|

市场调查报告书

商品编码

1851903

生物辨识技术:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Biometrics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

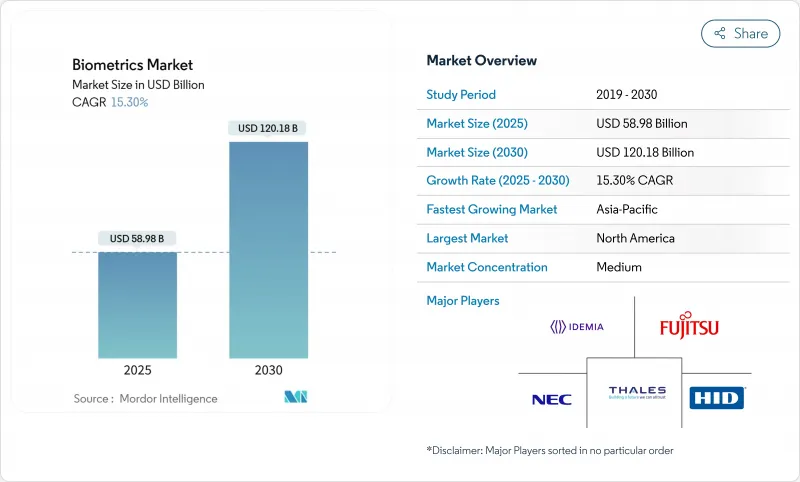

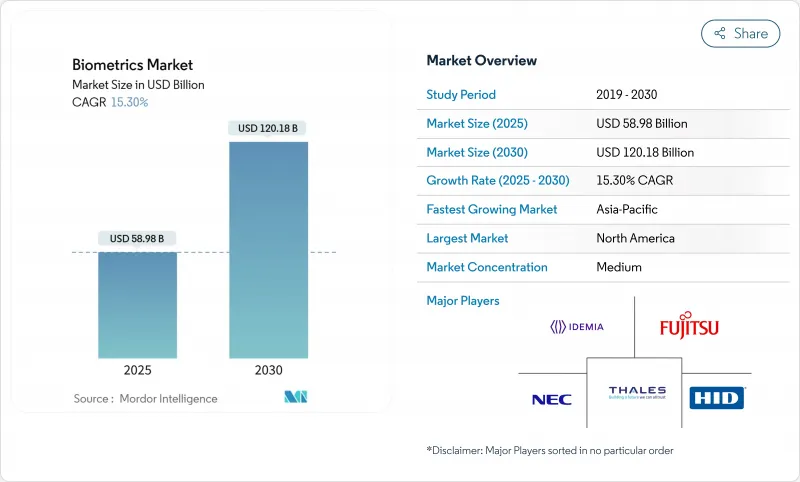

预计到 2025 年,生物辨识技术市场规模将成长至 589.8 亿美元,到 2030 年将成长至 1,201.8 亿美元,复合年增长率为 15.30%。

政府数位身分识别计划、支付代币化以及机场现代化建设的加速推动了这一增长,也催生了对无摩擦身份验证的需求。儘管目前的部署仍以硬体为主,但随着企业从点解决方案转向平台模式,云端软体引擎正经历最快的成长。中国和欧盟的新隐私法规在加强合规要求的同时,也鼓励采用兼顾准确性和用户授权管理的多模态架构。在北美,自2025年5月起实施的REAL ID引发了联邦和州政府的紧急采购浪潮,用于在机场和陆路交通管理部门部署相关设备。在亚太地区,将生物辨识技术整合到超级应用、电子钱包和银行电子KYC框架中,是推动长期需求成长的主要因素。

全球生物辨识市场趋势与洞察

亚洲各国政府支持的国家电子识别计划

亚洲各国政府正引领大规模数位身分转型。韩国基于智慧型手机的居民登记卡以及越南决定在2025年7月前将生物识别身份扩展到外国人,为建造包容性生态系统树立了标竿。印尼耗资2亿美元的INA数位平台以及菲律宾8,950万人的公民登记计划,将使此前银行帐户银行服务的成年人也能获得金融服务。斯里兰卡结合指纹、脸部和视网膜扫描的多模态计画于2026年完成,显示新兴经济体正在跨越传统基础设施的鸿沟。

EMVCo 和 ISO 标准先进指纹支付卡

随着EMVCo和ISO标准的统一,生物辨识卡已从试点阶段过渡到商业发行阶段。英飞凌SECORA Pay Bio晶片和泰雷兹公司的全球试验降低了误报率,并提高了交易限额。万事达卡的身份验证和密码支援功能可实现无缝认证,帮助发卡机构减少诈欺和扣回争议帐款。供应商预测,到2028年,生物辨识卡的出货量将达到1.133亿张,因为银行正在优先发展无需PIN码的非接触式支付体验。

GDPR 和 BIPA 诉讼风险抑制推广

2024年至2025年间,BIPA(伊利诺州生物辨识资讯隐私法案)的赔偿总额将超过2亿美元,其中包括Clearview AI支付的5,175万美元。这表明,未经明确同意部署脸部认证的公司将面临巨额赔偿责任。 GDPR(欧盟通用资料保护规范)严格的资料最小化和本地处理规则将使每个欧洲安装专案的合规成本增加5万至20万欧元(5.65万至22.6万美元),从而缩小小型计划的潜在市场。美国联邦贸易委员会(FTC)对Rite Aid的执法行动为美国演算法偏见审核树立了先例,迫使供应商重新设计系统架构,以实现隐私保护。

细分市场分析

软体引擎从辅助角色跃升为成长最快的元件,复合年增长率高达 16.6%,而硬体则维持了 42.5% 的收入份额。各组织正在评估云端协作、基于人工智慧的活体侦测以及能够持续适应不断演变的诈欺行为的去中心化身分钱包。 Entrust 收购 Onfido 延续了这一发展趋势,新增的深度造假防护功能可将身分防伪能力提升五倍。

在硬体领域,专用感测器对于向安全元件提供加密模板至关重要。英飞凌的汽车指纹识别晶片表明,量产级组件正在将生物识别市场拓展到移动出行和门禁领域。服务领域的规模虽然最小,但随着整合商为受监管行业量身打造多模态部署方案,其应用也日益广泛。

虹膜辨识将以18.2%的复合年增长率成长,这得益于液态透镜光学技术的进步,该技术可降低材料成本并缩小外形规格。指纹辨识技术将持续发展壮大,智慧型手机、支付卡和考勤系统等应用将推动其普及,预计到2024年将占据生物辨识市场37.0%的份额。脸部认证将稳定渗透到机场和体育场馆等场所,而语音分析技术将在客服中心身份验证领域占据一席之地。

行为生物辨识技术,特别是步态和击键动态特征,增加了一层被动式安全防护,在不增加使用者操作负担的情况下提升了安全性。成熟的指纹和脸部辨识解决方案正越来越多地与虹膜、手掌和语音模组相结合,形成多模态套件,从而实现收入来源多元化并降低单一模态辨识的风险。

随着卫生和便利性逐渐取代传统观念,非接触式辨识技术正以17.1%的复合年增长率快速成长。预计到2024年,非接触式系统将占据生物辨识市场37.0%的份额,但其成长动能正逐渐被医疗保健和零售领域部署的非接触式指纹、脸部认证和虹膜辨识终端所取代。 ZKTeco 认为,非接触式偏好是长期趋势。

以大陆集团车载摄影机和雷射组合为代表的隐形感测技术,将生物辨识技术从门禁扩展到健康监测。凭藉先进的人工智慧技术,非接触式辨识的精确度已接近接触式辨识的标准,满足了高安全保障领域的需求。

区域分析

2024年,北美将占全球收入的30.7%,这主要得益于联邦政府的资金支持和私人企业的广泛应用。美国运输安全管理局(TSA)加快扩容通道,以及国土安全部(DHS)为身分识别管理预留的2.508亿美元预算,为供应商提供了多年稳定的市场需求。加拿大和墨西哥将对其陆地边境的电子闸门进行现代化改造,以简化贸易流程并增强其在北美大陆的影响力。

预计到2030年,亚太地区的复合年增长率将达到18.5%,成为成长最快的地区。韩国全国行动身分识别系统的建成、中国人脸部辨识规则的规范化以及印度与Aadhaar(印度居民身分识别系统)挂钩的付费服务,将推动一个规模超过任何单一国家计画的统一生物辨识市场的发展。该地区48亿数位钱包用户正在推动银行和通讯业者将生物辨识KYC(了解你的客户)流程从可选转变为强制执行。

在 GDPR 的严格审查下,欧洲保持了稳步增长:欧盟边境系统在申根国家推广边境生物识别技术,美国新的信任框架促进了私营部门凭证创新,北欧国家证明,设备端处理既能满足隐私监管机构的要求,又不牺牲速度,从而塑造了整个欧洲大陆的采购标准。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 亚洲政府支持的国家电子识别计划

- 北美和欧洲的EMVCo和ISO标准推进指纹支付卡

- 疫情后欧洲商业不动产对非接触式实体存取的需求

- 美国运输安全管理局蓝图推动联邦采购激增

- 中国的「智慧机场2025」计画加速推进人脸和语音生物辨识技术的应用

- 海湾合作委员会和非洲中央银行的生物辨识KYC强制令

- 市场限制

- GDPR和BIPA诉讼风险阻碍了脸部认证的广泛应用

- 演算法对深色人种的偏见引发采购暂停

- CMOS影像感测器短缺阻碍了指纹模组的供应。

- 南美零售连锁店的整合与投资报酬率问题

- 价值/供应链分析

- 监理展望

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业相关利益者分析

- 投资与资金筹措分析

第五章 市场规模与成长预测

- 按组件

- 硬体

- 软体

- 服务

- 透过生物识别方式

- 生理生物辨识市场

- 指纹自动指纹辨识系统

- 非自动指纹辨识系统(AFIS)指纹识别

- 脸部辨识

- 虹膜辨识

- 其他(手掌、手部几何形状)

- 行为生物辨识市场

- 语音辨识

- 签名检验

- 其他(步态分析、击键动力学)

- 生理生物辨识市场

- 按联繫类型

- 联繫类型

- 非接触式

- 杂交种

- 按身份验证类型

- 单一因素

- 多因素

- 透过使用

- 物理和逻辑存取控制

- 考勤管理

- 支付和交易认证

- 电子护照和边境管制

- 病患识别及电子病历安全

- 客户註册(电子身份验证)

- 公共监督与安全

- 车载和智慧车辆接口

- 按最终用途行业划分

- 政府和执法部门

- BFSI

- 卫生保健

- 消费性电子产品

- 商业和零售

- 旅行和移民

- 军事/国防

- 车

- 教育

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲国家

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- ASEAN

- 澳洲

- 纽西兰

- 其他亚太地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 以色列

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 肯亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Thales Group

- NEC Corporation

- IDEMIA France SAS

- Fujitsu Limited

- HID Global Corporation

- Assa Abloy AB

- Aware Inc.

- Suprema Inc.

- Synaptics Incorporated

- Bio-Key International Inc.

- Zwipe AS

- Fingerprint Cards AB

- M2SYS Technology

- Infineon Technologies AG

- Entrust Corporation

- ImageWare Systems Inc.

- Phonexia sro

- BioID AG

- Crossmatch Technologies Inc.

- Hitachi Ltd.

第七章 市场机会与未来展望

The biometrics market size is valued at USD 58.98 billion in 2025 and is forecast to expand to USD 120.18 billion by 2030, advancing at a 15.30% CAGR.

The expansion is underpinned by government digital-ID programs, rising payments tokenization, and surging airport modernization that collectively elevate the need for frictionless identity proofing. Hardware still dominates current deployments, yet cloud-ready software engines are scaling fastest as enterprises shift from point solutions to platform models. New privacy regulations in China and the European Union are tightening compliance requirements, simultaneously encouraging multi-modal architectures that balance accuracy with consent management. In North America, REAL ID enforcement from May 2025 is driving an urgent wave of federal and state procurements for airport and DMV roll-outs. Asia Pacific's integration of biometrics into super-apps, wallets, and bank e-KYC frameworks positions the region as the long-run demand accelerator.

Global Biometrics Market Trends and Insights

Government-backed National e-ID Programs Across Asia

Asian authorities are orchestrating large-scale digital identity transformations. South Korea's smartphone-based resident registration card and Vietnam's decision to extend biometric IDs to foreign nationals by July 2025 have set benchmarks for inclusive ecosystems. Indonesia's USD 200 million INA Digital platform and the Philippines' registration of 89.5 million citizens unlock financial services for previously unbanked adults. Sri Lanka's multi-modal program combining fingerprints, face, and retina scans targets completion in 2026, illustrating how emerging economies leapfrog legacy infrastructures.

EMVCo and ISO Standards Catalyzing Fingerprint Payment Cards

Harmonized EMVCo and ISO rules have moved biometric cards from pilots to commercial issuance. Infineon's SECORA Pay Bio silicon and Thales' global trials cut false-accept rates and allow higher transaction ceilings . Mastercard's Identity Check and passkey support promise frictionless authentication, helping issuers reduce fraud and chargebacks. Vendors forecast shipments of 113.3 million biometric cards by 2028 as banks prioritize PIN-free contactless experiences.

GDPR and BIPA Litigation Risks Curtailing Roll-outs

More than USD 200 million in BIPA settlements during 2024-2025, including Clearview AI's USD 51.75 million payment, signals material liability for enterprises deploying facial recognition without explicit consent. GDPR's strict data-minimization and local-processing rules add EUR 50,000-200,000 (USD 56,500-226,000) compliance cost per European installation, shrinking the addressable base for small projects. The FTC's enforcement against Rite Aid sets a U.S. precedent for algorithmic-bias audits, compelling vendors to redesign architectures for privacy by design.

Other drivers and restraints analyzed in the detailed report include:

- U.S. TSA Biometrics Road-map Driving Federal Procurement Surge

- China's "Smart Airport 2025" Policy Accelerating Face & Voice Biometrics

- Algorithmic Bias Triggering Procurement Moratoriums

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software engines grew from a supporting role to the highest-growth component at a 16.6% CAGR, even while hardware kept the 42.5 revenue share. Organizations value cloud orchestration, AI-based liveness detection, and decentralized identity wallets that continuously adapt to evolving fraud. Entrust's acquisition of Onfido aligns with this trajectory, adding deep-fake countermeasures that improved forged-ID prevention five-fold.

The hardware segment remains indispensable where specialized sensors deliver cryptographic templates to secure elements. Infineon's automotive-qualified fingerprint ICs illustrate how production-grade components expand the biometrics market into mobility and access domains. Services, while smallest, record consistent uptake as integrators customize multi-modal deployments for regulated industries.

Iris recognition posts an 18.2% CAGR, supported by liquid-lens optics that lower bill-of-material cost and shrink form factors. Fingerprint remains entrenched with 37.0% of biometrics market share in 2024, thanks to smartphones, payment cards, and time-clock systems. Facial recognition steadily penetrates airports and stadiums, while voice analytics gains footing in call-center authentication.

Behavioral biometrics, particularly gait and keystroke dynamics, add passive layers that elevate security without user friction. Mature fingerprint and facial solutions increasingly pair with iris, palm-vein, or voice modules in multi-modal kits, diversifying revenue and diluting single-modality risk.

Contactless modalities are scaling at 17.1% CAGR as hygiene and convenience trump legacy mindset. The biometrics market size for contact-based systems, despite a 37.0% share in 2024, is losing momentum to touchless fingerprint, face, and iris kiosks rolled out in healthcare and retail. ZKTeco identifies contactless preference as a long-term secular shift.

Invisible sensing, showcased by Continental's in-vehicle camera-laser combo, morphs biometrics beyond access into wellness monitoring. AI improvements cut false rejects, moving touchless accuracy closer to contact-based benchmarks and satisfying high-assurance sectors.

The Biometrics Market Report is Segmented by Component (Hardware, Software, Services), Biometric Modality (Physiological, Behavioral), Contact Type (Contact-Based, Contactless, Hybrid), Authentication Type (Single-Factor, Multi-Factor), Application (Access Control, Payment Authentication, and More), End-Use Industry (Government, BFSI, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America produced 30.7% of global revenue in 2024, anchored by federal budgets and widespread private-sector adoption. TSA's accelerating lane expansions and DHS's USD 250.8 million line-item for identity management provide a multi-year demand floor for vendors . Canada and Mexico modernize land-border e-gates to streamline trade, reinforcing continental scale.

Asia Pacific records the steepest trajectory with an 18.5% CAGR forecast to 2030. South Korea's nationwide mobile-ID completion, China's codified face-recognition rules, and India's Aadhaar-linked pay services cultivate a unified biometrics market bigger than any single-country program. The region's 4.8 billion digital-wallet users push biometric KYC from optional to mandatory across banks and telecoms.

Europe's growth remains steady under strict GDPR oversight. The EU Entry/Exit System rolls out border biometrics across Schengen states, while the United Kingdom's new trust framework fosters private-sector credential innovation. Nordic pilots prove that on-device processing can satisfy privacy watchdogs without sacrificing speed, shaping procurement criteria across the continent.

- Thales Group

- NEC Corporation

- IDEMIA France SAS

- Fujitsu Limited

- HID Global Corporation

- Assa Abloy AB

- Aware Inc.

- Suprema Inc.

- Synaptics Incorporated

- Bio-Key International Inc.

- Zwipe AS

- Fingerprint Cards AB

- M2SYS Technology

- Infineon Technologies AG

- Entrust Corporation

- ImageWare Systems Inc.

- Phonexia s.r.o.

- BioID AG

- Crossmatch Technologies Inc.

- Hitachi Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government-backed National e-ID Programs Across Asia

- 4.2.2 EMVCo and ISO Standards Catalyzing Fingerprint Payment Cards in North America and Europe

- 4.2.3 Post-pandemic Demand for Touch-free Physical Access in European Commercial Real-estate

- 4.2.4 U.S. TSA Road-map Driving Federal Procurement Surge

- 4.2.5 China's "Smart Airport 2025" Policy Accelerating Face and Voice Biometrics

- 4.2.6 Biometric KYC Mandates by GCC and African Central Banks

- 4.3 Market Restraints

- 4.3.1 GDPR and BIPA Litigation Risks Curtailing Facial-Recognition Roll-outs

- 4.3.2 Algorithmic Bias Against Dark-Skin Demographics Triggering Procurement Moratoriums

- 4.3.3 CMOS Image-Sensor Shortages Constricting Fingerprint Module Supply

- 4.3.4 Integration and ROI Concerns in South-American Retail Chains

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Industry Stakeholder Analysis

- 4.9 Investment and Funding Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Biometric Modality

- 5.2.1 Physiological Biometrics

- 5.2.1.1 Fingerprint AFIS

- 5.2.1.2 Fingerprint Non-AFIS (Automated Fingerprint Identification System)

- 5.2.1.3 Facial Recognition

- 5.2.1.4 Iris Recognition

- 5.2.1.5 Others (Palm Vein, Hand Geometry)

- 5.2.2 Behavioral Biometrics

- 5.2.2.1 Voice Recognition

- 5.2.2.2 Signature Verification

- 5.2.2.3 Others (Gait Analysis, Keystroke Dynamics)

- 5.2.1 Physiological Biometrics

- 5.3 By Contact Type

- 5.3.1 Contact-based

- 5.3.2 Contactless

- 5.3.3 Hybrid

- 5.4 By Authentication Type

- 5.4.1 Single-factor

- 5.4.2 Multi-factor

- 5.5 By Application

- 5.5.1 Physical and Logical Access Control

- 5.5.2 Time and Attendance Management

- 5.5.3 Payment and Transaction Authentication

- 5.5.4 e-Passport and Border Control

- 5.5.5 Patient Identification and EHR Security

- 5.5.6 Customer On-boarding (eKYC)

- 5.5.7 Public Surveillance and Safety

- 5.5.8 Automotive and Smart Vehicle Interfaces

- 5.6 By End-Use Industry

- 5.6.1 Government and Law Enforcement

- 5.6.2 BFSI

- 5.6.3 Healthcare

- 5.6.4 Consumer Electronics

- 5.6.5 Commercial and Retail

- 5.6.6 Travel and Immigration

- 5.6.7 Military and Defense

- 5.6.8 Automotive

- 5.6.9 Education

- 5.6.10 Others

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 United Kingdom

- 5.7.3.2 Germany

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 Nordics

- 5.7.3.7 Russia

- 5.7.3.8 Rest of Europe

- 5.7.4 Asia Pacific

- 5.7.4.1 China

- 5.7.4.2 Japan

- 5.7.4.3 South Korea

- 5.7.4.4 India

- 5.7.4.5 ASEAN

- 5.7.4.6 Australia

- 5.7.4.7 New Zealand

- 5.7.4.8 Rest of Asia Paccific

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 Saudi Arabia

- 5.7.5.1.2 United Arab Emirates

- 5.7.5.1.3 Turkey

- 5.7.5.1.4 Israel

- 5.7.5.1.5 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Nigeria

- 5.7.5.2.3 Kenya

- 5.7.5.2.4 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes global overview, market overview, core segments, financials, strategic information, market rank/share, products and services, recent developments)

- 6.4.1 Thales Group

- 6.4.2 NEC Corporation

- 6.4.3 IDEMIA France SAS

- 6.4.4 Fujitsu Limited

- 6.4.5 HID Global Corporation

- 6.4.6 Assa Abloy AB

- 6.4.7 Aware Inc.

- 6.4.8 Suprema Inc.

- 6.4.9 Synaptics Incorporated

- 6.4.10 Bio-Key International Inc.

- 6.4.11 Zwipe AS

- 6.4.12 Fingerprint Cards AB

- 6.4.13 M2SYS Technology

- 6.4.14 Infineon Technologies AG

- 6.4.15 Entrust Corporation

- 6.4.16 ImageWare Systems Inc.

- 6.4.17 Phonexia s.r.o.

- 6.4.18 BioID AG

- 6.4.19 Crossmatch Technologies Inc.

- 6.4.20 Hitachi Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment