|

市场调查报告书

商品编码

1851643

自动内容识别:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Automatic Content Recognition - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

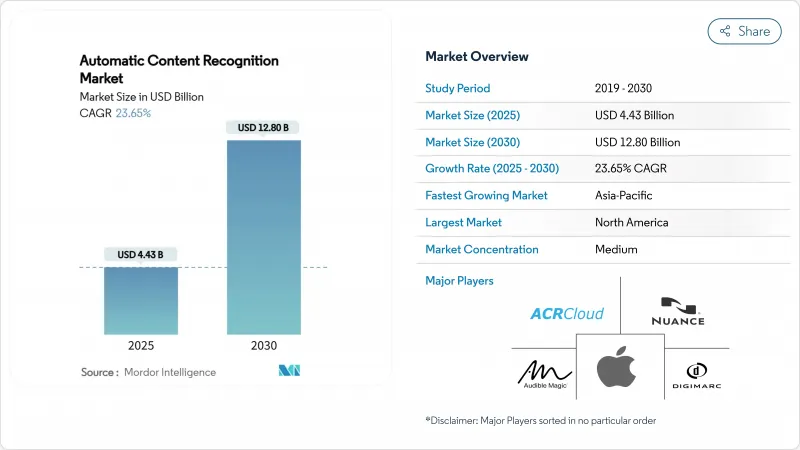

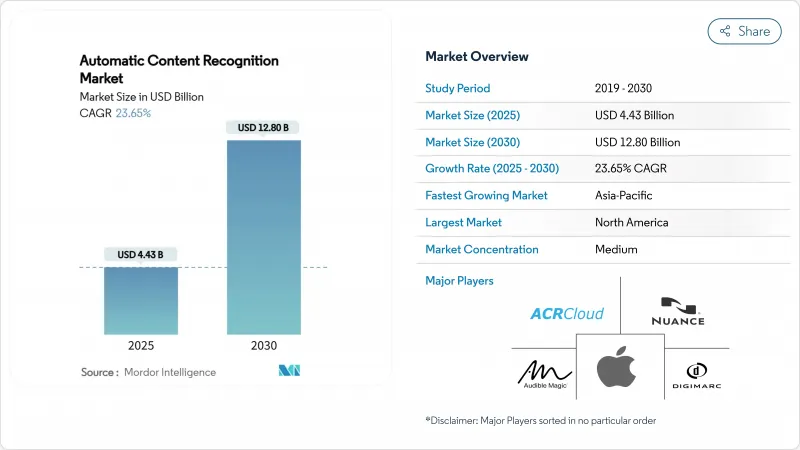

预计到 2025 年,自动内容辨识市场规模将达到 44.3 亿美元,到 2030 年将达到 128 亿美元,年复合成长率为 23.65%。

2025 年的基准反映了智慧型电视的广泛普及、预算向定向广告的重大转移,以及边缘人工智慧的稳步发展——这些进步使得指纹识别任务能够在本地以极低的能耗完成。诸如苹果 Shazam 在 2024 年实现 1000 亿次歌曲识别等突破性部署,展现了在日常消费环境中可以达到的规模。设备製造商正在常规地将自动内容识别 (ACR) 晶片整合到电路板上,从而能够在无需用户干预的情况下,从线性广播、串流应用和 HDMI 输入中持续提取特征码。这种硬体转型扩大了自动内容识别市场的可寻址资料池,同时降低了延迟。

关键数据也印证了这一成长动能。儘管软体仍占营收的64%,但随着品牌将合规性和模型调优外包,託管云端服务正以24.48%的速度成长。音讯和影像指纹辨识仍是领先技术,占46%的市场份额,但汽车和医疗保健领域的语音驱动应用案例成长最快,复合年增长率达24.11%。安全与版权保护解决方案支出占比最高,达29%,但面向快速通路的即时分析成长最快,复合年增长率达23.89%。就最终用户组成而言,媒体和娱乐产业以38%的市场份额领先,但受语音商务试点计画的推动,汽车资讯娱乐产业正以23.78%的复合年增长率迅速缩小差距。按地区划分,北美占据41%的市场份额,预计到2030年亚太地区将占据24.63%的市场份额,这进一步增强了成熟地区和新兴地区自动内容识别市场的活力。

全球自动内容识别市场趋势与洞察

内建ACR晶片的智慧型电视的普及

智慧型电视品牌现在将自动内容识别 (ACR) 处理功能路由到位于应用层下方的系统晶片)模组,即使隐私开关关闭,也能持续进行指纹识别。三星电视大约每分钟传输一次指纹,而 LG 电视则每 15 秒传输一次,从而在直播、串流媒体应用和任何 HDMI 来源之间创建不间断的远端检测串流。这些低延迟管道缩短了广告优化的回馈週期,并扩展了自动内容识别市场的数据资源。

可寻址电视广告预算增加

广告主正将广告支出转向可寻址格式,利用帧级自动内容辨识 (ACR) 的洞察。到 2025 年,可寻址电视广告预算预计将超过电视广告总支出的三分之一,到 2027 年将达到 42%。透过将这些洞察与其程序化工作流程结合,FAST 经销商能够超越人口统计定向,实现更高的用户参与度,而欧洲新推出的 HbbTV-TA 认证则规范了技术基准。自动内容辨识市场正受惠于依赖精准即时内容标记的广告插入技术。

《电子隐私权法》修正案收紧了选择加入式同意规则。

从2024年底开始,欧洲监管机构将强制执行更复杂的同意横幅和「同意或付费」指南,这将迫使智慧型电视厂商创建精细化的开关,将自动内容识别(ACR)数据与核心功能区分开来。合规性要求可能会增加工程成本并减少资料量,从而减缓欧洲自动内容识别市场的成长前景。

细分市场分析

到2024年,软体收入将占据自动内容辨识市场的大部分份额,这主要得益于电视作业系统和串流媒体SDK中紧密嵌入的程式码。然而,随着OEM厂商和广播公司将模型调优、合规性和执行时间管理外包,云端託管管理服务正以24.48%的复合年增长率快速成长。 Digimarc的年度经常性收入飙升44%至2,390万美元,显示在不断变化的隐私法规下,那些希望获得承包合规解决方案的客户更倾向于订阅收费模式。

服务的激增反映了企业 IT 领域向营运支出 (OPEX) 友善合约的转变,这些合约通常包含维护、审核日誌和服务等级协定 (SLA) 保障。对于许多中阶设备品牌而言,获得端到端服务的授权比建构必须适应特定地区授权框架的内部技术堆迭更具优势。因此,分析师预计,到 2030 年,服务在自动内容辨识市场的份额将逐年略有成长,而软体仍将占据基础地位,成长速度将放缓。

由于语音和视讯指纹辨识技术成熟,且在直播电视和点播库中展现出卓越的准确性,因此目前仍占总收入的 46%。然而,以语音为中心的辨识技术是自动内容辨识领域成长最快的市场,在车载语音助理、远端健康监测和客服中心分析等领域的推动下,其成长率高达 24.11%。 NTT 的超低延迟语音转换技术充分展现了即时品质如何满足企业阈值。

与云端相比,边缘晶片功耗降低了92%,使得在电池供电设备和汽车ECU上进行语音分析成为可能。同时,数位浮水印对版权所有者的重要性日益凸显,而光学字元辨识技术则推动了零售业的销售量成长。这些发展趋势丰富了自动内容辨识的产业套件,但并未取代指纹辨识演算法。

自动内容识别市场报告按组件(软体和服务)、技术(音讯和视讯指纹识别、数位数位浮水印等)、解决方案(即时内容分析、语音和语音介面等)、最终用户行业(媒体和娱乐、消费性电子 OEM、电信和 IT 等)以及地区进行细分。

区域分析

到2024年,北美将占据自动内容识别市场41%的收入份额,这主要得益于智慧电视家庭普及率超过75%以及成熟的定向广告供应链。各平台正在整合伺服器端插入技术,该技术高度依赖帧级识别,进一步巩固了该地区的数据优势。儘管联邦隐私立法仍处于草案阶段,但州级法规和消费者意识的不断提高可能会在中期内促进资料流动,促使供应商加强用户许可流程。

亚太地区是自动成长的引擎,预计到2030年将以24.63%的复合年增长率成长。智慧型电视的普及、可支配收入的增加以及对人工智慧实验室的政策支援共同推动了这一成长。韩国SK Telecom和LG CNS正在基于同一自动内容辨识(ACR)语音技术,建构多语言即时翻译层。日本的人工智慧法案目前正在国会审议,预计将为研发提供平衡的监管框架,并为供应商提供明确的监管指导。在中国,本土晶片製造企业和演算法公司正在推动在地化技术栈的开发,而国际企业也在努力克服出口障碍。这些因素累积刺激了亚太地区各子区域的自动内容辨识市场。

欧洲既充满机会也面临挑战。 HbbTV-TA认证统一了广告交易的技术路径,但欧洲日益严格的ePrivacy和GDPR法规使得用户选择加入率成为一个不确定因素。尝试联邦学习的供应商希望在准确性和匿名性之间取得平衡,从而创建可推广至其他地区的最佳实践。因此,欧洲自动内容识别市场的前景取决于该行业能否在遵守监管机构要求的同时,保留对盈利至关重要的数据密集型工作流程。

其他好处

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 内建ACR晶片的智慧型电视的普及

- 可寻址电视广告预算增加

- 将ACR整合到汽车资讯娱乐系统中

- FAST(免费广告支援型串流电视)频道的成长

- 边缘AI优化降低了装置上的ACR功耗

- 一种新的隐私保护型联邦学习模型

- 市场限制

- 《电子隐私权法》修正案收紧了选择加入同意规则

- 苹果和谷歌采取措施,透过作业系统更新阻止指纹辨识。

- 传统线性机上盒的 SKU 等级分析能力有限

- 关于浮水印智慧财产权组合的版税纠纷

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按组件

- 软体

- 服务

- 透过技术

- 音讯/视讯指纹识别

- 数位浮水印

- 语音辨识

- 光学字元辨识

- 透过解决方案

- 即时内容分析

- 安全性和权限管理

- 语音/言语介面

- 资料管理和元资料

- 其他的

- 按最终用户行业划分

- 媒体与娱乐

- 消费性电子产品OEM厂商

- 广告与行销

- 电讯和资讯技术

- 车

- 卫生保健

- 其他(零售、教育)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 阿根廷

- 巴西

- 其他南美洲

- 欧洲

- 英国

- 法国

- 德国

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 亚太其他地区

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 奈及利亚

- 南非

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Apple Inc.(Shazam)

- Audible Magic Corp.

- ACRCloud

- Digimarc Corp.

- Vobile Group Ltd.

- Nuance Communications Inc.

- Kantar Media SAS

- Signalogic Inc.

- VoiceInteraction SA

- Beatgrid BV

- Gracenote(Nielsen)

- SoundHound AI Inc.

- Clarivate(ComScore ACR)

- Yospace Ltd.

- Alphonso(Verizon Media)

- Sorenson Media

- Enswers Inc.

- Intrasonics Ltd.

- Audible Insights LLC

- Civolution BV

第七章 市场机会与未来展望

The Automatic Content Recognition market stood at USD 4.43 billion in 2025 and is on course to touch USD 12.80 billion by 2030, translating into a brisk 23.65% CAGR.

The 2025 baseline reflects broad-based adoption of smart TVs, a decisive budget shift toward addressable advertising, and steady improvements in edge AI that allow fingerprinting tasks to run locally with minimal energy draw. Milestone deployments such as Apple's Shazam logging 100 billion cumulative song recognitions in 2024 showcase the scale now achieved in everyday consumer settings. Device makers routinely embed ACR silicon at the board level, enabling continuous signature extraction from linear broadcasts, streaming apps, and HDMI inputs without user intervention. This hardware pivot enlarges the Automatic Content Recognition market addressable data pool while lowering latency, a combination that keeps advertisers, broadcasters, and analytics providers firmly invested in the technology.

Key data points confirm this momentum. Software still accounts for 64% revenue but managed cloud services are expanding at a 24.48% pace as brands outsource compliance and model tuning. Audio and video fingerprinting remains the leading technology with 46% share, yet speech-driven use cases in cars and healthcare are widening fastest at 24.11% CAGR. Security and copyright protection dominate solution spending with 29% share, although real-time analytics for FAST channels is the quickest riser at 23.89% CAGR. End-user mix is led by media and entertainment at 38%, while automotive infotainment is closing the gap at 23.78% CAGR thanks to voice commerce pilots. Regionally, North America commands 41% value share, whereas Asia Pacific is compounding at 24.63% through 2030-together reinforcing the Automatic Content Recognition market's vitality across both mature and emerging geographies.

Global Automatic Content Recognition Market Trends and Insights

Proliferation of Smart TVs with Embedded ACR Chips

Smart-TV brands now route ACR processing through system-on-chip blocks situated beneath the application layer, allowing continuous fingerprint capture even when privacy toggles are off. Samsung units dispatch signatures roughly every minute, while LG models do so every 15 seconds, creating an uninterrupted telemetry stream that spans live broadcasts, streaming apps, and any HDMI source. These low-latency pipelines shorten the feedback loop for ad optimization and broaden the Automatic Content Recognition market's data inventory.

Expansion of Addressable-TV Advertising Budgets

Advertisers are redirecting spend toward addressable formats that exploit frame-level ACR insights. Budgets dedicated to addressable TV surpassed one-third of total TV outlays in 2025 and are on track for 42% by 2027. FAST distributors pair these insights with programmatic workflows to lift engagement beyond demographic targeting, while new HbbTV-TA certifications in Europe standardize technical baselines. The Automatic Content Recognition market benefits as every incremental ad insertion relies on precise, real-time content labeling.

Stricter Opt-in Consent Rules Under Refreshed ePrivacy Law

European authorities began enforcing refined consent banners and "consent-or-pay" guidance in late 2024, pressuring smart-TV vendors to create granular toggles that isolate ACR data from core functions. Compliance adds engineering overhead and may shrink data volumes, dampening the Automatic Content Recognition market growth outlook within the bloc.

Other drivers and restraints analyzed in the detailed report include:

- Integration of ACR into Automotive Infotainment Systems

- Growth of FAST (Free Ad-Supported Streaming TV) Channels

- Apple/Google Anti-Fingerprinting Moves in OS Updates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software revenue formed the lion's share of the Automatic Content Recognition market size in 2024, thanks to code tightly woven into TV operating systems and streaming SDKs. However, cloud-hosted managed offerings are scaling at 24.48% CAGR as OEMs and broadcasters outsource model tuning, compliance, and uptime management. Digimarc's 44% jump in annual recurring revenue to USD 23.9 million underlines how subscription billing is resonating with customers who prefer turnkey compliance amid changing privacy rules.

The services surge mirrors a broader pivot in enterprise IT toward OPEX-friendly contracts that bundle maintenance, audit logs, and SLA guarantees, for many mid-tier device brands, licensing an end-to-end service beats building an in-house stack that must keep pace with region-specific consent frameworks. Accordingly, analysts expect services to nibble incremental Automatic Content Recognition market share each year through 2030 while software remains foundational yet slower growing.

Audio and video fingerprinting still anchors 46% of revenue due to its maturity and proven accuracy across live TV and on-demand libraries. Yet speech-centric recognition is the Automatic Content Recognition market's quickest riser, compounding at 24.11% on the back of in-car voice assistants, tele-health monitoring, and contact-center analytics. NTT's ultra-low-latency voice conversion work highlights how real-time quality now meets enterprise thresholds.

Edge silicon capable of shaving 92% power relative to cloud chains makes voice analytics feasible in battery-run devices and automotive ECUs. Meanwhile, watermarking gains renewed importance for rights holders, and optical character recognition adds incremental volume in retail. Together, these trajectories diversify the Automatic Content Recognition industry toolkit without displacing staple fingerprinting algorithms.

The Automatic Content Recognition Market Report is Segmented by Component (Software and Services), Technology (Audio and Video Fingerprinting, Digital Watermarking, and More), Solution (Real-Time Content Analytics, Voice and Speech Interfaces, and More), End-User Industry (Media and Entertainment, Consumer Electronics OEMs, Telecom and IT, and More), and Geography.

Geography Analysis

North America generated 41% of Automatic Content Recognition market revenue in 2024, benefiting from smart-TV household penetration above 75% and a well-established addressable-advertising supply chain. Platforms integrate server-side insertion that leans heavily on frame-level recognition, amplifying the region's data advantages. While federal privacy bills remain in draft form, state-level rules and greater consumer awareness could temper data flows mid-term, prompting vendors to reinforce consent flows.

Asia Pacific is the automatic growth engine, expanding at 24.63% CAGR through 2030. Mass-market smart-TV adoption, rising disposable incomes, and policy backing for AI labs act in concert. Korea's SK Telecom and LG CNS are adding multilingual real-time translation layers that rely on the same underlying ACR voices. Japan's AI Bill, now progressing through the Diet, is poised to set balanced R&D guardrails, giving suppliers regulatory clarity. In China, domestic chip fabrication and algorithm houses spur localized stacks even as international players navigate export hurdles. The cumulative effect keeps the Automatic Content Recognition market vibrant across APAC sub-regions.

Europe offers a mix of opportunity and constraint. HbbTV-TA certification has harmonized technical pathways for ad replacement, but the continent's reinforced ePrivacy and GDPR regimes make opt-in rates a swing factor. Vendors experimenting with federated learning expect to reconcile accuracy with anonymity, potentially birthing best practices that later export to other territories. The Automatic Content Recognition market outlook in Europe therefore hinges on the industry's ability to align with regulators while sustaining data-rich workflows critical for monetization.

- Apple Inc. (Shazam)

- Audible Magic Corp.

- ACRCloud

- Digimarc Corp.

- Vobile Group Ltd.

- Nuance Communications Inc.

- Kantar Media SAS

- Signalogic Inc.

- VoiceInteraction SA

- Beatgrid BV

- Gracenote (Nielsen)

- SoundHound AI Inc.

- Clarivate (ComScore ACR)

- Yospace Ltd.

- Alphonso (Verizon Media)

- Sorenson Media

- Enswers Inc.

- Intrasonics Ltd.

- Audible Insights LLC

- Civolution BV

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of Smart TVs with embedded ACR chips

- 4.2.2 Expansion of addressable-TV advertising budgets

- 4.2.3 Integration of ACR into automotive infotainment systems

- 4.2.4 Growth of FAST (Free Ad-Supported Streaming TV) channels

- 4.2.5 Edge AI optimisation lowering on-device ACR power draw

- 4.2.6 Emerging privacy-preserving federated learning models

- 4.3 Market Restraints

- 4.3.1 Stricter opt-in consent rules under refreshed ePrivacy law

- 4.3.2 Apple/Google anti-fingerprinting moves in OS updates

- 4.3.3 Limited SKU-level analytics from legacy linear STBs

- 4.3.4 Royalty disputes over watermark IP portfolios

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Software

- 5.1.2 Services

- 5.2 By Technology

- 5.2.1 Audio and Video Fingerprinting

- 5.2.2 Digital Watermarking

- 5.2.3 Speech and Voice Recognition

- 5.2.4 Optical Character Recognition

- 5.3 By Solution

- 5.3.1 Real-time Content Analytics

- 5.3.2 Security and Copyright Management

- 5.3.3 Voice and Speech Interfaces

- 5.3.4 Data Management and Metadata

- 5.3.5 Others

- 5.4 By End-User Industry

- 5.4.1 Media and Entertainment

- 5.4.2 Consumer Electronics OEMs

- 5.4.3 Advertising and Marketing

- 5.4.4 Telecom and IT

- 5.4.5 Automotive

- 5.4.6 Healthcare

- 5.4.7 Others (Retail, Education)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Argentina

- 5.5.2.2 Brazil

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 France

- 5.5.3.3 Germany

- 5.5.3.4 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Rest of Asia Pacific

- 5.5.5 Middle East

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Turkey

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 Nigeria

- 5.5.6.2 South Africa

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Apple Inc. (Shazam)

- 6.4.2 Audible Magic Corp.

- 6.4.3 ACRCloud

- 6.4.4 Digimarc Corp.

- 6.4.5 Vobile Group Ltd.

- 6.4.6 Nuance Communications Inc.

- 6.4.7 Kantar Media SAS

- 6.4.8 Signalogic Inc.

- 6.4.9 VoiceInteraction SA

- 6.4.10 Beatgrid BV

- 6.4.11 Gracenote (Nielsen)

- 6.4.12 SoundHound AI Inc.

- 6.4.13 Clarivate (ComScore ACR)

- 6.4.14 Yospace Ltd.

- 6.4.15 Alphonso (Verizon Media)

- 6.4.16 Sorenson Media

- 6.4.17 Enswers Inc.

- 6.4.18 Intrasonics Ltd.

- 6.4.19 Audible Insights LLC

- 6.4.20 Civolution BV

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment