|

市场调查报告书

商品编码

1906913

拉丁美洲油漆和涂料:市场份额分析、行业趋势、统计数据和成长预测(2026-2031 年)Latin America Paints And Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

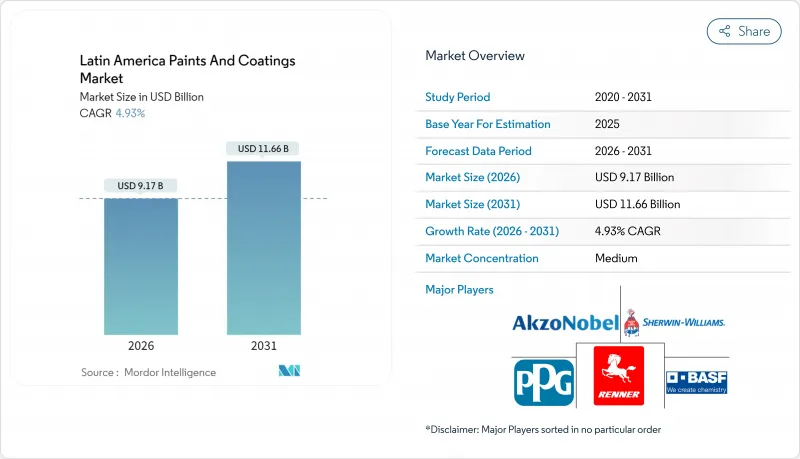

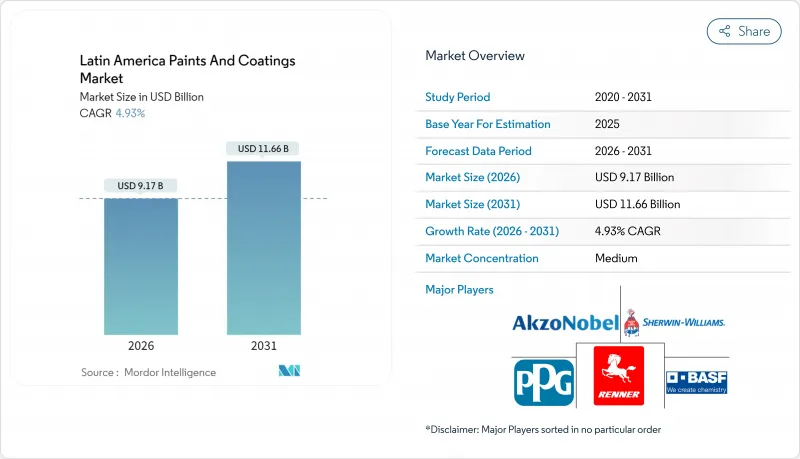

预计到 2026 年,拉丁美洲油漆和涂料市场价值将达到 91.7 亿美元。

这意味着从 2025 年的 87.4 亿美元成长到 2031 年的 116.6 亿美元,2026 年至 2031 年的复合年增长率为 4.93%。

这一扩张与多个国家建设活动的復苏、汽车生产的加速以及基础设施的升级改造相吻合。巴西凭藉多元化的产业基础支撑着市场需求,而墨西哥则透过近岸外包投资和出口导向製造走廊的建设,正加速发展。产品系列升级至低挥发性有机化合物(VOC)和紫外线固化技术,有助于供应商在石化产品价格波动的情况下维持利润率。随着跨国公司扩大其本地生产和分销网络,竞争日益激烈。同时,本地专业企业正利用其成本柔软性和紧密的客户关係来维持市场占有率。

拉丁美洲油漆和涂料市场趋势及洞察

住宅和商业建设活动復苏

拉丁美洲建筑支出正逐步恢復至疫情前水平,推动了建筑涂料市场的销售量成长。巴西东北部新建住宅计划以及墨西哥城商业建筑的复工復产,扩大了基本客群。开发商为满足更严格的建筑规范,指定使用低VOC(挥发性有机化合物)内墙涂料,促使涂料製造商加速水性涂料的创新研发。随着消费者信心的恢復,零售翻新週期缩短,对具有防污性能的高端内墙涂料的需求也随之增加。製造商正透过在靠近快速发展的区域城市的地方建立调色工厂,优化其供应链。

汽车产业需求不断成长

随着全球汽车製造商(OEM)将生产基地迁至墨西哥以享受美墨加协定(USMCA)的关税优惠,墨西哥的汽车组装量正接近历史最高水准。这一激增带动了OEM底涂层和碰撞修復漆的需求,进而推动了拉丁美洲涂料市场的发展。温度控管涂料对于电动车电池外壳至关重要,这催生了一个利润丰厚的新细分市场。巴西的汽车产业丛集正吸引创纪录的投资,其中包括丰田22.2亿美元的生产线现代化改造计画和Stellantis 27.4亿美元的产能扩张计画。涂料供应商正签署多年供应协议,在组装厂附近设立配色实验室。

石化原料成本波动

与石脑油相关的原物料价格波动正给树脂和溶剂买家的毛利率带来压力。在阿根廷和智利,货币贬值加剧了进口单体成本的上升,迫使混炼企业透过远期合约和现货货物互换进行避险。一些区域性企业正在后向整合整合,以稳定原料成本。同时,那些透过混合回收溶剂来降低波动性的企业面临着品质稳定性方面的挑战以及批次不合格的风险。利润率的压力正在推动行业整合,因为小规模的製造商正寻求增强自身的财务实力。

细分市场分析

预计到2025年,丙烯酸涂料将占拉丁美洲涂料市场销售额的43.78%,其丰富的规格涵盖室内、室外和防护涂料。配方柔软性,可快速调节光泽度、耐擦洗性和色彩精准度,即使在日益严格的环保法规下,该细分市场仍保持优势。聚氨酯化学品虽然基数较小,但由于OEM透明涂层性能和工业资产耐久性的需求不断增长,预计将以5.91%的复合年增长率成为市场增长最快的产品。丙烯酸-聚氨酯混合涂料兼具硬度和柔软性,为高端市场提供了有力支撑。

供应商正在探索生物基多元醇,以使他们的聚氨酯产品组合符合永续性目标,但价格平衡仍面临挑战。环氧树脂在地板材料,而乙烯基树脂和VAE乳液则用于对气味要求较高的特殊装饰涂料领域。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 住宅和商业建设活动復苏

- 汽车产业需求不断成长

- 增加基础设施现代化计划

- 透过工业扩张创造需求

- 热带城市强制要求使用冷屋顶涂料

- 市场限制

- 石化原料成本波动

- 更严格的VOC和HAP排放法规

- 物流瓶颈和货柜短缺

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依树脂类型

- 丙烯酸树脂

- 环氧树脂

- 醇酸树脂

- 聚酯纤维

- 聚氨酯

- 其他树脂类型(乙烯基树脂、VAE 等)

- 透过技术

- 水溶液

- 溶剂型

- 粉末涂装

- 紫外线固化型

- 按最终用户行业划分

- 建筑学

- 产业

- 车

- 木头

- 包装

- 运输

- 按地区

- 巴西

- 墨西哥

- 阿根廷

- 哥伦比亚

- 智利

- 秘鲁

- 其他拉丁美洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Akzo Nobel NV

- Allnex Gmbh

- Axalta Coating Systems LLC

- BASF SE

- Benjamin Moore & Co.

- Iquine

- Jotun

- Lanco Paints

- Pintuco SA

- PPG Industries Inc.

- Renner Herrmann SA

- The Sherwin-Williams Company

- WEG

第七章 市场机会与未来展望

Latin America Paints And Coatings Market size in 2026 is estimated at USD 9.17 billion, growing from 2025 value of USD 8.74 billion with 2031 projections showing USD 11.66 billion, growing at 4.93% CAGR over 2026-2031.

The expansion aligns with resurgent construction activity, accelerating automotive output, and multi-country infrastructure renewal. Brazil anchors demand through its diversified industrial base, while Mexico gains momentum from near-shoring investments and the build-out of export-oriented manufacturing corridors. Portfolio upgrades toward low-VOC and UV-cured technologies help suppliers defend margins in the face of petrochemical price swings. Competitive intensity rises as multinationals deepen local manufacturing and distribution footprints, whereas regional specialists leverage cost agility and intimate customer ties to hold share.

Latin America Paints And Coatings Market Trends and Insights

Resurgent Residential and Commercial Construction Activity

Construction spending recovers to pre-pandemic levels, lifting architectural sales volumes across the Latin America paints and coatings market. New housing projects in Brazil's Northeast and the restart of delayed commercial towers in Mexico City widen the customer base. Developers specify low-VOC interior paints to meet stricter building codes, prompting formulators to accelerate water-borne innovation. Retail repaint cycles shorten as consumer confidence rebounds, boosting demand for premium interior finishes with stain-blocking features. Producers optimize supply chains by staging tinting facilities closer to fast-growing secondary cities.

Growing Demand from Automotive Industry

Vehicle assembly in Mexico approaches historical peaks as global OEMs relocate platforms to capitalize on USMCA tariff advantages. The surge lifts OEM basecoat volumes and refinish demand for collision repair, enlarging the Latin America paints and coatings market. Electric-vehicle battery housings require thermal-management coatings, creating new high-margin niches. Brazil's automotive cluster attracts record inbound capital, including Toyota's USD 2.22 billion line modernization and Stellantis' USD 2.74 billion capacity upgrade. Coating suppliers lock in multi-year supply contracts by offering color-matching labs adjacent to assembly plants.

Petrochemical Feedstock Cost Volatility

Naphtha-linked raw-material swings compress gross margins for resin and solvent purchasers. Currency depreciation in Argentina and Chile exacerbates imported monomer bills, pushing formulators to hedge through forward contracts and spot cargo swaps. Some regional players pursue backward integration into resin synthesis to stabilize input cost. Others blend recycled solvents to temper volatility but face consistency challenges that can trigger batch rejects. Margin pressure feeds consolidation as smaller producers seek larger balance sheets.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Infrastructure Modernization Projects

- Industrial Expansion Creating Demand

- Stricter VOC and HAP Emission Norms

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Acrylic systems generated 43.78% of revenue in 2025, anchoring the Latin America paints and coatings market through broad specification in interior, exterior, and protective segments. The formulation versatility allows quick tweaking of sheen, scrub resistance, and tint accuracy, keeping the class entrenched despite rising environmental scrutiny. Polyurethane chemistries, though smaller in base, chart the steepest 5.91% CAGR as OEM clear-coat performance and industrial asset durability needs intensify. Hybrid acrylic-polyurethane blends blend hardness with flexibility, supporting the premium segment.

Suppliers seek bio-based polyols to align polyurethane lines with sustainability targets, but price parity remains elusive. Epoxies retain stronghold in floor and marine systems where chemical resistance overrides color retention concerns. Alkyds shrink slowly, confined to price-sensitive consumer segments yet shielded by compatibility with existing spray equipment. Polyester resins serve powder coatings for appliances and metal furniture, while vinyl and VAE emulsions fill specialized decor niches that prize low odor.

The Latin America Paints and Coatings Market Report is Segmented by Resin Type (Acrylics, Epoxy, Alkyd, Polyester, Polyurethane, and More), Technology (Water-Borne, Solvent-Borne, Powder Coating, UV Cured), End-User Industry (Architectural, Industrial, Automotive, Wood, and More), and Geography (Brazil, Mexico, Argentina, Colombia, Chile, Peru, Rest of South America). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Akzo Nobel N.V.

- Allnex Gmbh

- Axalta Coating Systems LLC

- BASF SE

- Benjamin Moore & Co.

- Iquine

- Jotun

- Lanco Paints

- Pintuco S.A.

- PPG Industries Inc.

- Renner Herrmann S.A.

- The Sherwin-Williams Company

- WEG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Resurgent residential and commercial construction activity

- 4.2.2 Growing demand from automotive industry

- 4.2.3 Increasing infrastructure modernisation projects

- 4.2.4 Industrial expansion creating demand

- 4.2.5 Cool-roof coating mandates in tropical cities

- 4.3 Market Restraints

- 4.3.1 Petrochemical feedstock cost volatility

- 4.3.2 Stricter VOC and HAP emission norms

- 4.3.3 Logistics bottlenecks and container shortages

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin Type

- 5.1.1 Acrylics

- 5.1.2 Epoxy

- 5.1.3 Alkyd

- 5.1.4 Polyester

- 5.1.5 Polyurethane

- 5.1.6 Other Resin Types (Vinyl and VAE, etc.)

- 5.2 By Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.2.3 Powder Coating

- 5.2.4 UV Cured

- 5.3 By End-user Industry

- 5.3.1 Architectural

- 5.3.2 Industrial

- 5.3.3 Automotive

- 5.3.4 Wood

- 5.3.5 Packaging

- 5.3.6 Transportation

- 5.4 By Geography

- 5.4.1 Brazil

- 5.4.2 Mexico

- 5.4.3 Argentina

- 5.4.4 Colombia

- 5.4.5 Chile

- 5.4.6 Peru

- 5.4.7 Rest of Latin America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Allnex Gmbh

- 6.4.3 Axalta Coating Systems LLC

- 6.4.4 BASF SE

- 6.4.5 Benjamin Moore & Co.

- 6.4.6 Iquine

- 6.4.7 Jotun

- 6.4.8 Lanco Paints

- 6.4.9 Pintuco S.A.

- 6.4.10 PPG Industries Inc.

- 6.4.11 Renner Herrmann S.A.

- 6.4.12 The Sherwin-Williams Company

- 6.4.13 WEG

7 Market Opportunities and Future Outlook

- 7.1 White-space and unmet-need assessment