|

市场调查报告书

商品编码

1906098

欧洲测试、检定和认证 (TIC):市场份额分析、行业趋势和统计数据、成长预测 (2026-2031)Europe Testing, Inspection And Certification (TIC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

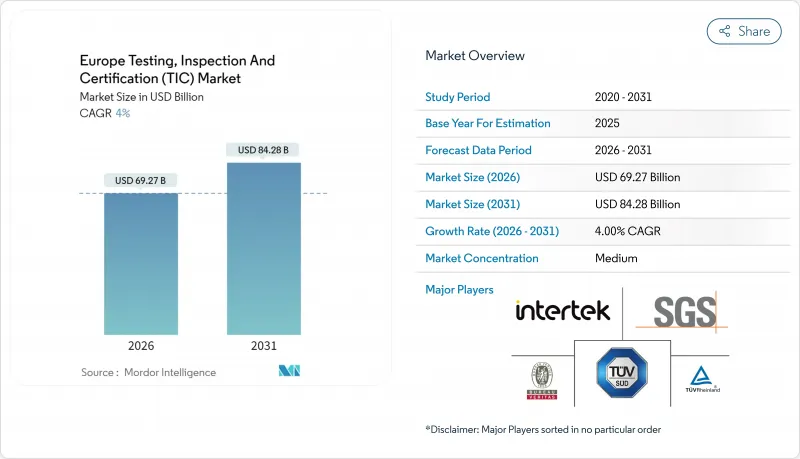

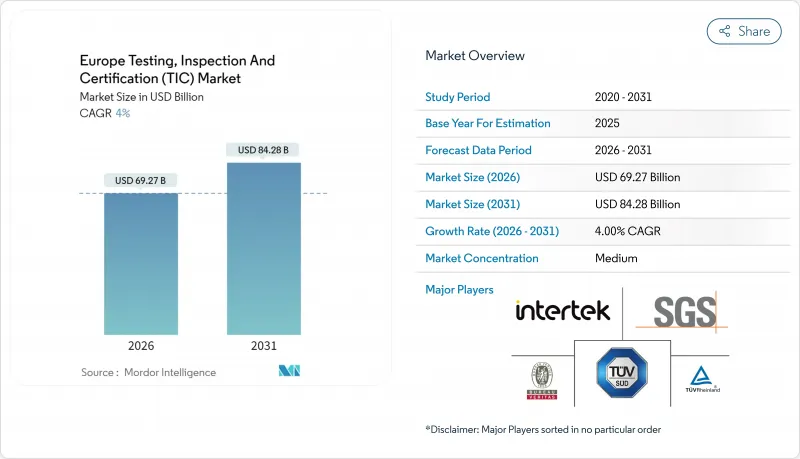

2025 年欧洲 TIC(测试、检验和认证)市场价值为 666.1 亿美元,预计到 2031 年将达到 842.8 亿美元,高于 2026 年的 692.7 亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 4.00%。

欧盟《数位商业韧性法案》、《企业永续发展报告指令》和《网路韧性法案》等法规不断提高的监管要求支撑了市场结构性成长。所有这些法规都强制要求在金融、永续发展和互联产品领域进行可验证的第三方保证。儘管各成员国的经济状况不尽相同,但可再生能源的快速发展、检验活动外包的持续趋势以及基于人工智慧的检测技术的迅速崛起,进一步增强了市场成长前景。同时,欧洲测试、检验和认证 (TIC) 市场仍然对价格敏感,网路安全限制了远端检验的全面应用,中小企业也面临着成本压力。诸如 SGS 和 Bureau Veritas 合併失败等整合倡议,凸显了规模化在世界监管最严格的商业服务领域之一的战略价值和复杂性。

欧洲TIC(测试、检验和认证)市场的趋势和洞察

欧盟各行业监管合规日益复杂

资料保护官指令 (DORA)、气候相关财务资讯揭露指令 (CSRD) 和网路韧性法案将于 2024 年生效,这些指令要求金融机构、大型企业和互联产品製造商分别针对资讯通讯技术风险、永续性资讯揭露和产品网路安全,获得多层第三方保证。目前,约 30% 的合规预算用于外部审核,这为能够透过单一合约涵盖网路安全、环境、社会和治理 (ESG) 以及营运韧性的端到端服务提供者创造了新的收入来源。这些领域需求的整合扩大了交叉销售机会,尤其是对于拥有整合数位审核平台的服务提供者。欧洲测试、检验和认证 (TIC) 市场是少数几个具有法律强制性要求的服务业之一,这意味着在更广泛的成本控制措施下,支出弹性仍然相对较低。因此,中期成长将取决于服务提供者在确保资料完整性标准符合监管机构要求的同时,扩展其多学科专业知识的能力。

需要专门认证的可再生能源计划正在不断扩大

在REPowerEU计划下,创纪录的风能和太阳能发电项目建设需要对涡轮机的健康状况、功率特性曲线性能和併网安全性进行全面检验,这为专注于船舶分类和环境影响评估的TIC(测试、检验和认证)实验室创造了商机。由于各国主管机关在维持严格技术标准的同时缩短了许可期限,计划开发商面临认证瓶颈,这使得拥有深厚专业知识的认证测试实验室具有重要的战略价值。仅北海离岸风力发电的扩张就需要在恶劣环境下进行复杂的海底电缆测试和材料认证,导致成本高昂。随着可再生能源资产所有者采用人工智慧无人机监控来应对老旧资产,能够检验硬体和数据分析演算法的认证实验室正在获得竞争优势。欧洲TIC(测试、检验和认证)市场被定位为与欧洲大陆净零排放时间表紧密相关的长期成长引擎。

中小企业认证和授权高成本

认证成本通常占中小企业收入的2-3%,迫使小规模的公司推迟全面合规,在某些情况下,甚至面临放弃出口机会的压力。儘管有核准协议,但多个国家认证机构仍要求提供重复的文件,增加了行政负担。虽然数位化审核平台降低了交易成本,但维持ISO认证能力的经济效益仍然有利于大型服务集团,造成了准入差距,阻碍了欧洲测试、检验和认证(TIC)市场的更广泛渗透,尤其是在购买力较低的东欧地区。

细分市场分析

至2025年,测试服务将占欧洲测试、检验和认证(TIC)市场360.9亿美元,即54.20%。这主要是因为先进电子产品、医疗设备和汽车零件在商业化之前都需要进行多学科性能评估。诸如基于云端的测试资料入口网站等数位化工作流程正在缩短交付时间,提高客户透明度,并增强早期采用者的竞争优势。认证服务目前规模较小,但由于企业永续性报告指令(CSRD)的保证要求以及管理体系标准扩展到网路安全、业务永续营运和社会责任等领域,预计将以4.58%的复合年增长率成长。检验服务在基础设施生命週期管理方面保持稳定的需求,这在传统製造场所尤其重要,因为定期结构评估是强制性的。

整合了测试调度、即时分析和认证颁发的平台正在模糊传统服务领域的界限。能够提供实验室测试和现场/远端检验服务并签订单一合约的供应商,正在赢得寻求一站式合规解决方案的客户的青睐。大量投资涌入人工智慧驱动的缺陷识别演算法,这些演算法在提高实验室效率的同时,也能确保数据完整性,从而巩固了测试在欧洲测试、检验和认证 (TIC) 市场的主导地位。

到2025年,外包检验将占欧洲测试、检验和认证(TIC)市场规模的63.05%,反映出企业正从资本密集的内部实验室转向外包模式。面对材料科学的进步和安全标准的不断演变,航太和汽车行业的製造商更倾向于基于产量的可变成本模式。外包服务也能让企业即时获得全球认证,缩短出口产品的上市时间,并降低监管风险。

基本契约(即TIC公司在特定范围内承担合规责任)正在不断扩展,不仅能带来持续收入,还能促进流程的持续改进。儘管出于知识产权方面的考虑,部分测试活动仍将保留在企业内部,但外包的整体趋势预计将保持4.37%的复合年增长率,其中,与长期框架协议相关的服务合约预计将为欧洲TIC(测试、检验和认证)市场带来两位数的稳定收入成长。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 欧盟各行业的监管合规性日益复杂。

- 越来越多的可再生能源计划需要专门的认证。

- 製造业外包TIC服务的趋势日益增长

- 欧盟「从农场到餐桌」战略下制定了严格的食品安全标准。

- 人工智慧巡检无人机在基础设施维护中的快速普及

- ESG挂钩贷款的兴起导致了强制性独立检验审核的出现。

- 市场限制

- 中小企业认证和授权高成本

- 非欧盟欧洲国家的法规结构碎片化

- 进阶无损检测 (NDT) 专业人员短缺

- 网路安全问题阻碍远端/数位化检查

- 产业价值链分析

- 宏观经济因素的影响

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按服务类型

- 测试

- 检查

- 认证

- 依采购类型

- 内部

- 外包

- 按行业

- 消费品和零售

- 资讯通信技术与通信

- 汽车/运输设备

- 航太/国防

- 石油、天然气和石化

- 能源与公共产业

- 工业製造和机械

- 化学/材料

- 建筑和基础设施

- 生命科学与医疗保健

- 食品、农业、饮料

- 其他产业领域(环境、永续发展等)

- 按服务类型

- 现场

- 异地/实验室

- 远端/数位

- 按国家/地区

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- SGS SA

- Bureau Veritas SA

- Intertek Group plc

- TUV SUD AG

- TUV Rheinland AG

- DEKRA SE

- Applus+Servicios Tecnologicos SLU

- Eurofins Scientific SE

- DNV AS

- Kiwa NV

- Lloyd's Register Group Limited

- British Standards Institution(BSI Group)

- RINA SpA

- UL Solutions Inc.

- ALS Limited

- Element Materials Technology Group Ltd.

- MISTRAS Group, Inc.

- TUV NORD Group

- VDE Testing and Certification Institute

- PhAST GmbH

- Safety Assessment Federation(SAFed)

- Exova Group Ltd.

- IAF International Accreditation Forum, Inc.

第七章 市场机会与未来展望

The European TIC market was valued at USD 66.61 billion in 2025 and estimated to grow from USD 69.27 billion in 2026 to reach USD 84.28 billion by 2031, at a CAGR of 4.00% during the forecast period (2026-2031).

The market's structural momentum is anchored in escalating regulatory demands under the EU Digital Operational Resilience Act, Corporate Sustainability Reporting Directive, and Cyber Resilience Act, each of which now compels demonstrable third-party assurance across financial, sustainability, and connected-product domains. Accelerated renewable-energy build-outs, a sustained shift toward outsourced verification, and the rapid emergence of AI-enabled inspection technologies further reinforce growth prospects even as economic sentiment remains uneven across member states. At the same time, the European TIC market is navigating cybersecurity constraints that temper full-scale remote inspection uptake, while cost pressures on small and medium enterprises keep price sensitivity elevated. Consolidation attempts such as the terminated SGS-Bureau Veritas merger illustrate both the strategic value and complexity of achieving scale in one of the world's most heavily regulated business services arenas.

Europe Testing, Inspection And Certification (TIC) Market Trends and Insights

Growing Regulatory Compliance Complexity Across EU Industries

DORA, CSRD, and the Cyber Resilience Act became enforceable during 2024, compelling financial firms, large corporates, and connected-product manufacturers to secure multi-layered third-party assurance for ICT risk, sustainability disclosures, and product cybersecurity, respectively. Compliance budgets now allocate roughly 30% to external audits, translating into fresh revenue pools for end-to-end providers able to cover cyber, ESG, and operational-resilience scopes in a single engagement. Demand aggregation across these domains amplifies cross-selling potential, particularly for providers with integrated digital audit platforms. Because the European TIC market is one of the few service categories legally mandated for market entry, spending remains relatively inelastic even amid broader cost-containment drives. Medium-term growth, therefore, hinges on providers' capacity to scale multidisciplinary expertise while assuring data-integrity standards acceptable to supervisory authorities.

Expansion of Renewable Energy Projects Requiring Specialized Certification

Record wind and solar build-outs under the REPowerEU plan require exhaustive verification of turbine integrity, power-curve performance, and grid-integration safety, creating high-margin opportunities for TIC specialists in marine classification and environmental impact assessment. Project developers face certification bottlenecks as national authorities uphold stringent technical codes but streamline permitting deadlines, magnifying the strategic value of accredited labs with deep domain know-how. Offshore wind growth in the North Sea alone commands premium fees because of complex subsea cabling tests and harsh-environment material qualification. As renewable-asset owners adopt AI-driven drone monitoring to manage aging fleets, certification bodies able to validate both hardware and data analytics algorithms gain a competitive advantage. The European TIC market consequently secures a long-run growth engine that is closely tied to the continent's net-zero timetable.

High Cost of Accreditation and Certification for SMEs

Certification expenses often equal 2-3% of SME revenue, pressuring smaller firms to postpone full compliance and, in some cases, forgo export opportunities. Multiple national accreditation bodies, despite mutual-recognition accords, still impose duplicative paperwork that raises administrative burdens. While digital audit portals are lowering transaction costs, the economics of maintaining ISO-accredited capacity continue to favor large service groups, creating an access gap that can inhibit broader European TIC market penetration, particularly in Eastern Europe, where purchasing power is lower.

Other drivers and restraints analyzed in the detailed report include:

- Rising Outsourcing Trend for TIC Services Among Manufacturers

- Emergence of ESG-Linked Financing Mandating Independent Verification Audits

- Fragmented Regulatory Framework Across Non-EU European States

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Testing services contributed USD 36.09 billion, equivalent to 54.20% of the European TIC market in 2025, as advanced electronics, medical devices, and automotive components all require multi-disciplinary performance assessments before commercialization. Digital workflows such as cloud-based test-data portals shorten turnaround times and enhance client transparency, deepening competitive moats for early adopters. Certification, though smaller today, is forecast to compound at 4.58% annually, driven by CSRD-mandated assurance and expanding management-system standards that now cover cybersecurity, business continuity, and social responsibility. Inspection maintains steady relevance in infrastructure life-cycle management, especially in legacy manufacturing hubs where periodic structural assessments are compulsory.

Integrated platforms that unify test scheduling, real-time analytics, and certificate issuance are blurring boundaries between traditional service silos. Providers that can bundle lab tests with on-site and remote inspection in a single engagement are capturing wallet share as clients pursue one-stop compliance solutions. Investment is flowing into AI-enabled defect-recognition algorithms that raise lab throughput while preserving data integrity, reinforcing Testing's primacy within the European TIC market.

Outsourced verification accounted for 63.05% of the European TIC market size in 2025, reflecting a decisive shift away from capital-intensive in-house labs. Manufacturers in aerospace and automotive segments, faced with material science advances and evolving safety standards, prefer variable cost models that align spending with production volumes. Outsourced services also provide immediate access to global accreditations, which accelerate time-to-market for exports and mitigate regulatory risk.

Outcome-based contracts under which TIC firms assume compliance responsibility for a defined scope are expanding, generating recurring revenue, and incentivizing continuous process improvement. Although intellectual-property concerns keep some testing activities internal, the broader outsourcing trend is expected to sustain a 4.37% CAGR, positioning the European TIC market for stable double-digit revenue contribution from service contracts linked to long-term framework agreements.

The Europe TIC Market Report is Segmented by Service Type (Testing, Inspection, and Certification), Sourcing Type (In-House and Outsourced), Industry Vertical (Consumer Goods and Retail, ICT and Telecom, Automotive and Transportation, and More), Mode of Service Delivery (On-Site, Off-site/Laboratory, and Remote/Digital), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- SGS SA

- Bureau Veritas SA

- Intertek Group plc

- TUV SUD AG

- TUV Rheinland AG

- DEKRA SE

- Applus+ Servicios Tecnologicos S.L.U.

- Eurofins Scientific SE

- DNV AS

- Kiwa NV

- Lloyd's Register Group Limited

- British Standards Institution (BSI Group)

- RINA S.p.A.

- UL Solutions Inc.

- ALS Limited

- Element Materials Technology Group Ltd.

- MISTRAS Group, Inc.

- TUV NORD Group

- VDE Testing and Certification Institute

- PhAST GmbH

- Safety Assessment Federation (SAFed)

- Exova Group Ltd.

- IAF International Accreditation Forum, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing regulatory compliance complexity across EU industries

- 4.2.2 Expansion of renewable energy projects requiring specialized certification

- 4.2.3 Rising outsourcing trend for TIC services among manufacturers

- 4.2.4 Stringent food-safety standards under EU Farm-to-Fork strategy

- 4.2.5 Rapid proliferation of AI-enabled inspection drones in infrastructure maintenance

- 4.2.6 Emergence of ESG-linked financing mandating independent verification audits

- 4.3 Market Restraints

- 4.3.1 High cost of accreditation and certification for SMEs

- 4.3.2 Fragmented regulatory framework across non-EU European states

- 4.3.3 Talent shortage of advanced NDT specialists

- 4.3.4 Cyber-security concerns hampering remote/digital inspections

- 4.4 Industry Value Chain Analysis

- 4.5 Impact of Macroeconomic Factors

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Service Type

- 5.1.1 Testing

- 5.1.2 Inspection

- 5.1.3 Certification

- 5.2 By Sourcing Type

- 5.2.1 In-house

- 5.2.2 Outsourced

- 5.3 By Industry Vertical

- 5.3.1 Consumer Goods and Retail

- 5.3.2 ICT and Telecom

- 5.3.3 Automotive and Transportation

- 5.3.4 Aerospace and Defense

- 5.3.5 Oil, Gas and Petrochemicals

- 5.3.6 Energy and Utilities

- 5.3.7 Industrial Manufacturing and Machinery

- 5.3.8 Chemicals and Materials

- 5.3.9 Construction and Infrastructure

- 5.3.10 Life Sciences and Healthcare

- 5.3.11 Food, Agriculture and Beverage

- 5.3.12 Other Industry Verticals (Environment, Sustainability, etc.)

- 5.4 By Mode of Service Delivery

- 5.4.1 On-site

- 5.4.2 Off-site / Laboratory

- 5.4.3 Remote / Digital

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Russia

- 5.5.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 SGS SA

- 6.4.2 Bureau Veritas SA

- 6.4.3 Intertek Group plc

- 6.4.4 TUV SUD AG

- 6.4.5 TUV Rheinland AG

- 6.4.6 DEKRA SE

- 6.4.7 Applus+ Servicios Tecnologicos S.L.U.

- 6.4.8 Eurofins Scientific SE

- 6.4.9 DNV AS

- 6.4.10 Kiwa NV

- 6.4.11 Lloyd's Register Group Limited

- 6.4.12 British Standards Institution (BSI Group)

- 6.4.13 RINA S.p.A.

- 6.4.14 UL Solutions Inc.

- 6.4.15 ALS Limited

- 6.4.16 Element Materials Technology Group Ltd.

- 6.4.17 MISTRAS Group, Inc.

- 6.4.18 TUV NORD Group

- 6.4.19 VDE Testing and Certification Institute

- 6.4.20 PhAST GmbH

- 6.4.21 Safety Assessment Federation (SAFed)

- 6.4.22 Exova Group Ltd.

- 6.4.23 IAF International Accreditation Forum, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment