|

市场调查报告书

商品编码

1852158

奈米纤维:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Nanofiber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

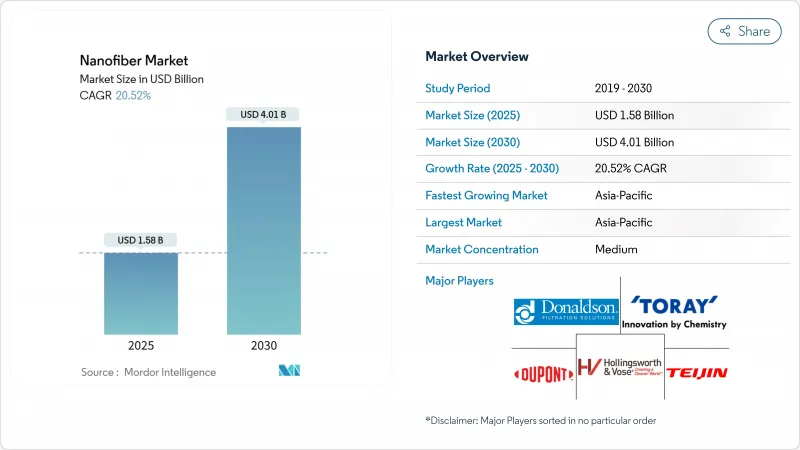

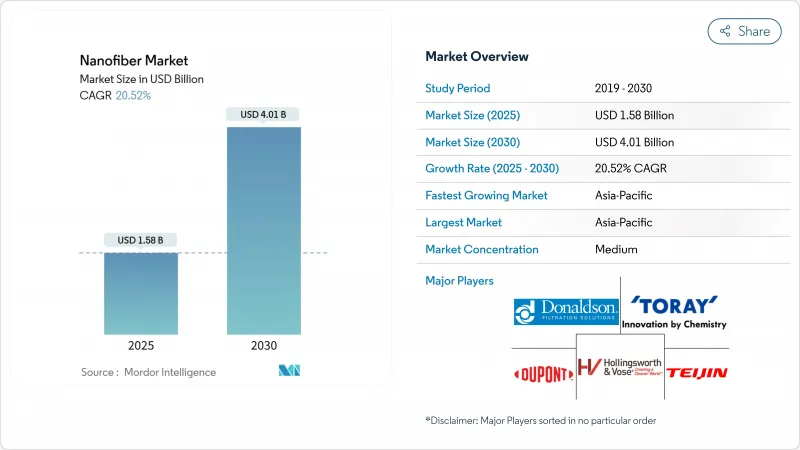

预计到 2025 年,奈米纤维市场规模将达到 15.8 亿美元,到 2030 年将达到 40.1 亿美元,预测期(2025-2030 年)的复合年增长率为 20.52%。

医疗、过滤、储能和先进纤维应用领域对高比表面积材料的需求不断增长,支撑了这一前景。亚太地区以38%的收入占比领先,并受益于强大的製造业生态系统,预计到2030年将以22%的复合年增长率增长,巩固其作为规模最大且增长最快的区域市场的双重地位。在成熟的静电纺丝生产能力的支持下,聚合物产品类型将占2024年收入的42%,而碳水化合物基产品将以27%的复合年增长率引领成长,反映了更广泛的永续性转型。东丽和杜邦等全球领导者保持其销售量领先地位,而奈米层等创新企业则利用其专有的製造技术,抢占高利润的医疗和能源细分市场。碳奈米纤维规模化生产面临的挑战依然严峻,加上聚丙烯腈(PAN)原料价格波动,削弱了近期的供应前景。

全球奈米纤维市场趋势与洞察

来自医疗和製药行业的需求不断增长

以奈米纤维为基础的药物传递平台目前可实现超过85%的载药量,并持续释放长达96小时,显着增强治疗药物的黏附性并降低全身毒性。其类似细胞外基质的结构支持卓越的细胞黏附,从而建构新一代组织支架,加速伤口癒合并最大限度地减少疤痕形成。采用先进伤口敷料的医院患者周转率不断提高,从而降低医疗成本并增加采购诱因。奈米纤维支架在整形外科的监管路径也日益清晰,降低了开发商的上市时间风险。总而言之,这些医学突破提升了报销前景,并增强了高价值医疗保健管道的持续需求。

电动车超级工厂对高表面积电池隔膜的需求

静电纺丝奈米纤维隔膜如今可在150°C高温下保持尺寸不变,从而满足电动车的关键安全标准。其离子电导率的提升可使快充性能提高高达40%,同时保持循环寿命,吸引了亚洲和美国超级工厂的采购。自动化卷对卷生产线的年产量超过300万平方米,缩小了与传统聚烯薄膜的成本差距。主要电池製造商的安装正在锁定多年供应合同,并为奈米纤维供应商提供可预测的产量资讯。中国和美国的国家清洁旅游激励政策进一步推动了新型电池化学体系中隔膜的应用。

PAN原料价格不稳定

聚丙烯腈(PAN)约占碳奈米纤维前驱物的90%,其现货价格每年波动高达20%,侵蚀了下游供应商的利润稳定性。丙烯腈原料短缺导致的供应中断加剧了库存风险,促使生产商寻求石油沥青质或木质素的替代品,这些替代品可以将原料成本降低至每公斤9美元以下,同时提升永续性。杂质控制和机械性能方面的差异延长了过渡期,也延长了PAN价格波动带来的风险。买家正透过指数挂钩合约进行避险,但由于长期价格前景依然有限,积极的产能扩张受到限制。

细分市场分析

2024年,聚合物基纤维将占总销售额的42%,这主要得益于成熟的静电纺丝生产线以及其在包装、过滤和生物医学设备等应用领域广泛的化学多功能性。碳水化合物基纤维虽然目前销量仍然较低,但正以27%的复合年增长率快速增长,因为终端用户正在寻求符合全球循环经济指令的可生物降解的生物来源替代品。纤维素奈米纤维的拉伸强度可与芳香聚酰胺媲美,在常温常压下即可生物降解,这促使包装供应商将其应用于一次性包装产品中。几丁质奈米纤维因其固有的抗菌性能而备受创伤护理产品製造商的青睐,并推动了贝壳废弃物回收利用方面的投资。碳奈米纤维在特种能源和电子领域正发挥着重要作用,但生产规模和成本的挑战限制了其近期成长。

碳水化合物基产品的发展势头得益于品牌所有者减少化石塑胶使用的承诺。欧盟多个成员国已立法禁止使用一次性合成纤维,进一步推动了这一趋势。复合奈米纤维(聚合物和陶瓷相的混合物)在高温过滤领域发挥关键作用。金属和金属氧化物级奈米纤维可用于催化和感测应用,这些应用对高导电性和光催化活性要求较高。陶瓷奈米纤维作为航太隔热材料和炉衬材料的需求仍然强劲。随着原料研发转向林业和农业废弃物,成本曲线预计将趋于一致,从而促进整个奈米纤维市场的发展。

区域分析

到2024年,亚太地区将占全球销售额的38%,其中中国、日本和韩国受益于发达的电子产品供应链和政府支持的奈米技术计画。中国蓬勃发展的电动车生产基地正在推动对奈米纤维倡议的需求。针对永续材料的区域振兴基金进一步降低了对木质素衍生奈米纤维工厂的投资风险。这项生态系统将推动亚太地区的复合年增长率达到22%,亚太地区将持续引领全球销售成长。

北美在全球产生收入中扮演关键角色,其中美国占据主导地位,其2025财年国家奈米技术计画预算高达22亿美元,用于津贴医疗保健、国防和能源领域。基于奈米纤维的再生植入的临床试验已获得美国食品药物管理局(FDA)的快速通道资格,加速了其商业化进程。国防机构正在资助过滤装置和防护衣的研发,从而加强国内供应链。加拿大的干净科技激励政策以及其接近性汽车产业中心的地理优势,正在推动电池材料领域的跨境合作。

在德国和法国严格的永续性框架的推动下,欧洲在可生物降解奈米纤维包装和暖通空调解决方案领域处于市场领先地位。 「地平线欧洲」津贴促进了产学研合作丛集的形成,从而加速规模化生产和标准化,而REACH法规则提供了监管确定性。儘管成长率落后于亚太地区,但欧盟禁止使用某些一次性塑胶的政策正在为餐饮服务和个人保健产品创造替代机会。在南美洲以及中东和非洲,为解决饮用水短缺和提高农业效率而采取的倡议正在推动收入成长,其中奈米纤维膜在海水淡化和控制释放肥料领域的应用尤为突出。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 来自医疗和製药行业的需求不断增长

- 电动车超级工厂对高表面积电池隔膜的需求

- 高效率过滤介质的需求

- 汽车产业的成长

- 纺织业的扩张

- 市场限制

- PAN原料价格不稳定

- 向碳奈米纤维过渡的困难

- 健康与安全问题

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 技术概览

- 专利分析

第五章 市场规模与成长预测

- 依产品类型

- 聚合物奈米纤维

- 碳奈米纤维

- 复合奈米纤维

- 金属和金属氧化物奈米纤维

- 陶瓷奈米纤维

- 碳水化合物基奈米纤维

- 透过使用

- 水和空气过滤

- 医疗保健

- 储能

- 汽车与运输

- 电子学

- 纺织品

- 其他用途

- 透过製造技术

- 静电纺丝(针式)

- 无针静电纺丝

- 解决方案

- 强制纺丝/旋转喷射纺丝

- 熔喷

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲国家

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Applied Sciences Inc.

- Argonide Corporation

- Asahi Kasei Corporation

- Chuetsu Pulp & Paper Co. Ltd.

- Donaldson Company Inc.

- DuPont

- Esfil Tehno AS

- eSpin Technologies Inc.

- FibeRio Technology Corp.

- Hollingsworth & Vose

- IREMA-Filter GmbH

- Japan Vilene Company Ltd.

- NanoLayr Ltd

- Nanoval GmbH & Co. KG

- NIPPON PAPER INDUSTRIES CO., LTD.

- Pardam SRO

- Rengo Co., Ltd.

- Sappi Ltd.

- SNC Fiber

- Spur AS

- Teijin Limited

- Toray Industries Inc.

- US Global Nanospace Inc.

第七章 市场机会与未来展望

The Nanofiber Market size is estimated at USD 1.58 billion in 2025, and is expected to reach USD 4.01 billion by 2030, at a CAGR of 20.52% during the forecast period (2025-2030).

Heightened demand for high-surface-area materials in medical, filtration, energy storage, and advanced textile applications anchors this outlook. Asia-Pacific, with an existing 38% revenue lead, benefits from strong manufacturing ecosystems and is expected to expand at 22% CAGR through 2030, reinforcing its dual role as both the largest and fastest-growing regional base. The polymeric product category holds 42% of 2024 revenue, supported by mature electrospinning capacity, while carbohydrate-based grades set the growth tempo at 27% CAGR, reflecting a wider sustainability shift. Global incumbents such as Toray Industries and DuPont maintain volume leadership while innovators like NanoLayr deploy proprietary manufacturing to capture high-margin medical and energy niches. Persistent scale-up hurdles for carbon nanofibers, coupled with price volatility in polyacrylonitrile (PAN) feedstock, temper the near-term supply outlook.

Global Nanofiber Market Trends and Insights

Increasing Demand from Medical and Pharmaceutical Industries

Nanofiber-based drug delivery platforms now achieve 85%-plus drug loading and sustained release for up to 96 hours, sharply improving therapeutic adherence and lowering systemic toxicity. Their extracellular-matrix-like architecture supports superior cell attachment, enabling next-generation tissue scaffolds that cut healing time and minimize scarring. Hospitals adopting advanced wound dressings cite patient-turnover gains that translate to reduced care costs, strengthening procurement appetite. Regulatory pathways for nanofiber scaffolds in orthopedics continue to clarify, lowering time-to-market risk for developers. Collectively, these medical breakthroughs elevate reimbursement prospects and reinforce recurring demand across high-value healthcare channels.

Demand for High-Surface-Area Battery Separators in EV Gigafactories

Electrospun nanofiber separators now withstand 150 °C thermal excursions without dimensional loss, addressing critical EV safety standards. Enhancements in ion conductivity are extending fast-charge capability by up to 40% while preserving cycle life, a gain attracting procurement from Asian and US gigafactories. Automated roll-to-roll lines scale output beyond 3 million m2 annually, narrowing cost gaps with conventional polyolefin films. Capital deployment by major cell producers is locking in multiyear supply contracts, providing predictable volume visibility for nanofiber vendors. National clean-mobility incentives in China and the United States further amplify separator adoption in new cell chemistries.

Volatile PAN Feedstock Prices

PAN constitutes about 90% of carbon nanofiber precursors, and its spot price fluctuates by up to 20% annually, eroding margin stability for downstream suppliers. Supply disruptions linked to acrylonitrile feed shortages intensify inventory risk, prompting producers to pursue petroleum-asphaltene or lignin alternatives that can cut raw-material cost below USD 9 per kg while raising sustainability credentials. Transition timeframes remain lengthy due to impurity management and variable mechanical performance, prolonging exposure to PAN volatility. Buyers hedge through index-linked contracts, but long-term pricing visibility is still limited, dampening aggressive capacity expansion.

Other drivers and restraints analyzed in the detailed report include:

- Demand for High-Efficiency Filtration Materials

- Growth in the Automotive Industry

- Difficulty in Shifting Carbon Nanofibers from Lab to Plant Scale

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The polymeric category anchors 42% of 2024 revenue, driven by well-established electrospinning lines and broad chemical versatility across packaging, filtration and biomedical devices. Carbohydrate-based grades, while smaller in volume, accelerate at a 27% CAGR as end-users pursue biodegradable, bio-sourced alternatives aligned with global circular-economy mandates. Cellulose nanofibers rival aramid tensile strength yet biodegrade under ambient conditions, compelling packaging suppliers to adopt them in single-use applications. Chitin nanofibers attract wound-care producers due to inherent antimicrobial traits, spurring investment in shellfish-waste valorization. Carbon nanofibers find significant use in specialty energy and electronics applications; however, production scale and cost challenges are restraining immediate growth.

Momentum for carbohydrate-based products is amplified by brand-owner commitments to cut fossil plastic use. Legislative bans on single-use synthetic fibers in several EU states compound this pull. Composite nanofibers, which blend polymer and ceramic phases, play a significant role in high-temperature filtration niches. Metal and metal-oxide grades serve catalytic and sensing applications where elevated conductivity or photocatalytic activity is critical. Ceramic nanofibers retain demand for thermal insulation in aerospace and furnace linings. As raw-material R&D migrates toward forestry and agricultural waste streams, cost curves are expected to converge, bolstering the broader nanofiber market.

The Nanofiber Market Report is Segmented by Product Type (Polymeric Nanofiber, Carbon Nanofiber, and More), Application (Water and Air Filtration, Medical, and More), Manufacturing Technology (Electrospinning (Needle-Based), Needle-Less Electrospinning, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commands 38% of 2024 revenue, with China, Japan and South Korea benefitting from deep electronic supply chains and government-backed nanotech initiatives. Robust EV production bases in China elevate local demand for nanofiber separators, while strict environmental guidelines accelerate uptake in air-filtration retrofits. Regional stimulus funds earmarked for sustainable materials further de-risk investment in lignin-derived nanofiber plants. This ecosystem underpins a 22% regional CAGR, ensuring Asia-Pacific continues to anchor global volume growth.

North America, driven by the U.S. with its USD 2.2 billion FY-25 National Nanotechnology Initiative budget, which allocates grants to medical, defense, and energy sectors, plays a significant role in global revenue generation. High-value healthcare projects dominate demand; clinical trials for nanofiber-based regenerative implants secure FDA fast-track status, accelerating commercialization. Defense agencies sponsor filtration and protective-wear R&D, fortifying domestic supply chains. Canada's clean-technology incentives and proximity to automotive hubs kindle cross-border collaboration in battery materials.

Europe, driven by Germany and France's stringent sustainability frameworks, leads in the market for biodegradable nanofiber packaging and HVAC solutions. Horizon Europe grants foster university-industry clusters that fast-track scale-up and standardization, while REACH compliance guidelines supply regulatory certainty. Although growth rates trail Asia-Pacific, EU directives banning select single-use plastics are opening replacement opportunities in food-service and personal-care products. In South America, the Middle East, and Africa, where programs addressing potable-water scarcity and enhancing agricultural efficiency are gaining traction, revenue is driven by the early adoption of nanofiber membranes in desalination and controlled-release fertilizers.

- Applied Sciences Inc.

- Argonide Corporation

- Asahi Kasei Corporation

- Chuetsu Pulp & Paper Co. Ltd.

- Donaldson Company Inc.

- DuPont

- Esfil Tehno AS

- eSpin Technologies Inc.

- FibeRio Technology Corp.

- Hollingsworth & Vose

- IREMA-Filter GmbH

- Japan Vilene Company Ltd.

- NanoLayr Ltd

- Nanoval GmbH & Co. KG

- NIPPON PAPER INDUSTRIES CO., LTD.

- Pardam SRO

- Rengo Co., Ltd.

- Sappi Ltd.

- SNC Fiber

- Spur AS

- Teijin Limited

- Toray Industries Inc.

- US Global Nanospace Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand from the Medical and Pharmaceutical Industries

- 4.2.2 Demand for High-Surface-Area Battery Separators in EV Gigafactories

- 4.2.3 Demand for High-Efficiency Filtration Materials

- 4.2.4 Growth in the Automotive Industry

- 4.2.5 Expansion in the Textile Industry

- 4.3 Market Restraints

- 4.3.1 Volatile PAN Feedstock Prices

- 4.3.2 Difficulty in Shift of Carbon Nanofibers from Lab Scale to Plant Scale due to Small Size and Complexity

- 4.3.3 Health and Safety Concerns

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

- 4.6 Technology Snapshot

- 4.7 Patent Analysis

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Polymeric Nanofiber

- 5.1.2 Carbon Nanofiber

- 5.1.3 Composite Nanofiber

- 5.1.4 Metal and Metal Oxide Nanofiber

- 5.1.5 Ceramic Nanofiber

- 5.1.6 Carbohydrate-based Nanofiber

- 5.2 By Application

- 5.2.1 Water and Air Filtration

- 5.2.2 Medical

- 5.2.3 Energy Storage

- 5.2.4 Automotive and Transportation

- 5.2.5 Electronics

- 5.2.6 Textiles

- 5.2.7 Other Applications

- 5.3 By Manufacturing Technology

- 5.3.1 Electrospinning (Needle-Based)

- 5.3.2 Needle-less Electrospinning

- 5.3.3 Solution Blow Spinning

- 5.3.4 ForceSpinning/Rotary Jet Spinning

- 5.3.5 Melt Blowing

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-Level Overview, Market-Level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Applied Sciences Inc.

- 6.4.2 Argonide Corporation

- 6.4.3 Asahi Kasei Corporation

- 6.4.4 Chuetsu Pulp & Paper Co. Ltd.

- 6.4.5 Donaldson Company Inc.

- 6.4.6 DuPont

- 6.4.7 Esfil Tehno AS

- 6.4.8 eSpin Technologies Inc.

- 6.4.9 FibeRio Technology Corp.

- 6.4.10 Hollingsworth & Vose

- 6.4.11 IREMA-Filter GmbH

- 6.4.12 Japan Vilene Company Ltd.

- 6.4.13 NanoLayr Ltd

- 6.4.14 Nanoval GmbH & Co. KG

- 6.4.15 NIPPON PAPER INDUSTRIES CO., LTD.

- 6.4.16 Pardam SRO

- 6.4.17 Rengo Co., Ltd.

- 6.4.18 Sappi Ltd.

- 6.4.19 SNC Fiber

- 6.4.20 Spur AS

- 6.4.21 Teijin Limited

- 6.4.22 Toray Industries Inc.

- 6.4.23 US Global Nanospace Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Increasing R&D and High-potential Market for Cellulosic Nanofibers