|

市场调查报告书

商品编码

1906206

欧洲物流自动化市场:市场占有率分析、产业趋势、统计数据和成长预测(2026-2031 年)Europe Intralogistics Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

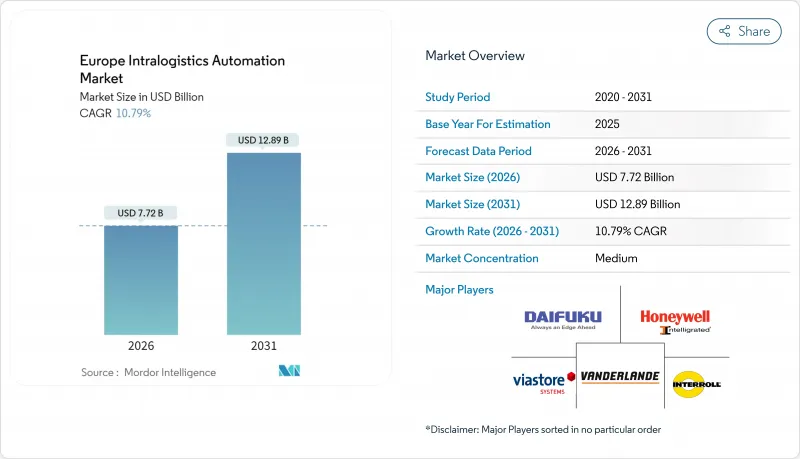

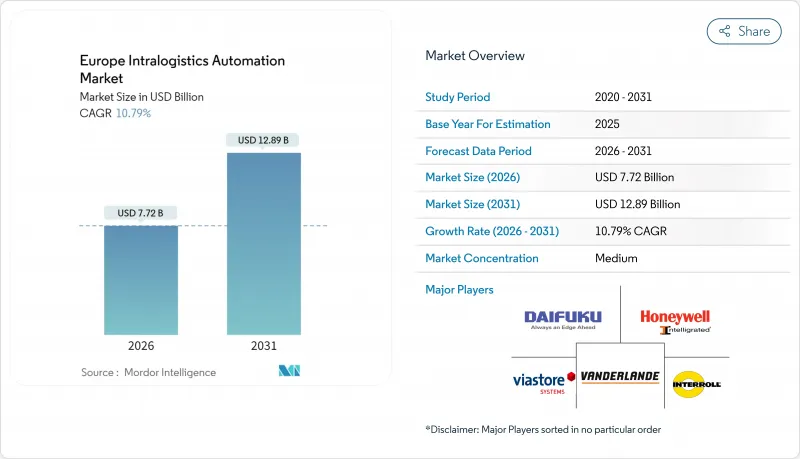

欧洲物流自动化市场规模预计到 2026 年将达到 77.2 亿美元,高于 2025 年的 69.7 亿美元,预计到 2031 年将达到 128.9 亿美元,2026 年至 2031 年的复合年增长率为 10.79%。

电子商务交易量的激增、结构性劳动力短缺以及欧盟永续性严格的永续发展法规,正在加速对自动化储存、拣选和物料输送方案的资本投资。全设施专用5G网路支援的即时调整提高了资产利用率,而人工智慧驱动的预测性维护数位双胞胎软体则提高了系统运作。德国仍然是关键的需求中心和技术研发中心,而新兴的东欧供应商正开始降低价格并缩短投资回收期。这些因素共同推动欧洲物流自动化市场在未来十年实现两位数的成长。

欧洲物流自动化市场趋势与洞察

电子商务的快速成长以及支援全通路的压力

线上销售的爆炸性成长正在重塑欧洲的履约格局。奥托集团投资2.6亿欧元在伊尔瓦建造了一座高吞吐量的物流中心,每小时可处理18,000件商品,目标是实现60%订单的隔天达。零售商和第三方物流(3PL)公司正在采用模组化的立方体和穿梭车系统,这些系统能够在批量补货和单件拣货之间灵活切换,而不会中断营运。都市区房地产的限制正在加速「货到人」(G2P)微型仓配中心的普及。同时,立方体储存系统使现有建筑的SKU密度提高了三倍,提高了生产效率,并缩短了自动化投资的投资回收期,即使是中型企业也能从中受益。预计这些趋势将推动资金持续流入扩充性的软体定义解决方案,以确保物流配送能够适应不断变化的订单履约。

欧盟27国面临劳动力短缺和薪资上涨问题

劳动力老化、英国脱欧后的移民趋势以及严格的工时法规,导致欧盟许多地区的物流业空缺率超过12%。在中欧和东欧,随着企业使用协作机器人填补劳动力短缺,机器人采用率成长了28%,德国机械工程产业正向东欧出口承包系统以满足此需求。每年6-8%的薪资成长进一步推高了成本效益,使资本投资更具优势。这种转变也体现在品质方面:企业越来越倾向于聘用能够管理车辆软体的技术人员,而不是人工负责人,这加速了原始设备製造商(OEM)与职业培训机构之间的合作,以提升工人的技能。总而言之,劳动力短缺正在将自动化从欧洲物流自动化市场的可选项转变为必需品。

高额资本投入和较长的投资回收期

全面的物流自动化通常需要500万至1000万欧元的前期投资,这对主导区域物流营运的中小型企业构成了一大障碍。一项调查发现,儘管生产力提升已得到证实,但仍有82%的仓库经理对投资规模感到担忧。利率上升进一步加剧了资金筹措压力。虽然将成本分摊到多年合约中的「机器人即服务」(RaaS)模式越来越受欢迎,但大多数金融机构仍然倾向于资产抵押贷款。儘管像Heemskerk Fresh & Easy的生鲜设施这样投资回收期不到四年的计划缓解了人们的担忧,但许多运营商仍在等待宏观经济前景更加明朗后再进行扩张。因此,资本支出的高度敏感度限制了欧洲物流自动化市场在低利润细分领域的渗透。

细分市场分析

儘管自主移动机器人 (AMR) 在 2025 年的收入占比相对小规模,但预计其在欧洲物流自动化市场中将以 11.21% 的复合年增长率 (CAGR) 实现最快增长。这一细分市场的成长动能主要得益于其对固定基础设施的极低要求,这意味着可以在几週内而非几个月内完成车队的添加或重新部署。同时,自动化仓库/零售系统 (AS/RS) 将在 2025 年继续保持欧洲物流自动化市场最大的份额 (27.32%),这主要得益于其成熟的立方体和穿梭车平台,这些平台已广泛应用于食品杂货和时尚产业的履约。

视觉SLAM导航部署成本的降低正推动自主移动机器人(AMR)在从电子商务到备件配送等各个领域的应用。凯傲集团的模组化机器人正是这种转变的体现,使中型企业能够即插即用。自动化立体仓库(AS/RS)供应商正积极回应,推出将机器人穿梭车整合到高密度立方体中的混合设计,以维护其现有基本客群。自动化分类、堆迭和输送子系统仍然是连接货物处理工作站和运送码头的重要补充功能。这些类别之间日益增强的整合促使买家倾向于选择能够协调不同类型机器人控制软体的平台供应商,从而加速欧洲物流自动化市场向整合生态系统的转型。

汽车工厂凭藉着数十年的精益生产经验,率先采用者了自动化牵引车队、扭力追踪拣选系统和即时品质分析等技术,预计到2025年将占据欧洲物流自动化市场32.10%的份额。然而,医药和医疗保健产业正以11.40%的复合年增长率加速发展,反映出日益严格的序列化法规和低温运输需求。连锁药局Dr. Max凭藉其自动化物流中心,支援了55%的电子商务成长,为可追溯性要求如何直接转化为自动化预算提供了一个真实案例。

邮政和小包裹业者正在部署高速分类机以应对B2C小包裹的激增,而食品和饮料加工商则正在实现箱拣自动化,以确保产品在24小时送达窗口期内保持新鲜度。机场和一般製造商分别透过现代化行李处理系统和准时制套件组装来满足需求。这带来了更广泛的基本客群,使欧洲物流自动化市场免受行业低迷的影响,同时也凸显了对适应性强、符合监管要求的解决方案的需求。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电子商务的快速成长以及支援全通路的压力

- 欧盟27国面临劳动力短缺和薪资上涨问题

- 人工智慧赋能的移动机器人和物联网领域正快速发展。

- 部署 5G/专用 LTE 以实现即时调整

- 欧盟绿色交易对低碳物流的奖励

- 城市微型仓配模式推动高密度自动化

- 市场限制

- 高额资本投入和较长的投资回收期

- 传统 IT/OT 整合的复杂性

- 网路机器人面临的日益严峻的网路安全威胁

- 由于半导体供应链中断,计划延期

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 邻近市场影响分析

- 拉伸缠绕机市场

- 货运电梯市场

第五章 市场规模与成长预测

- 依产品类型

- 移动机器人

- 自动化仓库系统(AS/RS)

- 自动分类系统

- 码垛和卸垛系统

- 自动运输系统

- 拣货系统

- 按最终用户行业划分

- 飞机场

- 邮件和小包裹

- 一般製造业

- 车

- 食品/饮料

- 零售、仓储和配送

- 其他终端用户产业

- 按组件

- 硬体

- 软体

- 服务

- 按功能

- 贮存

- 拣选和回收

- 分类和收集

- 包装和托盘堆垛

- 运输和配送

- 按国家/地区

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- ABB Ltd.

- AutoStore ASA

- BEUMER Group GmbH and Co. KG

- Daifuku Co., Ltd.

- Dematic GmbH(KION Group)

- Exotec SAS

- Honeywell International Inc.

- Interroll Holding AG

- Jungheinrich Aktiengesellschaft

- Kardex Holding AG

- KNAPP AG

- KUKA Aktiengesellschaft

- Linde Material Handling GmbH

- Murata Machinery, Ltd.

- Ocado Group plc

- SSI Schafer AG

- Swisslog Holding AG

- TGW Logistics Group GmbH

- Toyota Industries Corporation

- Vanderlande Industries BV

- Viastore Systems GmbH

- WITRON Logistik+Informatik GmbH

第七章 市场机会与未来展望

Europe intralogistics automation market size in 2026 is estimated at USD 7.72 billion, growing from 2025 value of USD 6.97 billion with 2031 projections showing USD 12.89 billion, growing at 10.79% CAGR over 2026-2031.

Surging e-commerce volumes, structural labor shortages, and tightening EU sustainability mandates are accelerating capital spending on automated storage, picking, and material-handling solutions. Real-time orchestration made possible by facility-wide private 5G networks is raising asset utilization, while AI-driven predictive maintenance and digital-twin software are boosting system uptime. Germany remains the pivotal demand center and technology incubator, yet emerging Eastern European suppliers are beginning to lower price points and shorten payback periods. Taken together, these forces position the Europe intralogistics automation market for a decade of double-digit expansion.

Europe Intralogistics Automation Market Trends and Insights

E-commerce Boom and Omnichannel Fulfillment Pressure

Explosive online sales growth is rewriting fulfillment blueprints across Europe. Otto Group invested EUR 260 million in a high-throughput facility in Ilowa that processes 18,000 items per hour and targets next-day delivery for 60% of orders. Retailers and 3PLs are specifying modular cube and shuttle systems that can flex between bulk replenishment and single-item picking without halting operations. Urban real-estate constraints are accelerating adoption of goods-to-person micro-fulfillment centers, while cube-based storage allows operators to triple SKU density in legacy buildings. The resulting productivity gains are shortening the payback period on automation investments even for mid-tier merchants. These dynamics are expected to keep capital flowing toward scalable, software-defined solutions that future-proof fulfillment against shifting order profiles.

Labor Shortages and Wage Inflation Across EU27

An aging workforce, post-Brexit migration patterns, and stringent working-time regulations have pushed vacancy rates in logistics above 12% in many EU regions. Robot installations climbed 28% in Central and Eastern Europe as companies offset staff gaps with collaborative automation, and Germany's mechanical-engineering sector is exporting turnkey systems eastward to capture that demand. Wage inflation averaging 6-8% annually is further tilting the cost-benefit equation toward capital investment. The shift is also qualitative: facilities seek technicians who can manage fleet software rather than manual pickers, spurring partnerships between OEMs and vocational institutes to upskill workers. Collectively, labor scarcity is transforming automation from optional to essential across the Europe intralogistics automation market.

High CAPEX and Long ROI Horizons

Comprehensive intralogistics automation often requires EUR 5-10 million upfront, a hurdle for SMEs that dominate regional logistics. Survey work shows 82% of warehouse leaders remain uneasy about investment volumes despite proven productivity gains; rising interest rates add to financing strain. A growing Robotics-as-a-Service model spreads costs over multi-year contracts, yet most banks still prefer asset-backed lending. Projects demonstrating sub-four-year payback-such as Heemskerk Fresh & Easy's produce facility-are easing concerns, but many operators still delay scope expansion until macro-economic clarity improves. CAPEX sensitivity therefore constrains penetration of the Europe intralogistics automation market in lower-margin verticals.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Advances in AI-Powered Mobile Robotics and IoT

- 5G/Private-LTE Roll-outs Enabling Real-Time Orchestration

- Legacy IT/OT Integration Complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Autonomous Mobile Robots (AMRs) accounted for a comparatively modest slice of 2025 revenue but are forecast to grow at 11.21% CAGR, the fastest within the Europe intralogistics automation market. The segment's momentum rests on minimal fixed infrastructure requirements: a fleet can be added or relocated in weeks rather than months. In contrast, Automated Storage and Retrieval Systems (AS/RS) retained the largest 27.32% share of Europe intralogistics automation market size in 2025 thanks to proven cube and shuttle platforms widely adopted in grocery and fashion fulfillment.

AMR adoption is spreading from e-commerce to spare-parts distribution as vision-SLAM navigation lowers commissioning costs. KION Group's modular robots illustrate this pivot by offering plug-and-play deployment for mid-cap firms. AS/RS suppliers are countering with hybrid designs that embed robot shuttles inside dense cubes, protecting their installed base. Automated sorting, palletizing, and conveyor subsystems remain critical complements that tie goods-to-person workstations into outbound docks. Convergence across these categories is prompting buyers to favor platform providers able to harmonize control software across mixed fleets, reinforcing the Europe intralogistics automation market's move toward integrated ecosystems.

Automotive plants locked in 32.10% of Europe intralogistics automation market share in 2025 as decades of lean-manufacturing expertise made them early adopters of automated tugger trains, torque-tracking pick systems, and real-time quality analytics. Yet the pharmaceuticals and healthcare vertical is accelerating at 11.40% CAGR, reflecting stricter serialization rules and cold-chain demands. Pharmacy chain Dr. Max commissioned an automated distribution hub that supports 55% e-commerce growth and illustrates how traceability requirements convert directly into automation budgets.

Post and parcel operators are embedding high-speed sorters to keep pace with B2C parcel surges, while food and beverage processors automate case picking to protect freshness under 24-hour delivery windows. Airports and general manufacturers round out demand with baggage-handling overhauls and just-in-sequence kitting respectively. The result is a broadening customer base that shields the Europe intralogistics automation market from sector-specific downturns and underscores the need for adaptable, regulation-aware solutions.

The Europe Intralogistics Automation Market Report is Segmented by Product Type (Mobile Robots, AS/RS, and More), End-User Industry (Airport, Post and Parcel, General Manufacturing, Automotive, Retail and Distribution, and More), Component (Hardware, Software, and Services), Function (Storage, Order Picking, Sorting, Packaging, Transportation), and Geography. Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- ABB Ltd.

- AutoStore ASA

- BEUMER Group GmbH and Co. KG

- Daifuku Co., Ltd.

- Dematic GmbH (KION Group)

- Exotec SAS

- Honeywell International Inc.

- Interroll Holding AG

- Jungheinrich Aktiengesellschaft

- Kardex Holding AG

- KNAPP AG

- KUKA Aktiengesellschaft

- Linde Material Handling GmbH

- Murata Machinery, Ltd.

- Ocado Group plc

- SSI Schafer AG

- Swisslog Holding AG

- TGW Logistics Group GmbH

- Toyota Industries Corporation

- Vanderlande Industries B.V.

- Viastore Systems GmbH

- WITRON Logistik + Informatik GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce boom and omnichannel fulfilment pressure

- 4.2.2 Labour shortages and wage inflation across EU27

- 4.2.3 Rapid advances in AI-powered mobile robotics and IoT

- 4.2.4 5G / private-LTE roll-outs enabling real-time orchestration

- 4.2.5 EU Green Deal incentives for low-carbon intralogistics

- 4.2.6 Urban micro-fulfilment model driving high-density automation

- 4.3 Market Restraints

- 4.3.1 High CAPEX and long ROI horizons

- 4.3.2 Legacy IT / OT integration complexity

- 4.3.3 Rising cyber-security threats to networked robotics

- 4.3.4 Semiconductor supply-chain disruptions delaying projects

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Adjacent Market Influence Analysis

- 4.7.1 Stretch-Wrapping Machines Market

- 4.7.2 Goods Elevator Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Mobile Robots

- 5.1.2 Automated Storage and Retrieval Systems (AS/RS)

- 5.1.3 Automated Sorting Systems

- 5.1.4 Palletising and De-palletising Systems

- 5.1.5 Automated Conveyors

- 5.1.6 Order-Picking Systems

- 5.2 By End-user Industry

- 5.2.1 Airport

- 5.2.2 Post and Parcel

- 5.2.3 General Manufacturing

- 5.2.4 Automotive

- 5.2.5 Food and Beverage

- 5.2.6 Retail, Warehousing and Distribution

- 5.2.7 Other End-user Industries

- 5.3 By Component

- 5.3.1 Hardware

- 5.3.2 Software

- 5.3.3 Services

- 5.4 By Function

- 5.4.1 Storage

- 5.4.2 Order Picking and Retrieval

- 5.4.3 Sorting and Consolidation

- 5.4.4 Packaging and Palletising

- 5.4.5 Transportation and Conveyance

- 5.5 By Country

- 5.5.1 United Kingdom

- 5.5.2 Germany

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ABB Ltd.

- 6.4.2 AutoStore ASA

- 6.4.3 BEUMER Group GmbH and Co. KG

- 6.4.4 Daifuku Co., Ltd.

- 6.4.5 Dematic GmbH (KION Group)

- 6.4.6 Exotec SAS

- 6.4.7 Honeywell International Inc.

- 6.4.8 Interroll Holding AG

- 6.4.9 Jungheinrich Aktiengesellschaft

- 6.4.10 Kardex Holding AG

- 6.4.11 KNAPP AG

- 6.4.12 KUKA Aktiengesellschaft

- 6.4.13 Linde Material Handling GmbH

- 6.4.14 Murata Machinery, Ltd.

- 6.4.15 Ocado Group plc

- 6.4.16 SSI Schafer AG

- 6.4.17 Swisslog Holding AG

- 6.4.18 TGW Logistics Group GmbH

- 6.4.19 Toyota Industries Corporation

- 6.4.20 Vanderlande Industries B.V.

- 6.4.21 Viastore Systems GmbH

- 6.4.22 WITRON Logistik + Informatik GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment