|

市场调查报告书

商品编码

1851664

水泵:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

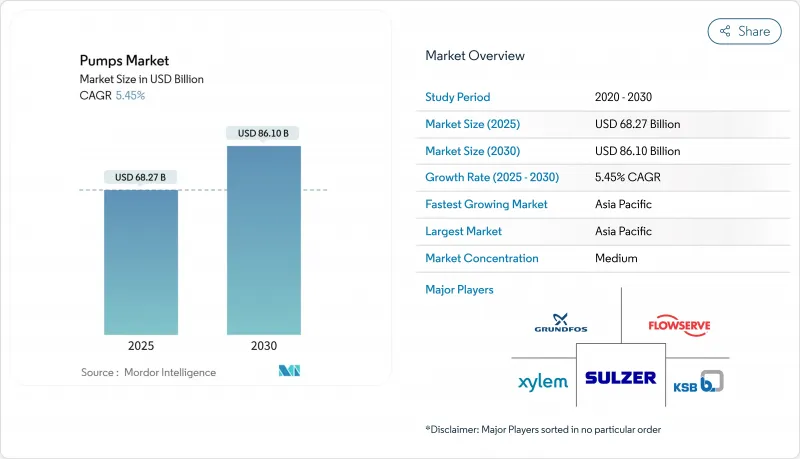

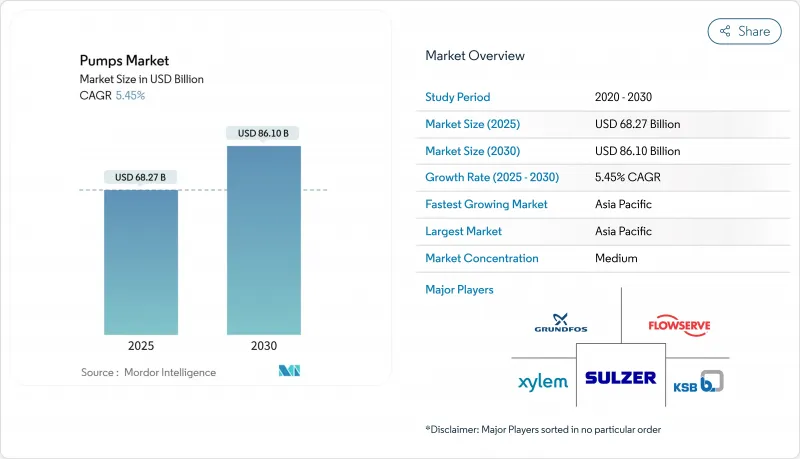

预计到 2025 年,泵浦市场规模将达到 682.7 亿美元,到 2030 年将达到 861 亿美元,预测期(2025-2030 年)的复合年增长率为 5.45%。

成长主要得益于大型水利基础设施升级、强劲的工业资本投资以及对节能设备的普遍需求。儘管电气化仍然是主要的能源来源,但太阳能发电系统在农业和离网环境中正迅速发展。技术规范正朝着智慧化、配备丰富感测器的水泵方向发展,这些水泵能够降低能耗、实现预测性维护并符合更严格的环境法规。随着现有供应商透过收购扩大产品组合,以及来自亚洲的低成本参与企业在价格和交货速度方面展开竞争,竞争日益加剧。为了因应原物料价格的波动,供应链策略越来越重视材料节约和多区域采购。

全球泵浦市场趋势与洞察

中东、非洲和亚太地区海水淡化计划的资本投资不断成长

预计到2024年,沙乌地阿拉伯和阿联酋的海水淡化计划总投资将超过48亿美元,这将刺激对高压泵的需求,这种高压泵的陶瓷复合材料湿润部件的使用寿命比同等不銹钢部件长40%。能源回收设备现已成为新建工厂的标配,可将营业成本降低高达60%,这提高了技术门槛,使拥有成熟的船用级材料技术专长的供应商更具优势。拥有海水淡化专案案例的製造商可以享受溢价,而竞争对手则竞相获取类似的资格。

欧洲和北美严格的污水再利用规定

修订后的欧盟都市废水处理指令旨在大幅降低磷和全氟烷基和多氟烷基物质(PFAS)的含量,加速采用精密喷射泵和变流量循环泵,以支援高级氧化和薄膜过滤。市政当局正在增加整合泵组的预算,平均订单金额增加了27%。随着公用事业公司转向基于结果的采购模式,能够提供控制和远端监控功能的供应商在竞标中脱颖而出。

镍和不銹钢价格波动导致物料清单成本上升。

据泵浦製造商称,容积式泵浦含有30-40%的不銹钢,因此价格上涨正在挤压利润净利率。知名品牌目前正利用计算流体力学,在某些型号中将合金重量减少15%,并透过从多个地区采购来分散风险。

细分市场分析

到2024年,离心泵将占据泵浦市场56.8%的份额。叶轮形状和导叶轮廓的不断改进,使水力效率提高了15%。预计该细分市场将以6.2%的复合年增长率成长,超过泵浦市场整体成长速度。离心泵在供水、暖通空调和炼油厂等领域的广泛应用为其提供了稳定的基础,而新兴的碳捕集装置则需要配备先进密封件和耐腐蚀合金的客製化二氧化碳处理装置。

专用离心式帮浦正逐渐应用于捕碳封存(CCS)迴路,此迴路处理液态与超临界二氧化碳时,会表现出复杂的动态行为。整合感测器阵列的供应商能够帮助营运商降低能耗和维护成本,并使泵浦的运作更接近最佳效率点。容积式泵浦在计量、化学药剂注入和高压浆料操作中仍然至关重要,并且由于这些特定领域对性能公差要求更高,因此价格也更高。

由于水平泵浦因其普及性、易于维护和初始成本低等优点,目前仍占据泵浦市场60%的份额。然而,随着都市区公共和资料中心建设者面临占地面积限制,立式直列泵浦和潜水泵浦预计将以5.8%的复合年增长率成长。 ABB即将收购Aurora Motors,这将增强其垂直马达产品线,显示该供应商对长期成长充满信心。

立式泵浦在驱动装置位于流体上方的应用中将得到更广泛的应用,例如深井给水、矿井排水和污水湿井装置。升级的轴承系统和耐磨涂层可以延长泵送运作的间隔时间。此外,更严格的建筑规范也促进了这一领域的需求,这些规范鼓励采用紧凑型机房和堆迭式机械空间。

泵浦市场报告按泵浦类型(离心泵浦、容积式泵浦、其他)、轴向(水平、垂直)、驱动动力(电力、引擎、气动、太阳能)、最终用户(水和污水公共产业、化学和石化、发电、其他)和地区(北美、欧洲、亚太、南美、中东和非洲)进行细分。

区域分析

预计亚太地区将在2024年以51.60%的市占率引领全球水泵市场,并在2030年之前维持6.0%的复合年增长率。大规模的都市化、雄心勃勃的海水淡化项目以及强劲的农业现代化是推动市场成长的主要动力。中国的国家蓝图和印度的太阳能水泵推广计画将持续维持强劲的需求。区域製造商正向价值链上游转型,开发配备感测器的设备,加剧了区域内的竞争。

北美依然是创新主导。 2024财年联邦政府拨款30亿美元用于铅水管更换,将刺激先进饮用水设备的订单。美国墨西哥湾沿岸页岩气开发将推动对10,000磅/平方英吋压裂设备的需求,而加拿大矿业公司则采购重型泥浆设备。到2024年,热泵的性能将比燃气炉高出27%,凸显了电气化对水泵选择的影响。

欧洲高度重视生命週期效率和环境合规性。欧盟污水指令已更新,为精密喷射泵和膜泵创造了巨大的市场。北欧区域供热网路正在快速扩张,需要能够在低温下运作的大型循环泵。德国和英国的公共产业正在实施预测性维护软体,以提高资产运转率并延长更换週期。中东正大力投资海水淡化和区域冷却。同时,许多非洲国家正在优先发展离网太阳能灌溉解决方案,以提高作物产量并减少对柴油燃料的依赖。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 最新进展

- 市场驱动因素

- 中东、非洲和亚太地区海水淡化计划的资本投资不断成长

- 欧洲和北美更严格的污水再利用规定

- 美国墨西哥湾沿岸和巴西页岩油气和深水油气计划快速扩张

- 北欧和中东地区区域供暖和製冷设施迅速成长

- 印度和非洲农业灌溉电气化(太阳能水泵)

- 市场限制

- 镍和不銹钢价格波动导致物料清单成本上升。

- 中国低成本製造商的激增正在挤压净利率。

- 减少经合组织国家的火力发电管路和循环泵

- 地方政府的更换週期较长(15-20年),限制了年销售额。

- 供应链分析

- 监理展望

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章 市场规模与成长预测

- 按泵类型

- 离心式(径流式、轴流式、混合流式)

- 容积式(旋转式(齿轮、凸轮、叶片、螺桿)、往復式(活塞、膜片、柱塞))

- 其他(特殊用途,喷射帮浦)

- 按轴方向

- 水平的

- 垂直的

- 驱动力

- 电的

- 引擎驱动

- 气动/空气驱动

- 太阳能发电

- 最终用户

- 用水和污水业务

- 石油和天然气(上游、中游、下游)

- 化工/石油化工

- 发电(火力发电、核能、可再生能源发电)

- 采矿和金属

- 暖通空调和楼宇服务

- 农业与灌溉

- 建筑和基础设施

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 北欧国家

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 澳洲

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 其他南美洲

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 埃及

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Flowserve Corporation

- Grundfos Holding A/S

- KSB SE & Co. KGaA

- ITT Inc.

- Sulzer Ltd.

- Ebara Corporation

- Weir Group plc

- Xylem Inc.

- Wilo SE

- Pentair plc

- Tsurumi Manufacturing Co. Ltd.

- Torishima Pump Mfg. Co. Ltd.

- Baker Hughes Company

- Schlumberger Limited

- Celeros Flow Technology LLC

- Atlas Copco AB

- Kirloskar Brothers Ltd.

- Ruhrpumpen Group

- Desmi A/S

- Zoeller Pump Co.

第七章 市场机会与未来展望

The Pumps Market size is estimated at USD 68.27 billion in 2025, and is expected to reach USD 86.10 billion by 2030, at a CAGR of 5.45% during the forecast period (2025-2030).

Growth is supported by large-scale water infrastructure upgrades, steady industrial capital spending, and the universal push for energy-efficient equipment. Electrification remains the dominant power source, while solar-powered systems create a fast-growing niche in agriculture and off-grid settings. Technical specifications are shifting toward smart, sensor-rich pumps that lower energy consumption, enable predictive maintenance, and meet tightening environmental rules. Competitive intensity is rising as established suppliers broaden portfolios through acquisitions and low-cost Asian entrants compete on price and delivery speed. Supply-chain strategies increasingly emphasize material savings and multi-regional sourcing to counter raw-material price swings.

Global Pumps Market Trends and Insights

Escalating CAPEX in Desalination Projects across MENA & APAC

Seawater-desalination build-outs in Saudi Arabia and the UAE exceeded USD 4.8 billion in 2024, spurring demand for high-pressure pumps with ceramic composite wetted parts that last 40% longer than stainless-steel equivalents. Energy-recovery devices now standardize in new plants, trimming operating costs by up to 60% and raising technical barriers that favor suppliers with proven marine-grade materials expertise. Manufacturers with desalination references are capitalizing on premium pricing while competitors race to secure similar credentials.

Stringent Wastewater Reuse Mandates in Europe & North America

The revised EU Urban Waste Water Treatment Directive targets steep cuts in phosphorus and PFAS, accelerating adoption of precision-dosing and variable-flow circulation pumps able to support advanced oxidation and membrane filtration. Municipalities allocate more budget to integrated pump packages, raising the average order value by 27%. Suppliers offering controls and remote-monitoring capabilities are winning bids as utilities shift to outcome-based procurement.

Volatility in Nickel & Stainless-Steel Prices Inflating BoM

Pump producers report stainless-steel content of 30-40% in positive-displacement designs, so price spikes squeeze margins. Leading European brands now use computational fluid dynamics to reduce alloy weight by 15% in selected models and hedge exposure through multi-regional sourcing.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Expansion of Shale & Deep-water O&G Projects in US Gulf & Brazil

- Surging District Cooling & Heating Installations in Nordics & Middle East

- Proliferation of Low-cost Chinese Manufacturers Compressing Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Centrifugal pumps accounted for 56.8% of pumps market share in 2024. Continuous improvements in impeller geometry and guide-blade profiles have lifted hydraulic efficiency by up to 15%. The segment is forecast to post a 6.2% CAGR, outpacing the overall pumps market. Widespread use in water supply, HVAC and refinery services provides a stable base, while emerging carbon-capture plants require tailored CO2-handling models with advanced seals and corrosion-resistant alloys.

Specialized centrifugal variants now enter carbon-capture and storage (CCS) circuits, where liquid and supercritical CO2 present complex thermodynamic behavior. Vendors integrating sensor arrays enable operators to run close to best-efficiency points, cutting energy consumption and maintenance costs. Positive-displacement designs remain indispensable in metering, chemical injection and high-pressure slurry duties, commanding premium pricing due to stricter performance tolerances across these niches.

Horizontal machines still dominate 60% of the pumps market share due to familiarity, straightforward maintenance, and lower initial cost. However, vertical inline and submersible models are set to grow by 5.8% CAGR as urban utilities and data-center builders confront floor-space constraints. ABB's pending addition of Aurora Motors strengthens its vertical-motor lineup, signaling supplier confidence in long-term upside.

Vertical pumps thrive in deep-well water supply, mining dewatering ,and wastewater wet-well installations where the driver remains above the fluid. Upgraded bearing systems and abrasion-resistant coatings allow longer run times between pulls. Segment demand also benefits from stricter building codes that favor compact plantrooms and stacked mechanical spaces.

The Pumps Market Report is Segmented by Pump Type (Centrifugal, Positive Displacement, and Others), Shaft Orientation (Horizontal and Vertical), Driving Force (Electric-Driven, Engine-Driven, Pneumatic, and Solar-Powered), End User (Water and Waste-Water Utilities, Chemicals and Petrochemicals, Power Generation, and Others), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific leads the pumps market with 51.60% share in 2024 and is expected to post a 6.0% CAGR through 2030. Massive urbanization, ambitious desalination pipelines, and strong agricultural modernization underpin growth. China's national heat-pump roadmap and India's solar-pump rollout sustain high-volume demand. Regional manufacturers move up the value chain toward sensor-enabled units, intensifying local competition.

North America remains innovation-driven. Federal water-infrastructure funding of USD 3.0 billion for lead-service-line replacement in FY2024 stimulates advanced potable-water equipment orders. Shale development in the US Gulf boosts demand for 10,000-psi fracturing pumps, while Canadian miners procure hard-wearing slurry units. Heat pumps outsold gas furnaces by 27% in 2024, highlighting electrification's ripple effect on pump selection.

Europe emphasizes lifecycle efficiency and environmental compliance. The updated EU wastewater directive creates a sizeable market for precision-dosing and membrane-feed pumps. Nordic district-heating networks scale rapidly, requiring large circulation pumps compatible with low-temperature operation. Utilities in Germany and the United Kingdom deploy predictive-maintenance software to lift asset availability and stretch replacement intervals. The Middle East channels heavy investment into desalination and district cooling, whereas many African economies prioritize off-grid solar irrigation solutions to raise farm yields and reduce diesel dependence.

- Flowserve Corporation

- Grundfos Holding A/S

- KSB SE & Co. KGaA

- ITT Inc.

- Sulzer Ltd.

- Ebara Corporation

- Weir Group plc

- Xylem Inc.

- Wilo SE

- Pentair plc

- Tsurumi Manufacturing Co. Ltd.

- Torishima Pump Mfg. Co. Ltd.

- Baker Hughes Company

- Schlumberger Limited

- Celeros Flow Technology LLC

- Atlas Copco AB

- Kirloskar Brothers Ltd.

- Ruhrpumpen Group

- Desmi A/S

- Zoeller Pump Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Recent Trends & Developments

- 4.3 Market Drivers

- 4.3.1 Escalating CAPEX in Desalination Projects across MENA & APAC

- 4.3.2 Stringent Waste-water Reuse Mandates in Europe & North America

- 4.3.3 Rapid Expansion of Shale & Deep-water O&G Projects in US Gulf & Brazil

- 4.3.4 Surging District Cooling & Heating Installations in Nordics & Middle East

- 4.3.5 Electrification of Agricultural Irrigation (Solar Pumps) in India & Africa

- 4.4 Market Restraints

- 4.4.1 Volatility in Nickel & Stainless-Steel Prices Inflating BoM

- 4.4.2 Proliferation of Low-cost Chinese Manufacturers Compressing Margins

- 4.4.3 Declining Thermal Power Pipeline in OECD Curtailing Circulation Pumps

- 4.4.4 Long Municipal Replacement Cycles (15?20 yrs) Limiting Annual Sales

- 4.5 Supply-Chain Analysis

- 4.6 Regulatory Outlook

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

- 4.9 Investment Analysis

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Pump Type

- 5.1.1 Centrifugal (Radial-flow, Axial-flow and Mixed-flow)

- 5.1.2 Positive Displacement (Rotary (Gear, Lobe, Vane, Screw), and Reciprocating (Piston, Diaphragm, Plunger))

- 5.1.3 Others (Specialty, Jet Pumps)

- 5.2 By Shaft Orientation

- 5.2.1 Horizontal

- 5.2.2 Vertical

- 5.3 By Driving Force

- 5.3.1 Electric-driven

- 5.3.2 Engine-driven

- 5.3.3 Pneumatic/Air-operated

- 5.3.4 Solar-powered

- 5.4 By End-user

- 5.4.1 Water and Waste-water Utilities

- 5.4.2 Oil and Gas (Upstream, Midstream, Downstream)

- 5.4.3 Chemicals and Petrochemicals

- 5.4.4 Power Generation (Thermal, Nuclear, Renewables)

- 5.4.5 Mining and Metals

- 5.4.6 HVAC and Building Services

- 5.4.7 Agriculture and Irrigation

- 5.4.8 Construction and Infrastructure

- 5.4.9 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Nordic Countries

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Malaysia

- 5.5.3.6 Thailand

- 5.5.3.7 Indonesia

- 5.5.3.8 Vietnam

- 5.5.3.9 Australia

- 5.5.3.10 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Egypt

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Flowserve Corporation

- 6.4.2 Grundfos Holding A/S

- 6.4.3 KSB SE & Co. KGaA

- 6.4.4 ITT Inc.

- 6.4.5 Sulzer Ltd.

- 6.4.6 Ebara Corporation

- 6.4.7 Weir Group plc

- 6.4.8 Xylem Inc.

- 6.4.9 Wilo SE

- 6.4.10 Pentair plc

- 6.4.11 Tsurumi Manufacturing Co. Ltd.

- 6.4.12 Torishima Pump Mfg. Co. Ltd.

- 6.4.13 Baker Hughes Company

- 6.4.14 Schlumberger Limited

- 6.4.15 Celeros Flow Technology LLC

- 6.4.16 Atlas Copco AB

- 6.4.17 Kirloskar Brothers Ltd.

- 6.4.18 Ruhrpumpen Group

- 6.4.19 Desmi A/S

- 6.4.20 Zoeller Pump Co.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment