|

市场调查报告书

商品编码

1851579

签章检验:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Signature Verification - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

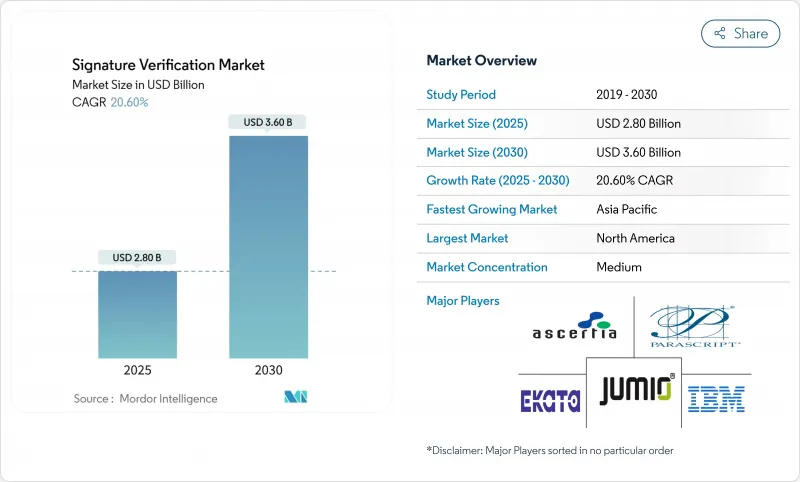

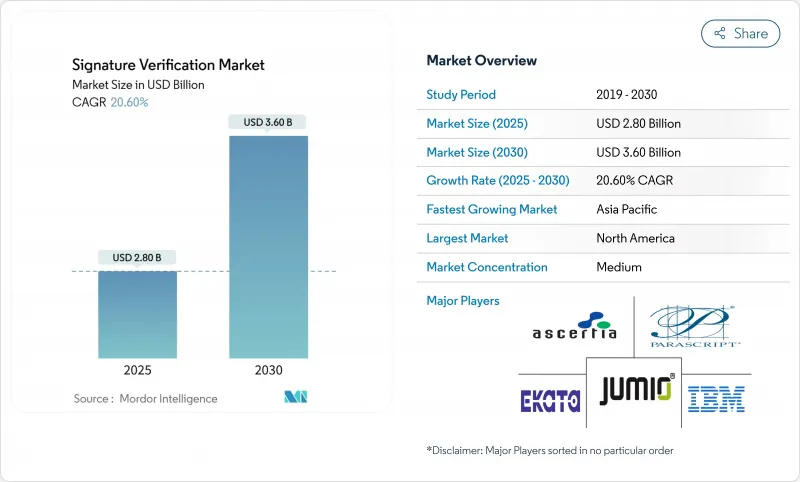

预计到 2025 年,签章检验市场规模将达到 28 亿美元,到 2030 年将成长至 36 亿美元,预测期内复合年增长率为 20.6%。

欧洲的eIDAS 2.0和美国的21 CFR Part 11正在加速推动受监管产业采用可靠的数位签章检验。诈欺数量的增加、人工智慧赋能的伪造分析技术的进步以及向云端的快速迁移进一步刺激了市场需求。从人工智慧赋能的邮寄选票处理到与Aadhaar卡关联的电子钱包,政府专案正在拓展应用场景和地理覆盖范围,而多模态认证和API优先的交付模式正在重塑整个签名检验市场的竞争格局。

全球签章检验市场趋势与洞察

eIDAS 2.0 和美国联邦法规第 11 部分合规性要求

eIDAS 2.0 要求所有欧盟公民在 2026 年前拥有可互通的数位身分钱包,并提高了由经认证的信任服务供应商支援的合格电子签章的标准。同时,FDA 指南也进行了更新,强调审核追踪和基于风险的验证,迫使製药公司转向人工智慧驱动的签名检验平台。因此,跨国公司正在寻求一种能够同时满足这两个体係要求的统一检验架构,从而加速围绕云端服务提供者的整合,以实现全球政策合规。

2024年大选后,邮寄选票签名查核数量将激增。

目前,美国已有31个州要求对缺席选票进行签名检验,推动了对高通量系统的需求。北卡罗来纳州的一项试点项目表明,自动化平台每小时可处理1000张选票,将人工审核时间缩短了95%。随后,加州强制要求采用技术辅助审核,并配备人工故障保障机制,优先考虑审核而非速度。能够处理多元文化和年龄相关签名差异的供应商价格更高,因为选举机构需要的是准确性、裁决透明度和监管审核能力。

整合采集设备的多样性与传统壁垒

机构通常依赖签名垫片、平板电脑和行动应用程式等多种设备,这些设备产生的资料解析度和取样率各不相同。演算法必须补偿不一致的压力曲线和时间数据,这会增加故障率和整体拥有成本。将现代检验与传统记录系统整合会增加复杂性,因为资料会变得孤立,从而阻碍全面的诈欺分析。小型金融机构会推迟升级,因为更换硬体的成本超过了预期收益,儘管升级可以提高安全性,但短期内仍难以采用。

细分市场分析

到2024年,软体将占据签章检验市场58%的份额,这反映出云端原生人工智慧模式的普及,这些模式能够跨网路、行动和分店通路实现即时诈欺侦测。虽然签名垫片等硬体设备在受监管的环境中仍然占据一席之地,但随着远端工作流程的普及,其市场份额将持续下降。预计到2030年,软体领域的复合年增长率将达到23.7%,这主要得益于将身分验证功能嵌入银行、医疗保健和政府入口网站的SDK。供应商正在静态影像比较的基础上迭加行为分析,以降低人工审核率和决策延迟。边缘部署模型解决了间歇性连接的问题,使其在物流和现场服务等应用情境中更具吸引力。持续的模型重新训练也使供应商能够在无需客户更改程式码的情况下适应新的攻击模式,这凸显了软体在签章检验市场中的结构性优势。

儘管硬体成长放缓,但在需要实体储存湿墨签名的领域,硬体仍然保持着重要的地位。法院、公证处和一些生命科学实验室仍然要求使用经过认证的设备进行现场签名采集,这些设备会添加加密时间戳记。然而,这些产业的采购週期仍然很长,资本预算固定,维修成本也很高。随着云端运算经济将决策标准转向营运支出,许多买家现在正在逐步淘汰使用寿命到期的设备,转而采用行动采集和后端人工智慧检验。这种转变巩固了以软体为中心的经营模式的主导地位,并确保供应商专注于订阅收入流,而不是一次性硬体销售。

到2024年,本地部署将占签名检验市场规模的55%,这主要得益于受监管严格的银行、保险公司和生命科学公司出于审核和延迟方面的考虑而倾向于本地管理。然而,预计到2030年,云端/SaaS的采用率将以每年28.2%的速度成长,并凭藉规模经济和通用API覆盖范围,将缩小本地部署与本地部署在签章验证用户基数上的差距。云端平台将模型训练集中在一个集中式环境中,利用多样化的资料集来提高抵御深度造假威胁的准确性。弹性运算资源配置可以减少閒置的基础设施支出,这对于在投票高峰期处理大量工作负载的选举委员会来说是一项关键优势。

区域云区域支援 GDPR 和 eIDAS 2.0 下的资料居住需求,并维护统一的策略引擎。将签名工件的小型资料库与云端基础的推理相结合的混合架构,为谨慎的采用者提供了一条合适的合规桥樑。服务提供者透过执行时间SLA、自动修补程式和无缝功能部署来增强其价值提案。随着企业逐渐意识到营运敏捷性比感知到的主权风险更为重要,签章检验市场有望加速 SaaS 订阅模式的转变。

区域分析

北美地区占2024年总收入的34%,这得益于其成熟的管理体制和风险投资支持的创新生态系统。各州从2024年选举週期开始实施自动选票签名系统,以增强选举公正性,促使选举委员会迅速升级系统。金融机构也扩大了利用人工智慧分析技术检测存款时细微签名偏差的系统部署,以防止日益复杂和大规模的支票诈骗。 USAA持续获得许可,虽然带来了收入,但也增加了银行整合远端存款模组的合规成本。该地区对FDA第11部分审核合规性的重视,进一步推动了对用于记录签名认证和监管链的专用平台的需求。

亚太地区预计在2025年至2030年间以25.44%的复合年增长率实现最高成长,这主要得益于印度基于Aadhaar身分识别系统的电子钱包和行动支付生态系统的快速发展。高交易量和频繁发生的诈骗案件促使印度储备银行收紧了KYC(了解你的客户)标准,并促使各银行将多模态签章检验纳入客户註册流程。日本和韩国正在推动指静脉和行为生物识别技术的研究,并经常将这些技术与签名分析相结合,以实现可靠的企业登入。透过国内可用区,Cloud Hyperscale确保签章检验市场在满足严格的居住法规要求的同时,还能利用全球威胁情报资讯。

欧洲的成长前景围绕着eIDAS 2.0展开,该标准规范了合格的电子签章,并强制要求区域内跨境互通性。认证信任服务提供者在颁发嵌入签章有效载荷的数位凭证方面发挥关键作用,这提高了演算法检验的技术要求。英国脱欧使英国欧工作流程复杂化,迫使供应商在承诺提供无缝使用者体验的同时,维护双重合规体系。 GDPR对隐私设计的期望迫使供应商采用联邦学习技术,并在不跨司法管辖区导出签名资料的情况下训练模型。因此,欧洲买家将权衡演算法准确性和可证明的隐私保护措施,并倾向于选择能够同时提供这两项服务的供应商。

其他好处

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 基于 eIDAS 2.0 和美国联邦法规第 11 部分的合规指令

- 2024年大选后,邮寄选票签名查核数量将激增。

- 金融犯罪受害者推动基于人工智慧的支票诈骗分析

- 将云端原生 API 整合到电子签章套件中

- GenAI的伪造签名检测演算法

- 印度的基于 Aadhaar 的数位签章钱包(UPI 3.0)

- 市场限制

- 整合采集设备的多样性与传统壁垒

- 多元文化选民名单上的高FRR引发诉讼

- 资料主权限制跨境模型训练

- 专利诉讼风险(例如,MITK v. USAA 案)

- 价值/供应链分析

- 监管环境

- 科技展望(人工智慧、边缘运算、世代人工智慧)

- 波特的五力模型

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按解决方案类型

- 硬体

- 签名垫片和感应器

- 生物辨识终端/自助服务终端

- 软体

- 静态(离线)检验

- 动态(线上)检验

- SDK/API平台

- 硬体

- 按部署模式

- 本地部署

- 云/SaaS

- 透过身份验证模式

- 独立签名

- 多模态(签名+文件影像/身分证/启动)

- 按最终用户行业划分

- 金融服务

- 政府与选举

- 卫生保健

- 运输与物流

- 法律与房地产

- 其他行业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Mitek Systems Inc.

- Parascript LLC

- IBM Corp.

- Adobe Inc.

- DocuSign Inc.

- Ascertia Ltd

- Jumio Corp.

- Ekata Inc.

- Acuant Inc.

- SutiSoft Inc.

- CERTIFY Global Inc.

- Scriptel Corp.

- iSign Solutions Inc.

- Veriff

- Hitachi Ltd.(Biometric systems)

- HID Global(Assa Abloy)

- Signicat AS

- Topaz Systems Inc.

- Aratek Biometrics

- Biometric Signature ID

第七章 市场机会与未来展望

The signature verification market reached USD 2.8 billion in 2025 and is expected to grow to USD 3.6 billion by 2030, delivering a 20.6% CAGR over the forecast period.

Momentum is fueled by eIDAS 2.0 in Europe and 21 CFR Part 11 in the United States, both of which compel regulated sectors to adopt trustworthy digital-signature validation. Rising fraud losses, advances in AI-driven forgery analytics, and rapid cloud migration further elevate demand. Government programs ranging from AI-assisted mail-in ballot processing to Aadhaar-linked wallets expand use-cases and geographic reach. Meanwhile, multimodal authentication and API-first delivery models are reshaping competitive positioning across the signature verification market.

Global Signature Verification Market Trends and Insights

Compliance mandates under eIDAS 2.0 & U.S. CFR Part 11

The harmonized push from Brussels and Washington is forcing enterprises to modernize outdated electronic-record systems. eIDAS 2.0 obliges all EU citizens to hold interoperable digital identity wallets by 2026, raising the bar for qualified electronic signatures backed by certified trust service providers. Simultaneously, updated FDA guidance stresses audit trails and risk-based validation, compelling pharmaceutical sponsors to shift toward AI-enabled signature verification platforms. Multinationals consequently seek unified verification architectures that satisfy both regimes, accelerating consolidation around cloud players capable of global policy compliance.

Surge in mail-in ballot signature checks post-2024 elections

Thirty-one U.S. states now require signature verification for absentee ballots, elevating demand for high-throughput systems. North Carolina's pilot demonstrated that automated platforms processed 1,000 ballots per hour, cutting manual review time by 95%. California subsequently mandated technology-assisted review with manual fail-safes, placing auditability above speed. Vendors able to accommodate multicultural signature variation and age-related changes command premium pricing as election agencies pay for accuracy, adjudication transparency, and regulatory audit features.

Variability across capture devices & legacy silo integration

Organizations often rely on a patchwork of signature pads, tablets, and mobile apps, each producing data at different resolutions and sampling rates. Algorithms must compensate for inconsistent pressure curves and timing data, which inflates false-reject rates and raises total cost of ownership. Integrating modern verification with legacy record systems adds complexity, as siloed data prevents holistic fraud analytics. Smaller institutions postpone upgrades because replacing hardware exceeds perceived benefits, restraining near-term adoption despite compelling security gains.

Other drivers and restraints analyzed in the detailed report include:

- Fin-crime losses driving AI-based check-fraud analytics

- Cloud-native APIs embedded in e-signature suites

- High FRR in multicultural voter rolls sparks litigation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software accounted for 58% of the 2024 signature verification market, reflecting widespread adoption of cloud-native AI models that deliver real-time fraud detection across web, mobile, and branch channels. Hardware devices such as signature pads remain entrenched in regulated environments, yet their share will continue to erode as remote workflows dominate. The software segment is forecast to post a 23.7% CAGR through 2030, propelled by SDKs that embed verification inside banking, healthcare, and government portals. Vendors are layering behavioral analytics atop static image comparison, thereby reducing manual review rates and shrinking decision latency. Edge-deployable models address locations with intermittent connectivity, broadening appeal to logistics and field-service use-cases. Continuous model retraining also enables vendors to counter emerging attack patterns without customer-side code changes, underscoring software's structural advantage within the signature verification market.

Hardware, though slower-growing, retains niche relevance where physical custody of wet-ink signatures is non-negotiable. Courts, notaries, and select life-sciences labs still require in-person capture using certified devices that append cryptographic timestamps. Yet procurement cycles in these verticals remain long, capital budgets fixed, and retrofit costs high. As cloud economics shift decision criteria toward operating expenditure, many buyers now phase out devices at end-of-life, migrating to mobile capture plus back-end AI validation. This transition reinforces the ascendancy of software-centric business models and cements provider focus on subscription revenue streams rather than one-time hardware sales.

On-premises deployments represented 55% of the signature verification market size in 2024 as heavily regulated banks, insurers, and life-sciences firms favored local control for audit and latency reasons. However, cloud/SaaS installations are projected to compound at 28.2% annually through 2030, narrowing the installed-base gap on economies of scale and universal API reach. Cloud platforms concentrate model training in centralized environments, leveraging diverse datasets that sharpen accuracy against deepfake threats. Elastic compute provisioning cuts idle infrastructure spending, a critical advantage for election boards that process workloads in intense bursts during peak voting periods.

Regional cloud zones support data-residency mandates under GDPR and eIDAS 2.0 while maintaining uniform policy engines. Hybrid architectures-local storage of signature artefacts combined with cloud-based inference-offer a compliance-friendly bridge for cautious adopters. Providers bolster value propositions with uptime SLAs, automated patching, and seamless feature rollouts that would be cost-prohibitive in isolated data centers. As organizations conclude that operational agility outweighs perceived sovereignty risks, the signature verification market is poised for an accelerated shift toward SaaS subscriptions.

Signature Verification Market Report is Segmented by Solution Type (Hardware, Software), Deployment Model (On-Premises, Cloud / SaaS), Authentication Mode (Stand-Alone Signature, Multimodal (signature + Doc Image / ID / Liveness)), End-User Industry (Financial Services, Healthcare and More), Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 34% of 2024 revenue, supported by mature regulatory regimes and venture-backed innovation ecosystems. States introduced automated ballot-signature systems to enhance electoral integrity after the 2024 cycle, driving rapid upgrades among election boards. Financial institutions also escalated adoption to blunt check-fraud schemes that escalated in sophistication and scale, leveraging AI analytics to detect subtle signature deviations at deposit time. Patent enforcement remains a double-edged sword: USAA's ongoing licensing victories generate revenue but elevate compliance costs for banks integrating remote-deposit modules. The region's focus on audit readiness under FDA Part 11 further solidifies demand for specialized platforms that document signature provenance and chain-of-custody.

Asia Pacific is forecast to deliver the highest regional CAGR of 25.44% between 2025 and 2030, anchored by India's Aadhaar-linked wallets and surging mobile-payment ecosystems. Massive transaction volumes and episodic fraud incidents encourage the Reserve Bank of India to tighten KYC norms, prompting banks to embed multimodal signature verification in onboarding workflows. Japan and South Korea advance finger-vein and behavioural-biometric research, often pairing those technologies with signature analysis for high-trust enterprise login. Local data-sovereignty mandates spur demand for regionally hosted inference clusters, which cloud hyperscale's provide through in-country availability zones, ensuring that the signature verification market meets stringent residency rules while still leveraging global threat-intelligence feeds.

Europe's growth narrative revolves around eIDAS 2.0, which formalizes qualified electronic signatures and compels cross-border interoperability throughout the bloc. Certified trust service providers play a pivotal role in issuing digital certificates embedded within signature payloads, raising technical requirements for algorithmic verification. Brexit complicates UK-EU workflows, forcing vendors to maintain dual compliance stacks while promising seamless user experiences. GDPR expectations of privacy-by-design push providers to adopt federated-learning techniques, training models without exporting signature artefacts beyond jurisdictional boundaries. As a result, European buyers weigh algorithmic precision alongside demonstrable privacy safeguards, favouring vendors that deliver both.

- Mitek Systems Inc.

- Parascript LLC

- IBM Corp.

- Adobe Inc.

- DocuSign Inc.

- Ascertia Ltd

- Jumio Corp.

- Ekata Inc.

- Acuant Inc.

- SutiSoft Inc.

- CERTIFY Global Inc.

- Scriptel Corp.

- iSign Solutions Inc.

- Veriff

- Hitachi Ltd. (Biometric systems)

- HID Global (Assa Abloy)

- Signicat AS

- Topaz Systems Inc.

- Aratek Biometrics

- Biometric Signature ID

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Compliance mandates under eIDAS 2.0 and U.S. CFR Part 11

- 4.2.2 Surge in mail in ballot signature checks post-2024 elections

- 4.2.3 Fin-crime losses driving AI-based check-fraud analytics

- 4.2.4 Cloud-native APIs embedded in e-signature suites

- 4.2.5 GenAI forged-signature detection algorithms

- 4.2.6 Indias Aadhaar linked digital signature wallets (UPI 3.0)

- 4.3 Market Restraints

- 4.3.1 Variability across capture devices and legacy silo integration

- 4.3.2 High FRR in multicultural voter rolls sparks litigation

- 4.3.3 Data-sovereignty limits on cross-border model training

- 4.3.4 Patent litigation risk (e.g., MITK vs USAA)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (AI, edge, GenAI)

- 4.7 Porters Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Solution Type

- 5.1.1 Hardware

- 5.1.1.1 Signature pads and sensors

- 5.1.1.2 Biometric terminals / kiosks

- 5.1.2 Software

- 5.1.2.1 Static (offline) verification

- 5.1.2.2 Dynamic (online) verification

- 5.1.2.3 SDK / API platforms

- 5.1.1 Hardware

- 5.2 By Deployment Model

- 5.2.1 On-premise

- 5.2.2 Cloud / SaaS

- 5.3 By Authentication Mode

- 5.3.1 Stand-alone signature

- 5.3.2 Multimodal (signature + doc image / ID / liveness)

- 5.4 By End-user Industry

- 5.4.1 Financial Services

- 5.4.2 Government and Elections

- 5.4.3 Healthcare

- 5.4.4 Transport and Logistics

- 5.4.5 Legal and Real-estate

- 5.4.6 Other Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Middle East

- 5.5.4.1 Israel

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Turkey

- 5.5.4.5 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Egypt

- 5.5.5.3 Rest of Africa

- 5.5.6 South America

- 5.5.6.1 Brazil

- 5.5.6.2 Argentina

- 5.5.6.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Recent Devs.)

- 6.4.1 Mitek Systems Inc.

- 6.4.2 Parascript LLC

- 6.4.3 IBM Corp.

- 6.4.4 Adobe Inc.

- 6.4.5 DocuSign Inc.

- 6.4.6 Ascertia Ltd

- 6.4.7 Jumio Corp.

- 6.4.8 Ekata Inc.

- 6.4.9 Acuant Inc.

- 6.4.10 SutiSoft Inc.

- 6.4.11 CERTIFY Global Inc.

- 6.4.12 Scriptel Corp.

- 6.4.13 iSign Solutions Inc.

- 6.4.14 Veriff

- 6.4.15 Hitachi Ltd. (Biometric systems)

- 6.4.16 HID Global (Assa Abloy)

- 6.4.17 Signicat AS

- 6.4.18 Topaz Systems Inc.

- 6.4.19 Aratek Biometrics

- 6.4.20 Biometric Signature ID

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment