|

市场调查报告书

商品编码

1851840

收缩标籤和弹力套筒标籤:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Shrink And Stretch Sleeve Labels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

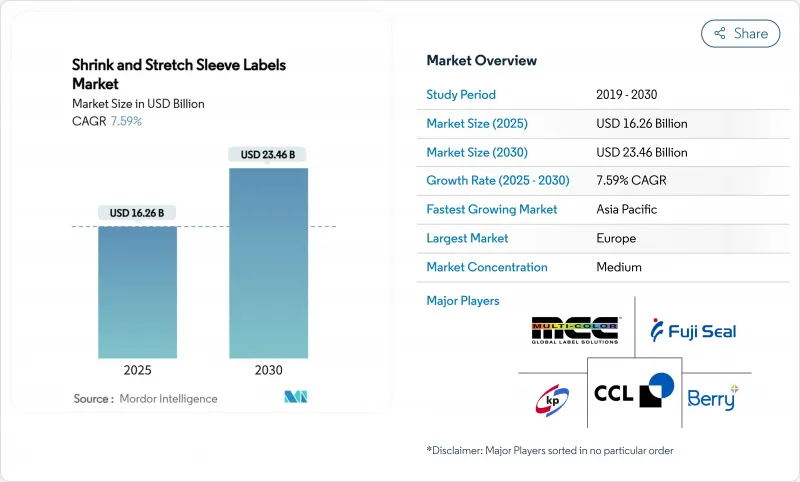

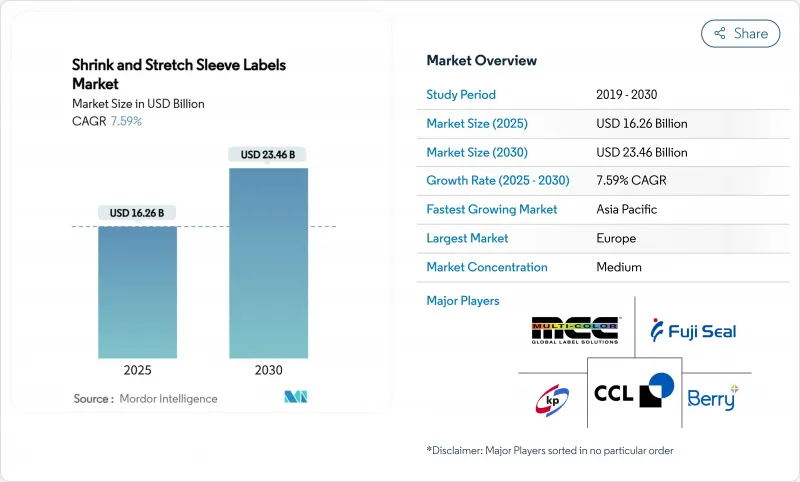

预计到 2025 年,收缩弹力套筒标籤市场规模将达到 162.6 亿美元,到 2030 年将达到 234.6 亿美元,复合年增长率将达到 7.59%。

品牌拥有者正在寻求能够提升货架视觉衝击力、满足防篡改要求并符合严格回收目标的360度全方位图形设计。数位喷墨生产能力的快速提升使得加工商能够印製1000个或更少的套标,从而降低了精酿啤酒商和利基饮料製造商的准入门槛。药品法规要求包装上必须有可见的完整性指示器,这刺激了市场需求;而机能饮料则更倾向于使用能够保持成分效力的避光套标。儘管欧洲因较早采用高端包装而占据市场主导地位,但亚太地区正展现出最快的成长速度,因为可支配收入的成长推动了包装饮料消费量的成长。

全球收缩标籤和弹力套筒标籤市场趋势及洞察

包装饮料和机能饮料的成长

机能饮料采用缩膜技术来保护光敏营养成分,并扩展营养成分錶。三分之一的消费者将增强免疫力列为首要购买标准,因此,富含维生素C、接骨木莓和益生菌的饮料需求正在上升。与感压标籤相比,全包覆式印刷技术可为品牌提供150%的印刷空间,因此可添加产品声明、QR码和防伪封条。 Premier Protein公司透过改用带有防光收缩膜的宝特瓶,减少了35%的塑胶用量,而收缩膜上还带有便于回收的穿孔。一家精酿啤酒厂以前需要订购10万个装饰罐,现在只需订购7000个收缩膜罐即可,从而扩大了季节性产品的供应范围。

利用数位喷墨技术进行小批量印刷,降低小众 SKU 的最小起订量

水性喷墨印刷机的生产速度比传统系统快2.3倍,同时消除了食品包装中溶剂残留的问题。加工商现在可以获利地完成1000件的订单,而柔版印刷的标准起印量为10万件,这使得针对区域促销和电商组合销售的SKU能够更加精准。设计迭代只需几天即可完成,而非几週,为负责人提供即时回馈。预计到2029年,数位生产将占标籤总产量的9.7%,以平方公尺计算的复合年增长率将达到4.4%。将收缩标籤和弹力套筒标籤联线后最后加工与喷墨印表机头整合在一起的市场参与企业,将获得传统凹版印刷生产线无法实现的灵活性。

立式袋与直接印刷袋竞争。

像Velox这样的数位罐体印刷机每分钟可以印刷500罐,无需使用套膜,因此深受注重永续性的精酿品牌的青睐。直接装饰流程省去了收缩线中常见的加热通道、边角料和黏合剂等问题。对于大量碳酸饮料而言,成本差异会进一步扩大,套膜的单价是胶印的2-2.5倍。然而,收缩标籤和弹力套筒标籤市场仍然存在,因为它们可以满足袋装和罐装饮料无法复製的异形容器的需求。

细分市场分析

收缩套标在2024年将占据收缩标籤和弹力套筒标籤市场73.2%的份额,其对复杂瓶型和防篡改安全封条的适用性已得到证实。高速自动化施用器每分钟可处理超过800瓶,误差率低于0.5%。拉伸套无需热风隧道,可降低高达40%的能源消耗,并方便消费者在丢弃前轻鬆移除,从而支持回收利用。到2030年,该细分市场将以8.3%的复合年增长率成长,超过整体市场成长速度,因为欧洲饮料品牌正在采用低碳包装以满足范围3目标。

儘管收缩标籤技术仍将保持其主导地位,但未来的生产模式可能会演变为双效解决方案的生态系统。收缩标籤将用于保护药品管瓶、机能饮料和需要贴合式封盖的异形家用清洁剂。拉伸套标将在价格敏感度和永续性定位相交的领域扩展,例如水、乳製品和经济型可乐。生产线越来越多地将伺服驱动的捲轴施用器与视觉系统相结合,以即时检测套标位置并最大限度地减少返工。供应商正在确保两种套标类型都能使用相同的水性喷墨墨水,从而简化图形切换,并增强收缩标籤和弹力套筒标籤市场的灵活生产策略。

收缩套标和弹力套筒标籤市场按类型(收缩套标、拉伸套)、材料(PVC、PET/PET-G、PE、OPP 和 OPS、其他材料)、最终用户(食品、软性饮料、酒精饮料、化妆品和家居用品、药品、其他最终用户)以及地区(北美、南美、欧洲、亚太、中东和非洲)进行细分。市场预测以美元计价。

区域分析

由于强而有力的环保政策和高端包装文化,欧洲预计2024年将维持29.8%的销售成长。德国、法国和英国正将相当一部分资本支出用于配备节能红外线隧道的套标薄膜生产线。欧盟包装废弃物法规要求包装材料在2030年之前必须可回收利用,这推动了对易于在清洗厂轻鬆剥离的PET材质套标的需求。受精品酒类对精美图案和低起订量要求的製约,该地区每千个套标的平均售价比全球平均高出12%。

亚太地区成长速度最快,年复合成长率达8.1%,主要得益于可支配所得激增、都市化进程加快以及机能饮料的兴起。中国的快递包装标准GB 43352-2023限製油墨中的重金属含量,迫使本地加工商采用符合标准的化学製程。泰国正在试行无标定宝特瓶,将产品资料储存在瓶盖上印刷的QR码中,这给传统的瓶套带来了压力,同时也为智慧互动薄膜铺平了道路。日本是柔性薄膜水性喷墨印刷技术的早期采用者,目前正积极响应《塑胶资源回收法》,并致力于推动本土创新,以期在区域市场引起共鸣。

北美受惠于蓬勃发展的精酿啤酒生态系统和完善的医疗保健系统。药品和非处方营养补充剂对防篡改的需求确保了稳定的需求。南美拥有丰富的PET树脂供应,但易受外汇波动的影响,限制了对高端印刷机的资本投资。中东和非洲的产能相对滞后,但它们是高端进口烈酒和个人护理用品的高价值市场,这些产品依赖套标来提升品牌形象。总而言之,地理多样性支撑了收缩标籤和弹力套筒标籤市场的长期韧性。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 对360度高清影像的需求提升了货架吸引力。

- 对防篡改和防伪包装的需求日益增长

- 包装饮料和机能饮料的成长

- 转向使用可回收的PETG和可漂浮的套管薄膜

- 数位喷墨小批量印刷降低了小众产品SKU的最小起订量

- 用于行销的智慧互动功能(感温变色、二维码)

- 市场限制

- 多材质套管污染PET回收流程的难题

- 与立式袋和DTP的竞争

- 地缘政治供应衝击导致树脂价格波动

- 欧盟/北美PVC套管法规推高了合规成本

- 供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争的激烈程度

- 评估市场的宏观经济因素

第五章 市场规模与成长预测

- 按类型

- 收缩套

- 拉伸套

- 材料

- PVC

- PET/PET-G

- PE

- OPP 和 OPS

- 其他材料(PO、PLA 等)

- 最终用户

- 食物

- 软性饮料

- 酒精饮料

- 化妆品和家居用品

- 製药

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲国家

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲和纽西兰

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- CCL Industries

- Fuji Seal International

- Berry Global Group

- Multi-Color Corporation

- KP Klockner Pentaplast

- Amcor PLC

- Huhtamaki Oyj

- Fort Dearborn Company

- Taghleef Industries

- Siegwerk Druckfarben

- Macfarlane Labels

- Avery Dennison Corp.

- Clondalkin Group

- Cenveo Worldwide

- Schur Flexibles

- Hammer Packaging

- Sleeve Seal Inc.

- PDC-Europe

- Fortalab Labels

- Akar Shrink Packs

第七章 市场机会与未来展望

The shrink and stretch sleeve labels market size stands at USD 16.26 billion in 2025 and is forecast to climb to USD 23.46 billion by 2030, reflecting a steady 7.59% CAGR.

Expansion rests on brand owners seeking 360-degree graphics that lift shelf impact, fulfill tamper-evident mandates, and align with strict recycling targets. Rapid gains in digital inkjet capacity let converters print short runs of 1,000 sleeves or fewer, slashing entry costs for craft brewers and niche beverage producers. Pharmaceutical regulations that require visible integrity indicators reinforce demand, while functional drinks favor light-blocking sleeves that maintain ingredient potency. Europe leads by value thanks to early adoption of premium packaging, yet Asia-Pacific registers the quickest growth as rising disposable incomes boost packaged beverage consumption.

Global Shrink And Stretch Sleeve Labels Market Trends and Insights

Growth in Packaged Beverages and Functional Drinks

Functional drinks use sleeve technology to protect light-sensitive nutrients and display expanded nutritional panels. One in three shoppers now ranks immune support as a top purchase criterion, strengthening demand for drinks formulated with vitamin C, elderberry, and probiotics. Full-body graphics give brands 150% more printable area than pressure-sensitive labels, allowing claims, QR codes, and authenticity seals. Premier Protein trimmed plastic by 35% by migrating to PET bottles wrapped in light-blocking shrink sleeves that feature perforations for easy removal during recycling. Craft brewers that previously needed orders of 100,000 decorated cans now source as few as 7,000 cans fitted with shrink sleeves, widening access for seasonal releases.

Digital Inkjet Short-Run Printing Lowering MOQ for Niche SKUs

Water-based inkjet presses achieve production speeds 2.3 times higher than earlier systems while eliminating solvent residue concerns in food packaging. Converters now profitably accept 1,000-unit jobs versus the 100,000-unit threshold required for flexography, enabling hyper-targeted SKUs for regional promotions and e-commerce bundles. Design iterations finalize in days, not weeks, giving marketers real-time feedback loops. Digital volume is projected to reach 9.7% of total label output by 2029, expanding at a 4.4% CAGR in square-meter terms. Shrink and stretch sleeve labels market participants that integrate inline finishing with inkjet heads gain agility that legacy gravure lines cannot match.

Competition from Stand-Up Pouches and Direct-to-Container Printing

Lightweight pouches use 60% less plastic than rigid bottles and cost only USD 0.20 per unit compared with USD 0.50 for comparable PET containers.Digital can printers such as Velox now run 500 cans per minute, eliminating sleeve film altogether and appealing to sustainability-focused craft brands. Direct decoration removes the heat tunnel, trim scrap, and adhesive usage inherent to shrink lines. Cost differentials widen in high-volume carbonated beverages where sleeve application adds 2-2.5 times unit cost relative to offset printing. The shrink and stretch sleeve labels market nonetheless preserves relevance by serving irregular containers that pouches or cans cannot mimic.

Other drivers and restraints analyzed in the detailed report include:

- Demand for 360° High-Definition Graphics to Boost Shelf Appeal

- Shift Toward Recyclable PETG and Floatable Sleeve Films

- Resin-Price Volatility from Geopolitical Supply Shocks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Shrink sleeves controlled 73.2% of the shrink and stretch sleeve labels market in 2024, reflecting their proven fit for complex bottle geometries and tamper-evident safety seals. High-speed automatic applicators run beyond 800 bottles per minute with error rates under 0.5%, a performance metric difficult for alternate formats. Stretch sleeves need no heat tunnel, trimming energy use by up to 40%, and support recycling because consumers can easily remove them before disposal. The segment's 8.3% CAGR through 2030 surpasses overall market pace as European beverage brands adopt low-carbon packaging to achieve Scope 3 commitments.

Although shrink technology retains primacy, future production likely evolves toward a dual-solution ecosystem. Shrink formats will secure pharmaceutical vials, functional drinks, and contoured household cleaners that demand form-fitting coverage. Stretch sleeves will expand in water, dairy, and economy cola where price sensitivity intersects with sustainability positioning. Production lines increasingly pair servo-driven mandrel applicators with vision systems that inspect sleeve placement in real time, minimizing rework. Suppliers confirm that both sleeve types now accept the same water-based inkjet inks, simplifying graphic changeovers and reinforcing flexible manufacturing strategies in the shrink and stretch sleeve labels market.

Shrink and Stretch Sleeve Labels Market is Segmented by Type (Shrink Sleeve, Stretch Sleeve), Material (PVC, PET/PET-G, PE, OPP and OPS, Other Materials), End User (Food, Soft Drinks, Alcoholic Drinks, Cosmetics and Household, Pharmaceutical, Other End Users), and Geography (North America, South America, Europe, Asia-Pacific, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe retained 29.8% revenue in 2024 due to robust environmental policies and a culture of premium packaging. Germany, France, and the United Kingdom direct a sizable share of capital expenditure toward sleeve film lines fitted with energy-efficient infrared tunnels. EU Packaging and Packaging Waste Regulation stipulates recyclability by 2030, driving demand for PET-based sleeves that detach cleanly in wash plants. The region's average selling price per thousand sleeves exceeds the global mean by 12% because of sophisticated graphic requirements and low minimum runs requested by boutique spirits.

Asia-Pacific records the fastest trajectory at an 8.1% CAGR thanks to surging disposable income, urbanization, and the rise of functional beverages. China's express packaging standard GB 43352-2023 restricts heavy metals in inks, compelling local converters to adopt compliant chemistries. Thailand pilots label-free PET bottles that store product data in QR codes printed on caps, pressuring traditional sleeve volumes yet opening new avenues for smart interactive films. Japan's early adoption of water-based inkjet for flexible film aligns with its plastics resource circulation act, fostering home-grown innovations that resonate across regional markets.

North America benefits from a vibrant craft beer ecosystem and a well-established healthcare framework. Tamper-evident needs in pharmaceuticals and over-the-counter nutritional supplements ensure a baseline of steady demand. South America leverages abundant PET resin supply yet remains exposed to currency swings that limit capital spending on high-end presses. The Middle East and Africa trail in installed capacity but exhibit pockets of high value in premium imported spirits and personal care, which rely on sleeves for brand elevation. Taken together, geographic diversity underpins the long-term resilience of the shrink and stretch sleeve labels market.

- CCL Industries

- Fuji Seal International

- Berry Global Group

- Multi-Color Corporation

- KP Klockner Pentaplast

- Amcor PLC

- Huhtamaki Oyj

- Fort Dearborn Company

- Taghleef Industries

- Siegwerk Druckfarben

- Macfarlane Labels

- Avery Dennison Corp.

- Clondalkin Group

- Cenveo Worldwide

- Schur Flexibles

- Hammer Packaging

- Sleeve Seal Inc.

- PDC-Europe

- Fortalab Labels

- Akar Shrink Packs

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand for 360 degrees high-definition graphics to boost shelf appeal

- 4.2.2 Rising demand for tamper-evident and anti-counterfeit packaging

- 4.2.3 Growth in packaged beverages and functional drinks

- 4.2.4 Shift toward recyclable PETG and floatable sleeve films

- 4.2.5 Digital inkjet short-run printing lowering MOQ for niche SKUs

- 4.2.6 Smart interactive features (thermochromic, QR) enabling marketing

- 4.3 Market Restraints

- 4.3.1 Recycling hurdles of multimaterial sleeves contaminating PET streams

- 4.3.2 Competition from stand-up pouches and direct-to-container printing

- 4.3.3 Resin-price volatility from geopolitical supply shocks

- 4.3.4 EU/NA curbs on PVC sleeves inflating compliance costs

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

- 4.8 Assesment of macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Shrink Sleeve

- 5.1.2 Stretch Sleeve

- 5.2 By Material

- 5.2.1 PVC

- 5.2.2 PET / PET-G

- 5.2.3 PE

- 5.2.4 OPP and OPS

- 5.2.5 Other Materials (PO, PLA, etc.)

- 5.3 By End User

- 5.3.1 Food

- 5.3.2 Soft Drinks

- 5.3.3 Alcoholic Drinks

- 5.3.4 Cosmetics and Household

- 5.3.5 Pharmaceutical

- 5.3.6 Other End Users

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 India

- 5.4.4.3 Japan

- 5.4.4.4 South Korea

- 5.4.4.5 Australia and New Zealand

- 5.4.4.6 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Saudi Arabia

- 5.4.5.1.2 UAE

- 5.4.5.1.3 Turkey

- 5.4.5.1.4 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Egypt

- 5.4.5.2.3 Nigeria

- 5.4.5.2.4 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 CCL Industries

- 6.4.2 Fuji Seal International

- 6.4.3 Berry Global Group

- 6.4.4 Multi-Color Corporation

- 6.4.5 KP Klockner Pentaplast

- 6.4.6 Amcor PLC

- 6.4.7 Huhtamaki Oyj

- 6.4.8 Fort Dearborn Company

- 6.4.9 Taghleef Industries

- 6.4.10 Siegwerk Druckfarben

- 6.4.11 Macfarlane Labels

- 6.4.12 Avery Dennison Corp.

- 6.4.13 Clondalkin Group

- 6.4.14 Cenveo Worldwide

- 6.4.15 Schur Flexibles

- 6.4.16 Hammer Packaging

- 6.4.17 Sleeve Seal Inc.

- 6.4.18 PDC-Europe

- 6.4.19 Fortalab Labels

- 6.4.20 Akar Shrink Packs

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment