|

市场调查报告书

商品编码

1905983

北美燃油添加剂:市场占有率分析、产业趋势与统计、成长预测(2026-2031 年)North America Fuel Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

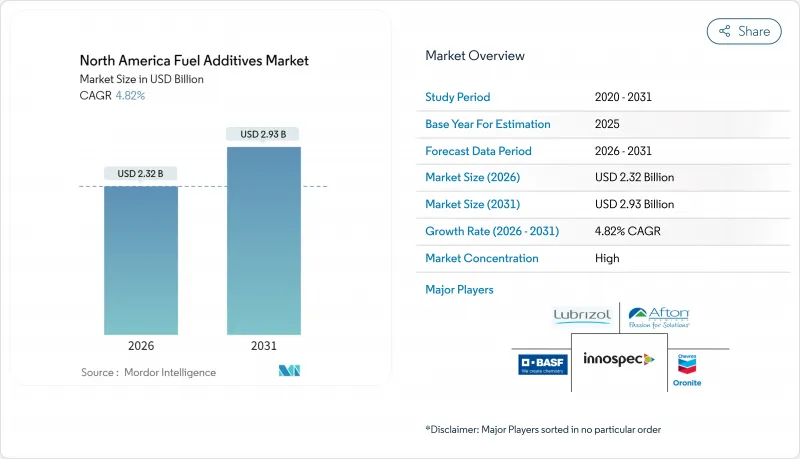

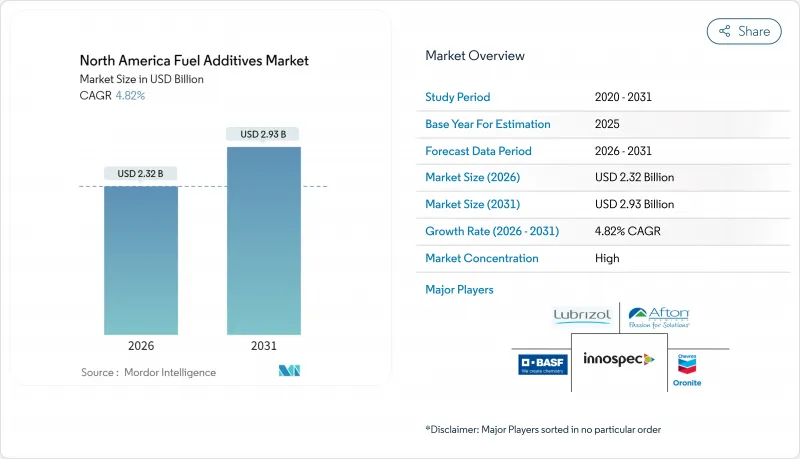

预计北美燃料添加剂市场将从 2025 年的 22.1 亿美元成长到 2026 年的 23.2 亿美元,到 2031 年将达到 29.3 亿美元,2026 年至 2031 年的复合年增长率为 4.82%。

目前市场成长的驱动因素包括:更严格的减硫法规、老旧内燃机车辆对耐久性的需求,以及随着可再生燃料的普及,维持汽油和柴油引擎效率的必要性。缸内喷油(GDI)引擎比传统的歧管喷射平台更容易积碳,因此积碳控制化学品的使用日益普遍。同时,随着炼油商寻求在不增加芳烃含量的情况下提高引擎压缩比,辛烷值提升型抗爆添加剂正成为成长最快的市场。商用柴油用户推动了对润滑性促进剂和十六烷改良剂的需求,以弥补超低硫柴油(ULSD)的不足。供应商也受惠于利润率高于炼油厂出口的售后市场管道。随着液体燃料市场继续为传统乘用车、重型商用车、船用燃料和永续航空燃料应用提供燃料,即使电池式电动车(BEV)日益普及,北美燃料添加剂市场仍在持续扩张。

北美燃油添加剂市场趋势与洞察

严格的第三阶段排放标准和排放控制区硫含量限制

Tier-3汽油10ppm的含硫量上限以及排放控制区(ECA)0.1%的船用燃料含硫量要求,永久改变了添加剂的需求格局。炼油厂依赖多功能添加剂来弥补润滑性能的损失、维持辛烷值、分散沉积物并防止腐蚀。在加州,先进清洁汽车II框架将低硫法规的有效期延长至2035年,进一步增加了合规成本。同时,码头业者正在采用杀菌剂来防止低硫燃料储存过程中的微生物污染。这些累积效应导致北美燃料添加剂市场加工量出现结构性成长,即使汽油和柴油的基准加工量保持稳定,也支撑了强劲的添加剂需求。

加快超低硫柴油和气体直接排放柴油清洁度标准

超低硫柴油(ULSD)本身润滑性较差,而缸内直喷(GDI)引擎的进气门积碳速度是端口式引擎的10倍。这种协同效应正推动清洁剂化学技术的快速创新,例如耐高温卡死的聚异丁胺和聚醚胺混合物。美国环保署(EPA)第三阶段排放法规要求汽车製造商维持触媒效率,而积碳的增加会降低触媒效率。同时,氢化可再生柴油的日益普及造成了传统石油基馏分油所不具备的润滑性差距。这些因素共同扩大了北美燃油添加剂市场中清洁剂、润滑性促进剂和十六烷改良剂的应用范围和商机。

由于电动车的普及,液态燃料市场正在萎缩。

预测显示,到2030年,人口稠密地区新车销售的一半将是电动车。每辆电动车都会永久取代部分汽油需求,逐步缩小北美燃油添加剂市场的潜在规模。随着宅配和城市公车试点使用电池动力平台,柴油车的防御优势正在削弱,面向高运转率商业客户的传统添加剂销售量也在下降。供应商正透过转向航空、海运和工业领域来应对这项挑战,因为这些领域在电气化方面仍然面临着巨大的障碍。

细分市场分析

北美燃油添加剂市场中,积碳控制产品占33.02%。基于聚醚胺和聚异丁烯琥珀酰亚胺的多功能清洁剂能够清除现代汽缸内直喷(GDI)引擎上积聚的气门、喷油器和燃烧室积碳。高压缩比引擎推动了辛烷值需求,进而带动抗爆添加剂销量在2031年前以5.28%的复合年增长率成长。

低温流动改良剂能确保柴油在加拿大和美国北部各州低至-10°F(约-23°C)的温度下仍能保持良好的运作性能。同时,十六烷改良剂、润滑性促进剂和腐蚀抑制剂在低芳烃和低硫含量的可再生柴油混合燃料中日益重要。供应商正越来越多地将这些化学品整合到一个包装中,使炼油厂能够在满足ASTM、EPA和加拿大运输部规范的同时降低加工成本。日益严格的检验要求使得少数技术实力雄厚的公司拥有了更强的议价能力,同时,生物柴油稳定剂和高闪点船用添加剂等细分领域也涌现出了许多专业公司,进一步加剧了北美燃料添加剂市场的竞争。

北美燃油添加剂、腐蚀抑制剂、低温流动十六烷改良剂、防腐蚀剂及其他产品类型)、应用领域(柴油、汽油、喷射机燃料及其他应用领域)和地区(美国、加拿大和墨西哥)进行细分。市场预测以美元以金额为准。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 严格的Tier-3和ECA硫排放法规

- 加快超低硫柴油和气体直接排放柴油清洁度标准的製定

- 车辆老化导致售后市场需求不断成长

- 可直接替代的可再生柴油和SAF相容性需求

- 配备SCR/DEF系统的非公路用车辆改装热潮

- 市场限制

- 由于电动车的普及,液体燃料需求下降

- 处理速率的检验成本和研发成本很高

- 特种化学品供应链中断

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 依产品类型

- 存款控制

- 十六烷改良剂

- 润滑添加剂

- 抗氧化剂

- 防腐蚀抑制剂

- 低温流动改善剂

- 抗爆剂

- 其他产品类型

- 透过使用

- 柴油引擎

- 汽油

- 喷射机燃料

- 其他用途

- 按地区

- 美国

- 加拿大

- 墨西哥

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- AFTON CHEMICAL

- Baker Hughes Company

- BASF

- Chevron Oronite Company LLC

- Clariant AG

- Croda International Plc

- Dorf Ketal Chemicals

- Evonik Industries AG

- Exxon Mobil Corporation

- Infineum International Limited

- Innospec

- LANXESS AG

- Shell plc

- The Lubrizol Corporation

- TotalEnergies

第七章 市场机会与未来展望

The North America Fuel Additives Market is expected to grow from USD 2.21 billion in 2025 to USD 2.32 billion in 2026 and is forecast to reach USD 2.93 billion by 2031 at 4.82% CAGR over 2026-2031.

Current growth rests on aggressive sulfur-reduction rules, the durability needs of an aging internal-combustion fleet, and the need to keep both gasoline and diesel engines efficient as renewable drop-ins enter mainstream supply. Deposit control chemistries dominate because gasoline direct-injection (GDI) engines foul more readily than legacy port-injection platforms, while octane-boosting antiknock agents record the quickest uptake as refiners strive for higher engine compression ratios without aromatics spikes. Commercial diesel users push demand for lubricity and cetane improvers that offset ultra-low-sulfur diesel (ULSD) shortcomings. Suppliers further benefit from aftermarket channels where margin opportunities remain stronger than at the refinery gate. Even with battery-electric vehicle (BEV) penetration climbing, the North America fuel additives market continues to expand because the liquid-fuel pool still serves legacy passenger vehicles, heavy-duty fleets, marine bunkers, and sustainable aviation fuel applications.

North America Fuel Additives Market Trends and Insights

Stringent Tier-3 and ECA Sulfur Limits

Tier-3 gasoline caps at 10 ppm sulfur and Emission Control Area marine requirements of 0.1% sulfur have permanently reset additive demand. Refiners rely on multifunctional packages that replace lost lubricity, maintain octane, disperse deposits, and guard against corrosion. Compliance costs rise further in California, where the Advanced Clean Cars II framework extends low-sulfur mandates through 2035. Terminal operators simultaneously adopt biocides that prevent microbial contamination during low-sulfur storage seasons. The cumulative effect drives a structural uptick in treat rates across the North America fuel additives market, keeping volumes resilient even when baseline gasoline and diesel throughput plateaus.

Accelerating ULSD and GDI Cleanliness Standards

ULSD carries lower natural lubricity, while GDI engines generate intake-valve deposits at 10X the rate of port systems. This intersection fuels rapid innovation in detergency chemistries such as polyisobutylamine and polyetheramine blends that resist high-temperature bake-on. EPA Tier 3 emission limits obligate automakers to maintain catalyst efficiency, which is compromised when coking rises. Concurrent growth in hydrogenated renewable diesel raises lubricity gaps that traditional petroleum fractions never posed. Together, these vectors expand the functional scope-and revenue opportunity-of detergent, lubricity, and cetane improvers across the North America fuel additives market.

BEV Penetration Reducing Liquid-Fuel Pool

Forecasts point to half of new-light-duty sales being electric by 2030 in densely populated corridors. Each incremental EV permanently displaces gasoline demand and gradually trims the North America fuel additives market addressable volume. Diesel's defensive moat erodes as parcel-delivery and municipal bus fleets test battery platforms, curtailing traditional additive sales to high-throughput commercial accounts. Suppliers respond by pivoting toward aviation, marine, and industrial channels where electrification hurdles remain significant.

Other drivers and restraints analyzed in the detailed report include:

- Rising Aftermarket Demand from Aging Fleet

- Drop-In Renewable Diesel and SAF Compatibility Needs

- High Validation and Treat-Rate Research and Development Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Deposit control packages held 33.02% of the North America fuel additives market share. Multifunctional detergents based on polyetheramines and polyisobutylene succinimides strip valve, injector, and combustion-chamber deposits that proliferate in modern GDI platforms. Higher compression engines spur octane demand, lifting antiknock agent sales at a projected 5.28% CAGR through 2031.

Cold-flow improvers preserve diesel operability below -10 °F in Canadian and Northern U.S. states, while cetane, lubricity, and corrosion inhibitors find fresh relevance in renewable diesel blends that arrive with low aromatics and sulfur. Suppliers increasingly bundle these chemistries into single packages, allowing refiners to reduce treat cost while meeting ASTM, EPA, and Transport Canada specifications. Escalating validation hurdles consolidate bargaining power within a handful of technology owners, yet specialty players still carve out sub-segments such as biodiesel stabilizers and high-flash-point marine additives, ensuring competitive churn inside the North America fuel additives market.

The North America Fuel Additives Report is Segmented by Product Type (Deposit Control, Cetane Improvers, Lubricity Additives, Antioxidants, Anticorrosion, Cold Flow Improvers, Antiknock Agents, and Other Product Types), Application (Diesel, Gasoline, Jet Fuel, and Other Applications), and Geography (United States, Canada, and Mexico). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- AFTON CHEMICAL

- Baker Hughes Company

- BASF

- Chevron Oronite Company LLC

- Clariant AG

- Croda International Plc

- Dorf Ketal Chemicals

- Evonik Industries AG

- Exxon Mobil Corporation

- Infineum International Limited

- Innospec

- LANXESS AG

- Shell plc

- The Lubrizol Corporation

- TotalEnergies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent Tier-3 and ECA sulfur limits

- 4.2.2 Accelerating ULSD and GDI cleanliness standards

- 4.2.3 Rising aftermarket demand from ageing fleet

- 4.2.4 Drop-in renewable diesel and SAF compatibility needs

- 4.2.5 Off-highway retrofit boom for SCR/DEF

- 4.3 Market Restraints

- 4.3.1 BEV penetration reducing liquid-fuel pool

- 4.3.2 High validation and treat-rate RandD costs

- 4.3.3 Specialty-chemical supply-chain shocks

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Deposit Control

- 5.1.2 Cetane Improvers

- 5.1.3 Lubricity Additives

- 5.1.4 Antioxidants

- 5.1.5 Anticorrosion

- 5.1.6 Cold Flow Improvers

- 5.1.7 Antiknock Agents

- 5.1.8 Other Product Types

- 5.2 By Application

- 5.2.1 Diesel

- 5.2.2 Gasoline

- 5.2.3 Jet Fuel

- 5.2.4 Other Applications

- 5.3 By Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Mexico

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AFTON CHEMICAL

- 6.4.2 Baker Hughes Company

- 6.4.3 BASF

- 6.4.4 Chevron Oronite Company LLC

- 6.4.5 Clariant AG

- 6.4.6 Croda International Plc

- 6.4.7 Dorf Ketal Chemicals

- 6.4.8 Evonik Industries AG

- 6.4.9 Exxon Mobil Corporation

- 6.4.10 Infineum International Limited

- 6.4.11 Innospec

- 6.4.12 LANXESS AG

- 6.4.13 Shell plc

- 6.4.14 The Lubrizol Corporation

- 6.4.15 TotalEnergies

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment