|

市场调查报告书

商品编码

1851734

相机模组:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Camera Module - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

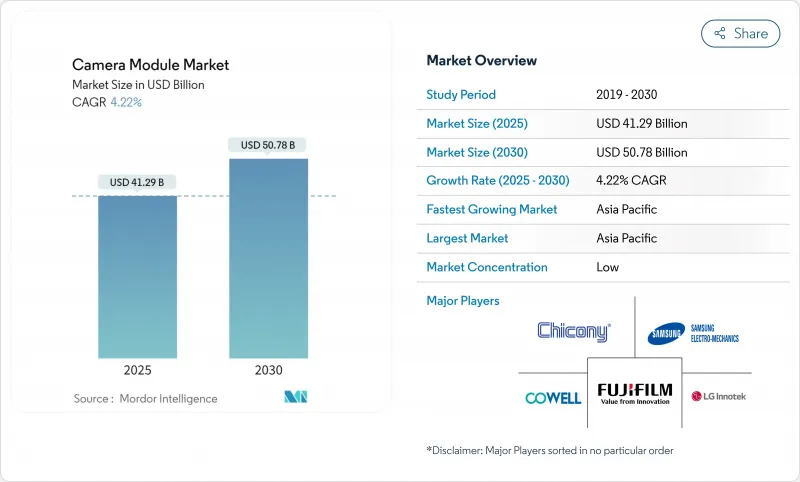

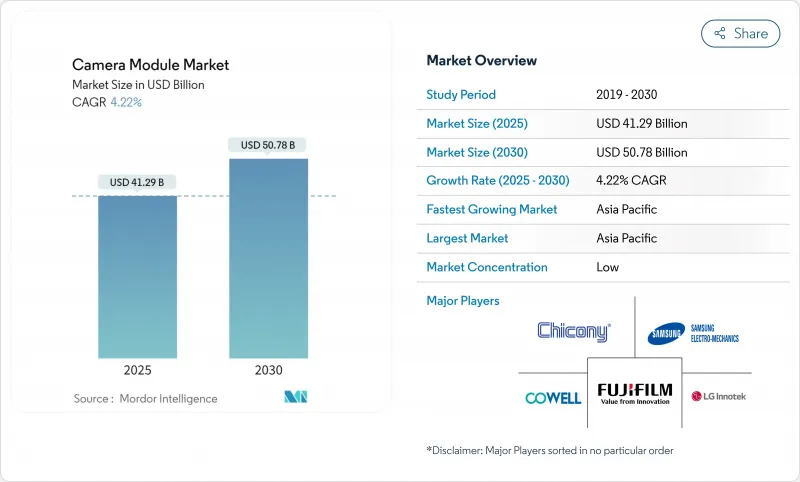

预计到 2025 年,相机模组市场规模将达到 412.9 亿美元,到 2030 年将达到 507.8 亿美元,在此期间的复合年增长率为 4.22%。

行动电话的饱和正促使製造商转向多摄影机阵列、折迭式光学变焦和装置端人工智慧处理,从而将成长重心从单纯的销量扩张转向功能丰富的创新。汽车安全法规、边缘分析监控以及新兴的XR设备正在拓展传统手机出货量以外的收入来源。 2024年台湾地震暴露了音圈马达(VCM)采购的脆弱性,零件製造商正优先考虑供应链的韧性,而印度等国的政府则利用与生产挂钩的奖励来促进本地组装并吸引新的投资。韩国、日本和中国的供应商正在竞相争夺屏下摄影机和潜望镜模组等高价值细分领域的智慧财产权。

全球相机模组市场趋势与洞察

中国旗舰智慧型手机的多镜头机型现在通常配备三个以上的镜头。

中国行动电话品牌正将多相机阵列推向主流,预计到2025年,平均镜头数量将达到五颗。更大的感光元件尺寸、专用的超广角和微距镜头,以及潜望式长焦模组,正在强化智慧型手机作为主要影像工具的地位。结合运算摄影技术,这些阵列能够实现夜景模式、人像模式和高倍变焦等功能,在竞争激烈的行动电话市场中脱颖而出。国内供应链正在快速扩张,这给现有厂商带来了压力,同时也提升了相机模组市场作为品牌形象和消费者升级意愿关键平台的地位。华为的2亿像素潜望式原型机标誌着光学领域的飞跃。人工智慧驱动的运算摄影技术能够从小像素中提取更大的动态范围和更强的降噪能力,使品牌无需使用大尺寸感测器即可销售专业级影像。

后视视野和ADAS摄影机强制要求(FMVSS 111,欧盟GSR)

美国和欧盟的安全法规已将后视摄影机和环景显示摄影机从可选配件转变为必备组件。汽车製造商正在整合多个镜头以满足盲点监测、车道维持辅助和行人侦测的要求,从而持续推动对坚固耐用、耐高温模组的需求。美国新车安全评鑑协会(美国 NCAP)现在对盲点警告、车道维持辅助和行人自动紧急煞车进行评分,提高了每辆车摄影机数量的基准值。因此,汽车製造商订购的环景显示系统必须超越最低合规标准,增加感测器节点数量,从而推动相机模组市场的发展。

2024年台湾地震后VCM致动器供应受限

2024年台湾地震扰乱了紧密相连的VCM(可变晶片製造)生态系统,导致供不应求,并波及全球智慧型手机组装。 OEM厂商加速了双源采购,并寻求功耗更低、响应速度更快的压电替代方案。零件製造商开始进行地理多元化布局,在东南亚地区建造产能,以避免未来的灾害风险。这次地震也促使韩国和中国的主要供应商采取垂直整合策略,因为在这些地区,关键致动器的供应对于高阶相机的上市至关重要。 Alps Alpine公司公开揭露了由于采购溢价而导致的利润压力,并正在向双源製造模式转型。压电替代方案可提供更安静、更低功耗的驱动,并减少对专业线圈绕线商的依赖。

细分市场分析

VCM致动器支援高速自动对焦和光学防手震,成为提升照片和影片效能的关键策略手段。此细分市场的复合年增长率(CAGR)为7.2%,超过了整个相机模组市场的成长速度。儘管地震造成的供不应求推动了压电和MEMS替代方案的发展,但VCM仍保持着成本和技术成熟度的优势。同时,影像感测器预计到2024年将占据48.8%的收入份额,这得益于整合式片上记忆体的堆迭式架构,从而实现了连拍和多帧HDR。背照式的进步降低了噪音基底,并扩展了移动和汽车应用的动态范围。

整合化趋势将VCM(可变光圈模组)与感测器内相位检测演算法结合,使系统关注点从硬体共生转向软体共生。随着折迭光学元件和可变光圈设计的日益普及,镜头组也变得越来越复杂,模组组装正在采用主动校准机器人技术来实现微米级的公差。这些变化强化了相机模组市场向更高单价的转变,即便智慧型手机的成长已趋于平缓。投资于致动器创新和感测器/镜头协同开发的供应商将在相机模组产业的利润曲线中占据高端位置。

CMOS技术占出货量的90.1%,其单晶片实现和低耗电量几乎使CCD技术被淘汰。背照式(BSI)技术引领创新趋势,以4.24%的复合年增长率快速成长,显着提升了夜视和自动驾驶视觉的量子效率。高动态范围(HDR)CMOS设计利用横向溢出电容,在单次曝光中捕捉极高的亮度范围,满足严格的汽车安全要求。

3D堆迭技术将处理逻辑置于光电二极体平面下方,简化了讯号路径,并为神经型态和事件驱动型感测技术铺平了道路,这些技术仅输出像素级变化。此类架构降低了频宽和能耗需求,这对边缘AI部署至关重要。随着CMOS技术的不断优化,相机模组市场将继续受到整合到整个成像子系统中的感测器技术进步的驱动。

800万至1300万像素的像素频宽仍然是业界的主流,占据了34.7%的市场份额,这得益于其在资料负载、电池消耗和影像清晰度方面的均衡表现。计算摄影技术能够在不成比例增加檔案大小的情况下提升细节,使OEM厂商能够优先考虑软体流程而非像素数量。双增益感测器和多帧融合技术能够从中等解析度硬体中提取出色的动态范围,进一步巩固了该解析度在对成本敏感的智慧型手机和物联网视觉节点领域的领先地位。

相反,1300万像素以上的分辨率正以6.8%的复合年增长率增长,这主要得益于旗舰级潜望式相机、医疗成像探头以及需要精细细节的工业检测系统。四拜耳像素合併技术使这些高解析度感测器能够在全解析度日间成像和低杂讯夜间成像之间切换,从而控制功耗。随着模组厚度持续受到限制,微透镜设计和深沟槽隔离技术的创新有助于保持量子效率,从而推动高阶相机模组市场的成长。

区域分析

亚太地区预计到2024年将占全球销售额的59.7%,这得益于其密集的供应链,该供应链涵盖日本和台湾的传感器、中国当地的镜头组件以及越南和印度的成品生产线。新德里的生产连结奖励计画计画为国内模组组装的资本支出提供报销,鼓励跨国代工製造商实现在地化生产并加快交付速度。台湾的半导体产业深度为相机AI协处理器提供尖端逻辑电路,进一步巩固了该地区的系统性重要地位。

北美和欧洲对高阶手机的需求与严格的车辆安全标准相结合,支撑了对高可靠性模组的稳定需求。美国的XR头显专案正在增加深度感测器阵列的上拉电阻,而欧盟的EN 303645网路安全基准虽然延长了设计週期,但却带来了稳健且可升级的连网摄影机。自动驾驶电动车的补助进一步巩固了摄影机作为关键感测输入的地位。

中东和非洲是成长最快的地区,复合年增长率达6.5%。海湾国家的智慧城市正在部署边缘人工智慧摄影机,用于交通流量和公共分析。当地整合商正与全球硬体供应商合作,部署符合FIPS标准的监控网络,从而带动了对储存、运算和网路升级的二次需求。随着智慧型手机普及率的提高以及区域车辆安全标准与欧盟和美国标准的趋同,南美洲具有长期成长潜力。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 中国旗舰智慧型手机多镜头普及率超过三摄。

- 后视视野和ADAS摄影机强制要求(FMVSS 111,欧盟GSR)

- 在中东智慧城市计划中部署人工智慧赋能的边缘分析监控

- 每个潜望镜/折迭式光学臂模组的升降镜头数量

- PLI计画主导的印度本地模组组装

- 美国和韩国对XR头显的3D/深度感知需求

- 市场限制

- 2024年台湾地震后VCM致动器供应受限

- 萤幕下相机模组晶圆级光学元件的产量比率损失

- 围绕堆迭式CIS架构的专利诉讼愈演愈烈

- EN 303645:欧盟对网路模组网路安全回应的延迟

- 产业生态系分析

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 定价分析

- 超小型相机模组的动态特性

- 投资分析(组装和测试线资本投资)

第五章 市场规模与成长预测

- 按组件

- 影像感测器

- 镜头组

- 相机模组组件

- 音圈马达(AF 和 OIS)

- 依感测器类型

- CMOS

- CCD

- 按像素/分辨率

- 最高可达700万像素

- 8-13 MP

- 1300万像素或以上

- 依焦点类型

- 固定焦距

- 自动对焦

- 透过製造工艺

- 板载晶片(COB)

- 覆晶/晶圆层次电子构装

- 按模组类型

- 紧凑型/CCM

- MIPI介面模组(CSI/DSI)

- 透过使用

- 手机/智慧型手机

- 消费性电子产品(不包括行动装置)

- 车

- 医疗保健和医学影像

- 安全与监控

- 工业与机器人

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 东南亚

- 澳洲

- 亚太其他地区

- 南美洲

- 巴西

- 其他南美洲

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东地区

- 非洲

- 南非

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略性倡议(併购、合资、资本投资)

- 市占率分析

- 公司简介

- LG Innotek Co. Ltd

- Samsung Electro-Mechanics Co. Ltd

- Sunny Optical Technology(Gp)Co. Ltd

- O-Film Group Co. Ltd

- Hon Hai Precision/Foxconn(incl. Sharp)

- Chicony Electronics Co. Ltd

- LuxVisions Innovation Ltd(Lite-On)

- Cowell E Holdings Inc.

- Sony Group Corporation

- OmniVision Technologies Inc.

- STMicroelectronics NV

- AMS Osram AG

- ON Semiconductor Corp.

- Panasonic Corp.

- Largan Precision Co. Ltd

- MinebeaMitsumi(Mitsumi Electric)

- Canon Inc.

- Robert Bosch GmbH

- Continental AG

- Magna International Inc.

- Valeo SA

- e-con Systems Pvt Ltd

第七章 市场机会与未来展望

The camera module market is valued at USD 41.29 billion in 2025 and is forecast to reach USD 50.78 billion by 2030, reflecting a 4.22% CAGR over the period.

Growth is shifting from pure volume expansion to feature-rich innovation, as handset saturation nudges manufacturers toward multi-camera arrays, folded-optics zoom, and on-device AI processing. Automotive safety mandates, edge-analytics surveillance, and emerging XR devices are broadening revenue streams beyond traditional mobile shipments. Component makers are prioritizing supply-chain resilience after the 2024 Taiwan earthquake exposed vulnerability in voice-coil motor (VCM) sourcing, while governments such as India are using production-linked incentives to localize assembly and attract fresh investment. Competitive intensity is rising as Korean, Japanese, and Chinese suppliers race to secure intellectual-property positions in high-value niches like under-display cameras and periscope modules.

Global Camera Module Market Trends and Insights

Multi-camera smartphone adoption exceeding three lenses in Chinese flagships

Chinese handset brands have turned multi-camera arrays into mainstream specifications, pushing the average lens count toward five by 2025. Larger sensor footprints, dedicated ultra-wide and macro shooters, and periscope telephoto modules reinforce smartphones as primary imaging tools. Combined with computational photography, these arrays enable night-mode, portrait, and high-zoom features that differentiate devices in a saturated handset field. Domestic supply chains scale rapidly, pressuring incumbents while elevating the camera module market as a critical arena for brand identity and consumer upgrade intent. Huawei's 200 MP periscope prototype illustrates the leap in optical ambition. AI-driven computational photography squeezes more dynamic range and noise control from small pixels, letting brands market professional-grade imagery without larger sensors.

Rear-visibility and ADAS camera mandates (FMVSS 111, EU GSR)

Safety regulations in the United States and European Union have transformed rear-view and surround-view cameras from optional accessories into compulsory components. Automakers integrate multiple lenses to satisfy blind-spot monitoring, lane-keeping, and pedestrian detection requirements, generating recurring demand for ruggedized, temperature-tolerant modules. The US NCAP now scores blind-spot warning, lane-keeping assist, and pedestrian automatic emergency braking, raising baseline camera count per vehicle. Automakers therefore order surround-view systems that exceed compliance minimums, multiplying sensor nodes and propelling the camera module market.

VCM actuator supply constraints post-2024 earthquake in Taiwan

he 2024 seismic event disrupted a tightly clustered VCM ecosystem, triggering shortages that rippled through smartphone assembly lines worldwide. OEMs accelerated dual-sourcing and pursued piezoelectric alternatives that promise lower power draw and faster response times. Component makers embarked on geographic diversification, erecting capacity in Southeast Asia to de-risk future disasters. The episode also fueled vertical-integration strategies among leading Korean and Chinese suppliers, as access to critical actuators became decisive for premium-camera launch schedule. Alps Alpine disclosed profit pressure from procurement premiums and is diversifying into dual-site manufacturing.Piezoelectric alternatives offer silent, low-power actuation and lower reliance on niche coil winders.

Other drivers and restraints analyzed in the detailed report include:

- AI-enabled edge-analytics surveillance roll-outs in Middle-East smart-city projects

- Periscope/folded-optics boom elevating lens count per module

- Wafer-level optics yield loss in under-display camera modules

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

VCM actuators underpin rapid autofocus and optical image stabilization, making them strategic levers for differentiating photo and video performance. The segment's 7.2% CAGR surpasses the broader camera module market as handset brands spotlight low-light clarity and cinematic motion capture. Earthquake-induced shortages spurred exploration of piezoelectric and MEMS alternatives, yet VCMs retain cost and maturity advantages. Concurrently, image sensors held 48.8% revenue share in 2024, benefiting from stacked architectures that integrate on-sensor memory, enabling burst capture and multi-frame HDR. Advancements in back-side illumination have reduced noise floors, widening dynamic range for mobile and automotive applications.

Integration trends link VCMs with in-sensor phase-detection algorithms, allowing focus systems to swing from hardware to software symbiosis. Lens sets grow in complexity as folded-optics and variable-aperture designs proliferate, while module assemblers adopt active alignment robotics to hit micron-level tolerances. These changes reinforce the camera module market's shift toward higher value per unit even as smartphone growth plateaus. Suppliers investing in actuator innovation and sensor-lens co-development position themselves at the premium end of the camera module industry's margin curve.

CMOS technology owns 90.1% of shipments, its single-chip integration and low power making CCD largely obsolete. Back-side-illuminated (BSI) variants lead the innovation front, expanding at 4.24% CAGR as they boost quantum efficiency for night-mode photography and autonomous-vehicle vision. High-dynamic-range (HDR) CMOS designs now leverage lateral overflow capacitors to capture extreme luminance ranges in a single exposure, satisfying stringent automotive safety requirements.

Three-dimensional stacking pushes processing logic under the photodiode plane, trimming signal paths and opening doors to neuromorphic, event-based sensing that outputs only pixel-level changes. Such architectures reduce bandwidth and energy demand, critical for edge AI deployments. Continuous CMOS optimization ensures the camera module market remains driven by sensor advances that cascade into entire imaging subsystems.

The 8-13 MP band remains the industry's workhorse, controlling 34.7% revenue thanks to its balance of data load, battery drain, and perceived image clarity. Computational photography techniques upscale detail without proportionally larger files, letting OEMs prioritize software pipelines over larger pixel counts. Dual-gain sensors and multi-frame fusion extract superior dynamic range from mid-resolution hardware, reinforcing the segment's dominance across cost-sensitive smartphones and IoT vision nodes.

Conversely, resolutions above 13 MP are climbing at a 6.8% CAGR, driven by flagship periscope cameras, medical imaging probes, and industrial inspection systems that need granular detail. Quad-Bayer pixel-binning enables these high-res sensors to toggle between full-resolution daylight capture and low-noise night shots, guarding power budgets. As module thickness constraints persist, innovations in micro-lens design and deep-trench isolation help maintain quantum efficiency, anchoring the camera module market size gains in premium tiers.

The Camera Module Market Report is Segmented by Component (Image Sensor, Lens Set, and More), Sensor Type (CMOS, and CCD), Pixel/Resolution (Up To 7 MP, 8 - 13 MP, and More), Focus Type (Fixed-Focus, and Autofocus), Manufacturing Process (Chip-On-Board (COB), and More), Module Form-Factor (Compact/CCM, and More), Application (Mobile/Smartphones, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific controlled 59.7% of global revenue in 2024, propelled by dense supply chains spanning sensors in Japan and Taiwan, lens assemblies in mainland China, and finishing lines in Vietnam and India. New Delhi's Production Linked Incentive program reimburses capital expenditure for domestic module assembly, enticing multinational contract manufacturers to localize production and shorten delivery times. Taiwan's semiconductor depth supplies leading-edge logic for on-camera AI co-processors, reinforcing the region's systemic importance.

North America and Europe combine premium handset demand with stringent vehicle-safety standards, underpinning stable requirements for high-reliability modules. US-based XR headset programs add incremental pulls for depth-sensing arrays, while the European Union's EN 303645 cybersecurity baseline extends design cycles but yields hardened, upgradable connected cameras. Subsidy regimes for electric-vehicle autonomy further embed cameras as critical perception inputs.

Middle East & Africa, the fastest-growing region at 6.5% CAGR, banks on smart-city deployments in the Gulf that deploy edge AI cameras for traffic flow and public-safety analytics. Local integrators partner with global hardware vendors to roll out FIPS-compliant surveillance grids, catalyzing secondary demand for storage, compute, and network upgrades. South America offers longer-run upside as smartphone penetration rises and regional auto-safety standards converge with EU and US precedents.

- LG Innotek Co. Ltd

- Samsung Electro-Mechanics Co. Ltd

- Sunny Optical Technology (Gp) Co. Ltd

- O-Film Group Co. Ltd

- Hon Hai Precision/Foxconn (incl. Sharp)

- Chicony Electronics Co. Ltd

- LuxVisions Innovation Ltd (Lite-On)

- Cowell E Holdings Inc.

- Sony Group Corporation

- OmniVision Technologies Inc.

- STMicroelectronics N.V.

- AMS Osram AG

- ON Semiconductor Corp.

- Panasonic Corp.

- Largan Precision Co. Ltd

- MinebeaMitsumi (Mitsumi Electric)

- Canon Inc.

- Robert Bosch GmbH

- Continental AG

- Magna International Inc.

- Valeo SA

- e-con Systems Pvt Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Multi-camera Smartphone Adoption Exceeding 3 Lenses in Chinese Flagships

- 4.2.2 Rear-Visibility and ADAS Camera Mandates (FMVSS 111, EU GSR)

- 4.2.3 AI-Enabled Edge-Analytics Surveillance Roll-outs in Middle-East Smart-City Projects

- 4.2.4 Periscope/Folded-Optics Boom Elevating Lens Count per Module

- 4.2.5 PLI Scheme-Driven Local Assembly of Modules in India

- 4.2.6 3D/Depth Sensing Demand for XR Headsets in United States and Korea

- 4.3 Market Restraints

- 4.3.1 VCM Actuator Supply Constraints Post 2024 Earthquake in Taiwan

- 4.3.2 Wafer-Level Optics Yield Loss in Under-Display Camera Modules

- 4.3.3 Escalating Patent Litigation on Stacked CIS Architectures

- 4.3.4 EN 303645 Cyber-Security Compliance Delays for Networked Modules in EU

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Pricing Analysis

- 4.8 Ultra-miniature Camera Module Dynamics

- 4.9 Investment Analysis (CapEx in Assembly and Test Lines)

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Image Sensor

- 5.1.2 Lens Set

- 5.1.3 Camera Module Assembly

- 5.1.4 Voice-Coil Motor (AF and OIS)

- 5.2 By Sensor Type

- 5.2.1 CMOS

- 5.2.2 CCD

- 5.3 By Pixel/Resolution

- 5.3.1 Up to 7 MP

- 5.3.2 8 - 13 MP

- 5.3.3 Above 13 MP

- 5.4 By Focus Type

- 5.4.1 Fixed-Focus

- 5.4.2 Autofocus

- 5.5 By Manufacturing Process

- 5.5.1 Chip-on-Board (COB)

- 5.5.2 Flip-Chip/Wafer-Level Packaging

- 5.6 By Module Form-Factor

- 5.6.1 Compact/CCM

- 5.6.2 MIPI-Interface Modules (CSI/DSI)

- 5.7 By Application

- 5.7.1 Mobile/Smartphones

- 5.7.2 Consumer Electronics (ex-Mobile)

- 5.7.3 Automotive

- 5.7.4 Healthcare and Medical Imaging

- 5.7.5 Security and Surveillance

- 5.7.6 Industrial and Robotics

- 5.8 By Geography

- 5.8.1 North America

- 5.8.1.1 United States

- 5.8.1.2 Canada

- 5.8.1.3 Mexico

- 5.8.2 Europe

- 5.8.2.1 Germany

- 5.8.2.2 United Kingdom

- 5.8.2.3 France

- 5.8.2.4 Italy

- 5.8.2.5 Spain

- 5.8.2.6 Rest of Europe

- 5.8.3 Asia-Pacific

- 5.8.3.1 China

- 5.8.3.2 Japan

- 5.8.3.3 South Korea

- 5.8.3.4 India

- 5.8.3.5 South East Asia

- 5.8.3.6 Australia

- 5.8.3.7 Rest of Asia-Pacific

- 5.8.4 South America

- 5.8.4.1 Brazil

- 5.8.4.2 Rest of South America

- 5.8.5 Middle East and Africa

- 5.8.5.1 Middle East

- 5.8.5.1.1 United Arab Emirates

- 5.8.5.1.2 Saudi Arabia

- 5.8.5.1.3 Rest of Middle East

- 5.8.5.2 Africa

- 5.8.5.2.1 South Africa

- 5.8.5.2.2 Rest of Africa

- 5.8.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JVs, CapEx)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 LG Innotek Co. Ltd

- 6.4.2 Samsung Electro-Mechanics Co. Ltd

- 6.4.3 Sunny Optical Technology (Gp) Co. Ltd

- 6.4.4 O-Film Group Co. Ltd

- 6.4.5 Hon Hai Precision/Foxconn (incl. Sharp)

- 6.4.6 Chicony Electronics Co. Ltd

- 6.4.7 LuxVisions Innovation Ltd (Lite-On)

- 6.4.8 Cowell E Holdings Inc.

- 6.4.9 Sony Group Corporation

- 6.4.10 OmniVision Technologies Inc.

- 6.4.11 STMicroelectronics N.V.

- 6.4.12 AMS Osram AG

- 6.4.13 ON Semiconductor Corp.

- 6.4.14 Panasonic Corp.

- 6.4.15 Largan Precision Co. Ltd

- 6.4.16 MinebeaMitsumi (Mitsumi Electric)

- 6.4.17 Canon Inc.

- 6.4.18 Robert Bosch GmbH

- 6.4.19 Continental AG

- 6.4.20 Magna International Inc.

- 6.4.21 Valeo SA

- 6.4.22 e-con Systems Pvt Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment