推动中东、北非和澳洲的产能成长

- 欧盟的「REPowerEU」快速审批系统将南欧陆上风电计画的前置作业时间缩短至12个月以内。

- 市场限制

- 美国ERCOT和中国内蒙古的电网拥塞和停电风险

- 德国和法国在处理废弃风力发电机叶片方面面临日益上涨的废弃物成本。

- 长期储存设施不足减缓了东南亚再生能源的推广。

- 在地采购政策推动印度和巴西离岸风力发电投资

- 供应链分析

- 监理展望

- 技术展望

- 最新进展

- 波特五力模型

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过技术

- 太阳能(光伏和聚光太阳能)

- 风力发电(陆上和海上)

- 水力发电(小型、大型、抽水蓄能)

- 生质能源

- 地热

- 海洋能源(潮汐和波浪)

- 最终用户

- 公用事业

- 商业和工业

- 住房

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 北欧国家

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 澳洲

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 埃及

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略性措施(併购、合资、资金筹措、购电协议)

- 市场占有率分析(主要企业的市场排名/份额)

- 公司简介

- EPC开发商/营运商/业主

- NextEra Energy, Inc.

- Orsted A/S

- Iberdrola, SA

- EDF Renewables(EDF SA)

- Duke Energy Corporation

- Berkshire Hathaway Energy

- Acciona Energia SA

- Engie SA

- China Three Gorges Corporation

- Enel Green Power SpA

- Statkraft AS

- Pattern Energy Group

- Invenergy LLC

- RWE Renewables GmbH

- ACWA Power

- EDP Renovaveis SA

- Brookfield Renewable Partners LP

- ReNew Energy Global PLC

- Scatec ASA

- 设备供应商

- First Solar, Inc.

- Vestas Wind Systems A/S

- Siemens Gamesa Renewable Energy SA

- GE Vernova(General Electric)

- JinkoSolar Holding Co. Ltd.

- Canadian Solar Inc.

- Longi Green Energy Technology Co., Ltd.

- Goldwind Science & Technology Co., Ltd.

- Trina Solar Co., Ltd.

- Enphase Energy, Inc.

- Sungrow Power Supply Co., Ltd.

- Mitsubishi Power, Ltd.

- Nordex SE

- MHI Vestas Offshore Wind A/S

- Shanghai Electric Group Co., Ltd.

- Hitachi Energy Ltd.

- ABB Ltd.

- Climeon AB

- Pelamis Wave Power Ltd.(in Administration)

- Ocean Power Technologies, Inc.

- EPC开发商/营运商/业主

第七章 市场机会与未来展望

The Renewable Energy Market size in terms of installed base is expected to grow from 5.08 Thousand gigawatt in 2025 to 7.04 Thousand gigawatt by 2030, at a CAGR of 8.94% during the forecast period (2025-2030).

A sharp fall in technology costs, supportive government policies, and rising corporate demand underpin this expansion. Solar power led the renewable energy market in 2024 with 42% of capacity and is forecast to grow at a 13% CAGR through 2030. Utility-scale projects remain the backbone of growth, but commercial and industrial (C&I) installations are gaining momentum as companies hedge against volatile fossil-fuel prices and tighten sustainability targets. Asia-Pacific holds the largest regional share, while South America is advancing the fastest on the back of pro-investment reforms and plentiful wind and solar resources.

Global Renewable Energy Market Trends and Insights

Corporate power-purchase agreements accelerating utility-scale builds in North America & Europe

Corporate power-purchase agreements (CPPAs) are now central to renewable energy procurement as tech firms and manufacturers lock in clean electricity for AI, cloud, and heavy-industry operations. An example is ENGIE's 85 CPPAs covering 4.3 GW signed in 2024, equal to 136 TWh of supply. Voluntary corporate offtake deals already support around half of new US utility-scale projects, providing developers with bankable revenue and lowering the cost of capital. Flexible "virtual" PPAs let buyers hedge price risk without physical delivery, although rising grid tariffs and complex contracting still deter smaller firms.

Hyperscale data-centre demand boosting solar-wind procurement in the Nordics & Ireland

Data-centre electricity demand is projected to reach 945 TWh by 2030, up from 415 TWh in 2024. Operators gravitate to the Nordics and Ireland for cool climates and abundant renewables. In May 2024 Microsoft signed a long-term CPPA that adds 30 MW of wind power from Lenalea Wind Farm in Ireland sse.com. Workload-shifting lets data centres act as flexible loads that absorb surplus wind power, reducing curtailment and increasing the renewable energy market's integration capability.

Grid congestion & curtailment risks in ERCOT (US) and Inner Mongolia (CN)

Solar and wind curtailment in ERCOT rose 29% in 2024 to 3.4 million MWh. West Texas resources and sparse transmission create bottlenecks that mirror China's Inner Mongolia, where similar constraints slow the renewable energy market. Battery storage and grid-enhancing devices are viable fixes, but deployment lags capacity additions, eroding developer revenue and deterring future projects.

Other drivers and restraints analyzed in the detailed report include:

- Green-hydrogen gigawatt pipelines driving capacity additions in MENA & Australia

- EU 'REPowerEU' fast-track permitting cutting onshore-wind lead times (<12 months) in Southern Europe

- End-of-life blade-waste regulations raising costs in Germany & France

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solar commanded 42% of capacity in 2024 and will rise at 13% CAGR to 2030. Utility-scale solar is now the cheapest new generation option in many countries. The renewable energy market size for solar installations is forecast to expand by 80% by 2030, aided by perovskite-silicon tandem cells achieving 31.6% lab efficiencies. Module oversupply, however, is squeezing producer margins, prompting diversification into domestic manufacturing in the United States and Europe to trim reliance on Chinese imports.

Massive installations such as China's desert solar bases and India's ultramega parks illustrate economies of scale that drive cost parity with conventional power. Residential rooftop uptake is also improving through third-party ownership and virtual net metering, easing upfront costs for households. These trends cement solar's role as the leading contributor to renewable energy market capacity.

Onshore and offshore wind add diversity to the renewable energy market, growing at roughly 8% annually. Turbine ratings now exceed 18 MW offshore, lifting energy capture per foundation. Yet inflation and supply-chain stress lifted costs above bid levels, forcing renegotiation and, in some cases, cancellation of power-purchase agreements. The renewable energy market size for offshore wind is forecast to double by 2025, but developers seek greater policy predictability to de-risk capital allocation.

End-of-life blade recycling mandates in Europe and local-content rules in India illustrate how policy can inflate costs if supply chains lag. Competition from low-cost Asian turbines is pushing Western manufacturers to focus on service contracts, digital optimisation, and modular designs to retain market presence.

The Renewable Energy Market Report is Segmented by Technology (Solar Energy, Wind Energy, Hydropower, Bioenergy, Geothermal, and Ocean Energy), End-User (Utility, Commercial and Industrial, and Residential), and Geography (North America, Asia-Pacific, Europe, South America, and Middle East and Africa). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW).

Geography Analysis

Asia-Pacific owns 55% of the renewable energy market capacity, led by China's 64% share of new global additions in 2024. India's renewable energy market size is set to quadruple to 62 GW by 2030 under incentive schemes, while Southeast Asian nations tackle storage and grid constraints. Foreign direct investment topped USD 58 billion in 2024, underlining investor confidence despite policy variability.

South America posts the fastest growth at 16% CAGR. Brazil recorded solar and wind additions in 2024, though rising transmission charges and permitting delays temper investor enthusiasm. Chile and Colombia are also scaling up merchant solar projects, helped by growing spot-market liquidity.

North America benefits from US tax credits within the Inflation Reduction Act. Solar capacity will climb 35% by 2025, though grid congestion slows project energisation. Corporate PPAs now dominate procurement in Texas and the Midwest, aligning data-centre needs with abundant wind and solar resources.

Europe is targeting 1,200 GW of renewables by 2030 through REPowerEU. Spain doubled its renewable capacity despite grid bottlenecks, and Italy is piloting capacity-market reforms that reward flexibility. Supply-chain competition with low-cost Chinese manufacturers challenges the European wind sector, though revamped permitting rules are shortening lead times.

MENA leverages cheap solar irradiation for green hydrogen. Saudi Arabia shortlisted 3.7 GW of solar in its 2024 tender round, including the 2 GW Al Sadawi project. Egypt's Benban complex and the UAE's Al Dhafra plant showcase large-scale builds that feed domestic grids and future hydrogen export hubs.

- EPC Developers / Operators / Owners

- Equipment Suppliers

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Renewable Energy Mix, 2024

- 4.3 Market Drivers

- 4.3.1 Corporate Power-Purchase Agreements Accelerating Utility-scale Builds in North America & Europe

- 4.3.2 Hyperscale Data-Centre Demand Boosting Solar-Wind Procurement in the Nordics & Ireland

- 4.3.3 Green-Hydrogen Gigawatt Pipelines Driving Capacity Additions in MENA & Australia

- 4.3.4 EU 'REPowerEU' Fast-Track Permitting Cutting Onshore-Wind Lead-Times (<12 Months) in Southern Europe

- 4.4 Market Restraints

- 4.4.1 Grid Congestion & Curtailment Risks in ERCOT (US) and Inner Mongolia (CN)

- 4.4.2 End-of-Life Blade Waste Regulations Raising Costs in Germany & France

- 4.4.3 Lack of Long-Duration Storage Slowing High VRE Penetration in SE-Asia

- 4.4.4 Local-Content Mandates Inflating Offshore-Wind CAPEX in India & Brazil

- 4.5 Supply-Chain Analysis

- 4.6 Regulatory Outlook

- 4.7 Technological Outlook

- 4.8 Recent Trends & Developments

- 4.9 Porter's Five Forces

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitute Products & Services

- 4.9.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Technology

- 5.1.1 Solar Energy (PV and CSP)

- 5.1.2 Wind Energy (Onshore and Offshore)

- 5.1.3 Hydropower (Small, Large, PSH)

- 5.1.4 Bioenergy

- 5.1.5 Geothermal

- 5.1.6 Ocean Energy (Tidal and Wave)

- 5.2 By End-User

- 5.2.1 Utility

- 5.2.2 Commercial and Industrial

- 5.2.3 Residential

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Nordic Countries

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Malaysia

- 5.3.3.6 Thailand

- 5.3.3.7 Indonesia

- 5.3.3.8 Vietnam

- 5.3.3.9 Australia

- 5.3.3.10 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.5.4 Egypt

- 5.3.5.5 Rest of Middle East and Africa

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JVs, Funding, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Products & Services, Recent Developments)

- 6.4.1 EPC Developers / Operators / Owners

- 6.4.1.1 NextEra Energy, Inc.

- 6.4.1.2 Orsted A/S

- 6.4.1.3 Iberdrola, S.A.

- 6.4.1.4 EDF Renewables (EDF S.A.)

- 6.4.1.5 Duke Energy Corporation

- 6.4.1.6 Berkshire Hathaway Energy

- 6.4.1.7 Acciona Energia S.A.

- 6.4.1.8 Engie S.A.

- 6.4.1.9 China Three Gorges Corporation

- 6.4.1.10 Enel Green Power S.p.A.

- 6.4.1.11 Statkraft A.S.

- 6.4.1.12 Pattern Energy Group

- 6.4.1.13 Invenergy LLC

- 6.4.1.14 RWE Renewables GmbH

- 6.4.1.15 ACWA Power

- 6.4.1.16 EDP Renovaveis S.A.

- 6.4.1.17 Brookfield Renewable Partners L.P.

- 6.4.1.18 ReNew Energy Global PLC

- 6.4.1.19 Scatec ASA

- 6.4.2 Equipment Suppliers

- 6.4.2.1 First Solar, Inc.

- 6.4.2.2 Vestas Wind Systems A/S

- 6.4.2.3 Siemens Gamesa Renewable Energy S.A.

- 6.4.2.4 GE Vernova (General Electric)

- 6.4.2.5 JinkoSolar Holding Co. Ltd.

- 6.4.2.6 Canadian Solar Inc.

- 6.4.2.7 Longi Green Energy Technology Co., Ltd.

- 6.4.2.8 Goldwind Science & Technology Co., Ltd.

- 6.4.2.9 Trina Solar Co., Ltd.

- 6.4.2.10 Enphase Energy, Inc.

- 6.4.2.11 Sungrow Power Supply Co., Ltd.

- 6.4.2.12 Mitsubishi Power, Ltd.

- 6.4.2.13 Nordex SE

- 6.4.2.14 MHI Vestas Offshore Wind A/S

- 6.4.2.15 Shanghai Electric Group Co., Ltd.

- 6.4.2.16 Hitachi Energy Ltd.

- 6.4.2.17 ABB Ltd.

- 6.4.2.18 Climeon AB

- 6.4.2.19 Pelamis Wave Power Ltd. (in Administration)

- 6.4.2.20 Ocean Power Technologies, Inc.

- 6.4.1 EPC Developers / Operators / Owners

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment