|

市场调查报告书

商品编码

1906958

北美农业机械市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031年)North America Agricultural Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

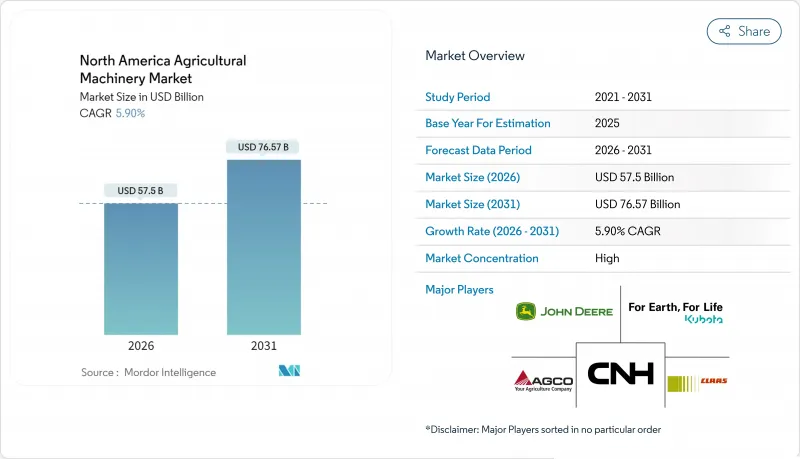

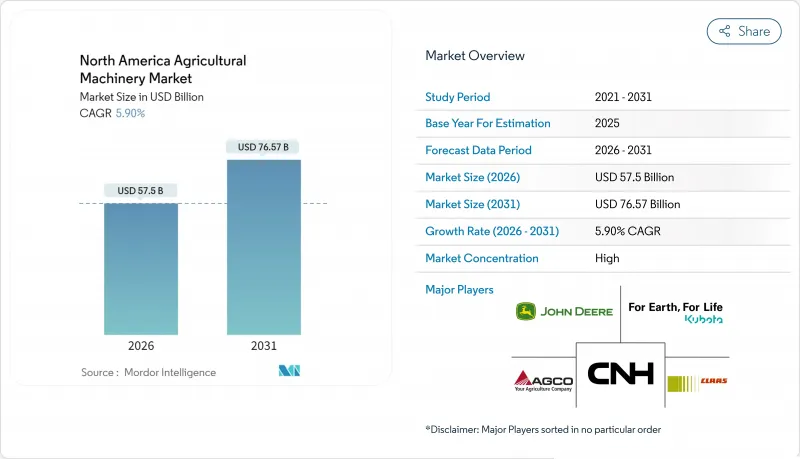

预计北美农业机械市场规模将从 2025 年的 543 亿美元成长到 2026 年的 575 亿美元,到 2031 年将达到 765.7 亿美元,2026 年至 2031 年的复合年增长率为 5.9%。

儘管2024年高利率和大宗商品价格波动限制了资本支出,但机械化需求仍持续成长,反映出市场扩张的趋势。结构性劳动力短缺、鼓励设备升级的联邦补贴计画以及精密农业的快速普及,都继续支撑着设备订单。在2025年国际消费电子展(CES)上展示的自主功能,正在加速设备更早的更换週期,因为农民越来越重视软体相容性,其重要性不亚于马力。同时,灌溉现代化,尤其是在缺水的墨西哥,正在扩大专业设备製造商的潜在基本客群。由于主要原始设备製造商(OEM)将嵌入式金融服务、软体订阅和经销商支援打包在一起,以客户维繫并稳定收入,市场竞争仍然激烈。

北美农业机械市场趋势与洞察

强劲的农业收入前景和补贴计划

联邦折旧免税额激励和直接津贴正在增强资本预算的韧性。光是美国农业部(USDA)的「气候智慧型商品计画」自2024年以来就已拨款超过30亿美元,用于购买旨在减少排放和提高效率的设备。第179条法规允许每个课税年度最高扣除116万美元,以抵销更高的借贷成本。中型生产商正在加快采购,以获得补贴和税收优惠。经销商回馈表明,市场对配备远端资讯处理系统以追踪永续性。因此,北美农业机械市场拥有可预测的补贴订单基础,从而缓解了需求的周期性下降。

劳动力短缺和工资上涨

农村劳动参与率持续下降,迫使农场将传统上由人工完成的工作机械化。墨西哥2024年的收成下滑凸显了劳动力短缺可能阻碍生产。自动喷洒器和机器人收割机减少了田间劳动力,并限制了薪资成长超过整体通货膨胀率。原始设备製造商(OEM)的演示表明,整合机器视觉可以减少农药用量,并进一步抵消人事费用。粮仓业者也在利用人工智慧感测器提高自动化程度,使设施运作。因此,持续的劳动力短缺将继续支持全部区域对先进设备的长期需求。

先进机械设备的高昂初始成本与维修成本

到2024年,高功率拖拉机的售价将超过40万美元,而精准改装则需额外花费每台5万至10万美元。现代引擎和软体需要专业技术人员,但这类人才仍然短缺,进一步推高了总拥有成本。约87%的经销商难以找到合格的维修人员。延长保固和维修合约虽然可以降低不确定性,但也会使购买价格增加1.5万至2.5万美元。因此,许多农民选择维修超过10年的设备,推迟技术升级,并在关键的农忙时期增加燃料消费量。结果,中小农场往往等到季末折扣时才购买新设备,这挤压了经销商的利润空间,并延长了设备的更新週期。

细分市场分析

到2025年,拖拉机将维持其在北美农业机械市场47.30%的份额,巩固其在整体种植的核心地位。这一领域受益于在5万英亩土地上测试的自动驾驶技术,这些技术证明了即时运作的有效性,并逐渐消除了人们对无人耕作的疑虑。然而,在水资源短缺缓解计划的推动下,灌溉设备预计到2031年将以13.4%的复合年增长率成长,超过所有其他设备类别。随着墨西哥加速向中心支轴式喷灌系统转型,预计北美灌溉设备市场规模在此期间将显着成长。

同时,随着精密农业技术将需求转向变数施肥,犁和中耕机等次要类别也呈现温和成长。在收割方面,谷物品质感测器和产量测绘技术的集成,使得传统的六年联合收割机更换週期提前。牧场和饲料设备受益于美国中西部北部和加拿大大平原地区酪农养殖和畜牧业的扩张。此外,「其他」类别的新兴产品包括可进行除草、定点喷洒和土壤监测的自主机器人。久保田的KATR机器人就是一个多功能设计的典范,它模糊了传统设备的界线。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 强劲的农业收入前景和补贴计划

- 劳动力短缺加剧和薪资压力上升

- 精密农业的引进正在加速,设备升级也不断推进。

- 透过OEM嵌入式融资提高购买力

- 基于订阅的机器使用模式

- 美国气候智慧型补助促进低排放设备的发展

- 市场限制

- 先进机械设备的高昂初始成本与维修成本

- 大宗商品价格波动阻碍了资本投资週期。

- 利率主导的信贷紧缩影响了农场层面

- 电动拖拉机用电池级半导体的供应受限

- 监管环境

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按类型

- 联结机

- 不到40马力

- 40-100马力

- 超过100马力

- 四驱拖拉机

- 装置

- 犁

- 光环

- 耕耘机和分蘗机

- 其他设备

- 灌溉机械

- 喷灌

- 滴灌

- 其他灌溉

- 收割机

- 结合

- 饲料收割机

- 其他收割机

- 干草和饲料机械

- 割草机

- 打包机

- 其他干草和饲料机械

- 其他类型

- 联结机

- 按地区

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Deere & Company

- CNH Industrial NV

- AGCO Corporation

- Kubota Corporation

- CLAAS KGaA mbH

- Mahindra & Mahindra Limited

- Netafim USA Inc.

- Lindsay Corporation

- Trimble Inc.

- Horsch Maschinen GmbH

- KUHN SAS

- Bernard Krone Holding SE & Co. KG

- The Toro Company

- Vermeer Corporation

- JC Bamford Excavators Ltd.

第七章 市场机会与未来展望

The North America agricultural machinery market is expected to grow from USD 54.3 billion in 2025 to USD 57.5 billion in 2026 and is forecast to reach USD 76.57 billion by 2031 at 5.9% CAGR over 2026-2031.

The expansion reflects persistent mechanization demand despite elevated interest rates and commodity price swings that limited capital spending in 2024. Structural labor shortages, federal subsidy programs that encourage fleet renewal, and rapid precision-ag adoption continue to underpin equipment orders. Autonomous capabilities showcased at Consumer Electronics Show (CES) 2025 are accelerating early replacement cycles because farms now weigh software compatibility on par with horsepower. Simultaneously, irrigation modernization, especially in water-stressed Mexico, widens the addressable base for specialized equipment makers. Competitive dynamics remain intense as leading OEMs bundle embedded finance, software subscriptions, and dealer support to retain customers and stabilize revenue.

North America Agricultural Machinery Market Trends and Insights

Robust Farm-Income Outlook and Subsidy Programs

Federal depreciation allowances and direct grants keep capital budgets resilient. The USDA Climate-Smart Commodities program alone has allocated more than USD 3 billion since 2024 for equipment that lowers emissions and improves efficiency. Section 179 rules allow deductions up to USD 1.16 million per tax year, offsetting higher borrowing costs. Mid-sized growers respond by front-loading purchases to capture both grant and tax benefits. Dealer feedback indicates stronger demand for mid-horsepower tractors equipped with telematics that document sustainability metrics required for grant compliance. As a result, the North America agricultural machinery market enjoys a predictable baseline of subsidized orders that cushions cyclical demand dips.

Rising Labor Scarcity and Wage Inflation

Rural workforce participation keeps falling, which pushes farms to mechanize tasks once handled manually. Mexico's crop yield setbacks in 2024 underscore how labor shortages can throttle production. Autonomous sprayers and robotic harvest aids reduce field crews and curb escalating wages that now outstrip general inflation. OEM demonstrations prove that integrated machine-vision lowers chemical use, which further offsets labor costs. Grain-elevator operators also automate with AI-enabled sensors that let facilities run at night without staff oversight. Persistent worker scarcity, therefore, sustains long-term demand for advanced equipment across the region.

High Upfront and Maintenance Costs of Advanced Machinery

A high-horsepower tractor exceeded USD 400,000 in 2024, while precision retrofits add USD 50,000-100,000 per unit. Total ownership costs climb further because modern engines and software demand specialized technicians that remain scarce. Nearly 87% of dealers struggle to hire qualified service staff. Extended warranties and service contracts ease uncertainty, yet they add another USD 15,000-25,000 to the purchase price. Many producers, therefore, refurbish decade-old machines, which postpones technology upgrades and raises fuel consumption during critical field windows. As a result, small and mid-sized farms often delay purchases until late-season discounting emerges, compressing dealer margins and extending replacement cycles.

Other drivers and restraints analyzed in the detailed report include:

- Precision-Agriculture Adoption Accelerating Equipment Replacement

- USDA Climate-Smart Grants Driving Low-Emission Equipment

- Volatile Commodity Prices Curbing CAPEX Cycles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Tractors maintained a 47.30% share of the North America agricultural machinery market in 2025, underscoring their central role across crop operations. The segment benefits from autonomous retrofits tested on 50,000 acres, validating real-world uptime and lowering skepticism about driverless tillage. Yet irrigation machinery, supported by water-scarcity mitigation projects, is projected to register a 13.4% CAGR through 2031, outpacing every other equipment class. The North America agricultural machinery market size for irrigation equipment is forecast to show a significant growth during the period as center-pivot conversions accelerate in Mexico.

Secondary categories such as plows and cultivators grow modestly because precision tech shifts demand toward variable-rate applications. In harvesting, integrated grain-quality sensors and yield mapping push farms to upgrade combines earlier than the traditional 6-year cycle. Haying and forage machinery benefits from dairy and beef expansion in the Upper Midwest and Canadian Prairies, while the other types bucket now covers autonomous robots that perform weeding, spot spraying, and soil monitoring. Kubota's KATR robot exemplifies a multifunctional design that blurs traditional equipment lines.

The North America Agricultural Machinery Market Report is Segmented by Type (Tractor, Equipment, Irrigation Machinery, Harvesting Machinery, Haying and Forage Machinery, Other Types) and Geography (United States, Canada, Mexico, Rest of North America). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Deere & Company

- CNH Industrial N.V.

- AGCO Corporation

- Kubota Corporation

- CLAAS KGaA mbH

- Mahindra & Mahindra Limited

- Netafim USA Inc.

- Lindsay Corporation

- Trimble Inc.

- Horsch Maschinen GmbH

- KUHN SAS

- Bernard Krone Holding SE & Co. KG

- The Toro Company

- Vermeer Corporation

- J.C. Bamford Excavators Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Robust farm-income outlook and subsidy programs

- 4.2.2 Rising labor scarcity and wage inflation

- 4.2.3 Precision-ag adoption accelerating equipment replacement

- 4.2.4 OEM embedded-finance boosting purchasing power

- 4.2.5 Subscription-based machinery access models (under-reported)

- 4.2.6 USDA Climate-Smart grants driving low-emission equipment (under-reported)

- 4.3 Market Restraints

- 4.3.1 High upfront and maintenance costs of advanced machinery

- 4.3.2 Volatile commodity prices curbing CAPEX cycles

- 4.3.3 Interest-rate-driven credit tightening at farm level

- 4.3.4 Battery-grade semiconductor supply constraints for e-tractors (under-reported)

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Tractor

- 5.1.1.1 Less Than 40 HP

- 5.1.1.2 40 to 100 HP

- 5.1.1.3 More than 100 HP

- 5.1.1.4 4WD Tractors

- 5.1.2 Equipment

- 5.1.2.1 Plows

- 5.1.2.2 Harrows

- 5.1.2.3 Cultivators and Tillers

- 5.1.2.4 Other Equipment

- 5.1.3 Irrigation Machinery

- 5.1.3.1 Sprinkler

- 5.1.3.2 Drip

- 5.1.3.3 Other Irrigation

- 5.1.4 Harvesting Machinery

- 5.1.4.1 Combine Harvesters

- 5.1.4.2 Forage Harvesters

- 5.1.4.3 Other Harvesting

- 5.1.5 Haying and Forage Machinery

- 5.1.5.1 Mowers

- 5.1.5.2 Balers

- 5.1.5.3 Other Haying and Forage

- 5.1.6 Other Types

- 5.1.1 Tractor

- 5.2 By Geography

- 5.2.1 United States

- 5.2.2 Canada

- 5.2.3 Mexico

- 5.2.4 Rest of North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 Deere & Company

- 6.4.2 CNH Industrial N.V.

- 6.4.3 AGCO Corporation

- 6.4.4 Kubota Corporation

- 6.4.5 CLAAS KGaA mbH

- 6.4.6 Mahindra & Mahindra Limited

- 6.4.7 Netafim USA Inc.

- 6.4.8 Lindsay Corporation

- 6.4.9 Trimble Inc.

- 6.4.10 Horsch Maschinen GmbH

- 6.4.11 KUHN SAS

- 6.4.12 Bernard Krone Holding SE & Co. KG

- 6.4.13 The Toro Company

- 6.4.14 Vermeer Corporation

- 6.4.15 J.C. Bamford Excavators Ltd.