|

市场调查报告书

商品编码

1907268

欧洲平板玻璃:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Europe Flat Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

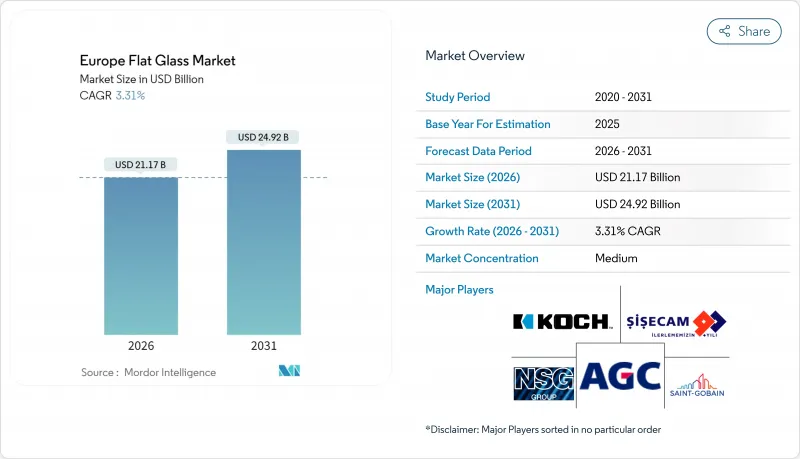

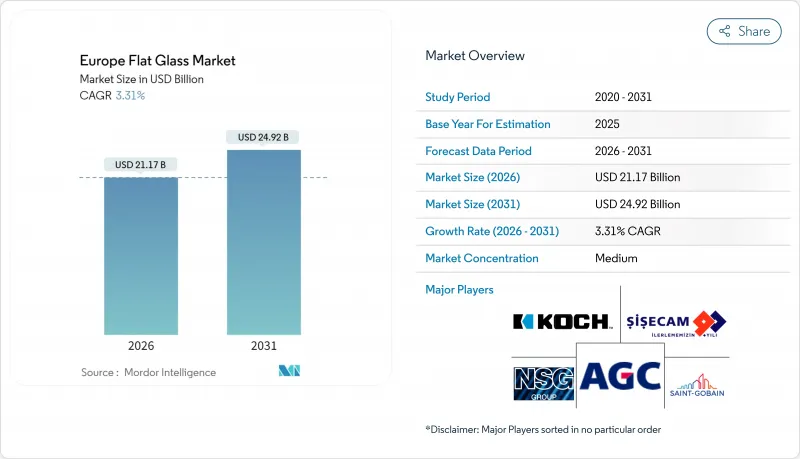

2025年欧洲平板玻璃市场价值为204.9亿美元,预计到2031年将达到249.2亿美元,而2026年为211.7亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 3.31%。

节能建筑法规、轻量化车辆趋势以及太阳能光电发电容量的不断增长之间存在着密切的关联,这正推动着欧洲平板玻璃市场的扩张。全部区域的建筑商都在加速安装低辐射(Low-E)玻璃和真空绝热板,而汽车製造商则采用全景玻璃来减少碳排放并提升内装美观度。同时,欧洲太阳能光电发电的快速普及也带动了对花纹玻璃和盖板玻璃的需求,从而形成了一个不同于传统建筑週期的结构性成长平台。随着欧盟排放交易体系(EU-ETS)第四阶段碳价的调整重塑了成本曲线,製造商正在投资建造电炉和氢气炉,以控制波动较大的碱灰和天然气成本。在所有终端应用领域,欧洲平板玻璃市场都受益于监管政策的利好,高性能玻璃已成为一项合规要求,而非可选项。

欧洲平板玻璃市场趋势与洞察

欧洲各地建筑和建筑幕墙维修增加

基础建设项目和商业维修正在推动2024年需求下滑后的復苏。西门子已获得240亿欧元的智慧基础设施订单,其中大部分与采用三层中空玻璃的节能建筑外围护结构相关。丹麦顶级办公大楼投资者优先考虑符合ESG(环境、社会和治理)标准的维修,从而推高了对低辐射(Low-E)玻璃的需求。在法国和义大利,老旧住宅存量也正进入维修週期,强制要求U值低于1.0 W/m²K。儘管不断上涨的建筑成本抑制了新建项目,但这一趋势仍提振了欧洲平板玻璃市场的基准需求。产品线中包含镀膜玻璃和真空中空玻璃的製造商最能掌握这股监管需求浪潮。

欧盟27个国家汽车轻量化和全景玻璃的应用

汽车製造商正用多面板全景玻璃模组取代钢製车顶面板,以减轻重量并提高纯电动车的续航里程。 Webasto 和 Gosey 的全景车顶销量均实现了两位数成长,而 AGC 已将用于抬头显示器的扩增实境(AR) 挡风玻璃商业化。加热、整合天线和隔音贴合加工玻璃具有高附加价值利润,从而推动了对加工玻璃的需求。随着空气动力学法规的日益严格,商用车製造商也遵循着类似的发展轨迹。这些趋势共同推动了每辆车每平方公尺平均消耗量的增加,增强了在汽车生产整体疲软的情况下,市场对玻璃的韧性。

欧盟排放第四阶段的高电力消耗与碳价格

第四阶段,免费配额将减少,预计2025年碳成本将超过85欧元/吨二氧化碳。由于平板玻璃熔炼是单位增加价值额排放最高的三大工业部门之一,製造商将透过电费承担直接和间接的碳成本。与低碳价格地区进口产品的竞争差距日益扩大,导致人们越来越呼吁引入碳边境调节措施。对富氧燃烧器、太阳能熔块窑和氢气测试的投资旨在确保资产的未来适用性,但对于所有营运商而言,数年的投资回收期并不现实。

细分市场分析

在欧洲平板玻璃市场,退火基板预计到2025年将占总价值的51.88%。日益严格的法规正在推动加工玻璃品类的成长。强化玻璃和夹层玻璃符合安全标准,而双层玻璃则符合低辐射(Low-E)法规。采用软镀银层的涂装解决方案可增强隔热性能,并可降低20%的空调负荷。镜子在家具产业仍保持一定的市场需求,但其价格仍受消费者支出週期的影响。

随着製造商不断推进技术创新,加工玻璃的产量已超过商用浮法玻璃。 Secak 的曲面强化玻璃生产线能够生产 6.5 公尺长的玻璃面板,为机场和博物馆等项目提供更大的设计自由度。 Leesec 的机器人分类技术可减少废弃物,并将厚度偏差控制在 ±0.1 毫米以内,达到三单元组装所需的精确度。自动化也有助于提高可追溯性,为众多金融机构所需的 ESG审核提供支援。这些创新增强了欧洲相对于低成本进口产品的竞争优势。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 欧洲各地建筑和建筑幕墙维修增加

- 欧盟27个成员国汽车轻量化与全景玻璃应用趋势

- 太阳能发电装置容量的快速成长正在推动对太阳能玻璃和花纹玻璃的需求。

- 欧盟「维修浪潮」补贴(针对低辐射玻璃和真空绝热玻璃)

- 建筑一体成型光伏(BIPV)帷幕墙的兴起

- 市场限制

- 碱灰、硅砂和天然气的价格波动

- 欧盟排放第四阶段下的高电力消耗量与碳价格

- 大型中空玻璃产品现场安装技能短缺问题日益凸显

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 依产品类型

- 退火(包括着色)

- 涂层(低辐射,隔热)

- 反射玻璃

- 加工产品(强化玻璃、夹层玻璃、双层玻璃)

- 镜子

- 按最终用户行业划分

- 建筑/施工

- 车

- 太阳能和光伏发电

- 家具和室内装饰

- 其他(家用电器、铁路、船舶)

- 按地区

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 波兰

- 比荷卢经济联盟

- 北欧国家(瑞典、挪威、丹麦、芬兰)

- 其他欧洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率/排名分析

- 公司简介

- AGC Inc.

- AGP Group

- Ardagh Group SA,

- Bohle AG

- Euroglas

- Interpane Glas Industrie AG

- Koch Industries

- Nippon Sheet Glass Co., Ltd.

- OGIS GmbH

- Press Glass SA

- Saint-Gobain

- SCHOTT

- Sisecam

- Vitro

第七章 市场机会与未来展望

The Europe Flat Glass Market was valued at USD 20.49 billion in 2025 and estimated to grow from USD 21.17 billion in 2026 to reach USD 24.92 billion by 2031, at a CAGR of 3.31% during the forecast period (2026-2031).

The strong correlation between energy-efficient construction regulations, vehicle lightweighting trends, and solar-photovoltaic capacity additions underpins this expansion of the Europe flat glass market. Builders across the region are accelerating the installation of low-emissivity (low-E) and vacuum-insulated units, while automakers are embedding panoramic glazing to cut carbon emissions and improve cabin aesthetics. Simultaneously, Europe's accelerating solar roll-out fuels demand for patterned and cover glass, creating a structural growth pillar distinct from conventional construction cycles. Producers are mitigating volatile soda-ash and natural-gas costs by investing in electric and hydrogen furnaces, even as EU-ETS Phase IV carbon prices reshape cost curves. Across every end-use, the Europe flat glass market benefits from regulatory tailwinds that make high-performance glazing a compliance necessity rather than a discretionary upgrade.

Europe Flat Glass Market Trends and Insights

Increasing Construction and Facade Renovation Across Europe

Infrastructure programs and commercial retrofits are reviving demand after the 2024 downturn. Siemens booked EUR 24 billion of smart-infrastructure orders in 2024, much of it tied to energy-efficient building envelopes that specify triple-insulated glazing. Danish prime office investors prioritize ESG-aligned refurbishments, translating to higher volumes of low-E units. Older housing stock in France and Italy is also entering a mandated upgrade cycle that prescribes U-values below 1.0 W/m2K. This dynamic lifts baseline volumes for the Europe flat glass market, even as high construction costs temper new-build activity. Producers with coated and vacuum-insulated portfolios are best positioned to capture this compliance-driven wave.

Automotive Lightweighting and Panoramic Glazing Adoption in EU-27 Vehicle Platforms

OEMs are replacing steel roof panels with multi-panel panoramic glass modules that cut weight and improve battery-electric range. Webasto and Gauzy report double-digit growth in panoramic roofs, while AGC has commercialized augmented-reality windshields for heads-up displays. Heated, antenna-embedded, and acoustic laminates command premium margins and push processed-glass demand higher. Commercial-vehicle makers follow the same trajectory as aerodynamic regulations tighten. These trends collectively widen average square-meter consumption per vehicle, reinforcing demand resilience when broader auto output softens.

High Electricity Intensity and Carbon Pricing Under EU-ETS Phase IV

Phase IV allocates fewer free allowances, lifting carbon costs above EUR 85/tCO2 in 2025. Flat-glass melting ranks among the top three industrial emitters per USD of value added, so producers pay both direct and indirect carbon charges via power tariffs. The competitive gap versus imports from low-carbon-price regions widens, raising calls for carbon-border adjustments. Investments in oxy-fuel burners, photovoltaic-powered frit kilns, and hydrogen trials aim to future-proof assets but require multi-year paybacks that not all operators can absorb.

Other drivers and restraints analyzed in the detailed report include:

- Surging Solar-PV Capacity Additions Driving Demand for Solar and Pattern Glass

- EU "Renovation Wave" Subsidies for Low-E and Vacuum-Insulated Glazing

- New Skill Gap for On-Site Installation of Oversized Insulated Glazing

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Europe flat glass market size attributable to annealed substrates reached 51.88% of the total value in 2025. Regulatory upgrades steer growth into processed categories. Tempered and laminated panes meet safety codes, while insulated units satisfy low-E mandates. Coated solutions incorporating soft-coat silver layers add solar-control functionality that can cut HVAC loads by 20%. Mirrors maintain niche uptake in furniture, yet remain tied to broader consumer spending cycles.

Processed glass volumes outpace commodity float because producers continually push the technology frontier. Sedak's curved-tempering line fabricates 6.5 m panels, unlocking design latitude for airports and museums. LiSEC's robotic sorting shrinks waste and delivers pane thickness variance within +-0.1 mm, a metric critical for triple-unit assemblies. Automation also improves traceability, aiding ESG audits now required by many lenders. These innovations fortify European competitive advantage against lower-cost imports.

The Europe Flat Glass Market Report is Segmented by Product Type (Annealed, Coated, Reflective, Processed, Mirrors), End-User Industry (Building and Construction, Automotive, Solar and Photovoltaic, Furniture and Interior Decor, Others), and Geography (Germany, United Kingdom, France, Italy, Spain, Poland, Benelux, Nordics, Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- AGC Inc.

- AGP Group

- Ardagh Group S.A,

- Bohle AG

- Euroglas

- Interpane Glas Industrie AG

- Koch Industries

- Nippon Sheet Glass Co., Ltd.

- OGIS GmbH

- Press Glass SA

- Saint-Gobain

- SCHOTT

- Sisecam

- Vitro

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing construction and facade renovation across Europe

- 4.2.2 Automotive lightweighting and panoramic glazing adoption in EU-27 vehicle platforms

- 4.2.3 Surging solar-PV capacity additions driving demand for solar and pattern glass

- 4.2.4 EU "Renovation Wave" subsidies for low-E and vacuum-insulated glazing

- 4.2.5 Rise of building-integrated-photovoltaic (BIPV) curtain-walls

- 4.3 Market Restraints

- 4.3.1 Volatile soda-ash, silica-sand and natural-gas prices

- 4.3.2 High electricity intensity and carbon-pricing under EU-ETS Phase IV

- 4.3.3 New skill-gap for on-site installation of oversized insulated glazing

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Annealed (incl. Tinted)

- 5.1.2 Coated (low-E, solar-control)

- 5.1.3 Reflective

- 5.1.4 Processed (tempered, laminated, IGU)

- 5.1.5 Mirrors

- 5.2 By End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Automotive

- 5.2.3 Solar and Photovoltaic

- 5.2.4 Furniture and Interior Decor

- 5.2.5 Others (appliances, rail, marine)

- 5.3 By Geography

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 France

- 5.3.4 Italy

- 5.3.5 Spain

- 5.3.6 Poland

- 5.3.7 Benelux

- 5.3.8 Nordics (Sweden, Norway, Denmark, Finland)

- 5.3.9 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share**/Ranking Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AGC Inc.

- 6.4.2 AGP Group

- 6.4.3 Ardagh Group S.A,

- 6.4.4 Bohle AG

- 6.4.5 Euroglas

- 6.4.6 Interpane Glas Industrie AG

- 6.4.7 Koch Industries

- 6.4.8 Nippon Sheet Glass Co., Ltd.

- 6.4.9 OGIS GmbH

- 6.4.10 Press Glass SA

- 6.4.11 Saint-Gobain

- 6.4.12 SCHOTT

- 6.4.13 Sisecam

- 6.4.14 Vitro

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment