|

市场调查报告书

商品编码

1907307

铟镓锌氧化物(IGZO):市场占有率分析、产业趋势与统计、成长预测(2026-2031)Indium Gallium Zinc Oxide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

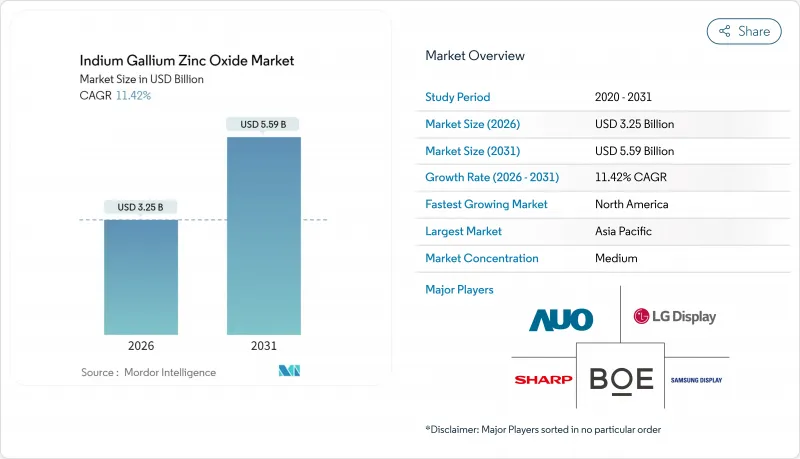

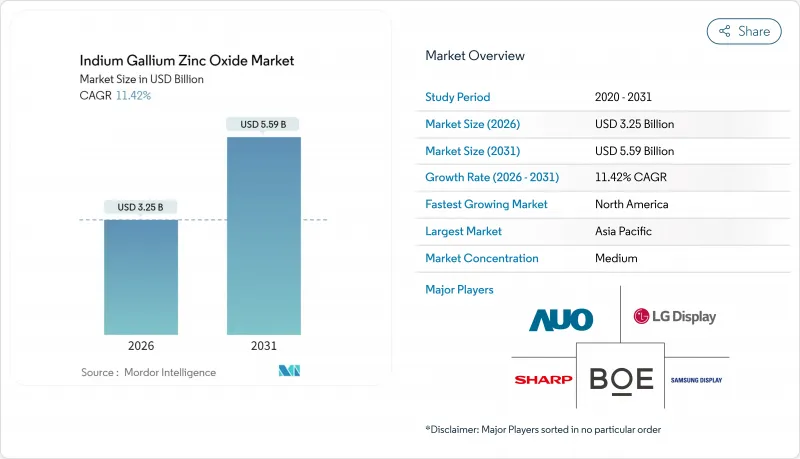

2025 年铟镓锌氧化物 (IGZO) 市值为 29.2 亿美元,预计到 2031 年将达到 55.9 亿美元,高于 2026 年的 32.5 亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 11.42%。

这一成长动能主要得益于显示器製造商向氧化物薄膜电晶体(TFT)的转型,与传统的硅背板相比,TFT能够实现更高的解析度和更低的功耗。消费者对节能型智慧型手机、笔记型电脑和大尺寸电视的偏好日益增长,恰逢亚洲氧化物TFT产能的提升。此外,市场也正在加速采用铟镓锌氧化物(IGZO)技术,应用于折迭式显示器和汽车显示器,因为这些应用对机械柔软性和宽温域稳定性要求极高。同时,主要面板供应商的垂直整合正在缩短开发週期,使IGZO在成本上能够与成熟的硅技术相媲美。

全球铟镓锌氧化物(IGZO)市场趋势及展望

高解析度OLED和8K电视的需求激增

向 8K 电视面板的过渡需要非晶质无法匹敌的高速开关性能。 IGZO 的高电子迁移率能够实现高密度电晶体阵列,这对于超高清内容至关重要,同时还能保持面板效率。 LG Display 于 2024 年开始量产 13 吋迭层 OLED 笔记型电脑面板,采用氧化物 TFT 背板技术,与层级构造相比,功耗降低了 40%。三星也在其透明电视原型机中使用了 IGZO,利用较小的电晶体在不牺牲驱动电流的情况下传输更多光线。随着广播公司和串流媒体公司大力推广 8K 内容,面板製造商正将氧化物 TFT 定位为在不超出功耗预算的情况下保持亮度裕度的唯一可扩展方案。

对节能型便携式设备的需求

智慧型手机和笔记型电脑製造商正努力在不牺牲更新率的前提下延长电池续航时间。 IGZO 背板在显示静态影像时可承受微安培等级漏电流,进而将面板功耗降低高达 50%。 Imec 展示了基于 IGZO 的动态随机存取记忆体 (DRAM) 单元,其能源效率优于传统 SRAM,这标誌着氧化物技术在低功耗运算模组中已广泛应用。苹果公司已将其第二代 LTPO 堆迭中的所有驱动 TFT 都升级为 IGZO,并报告智慧型手錶的能源效率提高了 5% 至 15%。随着远端办公设备需求的不断增长,显示器电力消耗仍然是关注的焦点,这为铟镓锌氧化物 (IGZO) 提供了长期的市场成长前景。

与 LTPS/LTPO 硅背板的竞争

面板製造商已在低温多晶硅生产线上投入巨资,这些生产线已达到旗舰智慧型手机的性能目标。低温多晶硅(LTPS)具有更高的电洞迁移率,并透过实现复杂的面板电路来减少驱动单元的数量。苹果公司继续在iPhone显示器中使用低温多晶硅,并选择性地添加铟镓锌氧化物(IGZO),这表明他们采取的是混合策略,而非完全转向。製程的成熟和成熟的晶圆厂产量比率曲线使得硅在成本敏感领域具有吸引力。这种现有的资本基础限制了铟镓锌氧化物(IGZO)市场在某些高端细分市场的近期成长潜力。

细分市场分析

到2025年,智慧型手机领域将占据铟镓锌氧化物(IGZO)市场43.95%的份额,这主要得益于氧化物薄膜电晶体(TFT)的广泛应用。氧化物TFT在提高像素密度的同时,也能降低电池消耗。可折迭和软性显示器将超越其他应用领域,到2031年将以12.63%的复合年增长率增长,这得益于IGZO优异的机械稳定性,即使经过数千次弯曲也能保持其柔韧性。平板电脑和二合一电脑利用氧化物背板在大萤幕上保持均匀亮度,这对于创新专业人士来说至关重要。穿戴式装置将利用IGZO的超低关断电流特性,在紧凑的机壳中显着延长电池续航力。电视和大型面板将利用氧化物的柔韧性,实现8K解析度和透明模式,从而重新定义观看体验。

二线应用也在不断扩展。随着驾驶座数位化,汽车显示器正逐步过渡到IGZO技术,以避免硅材料因高温和振动而导致的劣化。工业和监护仪也正在整合氧化物TFT,以提高手术和製程控制中的影像精度。这些多样化的应用场景正在推动铟镓锌氧化物(IGZO)应用市场规模的扩大,并支撑着均衡的需求结构,从而缓解单一最终产品週期性波动的影响。

截至2025年,家用电子电器将占铟镓锌氧化物(IGZO)市场59.55%的份额,这反映了该技术起源于行动装置和电视製造。汽车和交通运输行业将以12.44%的复合年增长率(CAGR)实现最快增长,因为原始设备製造商(OEM)正在用全景数位仪表板取代类比仪表。医疗机构正在利用IGZO的影像保真度来製造诊断监视器,而工业应用则在工厂车间部署坚固耐用的氧化物面板。航太和国防领域正在采用氧化物薄膜电晶体(TFT)来製造航空电子设备,因为这些应用对抗辐射性和热稳定性要求很高。

跨产业的成长动能正吸引新的资本流入氧化物供应链。京东方投资45吋9K氧化物面板用于汽车应用,显示市场对高效节能背板能够满足严格的汽车安全和亮度标准越来越有信心。这种多元化发展增强了市场韧性,降低了对消费者升级的依赖,并拓宽了铟镓锌氧化物(IGZO)市场的收入基础。

铟镓锌氧化物 (IGZO) 市场报告按应用领域(智慧型手机、功能手机等)、终端用户产业(家用电子电器等)、显示技术(LCD、OLED 等)、沉积技术(射频磁控溅镀等)、导电相(非晶质IGZO 等)和地区(北美、南美等)进行细分。市场预测以美元 (USD) 为以金额为准。

区域分析

2025年,亚太地区将占据铟镓锌氧化物(IGZO)市场65.20%的营收份额,京东方(BOE)、LG Display和三星显示器(Samsung Display)等厂商将扩大其氧化物TFT生产线,以满足全球对OLED智慧型手机和电视的需求。中国计划在2025年占全球76%的OLED产能,其中IGZO背板订单量大规模。日本凭藉单晶氧化物薄膜技术的研发,持续保持在该领域的主导;而韩国则利用混合LTPO-IGZO堆迭技术,确保其旗舰产品始终处于技术前沿。

北美地区成长最快,复合年增长率达12.18%,这主要得益于苹果公司对氧化物技术的日益普及以及该地区对AR/ VR头戴装置,而这些设备需要高分辨率、低延迟的显示器。应用材料公司累计,2024年第三季显示器相关业务收入将达到15.8亿美元,到年底先进製程节点业务收入将达到25亿美元,凸显了为支援区域产能扩张而不断增长的设备需求。

欧洲专注于汽车和工业领域的应用,在这些领域,能源效率与永续性的需求不谋而合。当地研究机构正主导镓和锗回收的研究,以缓解氧化物薄膜电晶体(TFT)生产中的原料压力。在中东、非洲和拉丁美洲,家用电子电器的日益普及带来了不断增长的需求,为铟镓锌氧化物(IGZO)市场创造了长期成长潜力。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 高解析度OLED和8K电视的需求激增

- 对节能型行动装置的需求

- 折迭式和软性显示器的快速普及

- 采用低洩漏IGZO背板的穿戴式装置普及

- 整合到空间计算头戴式设备(AR/VR/MR)

- 用于神经形态记忆体内运算的IGZO阵列

- 市场限制

- 与 LTPS/LTPO 硅背板的竞争

- 铟供应链波动及定价

- 废弃IGZO溅镀靶材的回收率低

- 潮湿环境中因亚能隙缺陷所引起的电流漂移

- 价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济因素如何影响市场

第五章 市场规模与成长预测

- 透过使用

- 智慧型手机和功能手机

- 平板电脑和二合一电脑

- 穿戴式装置

- 电视机和大显示屏

- 汽车显示器

- 工业和医疗显示器

- 按最终用途行业划分

- 家用电子电器

- 汽车和运输设备

- 卫生保健

- 工业和製造业

- 航太/国防

- 其他的

- 透过显示技术

- 液晶显示器

- 有机发光二极体

- 微型LED和迷你LED

- 电子纸和其他新兴技术

- 透过成膜技术

- 射频磁控溅射

- 脉衝直流磁控溅射

- 原子层沉积法

- 解决方案/喷墨列印

- 其他技术

- 透过传导阶段

- 非晶质IGZO

- 多晶IGZO

- 单晶IGZO

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 亚太其他地区

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

- 非洲

- 南非

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Sharp Corporation

- LG Display Co., Ltd.

- Samsung Display Co., Ltd.

- AU Optronics Corp.

- BOE Technology Group Co., Ltd.

- Japan Display Inc.

- Tianma Microelectronics Co., Ltd.

- Apple Inc.

- Sony Group Corporation

- ASUS(ASUSTeK Computer Inc.)

- Panasonic Holdings Corporation

- Innolux Corporation

- Visionox Technology, Inc.

- Everdisplay Optronics(Shanghai)Co., Ltd.

- TCL China Star Optoelectronics Technology Co., Ltd.

- Kunshan GVO Optoelectronics Co., Ltd.

- Fujitsu Limited

- Rohm Semiconductor

- ULVAC, Inc.

- Applied Materials, Inc.

第七章 市场机会与未来展望

The Indium gallium zinc oxide market was valued at USD 2.92 billion in 2025 and estimated to grow from USD 3.25 billion in 2026 to reach USD 5.59 billion by 2031, at a CAGR of 11.42% during the forecast period (2026-2031).

This momentum comes from display makers migrating to oxide-based thin-film transistors that enable sharper resolution and lower power draw than legacy silicon backplanes. Growing consumer preference for energy-efficient smartphones, laptops, and large-format TVs aligns with the rising supply of oxide TFT capacity across Asia. Indium gallium zinc oxide market adoption also accelerates in foldable and automotive displays, where mechanical flexibility and wide-temperature stability are critical. At the same time, vertical integration by major panel vendors shortens development cycles and brings cost parity with mature silicon technologies.

Global Indium Gallium Zinc Oxide Market Trends and Insights

Surge in High-Resolution OLED and 8K TV Demand

Migration to 8K television panels raises switching-speed requirements that amorphous silicon struggles to meet. IGZO's higher electron mobility enables dense transistor arrays essential for ultra-high-definition content while preserving panel efficiency. LG Display began mass production of 13-inch tandem OLED laptop panels in 2024 that cut power use 40% relative to single-layer stacks, a milestone made possible by oxide TFT backplanes. Samsung is also applying IGZO to transparent TV prototypes, leveraging smaller transistors that transmit more light without sacrificing drive current. As broadcasters and streaming firms promote 8K content, panel makers view oxide TFTs as the only scalable route to maintain brightness headroom without overshooting power budgets.

Requirement for Energy-Efficient Portable Devices

Smartphone and laptop brands seek longer battery life without sacrificing refresh rates. IGZO backplanes allow displays to retain static images at micro-ampere leakage levels, reducing panel power by up to 50%. Imec demonstrated IGZO-based dynamic RAM cells that outperform conventional SRAM in energy efficiency, hinting at wider oxide adoption in low-power computing blocks. Apple moved all drive TFTs in its second-generation LTPO stacks to IGZO, reporting 5-15% efficiency gains in smartwatches. Rising demand for remote work devices keeps display power under scrutiny, securing a long runway for Indium gallium zinc oxide market growth.

Competition from LTPS/LTPO Silicon Backplanes

Panel makers have invested heavily in low-temperature polysilicon lines that already meet flagship smartphone performance targets. LTPS offers higher hole mobility, facilitating complex on-panel circuitry that can reduce driver count. Apple continues to employ LTPO silicon on iPhone displays and adds IGZO selectively, showing a hybrid path rather than a full switch. Process maturity and fabs' established yield curves make silicon variants attractive where cost sensitivity is high. This entrenched capital base tempers near-term upside for the Indium gallium zinc oxide market in certain premium segments.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Adoption in Foldable and Flexible Displays

- Proliferation of Wearables Using Low-Leakage IGZO Backplanes

- Supply-Chain Volatility and Pricing of Indium

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The smartphone segment captured 43.95% of the Indium gallium zinc oxide market in 2025 owing to oxide TFT adoption that boosts pixel density without draining batteries. Foldable and flexible displays post a 12.63% CAGR to 2031, outpacing all other uses as IGZO's mechanical stability keeps mobility intact across thousands of bends. Tablets and 2-in-1 PCs leverage oxide backplanes to maintain uniform luminance on larger screens, a key spec for creative professionals. Wearables exploit IGZO's ultra-low off-current to multiply battery life in compact housings. TVs and large-format panels apply oxide mobility to unlock 8K and transparent modes that redefine viewing experiences.

Second-tier applications are also scaling. Automotive displays migrate to IGZO for cockpit digitization, where heat and vibration would otherwise degrade silicon. Industrial and medical monitors integrate oxide TFTs for image criticality in surgery and process control. These diverse use cases collectively lift the Indium gallium zinc oxide market size for applications, supporting a balanced demand profile that cushions cyclical shifts in any single end product.

Consumer electronics owned 59.55% of the Indium gallium zinc oxide market size in 2025, reflecting the technology's roots in mobile and TV manufacturing. Automotive and transportation exhibit the fastest climb at 12.44% CAGR as OEMs replace analog gauges with panoramic digital dashboards. Healthcare facilities favor IGZO's image fidelity for diagnostic monitors, while industrial players deploy rugged oxide panels on factory floors. Aerospace and defense adopt oxide TFTs for avionics, where radiation tolerance and thermal stability are mandatory.

Cross-industry momentum brings fresh capital into oxide supply chains. BOE's investment in 45-inch 9K oxide panels for vehicles signals growing confidence that power-efficient backplanes can meet stringent in-car safety and brightness standards. Such diversification strengthens market resilience, reducing reliance on consumer upgrades alone and widening the revenue canvas for the Indium gallium zinc oxide market.

The Indium Gallium Zinc Oxide Report is Segmented by Application (Smartphones and Feature Phones, and More), End-Use Industry (Consumer Electronics, and More), Display Technology (LCD, OLED, and More), Deposition Technology (RF Magnetron Sputtering, and More), Conductivity Phase (Amorphous IGZO, and More), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 65.20% of the Indium gallium zinc oxide market revenue in 2025 as BOE, LG Display, and Samsung Display ramped oxide TFT lines to feed the global appetite for OLED phones and TVs. China alone plans to control 76% of world OLED capacity by 2025, funnelling large orders for IGZO backplanes. Japan maintains research leadership through advances in single-crystal oxide films, while South Korea leverages hybrid LTPO-IGZO stacks to keep flagship devices on the cutting edge.

North America is the fastest-growing region at 12.18% CAGR, thanks to Apple's broadening oxide adoption and the region's push into AR/VR headsets that demand high-resolution, low-latency displays. Applied Materials booked USD 1.58 billion in Q3 2024 display-related revenue and projects USD 2.5 billion from advanced nodes by year-end, underscoring equipment momentum behind regional capacity expansion.

Europe follows with a focus on automotive and industrial deployments where energy efficiency aligns with sustainability mandates. Research institutes there lead gallium and germanium recycling studies aimed at easing raw-material pressure on oxide TFT production. Middle East and Africa plus Latin America show emerging uptake as consumer electronics penetration deepens, creating long-term whitespace for the Indium gallium zinc oxide market.

- Sharp Corporation

- LG Display Co., Ltd.

- Samsung Display Co., Ltd.

- AU Optronics Corp.

- BOE Technology Group Co., Ltd.

- Japan Display Inc.

- Tianma Microelectronics Co., Ltd.

- Apple Inc.

- Sony Group Corporation

- ASUS (ASUSTeK Computer Inc.)

- Panasonic Holdings Corporation

- Innolux Corporation

- Visionox Technology, Inc.

- Everdisplay Optronics (Shanghai) Co., Ltd.

- TCL China Star Optoelectronics Technology Co., Ltd.

- Kunshan GVO Optoelectronics Co., Ltd.

- Fujitsu Limited

- Rohm Semiconductor

- ULVAC, Inc.

- Applied Materials, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in high-resolution OLED and 8K TV demand

- 4.2.2 Requirement for energy-efficient portable devices

- 4.2.3 Rapid adoption in foldable and flexible displays

- 4.2.4 Proliferation of wearables using low-leakage IGZO backplanes

- 4.2.5 Integration in spatial-computing headsets (AR/VR/MR)

- 4.2.6 IGZO arrays enabling neuromorphic in-memory computing

- 4.3 Market Restraints

- 4.3.1 Competition from LTPS/LTPO silicon backplanes

- 4.3.2 Supply-chain volatility and pricing of indium

- 4.3.3 Low recycling rates of spent IGZO sputter targets

- 4.3.4 Current drift from sub-gap defects in humid environments

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Application

- 5.1.1 Smartphones and Feature Phones

- 5.1.2 Tablets and 2-in-1 PCs

- 5.1.3 Wearable Devices

- 5.1.4 Televisions and Large-format Displays

- 5.1.5 Automotive Displays

- 5.1.6 Industrial and Medical Displays

- 5.2 By End-use Industry

- 5.2.1 Consumer Electronics

- 5.2.2 Automotive and Transportation

- 5.2.3 Healthcare

- 5.2.4 Industrial and Manufacturing

- 5.2.5 Aerospace and Defense

- 5.2.6 Others

- 5.3 By Display Technology

- 5.3.1 LCD

- 5.3.2 OLED

- 5.3.3 MicroLED and MiniLED

- 5.3.4 E-Paper and Other Emerging

- 5.4 By Deposition Technology

- 5.4.1 RF Magnetron Sputtering

- 5.4.2 Pulsed-DC Magnetron Sputtering

- 5.4.3 Atomic Layer Deposition

- 5.4.4 Solution / Ink-jet Printing

- 5.4.5 Other Techniques

- 5.5 By Conductivity Phase

- 5.5.1 Amorphous IGZO

- 5.5.2 Polycrystalline IGZO

- 5.5.3 Single-crystal IGZO

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)}

- 6.4.1 Sharp Corporation

- 6.4.2 LG Display Co., Ltd.

- 6.4.3 Samsung Display Co., Ltd.

- 6.4.4 AU Optronics Corp.

- 6.4.5 BOE Technology Group Co., Ltd.

- 6.4.6 Japan Display Inc.

- 6.4.7 Tianma Microelectronics Co., Ltd.

- 6.4.8 Apple Inc.

- 6.4.9 Sony Group Corporation

- 6.4.10 ASUS (ASUSTeK Computer Inc.)

- 6.4.11 Panasonic Holdings Corporation

- 6.4.12 Innolux Corporation

- 6.4.13 Visionox Technology, Inc.

- 6.4.14 Everdisplay Optronics (Shanghai) Co., Ltd.

- 6.4.15 TCL China Star Optoelectronics Technology Co., Ltd.

- 6.4.16 Kunshan GVO Optoelectronics Co., Ltd.

- 6.4.17 Fujitsu Limited

- 6.4.18 Rohm Semiconductor

- 6.4.19 ULVAC, Inc.

- 6.4.20 Applied Materials, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment