|

市场调查报告书

商品编码

1851859

肉类、家禽和海鲜包装:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Meat, Poultry & Seafood Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

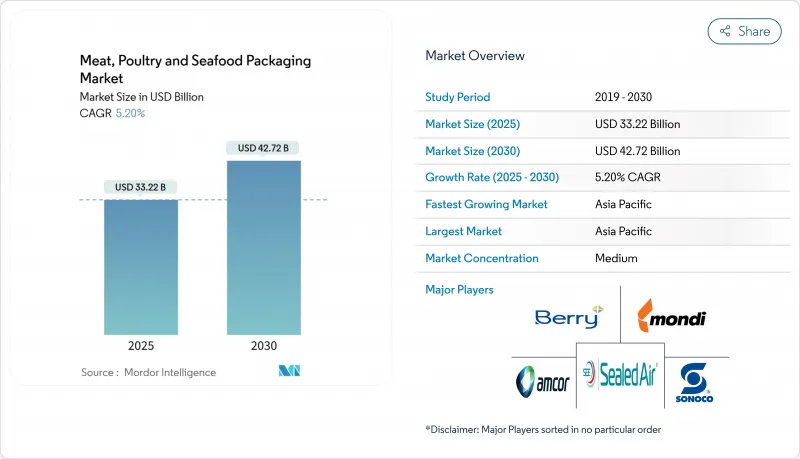

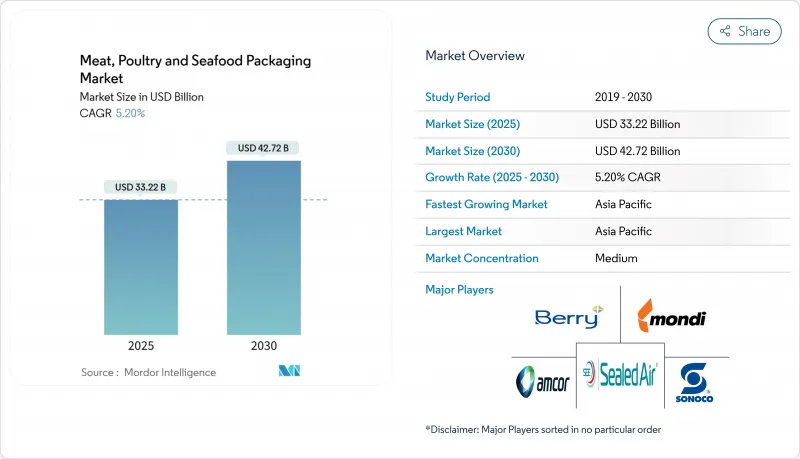

2025 年肉类、家禽和海鲜包装市场价值为 332.2 亿美元,预计到 2030 年将达到 427.2 亿美元,复合年增长率为 5.20%。

随着全球对动物性蛋白质的需求持续成长,加工商正转向先进材料和自动化技术,以在遵守日益严格的食品安全和环境法规的同时,保障净利率。柔性包装、单一材料开发和智慧标籤如今已成为任何工厂重建或新厂计画的标准考量。劳动力短缺推动了对机器人技术的资本投资,而欧盟、日本和北美监管标准的趋同则促进了能够跨境流通的统一设计。永续性概念正促使采购者减少对多层复合材料的依赖,转而选择可回收或可堆肥的结构,但聚合物和金属成本的波动持续对加工商和品牌所有者的盈利造成压力。

全球肉类、家禽及海鲜包装市场趋势及洞察

全球人均蛋白质消费量激增

亚洲收入的快速成长和非洲的都市化,使得肉类、家禽和鱼贝类的需求持续高涨,即便替代蛋白产品已逐渐成为主流。低温运输的日益普及,使得零售商能够将分销范围扩展到以往难以触及的内陆地区,从而增加了包装单位的数量。加工商竞相采购能够防止滴水和变色的材料。同时,成熟市场的优质化促使零售商指定使用能够提升产品大理石纹路和新鲜度的真空贴皮包装。随着消费成长加快,肉类、家禽和鱼贝类包装市场必须在加工能力和保质期性能之间取得平衡,而能够检验阻隔性性能的供应商则有望迅速赢得市场青睐。

日益严格的食品安全和标籤法规

日本的「正面表列」 ( Positive List System)将于2025年6月生效,该制度将允许使用的树脂种类缩减至21个系列和827种添加剂,迫使加工商根据全球通用的资料库检验所有原料。在欧洲,《包装废弃物法规》(Packaging 废弃物 Regulation)将于2030年前禁止使用全氟烷基和多氟烷基物质(PFAS),并强制要求包装可回收,这将重塑全球供应商的材料蓝图。北美零售商正提前调整其产品库存单位(SKU),使其符合相同的标准,以避免日后代价高昂的包装修改。统一的规则还能减少重复测试,并使跨国公司能够在各大洲推广同一套合规体系。因此,随着法律不确定性的消除,肉类、家禽和海鲜包装市场正在加速部署单一材料解决方案。

聚合物和铝投入价格波动

计划于2025年生效的树脂关税可能使北美聚丙烯和聚乙烯的成本上涨12%至20%,迫使加工商将额外费用转嫁给消费者或改变包装设计。铝的溢价可能翻倍至50%,给铝箔盖和蒸馏罐供应商带来压力。动态定价条款正逐渐成为加工商合约中的标准条款,这表明价格波动将是结构性的而非暂时性的。缺乏对冲机制的小型区域性公司面临利润率下降,导致产业整合。这种成本波动将抑制肉类、家禽和海鲜包装市场的短期盈利,并阻碍对新生产线的资本投资。

细分市场分析

预计到2024年,软包装将为肉类、家禽和水产品包装市场贡献142.6亿美元,并在2030年之前以4.3%的复合年增长率成长。凹版印刷的阻隔型枕式包装可在高速生产线上保护新鲜家禽,同时与硬托盘相比,可将包装重量减轻高达75%。加工商重视包装的立方体效率,这使他们能够增加每个托盘的包装数量,从而缓解运输压力。消费者偏好研究也表明,透明立式袋有助于消费者快速检查产品质量,从而增强销售点的信任度。

由于硬质托盘和桶在配送过程中经常堆迭,因此它们在散装商品包装中仍然占据主导地位。但即将实施的发泡聚苯乙烯禁令将加速生物基材料(例如模塑甘蔗浆)的试验。希悦尔(Sealed Air)的可堆肥托盘在满足ASTM D6400标准的同时,也维持了机器人取放所需的刚性。因此,该领域的韧性将取决于材料配方的更新,而不是沿用过时的基材。到2030年,多材料阻隔托盘将过渡到单层PET(聚对苯二甲酸乙二醇酯),这种材料与欧洲的押金返还系统兼容,从而确立其在更广泛的肉类、家禽和海鲜包装市场中的地位。

到2024年,调气包装薄膜将占据肉类、家禽和海鲜包装市场36.45%的最大份额,为全球冷藏柜中使用的气调包装和真空密着包装提供支援。这些薄膜采用EVOH或二氧化硅层,可将氧气渗入量抑制在0.1 cc/m²/天以下,从而确保牛肋眼肉在长达28天内保持色泽。然而,电子商务的兴起正推动预製包装袋和包装盒的发展,预计到2030年,其复合年增长率将达到4.84%,成为成长最快的包装形式。

仓库拣货员更倾向于选择风琴褶包装袋,因为其统一的形状可以避免自动化拣货过程中的计数错误。品牌商则利用其较大的印刷面积来印製烹饪说明或追踪产地的QR码。食品罐头市场日趋成熟,并重新成为紧急套件的必备品,而包装容器对于机构餐饮服务仍然至关重要。无论采用何种包装形式,规格选择的核心在于跌落强度和抗穿刺性能,以承受机器人卸垛作业,这些仍然是肉类、家禽和鱼贝类包装市场竞争的核心性能指标。

肉类、家禽和海鲜包装市场报告按包装类型(硬质包装、软质包装)、产品类型(容器、预製袋、食品罐、涂层薄膜、其他产品类型)、材料类型(聚丙烯 (PP)、聚苯乙烯 (PS)、其他)、包装技术(真空包装 (VP)、其他)、应用(新鲜和冷冻产品、加工产品、其他)和地区对行业进行分类。

区域分析

亚太地区在2024年占据了肉类、禽类和海鲜包装市场34.5%的份额,预计到2030年将维持6.04%的最高复合年增长率。中国和东南亚中阶收入的成长推动了人均肉类消费量的成长。全通路零售在都市区也蓬勃发展,对能够实现当日冷藏配送的坚固包装提出了更高的要求。中国国有科研机构已开始试验以米为原料的培养肉支架,这需要一个既符合生物技术纯度标准又能满足消费者感官需求的超低迁移包装袋。

儘管成长放缓,北美仍然是技术领域的领先者。由于树脂和金属关税可能大幅增加投入成本,加工商正在寻求轻质薄膜以维持毛利率。墨西哥不断成长的柔性包装工厂为美国杂货商和国内超级市场供货,并利用近岸外包策略来减少运输排放。区域加工商还透过将协作机器人与视觉引导式托盘封口机结合来解决劳动力短缺问题,从而加强了肉类、家禽和海鲜包装市场的设备主导采购。

欧洲透过包装和包装废弃物法规,不断扩大永续性的边界,这些法规禁止使用 PFAS 并要求包装可回收。一家跨国公司正在试验使用化学回收的聚酰胺屏蔽层,用于高阻隔牛肉糜包装袋,计划由 Sudpack、BASF和 Werz主导。德国将于 2026 年推出 PET 托盘押金返还系统,这将促使出口商在设计包装时考虑可回收性,以保持其产品在货架上的占有率。中东/非洲和南美洲的蛋白质消费量正在成长,但基础设施的不足阻碍了冷藏技术的广泛应用。然而,对低温运输走廊的投资正在缩小这一差距,这预示着包装供应商将有机会向肉类、家禽和海鲜包装市场的当地加工商提供信贷。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 全球人均蛋白质消费量激增

- 更严格的食品安全和标籤法规

- 零售业向即用型和高吞吐量托盘系统转型

- 冷藏食品电子商务通路的崛起

- 采用单一材料薄膜实现可回收性目标

- 面临劳动力短缺的肉类加工厂对自动化的需求

- 市场限制

- 聚合物和铝投入价格波动

- 再生塑胶在食品接触合规性方面面临的障碍

- 加速禁止使用EPS和多层复合板材

- 替代蛋白质的长期定量风险

- 关键法规结构评估

- 价值链分析

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 关键相关人员影响评估

- 主要用例和案例研究

- 宏观经济因素对市场的影响

- 投资分析

第五章 市场区隔

- 按包装类型

- 硬包装

- 软包装

- 依产品类型

- 容器

- 预製袋和包装袋

- 食品罐头

- 涂层膜

- 其他产品类型

- 依材料类型

- 聚丙烯(PP)

- 聚苯乙烯(PS)

- 聚酯(PET)

- 热成型级PVC/PET

- 铝

- 其他成分

- 透过使用

- 新鲜/冷冻食品

- 加工产品

- 已烹调产品

- 透过包装技术

- 真空包装(VP)

- 调气包装(MAP)

- 真空紧缩包装(VSP)

- 主动式智慧包装

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲国家

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 其他欧洲地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 奈及利亚

- 其他非洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ASEAN

- 澳洲

- 纽西兰

- 亚太其他地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Amcor PLC

- Berry Global Group, Inc.

- Mondi PLC

- Sealed Air Corporation

- Sonoco Products Company

- Smurfit Kappa Group PLC

- DS Smith PLC

- WestRock Company

- Stora Enso Oyj

- Crown Holdings, Inc.

- Can-Pack SA

- Winpak Ltd.

- Huhtamaki Oyj

- Graphic Packaging Holding Co.

- Coveris Holdings SA

- Tetra Pak International SA

- Klockner Pentaplast Group

- Silgan Holdings Inc.

- Bemis Company LLC

- Ardagh Group SA

第七章 市场机会与未来展望

The meat, poultry and seafood packaging market is valued at USD 33.22 Billion in 2025 and is projected to reach USD 42.72 Billion by 2030, reflecting a 5.20% CAGR.

Global appetite for animal protein keeps rising, and processors are turning to advanced materials and automation to protect margins while complying with ever-stricter food-safety and environmental rules. Flexible formats, mono-material developments, and smart labels are now standard considerations at every plant retrofit or greenfield project. Labor shortages intensify capital spending on robotics, and regulatory convergence across the European Union, Japan, and North America is encouraging harmonized designs that travel smoothly across borders. Sustainability ambitions are steering purchasing away from multi-layer laminates toward recyclable or compostable constructions, yet cost volatility in polymers and metals continues to squeeze profitability for converters and brand owners alike.

Global Meat, Poultry & Seafood Packaging Market Trends and Insights

Surging Global Per-Capita Protein Consumption

Rapid income growth across Asia and urbanization in Africa are keeping meat, poultry, and seafood demand high even as alternative proteins enter mainstream discussion. Higher cold-chain penetration enables retailers to extend distribution into once-inaccessible hinterlands, amplifying packaging unit volumes. Processors race to secure materials that prevent drip loss and color shift because quality lapses translate directly into brand erosion. Meanwhile, premiumization in mature markets prompts retailers to specify high-clarity vacuum skin formats that showcase marbling and freshness. As consumption accelerates, the meat, poultry, and seafood packaging market must balance throughput with shelf-life performance, and suppliers that can validate barrier claims quickly win specifications.

Growing Stringency of Food-Safety and Labeling Legislation

Japan's positive-list system, effective June 2025, narrows acceptable resins to 21 families and 827 additives, forcing converters to validate every input against a common global library. In Europe, the Packaging and Packaging Waste Regulation bans PFAS and mandates recyclability by 2030, reshaping material road maps for global suppliers. North American retailers pre-emptively align SKUs to meet these same criteria to avoid costly pack revisions later. Uniform rules also reduce testing duplication, letting multinationals scale one compliant structure across continents. The meat, poultry, and seafood packaging market, therefore, sees faster roll-outs of mono-material solutions as legal uncertainty fades.

Volatile Polymer and Aluminium Input Prices

Resin tariffs scheduled for 2025 could lift North American polypropylene and polyethylene costs by 12-20%, forcing converters to pass on surcharges or redesign packs. Aluminum premiums may double to 50%, pressuring suppliers of foil lidding and retortable cans. Dynamic pricing clauses are becoming standard in converter contracts, signaling structural rather than temporary volatility. Smaller regional firms without hedging instruments face margin erosion that leads to consolidation. This cost turbulence caps near-term profitability for the meat, poultry and seafood packaging market and tempers capital spending on novel lines.

Other drivers and restraints analyzed in the detailed report include:

- Retail Migration to Case-Ready and High-Throughput Tray Systems

- Automation Demand from Labor-Short Meat-Processing Plants

- Food-Contact Compliance Hurdles for Recycled Plastics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Flexible formats contributed USD 14,260 million to the meat, poultry and seafood packaging market size in 2024 and are forecast to climb at a 4.3% CAGR through 2030. Gravure-printed barrier flow wraps protect fresh poultry on high-speed lines while reducing pack weight by up to 75% compared with rigid trays. Processors value the cube efficiency that enables more packs per pallet, easing freight cost pressure. Consumer preference studies also reveal that clear stand-up pouches help shoppers quickly check product quality, reinforcing trust at the point of sale.

Rigid trays and tubs still dominate bulk club formats because they stack well in distribution, but upcoming bans on expanded polystyrene accelerate trials of bio-based options such as sugar-cane molded pulp. Sealed Air's compostable tray maintains the stiffness needed for robotic pick-and-place while meeting ASTM D6400 requirements. The segment's resilience therefore hinges on updating material recipes rather than defending outdated substrates. By 2030, multi-material barrier trays will likely migrate to mono-PET cousins that align with deposit-return systems in Europe, anchoring their relevance within the broader meat, poultry and seafood packaging market.

Coated films generated the largest slice of the meat, poultry and seafood packaging market share at 36.45% in 2024, underpinning modified-atmosphere and vacuum skin packs that appear in chilled cabinets worldwide. These films incorporate EVOH or silicon oxide layers to curb oxygen ingress below 0.1 cc/m2/day, safeguarding color retention on beef rib-eye cuts for up to 28 days. Rising e-commerce volumes are, however, tilting momentum toward pre-made bags and pouches, which are forecast to record the briskest 4.84% CAGR through 2030.

Warehouse pickers favor gusseted pouches because their uniform shape avoids miscounts during automated induction. Brand owners exploit the larger printable area to relay cooking instructions and QR codes that trace farms of origin. Food cans, although mature, enjoy renewed stocking in emergency kits, and containers remain vital in institutional catering. Across formats, specification choices concentrate on drop-strength ratings and puncture resistance to withstand robotic depalletizing, keeping performance metrics central to competition within the meat, poultry and seafood packaging market.

The Meat, Poultry & Seafood Packaging Market Report Segments the Industry Into Packaging Type (Rigid Packaging, and Flexible Packaging), Product Type (Containers, Pre-Made Bags, Food Cans, Coated Films, and Other Product Types), Material Type (Polypropylene (PP), Polystrene (PS), and More), Packaging Technology (Vacuum Packaging (VP), and More), Application (Fresh and Frozen Products, Processed Products, and More), and Geography.

Geography Analysis

Asia-Pacific led with a 34.5% stake in the meat, poultry and seafood packaging market share during 2024 and maintains the highest 6.04% CAGR outlook to 2030. Rising middle-class incomes in China and Southeast Asia elevate per-capita meat intake, and omnichannel retail booms in urban clusters where same-day chilled delivery requires robust packs. China's state-backed labs are already experimenting with rice-based scaffolds for cultured meat, calling for ultra-low-migration pouches that satisfy both biotech purity standards and consumer sensory expectations.

North America remains a technology bellwether even as growth moderates. Tariffs on resins and metals could lift input costs sharply, so converters explore lightweight films to preserve gross margin. Mexico's growing cluster of flexible plants supplies both US grocers and domestic supermarkets, leveraging near-shoring strategies that cut shipping emissions. Regional processors also respond to labor shortages by pairing collaborative robots with vision-guided tray sealers, reinforcing equipment-driven purchases in the meat, poultry and seafood packaging market.

Europe pushes sustainability boundaries through the Packaging and Packaging Waste Regulation, which bans PFAS and demands recyclability. Multinationals pilot chemically recycled polyamide shields for high-barrier beef mince bags, a project led by Sudpack, BASF, and Werz. Deposit-return systems for PET trays launch in Germany in 2026, spurring design-for-recycling among exporters aiming to retain shelf presence. Middle East and Africa along with South America register rising protein uptake, yet infrastructure gaps cap refrigerated penetration. Investments in cold-chain corridors are, however, narrowing that deficit, signaling upside for packaging suppliers willing to extend credit to local converters in the meat, poultry and seafood packaging market.

- Amcor PLC

- Berry Global Group, Inc.

- Mondi PLC

- Sealed Air Corporation

- Sonoco Products Company

- Smurfit Kappa Group PLC

- DS Smith PLC

- WestRock Company

- Stora Enso Oyj

- Crown Holdings, Inc.

- Can-Pack SA

- Winpak Ltd.

- Huhtamaki Oyj

- Graphic Packaging Holding Co.

- Coveris Holdings S.A.

- Tetra Pak International S.A.

- Klockner Pentaplast Group

- Silgan Holdings Inc.

- Bemis Company LLC

- Ardagh Group S.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging global per-capita protein consumption

- 4.2.2 Growing stringency of food-safety and labelling legislation

- 4.2.3 Retail migration to case-ready and high-throughput tray systems

- 4.2.4 Rise of direct-to-consumer chilled-meal e-commerce channels

- 4.2.5 Adoption of mono-material films to hit recyclability targets

- 4.2.6 Automation demand from labour-short meat-processing plants

- 4.3 Market Restraints

- 4.3.1 Volatile polymer and aluminium input prices

- 4.3.2 Food-contact compliance hurdles for recycled plastics

- 4.3.3 Accelerating EPS and multi-layer laminate bans

- 4.3.4 Long-term volume risk from alt-protein penetration

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact Assessment of Key Stakeholders

- 4.9 Key Use Cases and Case Studies

- 4.10 Impact on Macroeconomic Factors of the Market

- 4.11 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Packaging Type

- 5.1.1 Rigid Packaging

- 5.1.2 Flexible Packaging

- 5.2 By Product Type

- 5.2.1 Containers

- 5.2.2 Pre-made Bags and Pouches

- 5.2.3 Food Cans

- 5.2.4 Coated Films

- 5.2.5 Other Product Types

- 5.3 By Material Type

- 5.3.1 Polypropylene (PP)

- 5.3.2 Polystyrene (PS)

- 5.3.3 Polyester (PET)

- 5.3.4 Thermoform-grade PVC/PET

- 5.3.5 Aluminium

- 5.3.6 Other Materials

- 5.4 By Application

- 5.4.1 Fresh and Frozen Products

- 5.4.2 Processed Products

- 5.4.3 Ready-to-Eat Products

- 5.5 By Packaging Technology

- 5.5.1 Vacuum Packaging (VP)

- 5.5.2 Modified-Atmosphere Packaging (MAP)

- 5.5.3 Vacuum-Skin Packaging (VSP)

- 5.5.4 Active and Intelligent Packaging

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Nordics

- 5.6.3.7 Rest of Europe

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 Saudi Arabia

- 5.6.4.1.2 United Arab Emirates

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Egypt

- 5.6.4.2.3 Nigeria

- 5.6.4.2.4 Rest of Africa

- 5.6.5 Asia-Pacific

- 5.6.5.1 China

- 5.6.5.2 India

- 5.6.5.3 Japan

- 5.6.5.4 South Korea

- 5.6.5.5 ASEAN

- 5.6.5.6 Australia

- 5.6.5.7 New Zealand

- 5.6.5.8 Rest of Asia-Pacific

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor PLC

- 6.4.2 Berry Global Group, Inc.

- 6.4.3 Mondi PLC

- 6.4.4 Sealed Air Corporation

- 6.4.5 Sonoco Products Company

- 6.4.6 Smurfit Kappa Group PLC

- 6.4.7 DS Smith PLC

- 6.4.8 WestRock Company

- 6.4.9 Stora Enso Oyj

- 6.4.10 Crown Holdings, Inc.

- 6.4.11 Can-Pack SA

- 6.4.12 Winpak Ltd.

- 6.4.13 Huhtamaki Oyj

- 6.4.14 Graphic Packaging Holding Co.

- 6.4.15 Coveris Holdings S.A.

- 6.4.16 Tetra Pak International S.A.

- 6.4.17 Klockner Pentaplast Group

- 6.4.18 Silgan Holdings Inc.

- 6.4.19 Bemis Company LLC

- 6.4.20 Ardagh Group S.A.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment