|

市场调查报告书

商品编码

1906238

油压缸:市占率分析、产业趋势与统计、成长预测(2026-2031)Hydraulic Cylinder - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

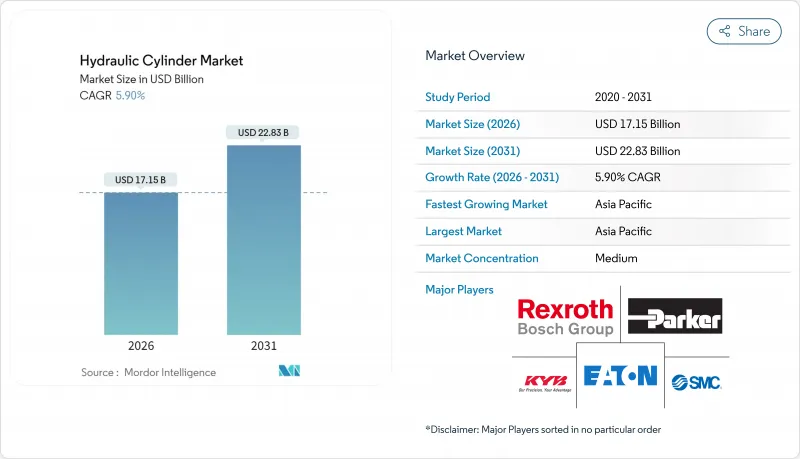

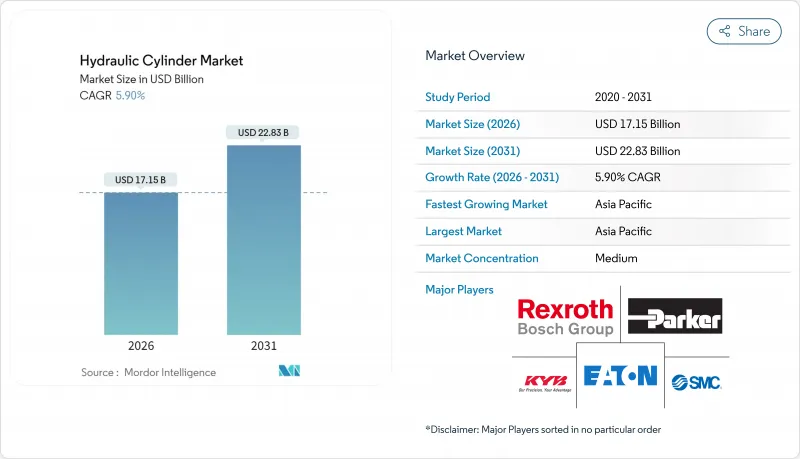

预计油压缸市场将从 2025 年的 161.9 亿美元成长到 2026 年的 171.5 亿美元,到 2031 年将达到 228.3 亿美元,2026 年至 2031 年的复合年增长率为 5.9%。

基础设施计划的强劲资本投资、仓储自动化的快速发展以及智慧电液解决方案的普及,正在推动油压缸市场的发展。然而,投入成本的波动和选择性电气化正在抑制其成长。施工机械(一台挖土机最多可整合六个液压缸)和电子商务物流网路对高循环次数的升降倾斜系统的需求,是推动市场成长的主要动力。亚太地区凭藉中国庞大的製造业规模和印度的公共工程支出,维持着市场领先地位;而北美则受益于1.2兆美元的《基础设施投资和就业创造法案》。在终端市场,供应商正透过整合感测器、物联网闸道和可再生驱动架构来扩大其竞争优势,从而降低生命週期能源成本,并透过预测性维护创造新的收入来源。

全球油压缸市场趋势与洞察

基础设施和施工机械繁荣

基础设施建设支出正带动对配备多个大吨位液压缸的挖土机、装载机和高空作业平台的需求激增。美国联邦政府的支出正在推动重型设备车队的成长,提高运转率。同样的情况也出现在亚洲,亚洲的离岸能源资本投资较去年同期成长了15%。原始设备製造商(OEM)正在积极应对,指定使用具有能源回收迴路的液压缸,以减少高达64%的液压损失,从而降低油耗,并符合企业脱碳政策。利率趋于稳定,缩短了融资週期,这进一步刺激了对高度依赖液压驱动的小型施工机械的需求。

发展中地区农业机械化的进展

印度、巴西和撒哈拉以南非洲的机械化计画正在推动拖拉机的普及,并增加液压系统的复杂性。三点式悬吊、装载臂和转向辅助系统都依赖能够在多尘高温环境下精确控制流量的液压缸。对水力发电混合动力传动系统的田间试验证实,犁地中峰值扭矩降低了18.8%,这表明该技术具有在保持液压密度的同时节省燃油的潜力。本地组装设施使製造商能够规避关税并缩短前置作业时间,从而增强了农业油压缸市场的韧性。

轻型应用中电动致动器的快速普及

电动致动器效率提升高达75-80%,且零洩漏,因此在精密包装、实验室自动化和小型装载机等领域越来越受欢迎。其超过1亿次的超长循环寿命,也使其在这些细分市场中比液压系统更俱生命週期成本优势。儘管油压缸行业选择性替代的趋势仍在继续,但製造商正透过扩展其混合动力和全电动产品线来降低风险并维持市场份额。

细分市场分析

双作用液压缸预计将占2025年总收入的57.74%,以巩固其在铲斗、压力机和转向柱设备的双向负载控制领域在整个油压缸市场中的地位。整合式压力感测器提高了精度,使原始设备製造商(OEM)能够在自动化焊接生产线上实现重复性目标。单作用液压缸采用重力回油机构,可缩小泵浦的尺寸和液压油的用量,其复合年增长率将达到5.93%,为剪式升降机和自卸车提供了极具吸引力的折衷方案。再生迴路选项进一步降低了能耗,为注重成本的买家拓展了应用场景。

市场结构分化促使企业采用客製化的筹资策略。大型非公路用车辆製造商签订多年期双作用液压缸供应协议,采购具有同步流路的液压缸;而售后市场经销商则更倾向于模组化的单作用液压缸产品,以满足其多样化的设备需求。能够在通用加工单元中切换生产两种不同设计的供应商,可以透过最大限度地减少製程切换期间的停机时间并提高毛利率,从而增强其在油压缸市场的竞争优势。

2025年,焊接式汽缸将占总收入的44.15%,这主要得益于其一体式汽缸体的强度和优异的性价比。农业和矿业原始设备製造商(OEM)正在指定使用压力高达3000 PSI的焊接式气压缸,利用一体式密封圈缩短安装时间。伸缩式汽缸虽然规模较小,但由于都市区週期。

拉桿式和铣削式液压缸分别在工厂自动化和金属加工领域仍然十分重要,因为在这些领域,产品的可维护性和严苛的运作条件决定了其选择。供应商透过专有的密封组件来延长维护週期,并透过满足工业4.0资料收集要求的在线连续位置感测技术来区分产品。如此广泛的规格范围使得油压缸市场能够提供功率、行程和运作等各种适用性的选择。

区域分析

到2025年,亚太地区将占全球营收的40.62%,年复合成长率达6.73%,主要得益于印度高铁走廊和中国离岸风力发电扩建等大型企划的推动。恆力等主要企业正在扩建其垂直整合工厂,以取代进口高端气瓶,从而缩短前置作业时间并降低到岸成本。供应商的接近性也符合区域整车厂商所采用的准时制生产模式。

北美位居第二,这得益于联邦政府对基础设施的投资,用于升级建筑车队和改造内陆港口的物料输送系统。随着预测性维护的日益普及,本地製造商正透过先进的冶金技术和数位化整合来满足终端用户对资料丰富型设备的需求,从而实现差异化竞争优势。

在欧洲,对永续性和降噪的重视正推动智慧电液设计的应用,以减少能源浪费。绿色交易指令的立法推动,促使原始设备製造商订单可生物降解的液压油和采用防漏技术的液压缸。

中东地区受原油价格波动影响,液压缸需求出现波动,但沙乌地阿拉伯天然气处理设施的扩建带动了管道建设用大口径液压缸订单的復苏。在非洲和拉丁美洲,农业机械化补贴和采矿特许权为市场提供了利好,但汇率波动给进口商带来了挑战。在所有地区,拥有本地服务网路和快速备件供应的供应商在油压缸市场中都占据了优势。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 对基础设施和施工机械的需求不断增长

- 发展中地区农业机械化的进展

- 电子商务主导了仓储物料输送自动化的激增

- 移动机械向电液「智慧」油缸的转变

- 油压缸在风力发电机变桨控制的应用日益广泛

- 航太和国防生产週期恢復

- 市场限制

- 轻型应用中电动致动器的快速普及

- 钢材价格波动推高了气瓶的成本结构。

- 旧有系统中的长期维护和洩漏问题

- 采矿和石油天然气产业的週期性资本支出

- 价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按功能

- 单作用

- 双动式

- 根据规格

- 焊接

- 拉桿

- 伸缩

- 铣床类型

- 按孔径

- 小于 50 毫米

- 50至150毫米

- 150毫米或以上

- 按最终用户行业划分

- 施工机械

- 农业

- 物料输送和堆高机

- 矿业

- 工业製造

- 航太/国防

- 海洋

- 石油和天然气

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 智利

- 哥伦比亚

- 其他南美洲

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 肯亚

- 埃及

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Bosch Rexroth AG

- Parker-Hannifin Corporation

- Eaton Corporation plc

- SMC Corporation

- KYB Corporation

- Caterpillar Inc.

- Enerpac Tool Group Corp.

- Wipro Infrastructure Engineering(division of Wipro Enterprises Pvt. Ltd.)

- Liebherr-International AG

- Jiangsu Hengli Hydraulic Co., Ltd.

- Texas Hydraulics Inc.

- Bucher Hydraulics GmbH

- Aggressive Hydraulics, Inc.

- Festo SE and Co. KG

- Bailey International, LLC

- PMC Hydraulics AB

- HYDAC International GmbH

- Kawasaki Heavy Industries, Ltd.

- Ingersoll-Rand plc(Doosan Portable Power cylinders)

- Caterpillar OEM Solutions(Aftermarket cylinders)

第七章 市场机会与未来展望

The hydraulic cylinder market is expected to grow from USD 16.19 billion in 2025 to USD 17.15 billion in 2026 and is forecast to reach USD 22.83 billion by 2031 at 5.9% CAGR over 2026-2031.

Robust capital spending on infrastructure projects, rapid warehouse automation, and the deployment of smart electro-hydraulic solutions together propel the hydraulic cylinder market, even as input-cost volatility and selective electrification temper expansion. Demand is anchored by construction machinery, where each excavator alone integrates up to six cylinders, and by e-commerce logistics networks that specify high-cycle lift and tilt systems. Asia-Pacific retains primacy on the back of Chinese manufacturing scale and Indian public-works outlays, while North America benefits from the USD 1.2 trillion Infrastructure Investment and Jobs Act. Across end-markets, suppliers widen their moats by embedding sensors, IoT gateways, and regenerative drive architectures that shrink lifetime energy costs and unlock predictive-maintenance revenue streams.

Global Hydraulic Cylinder Market Trends and Insights

Infrastructure and construction-equipment boom

Infrastructure outlays stimulate a cascading need for excavators, loaders, and aerial platforms, each fitted with multiple high-tonnage cylinders. In the United States, federal spending revives heavy-equipment fleets and raises utilization rates, an effect echoed in Asia where offshore-energy capex is growing 15% year-on-year. OEMs respond by specifying cylinders with energy-recovery circuits that save up to 64% of hydraulic losses, cutting fuel burn and aligning with corporate decarbonization mandates. Shorter financing cycles, enabled by stabilizing interest rates, further unlock compact-equipment demand that disproportionately relies on hydraulic actuation.

Rising farm mechanization in developing regions

Mechanization programs in India, Brazil, and sub-Saharan Africa accelerate tractor penetration and elevate hydraulic complexity. Three-point hitches, loader arms, and steering assist all depend on cylinders capable of precise flow-modulation under dusty, high-temperature conditions. Field research on hybrid hydraulic-electric drivelines shows peak-torque cuts of 18.8% during plowing, validating the technology's fuel-savings potential while preserving hydraulic force density. Localized assembly hubs help manufacturers sidestep tariff regimes and shorten lead times, reinforcing the hydraulic cylinder market's resilience in agriculture.

Rapid adoption of electric actuators in light-duty applications

Efficiency gains of 75-80% and zero-leakage operation make electric actuators attractive for precision packaging, lab automation, and compact loaders. High-cycle life beyond 100 million strokes also tilts lifecycle economics away from hydraulics in these niches. Manufacturers mitigate risk by expanding portfolios to include hybrid and all-electric offerings, ensuring wallet-share retention even as the hydraulic cylinder industry experiences selective substitution.

Other drivers and restraints analyzed in the detailed report include:

- E-commerce-led surge in warehouse material-handling automation

- Shift toward electro-hydraulic smart cylinders in mobile machinery

- Volatile steel prices inflating cylinder cost structure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Double-acting designs generated 57.74% of 2025 revenue, cementing their role in two-way load control for buckets, presses, and steering columns across the hydraulic cylinder market. Embedded pressure transducers elevate precision, enabling OEMs to achieve repeatability targets in automated welding lines. Single-acting models post a 5.93% CAGR as gravity-return architectures reduce pump sizing and fluid volume, a compelling trade-off for scissor-lifts and tipper bodies. Regenerative circuit options further cut energy draw, expanding addressable use-cases for cost-sensitive buyers.

The dual-market dynamic fosters tailored sourcing strategies. High-volume off-highway builders lock in multi-year supply agreements for double-acting cylinders with synchronized flow paths, while aftermarket distributors favor modular single-acting SKUs to match heterogeneous equipment fleets. Suppliers that can flex production between the two designs on common machining cells minimize changeover downtime and widen gross-margin spreads, reinforcing their competitiveness within the hydraulic cylinder market.

Welded cylinders contributed 44.15% of 2025 turnover thanks to their one-piece body strength and favorable cost-to-pressure ratio. OEMs in agriculture and mining specify welded models up to 3,000 PSI, leveraging integrated glands that shorten installation time. Telescopic cylinders, despite a smaller base, accelerate at a 6.14% CAGR as urban job-sites demand compact stowed lengths and extended reach. Telematik multi-section systems stretch seven stages without external chains, offering maintenance-free operation and cycle-time advantages.

Tie-rod and mill-type designs retain relevance in factory automation and metals processing respectively, where serviceability or extreme-duty requirements dictate product choice. Vendors differentiate through proprietary seal stacks that extend service intervals and through inline position sensing that satisfies Industry 4.0 data-collection mandates. This broad specification spectrum ensures the hydraulic cylinder market provides fit-for-purpose options across force, stroke, and duty-cycle axes.

The Hydraulic Cylinder Market Report is Segmented by Function (Single-Acting, and Double-Acting), Specification (Welded, Tie-Rod, Telescopic, and Mill-Type), Bore Size (Below 50 Mm, 50-150 Mm, and Above 150 Mm), End-User Industry (Construction Equipment, Agriculture, Material Handling and Forklifts, Mining, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific secured 40.62% of 2025 revenue and records an 6.73% CAGR, driven by megaprojects such as India's high-speed rail corridors and China's offshore wind build-out. Domestic champions like Hengli scale vertically integrated plants to replace imported high-end cylinders, trimming lead times and landed costs. Supplier proximity also aligns with just-in-time practices adopted by regional OEMs.

North America ranks second, buoyed by federal infrastructure spending that refreshes construction fleets and upgrades inland-port material-handling systems. Local producers differentiate via advanced metallurgy and digital integration, meeting end-user demand for data-rich equipment as predictive-maintenance adoption rises.

Europe emphasizes sustainability and noise reduction, prompting the uptake of smart electro-hydraulic designs that curtail energy waste. OEMs receive legislative stimulus from EU Green Deal directives, spurring orders for cylinders with biodegradable fluids and leak-prevention technologies.

The Middle East sees demand swings tied to oil-price cycles, but gas-processing expansion in Saudi Arabia revives large-bore cylinder orders for pipeline construction. Africa and Latin America benefit from agricultural mechanization subsidies and mining concessions, though currency volatility challenges importers. Across all regions, suppliers that offer localized service networks and rapid spare-parts fulfillment gain advantage in the hydraulic cylinder market.

- Bosch Rexroth AG

- Parker-Hannifin Corporation

- Eaton Corporation plc

- SMC Corporation

- KYB Corporation

- Caterpillar Inc.

- Enerpac Tool Group Corp.

- Wipro Infrastructure Engineering (division of Wipro Enterprises Pvt. Ltd.)

- Liebherr-International AG

- Jiangsu Hengli Hydraulic Co., Ltd.

- Texas Hydraulics Inc.

- Bucher Hydraulics GmbH

- Aggressive Hydraulics, Inc.

- Festo SE and Co. KG

- Bailey International, LLC

- PMC Hydraulics AB

- HYDAC International GmbH

- Kawasaki Heavy Industries, Ltd.

- Ingersoll-Rand plc (Doosan Portable Power cylinders)

- Caterpillar OEM Solutions (Aftermarket cylinders)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Infrastructure and construction-equipment boom

- 4.2.2 Rising farm mechanization in developing regions

- 4.2.3 E-commerce-led surge in warehouse material-handling automation

- 4.2.4 Shift toward electro-hydraulic "smart" cylinders in mobile machinery

- 4.2.5 Growing use of hydraulic cylinders in wind-turbine pitch control

- 4.2.6 Recovery of aerospace and defense production cycles

- 4.3 Market Restraints

- 4.3.1 Rapid adoption of electric actuators in light-duty applications

- 4.3.2 Volatile steel prices inflating cylinder cost structure

- 4.3.3 Chronic maintenance and leakage issues in legacy systems

- 4.3.4 Cyclical CAPEX in mining and oil and gas sectors

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Function

- 5.1.1 Single-Acting

- 5.1.2 Double-Acting

- 5.2 By Specification

- 5.2.1 Welded

- 5.2.2 Tie-Rod

- 5.2.3 Telescopic

- 5.2.4 Mill-Type

- 5.3 By Bore Size

- 5.3.1 Below 50 mm

- 5.3.2 50 - 150 mm

- 5.3.3 Above 150 mm

- 5.4 By End-User Industry

- 5.4.1 Construction Equipment

- 5.4.2 Agriculture

- 5.4.3 Material Handling and Forklifts

- 5.4.4 Mining

- 5.4.5 Industrial Manufacturing

- 5.4.6 Aerospace and Defense

- 5.4.7 Marine

- 5.4.8 Oil and Gas

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 South Korea

- 5.5.3.4 India

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Chile

- 5.5.4.4 Colombia

- 5.5.4.5 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Kenya

- 5.5.5.2.4 Egypt

- 5.5.5.2.5 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Bosch Rexroth AG

- 6.4.2 Parker-Hannifin Corporation

- 6.4.3 Eaton Corporation plc

- 6.4.4 SMC Corporation

- 6.4.5 KYB Corporation

- 6.4.6 Caterpillar Inc.

- 6.4.7 Enerpac Tool Group Corp.

- 6.4.8 Wipro Infrastructure Engineering (division of Wipro Enterprises Pvt. Ltd.)

- 6.4.9 Liebherr-International AG

- 6.4.10 Jiangsu Hengli Hydraulic Co., Ltd.

- 6.4.11 Texas Hydraulics Inc.

- 6.4.12 Bucher Hydraulics GmbH

- 6.4.13 Aggressive Hydraulics, Inc.

- 6.4.14 Festo SE and Co. KG

- 6.4.15 Bailey International, LLC

- 6.4.16 PMC Hydraulics AB

- 6.4.17 HYDAC International GmbH

- 6.4.18 Kawasaki Heavy Industries, Ltd.

- 6.4.19 Ingersoll-Rand plc (Doosan Portable Power cylinders)

- 6.4.20 Caterpillar OEM Solutions (Aftermarket cylinders)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment