|

市场调查报告书

商品编码

1851595

汽车液压系统:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Automotive Hydraulic Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

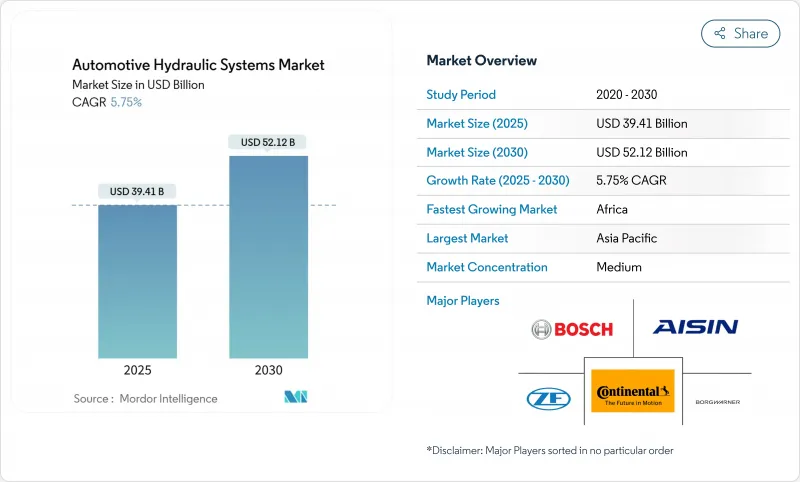

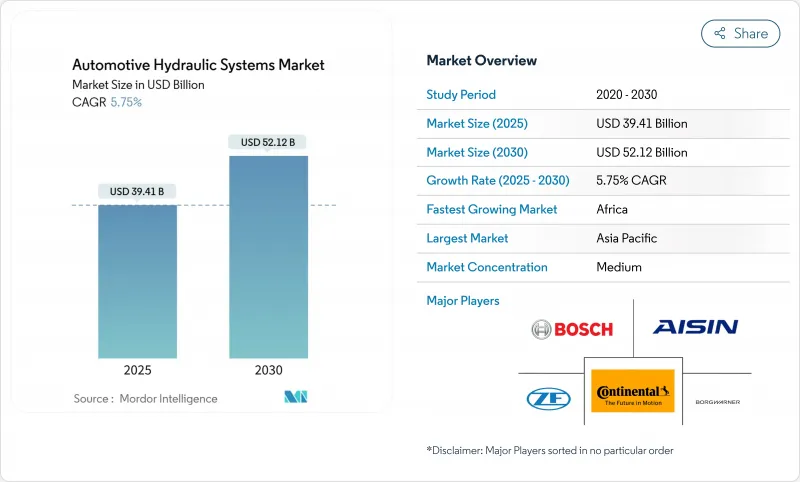

预计到 2025 年,汽车液压系统市场规模将达到 394.1 亿美元,到 2030 年将达到 521.2 亿美元,复合年增长率为 5.75%。

儘管电气化进程不断推进,但该行业仍保持稳步发展,这反映出其有能力继续发挥其在煞车、转向和悬吊方面的核心作用。日益严格的全球煞车安全法规、不断增长的商用车产量以及L3+级自动驾驶平台中电液模组的广泛应用,持续推动市场需求。亚太地区凭藉中国产量的成长和印度产能的扩张,仍然是製造中心;而非洲作为基础设施投资的驱动力,则代表着新的机会。同时,高端汽车製造商依靠液压悬吊来提升驾驶舒适性,而商用车则优先考虑液压悬吊试验的可靠性,而非实验性的替代方案。

全球汽车液压系统市场趋势与洞察

全球商用车产量与销售成长

卡车和客车生产蓬勃发展,需要多个高压迴路用于煞车、转向和辅助驱动,导致每辆车的液压元件数量增加。预计到2024年,印度汽车工业将生产3,060万辆汽车,将提振国内外市场对液压系统的需求。美国车队营运商面临底盘短缺,导致卡车利用率提高,需要定期进行液压系统维护。零排放卡车电动动力传动系统虽然仍采用液压系统,但引入了额外的温度控管迴路,进一步减少了元件数量。营运商重视久经考验的耐用性,这将在电气化进程不断推进的同时,支撑汽车液压系统市场的发展。

加强煞车安全法规(ABS、ESC、EBS)

新规要求汽车製造商安装自动紧急煞车系统和增强型稳定性控制系统,这些系统依赖精确的液压调节。美国国家公路交通安全管理局 (NHTSA) 的 FMVSS 127 标准规定,自 2029 年 9 月起,美国所有轻型车辆的碰撞避免速度目标为 62 英里/小时。欧盟即将实施的欧 7 标准将引入煞车颗粒物限制,推动低粉尘液压元件的普及。这些要求将带动汽车液压系统市场对可寻址先进阀门、助力器和微型泵浦的需求。

快速过渡到全电动煞车和转向系统

纯电动车平台追求轻量化和精准控制,倾向于采用无需液压管路的电子机械单元。在美国,环保署(EPA)的多污染物排放法规正在加速这项转型。随着电动车淘汰液压零件,德国供应商也正在调整其生产布局。商用卡车由于对液压系统的要求更高,转型速度较为缓慢,长期替代风险也对汽车液压系统市场带来压力。

细分市场分析

到2024年,煞车系统将占汽车液压系统总销量的45.12%,占据市场主导地位。诸如美国国家公路交通安全管理局(NHTSA)的紧急煞车规则等监管要求确保了市场需求的持续稳定,即使是纯电动车也保留了液压备用迴路。同时,动力方向盘辅助系统正以6.52%的复合年增长率快速成长,因为电动液压转向器在能源效率和转向手感之间取得了平衡。这表明,在电气化平台上,汽车液压系统的市场规模仍有可能继续扩大。

由于防碰撞系统需要高压调节,煞车性能稳定。转向辅助功能因依赖快速液压响应的主动车道维持技术而不断增强。悬吊应用将受益于高端汽车对乘坐舒适性的需求,而随着引擎电气化,离合器和风扇驱动的应用将会减少。商用车中的再生液压储能是一个新兴细分市场,将做出虽小但稳定的贡献。

到2024年,主缸将占零件销售额的35.26%,凸显其在各类车辆中的通用性。液压帮浦的复合年增长率将达到7.46%,成为成长最快的零件,因为进阶驾驶辅助功能需要按需供压。这些数据表明,液压泵将占据汽车液压系统市场份额的一部分,标誌着控制架构正从被动式转向主动式转变。

由于采用了复合材料管路的轻量化设计,储液罐、软管和歧管的价值提升。阀门和致动器也因整合感测器实现闭合迴路控製而价值增加。在开发不含 PFAS 的流体解决方案之前,蓄能器的发展前景尚不明朗,但预计它们在混合动力悬吊储能领域仍将具有长期应用价值。

汽车液压系统市场按应用(例如,煞车、离合器、悬吊)、组件(例如,主缸、工作缸)、车辆类型(例如,乘用车、轻型商用车)、销售管道(例如,OEM、售后市场)和地区进行细分。市场预测以价值(美元)和销售量(单位)为单位。

区域分析

至2024年,亚太地区将占全球汽车液压系统销售的48.89%,凸显其作为汽车液压系统市场中心的地位。预计2024年5月,中国汽车产量将达到235.3万辆,较去年同期成长7.6%,其中新能源车型产量将成长33.6%。预计2024年印度汽车产量将达到3,060万辆,将扩大该地区汽车液压系统的市场规模,并支撑长期需求。日本对电动车的补贴政策减少了部分动力传动系统液压系统的应用,但同时维持了对煞车系统和悬吊系统的需求,促使供应商调整产品组合。儘管亚太地区拥有深厚的供应链和丰富的劳动力资源,使其成为大众市场零件的首选,但PFAS和洩漏法规正迫使工厂升级其流体处理流程。

在北美,严格的安全法规和快速的电气化正在推动液压系统需求的双重浪潮。美国国家公路交通安全管理局 (NHTSA) 的新评估通讯协定和联邦机动车辆安全标准 (FMVSS) 127 维持了煞车液压系统的技术复杂性,而美国环保署 (EPA) 的排放法规则加速了电动车的普及,这可能会减少未来的车辆保有量。美国仍然是 L3 级自动驾驶中心,这为电液模组专家提供了研发优势。加拿大和墨西哥正在透过美墨加协定 (USMCA) 下的一体化走廊加强其区域规模,儘管政策有所变化,但仍能稳定对北美组装的供应。

欧洲在规则制定方面处于领先地位,但随着欧7颗粒物和PFAS排放法规的实施,其成本竞争力日益下降,迫使企业进行昂贵的重新设计,而这笔费用只有财力雄厚的企业才能承担。非洲将在2030年前实现7.57%的复合年增长率,基数较低,主要得益于尼日利亚、肯亚和埃及的基础设施投资,这些投资将提振非公路液压系统的需求。南美洲将随着采矿和农业设备的蓬勃发展而保持稳定成长,但宏观经济的不确定性将使前景蒙上阴影。中东市场既保留了传统的动力传动系统偏好,又有产业政策奖励,这可能会鼓励本地液压系统组装。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 全球商用车产量与销售成长

- 加强煞车安全法规(ABS、ESC、EBS)

- 豪华车对液压悬吊的需求日益增长

- 用于3级以上自动驾驶系统的电液模组

- 新兴市场入门级电动车的低成本液压动力总成

- 混合悬吊中的再生液压储能

- 市场限制

- 快速过渡到全电动煞车和转向系统

- 液压油洩漏引发的环境问题

- 原料短缺推高了弹性体密封的成本。

- OEM厂商对机器人计程车干式线传煞车的偏好

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过使用

- 煞车

- 离合器

- 暂停

- 动力方向盘辅助

- 风扇驱动系统

- 汽门机构(挺桿/致动器)

- 其他的

- 按组件

- 主缸

- 从动缸/轮缸

- 水库

- 软管和管件

- 液压泵浦

- 阀门和歧管

- 致动器/增压器

- 蓄能器及密封件

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 中型和大型商用车辆

- 非公路用车(农业和建筑)

- 按销售管道

- OEM

- 售后市场

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Continental AG

- Aisin Corporation

- BorgWarner Inc.

- Valeo SA

- Eaton Corporation plc

- Schaeffler AG

- KYB Corporation

- WABCO(ZF CVCS)

- JTEKT Corporation

- GKN Automotive

- Denso Corporation

- Nexteer Automotive Group

- Nissin Kogyo Co. Ltd

- Hitachi Astemo Ltd

- Brembo SpA

- Mando Corp

第七章 市场机会与未来展望

The Automotive Hydraulics Systems Market is valued at USD 39.41 billion in 2025 and is forecast to expand to USD 52.12 billion by 2030, registering a 5.75% CAGR.

Despite electrification, the steady advance reflects the sector's ability to preserve its core braking, steering, and suspension roles. Stricter global brake-safety mandates, rising commercial-vehicle output, and the spread of electro-hydraulic modules into Level 3+ autonomous driving platforms continue to lift demand. Thanks to China's production growth and India's capacity additions, Asia-Pacific remains the manufacturing hub, while Africa represents an emerging opportunity as infrastructure spending gains traction. At the same time, premium-vehicle makers rely on hydraulic suspension to differentiate ride quality, and commercial fleets prioritize tried-and-tested hydraulic reliability over experimental alternatives.

Global Automotive Hydraulic Systems Market Trends and Insights

Rising Global Commercial Vehicle Production & Sales

Surging truck and bus output increases hydraulic content per unit because heavy platforms need multiple high-pressure circuits for braking, steering, and auxiliary drives. India's industry produced 30.6 million vehicles in 2024, reinforcing hydraulic demand across domestic and export markets. U.S. fleet operators face chassis shortages, prompting higher utilisation of trucks requiring regular hydraulic upkeep. Electric powertrains in zero-emission trucks introduce extra thermal management loops that remain hydraulic, further sustaining component volumes. Operators value proven durability, which supports the automotive hydraulics systems market even as electrification spreads.

Stricter Brake-Safety Mandates (ABS, ESC, EBS)

New rules oblige carmakers to install automatic emergency braking and enhanced stability control that rely on precise hydraulic modulation. NHTSA's FMVSS 127 covers all U.S. light vehicles from September 2029 and sets collision-avoidance speed targets of 62 mph. The EU's upcoming Euro 7 standards bring brake particle limits, driving the adoption of low-dust hydraulic components. These requirements enlarge the addressable demand for advanced valves, boosters, and micro-pumps within the automotive hydraulics systems market

Rapid Shift to Fully-Electric Brake & Steering Systems

Battery EV platforms target weight savings and precise control, favouring electromechanical units that omit fluid lines. EPA multi-pollutant standards accelerate this transition in the United States. German suppliers reorganise production footprints as electric models trim hydraulic content. Commercial trucks move more slowly because of higher force requirements, yet long-term substitution risk weighs on the automotive hydraulics systems market.

Other drivers and restraints analyzed in the detailed report include:

- Growing Premium-Vehicle Demand for Hydraulic Suspension

- Electro-Hydraulic Modules for Level-3+ AD Systems

- Environmental Concerns Over Hydraulic-Fluid Leakage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Brakes generated 45.12% of 2024 revenue, giving this segment the largest stake in the automotive hydraulics systems market. Regulatory mandates such as NHTSA's emergency braking rule lock in resilient demand, and even pure EVs retain hydraulic backup circuits. Meanwhile, power-steering assist expands at a 6.52% CAGR as electro-hydraulic racks balance energy efficiency with steering feel. This illustrates how the automotive hydraulics systems market size can keep climbing inside electrified platforms.

Brake content remains stable because collision-avoidance systems need high-pressure modulation. Steering assist rises on the back of active-lane technologies that depend on fast hydraulic response. Suspension applications benefit from premium-car demand for ride comfort, while clutch and fan-drive uses fade in line with engine electrification. Regenerative hydraulic energy storage in commercial vehicles marks an emerging sub-segment with modest but steady contributions

Master cylinders constituted 35.26% of component sales in 2024, underscoring their universal fit across vehicle classes. Their dominance ensures stable volume, while hydraulic pumps post the highest 7.46% CAGR as advanced driver assistance features require on-demand pressure. These figures translate into a portion of the automotive hydraulics systems market share for pumps, signalling a pivot from passive to active control architectures.

Reservoirs, hoses, and manifolds record incremental gains driven by lightweight designs using composite lines. Valves and actuators climb in value because integrated sensors enable closed-loop control. Accumulators face mixed prospects pending PFAS-free fluid solutions, yet research promises long-term relevance in hybrid suspension energy storage.

The Automotive Hydraulic Systems Market is Segmented by Application (Brakes, Clutch, Suspension, and More), Component (Master Cylinder, Slave Cylinder, and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Sales Channel (OEM and Aftermarket), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific commands 48.89% of global revenue in 2024, underscoring its status as the centre of gravity for the automotive hydraulics systems market. China produced 2.353 million vehicles in May 2024, a 7.6% year-on-year rise, while new-energy models jumped 33.6%. India's 2024 output of 30.6 million units enlarges the regional automotive hydraulics systems market size and anchors long-term demand. Japan's subsidy-backed EV rollout reduces some power-train hydraulic applications yet preserves brake and suspension needs, prompting suppliers to recalibrate portfolios. Deep supply chains and abundant labour make Asia-Pacific the default choice for volume components, though PFAS and leakage regulations force factories to upgrade fluid-handling processes.

North America mixes rigorous safety regulations with fast-tracking electrification, creating a dual pull on hydraulic demand. NHTSA's new assessment protocols and FMVSS 127 sustain technical complexity in brake hydraulics, while EPA emissions rules accelerate EV adoption that can trim future volumes. The United States remains a Level 3 automation hub, giving electro-hydraulic module specialists a development advantage. Canada and Mexico buttress regional scale through integrated corridors under USMCA, stabilising supply for North American assemblers despite policy shifts.

Europe leads on rule-making yet battles eroding cost competitiveness, as Euro 7 particle limits and PFAS curbs force costly redesigns that only well-funded firms can absorb. Africa delivers the fastest 7.57% CAGR through 2030 from a low base, with infrastructure spending in Nigeria, Kenya and Egypt lifting off-highway hydraulic demand. South America shows steady growth tied to mining and agriculture machinery, though macroeconomic volatility clouds visibility. Middle Eastern markets combine legacy power-train preferences with industrial-policy incentives that could seed local hydraulic assembly.

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Continental AG

- Aisin Corporation

- BorgWarner Inc.

- Valeo SA

- Eaton Corporation plc

- Schaeffler AG

- KYB Corporation

- WABCO (ZF CVCS)

- JTEKT Corporation

- GKN Automotive

- Denso Corporation

- Nexteer Automotive Group

- Nissin Kogyo Co. Ltd

- Hitachi Astemo Ltd

- Brembo SpA

- Mando Corp

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising global commercial?vehicle production & sales

- 4.2.2 Stricter brake-safety mandates (ABS, ESC, EBS)

- 4.2.3 Growing premium-vehicle demand for hydraulic suspension

- 4.2.4 Electro-hydraulic modules for Level-3+ AD systems

- 4.2.5 Low-cost hydraulic packs for entry-level EVs in emerging markets

- 4.2.6 Regenerative hydraulic energy-storage in hybrid suspensions

- 4.3 Market Restraints

- 4.3.1 Rapid shift to fully-electric brake & steering systems

- 4.3.2 Environmental concerns over hydraulic?fluid leakage

- 4.3.3 Elastomer-seal raw-material shortages inflating costs

- 4.3.4 OEM preference for dry brake-by-wire in robotaxi fleets

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Application

- 5.1.1 Brakes

- 5.1.2 Clutch

- 5.1.3 Suspension

- 5.1.4 Power-steering Assist

- 5.1.5 Fan-drive Systems

- 5.1.6 Valve-train (Tappets/Actuators)

- 5.1.7 Others

- 5.2 By Component

- 5.2.1 Master Cylinder

- 5.2.2 Slave / Wheel Cylinder

- 5.2.3 Reservoir

- 5.2.4 Hose & Tubing

- 5.2.5 Hydraulic Pump

- 5.2.6 Valve & Manifold

- 5.2.7 Actuator / Booster

- 5.2.8 Accumulator & Seals

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Medium & Heavy-duty Commercial Vehicles

- 5.3.4 Off-highway Vehicles (Ag & Construction)

- 5.4 By Sales Channel

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Robert Bosch GmbH

- 6.4.2 ZF Friedrichshafen AG

- 6.4.3 Continental AG

- 6.4.4 Aisin Corporation

- 6.4.5 BorgWarner Inc.

- 6.4.6 Valeo SA

- 6.4.7 Eaton Corporation plc

- 6.4.8 Schaeffler AG

- 6.4.9 KYB Corporation

- 6.4.10 WABCO (ZF CVCS)

- 6.4.11 JTEKT Corporation

- 6.4.12 GKN Automotive

- 6.4.13 Denso Corporation

- 6.4.14 Nexteer Automotive Group

- 6.4.15 Nissin Kogyo Co. Ltd

- 6.4.16 Hitachi Astemo Ltd

- 6.4.17 Brembo SpA

- 6.4.18 Mando Corp

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessmen