|

市场调查报告书

商品编码

1905982

欧洲胶原蛋白:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Europe Collagen - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

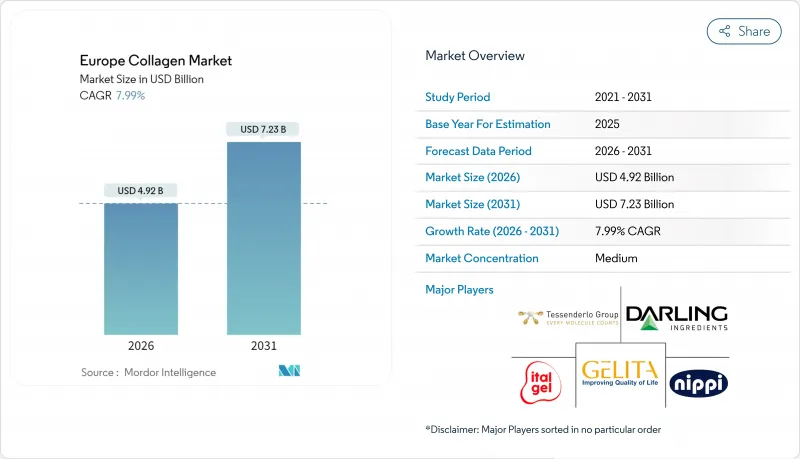

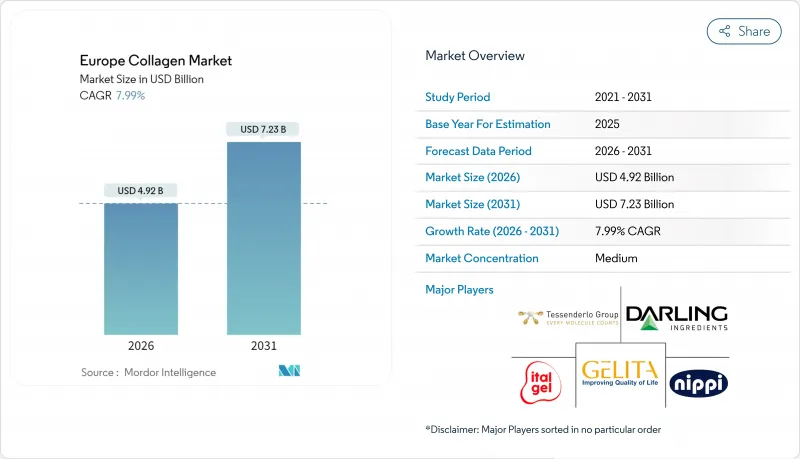

欧洲胶原蛋白市场预计将从 2025 年的 45.6 亿美元成长到 2026 年的 49.2 亿美元,预计到 2031 年将达到 72.3 亿美元,2026 年至 2031 年的复合年增长率为 7.99%。

随着消费者对健康维护、显着的皮肤改善效果和关节护理功效的日益关注,该品类正在稳步升级。同时,有关健康声明的监管政策日益明朗,加速了高级产品的创新。市场需求正从传统的牛和猪来源转向可追溯的海洋来源,后者俱有更高的生物利用度和更低的环境影响。将临床验证与负责任的采购相结合的品牌所有者正在获得显着的商店占有率。德国、法国和荷兰的零售商报告称,儘管海洋胶原蛋白产品的价格高于同类产品的平均水平,但其销售仍保持两位数的持续成长。精准发酵和重组平台的创新正在拓展医疗设备和机能性食品领域的应用范围,而一体化生产商则正利用其规模优势来应对欧盟严格的合规环境。

欧洲胶原蛋白市场趋势与洞察

消费者对健康和保健产品的需求不断增长

欧洲消费者正积极拥抱预防性医疗保健策略,将焦点从被动的医疗照护转向主动的健康管理。这种转变使得胶原蛋白的应用范围从传统的美容领域扩展到功能性营养领域。尤其值得一提的是,35至55岁的消费者普遍认为补充胶原蛋白对于维持关节活动度和皮肤弹性至关重要。人口老化以及日益增强的健康意识,共同推动了对高品质胶原蛋白产品的稳定需求。欧洲消费者尤其愿意为经科学验证的配方支付25%至40%的溢价。此外,在欧洲食品安全局(EFSA)的指导下,法规结构正逐步核准胶原蛋白肽的健康声明,为生产商提供了更清晰的产品定位和行销策略。

人口老化社会寻求关节护理解决方案

随着欧洲人口老化,对关节护理解决方案的需求激增。根据欧盟统计局的预测,欧洲老年人口扶养比预计将从2023年的33.4%上升至2100年的59.7%。发表在《整合与补充医学日誌》上的一项临床研究表明,补充未变性II型胶原蛋白可显着改善膝关节的柔软性。具体而言,在补充24週后,受试者的膝关节屈曲角度提高了3.23度,伸展角度提高了2.21度。这种人口结构的变化导致对胶原蛋白类关节保健产品的需求持续增长,尤其是在50岁以上、活动时容易出现关节不适的欧洲人群中。由于水解胶原蛋白类产品具有高生物利用度和已证实的临床益处,因此在欧洲市场更受欢迎。值得注意的是,每日摄取10克胶原蛋白正逐渐成为关节保健应用的标准剂量。此外,欧洲各地的医疗保健系统越来越重视胶原蛋白补充剂,认为这是一种经济有效的策略,不仅可以维持关节功能,还可以降低长期整形外科治疗费用。

植物蛋白替代品的兴起

在欧洲市场,植物来源蛋白替代品的成长和合成生物学的进步正加速传统胶原蛋白来源模式的挑战。 PlantForm公司用于生产重组人类胶原胶原蛋白的植物性系统证明了纯素替代品的商业性可行性,预计到2030年,该市场规模将达到114亿美元。消费者的偏好正转向符合伦理和永续的选择,尤其是在越来越关注环境影响和动物福利的年轻一代。随着纯素胶原蛋白替代品在功能上达到与动物源产品相当的水平,同时又具有更高的均一性和监管优势,市场竞争日益激烈。为了应对这项挑战,欧洲製造商正在投资基于发酵的生产技术,并开发融合传统和替代蛋白质来源的混合配方,以在保持市场地位的同时,解决伦理方面的担忧。

细分市场分析

动物源胶原胶原蛋白将继续引领市场,预计到2025年将占据65.05%的市场份额,这主要得益于成熟的供应链以及消费者对牛和猪源胶原蛋白成分的认知度不断提高。然而,海洋源胶原胶原蛋白预计将展现出更强劲的成长潜力,到2031年复合年增长率将达到10.11%,这主要得益于其永续性优势以及优先考虑可追溯海洋来源而非传统动物来源的监管优势。海洋胶原蛋白市场正受益于萃取技术的进步以及消费者对其卓越生物利用度的日益认可,其中鱼源胶原胶原蛋白的吸收率是哺乳动物源胶原蛋白的1.5倍。

由于海洋来源的原料能降低疯牛症风险并满足明确的可追溯性要求,欧洲法规结构越来越倾向于使用海洋来源的原料。欧洲食品安全局(EFSA)的评估也证实了海洋来源的胶原蛋白比反刍动物来源的胶原胶原蛋白更具安全优势。从鱼类加工产品中提取海洋胶原蛋白的创新技术,在解决永续性问题的同时,也为废弃物创造了经济价值。研究表明,仅欧洲渔业每年就具有超过6500吨的产量潜力。竞争格局正在发生变化,传统的动物胶原蛋白生产商正在投资海洋加工能力,而专业的海洋生物技术公司则透过高端定位和永续性认证来扩大市场份额。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 消费者对健康和保健产品的需求不断增长;

- 老龄化人口寻求关节护理解决方案

- 美容和个人护理领域的扩张

- 在营养补充品领域的应用不断拓展

- 向永续海洋胶原蛋白来源过渡

- 研究、开发和生产的创新进展

- 市场限制

- 植物蛋白替代品的兴起

- 严格的监管合规和认证要求

- 与动物源性胶原蛋白相关的伦理和致敏性问题

- 采购及加工优质胶原蛋白原料成本高昂

- 供应链分析

- 监理展望

- 波特五力模型

- 新进入者的威胁

- 买方/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 起源

- 动物源性

- 海洋来源

- 最终用户/使用

- 食品/饮料

- 营养补充品

- 个人护理及化妆品

- 製药

- 动物饲料

- 按地区

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 荷兰

- 其他欧洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市场排名分析

- 公司简介

- Gelita AG

- Darling Ingredients Inc.(Rousselot)

- PB Leiner(Tessenderlo Group)

- Italgel Srl

- Nippi, Incorporated

- Lapi Gelatine SpA

- Collagen Solutions Plc

- DSM-Firmenich

- Symrise AG

- Weishardt Group

- Gelnex

- Lonza Group Ltd.

- BioCell Technology LLC

- Jellagen Ltd

- CollaSwiss(Swiss Nutrivalor)

- Medichema GmbH

- Evonik Industries AG

- Essentia Protein Solutions

- PB Gelatins

- NovaColl(Geltor)

第七章 市场机会与未来展望

The European collagen market is expected to grow from USD 4.56 billion in 2025 to USD 4.92 billion in 2026 and is forecast to reach USD 7.23 billion by 2031 at 7.99% CAGR over 2026-2031.

Heightened consumer focus on proactive health, visible skin benefits, and joint-care efficacy underpins steady category trading up, while regulatory clarity on permissible health claims accelerates premium innovation. Demand is shifting from conventional bovine and porcine ingredients to traceable marine sources that offer superior bioavailability and a smaller environmental footprint. Brand owners that combine clinical substantiation with responsible sourcing capture disproportionate shelf visibility, and German, French, and Dutch retailers report sustained double-digit sell-out for marine collagen lines despite above-category price points. Innovation in precision fermentation and recombinant platforms is widening the addressable use-case set in medical devices and functional foods, while integrated producers leverage their scale to navigate the European Union's demanding compliance landscape.

Europe Collagen Market Trends and Insights

Increasing Consumer Demand for Health and Wellness Products

European consumers are increasingly adopting preventive health strategies, shifting their focus from reactive healthcare to proactive wellness management. This shift has expanded the use of collagen from traditional beauty applications to functional nutrition. Educated consumers aged 35-55, in particular, consider collagen supplementation essential for maintaining joint mobility and skin elasticity. The combination of aging demographics and rising health awareness is driving consistent demand for premium collagen products. European consumers are notably willing to pay 25-40% more for scientifically validated formulations. Additionally, regulatory frameworks under EFSA guidance are increasingly endorsing health claims for collagen peptides, providing manufacturers with clearer opportunities for product positioning and marketing communications.

Ageing Population Seeking Joint-Care Solutions

Europe's aging population is fueling a surge in demand for joint-care solutions. Projections from Eurostat indicate that the old-age dependency ratio in Europe will rise from 33.4% in 2023 to a staggering 59.7% by 2100. Clinical studies, as highlighted in the Journal of Integrative and Complementary Medicine, have shown that supplementation with undenatured type II collagen can notably enhance knee joint flexibility. Specifically, after 24 weeks of supplementation, subjects exhibited a 3.23° improvement in flexion and a 2.21° boost in extension. This demographic evolution is propelling a consistent demand for collagen-infused joint health products, especially among Europeans over 50 who often grapple with activity-induced joint discomfort. The European market is leaning towards collagen hydrolysate formulations, prized for their bioavailability and proven clinical benefits. Notably, a daily dosage of 10g has emerged as the benchmark for joint health applications. Furthermore, healthcare systems across Europe are increasingly viewing collagen supplementation as a budget-friendly strategy, not only to uphold joint function but also to potentially curtail long-term orthopedic care expenses.

Rise of Vegan Protein Alternatives

The European market is under increasing pressure from the growth of plant-based protein alternatives and advancements in synthetic biology, which challenge traditional collagen sourcing models. PlantForm Corporation's production of recombinant human collagen using plant-based systems highlights the commercial feasibility of vegan alternatives, with the market projected to reach USD 11.4 billion by 2030. Consumer preferences are shifting toward ethical and sustainable options, particularly among younger demographics who emphasize environmental impact and animal welfare. The competition intensifies as vegan collagen alternatives achieve functional equivalence with animal-derived products while offering better consistency and regulatory benefits. In response, European manufacturers are investing in fermentation-based production technologies and creating hybrid formulations that integrate traditional and alternative protein sources to retain their market position while addressing ethical concerns.

Other drivers and restraints analyzed in the detailed report include:

- Expansion in the Beauty and Personal Care Sector

- Increasing Applications in Dietary Supplements

- Stringent Regulatory Compliance and Certification Requirements

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Animal-based collagen maintains market leadership with a 65.05% share in 2025, reflecting established supply chains and consumer familiarity with bovine and porcine sources. However, marine-based collagen demonstrates superior growth dynamics at 10.11% CAGR through 2031, driven by sustainability advantages and regulatory preferences that favor traceable marine sources over traditional animal derivatives. The marine segment benefits from technological advances in extraction methods and growing consumer awareness of bioavailability advantages, with fish collagen demonstrating 1.5 times higher absorption rates than mammalian alternatives.

European regulatory frameworks increasingly favor marine sources due to reduced BSE risk and clearer traceability requirements, with EFSA assessments confirming safety advantages over ruminant-derived collagen. Innovation in marine collagen extraction from fish processing by-products addresses sustainability concerns while creating economic value from waste streams, with research demonstrating potential annual production exceeding 6,500 tons from European fisheries alone. The competitive landscape evolves as traditional animal collagen producers invest in marine processing capabilities while specialized marine biotechnology companies gain market share through premium positioning and sustainability credentials.

The Europe Collagen Market Report is Segmented by Source (Animal-Based, Marine-Based), End User/Application (Food & Beverages, Dietary Supplements, Personal Care & Cosmetics, Pharmaceuticals, Animal Nutrition), and Geography (Germany, United Kingdom, Italy, France, Spain, Netherlands, Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Gelita AG

- Darling Ingredients Inc. (Rousselot)

- PB Leiner (Tessenderlo Group)

- Italgel S.r.l.

- Nippi, Incorporated

- Lapi Gelatine S.p.A.

- Collagen Solutions Plc

- DSM-Firmenich

- Symrise AG

- Weishardt Group

- Gelnex

- Lonza Group Ltd.

- BioCell Technology LLC

- Jellagen Ltd

- CollaSwiss (Swiss Nutrivalor)

- Medichema GmbH

- Evonik Industries AG

- Essentia Protein Solutions

- PB Gelatins

- NovaColl (Geltor)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing consumer demand for health and wellness products,

- 4.2.2 Ageing population seeking joint-care solutions

- 4.2.3 Expansion in the beauty and personal care sector

- 4.2.4 Increasing Applications in Dietary Supplements

- 4.2.5 Shift toward sustainable marine collagen sources

- 4.2.6 Rising Innovation in research and production

- 4.3 Market Restraints

- 4.3.1 Rise of vegan protein alternatives

- 4.3.2 Stringent regulatory compliance and certification requirements

- 4.3.3 Ethical and allergenic concerns related to animal-derived collagen

- 4.3.4 High costs of sourcing and processing high-quality collagen raw materials

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECAST

- 5.1 By Source

- 5.1.1 Animal-based

- 5.1.2 Marine-based

- 5.2 By End User / Application

- 5.2.1 Food & Beverages

- 5.2.2 Dietary Supplements

- 5.2.3 Personal Care & Cosmetics

- 5.2.4 Pharmaceuticals

- 5.2.5 Animal Nutrition

- 5.3 By Geography

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 Italy

- 5.3.4 France

- 5.3.5 Spain

- 5.3.6 Netherlands

- 5.3.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Gelita AG

- 6.4.2 Darling Ingredients Inc. (Rousselot)

- 6.4.3 PB Leiner (Tessenderlo Group)

- 6.4.4 Italgel S.r.l.

- 6.4.5 Nippi, Incorporated

- 6.4.6 Lapi Gelatine S.p.A.

- 6.4.7 Collagen Solutions Plc

- 6.4.8 DSM-Firmenich

- 6.4.9 Symrise AG

- 6.4.10 Weishardt Group

- 6.4.11 Gelnex

- 6.4.12 Lonza Group Ltd.

- 6.4.13 BioCell Technology LLC

- 6.4.14 Jellagen Ltd

- 6.4.15 CollaSwiss (Swiss Nutrivalor)

- 6.4.16 Medichema GmbH

- 6.4.17 Evonik Industries AG

- 6.4.18 Essentia Protein Solutions

- 6.4.19 PB Gelatins

- 6.4.20 NovaColl (Geltor)