|

市场调查报告书

商品编码

1906185

北美商用车远端资讯处理市场:市场份额分析、产业趋势与统计及成长预测(2026-2031 年)North America Commercial Vehicle Telematics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

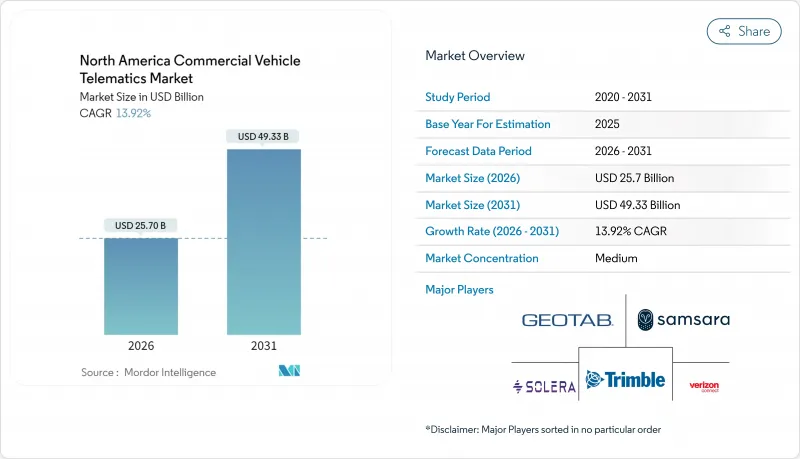

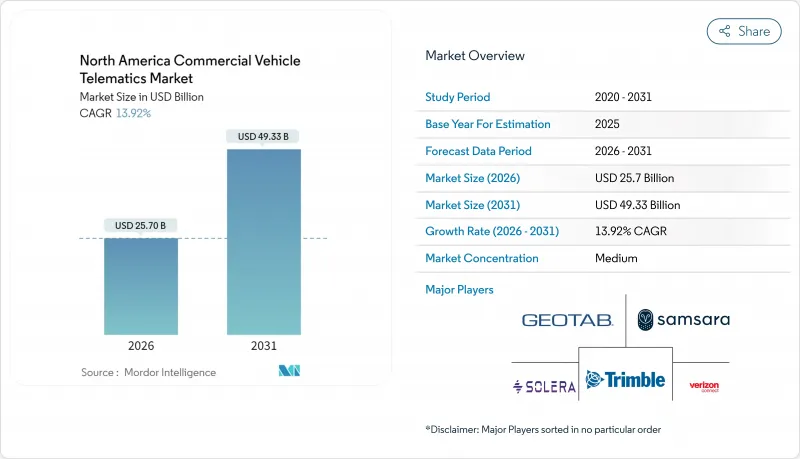

预计北美商用车远端资讯处理市场将从 2025 年的 225.6 亿美元成长到 2026 年的 257 亿美元,到 2031 年将达到 493.3 亿美元,2026 年至 2031 年的复合年增长率为 13.92%。

在日益严格的法令遵循、电气化分析以及人工智慧技术的推动下,智慧交通系统的普及速度正在加快,这些技术将说明仪錶板转化为预测性决策引擎。货运市场疲软反而促进了智慧交通系统的普及,承运商利用远端资讯处理技术挖掘出更细緻的成本节约点,而5G网路的快速部署则实现了高频宽、毫秒延迟的V2X资料流。汽车製造商透过将连网硬体作为出厂标配,扩大了客户群;保险公司也为那些展现出检验的安全改进的车队提供了显着的保费优惠。

北美商用车远端资讯处理市场趋势与洞察

监理合规方面的法律义务

美国联邦汽车运输安全管理局 (FMCSA) 移除不合规的电子记录设备,催生了强制性的更新週期,这将推动 2024-2025 年的设备出货量成长。执法行动标誌着认证方式从一次性认证转向持续的技术审核,迫使车队选择拥有成熟更新週期和安全资料管道的供应商。 2025 年 6 月引擎类型标准的延期以及自动紧急煞车法规的实施扩大了合规范围。远端资讯处理系统被定位为自动驾驶记录采集、远距离诊断和召回管理的中心枢纽。能够提供符合审核要求的报告和无线韧体更新的供应商将获得定价权,尤其是在需要应对联邦和跨境法规的长途运输业者中。

映像基础的安全措施和人工智慧分析

人工智慧摄影机已从被动式录影设备发展成为能够预测碰撞风险并触发车内警报的边缘处理引导设备。 Geotab 的报告显示,配备预测性安全评分系统的车队碰撞事故减少了 40%。如果事故频率的改善得到证实,保险公司可提供高达 30% 的保费折扣。即时车道偏离预警、跟车距离测量和自动事故资料上传功能能够产生可验证的证据,从而降低责任风险,并且正被越来越多的车队采用,甚至小规模车队也在使用。感测器价格的暴跌和云端原生分析技术的进步推动了影像和追踪捆绑订阅服务的普及,提高了每位用户的平均收入。保护隐私的设备内处理技术正在缓解驾驶者的担忧,并加速主要城市市场的工会化进程。

网路安全与资料主权责任

根据伊利诺伊州生物识别隐私法案提起的高调诉讼以及指控未经授权转售数据的集体诉讼,增加了远端资讯处理供应商和车主面临的财务风险。诸如 Lytx 支付 425 万美元的和解金等案例,推动了对端对端加密、区域资料储存和明确驾驶员同意工作流程的需求。车队营运商现在要求供应商提供合约安全审核和网路保险证明,从而提高了供应商的资格标准。投资 SOC 2 认证和零信任架构的供应商正在将风险转化为竞争优势,但小规模的供应商往往缺乏足够的财力来满足更高的安全保障标准。

细分市场分析

截至2025年,售后市场设备占据了北美商用车远端资讯处理市场62.35%的份额,这主要得益于车队营运商无需等待新车型发布即可对多种品牌的卡车进行改装。然而,成长主要倾向OEM嵌入式平台,预计到2031年,随着製造商在工厂预装支援4G/5G的网关,其复合年增长率将达到14.62%。对于拥有严格安全通讯协定的大型运输公司而言,工厂出货时装载硬体极具吸引力,因为它无需安装运作,能够深度存取CAN总线数据,并提高防篡改能力。同时,售后市场供应商凭藉现有车队的覆盖范围、快速的功能更新以及与品牌无关的仪錶板,仍然保持优势。两种模式的共存要求供应商提供双重整合策略,既要保持向后相容性,又要扩展软体生态系统。

随着第二代售后市场供应商越来越多地与原始设备製造商 (OEM) 合作,透过连接器进行资料访问,这两类供应商之间的界限正变得日益模糊。 Platform Science 收购 Trimble 的交通运输远端资讯处理资产就是一个很好的整合策略案例,该策略将 OEM 认证的软体与可设定的硬体抽象层结合。在预测期内,市场领导将透过销售模组化订阅方案来提高车队更新周期中的客户留存率,使车队能够无缝地从旧设备上的插入式单元切换到新车辆中的嵌入式网关。

到2025年,轻型商用车将占北美商用车远端资讯处理市场规模的51.20%,主要得益于车队规模庞大以及服务车更新换代速度快。电商最后一公里配送车队采用基本的GPS和交付证明工作流程,虽然收入稳定,但单车收入较低。大型商用车虽然数量较少,但预计到2031年将维持15.08%的复合成长率,因为严格的营运时间规定和高昂的停机成本促使大型商用车部署需要付费订阅的综合感测器套件。

食品、药品和高价值电子产品领域对监管链透明度的需求日益增长,正在加速重型车辆市场的成长。预测性维护模组可预防关键引擎故障,而拖车温度监控则可保护生鲜产品并提升其价值感知。中型商用车和非公路用设备虽然市场定位较为独特,但市场需求稳定,其普及程度与建筑週期和农业季节性密切相关,而非干线货运的经济效益。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 合规性的监理要求

- 映像基础的安全措施和人工智慧分析

- 车队电气化分析

- OEM工厂安装的远端资讯处理标准化

- 支援5G的即时V2X数据

- 货运低迷时期的成本优化

- 市场限制

- 网路安全与资料主权责任

- 5G和人工智慧硬体成本不断上涨

- 整合遗留IT债务

- 驾驶员隐私诉讼风险

- 产业价值链分析

- 监管环境

- 技术展望

- 宏观经济因素的影响

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 按类型

- OEM嵌入式

- 售后市场

- 按车辆类型

- 轻型商用车

- 中型商用车

- 大型商用车辆

- 非公路用车辆

- 按部署模式

- 基于云端的

- 本地部署

- 透过解决方案

- 车队追踪与监控

- 驾驶员管理

- 保险远端资讯处理

- 安全与合规

- 视讯远端资讯处理

- V2X解决方案

- 其他解决方案

- 按国家/地区

- 美国

- 加拿大

- 墨西哥

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Geotab Inc.

- Verizon Connect Inc.

- Samsara Inc.

- Trimble Inc.

- Solera Holdings LLC

- Motive Technologies Inc.

- Teletrac Navman US Ltd.

- CalAmp Corp.

- Zonar Systems Inc.

- Lytx Inc.

- Spireon Holdings LP

- Fleet Complete USA Inc.

- GPS Insight LLC

- Gurtam UAB

- Powerfleet Inc.

- Platform Science Inc.

- EROAD Inc.

- Netradyne Inc.

- IntelliShift(BrainWave LLC)

- Geoforce LLC

- Azuga Inc.

- Michelin Connected Fleet SAS

第七章 市场机会与未来展望

The North America commercial vehicle telematics market is expected to grow from USD 22.56 billion in 2025 to USD 25.7 billion in 2026 and is forecast to reach USD 49.33 billion by 2031 at 13.92% CAGR over 2026-2031.

Strong adoption momentum arises from tightening compliance enforcement, electrification analytics, and artificial intelligence capabilities that transform descriptive dashboards into predictive decision engines. Freight-market softness paradoxically fueled penetration as carriers used telematics to uncover granular cost savings, while accelerating 5G rollouts unlocked high-bandwidth, millisecond-latency vehicle-to-everything data flows. OEMs widened the addressable pool by factory-installing connected hardware, and insurers offered sizable premium incentives for fleets demonstrating verifiable safety improvements.

North America Commercial Vehicle Telematics Market Trends and Insights

Regulatory Mandates for Compliance

Federal Motor Carrier Safety Administration (FMCSA) removals of non-compliant electronic logging devices created mandatory replacement cycles that lifted 2024-2025 unit shipments. Enforcement actions signal a shift from one-time certification to ongoing technical audits, compelling fleets to select providers with proven update cadences and secure data pipelines. June 2025 engine-vintage extensions and pending automatic emergency-braking rules expand the compliance footprint, positioning telematics as the central hub that automates log capture, remote diagnostics, and recall management. Providers differentiating on audit-ready reporting and over-the-air firmware updates gain pricing power, particularly among long-haul carriers balancing federal and cross-border mandates.

Video-Based Safety and AI Analytics

Artificial-intelligence cameras transitioned from passive recorders to edge-processed coaching devices that predict collision risk and trigger in-cab alerts. Geotab reports 40% collision reduction on fleets using predictive safety scoring, while insurers grant premium cuts of up to 30% for documented loss frequency improvements. Real-time lane-departure warnings, tailgating metrics, and automatic incident uploads generate defensible evidence for liability mitigation, prompting rising procurement even among small fleets. Rapid sensor price declines and cloud-native analytics encourage bundled video and tracking subscriptions that lift average revenue per user. Privacy-preserving on-device processing assuages driver concerns, accelerating union acceptance in major urban markets.

Cyber-Security and Data-Sovereignty Liability

High-profile lawsuits under the Illinois Biometric Information Privacy Act and class actions alleging unauthorized data resale heightened financial exposure for both telematics vendors and fleets. Settlements such as Lytx's USD 4.25 million payment catalyzed demand for end-to-end encryption, regional data residency, and explicit driver consent workflows. Fleets now stipulate contractual security audits and cyber insurance proof, increasing vendor qualification hurdles. Providers investing in SOC 2 certifications and zero-trust architectures convert risk into differentiation, whereas small vendors often lack the balance sheet to meet escalated assurance standards.

Other drivers and restraints analyzed in the detailed report include:

- Fleet Electrification Analytics

- 5G-Enabled Real-Time V2X Data

- Rising 5G and AI Hardware Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Aftermarket devices controlled 62.35% of the North America commercial vehicle telematics market share in 2025 as fleets retrofitted mixed-brand trucks without waiting for new-model cycles. Growth, however, tilts toward OEM embedded platforms, which are forecast to post a 14.62% CAGR through 2031 as manufacturers pre-install 4G- and 5G-enabled gateways at the factory. Factory-fit hardware eliminates installation downtime, enables deeper CAN bus data access, and improves tamper resistance, appealing to large carriers with rigorous security protocols. Aftermarket vendors retain advantages in legacy fleet coverage, rapid feature iterations, and brand-agnostic dashboards. The coexistence of both models demands that providers offer dual integration strategies, thereby widening software ecosystems while preserving backward compatibility.

Second-generation aftermarket suppliers increasingly partner with OEMs for data-through-connector access, blurring lines between the two categories. Platform Science's acquisition of Trimble's transportation telematics assets exemplifies a convergence play that marries OEM-certified software with configurable hardware-abstraction layers. Over the forecast horizon, market leaders are expected to sell modular subscription tiers that allow fleets to toggle seamlessly from plug-in units on older equipment to embedded gateways on new builds, strengthening customer lock-in amid fleet turnover cycles.

Light commercial vehicles accounted for 51.20% of the North America commercial vehicle telematics market size in 2025 due to high fleet volumes and quick service-van replacement intervals. E-commerce last-mile fleets leverage basic GPS and proof-of-delivery workflows, generating steady but lower revenue per unit. Heavy commercial vehicles, although smaller in count, are set to compound at 15.08% through 2031 because stringent hours-of-service rules and costly downtime justify comprehensive sensor suites that command premium subscriptions.

Growth in heavy-duty segments accelerates as shippers demand chain-of-custody transparency for food, pharmaceuticals, and high-value electronics. Predictive maintenance modules avert catastrophic engine failures, and trailer-temperature monitoring safeguards perishables, bolstering value perception. Medium commercial and off-highway equipment occupy niche but stable roles, with adoption tied to construction cycles and agriculture seasonality rather than line-haul freight economics.

The North America Commercial Vehicle Telematics Market Report is Segmented by Type (OEM Embedded and Aftermarket), Vehicle Type (Light Commercial Vehicles, Medium Commercial Vehicles, and More), Deployment Model (Cloud-Based and On-Premise), Solution (Fleet Tracking and Monitoring, Driver Management, and More), and Country (United States, Canada, and Mexico). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Geotab Inc.

- Verizon Connect Inc.

- Samsara Inc.

- Trimble Inc.

- Solera Holdings LLC

- Motive Technologies Inc.

- Teletrac Navman US Ltd.

- CalAmp Corp.

- Zonar Systems Inc.

- Lytx Inc.

- Spireon Holdings LP

- Fleet Complete USA Inc.

- GPS Insight LLC

- Gurtam UAB

- Powerfleet Inc.

- Platform Science Inc.

- EROAD Inc.

- Netradyne Inc.

- IntelliShift (BrainWave LLC)

- Geoforce LLC

- Azuga Inc.

- Michelin Connected Fleet SAS

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Regulatory Mandates for Compliance

- 4.2.2 Video-Based Safety and AI Analytics

- 4.2.3 Fleet Electrification Analytics

- 4.2.4 OEM Factory-Fit Telematics Standardisation

- 4.2.5 5G-Enabled Real-Time V2X Data

- 4.2.6 Freight Recession Cost Optimisation

- 4.3 Market Restraints

- 4.3.1 Cyber-Security and Data-Sovereignty Liability

- 4.3.2 Rising 5G and AI Hardware Costs

- 4.3.3 Integration Debt with Legacy IT

- 4.3.4 Driver Privacy Litigation Risk

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Type

- 5.1.1 OEM Embedded

- 5.1.2 Aftermarket

- 5.2 By Vehicle Type

- 5.2.1 Light Commercial Vehicles

- 5.2.2 Medium Commercial Vehicles

- 5.2.3 Heavy Commercial Vehicles

- 5.2.4 Off-Highway Vehicles

- 5.3 By Deployment Model

- 5.3.1 Cloud-Based

- 5.3.2 On-Premise

- 5.4 By Solution

- 5.4.1 Fleet Tracking and Monitoring

- 5.4.2 Driver Management

- 5.4.3 Insurance Telematics

- 5.4.4 Safety and Compliance

- 5.4.5 Video Telematics

- 5.4.6 V2X Solutions

- 5.4.7 Other Solutions

- 5.5 By Country

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Geotab Inc.

- 6.4.2 Verizon Connect Inc.

- 6.4.3 Samsara Inc.

- 6.4.4 Trimble Inc.

- 6.4.5 Solera Holdings LLC

- 6.4.6 Motive Technologies Inc.

- 6.4.7 Teletrac Navman US Ltd.

- 6.4.8 CalAmp Corp.

- 6.4.9 Zonar Systems Inc.

- 6.4.10 Lytx Inc.

- 6.4.11 Spireon Holdings LP

- 6.4.12 Fleet Complete USA Inc.

- 6.4.13 GPS Insight LLC

- 6.4.14 Gurtam UAB

- 6.4.15 Powerfleet Inc.

- 6.4.16 Platform Science Inc.

- 6.4.17 EROAD Inc.

- 6.4.18 Netradyne Inc.

- 6.4.19 IntelliShift (BrainWave LLC)

- 6.4.20 Geoforce LLC

- 6.4.21 Azuga Inc.

- 6.4.22 Michelin Connected Fleet SAS

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment