|

市场调查报告书

商品编码

1851653

语音辨识:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Voice Recognition - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

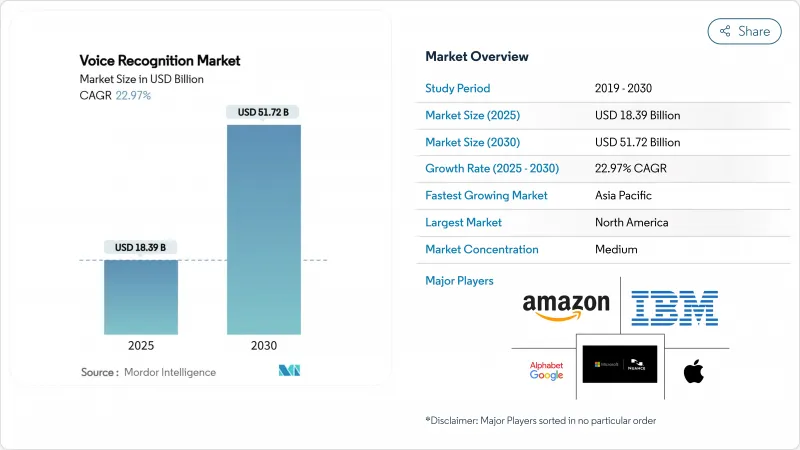

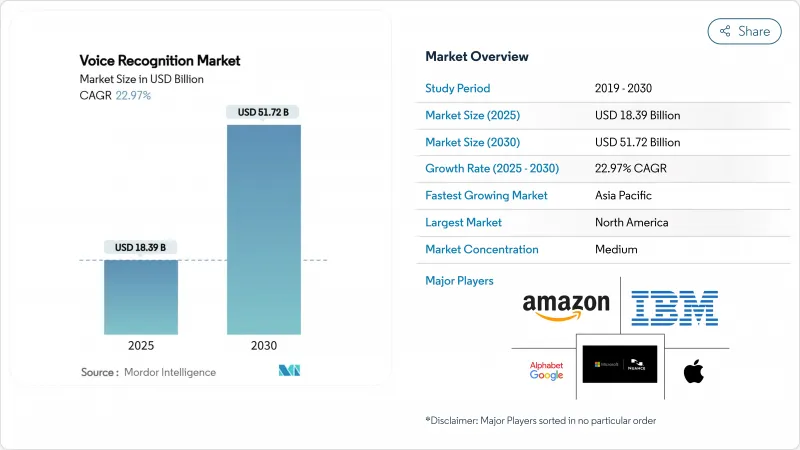

全球语音辨识市场预计到 2025 年将达到 183.9 亿美元,到 2030 年将达到 517.2 亿美元,复合年增长率为 22.97%。

市场扩张反映了三大同步驱动力:边缘人工智慧 (AI) 晶片组的快速部署、监管机构对紧急通讯网路现代化施加的压力,以及企业向语音生物识别技术迁移以进行客户身份验证。目前,以软体为中心的架构占据主导地位,软体开发套件)和应用程式介面 (API) 平台将占市场份额的 70.7%,而云端部署预计到 2024 年将占 62.1%。从区域来看,亚洲在多语言介面需求和强大的晶片製造生态系统的推动下,预计到 2024 年将占据 32.5% 的市场份额。虽然语音辨识仍然是关键技术支柱,占据 81.2% 的市场份额,但嵌入式设备端处理将实现 25% 的复合年增长率,成为增长最快的技术,这标誌着推理引擎将从纯云设计转向混合或完全本地化设计。

全球语音辨识市场趋势与洞察

亚洲边缘设备语音AI晶片爆炸性成长

Chipintelli 的 14 款离线 AI 语音晶片和联发科的 MR Breeze ASR 25 晶片的发布,标誌着对区域语言优化的专用晶片的投资不断增长。在地化能够降低延迟,解决云端串流传输的隐私问题,并巩固以往依赖北美超大规模资料中心的国内供应链。亚洲半导体公司正利用这一优势,为设备 OEM 厂商提供可处理印尼、越南和印度等市场语码转换的承包语音协定栈,从而巩固该地区在边缘推理创新领域的领先地位。

北美地区对支援语音功能的911和紧急呼叫升级实施更严格的监管

美国联邦语音辨识委员会 (FCC) 的新规要求美国通讯业者使用基于 IP 的对话启动协定)路由 911 紧急通讯业者,在 165 公尺半径范围内以 90% 的置信度消除误路由,并支援即时文字和视讯。语音辨识供应商需要在 6 至 12 个月内完成合规,这为处于紧急服务前沿的供应商带来了可预见的收入成长。这项强制性规定可能会影响欧洲公共网络,扩大对语音分析的需求,以便利用转录音讯和元资料丰富事件资料。

口音和方言意识的不足限制了非洲地区的普及。

93种非洲方言的测试发现,医疗保健提供者遇到的错误率高达25%至34%,需要针对不同方言进行微调。 NaijaVoices提供的1800小时资料集将Whisper模型的字词错误率降低了75.86%,但建构文化丰富的语料库成本高且复杂,阻碍了商业性部署。 Intron Health的160万美元种子轮融资显示投资者已意识到这个问题,同时也凸显了在地化模型训练的资金需求。

细分市场分析

预计到2024年,云端交付将占全球收入的62.1%,随着企业优先考虑快速部署、持续模型更新和广泛的语言覆盖,这一比例预计还将继续增长。金融机构和医疗保健提供者越来越多地选择混合架构,将原始录音保存在本地,并将模型训练资料汇总到云端。这种方法既满足了合规性要求,也兼顾了集中式学习带来的表现优势。因此,本地部署仍然非常适合满足自主资料需求,这将推动该领域在2030年之前持续保持两位数的成长。

对高可用性语音终端的需求正促使超大规模云端服务供应商开放承包API,从而降低中型企业的整体拥有成本,并降低独立开发者的进入门槛。因此,语音辨识的应用领域正在不断拓展,从消费性设备扩展到流程自动化、物流和现场服务工作流程等领域。预计到2030年,云端语音辨识的市场规模将接近320亿美元,这反映了新增工作负载和现有部署的扩展。

到2024年,软体平台将占全球支出的70.7%,这一关键比例凸显了产业正从专有硬体转向模组化、对开发者友善的工具。 RESTful API和预先建构语言模型的普及,使得许多应用场景无需自订晶片。随着企业越来越多地转向专业供应商寻求领域优化、语音识别和安全合规方面的支持,服务业务将以23.7%的复合年增长率成长。

在边缘延迟、离线可用性和声波束成形至关重要的应用中,硬体仍然非常重要,例如车载资讯娱乐系统和工业头戴式显示器,但大多数新参与企业正在透过使用平台即服务产品来绕过硬件,这表明横向软体提供商和垂直整合的硬体专家之间的差距正在扩大。

语音辨识市场配置(云端、本地部署)、组件(软体/SDK、硬体、服务)、科技(语音辨识、语音生物识别、边缘语音AI)、装置类型(智慧型手机、智慧音箱、汽车、穿戴式装置、POS)、应用程式(身分验证、语音搜寻、其他)、最终用户垂直产业(汽车、银行、金融服务和其他市场价值

区域分析

亚洲将占2024年收入的32.5%,这反映了该地区的半导体製造能力和语言多样性。日本资助东南亚语言模式的倡议就是一个例子。北美仍然是技术的早期采用者,但由于积极的本地化和设备成本的下降,其市场份额已被亚洲蚕食。欧洲则维持了稳定成长,主要得益于汽车和银行、金融服务及保险(BFSI)产业的主题式应用。

中东地区以23.1%的复合年增长率领先,海湾地区的智慧城市计画将对话式自助服务终端融入市民服务基础建设。南美洲的电子商务语音搜寻和银行身份验证业务也实现了两位数以上的成长。非洲由于口音多样,难以采用一般模式,发展相对落后。然而,捐助方资助的语言计划和电讯升级可望释放2027年以后的潜在需求。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 亚洲边缘设备中的语音AI晶片正在爆炸式增长。

- 北美监管机构推动语音911和紧急呼叫系统升级

- 汽车製造商转向嵌入式语音操作系统以实现驾驶座个性化

- 银行、金融服务和保险业采用语音生物辨识技术取代基于知识的身份验证(欧洲)

- 智慧音箱家庭中语音商务的快速普及

- 亚太新兴市场对多语言语音使用者体验的需求日益增长

- 市场限制

- 口音和方言识别方面的差距阻碍了非洲的广泛应用。

- 限制语音资料保存在云端的隐私法规(GDPR、印度的DPDP)

- 标註特定领域语音语料库的高成本

- 在吵杂的工业环境中,精度持续存在滞后。

- 价值/供应链分析

- 监理展望

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

第五章 市场规模与成长预测

- 透过部署

- 云

- 本地部署

- 按组件

- 软体/SDK

- 硬体(ASIC、DSP、麦克风阵列)

- 服务(託管和专业服务)

- 透过技术

- 语音辨识

- 说话者/语音生物识别

- 嵌入式/边缘语音人工智慧

- 依设备类型

- 智慧型手机和平板电脑

- 智慧音箱和显示器

- 汽车资讯娱乐和远端资讯处理

- 穿戴式装置(TWS、智慧型手錶、AR/VR)

- 商用自助服务终端和POS机

- 透过使用

- 身份验证和安全

- 语音搜寻和命令

- 文字稿和字幕

- 虚拟助理和聊天机器人

- 医疗文件

- 按最终用户行业划分

- 车

- 银行和金融服务

- 通讯领域

- 医疗保健提供者

- 政府和国防部

- 消费性电子产品

- 零售与电子商务

- 工业和製造业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- ASEAN

- 澳洲

- 纽西兰

- 亚太其他地区

- 中东和非洲

- 中东

- GCC

- 土耳其

- 以色列

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Apple Inc.

- Alphabet Inc.(Google LLC)

- Amazon.com Inc.

- Nuance Communications Inc.(Microsoft)

- IBM Corporation

- Baidu Inc.

- Samsung Electronics Co. Ltd.

- SoundHound AI Inc.

- iFLYTEK Co. Ltd.

- Sensory Inc.

- Cerence Inc.

- Verint Systems Inc.

- NICE Ltd.

- ElevenLabs

- Auraya Systems Pty Ltd.

- Intron Health

- PlayAI

- Mobvoi Information Technology Co. Ltd.

- Deepgram Inc.

- AssemblyAI Inc.

- Speechmatics Ltd.

第七章 市场机会与未来展望

The global voice recognition market size reached USD 18.39 billion in 2025 and is forecast to advance at a 22.97% CAGR to attain USD 51.72 billion by 2030.

Market expansion reflects three concurrent forces: the rapid roll-out of edge artificial intelligence (AI) chipsets, regulatory pressure for modernising emergency communications networks, and enterprise migration to voice biometrics for customer authentication. Software-centric architectures now dominate because 70.7% of market value sits in software development kits and application-programming-interface platforms, while cloud deployment accounts for 62.1% of implementations in 2024. Regionally, Asia led with 32.5% market share in 2024 on the back of multilingual interface demand and strong chip manufacturing ecosystems; speech recognition technology remained the principal technology pillar with 81.2% share, yet embedded on-device processing delivered the fastest 25% CAGR, showing a decisive shift from cloud-only designs to hybrid or fully local inference engines.

Global Voice Recognition Market Trends and Insights

Explosion of Voice-AI Chips in Edge Devices across Asia

The release of 14 offline AI speech chips by Chipintelli and MediaTek's MR Breeze ASR 25 model signal escalating investment in specialised silicon optimised for regional languages. Localisation delivers lower latency, resolves privacy concerns tied to cloud streaming, and entrenches domestic supply chains that historically depended on North American hyperscalers. Asian semiconductor firms leverage this advantage to offer device OEMs turnkey voice stacks that handle code-switching in markets such as Indonesia, Vietnam, and India, reinforcing the region's leadership in edge inference innovation.

Regulatory Push for Voice-Enabled 911 and Emergency Dispatch Upgrades in North America

New FCC rules obligate US carriers to route 911 calls via IP-based Session Initiation Protocol, cut misrouting below a 165-meter radius at 90% confidence, and support real-time text and video. Voice recognition vendors positioned around emergency services gain a predictable revenue ramp because compliance deadlines fall within a 6-12-month horizon for nationwide and regional operators. The mandate creates a template likely to influence European public safety networks, expanding total addressable demand for voice analytics that enrich incident data with transcribed speech and metadata.

Accent and Dialect Recognition Gaps Limiting Adoption in Africa

Tests across 93 African accents showed medical entity error rates that still required 25-34% refinement via accent-specific fine-tuning. NaijaVoices' 1,800-hour dataset cut word-error rates for Whisper models by 75.86%, but the cost and complexity of curating culturally rich corpora slow commercial roll-outs. Intron Health's USD 1.6 million seed round underlines investor recognition of the problem, yet it also highlights the capital demands of localised model training.

Other drivers and restraints analyzed in the detailed report include:

- Automotive OEM Shift to Embedded Voice OS for Cockpit Personalisation

- BFSI Adoption of Voice Biometrics to Replace Knowledge-Based Authentication in Europe

- Privacy Regulations (GDPR, India DPDP) Restricting Cloud Voice-Data Retention

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud delivery generated 62.1% of global revenue in 2024, and that share is projected to widen as enterprises prioritise rapid rollout, continuous model updates, and broad language coverage. Financial institutions and healthcare providers increasingly select hybrid architectures that keep raw recordings on premises but pool model-training insights in the cloud. The approach balances compliance with the performance gains of aggregated learning. On-premise deployments therefore remain relevant for sovereign-data mandates, explaining why the segment still posts double-digit growth through 2030.

Demand for high-availability voice endpoints has pushed hyperscalers to expose turnkey APIs. Consequently, total cost of ownership falls for mid-sized enterprises, and barriers to entry lower for independent developers. The result is a wider application funnel for voice recognition market adoption, extending beyond consumer devices into process automation, logistics, and field-service workflows. The voice recognition market size for cloud implementations is set to approach USD 32 billion by 2030, reflecting both new workloads and expansion of existing deployments.

Software platforms captured 70.7% of global spend in 2024, a decisive margin that underpins the industry's pivot from proprietary hardware to modular, developer-friendly tooling. The availability of RESTful APIs and pre-built language models removes the need for bespoke silicon in many use cases. Services, although representing a smaller base, rise at 23.7% CAGR as enterprises engage specialist vendors for domain tuning, accent adaptation, and security compliance.

Hardware maintains relevance where edge latency, offline availability, or acoustic beam-forming matter, such as in automotive infotainment or industrial head-mounted displays. Yet most new entrants bypass hardware by consuming platform-as-a-service offerings, illustrating an expanding gap between horizontally oriented software providers and vertically integrated hardware specialists.

Voice Recognition Market is Segmented by Deployment (Cloud, On-Premise), Component (Software/SDK, Hardware, Services), Technology (Speech Recognition, Voice Biometrics, Edge Voice AI), Device Type (Smartphones, Smart Speakers, Automotive, Wearables, POS), Application (Authentication, Voice Search, and More), End-User Vertical (Automotive, BFSI, and Morel), and by Geography. Market Forecasts in Value (USD).

Geography Analysis

Asia generated 32.5% of 2024 turnover, reflecting the region's semiconductor capacity and linguistic diversity. Domestic policy supports AI acceleration; Japan's initiative to fund Southeast Asian language models is one example. North America remains technology's early-adopter hub but ceded share to Asia because of aggressive localisation and lower device costs. Europe grew steadily, influenced by automotive and BFSI thematic adoption.

The Middle East exhibits the quickest 23.1% CAGR as Gulf smart-city programmes embed conversational kiosks in citizen-services infrastructure. South America records mid-teens growth from e-commerce voice search and banking authentication. Africa faces a lag because accent diversity complicates universal models; however, donor-funded language projects and telecom upgrades may unlock latent demand from 2027 onward.

- Apple Inc.

- Alphabet Inc. (Google LLC)

- Amazon.com Inc.

- Nuance Communications Inc. (Microsoft)

- IBM Corporation

- Baidu Inc.

- Samsung Electronics Co. Ltd.

- SoundHound AI Inc.

- iFLYTEK Co. Ltd.

- Sensory Inc.

- Cerence Inc.

- Verint Systems Inc.

- NICE Ltd.

- ElevenLabs

- Auraya Systems Pty Ltd.

- Intron Health

- PlayAI

- Mobvoi Information Technology Co. Ltd.

- Deepgram Inc.

- AssemblyAI Inc.

- Speechmatics Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosion of Voice-AI Chips in Edge Devices across Asia

- 4.2.2 Regulatory Push for Voice-Enabled 911 and Emergency Dispatch Upgrades in North America

- 4.2.3 Automotive OEM Shift to Embedded Voice OS for Cockpit Personalisation

- 4.2.4 BFSI Adoption of Voice Biometrics to Replace Knowledge-Based Authentication in Europe

- 4.2.5 Rapid Proliferation of Voice Commerce in Smart-Speaker Centric Households

- 4.2.6 Growth of Multilingual Voice UX Demand in Emerging APAC Markets

- 4.3 Market Restraints

- 4.3.1 Accent and Dialect Recognition Gaps Limiting Adoption in Africa

- 4.3.2 Privacy Regulations (GDPR, India DPDP) Restricting Cloud Voice Data Retention

- 4.3.3 High Cost of Annotated Domain-Specific Speech Corpora

- 4.3.4 Persistent Accuracy Lags in Noisy Industrial Environments

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment

- 5.1.1 Cloud

- 5.1.2 On-premise

- 5.2 By Component

- 5.2.1 Software/SDK

- 5.2.2 Hardware (ASIC, DSP, Microphone Arrays)

- 5.2.3 Services (Managed and Professional)

- 5.3 By Technology

- 5.3.1 Speech Recognition

- 5.3.2 Speaker/Voice Biometrics

- 5.3.3 Embedded/Edge Voice AI

- 5.4 By Device Type

- 5.4.1 Smartphones and Tablets

- 5.4.2 Smart Speakers and Displays

- 5.4.3 Automotive Infotainment and Telematics

- 5.4.4 Wearables (TWS, Smart-watch, AR/VR)

- 5.4.5 Commercial Kiosks and POS

- 5.5 By Application

- 5.5.1 Authentication and Security

- 5.5.2 Voice Search and Command

- 5.5.3 Transcription and Captioning

- 5.5.4 Virtual Assistants and Chatbots

- 5.5.5 Medical Documentation

- 5.6 By End-user Vertical

- 5.6.1 Automotive

- 5.6.2 Banking and Financial Services

- 5.6.3 Telecommunications

- 5.6.4 Healthcare Providers

- 5.6.5 Government and Defence

- 5.6.6 Consumer Electronics

- 5.6.7 Retail and E-commerce

- 5.6.8 Industrial and Manufacturing

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 United Kingdom

- 5.7.3.2 Germany

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 Rest of Europe

- 5.7.4 Asia Pacific

- 5.7.4.1 China

- 5.7.4.2 Japan

- 5.7.4.3 India

- 5.7.4.4 South Korea

- 5.7.4.5 ASEAN

- 5.7.4.6 Australia

- 5.7.4.7 New Zealand

- 5.7.4.8 Rest of Asia Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 GCC

- 5.7.5.1.2 Turkey

- 5.7.5.1.3 Israel

- 5.7.5.1.4 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Nigeria

- 5.7.5.2.3 Egypt

- 5.7.5.2.4 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)}

- 6.4.1 Apple Inc.

- 6.4.2 Alphabet Inc. (Google LLC)

- 6.4.3 Amazon.com Inc.

- 6.4.4 Nuance Communications Inc. (Microsoft)

- 6.4.5 IBM Corporation

- 6.4.6 Baidu Inc.

- 6.4.7 Samsung Electronics Co. Ltd.

- 6.4.8 SoundHound AI Inc.

- 6.4.9 iFLYTEK Co. Ltd.

- 6.4.10 Sensory Inc.

- 6.4.11 Cerence Inc.

- 6.4.12 Verint Systems Inc.

- 6.4.13 NICE Ltd.

- 6.4.14 ElevenLabs

- 6.4.15 Auraya Systems Pty Ltd.

- 6.4.16 Intron Health

- 6.4.17 PlayAI

- 6.4.18 Mobvoi Information Technology Co. Ltd.

- 6.4.19 Deepgram Inc.

- 6.4.20 AssemblyAI Inc.

- 6.4.21 Speechmatics Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment