|

市场调查报告书

商品编码

1905992

德国农业机械市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031年)Germany Agricultural Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

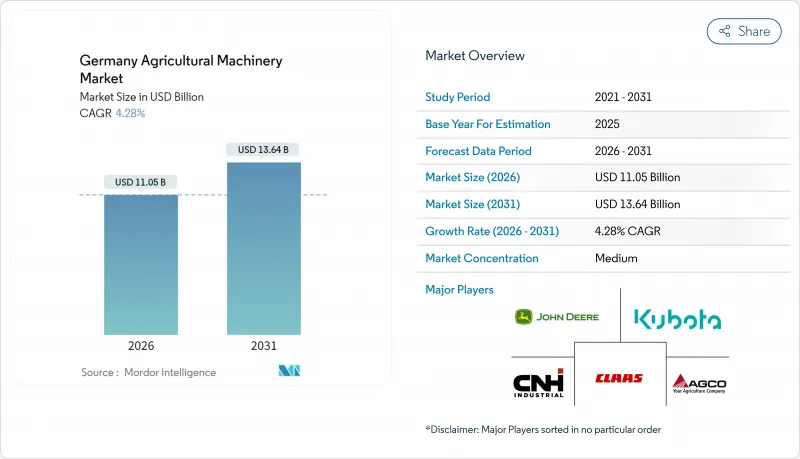

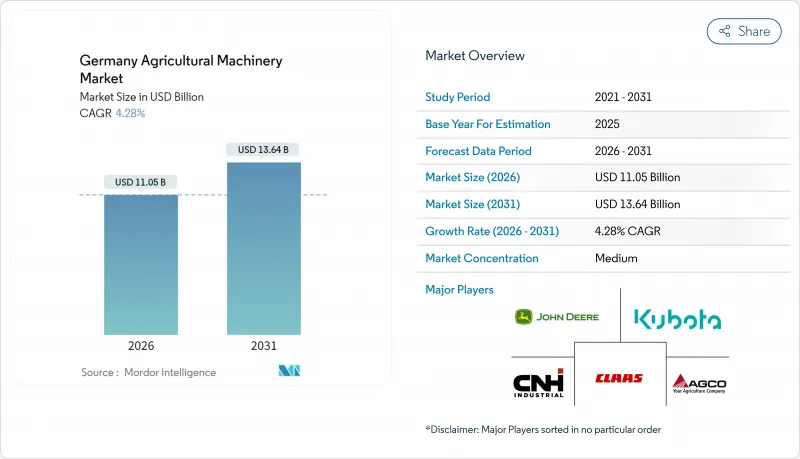

德国农业机械市场预计到 2026 年将达到 110.5 亿美元,高于 2025 年的 106 亿美元。

预计到 2031 年,该市场规模将达到 136.4 亿美元,2026 年至 2031 年的复合年增长率为 4.28%。

强劲的拖拉机需求、灌溉系统的快速普及以及持续不断的补贴抵消了註册量和农场收入的下降。农民正转向精密农业和自动化技术,以应对劳动力短缺、排放目标以及气候变迁造成的水资源压力。製造商正在增加符合ISOBUS标准并具备智慧连网功能的改装套件的供应,从而降低了老旧农机设备的升级门槛。原始设备製造商(OEM)也在实施创造性的融资模式,以平滑季节性现金流量并降低高昂的前期成本。同时,儘管大宗商品价格波动,但诸如每年62亿欧元(68亿美元)的通用农业政策(CAP)转移支付等政策奖励,正在支持德国农业机械市场的强劲资本投资。

德国农业机械市场趋势与洞察

老化导致的劳动力短缺

由于劳动力老化和年轻一代缺乏兴趣,德国农业部门正面临严重的劳动力短缺。随着老农退休,就业缺口不断扩大,促使农业机械化和自动化程度大幅提升。政府政策支持引入小型机器人执行特定农活,从而减少对人工的依赖。即插即用的介面和改造套件使得老旧机械的升级改造更加便捷,能够与智慧农具无缝整合。这项变革正在重塑农业机械市场,推动对自主解决方案和自适应技术的需求,以确保不同规模农场和不同作物类型的生产力。

欧盟和联邦政府对购买精密农业机械的补贴

欧盟和联邦层级的政策改革正在推动德国对精密农业技术的投资增加。通用农业政策(CAP)改革将绿色补贴提高到基准金额的130%,鼓励农民改用精准喷洒器和智慧灌溉系统。为了降低高科技拖拉机的营运成本,柴油税每公升降低了0.21480欧元(0.24美元)。诸如「国际农业机械联盟2023」(ILU 2023)等州级计画增加了对排放机械的津贴,从而支持德国农业机械市场设备的持续更新。农业机械市场的现代化使经济奖励与环境目标一致,并加强了德国的农业基础设施。

前期成本高,投资回收期长

对于德国农民,尤其是小规模农民而言,先进农业机械的高昂购买成本仍是一大挑战。大型联合收割机和精密设备需要大量投资,而不断上涨的资金筹措成本延长了收回成本所需的时间。因此,许多农民推迟了设备升级,减缓了整个市场的升级速度,并影响了製造商的销售。小规模农民受到的影响最大,因为他们往往缺乏投资新技术所需的资金。这种情况限制了德国农业机械市场的成长,成本和投资报酬率成为现代化的主要障碍。

细分市场分析

拖拉机将继续主导德国农业机械市场,预计到2025年将占市场份额的62.28%。儘管註册量有所下降,但由于燃油效率高的引擎和与智慧农具的兼容性,市场需求仍然强劲。农民们正在透过ISOBUS改造和即插即用升级来更新现有的拖拉机车队,而不是直接更换。电动拖拉机在蔬菜种植和市政服务领域正得到越来越广泛的应用,而像e100 Vario这样的车型试验表明,随着电池技术的进步,农业机械正逐步向电气化转型。

受气候变迁和节水农业需求的推动,预计到2031年,灌溉机械将以6.56%的复合年增长率实现最高增长。儘管灌溉技术的普及速度仍然缓慢,但日益严重的干旱和不断变化的气候模式正在加速喷灌和滴灌系统的推广应用。政府补贴和能源税收优惠政策优惠政策正在降低营运成本,并提高精准灌溉系统的普及率。对气候适应能力的需求正使灌溉从一项补充投资转变为关键组成部分,从而影响德国农业机械市场的市场动态和基础设施规划。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 老化导致的劳动力短缺

- 欧盟和联邦政府对精密机械采购的补贴

- 智慧型互联机器和 ISOBUS 标准的快速普及

- 碳排放法规有利于第五阶段排放标准和电动拖拉机

- 自主多任务平台试验部署进展

- 合适的OEM融资模式

- 市场限制

- 前期成本高,投资回收期长

- 日益数位化的车队中存在的网路安全和资料所有权问题

- 大宗商品价格下跌和能源成本波动导致利润率承压。

- 关于减少农药使用和氮排放上限的监管不确定性

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按类型

- 联结机

- 按马力

- 不到40马力

- 40-100马力

- 101-150马力

- 超过150马力

- 按拖拉机类型

- 紧凑型多用途车

- 公用事业

- 农田作物

- 按马力

- 犁地机械

- 犁

- 光环

- 耕耘机

- 其他(起垄机、旋转耕耘机等)

- 种植机械

- 播种机

- 播种机

- 撒布器

- 其他(移植机、精密播种机等)

- 收割机

- 结合

- 饲料收割机

- 其他(马铃薯收割机、马铃薯收割机等)

- 干草和饲料机械

- 死神

- 打包机

- 其他(耙子、翻晒机等)

- 灌溉机械

- 喷灌

- 滴

- 其他方式(微喷灌、中心枢轴式灌溉等)

- 其他类型

- 联结机

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- AGCO Corporation

- Deere & Company

- CLAAS KGaA mbH

- CNH Industrial NV

- Kubota Corporation

- SDF SpA

- Lemken Beteiligungs-GmbH

- Maschinenfabrik Bernard KRONE GmbH & Co.KG

- Horsch Holding SE

- GRIMME Landmaschinenfabrik GmbH & Co. KG

- AMAZONEN-Werke H. Dreyer GmbH & Co. KG

- Rauch Landmaschinenfabrik GmbH

- Kalverkamp Innovation GmbH(Nexat GmbH)

- Duport Machinery(Gustrower Maschinenbau GmbH)

第七章 市场机会与未来展望

The Germany agricultural machinery market size in 2026 is estimated at USD 11.05 billion, growing from 2025 value of USD 10.6 billion with 2031 projections showing USD 13.64 billion, growing at 4.28% CAGR over 2026-2031.

Strong demand for tractors, rapid irrigation system uptake, and sustained subsidy inflows offset reduced equipment registrations and lower farm incomes. Farmers pivot toward precision and autonomous technologies to cope with labor shortages, regulatory emission targets, and climate-driven water stress. Manufacturers scale retrofit kits that embed ISOBUS compliance and smart-connected features, lowering barriers for aging machine fleets. OEMs (Original Equipment Manufacturers) also deploy creative finance models that smooth seasonal cash flows and mitigate high upfront costs. Meanwhile, policy incentives such as EUR 6.2 billion (USD 6.8 billion) in annual CAP transfers keep equipment investment resilient in the Germany agricultural machinery market amid volatile commodity prices.

Germany Agricultural Machinery Market Trends and Insights

Ageing-workforce-driven Labor Scarcity

Germany's agricultural sector faces a significant labor shortage due to an aging workforce and limited interest among younger generations. As older farmers retire, hiring gaps widen, prompting a surge in mechanization and automation. Government initiatives support the deployment of mini-robots for targeted field tasks, reducing reliance on manual labor. Plug-and-play interfaces and retrofit kits allow older machinery to integrate with smart implements, making upgrades more accessible. This shift transforms the agricultural machinery market, with increased demand for autonomous solutions and adaptable technologies that maintain productivity across diverse farm sizes and crop types.

EU and Federal Subsidies for Precision-Machinery Purchases

Policy reforms at both the EU and federal levels are increasing investment in precision agriculture technologies across Germany. CAP reforms lift green premium payouts to 130% of the base rate, steering farmers toward precision sprayers and smart irrigation. Gas-oil tax relief of EUR 0.21480 per liter (USD 0.24) cuts running costs for high-tech tractors. State plans such as ILU 2023 add grants for emission-cutting machinery, supporting steady equipment turnover in the Germany agricultural machinery market.This modernization of the agricultural machinery market aligns economic incentives with environmental goals and strengthens Germany's farming infrastructure.

High Upfront Cost and Long Payback Period

The high capital cost of advanced agricultural machinery continues to challenge German farmers, particularly those operating smaller farms. Large combines and precision equipment require substantial investment, and rising financing costs have extended the time needed to recover these expenses. As a result, many farmers are postponing equipment upgrades, which slows overall market turnover and affects manufacturer sales. Smaller farms experience the greatest impact, as they often lack the financial resources to invest in newer technologies. This situation moderates growth in Germany's agricultural machinery market, where cost and return on investment remain significant barriers to modernization.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Adoption of Smart-connected Implements and ISOBUS Standards

- Carbon-footprint Regulations Favoring Tier-V and Electric Tractors

- Cybersecurity and Data Ownership Concerns in Digitally Enabled Fleets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Tractors represent 62.28% of the Germany agricultural machinery market size in 2025, maintaining their dominant position. Despite decreased registration volumes, demand remains robust due to fuel-efficient engines and smart implement compatibility. Farmers are modernizing existing fleets through ISOBUS retrofits and plug-and-play upgrades rather than complete replacements. Electric tractors are gaining adoption in the vegetable farming and municipal services segments. The testing of models like the e100 Vario indicates a gradual transition toward electrification as battery technology advances.

Irrigation machinery demonstrates the highest growth rate at 6.56% CAGR through 2031, driven by climate variability and water-efficient farming requirements. While irrigation adoption remains moderate, increasing drought conditions and changing weather patterns accelerate the uptake of sprinkler and drip systems. Government subsidies and energy tax incentives reduce operational costs, improving access to precision irrigation systems. Climate resilience requirements are transforming irrigation from a supplementary investment to an essential component, influencing Germany's agricultural machinery market dynamics and infrastructure planning.

The Germany Agricultural Machinery Market Report is Segmented by Type (Tractors, Plowing and Cultivating Machinery, Planting Machinery, Harvesting Machinery, Haying and Forage Machinery, Irrigation Machinery, and Other Types). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- AGCO Corporation

- Deere & Company

- CLAAS KGaA mbH

- CNH Industrial N.V.

- Kubota Corporation

- SDF S.p.A.

- Lemken Beteiligungs-GmbH

- Maschinenfabrik Bernard KRONE GmbH & Co.KG

- Horsch Holding SE

- GRIMME Landmaschinenfabrik GmbH & Co. KG

- AMAZONEN-Werke H. Dreyer GmbH & Co. KG

- Rauch Landmaschinenfabrik GmbH

- Kalverkamp Innovation GmbH (Nexat GmbH)

- Duport Machinery (Gustrower Maschinenbau GmbH)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ageing-workforce-driven Labor Scarcity

- 4.2.2 EU and Federal Subsidies for Precision-Machinery Purchases

- 4.2.3 Rapid Adoption of Smart-connected Implements and ISOBUS Standards

- 4.2.4 Carbon-footprint Regulations Favouring Tier-V and Electric Tractors

- 4.2.5 Autonomous Multi-task Platforms Gaining Pilot Traction

- 4.2.6 Suitable OEM Finance Models

- 4.3 Market Restraints

- 4.3.1 High Upfront Cost and Long Payback Period

- 4.3.2 Cybersecurity and Data Ownership Concerns in Digitally Enabled Fleets

- 4.3.3 Margin Pressure from Falling Commodity Prices and Volatile Energy Costs

- 4.3.4 Regulatory Uncertainty over Pesticide Reduction and Nitrogen Caps

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Tractors

- 5.1.1.1 By Horse-Power

- 5.1.1.1.1 Less than 40 HP

- 5.1.1.1.2 40-100 HP

- 5.1.1.1.3 101-150 HP

- 5.1.1.1.4 Above 150 HP

- 5.1.1.2 By Tractor Type

- 5.1.1.2.1 Compact Utility

- 5.1.1.2.2 Utility

- 5.1.1.2.3 Row-Crop

- 5.1.1.1 By Horse-Power

- 5.1.2 Plowing and Cultivating Machinery

- 5.1.2.1 Plows

- 5.1.2.2 Harrows

- 5.1.2.3 Cultivators and Tillers

- 5.1.2.4 Others (Ridger, Rotary tillers, etc.)

- 5.1.3 Planting Machinery

- 5.1.3.1 Seed Drills

- 5.1.3.2 Planters

- 5.1.3.3 Spreaders

- 5.1.3.4 Others(Transplanters, Precision Seeders, etc.)

- 5.1.4 Harvesting Machinery

- 5.1.4.1 Combine Harvesters

- 5.1.4.2 Forage Harvesters

- 5.1.4.3 Others (Potato Harvesters, Potato Harvesters, etc.)

- 5.1.5 Haying and Forage Machinery

- 5.1.5.1 Mowers

- 5.1.5.2 Balers

- 5.1.5.3 Others (Rakes, Tedders, etc.)

- 5.1.6 Irrigation Machinery

- 5.1.6.1 Sprinkler

- 5.1.6.2 Drip

- 5.1.6.3 Others (Micro-Sprinklers, Center-Pivot Irrigation, etc.)

- 5.1.7 Other Types

- 5.1.1 Tractors

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 AGCO Corporation

- 6.4.2 Deere & Company

- 6.4.3 CLAAS KGaA mbH

- 6.4.4 CNH Industrial N.V.

- 6.4.5 Kubota Corporation

- 6.4.6 SDF S.p.A.

- 6.4.7 Lemken Beteiligungs-GmbH

- 6.4.8 Maschinenfabrik Bernard KRONE GmbH & Co.KG

- 6.4.9 Horsch Holding SE

- 6.4.10 GRIMME Landmaschinenfabrik GmbH & Co. KG

- 6.4.11 AMAZONEN-Werke H. Dreyer GmbH & Co. KG

- 6.4.12 Rauch Landmaschinenfabrik GmbH

- 6.4.13 Kalverkamp Innovation GmbH (Nexat GmbH)

- 6.4.14 Duport Machinery (Gustrower Maschinenbau GmbH)