|

市场调查报告书

商品编码

1910523

物流自动化:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Logistics Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

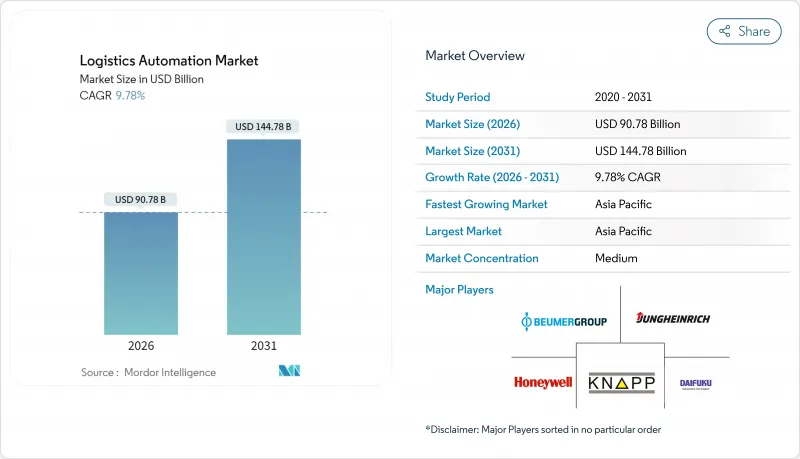

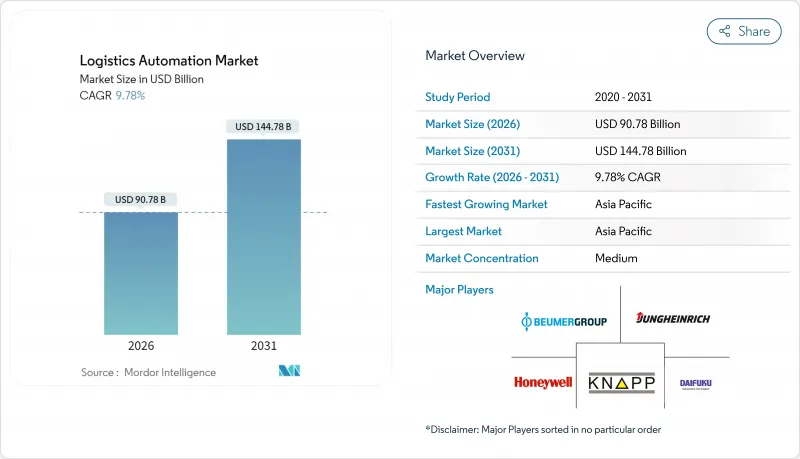

预计到 2026 年,物流自动化市场规模将达到 907.8 亿美元,高于 2025 年的 826.9 亿美元。

预计到 2031 年,市场规模将达到 1,447.8 亿美元,2026 年至 2031 年的复合年增长率为 9.78%。

在电子商务小包裹量激增、劳动力严重短缺以及企业不断扩大的净零排放目标的推动下,自动化已从一种战术性选择演变为现代供应链设计的关键支柱。零售商如今将自动化订单履行能力视为抵御薪资上涨的利器。仓库中5G和专用LTE网路的整合也实现了机器人与堆场车辆之间前所未有的即时协作。环境目标也影响资本支出优先事项,绿色债券资金筹措越来越多地与用于拣货、储存和运输的节能係统投资挂钩。虽然半自动化部署目前已成为主流,但随着人工智慧视觉技术和功能安全晶片认证门槛的降低以及执行风险认知的下降,全自动化计划正在迅速扩展。亚太地区展现出新的发展态势,政府补贴、新设施的增加以及专用5G试点计画的激增使其成为规模最大、成长最快的市场。

全球物流自动化市场趋势与洞察

快速增长的电子商务小包裹量推动基础设施现代化

如今,履约公司面临全年订单高峰的挑战,迫使它们从批次拣货转向持续的「货到人」流,从而在不增加人手的情况下缩短週期。像克罗格这样的零售商加强了与Ocado的自动化合作,以确保当日送达的生鲜配送服务水平,而这种水平如果采用人工方式是无法实现的。同时,优化包装规模技术的进步使UPS能够在维持稳定吞吐量目标的同时,减少30%的包装废弃物。高密度城市微型仓配中心正在迅速发展,预计到2027年,光是在印度,其面积就将超过3,500万平方英尺。这进一步推动了对高效自动化的需求,使成本受限的城市仓库能够充分利用每一立方英尺的空间。机器人技术正在整合到电子商务工作流程的各个环节,对自动化纸箱封口、贴标和最后一公里配送的速度要求也越来越高。这些因素共同推动了物流自动化市场的近期成长。

劳动力短缺加剧,自动化投资週期加速。

人口结构变化带来的不利影响使得劳动力供应成为策略性瓶颈,尤其是在北美和欧洲。儘管印度的采购经理人指数(PMI)在2024年3月创下16年来的新高,但像NIDO集团这样的整合商正在向面临技术纯熟劳工短缺的区域城市部署无人货运平台。协作式自主移动机器人(AMR)正在缓解这种压力。根据Fleet Feet报道,移动机器人透过接管重复性的运输任务,使生产力提高了两到三倍,从而使员工能够专注于异常情况的处理。随着企业寻求季节性产能而无需承担长期人事费用成本,机器人服务合约正在不断增加。在亚太地区,製造业扩张速度超过劳动力成长速度,这种模式正在重新定义部署的经济效益。劳动力供应限制和灵活的资金筹措选择共同推动了物流自动化市场的发展。

高昂的初始投资阻碍了中小企业采用该系统。

综合性仓库计划,包括结构维修和新设备购置,成本可能超过500万美元,令许多中小企业望而却步。 AutoStore的「按拣货收费」订阅方案可将网格安装成本降低高达40%,但并未免除建造和系统整合成本。新兴市场同样面临货币波动,资金筹措难度加大,风险意识也日益增强。因此,采用租赁和服务模式的供应商正在崛起,而大型整合商则收购专注于特定领域的机器人公司,并建立更容易获得贷款机构批准的承包工程方案。儘管取得了一些进展,但资本支出(CAPEX)仍然是物流自动化市场近期发展面临的最大阻力。

细分市场分析

到2025年,仓储营运将占物流自动化市场收入的59.55%,构成比物料驱动拣货站、自动化仓库和机器人分类系统能够为企业带来快速的投资回报。这些成熟的技术在可控环境下效果最佳,使零售商能够在不增加员工的情况下缩短订单到出货週期。儘管目前运输自动化规模较小,但随着自动驾驶卡车和场内牵引车从试点阶段过渡到商业化应用,尤其是在可靠的货运走廊沿线,预计到2031年,运输自动化将以11.05%的复合年增长率增长。

仓储领域的领先地位将透过持续创新得以维持。 AutoStore 的 CarouselAI 计划于 2025 年部署,它将实现可改造相容的机器人拣选功能,从而无需建造混凝土夹层即可扩展现有设施。然而,功能边界正在变得模糊。例如,CJ 物流等物流设施的私人 5G 部署正在整合室内机器人和自动驾驶车辆,从而建立统一的资料基础,减少装卸货平台的拥塞。儘管在预测期内,整合编配平台可能会促使支出转向跨功能解决方案,但仓储仍将是物流自动化市场的主要驱动力。

区域分析

预计到2025年,亚太地区将占全球营收的31.30%,并在2031年之前以11.56%的复合年增长率成长,使其成为规模最大、成长最快的物流自动化市场中心。中国已连续11年成为全球最大的工业机器人采购国,2023年产量达43万台,并为国内市场提供约17.5%的资本成本补贴,以促进工业机器人的普及应用。印度市场也展现出强劲的成长动能。在国家物流政策将物流成本降低至GDP的10%的目标以及都市区微型仓配需求快速增长的推动下,预计到2027年,印度A级仓库的库存面积将从2.9亿平方英尺扩大到4亿平方英尺。

北美仍然是关键市场,复杂的传统IT系统和严格的网路安全法规延长了计划週期,而高昂的人事费用则提高了自动化投资的回报率。美国自由贸易区的扩张支持了分散式库存策略,使自动化中心在最终销售前免受关税影响,并增强了跨境电子商务的竞争力。欧洲也呈现类似的趋势,但同时也增加了碳减排的监管激励措施,推动了资金流入节能型自动化仓储/零售系统(AS/RS)和人工智慧路径规划工具。

拉丁美洲和中东及非洲地区尚处于物流自动化应用的早期阶段。儘管资金短缺和整合商生态系统有限表面上减缓了成长速度,但人口结构变化和电子商务的快速发展表明,这些地区存在巨大的潜在需求。随着资金筹措机制的完善和本地供应商业务的拓展,这些地区有望成为全球物流自动化市场的下一批重要贡献者。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电子商务小包裹数量快速成长

- 劳动力短缺加剧和薪资压力上升

- 企业为实现净零物流所做的努力

- 免税微型仓配区法规

- 5G与专用LTE在仓库中的融合

- 开放原始码机器人作业系统(ROS-2)的成熟

- 市场限制

- 高昂的初始投资成本

- 与现有IT系统整合的复杂性

- 功能安全认证人工智慧晶片短缺

- OT网路的网路保险保费正在上涨

- 供应链分析

- 监管环境

- 技术展望

- 宏观经济因素如何影响市场

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按功能

- 仓库自动化

- 按组件

- 硬体

- 移动机器人(AGV、AMR)

- 自动化仓库系统(AS/RS)

- 自动分类系统

- 卸垛/码垛系统

- 输送机系统

- 自动识别和数据采集(AIDC)

- 拣货

- 软体

- 服务

- 硬体

- 按组件

- 运输自动化

- 按组件

- 硬体

- 软体

- 服务

- 按组件

- 仓库自动化

- 按自动化级别

- 全自动系统

- 半自动系统

- 按最终用户行业划分

- 电子商务和小包裹递送

- 食品/饮料

- 食品零售

- 服装与时尚

- 製造业

- 其他终端用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Dematic Corp.(KION Group AG)

- Daifuku Co., Ltd.

- Honeywell International Inc.

- Jungheinrich AG

- Murata Machinery, Ltd.

- KNAPP AG

- TGW Logistics Group GmbH

- Kardex Holding AG

- Mecalux, SA

- BEUMER Group GmbH & Co. KG

- SSI SCHAFER AG

- Vanderlande Industries BV

- WITRON Logistik+Informatik GmbH

- Interroll Holding AG

- GreyOrange Pte Ltd.

- Locus Robotics Corp.

- Geek+Technology Co., Ltd.

- Ocado Group plc(Ocado Intelligent Automation)

- AutoStore Holdings Ltd.

- Exotec SAS

- Fetch Robotics Inc.(Zebra Technologies)

- Korber Supply Chain GmbH

- Cimcorp Oy

- Manhattan Associates Inc.

第七章 市场机会与未来展望

Logistics automation market size in 2026 is estimated at USD 90.78 billion, growing from 2025 value of USD 82.69 billion with 2031 projections showing USD 144.78 billion, growing at 9.78% CAGR over 2026-2031.

Rising e-commerce parcel volumes, acute labor shortages, and expanding corporate net-zero commitments are transforming automation from a tactical option into an essential pillar of modern supply chain design. Retailers now treat automated order-fulfillment capacity as a hedge against wage inflation, while the convergence of 5G and private LTE networks inside warehouses enables real-time orchestration between robots and yard vehicles that was previously impossible. Environmental targets are also influencing capital-spending priorities, with green-bond financing increasingly tied to energy-efficient systems for picking, storage, and transport. Against this backdrop, semi-automated deployments currently dominate, but fully automated projects are scaling quickly as AI vision and functional-safety chips clear certification hurdles, thereby lowering perceived execution risk. Geographically, Asia-Pacific is rewriting the playbook: government subsidies, greenfield facility growth, and a surge in private 5G pilots are combining to make the region both the largest and fastest-growing market node.

Global Logistics Automation Market Trends and Insights

Rapid E-Commerce Parcel Volumes Drive Infrastructure Modernization

Fulfillment operators now face holiday-level order velocity all year, forcing a shift from batch-picking to continuous, goods-to-person flows that shrink cycle times without expanding headcount. Retailers such as Kroger deepened automation partnerships with Ocado to guarantee same-day grocery delivery service levels that manual processes cannot sustain.Parallel advances in right-sizing technology enable UPS to cut packaging waste by 30% while maintaining steady throughput targets. Dense urban micro-fulfillment hubs are proliferating, and India alone is projected to reach more than 35 million ft2 of such space by 2027, intensifying demand for high-cube automation capable of monetizing every cubic foot in cost-constrained city warehouses. The velocity mandate now extends to automated carton closing, labeling, and last-mile hand-off, embedding robotics across the full e-commerce workflow. Together, these forces anchor the near-term growth engine for the logistics automation market.

Rising Labor Shortages Accelerate Automation Investment Cycles

Demographic headwinds have turned labor availability into a strategic bottleneck, especially in North America and Europe. The Indian PMI reached a 16-year high in March 2024, yet integrators such as NIDO Group are rolling out unmanned goods-movement platforms for Tier 2 and Tier 3 cities, where skilled labor is scarce. Collaborative AMRs are easing the pinch: Fleet Feet reported productivity gains of 2-3X when mobile robots assumed repetitive transport chores, freeing human associates for exception handling tasks. Robotics-as-a-service contracts are rising because businesses want seasonal capacity without long-term payroll commitments. In the Asia-Pacific region, where manufacturing expansion outpaces workforce growth, these models are redefining adoption economics. The combination of constrained labor supply and flexible financing options is propelling the logistics automation market forward.

High Upfront Capital Requirements Constrain SME Adoption

Comprehensive warehouse projects can exceed USD 5 million when structural retrofits are combined with new equipment, keeping many small enterprises on the sidelines. Pay-per-pick subscription programs, championed by AutoStore, lower grid installation costs by up to 40% but do not eliminate construction and systems integration expenses. Access to affordable financing is toughest in emerging markets that also face currency volatility, elevating perceived risk. As a result, vendors with rental or service-based models are gaining share, and larger integrators are acquiring niche robotics firms to assemble turnkey packages that are easier for lenders to underwrite. Despite progress, CAPEX remains the most stubborn near-term brake on the logistics automation market.

Other drivers and restraints analyzed in the detailed report include:

- Corporate Net-Zero Commitments Reshape Facility Design Priorities

- Customs-Free Micro-Fulfillment Zones Enable Distributed Inventory Models

- Integration Complexity with Legacy IT Systems Delays Implementation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Warehouse operations captured 59.55% of the 2025 revenue within the logistics automation market share, underscoring the immediate ROI companies achieve from goods-to-person pick stations, automated storage, and robotic sortation. These proven technologies thrive in controlled environments, letting retailers compress order-to-ship cycles without adding workers. Transportation automation is currently smaller but is slated for an 11.05% CAGR to 2031 as autonomous trucks and yard tractors transition from pilots to revenue service, especially along reliable freight corridors.

Continued innovation sustains warehouse leadership: AutoStore's 2025 launch of CarouselAI delivers retrofit-friendly robotic piece-picking, enabling existing sites to scale without concrete mezzanine work. Yet the functional boundary is blurring. Private 5G deployments at sites like CJ Logistics integrate indoor robots and autonomous yard vehicles, creating a unified data fabric that reduces dock-door congestion. Over the forecast horizon, integrated orchestration platforms could shift spending toward cross-functional solutions, but warehouses will remain the volume anchor of the logistics automation market.

The Logistic Automation Market Report is Segmented by Function (Warehouse Automation and Transportation Automation), Automation Level (Fully Automated Systems and Semi-Automated Systems), End-User Industry (E-Commerce and Parcel, Grocery Retail, Manufacturing, and More), and Geography (North America, South America, Europe, Asia-Pacific, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Asia-Pacific region accounted for 31.30% of 2025 revenue and is projected to grow at a 11.56% CAGR to 2031, earning the region a dual distinction as both the largest and fastest-growing node of the logistics automation market. China has been the world's top industrial-robot buyer for 11 consecutive years, producing 430,000 units in 2023 while subsidizing roughly 17.5% of equipment costs to accelerate domestic uptake. India brings complementary momentum; Grade A warehouse inventory is on track to increase from 290 million to 400 million ft2 by 2027, driven by the National Logistics Policy's push to reduce logistics costs to 10% of GDP and by surging urban micro-fulfillment demand.

North America remains a cornerstone market, thanks to high labor costs that strengthen the payback math for automation, even as complex legacy IT systems and strict cybersecurity rules lengthen project cycles. The expansion of U.S. Foreign Trade Zones supports distributed inventory strategies, freeing automated hubs from duty liabilities until final sale and sharpening cross-border e-commerce competitiveness. Europe mirrors many of these patterns, with an added regulatory premium on carbon reduction, which is funneling capital toward energy-efficient AS/RS and AI route-planning tools.

Latin America, the Middle East, and Africa are in earlier stages of adoption. Capital scarcity and limited integrator ecosystems slow headline growth, yet demographic trends and rapid e-commerce penetration outline substantial latent demand. As financing mechanisms evolve and local vendor footprints expand, these regions are positioned to become the next wave of contributors to the global logistics automation market.

- Dematic Corp. (KION Group AG)

- Daifuku Co., Ltd.

- Honeywell International Inc.

- Jungheinrich AG

- Murata Machinery, Ltd.

- KNAPP AG

- TGW Logistics Group GmbH

- Kardex Holding AG

- Mecalux, S.A.

- BEUMER Group GmbH & Co. KG

- SSI SCHAFER AG

- Vanderlande Industries B.V.

- WITRON Logistik + Informatik GmbH

- Interroll Holding AG

- GreyOrange Pte Ltd.

- Locus Robotics Corp.

- Geek+ Technology Co., Ltd.

- Ocado Group plc (Ocado Intelligent Automation)

- AutoStore Holdings Ltd.

- Exotec SAS

- Fetch Robotics Inc. (Zebra Technologies)

- Korber Supply Chain GmbH

- Cimcorp Oy

- Manhattan Associates Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid e-commerce parcel volumes

- 4.2.2 Rising labor shortages and wage inflation

- 4.2.3 Corporate net-zero logistics commitments

- 4.2.4 Customs-free micro-fulfilment zoning laws

- 4.2.5 Convergence of 5G and private-LTE inside warehouses

- 4.2.6 Open-source robotics operating systems (ROS-2) maturation

- 4.3 Market Restraints

- 4.3.1 High upfront CAPEX

- 4.3.2 Integration complexity with brown-field IT

- 4.3.3 Scarcity of functional-safety certified AI chips

- 4.3.4 Rising cyber-insurance premiums for OT networks

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors on the Market

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Function

- 5.1.1 Warehouse Automation

- 5.1.1.1 By Component

- 5.1.1.1.1 Hardware

- 5.1.1.1.1.1 Mobile Robots (AGV, AMR)

- 5.1.1.1.1.2 Automated Storage And Retrieval Systems (AS/RS)

- 5.1.1.1.1.3 Automated Sorting Systems

- 5.1.1.1.1.4 De-Palletizing/Palletizing Systems

- 5.1.1.1.1.5 Conveyor Systems

- 5.1.1.1.1.6 Automatic Identification and Data Collection (AIDC)

- 5.1.1.1.1.7 Order Picking

- 5.1.1.1.2 Software

- 5.1.1.1.3 Services

- 5.1.1.1.1 Hardware

- 5.1.1.1 By Component

- 5.1.2 Transportation Automation

- 5.1.2.1 By Component

- 5.1.2.1.1 Hardware

- 5.1.2.1.2 Software

- 5.1.2.1.3 Services

- 5.1.2.1 By Component

- 5.1.1 Warehouse Automation

- 5.2 By Automation Level

- 5.2.1 Fully-automated Systems

- 5.2.2 Semi-automated Systems

- 5.3 By End-user Industry

- 5.3.1 E-commerce and Parcel

- 5.3.2 Food and Beverage

- 5.3.3 Grocery Retail

- 5.3.4 Apparel and Fashion

- 5.3.5 Manufacturing

- 5.3.6 Other End-user Industries

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 South-East Asia

- 5.4.4.6 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Saudi Arabia

- 5.4.5.1.2 United Arab Emirates

- 5.4.5.1.3 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Egypt

- 5.4.5.2.3 Rest of Africa

- 5.4.5.1 Middle East

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Dematic Corp. (KION Group AG)

- 6.4.2 Daifuku Co., Ltd.

- 6.4.3 Honeywell International Inc.

- 6.4.4 Jungheinrich AG

- 6.4.5 Murata Machinery, Ltd.

- 6.4.6 KNAPP AG

- 6.4.7 TGW Logistics Group GmbH

- 6.4.8 Kardex Holding AG

- 6.4.9 Mecalux, S.A.

- 6.4.10 BEUMER Group GmbH & Co. KG

- 6.4.11 SSI SCHAFER AG

- 6.4.12 Vanderlande Industries B.V.

- 6.4.13 WITRON Logistik + Informatik GmbH

- 6.4.14 Interroll Holding AG

- 6.4.15 GreyOrange Pte Ltd.

- 6.4.16 Locus Robotics Corp.

- 6.4.17 Geek+ Technology Co., Ltd.

- 6.4.18 Ocado Group plc (Ocado Intelligent Automation)

- 6.4.19 AutoStore Holdings Ltd.

- 6.4.20 Exotec SAS

- 6.4.21 Fetch Robotics Inc. (Zebra Technologies)

- 6.4.22 Korber Supply Chain GmbH

- 6.4.23 Cimcorp Oy

- 6.4.24 Manhattan Associates Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment