|

市场调查报告书

商品编码

1906873

光达:市场份额分析、产业趋势与统计、成长预测(2026-2031)LiDAR - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

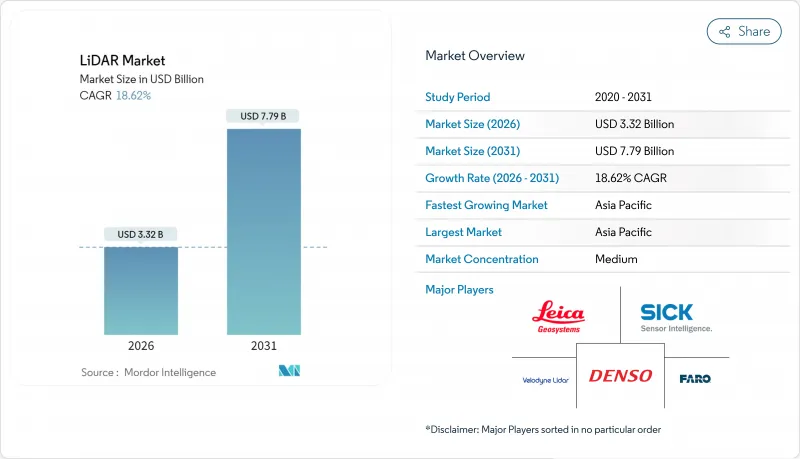

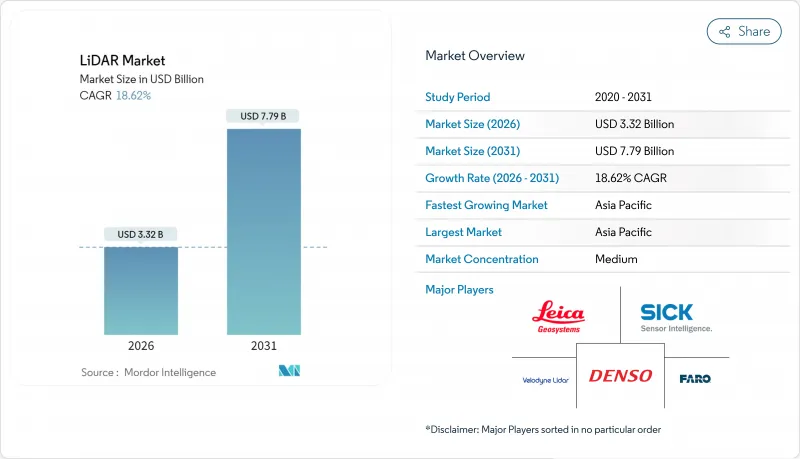

预计光达市场将从 2025 年的 28 亿美元成长到 2026 年的 33.2 亿美元,到 2031 年达到 77.9 亿美元,2026 年至 2031 年的复合年增长率为 18.62%。

成本优化的垂直共振腔面射型雷射(VCSEL)、成熟的单光子崩溃式二极体(SPAD) 阵列以及车规级系统晶片)正在降低量产车辆的进入门槛,同时提升侦测范围和可靠性。联合国 R-157 法规限制了感测器的选择,强制要求其深度感知能力超越雷达和摄影机系统本身的能力,这为雷射雷达 (LiDAR) 市场持续符合监管要求提供了有利条件。联邦政府的支出,例如 8.3 亿美元的 PROTECT津贴和不断扩展的美国地质调查局 (USGS) 三维高程计划,正在支撑北美地区走廊测绘的需求。同时,中国供应商正利用其完全本土化的供应链和政府奖励在全球范围内降低价格,加剧竞争压力,同时降低准入门槛,扩大雷射雷达市场。

全球光达市场趋势与洞察

VCSEL发射器和堆迭式SPAD探测器成本的快速下降,使得完整的车规级感测器模组价格分布降至500美元以下,同时仍能保持300公尺的侦测距离和5公分的深度解析度。和赛计画在2025年将产品价格进一步减半,这表明价格弹性将更多地体现在中阶车型而非高阶旗舰车型上,从而推动了全球超过23家OEM厂商在短期内采用该设计。欧洲汽车製造商正在同步调整产品上市週期,以充分利用不断提升的成本绩效优势,而固态架构则无需机械致动器,从而缩短了检验时间。

联合国R-157自动驾驶法规推动L3级自动驾驶光达的大规模生产

联合国R-157标准规定了高速公路自动驾驶的最低深度感知、视野和冗余标准,这些标准无法透过摄影机-雷达组合来满足,实际上使得雷射雷达成为所有认证的L3级自动驾驶系统的必备组件。欧盟率先实施该法规(以及中国正在製定的GB/T 45500-2025标准)将有助于实现全球平台通用,从而降低重新设计成本并加快OEM厂商的部署速度。由何赛公司主导的ISO/PWI 13228标准正在推动产业范围内的合作,规范测试通讯协定并减少认证过程中的摩擦。

欧盟眼部安全法规禁止使用1550奈米长距离汽车光达

IEC 60825-1 1 类标准对乘用车中 1550nm 雷射器的允许功率输出有严格限制,导致无法实现高速公路自动驾驶所需的 200 公尺以上的实际探测距离。这促使原始设备製造商 (OEM) 将重点转向 905nm 雷射和多感测器融合技术,但这增加了成本和架构复杂性,同时也限制了大气渗透性更高的波长的应用潜力。

细分市场分析

到2025年,机载平台仍将维持37.45%的雷射雷达市场份额,因为用于洪水风险缓解、离岸风力发电选址和精密农业的位置面积测绘将持续推动飞行时间的需求。单光子测量设备现在每秒可收集1400万个数据点,从而缩短任务时间,并提高在全国范围内绘製走廊资产地图的机构的投资回报率。

同时,在智慧城市和车载道路资产管理系统与高清地图生成无缝整合的推动下,移动地面单元正以23.1%的复合年增长率快速成长。随着自动驾驶高速公路的普及,数据采集频率不断提高,行动平台预计将在本十年末超越空中平台。惯性测量单元(IMU)和即时动态校正技术成本的持续下降,进一步增强了城市地区的成长动能。

到2025年,固体感测器将占总收入的82.95%,这反映出原始设备製造商(OEM)对抗震结构和简化组装的重视,从而实现长期可靠性目标。固体模组雷射雷达市场预计将以18.4%的复合年增长率成长,为该细分市场中最高的成长速度,到2031年市场规模将超过61.5亿美元。

频率调製连续波 (FMCW) 技术除了测量距离外,还能测量多普勒速度,从而为感测器堆迭添加传统飞行时间技术无法提供的瞬时运动资讯。 FMCW 不受串扰和外部光线的影响,因此能够在车辆密集的都市区部署,即使多个车辆同时运作感测器也能正常运作。机械扫描仍将继续用于超高解析度应用场景,但随着晶圆级光束控制技术的成熟,其体积的不断下降预示着不可避免的转型。

区域分析

到2025年,亚太地区将以25.1%的复合年增长率引领成长。这主要归功于中国汽车製造商在一次重大摄影机故障暴露出深度感知限制后,开始在中檔电动车上标准化使用光达(LiDAR)。合赛科技和RoboSense利用垂直整合的供应链和地方政府补贴计划,以低于全球平均水平40%的价格分布提供感测器,推动了国内市场的广泛应用,并为海外市场树立了极具竞争力的标竿。国家标准GB/T 45500-2025制定了性能标准,影响了全球认证体系,促进了出口导向硬体的合规性。

北美市场依然占据主导地位,这主要得益于联邦政府的基础设施支出以及创业投资投资对自动驾驶Start-Ups的大力支持。 PROTECT津贴8.3 亿美元用于基于雷射雷达的气候变迁测绘,确保了汽车行业以外的持续需求。 NASA 的 GEDI 等先进的太空计画不断突破技术边界,并将衍生组件推向商业管道。加拿大大力发展海洋技术,例如 Kraken 收购 3D at Depth,正在拓展水下勘测能力并实现收入来源多元化。

在欧洲,强劲的监管势头与严格的雷射安全限制相平衡。欧盟核准2019/2144强制要求使用高级驾驶辅助系统(ADAS)并推动雷射雷达(LiDAR)的采购,但IEC 60825-1标准限制了1550nm波长在汽车应用中的使用,迫使平台开发人员在人眼安全和测距性能之间寻求平衡。北海离岸风力发电推动了对用于测深测量的雷射雷达的需求,而单光子航空感测器则缩短了跨境铁路走廊的测绘时间。在拉丁美洲和非洲等新兴市场,飞行成本的下降和蜂窝回程传输网路的扩展正在推动无人机搭载雷射雷达的普及,以加速可再生能源位置和矿产探勘。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 突破性进展:售价低于500美元的固体感测器加速了中国和欧盟汽车设计领域的应用

- 联合国R-157号自动驾驶法规促进L3级光达的大规模生产

- 美国基础设施法案资金筹措:走廊和气候适应力雷射雷达测绘

- 利用无人机进行地形测绘,用于非洲和南美洲的大型可再生能源项目

- 北海和东亚近海风能测深光达调查

- 对整合识别功能的暗室仓库机器人的需求

- 市场限制

- 欧盟眼部安全法规阻碍了1550nm远程汽车雷射雷达的普及应用

- 4D成像雷达价格压力及其对短程ADAS感测器的影响

- 用于轨道光达任务的航天级零件短缺

- 点云资料的爆炸性成长正使各国测绘机构不堪负荷。

- 价值/供应链分析

- 监理与技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- 技术概述

- 测量过程选项

- 雷射选项

- 光束转向选项

- 检测器选项

第五章 市场规模与成长预测

- 按类型

- 航空

- 地形

- 水深测量

- 地面以上

- 移动的

- 静止的

- 航空

- 按产品/技术

- 机器

- 固体(MEMS)

- 按组件

- 雷射扫描仪

- 导航与定位(IMU/GNSS)

- 光束控制和MEMS反射镜

- 检测器/接收器

- 软体和服务

- 按范围

- 短距离(不足100公尺)

- 中等大小(100-200公尺)

- 长(超过200公尺)

- 透过使用

- 高级驾驶辅助系统(ADAS)

- 机器人和自动驾驶汽车

- 送货

- 走廊和地形测绘

- 环境和森林监测

- 城市规划和智慧基础设施

- 海洋学和水深测量

- 按最终用户行业划分

- 车

- 航太/国防

- 土木工程/建筑

- 能源与公共产业

- 农业

- 石油和天然气

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 印尼

- 亚太其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 南非

- 沙乌地阿拉伯

- 奈及利亚

- 肯亚

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Hesai Technology

- RoboSense LiDAR

- Velodyne Lidar Inc.

- Innoviz Technologies Ltd

- Valeo SA

- Leica Geosystems AG(Hexagon AB)

- Sick AG

- Teledyne Optech

- FARO Technologies Inc.

- Topcon Corporation

- Luminar Technologies Inc.

- Ouster Inc.

- Continental AG

- Valeo Schalter und Sensoren GmbH

- DENSO Corporation

- Aeva Technologies

- Neptec Technologies Corp.(MDA)

- Argo LiDAR(Argo AI)

第七章 市场机会与未来展望

The LiDAR market is expected to grow from USD 2.8 billion in 2025 to USD 3.32 billion in 2026 and is forecast to reach USD 7.79 billion by 2031 at 18.62% CAGR over 2026-2031.

Cost-optimized vertical-cavity surface-emitting lasers (VCSELs), maturing single-photon avalanche diode (SPAD) arrays, and automotive-grade system-on-chips are lowering entry costs for mass-production vehicles while extending detection range and reliability. Regulation UN R-157 has removed optionality from sensor choice by specifying depth perception capabilities that radar-camera suites alone cannot satisfy, giving the LiDAR market a durable compliance tail-wind . Federal spending-such as the USD 830 million PROTECT grants and the expanding USGS 3D Elevation Program-anchors the corridor-mapping demand base across North America . Meanwhile, Chinese suppliers leverage complete domestic supply chains and state incentives to compress prices globally, intensifying competitive pressure but simultaneously expanding the LiDAR market by lowering adoption thresholds.

Global LiDAR Market Trends and Insights

Rapid cost compression in VCSEL emitters and stacked SPAD receivers has pushed complete automotive-grade sensor modules below USD 500 without sacrificing 300 m detection range or 5 cm depth resolution . Hesai's plan to halve list prices again in 2025 signals a price-elastic expansion toward mid-tier models rather than premium flagships, propelling near-term design-win volumes across more than 23 global OEMs . European automakers are synchronizing launch cycles to exploit the improved cost-performance curve, shortening validation timelines because solid-state architecture eliminates mechanical actuators.

Autonomous-Driving Regulation UN R-157 Triggering L3 LiDAR Ramp-ups

UN R-157 enforces minimum depth-perception, field-of-view, and redundancy benchmarks that camera-radar combinations cannot satisfy in highway automation, effectively hard-coding LiDAR into every homologated Level 3 stack. The regulation's early EU implementation, mirrored by China's forthcoming GB/T 45500-2025, enables global platform commonality, cutting OEM re-engineering costs and accelerating rollout schedules. Industry-wide collaboration through ISO/PWI 13228 chaired by Hesai is standardizing test protocols, reducing certification friction.

EU Eye-Safety Rules Hindering 1550 nm Long-Range Automotive LiDAR

IEC 60825-1 Class 1 limits severely restrict permissible laser power at 1550 nm in passenger vehicles, curbing practical detection ranges below the 200 m required for highway autonomy. OEMs therefore pivot to 905 nm or multi-sensor fusion, adding cost and architectural complexity while capping the potential of otherwise superior atmospheric-penetration wavelengths.

Other drivers and restraints analyzed in the detailed report include:

- US Infrastructure Bill Funding Corridor & Climate-Resilience LiDAR Mapping

- Drone-based Topographical Surveys for Utility-Scale Renewables in Africa & South America

- 4D Imaging Radar Price-Pressure on Short-Range ADAS Sensors

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Aerial platforms retained 37.45% of 2025 LiDAR market share as large-area surveys for flood-risk mitigation, offshore-wind siting, and precision agriculture drove sustained flight-hour demand. Single-photon instruments now capture 14 million points per second, cutting mission time and boosting return-on-investment for agencies mapping corridor assets at national scales.

Mobile terrestrial units, however, are expanding at 23.1% CAGR, propelled by smart-city and vehicle-mounted road-asset inventories that integrate seamlessly with HD map generation. As autonomous-ready highways proliferate, data-collection frequency rises, positioning mobile platforms to rival aerial share by the decade's end. Continued cost drops in inertial measurement units and real-time kinematic corrections reinforce growth momentum across urban regions.

Solid-state sensors accounted for 82.95% of 2025 revenues, reflecting OEM preference for vibration-proof architectures and simplified assembly that enable long-term reliability targets. The LiDAR market size for solid-state modules is on track to exceed USD 6.15 billion by 2031 at segment-leading 18.4% CAGR.

Frequency-modulated continuous-wave designs measure Doppler velocity alongside range, enriching perception stacks with instantaneous motion cues that traditional time-of-flight lacks. Immune to crosstalk and external illumination, FMCW unlocks high-density urban deployment where many vehicles operate concurrent sensors. Mechanical scanning persists in niche ultra-resolution use-cases, yet declining unit volumes suggest an inevitable transition as wafer-scale beam-steering matures.

The LiDAR Market Report is Segmented by Product/Technology (Mechanical and More), Component (Laser Scanner and More), by Range (Short (<100 M) and More), Application (Robotic Vehicle, ADAS, and Morel), Type (Aerial and Terrestrial), End-User Industry (Automotive and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led in growth with a 25.1% regional CAGR in 2025, driven by Chinese OEM production that now integrates LiDAR on mid-tier EVs after high-profile camera failures highlighted depth-perception gaps. Hesai and RoboSense leverage vertically integrated supply chains and provincial subsidies to offer sensors at price points that undercut global averages by up to 40%, broadening domestic adoption and setting aggressive benchmarks abroad. National standard GB/T 45500-2025 establishes performance floors that ripple across global homologation programs and incentivize export-oriented hardware conformity.

North America maintains sizable share anchored by federal infrastructure outlays and strong venture capital backing for autonomous-driving startups. The PROTECT grants allocate USD 830 million toward LiDAR-enabled climate resilience mapping, ensuring recurring demand beyond automotive verticals. Advanced space-borne programs such as NASA's GEDI continue to stretch technical frontiers and funnel spin-off components into commercial channels. Canada's offshore technology push, exemplified by Kraken's acquisition of 3D at Depth, expands underwater-survey capabilities and diversifies revenue streams.

Europe balances strong regulatory pull with stringent laser-safety limitations. Type-approval Regulation (EU) 2019/2144 compels ADAS fitment, elevating LiDAR procurement, yet IEC 60825-1 hampers 1550 nm automotive adoption, forcing platform developers to juggle eye-safety and range needs. High offshore-wind build-rates in the North Sea drive bathymetric LiDAR campaigns, while single-photon airborne sensors shorten survey windows for cross-border rail corridors. Emerging markets in Latin America and Africa increasingly deploy drone-based LiDAR to accelerate renewable-energy siting and mining exploration, benefitting from falling per-flight costs and expanding cellular backhaul coverage.

- Hesai Technology

- RoboSense LiDAR

- Velodyne Lidar Inc.

- Innoviz Technologies Ltd

- Valeo SA

- Leica Geosystems AG (Hexagon AB)

- Sick AG

- Teledyne Optech

- FARO Technologies Inc.

- Topcon Corporation

- Luminar Technologies Inc.

- Ouster Inc.

- Continental AG

- Valeo Schalter und Sensoren GmbH

- DENSO Corporation

- Aeva Technologies

- Neptec Technologies Corp. (MDA)

- Argo LiDAR (Argo AI)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Breakthrough <USD 500 Solid-State Sensors Accelerating Automotive Design-wins in China and EU

- 4.2.2 Autonomous-Driving Regulation UN R-157 Triggering L3 LiDAR Ramp-ups

- 4.2.3 US Infrastructure Bill Funding Corridor and Climate-Resilience LiDAR Mapping

- 4.2.4 Drone-based Topographical Surveys for Utility-Scale Renewables in Africa and South America

- 4.2.5 Offshore Wind Bathymetric LiDAR Campaigns in North Sea and East Asia

- 4.2.6 Perception-Fusion Demand for Dark-Warehouse Robotics

- 4.3 Market Restraints

- 4.3.1 EU Eye-Safety Rules Hindering 1550 nm Long-Range Automotive LiDAR

- 4.3.2 4D Imaging Radar Price-Pressure on Short-Range ADAS Sensors

- 4.3.3 Scarcity of Space-Grade Components for Orbital LiDAR Missions

- 4.3.4 Point-Cloud Data Deluge Overloading National Mapping Agencies

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Industry Value-Chain Analysis

- 4.8 Technology Snapshot

- 4.8.1 Measurement Process Options

- 4.8.2 Laser Options

- 4.8.3 Beam-Steering Options

- 4.8.4 Photodetector Options

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Aerial

- 5.1.1.1 Topographic

- 5.1.1.2 Bathymetric

- 5.1.2 Terrestrial

- 5.1.2.1 Mobile

- 5.1.2.2 Static

- 5.1.1 Aerial

- 5.2 By Product/Technology

- 5.2.1 Mechanical

- 5.2.2 Solid-State (MEMS)

- 5.3 By Component

- 5.3.1 Laser Scanner

- 5.3.2 Navigation and Positioning (IMU / GNSS)

- 5.3.3 Beam-Steering and MEMS Mirrors

- 5.3.4 Photodetector / Receiver

- 5.3.5 Software and Services

- 5.4 By Range

- 5.4.1 Short (<100 m)

- 5.4.2 Medium (100-200 m)

- 5.4.3 Long (>200 m)

- 5.5 By Application

- 5.5.1 Advanced Driver-Assistance Systems (ADAS)

- 5.5.2 Robotic and Autonomous Vehicles

- 5.5.2.1 Delivery

- 5.5.3 Corridor and Topographic Mapping

- 5.5.4 Environmental and Forestry Monitoring

- 5.5.5 Urban Planning and Smart Infrastructure

- 5.5.6 Marine and Bathymetric Survey

- 5.6 By End-User Industry

- 5.6.1 Automotive

- 5.6.2 Aerospace and Defense

- 5.6.3 Civil Engineering and Construction

- 5.6.4 Energy and Utilities

- 5.6.5 Agriculture

- 5.6.6 Oil and Gas

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 France

- 5.7.3.3 United Kingdom

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 Japan

- 5.7.4.3 South Korea

- 5.7.4.4 India

- 5.7.4.5 Australia

- 5.7.4.6 Indonesia

- 5.7.4.7 Rest of Asia-Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 United Arab Emirates

- 5.7.5.2 South Africa

- 5.7.5.3 Saudi Arabia

- 5.7.5.4 Nigeria

- 5.7.5.5 Kenya

- 5.7.5.6 Rest of Middle East and Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles

- 6.4.1 Hesai Technology

- 6.4.2 RoboSense LiDAR

- 6.4.3 Velodyne Lidar Inc.

- 6.4.4 Innoviz Technologies Ltd

- 6.4.5 Valeo SA

- 6.4.6 Leica Geosystems AG (Hexagon AB)

- 6.4.7 Sick AG

- 6.4.8 Teledyne Optech

- 6.4.9 FARO Technologies Inc.

- 6.4.10 Topcon Corporation

- 6.4.11 Luminar Technologies Inc.

- 6.4.12 Ouster Inc.

- 6.4.13 Continental AG

- 6.4.14 Valeo Schalter und Sensoren GmbH

- 6.4.15 DENSO Corporation

- 6.4.16 Aeva Technologies

- 6.4.17 Neptec Technologies Corp. (MDA)

- 6.4.18 Argo LiDAR (Argo AI)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment