|

市场调查报告书

商品编码

1851707

美国油漆和涂料:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)United States Paints And Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

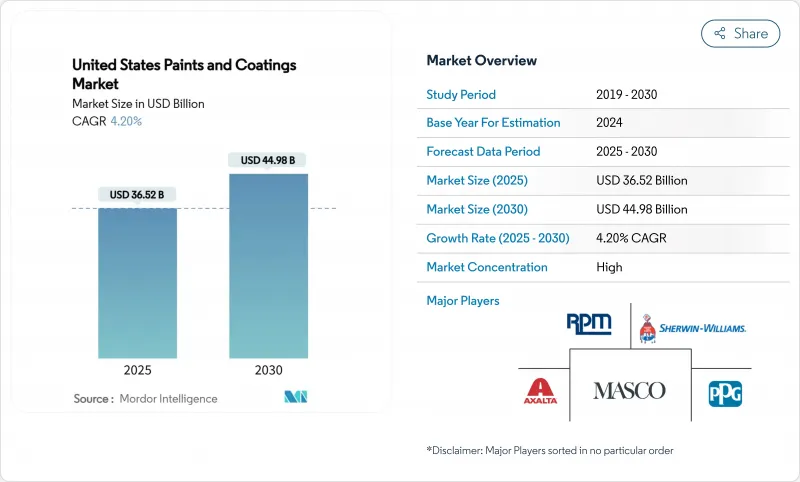

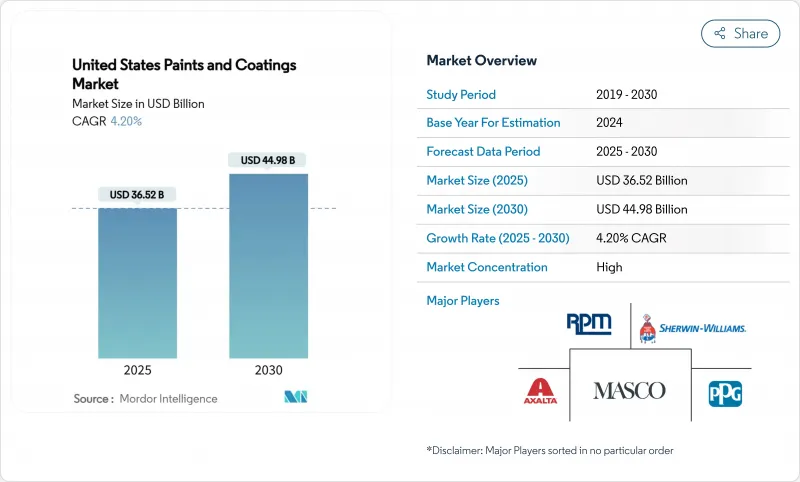

预计到 2025 年,美国油漆和涂料市场规模将达到 365.2 亿美元,到 2030 年将达到 449.8 亿美元,预测期(2025-2030 年)的复合年增长率为 4.20%。

当前市场扩张主要得益于建筑涂料翻新市场的持续强劲增长、水性配方涂料的迅速普及以及联邦政府基础设施建设浪潮对防护涂料需求的推动。人口向阳光地带迁移、製造业向东南部集中以及电商涂料销售额的稳定成长也提振了潜在需求。此外,由于二氧化钛价格波动和劳动力市场紧张导致价格上涨,生产商也受益于短期定价权。然而,随着私募股权支持的整合者运用收购合併策略,以及大型现有企业缩减业务组合以专注于利润更高的行业细分领域,市场竞争日益加剧。

美国油漆及涂料市场趋势及洞察

联邦基础设施投资和就业法案

自采用IIJA以来,已资助超过4万个桥樑和道路计划,并使公路和道路支出增加了36%。高性能环氧树脂、聚天冬胺酸酯和富锌底漆受益于此,因为美国交通部(DOT)的规范优先考虑防腐蚀性能而非最低价格的涂层系统。随着联邦政府在饮用水基础设施方面的支出激增62%,水务设施中NSF认证衬里的规范也不断扩展。预计到2025年,交通运输建设将再成长8%,这将为防护涂层施工商带来未来两年的稳定订单。虽然通货膨胀正在吸收部分拨款并限制订单量的成长,但由于各机构指定使用更长寿命的系统,价格结构仍保持积极态势。劳动力短缺是一个主要限制因素,导致计划工期延长,支出分散到更多季度。

房屋翻新热潮

由于“锁定效应”,房屋翻新需求弥补了新房屋建设的疲软,这种效应促使抵押房屋抵押贷款低于3%的业主选择重建而非搬迁。剪切机-Williams)报告称,到2024年,房屋翻新市场将保持高个位数成长。千禧世代组成首个家庭以及婴儿潮世代维修老旧房屋的需求将支撑涂料销售的持续成长。数位色彩工具和隔天送达服务正在扩大DIY人群,而专业油漆工则利用行动订购来减少到店次数。虽然房屋改造需求本质上属于非必需消费,但人口结构的基本面和老旧住宅存量使其能够抵御经济週期波动。

二氧化钛价格波动剧烈

二氧化钛占建筑白色涂料原料成本的50%之多,配方师也证实了这一点。 2024年夏季的价格飙升挤压了利润空间,导致立邦涂料等公司宣布2025年合约价格上涨高达9%。大型製造商透过签订多年供应协议和采用颜料稀释技术来规避风险,而小型製造商则面临库存损失的风险。目前,针对不透明度优化的树脂体系和奈米颗粒分散体的研究正在加速推进,这些技术能够在不牺牲遮盖力的前提下降低二氧化钛的用量,但商业化应用仍需三到四年。

细分市场分析

丙烯酸树脂将占最大份额,到2024年将占总销售额的35%,这得益于其在墙面涂料和养护涂料中兼具的硬度和柔韧性。终端用户青睐新一代水性丙烯酸树脂的低温成膜和减少异味的特性。随着汽车製造商和地板涂料规范制定者采用耐久性可与溶剂型配方媲美的双组分水性配方,聚氨酯的复合年增长率(CAGR)达到5.10%。配方师正在利用脂肪族异氰酸酯的进步,这种材料即使在强烈的紫外线照射下也能抵抗泛黄。醇酸树脂的市场份额正在下降,但它仍然服务于快干金属底漆和对成本敏感的承包商市场。聚酯树脂正在围栏和暖通空调面板的粉末涂料领域开闢一片天地。特种混合体系利润丰厚,使中型製造商能够与丙烯酸树脂的通用供应商竞争。在美国涂料市场,聚氨酯预计将在工业和汽车应用领域削弱丙烯酸的主导,而丙烯酸将在消费品和建筑应用领域保持其统治地位。

2024年,水性涂料系统将占销售额的67%,反映了监管和消费者需求的成长趋势。流变改质剂和非团聚黏合剂的持续进步正在缩小水性涂料与溶剂型涂料的性能差距,随着美国涂料市场向更环保的选择转型,水性涂料的增长速度将高于平均水平。粉末涂料技术凭藉零VOC认证和可再生喷涂工艺,在电器、金属家具和汽车轮毂等领域的市场份额不断增长。虽然溶剂型涂料在一些对固化条件要求苛刻的重型和海洋环境中仍然不可或缺,但由于空气品质法规的日益严格,其市场份额将继续下降。需要色彩灵活性和高涂膜性能的涂装车间正在兴起混合型粉末和液体涂料生产线。总而言之,这些变化正在重塑技术组合,并推动对固化能量模型、粉末喷涂机器人和LED-UV灯系统的投资。

美国油漆市场细分报告按树脂类型(丙烯酸树脂、醇酸树脂、聚氨酯树脂、环氧树脂、聚酯树脂、其他树脂类型)、技术(水性涂料、溶剂型涂料、粉末涂料、UV技术)、分销渠道(公司自营商店、独立油漆分销商、其他)和最终用户行业(建筑、汽车、木材、防护涂料、一般工业、其他)对行业进行细分。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 联邦基础设施投资和就业法案推动桥樑和公路被覆剂需求

- 家居装修热潮带动了DIY建筑涂料的销售量。

- 转向粉末涂料和紫外光固化涂料推动美国空气排放标准提高

- 製造业回流刺激了美国地区对工业涂料的需求

- 汽车产业的成长

- 市场限制

- 二氧化钛价格波动对生产商的净利率带来压力。

- 工业涂装技术人员短缺导致计划工期延误

- 运费上涨扰乱油漆零售商的库存週期

- 改用PVC墙板和复合材料墙板可以减少外墙涂料的消耗。

- 价值链分析

- 监理展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 产业间竞争

第五章 市场规模与成长预测

- 依树脂类型

- 丙烯酸纤维

- 醇酸

- 聚氨酯

- 环氧树脂

- 聚酯纤维

- 其他树脂类型

- 透过技术

- 水溶液

- 溶剂型

- 粉末涂装

- 紫外线技术

- 透过分销管道

- 直营店

- 独立油漆经销商

- 大型超市和五金店

- 直接向工业OEM厂商销售

- 电子商务

- 按最终用户行业划分

- 建筑学

- 车

- 木头

- 保护漆

- 一般工业

- 运输

- 包装

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Akzo Nobel NV

- Axalta Coating Systems, LLC

- BASF

- Beckers Group

- Benjamin Moore & Co.

- Carboline

- Diamond Vogel

- Dunn-Edwards Corporation

- Hempel A/S

- Masco Corporation

- Nippon Paint Holdings Co., Ltd.

- Parker Hannifin

- PPG Industries, Inc.

- RPM International Inc.

- Rust-Oleum Corporation

- Sika AG

- The Sherwin-Williams Company

- Tnemec

- Wacker Chemie AG

第七章 市场机会与未来展望

The United States Paints And Coatings Market size is estimated at USD 36.52 billion in 2025, and is expected to reach USD 44.98 billion by 2030, at a CAGR of 4.20% during the forecast period (2025-2030).

The current expansion rests on the sustained strength of architectural repaint activity, the sharp pivot toward waterborne formulations, and a federal infrastructure wave lifting volumes of protective products. Underlying demand is reinforced by population migration to the Sun Belt, manufacturing reshoring in the Southeast, and a steady rise in e-commerce paint sales. Producers also benefit from near-term pricing power as volatile titanium-dioxide costs and tight labor conditions make price increases stick. Competitive intensity, however, is heightening as private-equity backed consolidators apply a buy-and-build playbook while large incumbents prune portfolios to favor higher-margin industrial niches.

United States Paints And Coatings Market Trends and Insights

Federal Infrastructure Investment and Jobs Act

The IIJA has funded more than 40,000 bridge and roadway projects, lifting highway and street spending by 36% since its adoption. High-performance epoxy, polyaspartic, and zinc-rich primers benefit because DOT specifications prioritize corrosion protection over lowest-bid paint systems. Specifications for NSF-certified linings in water projects are expanding alongside a 62% federal outlay jump in drinking-water infrastructure. Transportation construction is projected to climb another 8% in 2025, creating a visible two-year order pipeline for protective-coatings applicators. Inflation is absorbing a portion of allocated funds, tempering volume upside, yet price-mix remains positive as agencies specify longer-life systems. Labor availability is the main gating factor, prolonging project schedules and stretching consumption over more calendar quarters.

Home Remodeling Boom

Residential repaint volumes have offset softness in new-build housing thanks to a "lock-in" effect that encourages owners with sub-3% mortgages to renovate rather than relocate. Sherwin-Williams reported high-single-digit growth in repaint categories through 2024. Millennials forming first-time households and baby boomers retrofitting aging homes underpin sustained gallonage. Digital color tools and next-day delivery have expanded the addressable DIY audience, while pro painters use mobile ordering to cut store trips. Remodel demand is inherently discretionary, yet demographic fundamentals and an aging housing stock provide resilience through economic cycles.

Volatile TiO2 Pricing

TiO2 constitutes up to 50% of a white architectural coating's raw-material cost, exposing formulators. Margins compressed during the 2024 summer spike, prompting Nippon Paint and others to announce up to 9% price rises for 2025 contracts. Larger players hedge through multi-year supply deals and pigment-extension technology, while smaller producers risk inventory losses. R&D is intensifying around opacity-optimized resin systems and nanoparticle dispersions that lower TiO2 loading without sacrificing hide, yet widespread commercial scale is still three to four years away.

Other drivers and restraints analyzed in the detailed report include:

- Shift to Powder and UV-Curable Coatings

- Manufacturing Reshoring

- Shortage of Skilled Industrial Painters

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Acrylic chemistries generated the largest slice of 2024 revenue at 35% because they balance hardness and flexibility across both wall paints and maintenance finishes. End-users appreciate low-temperature film formation and odor reduction in next-generation waterborne acrylics. The polyurethane cohort is advancing at a 5.10% CAGR as automakers and floor-coating specifiers adopt two-component water-borne versions that rival solvent-borne durability. Formulators capitalize on aliphatic isocyanate advances that resist yellowing under harsh UV. Alkyds are losing share yet still serve quick-dry metal primers and cost-sensitive contractor markets. Polyester resins are carving powder-coating niches on fencing and HVAC panels. Specialty hybrid systems fetch higher margins, allowing mid-size producers to defend pricing against bulk commodity acrylic suppliers. Over the forecast horizon, the US paints and coatings market will see polyurethane chip away at acrylic leadership in industrial and automotive uses, although acrylic will stay dominant in consumer and builder channels.

Water-borne systems held 67% of 2024 sales, reflecting regulatory and consumer momentum. Continuous advances in rheology modifiers and coalescent-free binders have closed historical performance gaps versus solvent alternatives, driving above-trend growth as the US paints and coatings market shifts toward greener options. Powder technology is gaining share in appliances, metal furniture, and automotive wheels thanks to zero-VOC credentials and reclaimable overspray. Solvent-borne platforms remain essential in select heavy-duty and marine settings where cure conditions are severe, but successive air-quality rules will keep eroding their share. Hybrid powder-liquid lines are emerging in job-coat shops that need color flexibility and high film build capabilities. Collectively, these shifts are reshaping the technology mix and fueling investment in cure-energy modeling, powder spray robots, and LED-UV lamp systems.

The United States Paints and Coatings Market Report Segments the Industry by Resin Type (Acrylic, Alkyd, Polyurethane, Epoxy, Polyester, and Other Resin Types), Technology (Water-Borne, Solvent-Borne, Powder Coating, and UV Technology), Distribution Channel (Company-Owned Stores, Independent Paint Dealers, and More), and End-User Industry (Architectural, Automotive, Wood, Protective Coatings, General Industrial, and More).

List of Companies Covered in this Report:

- Akzo Nobel N.V.

- Axalta Coating Systems, LLC

- BASF

- Beckers Group

- Benjamin Moore & Co.

- Carboline

- Diamond Vogel

- Dunn-Edwards Corporation

- Hempel A/S

- Masco Corporation

- Nippon Paint Holdings Co., Ltd.

- Parker Hannifin

- PPG Industries, Inc.

- RPM International Inc.

- Rust-Oleum Corporation

- Sika AG

- The Sherwin-Williams Company

- Tnemec

- Wacker Chemie AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Federal Infrastructure Investment and Jobs Act Catalyzing Bridge and Highway Coatings Demand

- 4.2.2 Home Remodeling Boom Elevating DIY Architectural Paint Volumes

- 4.2.3 Shift to Powder and UV-Curable Coatings to Meet U.S. Air-Emission Standards

- 4.2.4 Manufacturing Reshoring Spurring Industrial Coatings Demand in U.S. Southeast

- 4.2.5 Growth in the Automotive Sector

- 4.3 Market Restraints

- 4.3.1 Volatile TiO2 Pricing Compressing Producer Margins

- 4.3.2 Shortage of Skilled Industrial Painters Delaying Project Completions

- 4.3.3 Freight-Cost Inflation Disrupting Paint-Retailer Inventory Cycles

- 4.3.4 Shift to PVC and Composite Siding Reducing Exterior Paint Consumption

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Industry Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin Type

- 5.1.1 Acrylic

- 5.1.2 Alkyd

- 5.1.3 Polyurethane

- 5.1.4 Epoxy

- 5.1.5 Polyester

- 5.1.6 Other Resin Types

- 5.2 By Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.2.3 Powder Coating

- 5.2.4 UV technology

- 5.3 By Distribution Channel

- 5.3.1 Company-Owned Stores

- 5.3.2 Independent Paint Dealers

- 5.3.3 Big-Box Retailers and Home Centers

- 5.3.4 Direct to Industrial OEM

- 5.3.5 E-Commerce

- 5.4 By End-user Industry

- 5.4.1 Architectural

- 5.4.2 Automotive

- 5.4.3 Wood

- 5.4.4 Protective Coatings

- 5.4.5 General Industrial

- 5.4.6 Transportation

- 5.4.7 Packaging

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Axalta Coating Systems, LLC

- 6.4.3 BASF

- 6.4.4 Beckers Group

- 6.4.5 Benjamin Moore & Co.

- 6.4.6 Carboline

- 6.4.7 Diamond Vogel

- 6.4.8 Dunn-Edwards Corporation

- 6.4.9 Hempel A/S

- 6.4.10 Masco Corporation

- 6.4.11 Nippon Paint Holdings Co., Ltd.

- 6.4.12 Parker Hannifin

- 6.4.13 PPG Industries, Inc.

- 6.4.14 RPM International Inc.

- 6.4.15 Rust-Oleum Corporation

- 6.4.16 Sika AG

- 6.4.17 The Sherwin-Williams Company

- 6.4.18 Tnemec

- 6.4.19 Wacker Chemie AG

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Self-Healing Protective Coatings for Offshore Wind Infrastructure