|

市场调查报告书

商品编码

1906161

工业网路解决方案:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Industrial Networking Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

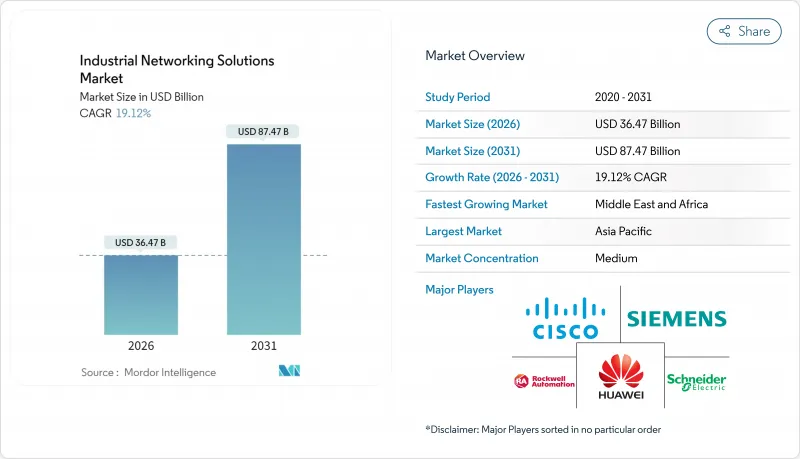

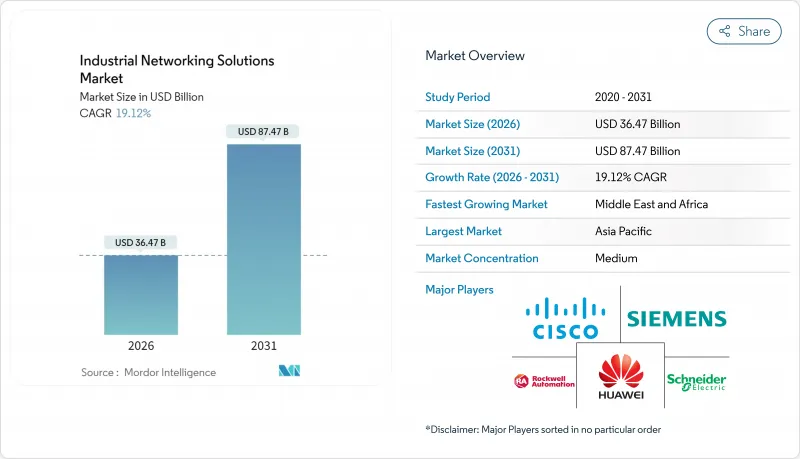

预计到 2026 年,工业网路解决方案市场规模将达到 364.7 亿美元,高于 2025 年的 306.1 亿美元。

预计到 2031 年将达到 874.7 亿美元,2026 年至 2031 年的复合年增长率为 19.12%。

这种快速成长反映了操作技术资产和企业IT网路的快速整合,使得在日益自动化的生产环境中实现即时可视性成为可能。从传统现场汇流排向以乙太网路为基础的工厂车间迁移进一步推动了需求,实现了自主设备亚毫秒的延迟目标。私有5G与边缘人工智慧的结合,透过预测性维护,将重工业的整体拥有成本降低了高达30%。在政府推动智慧製造的措施支持下,光是中国就计划在2024年投入28亿美元用于工业网路升级。这些因素共同推动工业网路解决方案市场维持结构性高成长。

全球工业网路解决方案市场趋势与洞察

快速将支援工业物联网的乙太网路基础设施迁移到工厂车间

随着工厂进行现代化改造以应对超过 1Gbps 的机器视觉工作负载,乙太网路目前已占新建製造网路部署的 73%(高于 2020 年的 45%)。宝马位于斯帕坦堡的工厂运营着一个私有的 5G 网络,确保视觉驱动的品质检测 99.9% 的正常运行时间。然而,由于生产线维修成本高达 250 万美元,中型企业采用 5G 网路的运转率仍然较慢。

OT/IT融合推动工厂采用SD-WAN

到2024年,製造业采用SD-WAN的比例将激增340%,这主要得益于企业需要将安全策略应用于确定性的现场流量。现代汽车公司旗下子公司现代汽车电子(Hyundai Autoever)在47个站点上,透过SD-WAN技术,将网路管理成本降低了60%,应用效能提高了35%。由于传统的VLAN分段缺乏自主移动机器人所需的弹性,支援OT的SD-WAN正逐渐成为业界标准。

现有设施中网路实体安全技能的缺口

约78%的製造商缺乏OT/网路安全人才,这延缓了他们的融合计画。预计到2024年,与OT相关的网路安全事件将增加87%,暴露出旧有系统的漏洞。思科和罗克韦尔的「面向产业的数位化技能」倡议旨在透过在亚太地区培训10万名专业人员来克服这一瓶颈。

细分市场分析

到2025年,硬体收入将占总收入的60.35%,这印证了市场对坚固耐用的交换器、路由器和网路基地台在严苛环境下工业网路解决方案中的依赖。高阶无风扇交换器的价格通常是企业级产品的三倍,并且能够承受持续的高温和振动。然而,软体和服务正以21.95%的复合年增长率快速成长,这标誌着网路监控和订阅模式正发生决定性的转变。西门子的SIRIUS 3RC7模组在控制层嵌入了软体定义网络,展现了软硬体的融合。随着企业将网路安全加固和全天候监控外包,託管服务供应商预计在2024年将实现45%的年增长率。

由于确定性控制要求以及乙太网路APL(乙太网路应用层)1000公尺的本质安全距离,有线乙太网路预计在2025年将占据67.55%的市场份额。无线技术正以25.1%的复合年增长率成长,因为私有5G网路的普及打破了自主机器人的限制,并加速了工厂的重构。丰田公司在物料搬运领域部署的5G技术实现了99.5%的可靠性,并且与铜线相比,安装预算降低了60%。德克萨斯的超低功耗模组可将能耗降低90%,进而提升电池供电感测器的经济性。

区域分析

亚太地区持续引领工业网路解决方案市场,预计2025年将占据34.55%的市场份额,主要得益于中国政策支持的数位化和日本高产能的电子製造生态系统。该地区的成长前景依然强劲,这主要得益于印度「印度製造」计画和东协「工业4.0」计画推动智慧工厂的普及。北美地区紧随其后,作为成熟的应用区域,美国联邦政府津贴8亿美元用于支持安全的OT-IT整合。欧洲受益于严格的网路安全指令以及德国为中小企业设立的12亿欧元基金,推动了网路现代化进程的广泛推进。中东和非洲地区虽然规模较小,但其复合年增长率将达到22.95%,成为成长最快的地区,这主要得益于沿岸地区的主要石油公司在腐蚀性沙漠和海上平台部署专用5G网络,用于钻井设备作业。拉丁美洲的机会在于采矿业和可再生能源的扩张,这些产业需要高弹性的光纤乙太网路(EoF)拓朴结构。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 快速将支援工业物联网的乙太网路基础设施迁移到工厂车间

- OT/IT融合推动工厂采用SD-WAN

- 透过 5G 专用网路实现超低延迟控制

- 利用边缘人工智慧进行预测性维护,降低整体拥有成本 (TCO)

- 政府智慧製造促进措施

- 开放原始码时间敏感网路 (TSN) 协定栈

- 市场限制

- 现有设施中网路实体安全技能的缺口

- 由于专有通讯协定的锁定,迁移成本增加

- 工业网卡半导体供应链的波动性

- 无风扇工业开关设计中的功率密度限制

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按组件

- 硬体

- 软体和服务

- 按连线类型

- 有线

- 无线的

- 依部署类型

- 本地部署

- 云

- 按最终用户行业划分

- 车

- 金融服务

- 製造业

- 沟通

- 物流/运输

- 采矿、石油天然气、能源与公共产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- ABB Ltd

- Advantech Co., Ltd.

- Antaira Technologies LLC

- Aruba Networks(Hewlett Packard Enterprise Co.)

- Belden Inc.

- Cisco Systems, Inc.

- Dell Technologies Inc.

- Eaton Corporation plc

- Hirschmann Automation(Belden)

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- Juniper Networks, Inc.

- Moxa Inc.

- Nokia Corporation

- Phoenix Contact GmbH and Co. KG

- Red Lion Controls Inc.(Spectris plc)

- Rockwell Automation, Inc.

- Schneider Electric SE

- Sierra Wireless Inc.

- Siemens AG

第七章 市场机会与未来展望

Industrial networking solutions market size in 2026 is estimated at USD 36.47 billion, growing from 2025 value of USD 30.61 billion with 2031 projections showing USD 87.47 billion, growing at 19.12% CAGR over 2026-2031.

The surge reflects rapid convergence of operational-technology assets with enterprise IT networks, creating real-time visibility across increasingly automated production environments. Demand is amplified by a shift from legacy fieldbus to Ethernet-based factory floors that meets sub-millisecond latency targets for autonomous equipment. Private 5G in combination with edge AI is lowering total cost of ownership by up to 30% for heavy industries through predictive maintenance. Government smart-manufacturing stimulus is another catalyst: China alone routed USD 2.8 billion of 2024 funds into industrial networking upgrades. Together, these forces underpin a structurally high-growth trajectory for the Industrial networking solutions market.

Global Industrial Networking Solutions Market Trends and Insights

Rapid Shift to IIoT-Ready Ethernet-Based Factory Floors

Ethernet now powers 73% of new manufacturing network installs, up from 45% in 2020, as factories modernize for machine-vision workloads exceeding 1 Gbps. BMW's Spartanburg plant runs a private 5G grid that secures 99.9% uptime for vision-driven quality checks. Yet mid-size firms still face USD 2.5 million line-level retrofit costs that slow broad adoption.

Convergence of OT/IT Driving SD-WAN Adoption in Plants

SD-WAN deployments in manufacturing jumped 340% in 2024 as enterprises exported enterprise-security policies to deterministic shop-floor traffic. Hyundai AutoEver cut 60% in network management expense across 47 sites while boosting application performance 35%. Traditional VLAN segmentation lacks the agility required for autonomous mobile robots, so OT-aware SD-WAN is becoming standard.

Cyber-Physical Security Skill-Gap in Brown-Field Sites

Some 78% of manufacturers cannot find OT-cyber talent, slowing convergence plans. OT-oriented cyber incidents rose 87% in 2024, exposing legacy weaknesses. Cisco and Rockwell's Digital Skills for Industry initiative aims to train 100,000 APAC professionals to ease the bottleneck.

Other drivers and restraints analyzed in the detailed report include:

- 5G Private Networks Enabling Ultra-Low-Latency Control

- Edge-AI-Powered Predictive Maintenance Lowering TCO

- Proprietary Protocol Lock-In Inflating Migration Cost

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware commanded 60.35% revenue in 2025, reinforcing the Industrial networking solutions market's dependence on rugged switches, routers, and access points for harsh sites. Premium fanless switches often list at triple enterprise prices, supporting sustained temperatures and vibration. However, software and services are scaling at 21.95% CAGR, signaling a decisive pivot toward AI-driven network monitoring and subscription models. Siemens' SIRIUS 3RC7 module embeds software-defined networking at the control layer, evidencing hardware-software convergence. Managed-service providers booked 45% annual growth in 2024 as firms outsourced cyber-hardening and 24X7 monitoring.

Wired Ethernet secured 67.55% share in 2025 owing to deterministic control requirements and Ethernet-APL's 1,000-m intrinsic-safety reach. Wireless is rising at a 25.1% CAGR as private 5G untethers autonomous robots and accelerates plant re-configuration. Toyota's material-handling 5G rollout clocked 99.5% reliability while slicing install budgets 60% versus copper. Ultra-low-power modules from Texas Instruments now consume 90% less energy, strengthening battery-powered sensor economics.

The Industrial Networking Solutions Market Report is Segmented by Component (Hardware, Software and Services), Type of Connectivity (Wired, Wireless), Deployment Type (On-Premises, Cloud), End-User Industry (Automotive, Financial Services, Manufacturing, Telecommunications, Logistics and Transportation, Mining, Oil and Gas, Energy and Utilities), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific continues to anchor the Industrial networking solutions market with 34.55% 2025 share, propelled by China's policy-backed digitalization and Japan's high-throughput electronics manufacturing ecosystems. The region's growth outlook remains compelling as India and ASEAN economies scale smart-factory rollouts under Make-in-India and Industry4WRD programs. North America follows as a mature adopter, sustained by USD 800 million of US federal grants that subsidize secure OT-IT upgrades. Europe benefits from stringent cyber-resilience directives and Germany's EUR 1.2 billion SME fund, fostering broad-based network modernization. The Middle East & Africa region, though smaller, showcases the highest 22.95% CAGR, with Gulf oil majors installing private 5G to operate drilling assets in corrosive deserts and offshore platforms. Latin America's opportunity hinges on mining and renewable-energy build-outs that demand resilient Ethernet-over-fiber topologies.

- ABB Ltd

- Advantech Co., Ltd.

- Antaira Technologies LLC

- Aruba Networks (Hewlett Packard Enterprise Co.)

- Belden Inc.

- Cisco Systems, Inc.

- Dell Technologies Inc.

- Eaton Corporation plc

- Hirschmann Automation (Belden)

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- Juniper Networks, Inc.

- Moxa Inc.

- Nokia Corporation

- Phoenix Contact GmbH and Co. KG

- Red Lion Controls Inc. (Spectris plc)

- Rockwell Automation, Inc.

- Schneider Electric SE

- Sierra Wireless Inc.

- Siemens AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid shift to IIoT-ready Ethernet-based factory floors

- 4.2.2 Convergence of OT/IT driving SD-WAN adoption in plants

- 4.2.3 5G private networks enabling ultra-low-latency control

- 4.2.4 Edge-AI-powered predictive maintenance lowering TCO

- 4.2.5 Government smart-manufacturing stimulus packages

- 4.2.6 Open-source Time-Sensitive Networking (TSN) stacks

- 4.3 Market Restraints

- 4.3.1 Cyber-physical security skill-gap in brown-field sites

- 4.3.2 Proprietary protocol lock-in inflating migration cost

- 4.3.3 Semiconductor supply-chain volatility for industrial NICs

- 4.3.4 Power-density limits in fan-less industrial switch design

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software and Services

- 5.2 By Type of Connectivity

- 5.2.1 Wired

- 5.2.2 Wireless

- 5.3 By Deployment Type

- 5.3.1 On-premises

- 5.3.2 Cloud

- 5.4 By End-User Industry

- 5.4.1 Automotive

- 5.4.2 Financial Services

- 5.4.3 Manufacturing

- 5.4.4 Telecommunications

- 5.4.5 Logistics and Transportation

- 5.4.6 Mining, Oil and Gas, Energy and Utilities

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Middle East

- 5.5.4.1 Israel

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Turkey

- 5.5.4.5 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Egypt

- 5.5.5.3 Rest of Africa

- 5.5.6 South America

- 5.5.6.1 Brazil

- 5.5.6.2 Argentina

- 5.5.6.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ABB Ltd

- 6.4.2 Advantech Co., Ltd.

- 6.4.3 Antaira Technologies LLC

- 6.4.4 Aruba Networks (Hewlett Packard Enterprise Co.)

- 6.4.5 Belden Inc.

- 6.4.6 Cisco Systems, Inc.

- 6.4.7 Dell Technologies Inc.

- 6.4.8 Eaton Corporation plc

- 6.4.9 Hirschmann Automation (Belden)

- 6.4.10 Honeywell International Inc.

- 6.4.11 Huawei Technologies Co., Ltd.

- 6.4.12 Juniper Networks, Inc.

- 6.4.13 Moxa Inc.

- 6.4.14 Nokia Corporation

- 6.4.15 Phoenix Contact GmbH and Co. KG

- 6.4.16 Red Lion Controls Inc. (Spectris plc)

- 6.4.17 Rockwell Automation, Inc.

- 6.4.18 Schneider Electric SE

- 6.4.19 Sierra Wireless Inc.

- 6.4.20 Siemens AG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment