|

市场调查报告书

商品编码

1906189

欧洲路灯市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031年)Europe Street Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

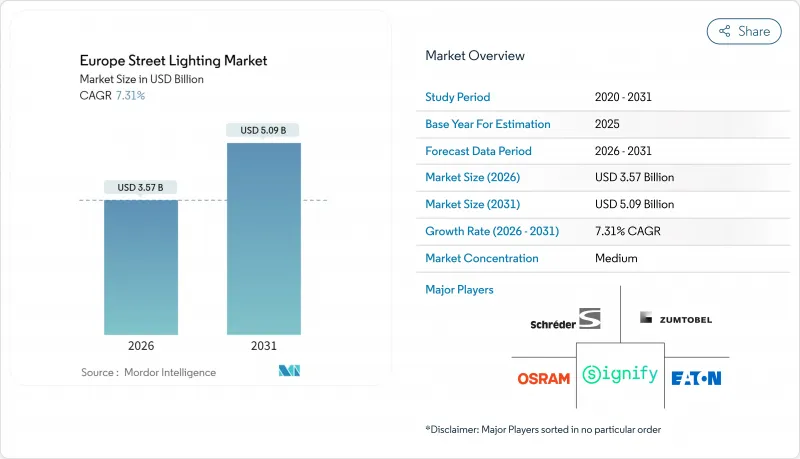

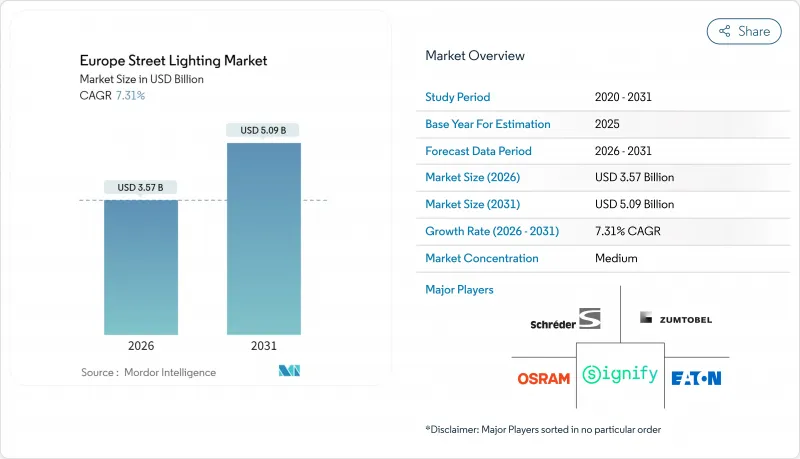

2025 年欧洲路灯市场价值 33.3 亿美元,预计从 2026 年的 35.7 亿美元成长到 2031 年的 50.9 亿美元,在预测期(2026-2031 年)内复合年增长率为 7.31%。

欧盟范围内的萤光禁令、更严格的高压放电灯泡汞含量限制以及强制性的公共部门能源效率目标等政策驱动因素,正在推动对智慧LED灯具的需求。与传统灯具相比,智慧LED灯具可减少50%至80%的电力消耗。德国透过大规模维修计画主导智慧照明的普及,而义大利则利用其国家復苏和韧性计画的资金来加速智慧照明的推广。虽然硬体仍占销售额的大部分,但随着市政当局转向基于绩效的采购模式,软体和服务相关的合约正以每年约9%的速度增长。 LED、感测器和无线模组成本的下降,正在巩固欧洲路灯市场作为5G小型基地台和城市物联网感测器网路基础层的地位。

欧洲路灯市场趋势与洞察

欧盟禁止萤光并制定严格的能源效率目标

RoHS指令的逐步淘汰将于2023年8月终止紧凑型萤光和T5/T8灯管的销售,这将促使约110亿盏灯具即时维修,从而加速欧洲路灯市场的发展。此外,市政当局也依法有义务在2030年前将公共部门的能源消费量降低11.7%,因此,使用连网LED灯具是合规的强制性要求。 Signify估计,如果欧洲大陆所有剩余的传统路灯都进行改造,则可将整体电力需求降低13%至8%,相当于关闭267座中等规模的发电厂。修订后的能源效率指令现在对不合规行为处以罚款,这使得采购工作更加紧迫。

智慧城市政策加速智慧照明的普及

欧盟智慧城市市场已承诺将在100个计划投入9.24亿欧元(约10.76亿美元),将智慧照明设备定位为5G和物联网的基础设施节点。坦佩雷的试验计画采用BrightSites灯桿,以比埋地光纤安装低40%的成本提供高速无线回程传输。慕尼黑正在升级4.8万盏LED灯,采用自适应调光系统,可将离峰时段的能源消耗降低93%。巴塞隆纳是欧盟100个承诺在2030年前实现气候中和的城市之一,目前已透过中央监控系统管理其14.6万个照明点中的一半以上,并将照度维持在20-30勒克斯的安全标准。

智能维修需要较高的前期投资

一套完整的智慧化改造方案每套成本为 300 至 500 欧元,而基本的 LED 改造方案成本仅为 150 至 200 欧元。这减缓了资金紧张的市政当局的采用速度,也阻碍了欧洲路灯市场的成长。欧盟的证据表明,儘管存在津贴,但资金筹措缺口依然存在,迫使供应商提案「照明即服务」合同,将投资从资产负债表中移除。然而,一些成员国的采购规则仍然难以适应基于结果的模式,导致合约授予延迟。

细分市场分析

儘管到2025年,传统路灯仍将占据欧洲路灯市场59.45%的份额,但随着城市管理者对更高连接性和能源分析能力的需求日益增长,智慧路灯系统正以9.11%的复合年增长率快速发展。德国慕尼黑4.8万根灯桿的维修标誌着一个转折点,自适应调光技术的应用使夜间电力消耗降低了93%,这一数据对整个欧洲路灯行业的规划产生了重大影响。

在巴塞隆纳,透过对 146,000 个地点进行集中控制,远端控制 20-30 勒克斯的照度,同时降低即时负荷,证明了扩充性,增强了欧洲路灯市场对智慧路灯的信心。

已经改用LED照明的市政当局正在考虑第二阶段的维修,重点是安装感测器、交通监控系统和5G小型基地台,并在建立业务收益基础方面取得进展。在斯特拉斯堡,透过在凌晨1点至5点之间关闭部分路灯,在确保安全的前提下实现了30%的节能,这表明调光策略可以与安全措施兼顾。智慧城市市场平台的资金筹措计画将使智慧照明试点计画也能在中等规模的城市中实施,预计未来需求将会扩大。

根据汞灯逐步淘汰计划,预计到 2025 年,LED 灯将占欧洲路灯市场的 69.10%,到 2031 年将以 8.56% 的复合年增长率增长。传统的萤光和 HID 产品仅在预算限制导致更换延迟或没有其他高功率灯具替代方案的地区仍然保留。

由于性能显着提升(从 35 lm/W 提升至 100 lm/W)以及长达 50,000 小时的使用寿命,LED 照明如今已成为大多数竞标的预设配置,巩固了其市场主导。昕诺飞 (Signify) 90% 的销售额来自 LED 产品,这表明市场已趋于成熟,儘管可靠性问题仍在推动散热解决方案的研发。欧盟 2040 年气候法规要求排放90%,因此对于旨在实现净零排放的市政当局而言,采用 LED 照明势在必行。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 欧盟禁止萤光并制定严格的能源效率目标

- 智慧城市政策加速智慧照明的普及

- 降低LED、感测器和连接成本

- 由欧盟復苏与韧性基金资助

- 第二波第一代LED灯更换浪潮(2024-2030年)

- 利用路灯桿作为边缘物联网房地产

- 市场限制

- 智慧维修需要较高的初始资本投资成本

- LED驱动器可靠性与热故障问题

- 网路安全与GDPR合规性障碍

- 半导体级元件的供应波动

- 价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济因素如何影响市场

第五章 市场规模与成长预测

- 依照明类型

- 传统照明

- 智慧照明

- 透过光源

- LED

- 萤光

- HID灯

- 报价

- 硬体

- 灯具和灯泡

- 照明设备

- 控制系统

- 软体和服务

- 硬体

- 透过连接技术

- 有线连接(PLC、DALI、乙太网路)

- 无线(Zigbee、LoRa-WAN、NB-IoT、5G)

- 按安装类型

- 新安装

- 维修/二次更换

- 按国家/地区

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Signify NV

- Zumtobel Group AG

- Schreder SA

- Eaton Corporation plc(Cooper Lighting)

- OSRAM GmbH

- Acuity Brands Inc.

- Cree Lighting, a division of IDEAL Industries

- Itron Inc.

- Telensa Ltd.

- Sensus, a Xylem Brand

- Flashnet SRL

- Lucy Zodion Ltd.

- Gelighting Solutions LLC

- Thorn Lighting Ltd.(Zumtobel)

- Le-Tehnika doo(Luxtella)

- Hubbell Incorporated

- Urban Control Ltd.

- Flashnet Smart-City

- AEC Illuminazione Srl

第七章 市场机会与未来展望

The European street lighting market was valued at USD 3.33 billion in 2025 and estimated to grow from USD 3.57 billion in 2026 to reach USD 5.09 billion by 2031, at a CAGR of 7.31% during the forecast period (2026-2031).

Policy drivers-including the EU-wide fluorescent-lamp ban, looming mercury restrictions on high-pressure discharge lamps, and binding public-sector energy-efficiency targets-anchor demand for connected LED luminaires that can cut electricity use by 50-80% versus legacy fixtures. Germany leads adoption through large-scale retrofit programs, while Italy leverages National Recovery and Resilience Plan funds to accelerate smart lighting roll-outs. Hardware still dominates sales, yet software- and service-centric contracts are growing almost 9% annually as municipalities shift toward outcomes-based purchasing. Cost declines in LEDs, sensors, and wireless modules reinforce the European street lighting market as a foundational layer for 5G small cells and city-wide IoT sensor networks.

Europe Street Lighting Market Trends and Insights

EU Ban on Fluorescent Lamps and Strict Efficiency Targets

RoHS phase-outs removed compact fluorescent and T5/T8 tubes from sale in August 2023, triggering immediate retrofits across an estimated 11 billion lamp points and accelerating the European street lighting market. Municipalities also face binding 11.7% public-sector energy-consumption cuts by 2030, turning connected LED luminaires into compliance essentials. Signify calculates that converting the continent's remaining conventional streetlights would trim overall electricity demand from 13% to 8%, roughly equal to shutting 267 average power plants. Procurement urgency has intensified because non-compliance now attracts financial penalties under updated Energy Efficiency Directive rules.

Smart-City Stimulus Accelerating Smart-Lighting Roll-Outs

The EU Smart Cities Marketplace has channeled EUR 924 million (USD 1.076 billion) into 100 projects, positioning intelligent luminaires as foundational 5G and IoT nodes. Tampere's pilot used BrightSites poles to deliver high-speed wireless backhaul at 40% lower cost than trenching fiber. Munich's 48,000-unit LED upgrade includes adaptive dimming that slashes energy use by 93% during off-peak hours. As one of 100 EU cities pledged to be climate-neutral by 2030, Barcelona centrally monitors more than half of its 146,000 lighting points while upholding 20-30 lux safety levels.

High Upfront CAPEX for Smart Retrofits

Full smart-ready replacements cost EUR 300-500 per pole versus EUR 150-200 for basic LED swaps, delaying adoption in cash-constrained municipalities and tempering the European street lighting market trajectory. EU evidence calls highlight a financing gap, even though grants exist, pushing vendors to propose light-as-a-service contracts that shift investment off balance sheet. Yet procurement codes in several member states still struggle to accommodate outcome-based models, slowing deal closure.

Other drivers and restraints analyzed in the detailed report include:

- Falling LED, Sensor and Connectivity Costs

- EU Recovery and Resilience Facility Funding

- LED Driver Reliability and Thermal Failure Issues

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Conventional luminaires still represented 59.45% of the Europe street lighting market in 2025, but smart systems are accelerating at a 9.11% CAGR as city managers chase connectivity and energy analytics. Germany's Munich retrofit illustrates the pivot: 48,000 upgraded poles use adaptive dimming to save 93% of overnight power, a data point that resonates across the European street lighting industry planning.

Barcelona's centralized control over 146,000 points shows scalability; remote commands keep illumination at 20-30 lux while trimming real-time load, reinforcing confidence in smart upgrades within the European street lighting market.

Municipalities that already switched to LEDs now consider a second wave focused on sensors, traffic monitoring, and 5G small-cell attachment, underpinning service revenue streams. Strasbourg proves dimming policies can coexist with safety by timing partial shut-offs between 01:00-05:00 and cutting energy by 30%. Funding schemes under the Smart Cities Marketplace keep smart-lighting pilots within reach for mid-sized cities, boosting future demand.

LEDs captured 69.10% share of the European street lighting market size in 2025 and are on track for an 8.56% CAGR through 2031 under the mercury-phase-out timetable. Legacy fluorescent and HID products linger only where budgets delay retrofits or where extreme-output fixtures remain unmatched.

Performance leaps - from 35 lm/W to 100 lm/W - plus 50,000-hour durability mean most tenders now specify LEDs by default, locking in market leadership. Signify already derives 90% of sales from LED products, signaling maturity even as reliability concerns spur R&D on thermal solutions. EU 2040 climate rules requiring a 90% emissions cut make LED roll-outs non-negotiable for municipalities pursuing net-zero pathways.

The Europe Street Lighting Market Report is Segmented by Lighting Type (Conventional Lighting, and Smart Lighting), Light Source (LEDs, Fluorescent Lamps, and HID Lamps), Offering (Hardware, and Software, and Services), Connectivity Technology (Wired, and Wireless), Installation Type (New Installation, and Retrofit), and Country (Germany, United Kingdom, France, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Signify N.V.

- Zumtobel Group AG

- Schreder SA

- Eaton Corporation plc (Cooper Lighting)

- OSRAM GmbH

- Acuity Brands Inc.

- Cree Lighting, a division of IDEAL Industries

- Itron Inc.

- Telensa Ltd.

- Sensus, a Xylem Brand

- Flashnet SRL

- Lucy Zodion Ltd.

- Gelighting Solutions LLC

- Thorn Lighting Ltd. (Zumtobel)

- Le-Tehnika d.o.o. (Luxtella)

- Hubbell Incorporated

- Urban Control Ltd.

- Flashnet Smart-City

- AEC Illuminazione Srl

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU ban on fluorescent lamps and strict efficiency targets

- 4.2.2 Smart-city stimulus accelerating smart-lighting roll-outs

- 4.2.3 Falling LED, sensor and connectivity costs

- 4.2.4 EU Recovery and Resilience Facility funding

- 4.2.5 Secondary-replacement wave for first-gen LEDs (2024-30)

- 4.2.6 Street-light poles as edge-IoT real-estate

- 4.3 Market Restraints

- 4.3.1 High upfront CAPEX for smart retrofits

- 4.3.2 LED driver reliability and thermal failure issues

- 4.3.3 Cyber-security and GDPR compliance hurdles

- 4.3.4 Semiconductor-grade component supply volatility

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Lighting Type

- 5.1.1 Conventional Lighting

- 5.1.2 Smart Lighting

- 5.2 By Light Source

- 5.2.1 LEDs

- 5.2.2 Fluorescent Lamps

- 5.2.3 HID Lamps

- 5.3 By Offering

- 5.3.1 Hardware

- 5.3.1.1 Lights and Bulbs

- 5.3.1.2 Luminaires

- 5.3.1.3 Control Systems

- 5.3.2 Software and Services

- 5.3.1 Hardware

- 5.4 By Connectivity Technology

- 5.4.1 Wired (PLC, DALI, Ethernet)

- 5.4.2 Wireless (Zigbee, LoRa-WAN, NB-IoT, 5G)

- 5.5 By Installation Type

- 5.5.1 New Installation

- 5.5.2 Retrofit / Secondary Replacement

- 5.6 By Country

- 5.6.1 Germany

- 5.6.2 United Kingdom

- 5.6.3 France

- 5.6.4 Italy

- 5.6.5 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Signify N.V.

- 6.4.2 Zumtobel Group AG

- 6.4.3 Schreder SA

- 6.4.4 Eaton Corporation plc (Cooper Lighting)

- 6.4.5 OSRAM GmbH

- 6.4.6 Acuity Brands Inc.

- 6.4.7 Cree Lighting, a division of IDEAL Industries

- 6.4.8 Itron Inc.

- 6.4.9 Telensa Ltd.

- 6.4.10 Sensus, a Xylem Brand

- 6.4.11 Flashnet SRL

- 6.4.12 Lucy Zodion Ltd.

- 6.4.13 Gelighting Solutions LLC

- 6.4.14 Thorn Lighting Ltd. (Zumtobel)

- 6.4.15 Le-Tehnika d.o.o. (Luxtella)

- 6.4.16 Hubbell Incorporated

- 6.4.17 Urban Control Ltd.

- 6.4.18 Flashnet Smart-City

- 6.4.19 AEC Illuminazione Srl

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment