|

市场调查报告书

商品编码

1851746

隔热涂层:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Thermal Barrier Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

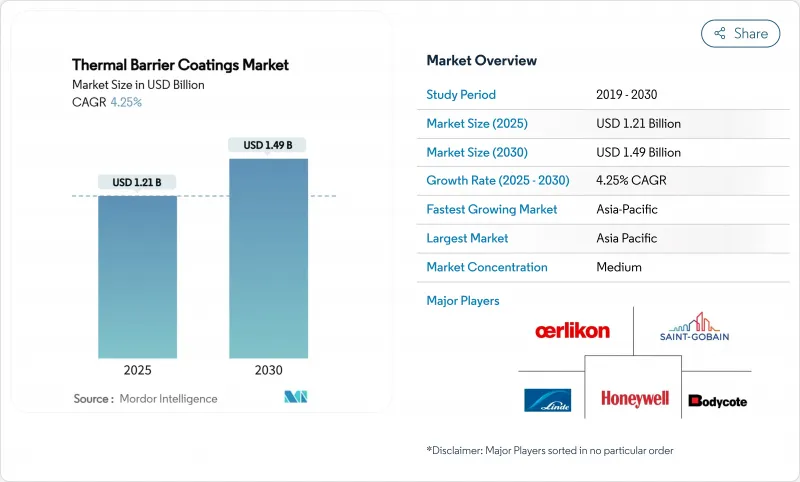

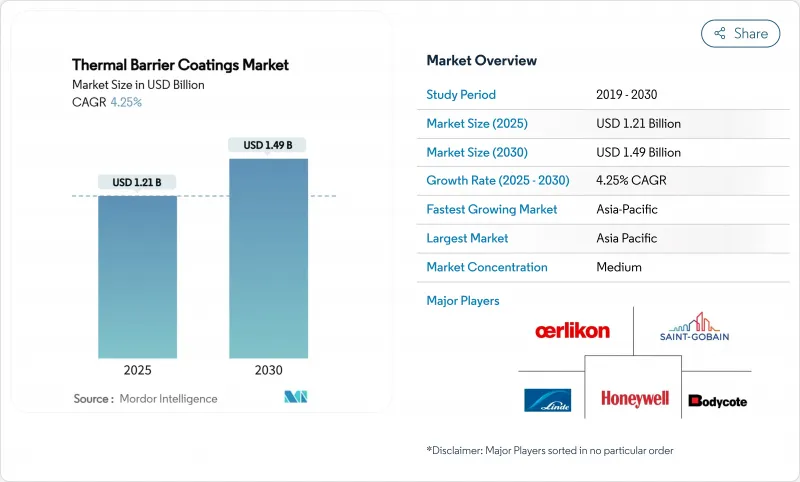

预计到 2025 年,隔热障涂层市场规模将达到 12.1 亿美元,到 2030 年将达到 14.9 亿美元,在预测期(2025-2030 年)内复合年增长率为 4.25%。

持续的需求源自于高温燃气涡轮机、对重量敏感的航太发动机以及依赖先进陶瓷-金属迭层实现可靠隔热的新型高超音速平台。民航机燃油效率目标、工业发电排放减排的需求以及对极端温度研究计画的持续投资,都支撑着隔热涂层市场的上升趋势。中端市场的分散化加剧了竞争激烈程度,传统供应商纷纷部署智慧喷涂设备,而新参与企业则专注于小众、小批量应用领域。同时,在经历了多年的价格波动之后,钇安定氧化锆和稀土元素稳定剂的供应链仍然是战略重点。

全球隔热涂布市场趋势与洞察

航太发动机需求不断成长

新一代涡扇引擎核心燃烧温度接近1650 度C,这迫使涡轮热端零件采用能够承受高强度热循环的多层陶瓷材料。稀土元素锆酸盐的晶格热导率低于传统的8YSZ,因此需要一种新型的专利双层层级构造,以确保金属温度低于临界阈值。通用电气航空航太公司已在2025年前累计10亿美元用于陶瓷基质材料及相关涂层,显示燃料中性推进系统依赖强大的温度控管。永续航空燃料的出现增加了复杂性,因为新的火焰化学成分会改变燃烧室的热通量,从而提升了配备原位健康感测器的智慧涂层的价值。

安装的工业用燃气涡轮机数量不断增加

中国、印度和海湾国家的复合迴圈电厂运转温度超过摄氏1500度C,以实现50%以上的热效率,因此,进气冷却和可使用氢气的燃烧器使得耐应力涂层变得日益重要。由于涡轮燃烧温度每提高摄氏1度都能降低燃料成本,随着电力公司对其机组进行现代化改造以稳定以再生能源为主的电网,隔热涂层市场正在蓬勃发展。供应商现在提供功能梯度烟囱,可在10分钟内将空载加速到满载过程中的热衝击降至最低。

氧化锆和稀土稳定剂的价格波动

2020年全球锆砂产量下降了28%,至今尚未完全恢復,导致涂料生产商面临价格上涨的压力,利润空间受到挤压。钇的供应仍集中在中国矿山,预计2022年产量仅45吨,远低于1500吨的额定产能,这给隔热涂料市场带来了地缘政治风险。主要供应商正透过策略性库存累积和使用钆等替代掺杂剂来降低风险敞口。

细分市场分析

预计到2024年,陶瓷面涂层将占隔热涂层市场56.02%的份额,这进一步证实了钇安定氧化锆系统无与伦比的隔热性能。随着航太业采用结合锆酸钆和8YSZ的双层堆迭结构以提高抗CMAS性能,陶瓷隔热涂层市场的规模预计将持续扩大。

金属黏结层(仅作为底层)的成长速度最快,年复合成长率达 5.91%,这得益于新型 MCrAlY 化学体系能够形成均匀的氧化铝层并减缓剥落。金属间化合物涂层和梯度涂层在电厂维修专案中越来越受欢迎,尤其适用于零件寿命超过 25,000 小时的应用。

到 2024 年,空气等离子喷涂将占据 41.64% 的市场份额,其优势在于材料范围广,且加工经济高效,适用于涡轮叶片、整流罩、燃烧室面板等零件。数位双胞胎模型现在可以即时调整焊枪电流,将孔隙率保持在 ±1% 以内,从而支援以品质为导向的航太供应链。

等离子喷涂PVD技术正以5.48%的复合年增长率快速成长,其低压蒸气羽流沉积出的柱状微结构能够因应热循环而弯曲。电子束PVD仍然是宽体引擎单晶叶片的首选技术,而HVOF则用于油气阀门的耐磨涂层。溶液前驱体等离子喷涂和CVD技术则在需要緻密、无裂纹涂层的领域中占有一席之地。

区域分析

预计到2024年,亚太地区将占据隔热障涂层市场35.14%的份额,并在2030年之前以5.05%的复合年增长率成长。该地区受惠于中国50吉瓦燃气涡轮机建设计画以及日本垂直整合的航空发动机供应链(该供应链同时为国内和出口零件提供涂层服务)。韩国造船厂正在为双燃料液化天然气引擎采用陶瓷烟囱,而印度的民用航太生态系统正在增设专门用于单通道喷射机的独立喷涂工厂。

北美受惠于其强大的航太工业基础,是高超音速技术研发领域最大的投入地区。美国能源局正在资助一项极端温度研究,探索一种适用于1700°C涡轮进口温度的钇铝石榴石变体。加拿大在蒙特利尔为支线喷射机项目提供涂层支持,而墨西哥的巴希奥丛集则为全球汽车原始设备製造商(OEM)提供涡轮增压器部件的涂层,并将其供应给一个整合的供应链。

儘管欧洲产能成长放缓,但其技术实力依然雄厚。德国汽车製造商正在改造涡轮增压器生产线,增设内部喷涂室,以保护智慧财产权。英国和法国正利用「地平线欧洲」津贴来推进陶瓷研究。东欧人事费用低廉,吸引了许多涂层代工企业,但遵守REACH法规的要求迫使当地企业迅速投资减排系统。中东等新兴地区正在开拓大型燃气涡轮机售后市场,而南美洲则在重型燃料发电装置上进行涂层处理,以减少硫化现象。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 航太发动机需求不断成长

- 工业用燃气涡轮机的应用日益普及

- 提高高性能汽车和赛车引擎的效率

- 高超音速飞行器热防护研发计划

- 在海洋和国防领域的应用日益广泛

- 市场限制

- 氧化锆和稀土稳定剂的价格波动

- 加强等离子喷涂车间排放物和粉尘的健康、安全和环境管理措施

- 是否有合适的替代方案

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 依产品类型

- 金属

- 陶瓷製品

- 金属间化合物

- 其他产品(金属玻璃复合材料等)

- 透过涂层技术

- 空气等离子喷涂(APS)

- 高速氧燃料(HVOF)

- 电子束物理气相沉积(EB-PVD)

- 化学气相沉积(CVD)

- 等离子喷涂-PVD(PS-PVD)

- 溶液前驱体等离子喷涂(SPPS)

- 透过涂层材料

- 钇安定氧化锆(8YSZ)

- 稀土元素锆酸盐(GdZrO、LaZrO)

- 氧化铝和莫来石

- MCrAlY黏结层

- 高熵合金涂层

- 按最终用户行业划分

- 航太

- 发电厂

- 车

- 石油和天然气

- 其他终端用户产业(铁路、航运等)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- AandA Thermal Spray Coatings

- APS Materials, Inc.

- Bodycote

- Cincinnati Thermal Spray, Inc.

- General Electric Company

- Hayden Cororation

- Honeywell International Inc.

- KECO Coatings

- Linde Plc.

- Metallic Bonds, Ltd.

- Northwest Mettech Corp.,

- OC Oerlikon Management AG

- Astro Alloys Inc.

- Saint-Gobain

- Sulzer Ltd.

- Tech Line Coatings Industries, Inc.

- Turbine Surface Technologies

- ZIRCOTEC

第七章 市场机会与未来展望

The Thermal Barrier Coatings Market size is estimated at USD 1.21 billion in 2025, and is expected to reach USD 1.49 billion by 2030, at a CAGR of 4.25% during the forecast period (2025-2030).

Sustained demand stems from hotter-running gas turbines, weight-sensitive aerospace engines, and new hypersonic platforms that all rely on advanced ceramic-metal stacks for reliable insulation. Greater fuel-efficiency targets in commercial aviation, the need to curb CO2 from industrial power generation, and persistent investments in ultra-high temperature research programs underpin the upward curve of the thermal barrier coatings market. Competitive intensity is shaped by mid-sized fragmentation as legacy suppliers introduce smart-spray factories while newer entrants chase niche, low-volume applications. Meanwhile, supply chain resilience for yttria-stabilized zirconia and rare-earth stabilizers remains a strategic priority after a multi-year run of price volatility.

Global Thermal Barrier Coatings Market Trends and Insights

Increasing Demand from Aerospace Engines

Next-generation turbofan cores now burn near 1,650 °C, forcing turbine hot sections to adopt multi-layer ceramics that can survive intense thermal cycling. Rare-earth zirconates deliver lower lattice thermal conductivity than conventional 8YSZ, prompting new patents in double-layer architectures that keep metal temperatures below critical thresholds. GE Aerospace earmarked USD 1 billion in 2025 for ceramic matrix composites and allied coatings, signaling that fuel-neutral propulsion hinges on robust thermal management. Sustainable aviation fuels add complexity because new flame chemistries alter heat flux in combustors, raising the value of smart coatings with in-situ health sensors.

Rising Installation of Industrial Gas Turbines

Combined-cycle plants in China, India, and the Gulf are running at >1,500 °C to chase mid-fifties thermal efficiency, so inlet air cooling and hydrogen-capable combustors are sharpening the focus on strain-tolerant coatings. Every percentage point of turbine firing-temperature gain trims fuel cost, which propels the thermal barrier coatings market as utilities modernize fleets to stabilize grids dominated by renewables. Vendors now field functionally graded stacks that dampen thermal shock when ramping from idle to full load in under ten minutes.

Volatile Prices of Zirconia and Rare-Earth Stabilizers

Global zircon sand output slipped by 28% during 2020 and has not fully recovered, exposing coat producers to price spikes that erode margin. Yttrium remains heavily concentrated in Chinese mines, where output reached only 45 t in 2022 against nameplate capacity of 1,500 t, maintaining geopolitical risk for the thermal barrier coatings market. Leading suppliers have turned to strategic stock builds and alternate dopants such as gadolinium to cap exposure.

Other drivers and restraints analyzed in the detailed report include:

- Efficiency Push in High-Performance Automotive and Motorsport Engines

- Hypersonic Vehicle Thermal-Protection R&D Programs

- Tightening HSE Norms on Plasma-Spray Shop Emissions and Dust

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ceramic top coats contributed 56.02% to the thermal barrier coatings market in 2024, underscoring the unmatched thermal insulation offered by yttria-stabilized zirconia systems. The thermal barrier coatings market size for ceramic products is expected to keep expanding as aerospace primes qualify double-layer stacks that pair gadolinium zirconate with 8YSZ for better CMAS resistance.

Metal bond coats, while only a sub-layer, register the quickest growth at 5.91% CAGR, thanks to new MCrAlY chemistries that form uniform alumina scales and delay spallation. Intermetallic and graded coats are spreading in power-plant retrofit programs where component lives stretch beyond 25,000 h. High-entropy alloy coats remain a research subject but they promise phase stability across wider temperature bands.

Air plasma spray held 41.64% share in 2024, favoured for its wide material window and economical throughput across turbine vanes, shrouds, and combustor panels. Digital twin models now adjust torch current in real time to keep porosity within +-1%, supporting the quality-centric aerospace supply chain.

Plasma spray-PVD is climbing at a 5.48% CAGR because its low-pressure vapour plume deposits columnar microstructures that flex with thermal cycles. Electron-beam PVD stays the premium choice for single-crystal blades in wide-body engines, whereas HVOF dominates wear-resistant coatings in oil and gas valves. Solution precursor plasma spray and CVD occupy niches where dense, crack-free films are mandatory.

The Thermal Barrier Coating Market Report Segments the Industry by Product (Metal, Ceramic, and More), Coating Technology (Air Plasma Spray (APS), High-Velocity Oxygen Fuel (HVOF), and More), Coating Material (Yttria-Stabilized Zirconia (8YSZ), Rare-Earth Zirconates (GdZrO, Lazro), and More), End-User Industry (Aerospace, Power Plants, and More) and Geography (Asia-Pacific, North America, Europe, and More).

Geography Analysis

Asia-Pacific held a 35.14% share of the thermal barrier coatings market in 2024 and is set to grow at 5.05% CAGR to 2030. The region gains from China's 50-GW gas-turbine build-out program and Japan's vertically integrated aero-engine supply chain that coats both domestic and export components. South Korea's shipyards adopt ceramic stacks on dual-fuel LNG engines, and India's private aerospace ecosystem adds independent spray shops dedicated to single-aisle jets.

North America benefits from its strong aerospace tier base, standing as the largest spender on hypersonic R&D. The U.S. Department of Energy funds ultra-high temperature research that explores yttrium-aluminium-garnet variants suited for 1,700 °C turbine inlet temperatures. Canada supports coatings for regional-jet programs in Montreal, while Mexico's Bajio cluster coats turbo parts for global auto OEMs, feeding integrated supply chains.

Europe remains technology-rich despite lower installed capacity growth. Germany's carmakers retrofit turbocharger lines with in-house spray booths to protect intellectual property. The UK and France channel Horizon Europe grants to phase-shifting ceramic research. Eastern Europe's lower labour cost lures contract coaters, but compliance with REACH regulation obliges rapid investment in abatement systems. Emerging regions such as the Middle East leverage large gas-turbine aftermarket deals, whereas South America applies coatings on heavy-fuel power units to mitigate sulphidation.

- AandA Thermal Spray Coatings

- APS Materials, Inc.

- Bodycote

- Cincinnati Thermal Spray, Inc.

- General Electric Company

- Hayden Cororation

- Honeywell International Inc.

- KECO Coatings

- Linde Plc.

- Metallic Bonds, Ltd.

- Northwest Mettech Corp.,

- OC Oerlikon Management AG

- Astro Alloys Inc.

- Saint-Gobain

- Sulzer Ltd.

- Tech Line Coatings Industries, Inc.

- Turbine Surface Technologies

- ZIRCOTEC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand from Aerospace Engine

- 4.2.2 Rising Installation of Industrial Gas Turbines

- 4.2.3 Efficiency Push in High-Performance Automotive and Motorsport Engines

- 4.2.4 Hypersonic Vehicle Thermal-Protection Research and Development Programs

- 4.2.5 Growing Usage in Marine and Defense Applications

- 4.3 Market Restraints

- 4.3.1 Volatile Prices of Zirconia and Rare-Earth Stabilizers

- 4.3.2 Tightening HSE Norms on Plasma-Spray Shop Emissions and Dust

- 4.3.3 Availability of Suitable Alternatives

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Metal

- 5.1.2 Ceramic

- 5.1.3 Intermetallic

- 5.1.4 Other Products (Metal-Glass Composite, etc.)

- 5.2 By Coating Technology

- 5.2.1 Air Plasma Spray (APS)

- 5.2.2 High-Velocity Oxygen Fuel (HVOF)

- 5.2.3 Electron-Beam PVD (EB-PVD)

- 5.2.4 Chemical Vapor Deposition (CVD)

- 5.2.5 Plasma Spray-PVD (PS-PVD)

- 5.2.6 Solution Precursor Plasma Spray (SPPS)

- 5.3 By Coating Material

- 5.3.1 Yttria-Stabilized Zirconia (8YSZ)

- 5.3.2 Rare-Earth Zirconates (GdZrO, LaZrO)

- 5.3.3 Alumina and Mullite

- 5.3.4 MCrAlY Bond Coats

- 5.3.5 High-Entropy Alloy Coats

- 5.4 By End-user Industry

- 5.4.1 Aerospace

- 5.4.2 Power Plants

- 5.4.3 Automotive

- 5.4.4 Oil and Gas

- 5.4.5 Other End-user Industries (Railways, Marine, etc.)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AandA Thermal Spray Coatings

- 6.4.2 APS Materials, Inc.

- 6.4.3 Bodycote

- 6.4.4 Cincinnati Thermal Spray, Inc.

- 6.4.5 General Electric Company

- 6.4.6 Hayden Cororation

- 6.4.7 Honeywell International Inc.

- 6.4.8 KECO Coatings

- 6.4.9 Linde Plc.

- 6.4.10 Metallic Bonds, Ltd.

- 6.4.11 Northwest Mettech Corp.,

- 6.4.12 OC Oerlikon Management AG

- 6.4.13 Astro Alloys Inc.

- 6.4.14 Saint-Gobain

- 6.4.15 Sulzer Ltd.

- 6.4.16 Tech Line Coatings Industries, Inc.

- 6.4.17 Turbine Surface Technologies

- 6.4.18 ZIRCOTEC

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment