|

市场调查报告书

商品编码

1851916

垂直升降模组(VLM):市场占有率分析、产业趋势、统计数据、成长预测(2025-2030)Vertical Lift Module (VLM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

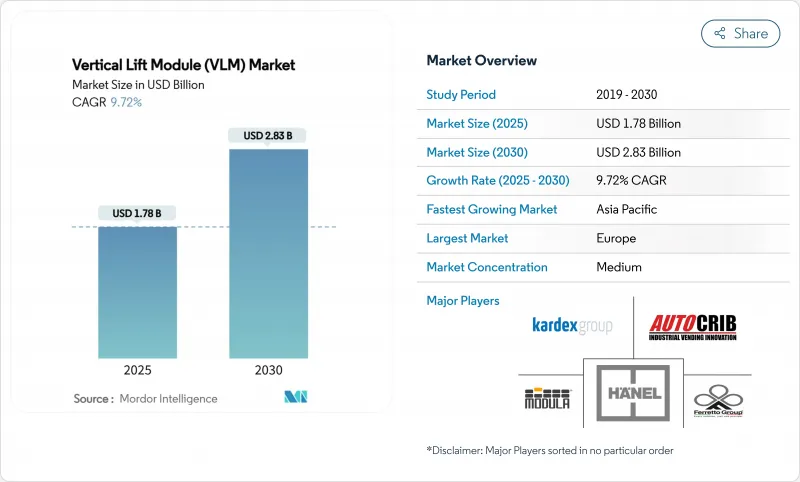

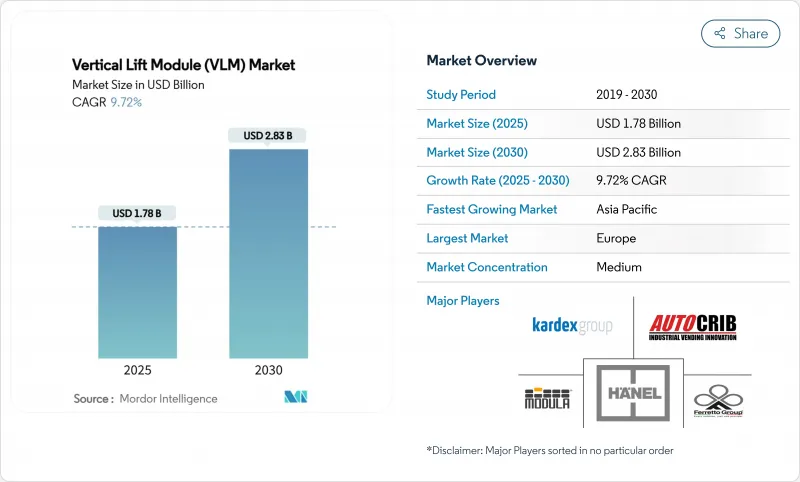

预计到 2025 年,垂直升降模组市场规模将达到 17.8 亿美元,到 2030 年将达到 28.3 亿美元,年复合成长率为 9.72%。

随着电商企业用货到人系统取代履约的托盘货架,将订单履行週期从数天缩短至数小时,市场需求加速成长。汽车製造商增设自动化缓衝储存系统以维持准时制生产节奏,生命科学无尘室采用封闭式模组以满足可追溯性和污染控制要求。低温运输营运商将节能型双碟马达视为24个月内实现投资回报的途径,而预测性维护软体套件则为设备製造商开闢了售后服务收入来源。

全球垂直升降模组(VLM)市场趋势与洞察

电子商务主导的微型履约的兴起

零售商正从区域配送中心转向位于现有门市内部或附近的自动化微型履约中心。预计到2030年,全球将有超过7300个自动化微型履约中心运作,其中近一半位于美国,这将持续推动对占地面积不超过10000平方英尺的紧凑型高密度模组的运作。透过与机器人拣货机集成,垂直物流模组(VLM)可实现99.99%的订单准确率,同时减少高达66%的人工需求。儘管供应链的限制减缓了部分零售商的采用速度,但早期采用者正透过缩短最后一公里配送前置作业时间而获得快速的投资回报。

都市区仓库中垂直整合管理(VLM)的应用加速

亚洲主要城市的工业仓库租金正高于区域平均水平,迫使营运商寻求垂直空间。垂直物流仓库(VLM)层高可达98英尺(约30公尺),储存密度是传统仓库的四倍,同时将搬运任务转移到拣选任务,这在劳动力稀缺且成本高昂的地区至关重要。DAIFUKU CO. LTD.在印度新建的製造工厂正是为了满足都市区自动化需求的激增。因此,房地产资源紧张和工资上涨共同推动了垂直物流仓库投资在管理层优先事项清单上的优先顺序上升。

欧洲棕地设施的屋顶高度限制

许多建于1990年之前的欧洲工厂缺乏25英尺的净空高度,无法充分发挥垂直升降机(VLM)的效率。改装需要加固地板和进行结构检查,这会增加计划成本。 AutoStore估计,欧洲65%的VLM装置都需要进行此类维修,这不仅凸显了机会,也暴露了其限制。

细分市场分析

单层系统占2024年销售额的57%,这反映了其与现有建筑高度的兼容性以及易于操作的特点。典型的吞吐量平均为每小时250件,足以满足中等速度环境的需求。然而,预计到2030年,双层系统将以11.9%的复合年增长率成长。透过实现拣选和托盘展示的同步进行,这些系统每小时可处理350件商品,使其成为拥有充足垂直空间的棕地项目的首选。卡迪斯正在升级其控制器韧体,以允许两种配置在同一仓库管理系统 (WMS) 中共存,从而使营运商能够根据订单模式的变化灵活地混合使用不同类型的系统。随着仓库追求更高的单位面积拣选量,垂直升降模组市场将继续向双层系统投资倾斜。

模组化设计框架降低了工程成本并加快了安装速度。如今,原始设备製造商 (OEM) 提供即插即用的输送机对接平台和机器人接口,使得单级模组可以作为相邻高吞吐量区域的缓衝,而双级单元则可以处理高速移动的物体。这种混合策略确保了在季节性高峰期生产的连续性,而无需为满足平均需求而过度配置设备,从而增强了垂直升降模组市场在平衡资本投资规划方面的价值提案。

到2024年,额定载重在20至50吨之间的设备将占据43%的市场份额,这反映出它们适用于盒装汽车零件、手提式电商库存以及单托盘重量很少超过1000磅的药品有效载荷。这些系统无需特殊地板材料或起重机辅助,因此成为多行业部署的支柱。 50吨以上的模组将以12.6%的复合年增长率成长,这主要得益于航太和重型设备供应商将超大型零件集中储存。相反,20吨以下的设备在电子和医疗设备组装中占据着独特的地位,在这些领域,清洁度和精度比重量更重要。

Schaefer 的 LOGIMAT 系统正是这一趋势的典型代表,其单托盘承重能力高达 1 吨,并配备 ERP 连接器,可将整合时间缩短 30%。随着工业 4.0 的日益普及,工厂将基于数位双胞胎模拟而非传统经验法则来选择负载等级。因此,采购週期将因资料建模的加入而延长,但随着垂直升降模组的市场规模与可量化的生产力提升紧密相关,其应用势头将持续强劲。

垂直升降模组(VLM)市场按类型(单层输送、双层输送)、承载能力(20吨以下、20-50吨、50吨以上)、应用(储存和缓衝等)、终端用户行业(汽车、电气电子等)和地区进行细分。市场预测以美元计价。

区域分析

以德国、西班牙和法国等汽车製造中心为首的欧洲,到2024年将占36%的市场。由于许多工厂的净空高度已超过现代标准,因此现有棕地的维修十分普遍。儘管新建项目成长放缓,原始计划製造商(OEM)对可追溯性和降低能耗的强制性要求,以及严格的工人安全规范,仍在推动该地区垂直升降模组市场的成长。德国一级供应商正在整合基于人工智慧的马达诊断系统,以防止生产线意外停机,目前该系统已被纳入大多数欧洲采购规范。

到2030年,亚太地区将以12.3%的复合年增长率成为成长最快的地区。中国正在新建智慧工厂中部署待开发区模组(VLM),这些工厂采用单元式製造模式,需要紧凑的销售点门市。随着印度新建产业走廊获得公共资金用于建造综合供应链园区,其在物流自动化方面的支出也在增加,这进一步增强了该地区对高密度垂直储存的需求。日本和韩国正在应用模组技术来缓解人口老化导致的劳动力短缺问题。该地区的规模和待开发区的性质意味着供应商正在以承包工程的形式销售完整的生态系统——包括VLM硬体、仓库管理系统(WMS)和自主移动机器人(AMR)车队——这将在未来十年内持续推动垂直升降模组市场规模的成长。

北美市场持续稳定扩张。零售商正在对郊区门市维修,增设微型履约中心;美国东北部的生命科学丛集正在采用符合GMP标准的生技药品模组。美国和加拿大的冷藏仓库营运商对双碟起吊装置的效率讚赏有加,因为它可以降低尖峰时段的电力成本。拉丁美洲和中东及非洲市场正在崛起,但发展并不均衡。巴西的合约物流公司正在探索租赁模式,以避免资本投资障碍;而南非的经销商则面临电力品质问题,需要附加元件,这在短期内限制了垂直升降模组的市场渗透率。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电子商务主导的微型仓配的扩张将加速城市仓库中垂直物流管理(VLM)技术的应用。

- 原始设备製造商推动全面自动化

- 欧洲汽车产业的闭合迴路备件存储

- 美国生命科学无尘室中以合规为主导的可追溯性需求

- 东南亚人事费用差距扩大推动了自动化立体改装

- 节能型双碟马达可在24个月内为冷冻设施带来投资回报。

- AI赋能的VLM OEM预测性维护套餐提升售后服务收入

- 市场限制

- 欧洲棕地设施的屋顶高度限制

- 亚太地区两大城市前期投资高昂,且提供多种接驳路线选择

- 非洲新兴物流中心电力品质不平衡

- 中小企业领域中可进行改装升级的ERP/WMS介面有限

- 价值/供应链分析

- 技术展望

- 监理展望

- 波特五力分析

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 定价分析

- 投资分析

第五章 市场规模与成长预测

- 按类型

- 单层交付

- 双层交付

- 按载重能力

- 不足20吨

- 20至50吨

- 超过50吨

- 透过使用

- 储存和缓衝

- 拣货和组装

- 备用零件处理

- 按最终用户行业划分

- 车

- 金属和机械

- 电气和电子

- 零售、分销和电子商务

- 生命科学(製药和医疗设备)

- 食品和饮料

- 其他行业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲国家

- 中东和非洲

- 土耳其

- 沙乌地阿拉伯

- 南非

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Kardex Group

- Hnel Storage Systems

- Modula Inc.(System Logistics)

- SSI SCHFER Systems International Inc.

- Ferretto Group SpA

- AutoCrib Inc.

- Weland Lagersystem AB

- Automha SpA

- Stanley Black & Decker Storage Solutions

- Green Automated Solutions Inc.

- Intertex Maschinenbau GmbH

- ICAM srl

- Mecalux SA

- Godrej

- Koerber Logistics Solutions

- Dexion(Gonvarri Material Handling)

- Constructor Group(Kasten)

- EffiMat Storage Technology A/S

- Randex Ltd.

- Omnia Technologies

- Sapient Automation

- ICY Lift Systems

第七章 市场机会与未来展望

The vertical lift module market size stands at USD 1.78 billion in 2025 and is forecast to reach USD 2.83 billion by 2030, advancing at a 9.72% CAGR.

Demand accelerates as e-commerce firms replace bulky pallet racking with goods-to-person systems that compress fulfillment cycles from days to hours. Automakers add automated buffer storage to sustain just-in-time production rhythms, while life-sciences cleanrooms adopt enclosed modules that meet traceability and contamination-control mandates. Cold-chain operators view energy-efficient dual-drive motors as a route to ROI in less than 24 months, and predictive-maintenance software packages open an after-sales revenue stream for equipment makers.

Global Vertical Lift Module (VLM) Market Trends and Insights

E-commerce-led micro-fulfillment expansion

Retailers are shifting from regional distribution centers to automated micro-fulfillment nodes located inside or adjacent to existing stores. More than 7,300 automated micro-fulfillment centers are expected to be operational worldwide by 2030, almost half of them in the United States, creating sustained demand for compact, high-density modules that fit within 10,000 square-foot footprints . VLMs integrate with robotic pickers to achieve 99.99% order-accuracy rates while reducing labor needs by up to 66% . Although supply-chain constraints have slowed some retailer roll-outs, early adopters demonstrate rapid payback by compressing last-mile delivery lead times.

Accelerating VLM adoption in urban warehouses

Industrial rents in key Asian capitals outpace regional averages, forcing operators to reclaim vertical space. VLMs that reach ceiling heights of 98 feet quadruple storage density while shifting work from travel to picking, essential where labor is scarce and expensive. Daifuku's new manufacturing plant in India was commissioned to satisfy this surge in urban automation demand. Real-estate constraints and wage inflation thus act in tandem to move VLM investments higher on management priority lists.

Facility roof-height limitations in brownfield European sites

Many European plants built before 1990 lack the 25-foot clear height that unlocks peak VLM efficiency. Retrofitting involves floor reinforcement and structural checks that inflate project costs; in some locations, heritage rules bar vertical alterations. AutoStore estimates that 65% of its European installs occur in such retrofit scenarios, highlighting both opportunity and constraint

Other drivers and restraints analyzed in the detailed report include:

- OEM push for fully automated, closed-loop spare-parts storage in European automotive sector

- Compliance-driven traceability needs in U.S. life-sciences cleanrooms

- High up-front investment vs. multi-shuttle alternatives in APAC tier-2 cities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Single-level systems captured 57% of 2024 revenue, a reflection of their compatibility with existing building heights and straightforward operations. Typical throughput averages 250 items per hour, adequate for medium-velocity environments. Dual-level variants, however, post an 11.9% CAGR through 2030. They hit 350 items per hour by allowing simultaneous extraction and presentation trays, making them a preferred choice when brownfield sites possess sufficient vertical clearance. Kardex has upgraded controller firmware to harmonize either configuration within the same WMS, giving operators flexibility to mix system types as order profiles evolve. The vertical lift module market continues to tilt toward dual-level investments as facilities chase higher picks-per-square-foot.

A modular design framework lowers engineering costs and accelerates installation. OEMs now offer plug-and-play conveyor docks and robotic interfaces, allowing single-level modules to serve as buffers for adjacent high-throughput zones while dual-level units handle fast movers. This hybrid strategy ensures continuity during seasonal spikes without oversizing equipment for average demand, reinforcing the vertical lift module market's value proposition for balanced capex planning.

Units rated for 20-50 tons held 43% market share in 2024, reflecting their suitability for boxed automotive parts, tote-handled e-commerce inventory, and pharmaceutical payloads that rarely exceed 1,000 pounds per tray. These systems form the backbone of multi-industry deployments because they require no special flooring or crane assistance. Above-50-ton modules record a 12.6% CAGR, fueled by aerospace and heavy-machinery suppliers consolidating oversized components into single storage points. Conversely, sub-20-ton machines occupy niche roles in electronics and medical device assembly lines where cleanliness and precision outweigh weight metrics.

Schaefer's LOGIMAT illustrates the trend, offering capacities up to 1 ton per tray with ERP connectors that reduce integration times by 30%. As Industry 4.0 spreads, facilities select load classes based on digital-twin simulations rather than generic rules of thumb. Consequently, procurement cycles extend to include data modeling, yet adoption momentum sustains because the vertical lift module market size aligns closely with quantifiable productivity gains.

Vertical Lift Module (VLM) Market is Segmented by Type (Single-Level Delivery, Dual-Level Delivery), Load Capacity (Up To 20 Tons, 20 - 50 Tons, Above 50 Tons ), Application (Storage and Buffering and More), End-User Industry (Automotive, Electrical and Electronics and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe leads with 36% revenue share in 2024, anchored by automotive manufacturing corridors in Germany, Spain, and France. Brownfield retrofits dominate because many facilities predate modern ceiling-height norms. OEM mandates for traceability and energy-footprint reduction, combined with strict worker-safety codes, keep the regional vertical lift module market growing even when new-build projects slow. Germany's Tier-1 suppliers integrate AI-based motor diagnostics to prevent unscheduled line stops, a feature now embedded in most European purchase specifications.

Asia-Pacific posts the fastest 12.3% CAGR through 2030. China deploys VLMs in greenfield smart factories where cell-based manufacturing needs compact point-of-use stores. India's logistics automation spending is climbing as new industrial corridors receive public funding for integrated supply-chain parks, reinforcing regional appetite for high-density vertical storage. Japan and South Korea apply modules to alleviate labor shortages caused by aging demographics. The region's scale and greenfield nature mean suppliers sell complete ecosystems-VLM hardware, WMS, and AMR fleets-in one turnkey package, bolstering the vertical lift module market size across the decade.

North America maintains a steady expansion track. Retailers retrofit suburban outlets with micro-fulfillment nodes, and life-sciences clusters in the U.S. Northeast adopt GMP-compliant modules for biologics. Cold-storage operators in the U.S. Midwest and Canada appreciate dual-drive hoist efficiencies that curb utility bills during peak tariffs. Latin America and the Middle East & Africa are emerging but uneven. Brazil's contract-logistics firms explore leasing models to bypass capex barriers, while South African distributors face power-quality issues that necessitate voltage-regulation add-ons, a factor that suppresses near-term vertical lift module market penetration.

- Kardex Group

- Hnel Storage Systems

- Modula Inc. (System Logistics)

- SSI SCHFER Systems International Inc.

- Ferretto Group S.p.A.

- AutoCrib Inc.

- Weland Lagersystem AB

- Automha S.p.A.

- Stanley Black & Decker Storage Solutions

- Green Automated Solutions Inc.

- Intertex Maschinenbau GmbH

- ICAM srl

- Mecalux S.A.

- Godrej

- Koerber Logistics Solutions

- Dexion (Gonvarri Material Handling)

- Constructor Group (Kasten)

- EffiMat Storage Technology A/S

- Randex Ltd.

- Omnia Technologies

- Sapient Automation

- ICY Lift Systems

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce-led Micro-fulfilment Expansion Accelerating VLM Adoption in Urban Warehouses

- 4.2.2 OEM Push for Fully Automated

- 4.2.2.1 Closed-Loop Spare-Parts Storage in the European Automotive Sector

- 4.2.3 Compliance-Driven Traceability Needs in U.S. Life-Sciences Cleanrooms

- 4.2.4 Rising Labor-Cost Differentials in South-East Asia Driving AS/RS Retrofits

- 4.2.5 Energy-Efficient Dual-Drive Motors Enabling ROI < 24 Months in Cold-Storage Facilities

- 4.2.6 AI-Enabled Predictive-Maintenance Bundles from VLM OEMs Boosting After-sales Revenues

- 4.3 Market Restraints

- 4.3.1 Facility Roof-Height Limitations in Brownfield European Sites

- 4.3.2 High Up-front Investment vs. Multi-Shuttle Alternatives in APAC Tier-2 Cities

- 4.3.3 Power-Quality Variations in Emerging African Logistics Hubs

- 4.3.4 Limited Retrofit-Ready ERP/WMS Interfaces in SME Segments

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Pricing Analysis

- 4.9 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Single-Level Delivery

- 5.1.2 Dual-Level Delivery

- 5.2 By Load Capacity

- 5.2.1 Up to 20 Tons

- 5.2.2 20 - 50 Tons

- 5.2.3 Above 50 Tons

- 5.3 By Application

- 5.3.1 Storage and Buffering

- 5.3.2 Order-Picking and Kitting

- 5.3.3 Spare-Parts Handling

- 5.4 By End-User Industry

- 5.4.1 Automotive

- 5.4.2 Metal and Machinery

- 5.4.3 Electrical and Electronics

- 5.4.4 Retail / Distribution and E-commerce

- 5.4.5 Life-Sciences (Pharma Medical Devices)

- 5.4.6 Food and Beverage

- 5.4.7 Other Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 South Korea

- 5.5.3.4 India

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Turkey

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 United Arab Emirates

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Kardex Group

- 6.4.2 Hnel Storage Systems

- 6.4.3 Modula Inc. (System Logistics)

- 6.4.4 SSI SCHFER Systems International Inc.

- 6.4.5 Ferretto Group S.p.A.

- 6.4.6 AutoCrib Inc.

- 6.4.7 Weland Lagersystem AB

- 6.4.8 Automha S.p.A.

- 6.4.9 Stanley Black & Decker Storage Solutions

- 6.4.10 Green Automated Solutions Inc.

- 6.4.11 Intertex Maschinenbau GmbH

- 6.4.12 ICAM srl

- 6.4.13 Mecalux S.A.

- 6.4.14 Godrej

- 6.4.15 Koerber Logistics Solutions

- 6.4.16 Dexion (Gonvarri Material Handling)

- 6.4.17 Constructor Group (Kasten)

- 6.4.18 EffiMat Storage Technology A/S

- 6.4.19 Randex Ltd.

- 6.4.20 Omnia Technologies

- 6.4.21 Sapient Automation

- 6.4.22 ICY Lift Systems

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet