|

市场调查报告书

商品编码

1906921

空调设备:市场占有率分析、产业趋势与统计、成长预测(2026-2031)HVAC Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

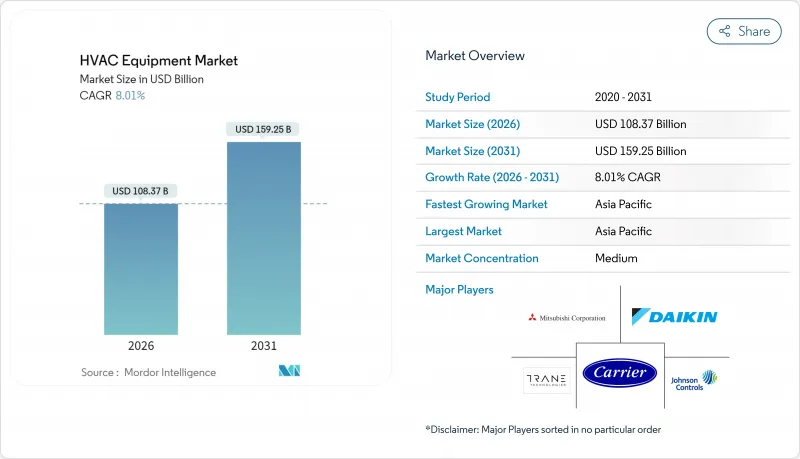

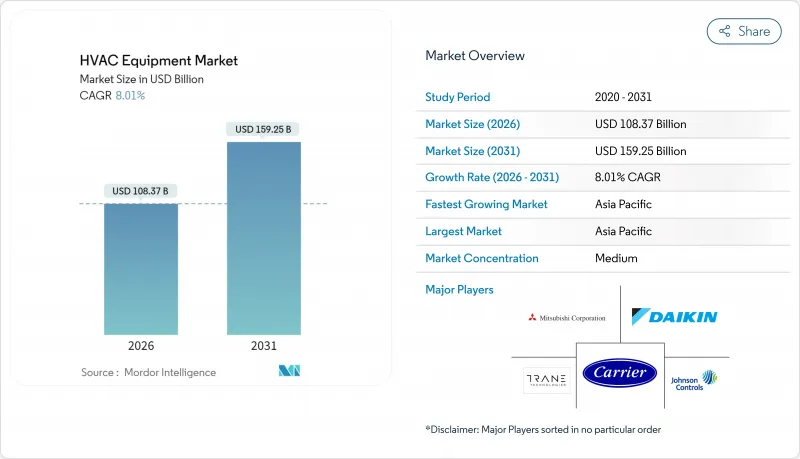

预计到 2025 年,暖通空调设备市场价值将达到 1,003.3 亿美元,到 2026 年将成长至 1,083.7 亿美元,到 2031 年将成长至 1,592.5 亿美元,预测期(2026-2031 年)的复合成长率为 8.01%。

日益严格的能源效率法规、向低全球暖化潜势(GWP)冷媒的转变以及提升运行性能和终端用户价值的数位化控制升级,共同推动了成长势头。市场需求广泛:欧洲和北美对热泵的支持措施正在重塑供暖系统格局;资料中心的扩张给传统製冷设计带来了压力;亚洲的都市化进程持续推动着室内空调的销售。随着原始设备製造商(OEM)竞相获取适用于寒冷气候的软体人才和热泵技术(智慧财产权),领先供应商之间的整合正在加速。同时,区域性专业厂商正在拓展尚未开发的细分市场,例如面向偏远地区的太阳能混合系统。预计到2027年,与2025年1月冷媒法规截止日期相关的短期供应摩擦将有所缓解,这将使高端电气化解决方案的发展轨迹更加清晰。

全球暖通空调设备市场趋势与洞察

欧洲严格的建筑节能标准加速了热泵的普及应用。

欧洲「近零能耗建筑」强制令将推动2024年热泵装机量较2022年增长38%,其中新建建筑的热泵装机量将占该地区总销量的一半。北欧国家超过60%的新建住宅将安装热泵,而大容量型号的热泵也正进入商业维修市场,从而持续推动对寒冷气候技术供应商的需求。

北欧和FLAP-D地区资料中心建设的快速成长将推动精密冷却的需求。

受以下因素推动,液冷技术的应用正在加速:机架密度超过30kW的增加、冷冻能力年增长率达35%,以及瑞典和挪威新开工项目数量成长65%。江森自控表示,资料中心计划占其商用空调收入的18%,高于去年同期的12%。

成熟市场中合格暖通空调技术人员短缺

目前,整个产业的重新设计成本超过 100 亿美元,导致平均係统价格上涨 8-12%,这将是短期负担,直到 2026 年开始规模经济改善。

细分市场分析

到2025年,空调设备在暖通空调设备市场中占比达到45.62%。气温上升和都市区的壮大推动了强劲的需求。同年,中国住宅室内空调的普及率达73% [cheaa.org]。在北美,无管道迷你分离式空调正以每年18%的速度成长,因为住宅希望在无需维修管道系统的情况下实现分区舒适度。

VRF系统是成长最快的细分市场,预计到2031年将以12.49%的复合年增长率成长。医院、饭店和综合用途大楼非常重视同时供暖和冷气的柔软性。三菱电机预计,到2024年,其全球VRF系统装置量将成长32%。

到2025年,维修和更换需求将占暖通空调设备市场规模的62.78%,主要是由于2005年至2010年需求扩张期间安装的系统达到使用寿命终点。哈佛大学的一项研究预测,到2024年,受业主追求节能成本的驱动,美国家庭的暖通空调更换需求将增加14%。

新建设虽然规模仍然较小,但预计将以每年 9.18% 的速度成长。美国将于 2023 年生效的更严格的能源标准将使最低能源效率标准提高 15%,这将促使建筑商越来越多地采用高性能节能方案。基于性能的维修持续成长,江森自控目前已占其维修累积订单的 32%。

暖通空调设备市场报告按设备类型(锅炉/炉灶、热泵等)、安装类型(新建、维修/更换等)、最终用户(住宅、商业等)、建筑类型(办公大楼、医疗机构等)和地区(美国、中国等)对产业进行细分。市场规模和预测均以美元计价。

区域分析

受城市建设和中产阶级壮大的推动,亚太地区预计到2025年将占全球暖通空调设备市场34.42%的份额。其中,中国市场占该地区总价值的42%,但随着房地产市场趋于稳定,年增长率放缓至6.73% [daikin.com]。日本和韩国市场青睐高规格的VRF系统和空气净化机型,而越南和印尼的商业建筑市场则呈现两位数成长。

北美地区占总收入的29.03%,这主要得益于美国热泵销量激增32%,而热泵销量激增则源于强劲的更换需求以及《通货膨胀控制法案》的奖励[carrier.com]。资料中心和医疗计划推动商业收入成长了22%。

欧洲占24.16%。儘管面临宏观经济逆风,2024年热泵出货量仍成长了17%。随着欧盟成员国计划逐步淘汰石化燃料,维修热潮推动了暖通空调设备的更换,暖通空调设备的更换支出占总支出的38%。

中东是成长最快的市场,预计复合年增长率将达到 10.44%,这主要得益于沙乌地阿拉伯的「2030 愿景」计画推动了大规模区域供冷扩张,以及阿联酋开发商迅速采用 VRF 系统。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 欧洲严格的建筑节能标准加速了热泵的普及应用。

- 北欧和FLAP-D地区资料中心建设的快速成长正在推动对精密冷却的需求。

- 亚洲高层住宅楼宇中变冷媒流量(VRF)系统的快速普及

- 美国《通货膨胀控制法案》的税额扣抵促进了炉子早期更换週期。

- 东欧区域供热的扩张推动了大容量锅炉的维修

- 在非洲的离网矿区,太阳能混合空调系统正变得越来越受欢迎。

- 市场限制

- 原始设备製造商 (OEM) 向低全球暖化潜势 (GWP) 冷媒过渡的初始成本较高

- 成熟市场中合格暖通空调技术人员短缺

- 半导体供应链的波动限制了VRF逆变器的供应。

- 欧盟对氟碳化合物实施的严格配额制度增加了进口商的合规负担。

- 价值/供应链分析

- 监理展望

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 关键绩效指标

第五章 市场规模与成长预测

- 透过装置

- 加热设备

- 锅炉和熔炉

- 热泵

- 单元式加热器

- 通风设备

- 空调机组

- 加湿器和除湿器

- 空气过滤器

- 风机盘管机组

- 空调设备

- 单元空调

- 管道式分离空调

- 无管道迷你分离式空调

- 屋顶式空调机组

- 可变冷媒流量(VRF)系统

- 室内空调

- 包装式终端空调

- 冷却器

- 单元空调

- 加热设备

- 按安装类型

- 新建设

- 维修/更新

- 最终用户

- 住宅

- 商业的

- 产业

- 依建筑类型(商业设施)

- 办公大楼

- 医疗设施

- 饭店及休閒

- 零售商店和购物中心

- 教育机构

- 资料中心

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ASEAN

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 卡达

- 非洲

- 南非

- 奈及利亚

- 埃及

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Daikin Industries Ltd.

- Carrier Global Corp.

- Trane Technologies PLC

- Johnson Controls International PLC

- Mitsubishi Electric Corp.

- Lennox International Inc.

- Rheem Manufacturing Co.

- Midea Group

- Gree Electric Appliances Inc.

- NIBE Group

- Panasonic Corp.

- Samsung Electronics(HVAC Division)

- LG Electronics(Air-Solution)

- Bosch Thermotechnology

- Vaillant Group

- Alfa Laval AB

- Stiebel Eltron GmbH and Co. KG

- Systemair AB

- Greenheck Fan Corporation

- FlaktGroup

- TROX GmbH

- Swegon Group AB

- Hitachi-Johnson Controls Air Conditioning

- Danfoss A/S(Commercial Compressors)

第七章 市场机会与未来展望

The HVAC equipment market was valued at USD 100.33 billion in 2025 and estimated to grow from USD 108.37 billion in 2026 to reach USD 159.25 billion by 2031, at a CAGR of 8.01% during the forecast period (2026-2031).

Growth momentum rests on tightening energy-efficiency rules, the pivot to low-GWP refrigerants and digital-control upgrades that lift both operating performance and end-user value. Demand is broad-based: heat-pump incentives in Europe and North America are reshaping heating portfolios, data-center build-outs are straining traditional cooling designs and urbanization in Asia keeps room-air-conditioner volumes rising. Consolidation among tier-one vendors is accelerating as OEMs race to lock in software talent and cold-climate heat-pump IP, while regional specialists are moving into unserved niches such as solar-hybrid systems for remote sites. Short-term supply frictions tied to the January 2025 refrigerant deadline are likely to ease by 2027, setting a clearer runway for premium electrification solutions.

Global HVAC Equipment Market Trends and Insights

Stringent Building-Energy Codes in Europe Accelerating Heat-Pump Adoption

Europe's near-zero-energy-building mandate moved heat-pump installations 38% higher in 2024 versus 2022, pushing penetration in new builds to half of all units sold across the bloc. Nordic countries now deploy heat pumps in more than 60% of new homes, and large-capacity variants are entering commercial retrofits, creating a durable pull for cold-climate technology providers

Surge in Data-Center Construction in Nordics and FLAP-D Elevating Precision-Cooling Demand

Rack densities topping 30 kW, a 35% annual leap in cooling capacity and 65% growth in Swedish-Norwegian build-starts are fuelling liquid-cooling adoption. Johnson Controls notes that data-center projects now generate 18% of its commercial HVAC revenue, up from 12% a year earlier.

Talent Shortage of Certified HVAC Technicians in Mature Markets

Industrywide redesign outlays now exceed USD 10 billion and have lifted average system prices 8-12%, a short-lived drag until economies of scale improve after 2026

Other drivers and restraints analyzed in the detailed report include:

- Rapid Uptake of VRF Systems in High-Rise Asian Residential Complexes

- Inflation Reduction Act Tax Credits Catalyzing Early Furnace-Replacement Cycles

- High Up-Front Cost of Low-GWP Refrigerant Transition for OEMs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Air-conditioning units contributed 45.62% to the HVAC equipment market in 2025 as rising temperatures and urban middle-class growth kept demand resilient. Residential room air conditioners in China reached 73% penetration that year [cheaa.org]. Ductless mini-splits advanced 18% annually in North America, where homeowners want zonal comfort without duct retrofits.

VRF remains the fastest-growing sub-segment, expanding at a 12.49% CAGR through 2031. Hospitals, hotels and mixed-use towers prize its simultaneous heating-cooling flexibility. Mitsubishi Electric recorded a 32% jump in global VRF installations in 2024

Retrofit and replacement activity represented 62.78% of the HVAC equipment market size in 2025, largely because systems commissioned during the 2005-2010 boom have reached end of life. Harvard research shows U.S. household HVAC replacements rose 14% in 2024 as owners chased lower utility bills.

New construction, although smaller, is forecast to climb 9.18% annually. Stricter 2023 U.S. energy-code updates lifted minimum efficiency thresholds 15%, prompting builders to specify premium packages. Performance-based retrofits continue to gain ground, with Johnson Controls indicating such contracts account for 32% of its retrofit backlog

HVAC Equipment Market Report Segments the Industry by Equipment Type (Boilers and Furnaces, Heat Pumps and More), Installation Type (New Construction, Retrofit / Replacement and More), End User (Residential, Commercial and More), Building Type (Office Buildings, Healthcare Facilities and More), and Geography (United States, China and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific controlled 34.42% of the HVAC equipment market in 2025, driven by urban construction and middle-income expansion. China alone made up 42% of regional value, though its annual growth cooled to 6.73% as real-estate activity stabilized [daikin.com]. Japan and Korea favor high-spec VRF and air-purification models, while Vietnam and Indonesia post double-digit gains on commercial builds.

North America accounted for 29.03%, buoyed by robust replacement demand and a 32% surge in U.S. heat-pump sales following Inflation Reduction Act incentives [carrier.com]. Data-center and healthcare projects lifted commercial revenue 22%.

Europe held 24.16%; heat-pump shipments climbed 17% in 2024 despite macro headwinds. HVAC upgrades made up 38% of EU renovation-wave spending as member states schedule fossil-fuel phaseouts.

The Middle East is the fastest-growing pocket, forecast at a 10.44% CAGR, with Saudi Arabia's Vision 2030 adding large-scale district-cooling capacity and UAE developers adopting VRF at speed.

- Daikin Industries Ltd.

- Carrier Global Corp.

- Trane Technologies PLC

- Johnson Controls International PLC

- Mitsubishi Electric Corp.

- Lennox International Inc.

- Rheem Manufacturing Co.

- Midea Group

- Gree Electric Appliances Inc.

- NIBE Group

- Panasonic Corp.

- Samsung Electronics (HVAC Division)

- LG Electronics (Air-Solution)

- Bosch Thermotechnology

- Vaillant Group

- Alfa Laval AB

- Stiebel Eltron GmbH and Co. KG

- Systemair AB

- Greenheck Fan Corporation

- FlaktGroup

- TROX GmbH

- Swegon Group AB

- Hitachi-Johnson Controls Air Conditioning

- Danfoss A/S (Commercial Compressors)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent Building Energy Codes in Europe Accelerating Heat-Pump Adoption

- 4.2.2 Surge in Data-Center Construction in Nordics and FLAP-D Region Elevating Precision Cooling Demand

- 4.2.3 Rapid Uptake of Variable-Refrigerant-Flow (VRF) Systems in High-Rise Asian Residential Complexes

- 4.2.4 Inflation Reduction Act (U.S.) Tax Credits Catalyzing Early Furnace Replacement Cycles

- 4.2.5 District-Heating Expansion in Eastern Europe Spurring Large-capacity Boiler Retrofits

- 4.2.6 Solar-Hybrid HVAC Packages Gaining Traction in Off-Grid African Mining Camps

- 4.3 Market Restraints

- 4.3.1 High Up-front Cost of Low-GWP Refrigerant Transition for OEMs

- 4.3.2 Talent Shortage of Certified HVAC Technicians in Mature Markets

- 4.3.3 Semiconductor Supply-Chain Volatility Constraining VRF Inverter Availability

- 4.3.4 Stringent F-Gas Quotas in EU Increasing Compliance Burden for Importers

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Key Performance Indicators

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Equipment Type

- 5.1.1 Heating Equipment

- 5.1.1.1 Boilers and Furnaces

- 5.1.1.2 Heat Pumps

- 5.1.1.3 Unitary Heaters

- 5.1.2 Ventilation Equipment

- 5.1.2.1 Air Handling Units

- 5.1.2.2 Humidifiers and Dehumidifiers

- 5.1.2.3 Air Filters

- 5.1.2.4 Fan Coil Units

- 5.1.3 Air-Conditioning Equipment

- 5.1.3.1 Unitary Air Conditioners

- 5.1.3.1.1 Ducted Splits

- 5.1.3.1.2 Ductless Mini-Splits

- 5.1.3.1.3 Packaged Rooftops

- 5.1.3.1.4 Variable Refrigerant Flow (VRF) Systems

- 5.1.3.2 Room Air Conditioners

- 5.1.3.3 Packaged Terminal Air Conditioners

- 5.1.3.4 Chillers

- 5.1.3.1 Unitary Air Conditioners

- 5.1.1 Heating Equipment

- 5.2 By Installation Type

- 5.2.1 New Construction

- 5.2.2 Retrofit / Replacement

- 5.3 By End User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial

- 5.4 By Building Type (Commercial)

- 5.4.1 Office Buildings

- 5.4.2 Healthcare Facilities

- 5.4.3 Hospitality and Leisure

- 5.4.4 Retail Stores and Malls

- 5.4.5 Educational Institutions

- 5.4.6 Data Centers

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 ASEAN

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 Qatar

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Egypt

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Daikin Industries Ltd.

- 6.4.2 Carrier Global Corp.

- 6.4.3 Trane Technologies PLC

- 6.4.4 Johnson Controls International PLC

- 6.4.5 Mitsubishi Electric Corp.

- 6.4.6 Lennox International Inc.

- 6.4.7 Rheem Manufacturing Co.

- 6.4.8 Midea Group

- 6.4.9 Gree Electric Appliances Inc.

- 6.4.10 NIBE Group

- 6.4.11 Panasonic Corp.

- 6.4.12 Samsung Electronics (HVAC Division)

- 6.4.13 LG Electronics (Air-Solution)

- 6.4.14 Bosch Thermotechnology

- 6.4.15 Vaillant Group

- 6.4.16 Alfa Laval AB

- 6.4.17 Stiebel Eltron GmbH and Co. KG

- 6.4.18 Systemair AB

- 6.4.19 Greenheck Fan Corporation

- 6.4.20 FlaktGroup

- 6.4.21 TROX GmbH

- 6.4.22 Swegon Group AB

- 6.4.23 Hitachi-Johnson Controls Air Conditioning

- 6.4.24 Danfoss A/S (Commercial Compressors)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment