|

市场调查报告书

商品编码

1851942

非洲农药:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Africa Agrochemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

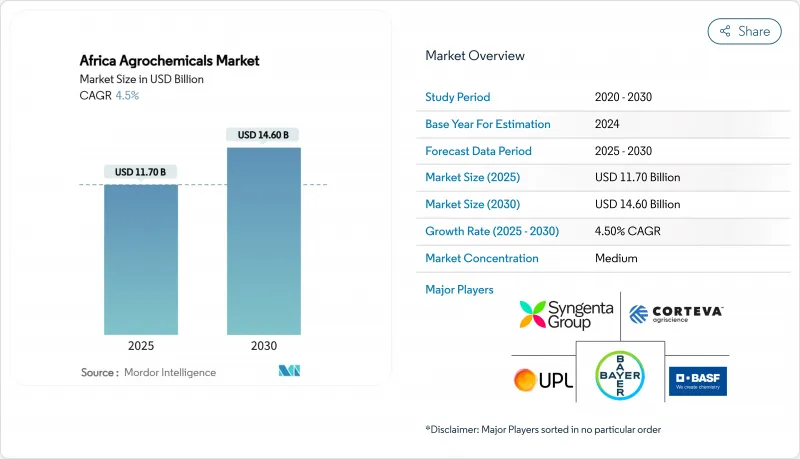

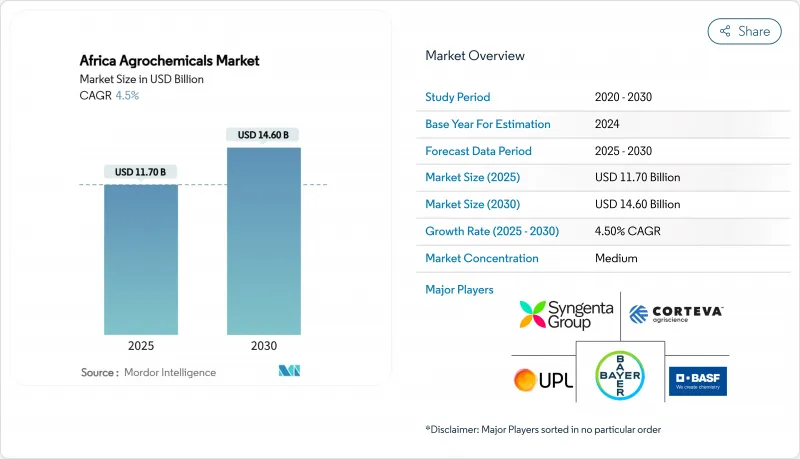

预计到 2025 年,非洲农药市场规模将达到 117 亿美元,到 2030 年将达到 146 亿美元,年复合成长率为 4.5%。

预计到2024年,化肥将占据市场主导地位,市场占有率高达51%,这主要受非洲普遍存在的土壤养分流失问题的推动。随着农民采用精准施肥方法,植物生长调节剂预计将以6.90%的复合年增长率达到最高成长。市场成长的驱动因素包括病虫害日益增加、人口成长导致粮食需求增加以及政府补贴改善了小农户的取得途径。高昂的投入成本和各地区监管的不一致限制了解决农业产量差异的努力。市场参与企业正在建立本地生产设施、开发创新分销网络,并建立以精准化学解决方案为永续产品线。此外,各国政府正在扩大仓储取货融资和机械化支持计划,这些措施也有助于推动农业化学品市场的需求。

非洲农药市场趋势与洞察

气候相关病虫害增加

不稳定的气候模式导致秋尺蛾等入侵虫在多个非洲国家广泛蔓延,严重影响玉米产量。谷物种植区的独脚金杂草持续侵染,影响作物产量,促使农民实施综合化学防治方案。肯亚、加纳和衣索比亚已建立紧急应变通讯协定,区域组织正在协调害虫监测网。农业相关企业正加速研发针对害虫幼虫的精准杀虫剂,数位监测平台则为农民提供即时预警。这些因素推动了非洲农药市场的持续成长,而对种子处理和农民教育计画的投资进一步增强了这一成长势头。官民合作关係正在改善农民获得新型作物保护方案的途径。

人口成长加速导致的粮食需求缺口

由于小农户农药使用量低于建议水平,农业生产力仍受到限制。在奈及利亚、衣索比亚和坦尚尼亚,人口向都市区迁移造成了严重的限制,导致农业劳动力减少。政府措施包括透过国内化肥生产和投资灌溉基础设施来提高产量。埃塞俄比亚的灌溉扩建计划专注于提高低地地区的生产力并减少对进口的依赖。不断增长的粮食需求持续推动非洲化肥、农药和植物生长调节剂市场的发展。不断扩大的农业经销商网路和行动咨询服务正在帮助农民更好地获取投入品和知识。为了适应不断变化的气候条件,农民越来越多地采用气候适应型农药解决方案。

高昂的农药价格令小农户难以负担。

在内陆国家,运输成本占最终零售价格的50%之多,而衣索比亚的化肥价格近年来大幅上涨。肯亚提案通过2025年财政法案对农药征收16%的增值税,可能会显着增加生产成本。尼日利亚在2024年中期经历了创纪录的食品通膨,迫使家庭将收入的很大一部分用于食品支出,从而减少了可用于农业投资的资金。农民往往转向收取高利息的非正规贷款机构,形成债务循环,限制了非洲农药市场的成长。因此,价格承受能力的挑战降低了有效农作物保护产品的使用率,导致产量不足和粮食安全问题持续存在。

细分市场分析

至2024年,化学肥料将占非洲农业化学品市场份额的51%,有效解决普遍存在的土壤养分缺乏问题,并支持不同农业生态学区域的农业生产力。虽然氮肥仍然是作物生产的关键,但磷肥和钾肥正透过均衡营养计画得到越来越广泛的应用。数位补贴电子代金券和仓库自提信贷系统降低了经济门槛,确保了及时施肥。

植物生长调节剂的复合年增长率将达到6.9%,这主要得益于人们越来越多地采用能够提高植物抗逆性、促进根系发育和提升产量潜力的营养物质。农药在非洲仍将占据重要地位,其中除草剂由于劳动力短缺和杂草抗药性问题而成为主要需求。受气候相关病虫害爆发的影响,杀虫剂的需求将会增加,而杀菌剂在园艺领域的应用也将扩大。助剂虽然市占率较小,但其重要性日益凸显,因为精准喷雾设备需要更先进的配方才能实现更好的叶面覆盖和更简单的罐混。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 气候变迁导致害虫压力增加

- 人口成长加剧了粮食需求缺口

- 政府对引种进化肥料和农药的补贴计划

- 机械化和精密农业技术的引入将提高投入效率

- 扩大仓储融资规模可释放营运资金投入

- 自有品牌农产品零售连锁店的出现有助于改善最后一公里配送

- 市场限制

- 高昂的投入成本令小农户难以承受。

- 严格而详细的监管核准时间表

- 假农药的氾滥损害了农民的信任。

- 透过有机和无残留出口作物计划减少合成农药的使用

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依产品类型

- 肥料

- 氮

- 磷肥

- 钾

- 杀虫剂

- 除草剂

- 杀虫剂

- 消毒剂

- 佐剂

- 植物生长调节剂

- 肥料

- 透过使用

- 谷物和谷类

- 豆类和油籽

- 水果和蔬菜

- 经济作物(甘蔗、棉花等)

- 按地区

- 埃及

- 摩洛哥

- 阿尔及利亚

- 肯亚

- 坦尚尼亚

- 衣索比亚

- 南非

- 尚比亚

- 辛巴威

- 奈及利亚

- 迦纳

- 刚果民主共和国

- 其他非洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Bayer AG

- Syngenta Group

- Corteva Agriscience

- BASF SE

- FMC Corporation

- UPL Limited

- Yara International ASA

- Sumitomo Chemical Co., Ltd.

- Gowan Company(Isagro Srl)

- Rovensa SA(Partners Group)

- Sasol Limited

- Twiga Chemical Industries Ltd.(AJ Group)

- OCP Group

- Indorama Corporation

- Albaugh LLC

第七章 市场机会与未来展望

The Africa agrochemicals market size reached USD 11.7 billion in 2025 and is projected to grow at a CAGR of 4.5% to USD 14.6 billion by 2030.

Fertilizers dominated the market with a 51% share in 2024, driven by widespread soil nutrient depletion across Africa. Plant growth regulators exhibited the highest growth rate at 6.90% CAGR, as farmers adopt precision application methods. The market growth is supported by increasing pest challenges, growing food demand from population expansion, and government subsidy programs that improve access for smallholder farmers. High input costs and inconsistent regulations across regions limit efforts to close the agricultural yield gap. Market participants are establishing local manufacturing facilities, developing innovative distribution networks, and creating sustainable product lines with precision chemical solutions. Additionally, governments are expanding warehouse-receipt financing systems and mechanization support programs, which drive increased demand in the agrochemicals market.

Africa Agrochemicals Market Trends and Insights

Climate-driven Rise in Pest and Disease Pressure

Variable weather patterns have increased the spread of invasive pests like fall armyworm across multiple African nations, significantly impacting maize yields. Striga weed infestations in cereal-growing regions continue to affect harvests, leading farmers to implement integrated chemical control programs. Kenya, Ghana, and Ethiopia have established emergency response protocols, while regional organizations coordinate pest surveillance networks. Agricultural companies have accelerated the development of precision insecticides targeting pest larvae, and digital monitoring platforms provide real-time alerts to farmers. These factors drive sustained growth in the Africa agrochemicals market. The market gains additional momentum through investments in seed treatment chemicals and farmer education programs. Public-private partnerships are improving farmer access to new crop protection solutions.

Population Growth Accelerating Food-demand Gap

Agricultural productivity remains limited as smallholder farmers use agrochemicals below recommended levels. Nigeria, Ethiopia, and Tanzania experience significant constraints due to urban migration, reducing the agricultural workforce. Government initiatives include investments in domestic fertilizer production and irrigation infrastructure to improve yields. Ethiopia's irrigation expansion program focuses on increasing lowland productivity and decreasing import dependence. Growing food demand continues to drive the African agrochemicals market for fertilizers, pesticides, and plant growth regulator products. The expansion of agricultural dealer networks and mobile advisory services helps improve farmers' access to inputs and knowledge. Farmers increasingly adopt climate-resilient agrochemical solutions to address changing weather conditions.

High Agrochemical Prices Unaffordable to Smallholders

Transport costs in landlocked countries account for up to 50% of final retail prices, while Ethiopia experienced significant increases in fertilizer prices in recent years. Kenya's proposed 16% VAT on agrochemicals through the 2025 Finance Bill may substantially increase production costs. Nigeria's record-high food inflation in mid-2024 forced households to spend most of their income on food, reducing funds available for farm investments. Farmers often turn to informal lenders charging high weekly interest rates, creating debt cycles that limit growth in the Africa agrochemicals market. The resulting affordability issues reduce the adoption of effective crop protection products, leading to suboptimal yields and continued food security challenges.

Other drivers and restraints analyzed in the detailed report include:

- Government Subsidy Programs for Fertilizer and Pesticide Adoption

- Expansion of Warehouse-receipt Financing Unlocking Working-capital for Inputs

- Fragmented and Stringent Regulatory Approval Timelines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fertilizers held 51% of the Africa agrochemicals market share in 2024, addressing widespread soil nutrient deficiencies and supporting agricultural productivity across various agroecological zones. Nitrogen-based formulations remain essential for cereal production, while phosphatic and potassic fertilizers gain adoption through balanced nutrition programs. Digital subsidy e-vouchers and warehouse-receipt credit systems reduce financial barriers and enable timely fertilizer application.

Plant growth regulators demonstrate a 6.9% CAGR, driven by increased adoption of nutrients that improve stress tolerance, root development, and yield potential. Pesticides maintain significant volume across Africa, with herbicides dominating due to labor shortages and resistant weed populations. Insecticide demand increases in response to climate-related pest outbreaks, while fungicide use expands in horticultural regions. Adjuvants, though a smaller segment, grow in importance as precision spraying equipment requires advanced formulations for improved leaf coverage and simplified tank mixing.

The African Agrochemicals Market Report is Segmented by Product Type (Fertilizers, Pesticides, Adjuvants, and Plant Growth Regulators), by Application (Grains and Cereals, Pulses and Oilseeds, Fruits and Vegetables, and Commercial Crops), and by Geography (Egypt, Morocco, Tanzania, South Africa, and More). The Report Offers the Market Size and Forecasts in Terms of Value (USD).

List of Companies Covered in this Report:

- Bayer AG

- Syngenta Group

- Corteva Agriscience

- BASF SE

- FMC Corporation

- UPL Limited

- Yara International ASA

- Sumitomo Chemical Co., Ltd.

- Gowan Company (Isagro S.r.l.)

- Rovensa S.A (Partners Group)

- Sasol Limited

- Twiga Chemical Industries Ltd. (AJ Group)

- OCP Group

- Indorama Corporation

- Albaugh LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Climate-driven Rise in Pest and Disease Pressure

- 4.2.2 Population Growth Accelerating Food-demand Gap

- 4.2.3 Government Subsidy Programs for Fertilizer and Pesticide Adoption

- 4.2.4 Mechanizsation and Precision-ag Adoption Boosting Input Efficiency

- 4.2.5 Expansion of Warehouse-receipt Financing Unlocking Working-capital for Inputs

- 4.2.6 Emergence of Private-label Agro-retail Chains Improving Last-mile Distribution

- 4.3 Market Restraints

- 4.3.1 High Input Prices Unaffordable to Smallholders

- 4.3.2 Fragmented and Stringent Regulatory Approval Timelines

- 4.3.3 Proliferation of Counterfeit Agrochemicals Eroding Farmer Trust

- 4.3.4 Organic and Residue-free Export Crop Programs Curbing Synthetic Usage

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Fertilizers

- 5.1.1.1 Nitrogenous

- 5.1.1.2 Phosphatic

- 5.1.1.3 Potassic

- 5.1.2 Pesticides

- 5.1.2.1 Herbicides

- 5.1.2.2 Insecticides

- 5.1.2.3 Fungicides

- 5.1.3 Adjuvants

- 5.1.4 Plant Growth Regulators

- 5.1.1 Fertilizers

- 5.2 By Application

- 5.2.1 Grains and Cereals

- 5.2.2 Pulses and Oilseeds

- 5.2.3 Fruits and Vegetables

- 5.2.4 Commercial Crops (Sugarcane, Cotton, and Others)

- 5.3 By Geography

- 5.3.1 Egypt

- 5.3.2 Morocco

- 5.3.3 Algeria

- 5.3.4 Kenya

- 5.3.5 Tanzania

- 5.3.6 Ethiopia

- 5.3.7 South Africa

- 5.3.8 Zambia

- 5.3.9 Zimbabwe

- 5.3.10 Nigeria

- 5.3.11 Ghana

- 5.3.12 DR Congo

- 5.3.13 Rest of Africa

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Bayer AG

- 6.4.2 Syngenta Group

- 6.4.3 Corteva Agriscience

- 6.4.4 BASF SE

- 6.4.5 FMC Corporation

- 6.4.6 UPL Limited

- 6.4.7 Yara International ASA

- 6.4.8 Sumitomo Chemical Co., Ltd.

- 6.4.9 Gowan Company (Isagro S.r.l.)

- 6.4.10 Rovensa S.A (Partners Group)

- 6.4.11 Sasol Limited

- 6.4.12 Twiga Chemical Industries Ltd. (AJ Group)

- 6.4.13 OCP Group

- 6.4.14 Indorama Corporation

- 6.4.15 Albaugh LLC