|

市场调查报告书

商品编码

1907209

欧洲阻燃剂市场:市场份额分析、行业趋势、统计数据和成长预测(2026-2031 年)Europe Flame Retardant Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

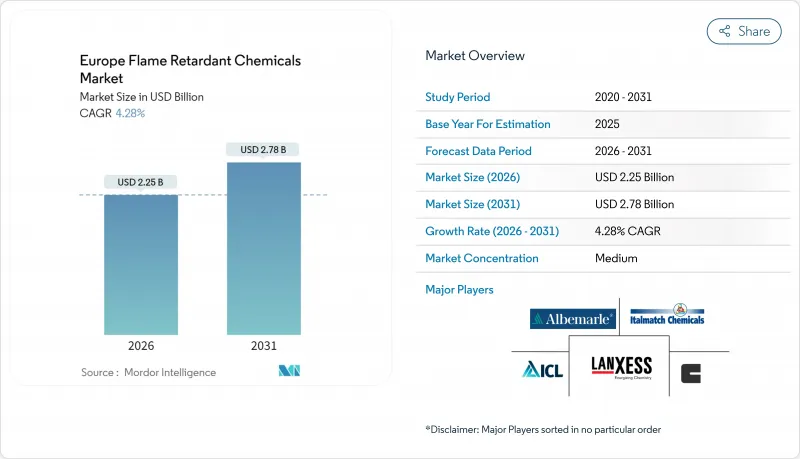

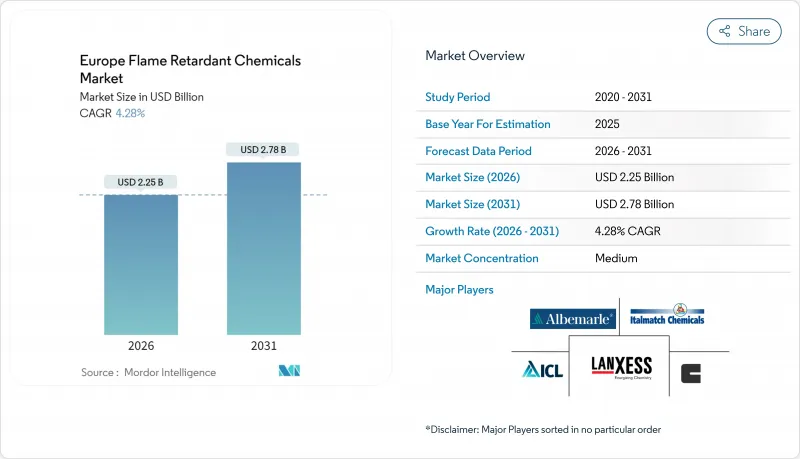

预计到 2026 年,欧洲阻燃化学品市场规模将达到 22.5 亿美元。预计该市场规模将从 2025 年的 21.6 亿美元成长到 2031 年的 27.8 亿美元,2026 年至 2031 年的复合年增长率为 4.28%。

遵守REACH法规、加速替代溴化体係以及持续的基础设施投资,使该地区成为无卤添加剂的可靠需求中心。外墙板、隔热材料和结构钢的防火安全标准日益严格,主导了建筑业的消费量。半导体自给自足措施和5G部署的推动,促进了电子产品生产,使其成为第二个成长引擎。同时,中欧和东欧的汽车轻量化和家具製造业正在扩大下游基本客群。随着生产商竞相推出符合欧盟即将推出的永续性目标的无PFAS且符合循环经济标准的等级产品,市场竞争日益激烈。儘管原物料价格波动仍然是铝、磷和镁市场的主要风险因素,但采购多元化策略和不断增长的库存缓衝在一定程度上缓解了供应方面的波动。

欧洲阻燃剂市场趋势及分析

消费性电子电气製造增加

欧洲电子产品製造商正根据欧盟晶片法规缩短供应链并加强回流计画。电池外壳和5G无线单元的无卤素法规对阻燃材料的选择有严格的要求。朗盛近期推出的聚酰胺6型阻燃剂在1.5毫米厚度下即可达到UL 94 V-0阻燃等级,帮助汽车製造商在不影响安全性的前提下整合厚电池盖。 USB-C线缆的配方商目前正采用无卤素TPE混合物,这些混合物也符合资料中心和充电基础设施所需的低烟、零卤素标准。此外,欧盟对优先采购符合欧盟标准的聚合物的半导体製造厂提供的补贴也推动了市场需求的成长。

加强建筑业的消防法规

2024 年修订的 EN 13501-1 标准和各国关于木质覆材的法规规定,低层住宅建筑幕墙必须达到 D-s3,d1 等级,而高层建筑则维持 B-s3,d1 等级。这促进了膨胀型防火涂料和氢氧化铝填充材的应用。德国建筑技术研究所 (DIBt) 扩大了其认可的不燃板材和涂层钢系统清单,为製造商提供了清晰的认证途径。绿色交易下的计划指定使用磷基膨胀型防火系统,该系统兼具阻燃性和低碳排放的优点。新建住宅和维修必须满足更高的标准,而法律体制则确保了长期消费成长。

溴化阻燃剂的毒性问题

欧洲化学品管理局 (ECHA) 在 2025 年 4 月的报告中指出,几种溴代芳香族化合物可能需要获得授权,这进一步加剧了市场对这些化学物质的抗拒。北欧部长理事会继续推动 2030 年前全面淘汰这些化学品,进一步降低了市场需求。虽然溴化体系在薄壁电子产品领域表现出色,但替代压力迫使原始设备製造商 (OEM) 重新设计机壳形状,并转向双协同磷氮系统。合规成本和潜在的过时风险抑制了对新建溴化物生产能力的投资,导致未来销售损失。

细分市场分析

在欧洲阻燃化学品市场中,无卤阻燃系统占88.83%的份额。预计到2031年,该市场将以5.52%的复合年增长率成长,这主要得益于磷基、无机和氮基阻燃剂的日益普及,这些阻燃剂简化了建筑和电子行业REACH法规的合规性。氢氧化铝因其抑烟性能,在墙板和电线电缆行业占据最大份额,而氢氧化镁的应用范围正在扩展到高温领域。磷基添加剂能够提高薄壁材料的效率,这对于电动车电池机壳至关重要。

创新活动围绕着活性磷寡聚物,这些低聚物可聚合形成聚氨酯和环氧树脂网络,从而防止回收过程中迁移。来自特种化学品领域的新参与企业正在利用金属膦酸盐添加剂的协同效应来降低用量,同时保持材料的机械性能。将内部磷生产商垂直整合到高纯度衍生物的生产中,提高了成本竞争力,并缓解了价格波动。取得再生原料仍然是一个瓶颈,但德国的初步试验成功地将回收的聚碳酸酯与25%的包覆磷酸酯混合,在不影响性能的前提下达到了UL-94 V-0标准。

欧洲阻燃化学品市场报告按产品类型(非卤代阻燃剂和卤代阻燃剂)、终端用户行业(电气电子、建筑施工、交通运输、纺织家具)以及地区(德国、英国、义大利、法国、西班牙、欧洲其他地区)进行细分。市场预测以美元以金额为准。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 消费性电子电气製造增加

- 加强建筑业的消防安全法规

- 中欧及东欧家具及室内装饰品生产的成长

- 过渡到与循环经济相容的阻燃添加剂

- 5G电缆和资料中心安装量激增

- 市场限制

- 人们对溴化阻燃剂的毒性表示担忧

- 原料价格波动(铝、磷、镁矿石)

- 欧盟限制聚合物使用的微塑胶法规尚未出台

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 依产品类型

- 非卤素

- 无机物

- 氢氧化铝

- 氢氧化镁

- 硼化合物

- 磷

- 氮基

- 其他的

- 无机物

- 卤化

- 溴化合物

- 氯基化合物

- 非卤素

- 按最终用户行业划分

- 电气和电子设备

- 建筑/施工

- 运输

- 纺织品和家具

- 按地区

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 其他欧洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- Adeka Corporation

- Albemarle Corporation

- BASF

- Clariant

- DIC Corporation

- Dow

- Eti Maden

- ICL

- Italmatch Chemicals SpA

- JM Huber Corp.(Huber Engineered Materials)

- LANXESS

- MPI Chemie BV

- Nabaltec AG

- RTP Company

- THOR Group

- TOR Minerals

第七章 市场机会与未来展望

The Europe Flame Retardant Chemicals Market size in 2026 is estimated at USD 2.25 billion, growing from 2025 value of USD 2.16 billion with 2031 projections showing USD 2.78 billion, growing at 4.28% CAGR over 2026-2031.

Regulatory alignment with REACH, accelerated replacement of brominated systems, and sustained infrastructure investment make the region a dependable demand center for non-halogenated additives. Construction leads the volume offtake owing to tightened fire-safety rules for cladding, insulation, and structural steel. Electronics production, revitalized by semiconductor sovereignty initiatives and 5G rollouts, adds a second growth engine, while automotive lightweighting and furniture manufacturing in Central and Eastern Europe expand the downstream customer base. Competitive intensity is rising as producers race to launch PFAS-free, circular-economy-ready grades that satisfy upcoming EU sustainability targets. Raw-material price swings in aluminum, phosphorus, and magnesium markets remain the chief risk, yet supply-side volatility is partly cushioned by diversified sourcing strategies and higher inventory buffers.

Europe Flame Retardant Chemicals Market Trends and Insights

Rising Consumer Electrical and Electronics Manufacturing

European electronics producers have intensified reshoring programs that shorten supply lines and align with the EU Chips Act. Flame-retardant selection is governed by halogen-free mandates for battery housings and 5G radio units. Recent polyamide 6 grades introduced by LANXESS achieve UL 94 V-0 at 1.5 mm, helping automakers integrate thicker battery covers without sacrificing safety. Formulators targeting USB-C cables now deploy halogen-free TPE blends that also meet low-smoke zero-halogen criteria, a requirement for data centers and charging infrastructure. Demand strength is reinforced by EU subsidies for local semiconductor fabs that prioritize in-region procurement of compliant polymers.

Stricter Fire-Safety Regulations in Construction

The 2024 update of EN 13501-1 and national rules for wood cladding imposed class D-s3,d1 for low-rise residential facades and maintained B-s3,d1 for taller buildings, spurring uptake of intumescent coatings and aluminum hydroxide fillers. Germany's DIBt expanded its list of non-combustible boards and coated steel systems, giving manufacturers clear pathways for approval. Projects funded under the EU Green Deal specify phosphorus-based intumescent systems that provide both flame retardancy and embodied-carbon reductions. The legal framework locks in long-term consumption growth as new dwellings and retrofits must meet higher standards.

Toxicity Concerns Over Brominated FRs

ECHA signaled potential authorization requirements for several aromatic brominated compounds in its April 2025 report, intensifying market aversion toward this chemistry. The Nordic Council of Ministers continues to lobby for a complete phase-out by 2030, further dampening demand. While brominated systems excel in thin-wall electronics, substitution pressures compel OEMs to redesign housing geometries or shift to dual-synergy phosphorus-nitrogen systems. Compliance costs and potential obsolescence reduce investment appetite for new brominated capacity, lowering future sales.

Other drivers and restraints analyzed in the detailed report include:

- Growth in Furniture and Upholstery Production in CEE

- Shift to Circular-Economy Compliant FR Additives

- Pending EU Microplastics Legislation Limiting Polymer Uses

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Europe flame retardant chemicals market size for non-halogenated systems is equal to 88.83% share. Growth continues at 5.52% CAGR through 2031 as construction and electronics buyers adopt phosphorus, inorganic, and nitrogen chemistries that simplify REACH compliance. Aluminum hydroxide remains volume leader in wallboard and wire-cable owing to its smoke-suppressant action, while magnesium hydroxide penetrates higher-temperature applications. Phosphorus-based additives deliver thin-wall efficiency critical for electric vehicle battery enclosures.

Innovation activity clusters around reactive phosphorus oligomers that polymerize into polyurethane or epoxide networks, preventing migration during recycling. Market entrants from specialty chemicals leverage metal phosphinate-based synergies to lower loading levels, preserving material mechanics. Cost competitiveness improves as captive phosphorus producers forward-integrate into high-purity derivatives, smoothing price spikes. Access to recycled feedstock grades remains a bottleneck; however, pilot trials in Germany demonstrate successful incorporation of reclaimed polycarbonate blended with locked-in phosphorus esters at 25% levels without sacrificing UL-94 V-0 ratings.

The Europe Flame Retardant Chemicals Report is Segmented by Product Type (Non-Halogenated and Halogenated), End-User Industry (Electrical and Electronics, Buildings and Construction, Transportation, and Textiles and Furniture), and Geography (Germany, United Kingdom, Italy, France, Spain, and Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Adeka Corporation

- Albemarle Corporation

- BASF

- Clariant

- DIC Corporation

- Dow

- Eti Maden

- ICL

- Italmatch Chemicals SpA

- J.M. Huber Corp. (Huber Engineered Materials)

- LANXESS

- MPI Chemie BV

- Nabaltec AG

- RTP Company

- THOR Group

- TOR Minerals

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising consumer electrical and electronics manufacturing

- 4.2.2 Stricter fire-safety regulations in construction

- 4.2.3 Growth in furniture and upholstery production in CEE

- 4.2.4 Shift to circular-economy compliant FR additives

- 4.2.5 Surge in 5G cable and data-center installations

- 4.3 Market Restraints

- 4.3.1 Toxicity concerns over brominated FRs

- 4.3.2 Raw-material price volatility (Al, P, Mg ores)

- 4.3.3 Pending EU micro-plastics legislation limiting polymer uses

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Non-Halogenated

- 5.1.1.1 Inorganic

- 5.1.1.1.1 Aluminum Hydroxide

- 5.1.1.1.2 Magnesium Hydroxide

- 5.1.1.1.3 Boron Compounds

- 5.1.1.2 Phosphorus-based

- 5.1.1.3 Nitrogen-based

- 5.1.1.4 Others

- 5.1.1.1 Inorganic

- 5.1.2 Halogenated

- 5.1.2.1 Brominated Compounds

- 5.1.2.2 Chlorinated Compounds

- 5.1.1 Non-Halogenated

- 5.2 By End-user Industry

- 5.2.1 Electrical and Electronics

- 5.2.2 Buildings and Construction

- 5.2.3 Transportation

- 5.2.4 Textiles and Furniture

- 5.3 By Geography

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 Italy

- 5.3.4 France

- 5.3.5 Spain

- 5.3.6 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Adeka Corporation

- 6.4.2 Albemarle Corporation

- 6.4.3 BASF

- 6.4.4 Clariant

- 6.4.5 DIC Corporation

- 6.4.6 Dow

- 6.4.7 Eti Maden

- 6.4.8 ICL

- 6.4.9 Italmatch Chemicals SpA

- 6.4.10 J.M. Huber Corp. (Huber Engineered Materials)

- 6.4.11 LANXESS

- 6.4.12 MPI Chemie BV

- 6.4.13 Nabaltec AG

- 6.4.14 RTP Company

- 6.4.15 THOR Group

- 6.4.16 TOR Minerals

7 Market Opportunities and Future Outlook

- 7.1 White-space and unmet-need assessment