|

市场调查报告书

商品编码

1907326

欧洲3D列印市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031年)Europe 3D Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

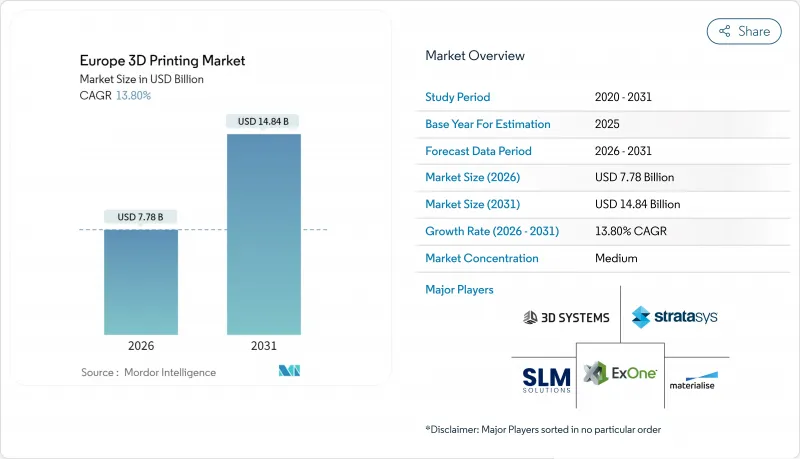

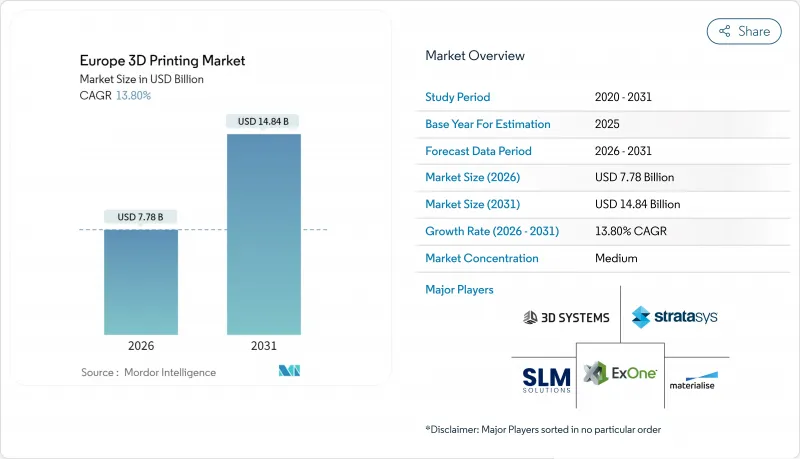

欧洲 3D 列印市场预计将从 2025 年的 68.4 亿美元成长到 2026 年的 77.8 亿美元,到 2031 年达到 148.4 亿美元,2026 年至 2031 年的复合年增长率为 13.8%。

这项扩张的驱动力来自全部区域製造商加速推进分散式生产策略,从而缩短前置作业时间,应对供应链中断,并满足鼓励本地生产的碳边境调节措施的要求。快速的创新週期、金属3D列印机成本的下降以及人工智慧驱动的製程控制的集成,都促进了汽车、医疗和海事行业生产级应用案例的扩展。儘管硬体销售仍然占据收入的大部分,但面向服务的「製造即服务」(MaaS)模式正在迅速发展,反映出用户希望在无需大规模支出的情况下获得灵活的生产能力。各国的发展趋势各不相同。德国凭藉其深厚的专利基础和自动化技术专长,保持着主导地位;而拥有世界一流物流和海事丛集的荷兰,则实现了最快的增长速度。随着现有企业进行垂直整合,新进业者致力于开发新材料,以及欧盟协调技术标准以简化跨境运营,竞争日益激烈。

欧洲3D列印市场趋势与洞察

政府对工业4.0和增材製造业的主导和资金支持

欧洲各国政府正投入大量资金,以促进积层製造技术的广泛应用。法国耗资540亿欧元的「法国2030」计画为先进製造平台拨款,而「地平线欧洲」计画则进一步支持「製造即服务」试点项目,将跨境设施整合到云端管理的生产线中。在德国,积层製造企业将销售额的30.6%投入研发,并得到国家和欧盟津贴的进一步支持,巩固了在金属系统领域的领先地位。这种联合资助模式促进了科技从实验室到实际应用的转化,并建构了一个符合通用技术标准的供应商体系。因此,欧洲3D列印市场受益于规模经济,并降低了中型企业的进入门槛。

汽车製造商对轻量化原型製作和模具製造的需求

汽车製造商正在将积层製造技术应用于初始原型製作以外的领域。欧盟资助的Multi-FUN计划发现了一种复合材料列印技术,可将线束和感测器整合到轻量化结构中。德国供应商正在列印用于小批量生产的模具,以便在无需高成本库存的情况下管理特定车型的零件。透过利用无需焊接和螺栓的整体式组件,企业正在减轻重量并缩短生产週期,从而保持3D列印市场在欧洲主要汽车市场的成长势头。

高昂的资本投资和维修成本

工业级印表机的价格高达六位数,使用者还需要添置粉末处理、后处理和品质保证设备。儘管硬体价格不断下降,中小企业往往仍会推迟采购。医疗设备法规要求严格的文件记录和上市后监管,这增加了医疗保健使用者的营运成本。铁路、航太和能源产业的认证体系分散,导致测试预算增加,并缩小了欧洲3D列印市场的潜在基本客群,直到租赁和服务模式能够抵消这些风险。

细分市场分析

随着企业将柔软性置于优先地位,服务供应商正占据越来越大的收入份额。儘管到2025年,硬体仍将占欧洲3D列印市场67.62%的份额,但随着越来越多的企业将设计最佳化、建置准备和后处理外包,以服务为导向的模式正以15.97%的复合年增长率快速扩张。 K3D和FKM等契约製造製造商正在部署由多台印表机组成的列印集群,使客户能够及时获得零件,而无需在设备上投入大量资金。这种转变降低了实验成本,并将风险分散到不同的客户通路。

同时,硬体供应商将软体、维护和培训订阅服务捆绑销售,模糊了设备销售和后续服务之间的界线。云端控制面板整合了整个设备群的数据,并支援预测性维护和耗材补充。这些整合服务正在推动3D列印技术的普及,并引领欧洲3D列印市场朝着基于结果的采购模式发展。

到2025年,FDM将维持29.12%的最大市场份额,这主要得益于成熟的材料、低廉的营运成本以及广泛的用户认知。同时,DLP将达到14.42%的显着复合年增长率,这主要得益于其50微米以下的微加工能力,该技术适用于正畸矫正器、助听器和组织支架研究等领域。植物来源光敏聚合物的进步在提升永续性。 SLA和SLS满足了航太和汽车行业对耐热部件的需求,而电子束熔化仍然是製造用于整形外科植入的钛晶格结构的主流技术。

如今,差异化技术依赖自动化和封闭回路型控制。人工智慧驱动的体素级校正可减少支撑材料用量并简化除粉过程,进而提高欧洲3D列印市场的运转率。粉末层系统中的多雷射协同技术实现了生产效率和表面光洁度之间的平衡,使製造商能够更有信心地对零件进行生产认证。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 政府主导的工业4.0及增材製造政策及经费支持

- 汽车原始设备製造商对轻量化原型製作和模具製造的需求

- 医疗领域中病患专用医疗设备的现状

- 金属3D列印机和材料成本下降

- 欧盟碳边境调节措施促进了本地生产

- 铁路和海运行业的按需零件需求

- 市场限制

- 高昂的资本投资和维护成本

- 从设计阶段开始就缺乏积层製造人员

- 欧盟认证和标准体系的碎片化现状

- 金属粉末供应不稳定和回收障碍

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按组件

- 硬体

- 服务

- 透过技术

- 立体光刻技术(SLA)

- 熔融沈积成型(FDM)

- 选择性雷射烧结(SLS)

- 电子束熔化(EBM)

- 数位光处理(DLP)

- 其他技术

- 材料

- 聚合物

- 金属和合金

- 陶瓷

- 复合材料及其他

- 按最终用户行业划分

- 车

- 航太与国防

- 卫生保健

- 建筑/建筑设计

- 能源与公共产业

- 食品/饮料

- 其他行业

- 按国家/地区

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 其他欧洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Stratasys Ltd.

- 3D Systems Corporation

- EOS GmbH

- General Electric Company(GE Additive)

- Hoganas AB(Digital Metal(R))

- Sisma SpA

- ExOne Company

- SLM Solutions Group AG

- HP Inc.

- Ultimaker BV

- Materialise NV

- voxeljet AG

- Renishaw plc

- Prodways Group SA

- Arcam AB

- Carbon, Inc.

- Markforged Holding Corp.

- XJet Ltd.

- Photocentric Ltd.

- Desktop Metal, Inc.

- BEAMIT SpA

- DWS Systems Srl

- Farsoon Technologies Europe GmbH

- B9Creations, LLC

第七章 市场机会与未来展望

The Europe 3D printing market is expected to grow from USD 6.84 billion in 2025 to USD 7.78 billion in 2026 and is forecast to reach USD 14.84 billion by 2031 at 13.8% CAGR over 2026-2031.

This expansion occurs as manufacturers across the region accelerate distributed-production strategies to cut lead times, hedge against supply-chain shocks and meet carbon-border adjustment requirements that reward localized output. Fast innovation cycles, falling metal-printer costs and the integration of artificial-intelligence process control underpin a widening set of production-grade use cases across automotive, healthcare and maritime industries. Hardware sales still dominate revenue, yet service-oriented "manufacturing as a service" models are scaling quickly, reflecting user preference for flexible capacity without large capital outlays. Country-level momentum is uneven: Germany leverages patent depth and automation expertise to safeguard its leadership position, while the Netherlands deploys world-class logistics and maritime clusters to register the highest growth pace. Competitive intensity rises as incumbents integrate vertically, newer entrants push novel materials and the European Union harmonizes technical standards to ease cross-border operations.

Europe 3D Printing Market Trends and Insights

Government Initiatives and Funding for Industry 4.0 and AM

European governments deploy sizeable capital to speed additive-manufacturing adoption. France's EUR 54 billion "France 2030" program earmarks funds for advanced manufacturing platforms. Horizon Europe further backs "manufacturing as a service" pilots that network equipment across borders into cloud-managed production lines. In Germany, additive-manufacturing firms invest 30.6% of turnover in research, amplified by national and EU grants, cementing leadership in metal systems. The shared funding model drives technology transfer from laboratories to shop floors and builds a cadre of suppliers aligned to common technical standards. As a result, the Europe 3D printing market secures economies of scale that lower entry barriers for mid-sized enterprises.

Automotive OEM Demand for Lightweight Prototyping and Tooling

Automotive manufacturers now pursue additive-manufacturing beyond early prototyping. The EU-funded Multi-FUN project reveals multi-material builds that embed wiring and sensors into lightweight structures. German suppliers print low-volume production tooling to manage model-specific parts without storing costly inventory. By exploiting single-build assemblies that cut welds and bolts, companies save weight and shorten production cycles, sustaining momentum for the Europe 3D printing market in core automotive corridors.

High Capital Investment and Maintenance Costs

Industrial-grade printers carry six-figure price tags, and users must add powder-handling, post-processing, and quality-assurance gear. Small and medium-sized enterprises often defer purchases even as hardware prices decline. Compliance with the EU Medical Device Regulation imposes rigorous documentation and post-market surveillance, inflating overhead for healthcare adopters. Fragmented certification regimes for rail, aerospace, and energy sectors multiply testing budgets, narrowing the addressable base of the Europe 3D printing market until rental or service models offset risk.

Other drivers and restraints analyzed in the detailed report include:

- Healthcare Adoption for Patient-Specific Devices

- Declining Cost of Metal Printers and Materials

- Shortage of Design-for-AM Talent

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Service providers captured a growing slice of revenue as enterprises prioritize flexibility. Although hardware still anchored 67.62% of the Europe 3D printing market in 2025, service-oriented models are scaling at 15.97% CAGR as firms outsource design optimization, build preparation and post-processing. Contract manufacturers such as K3D and FKM deploy multi-printer farms, giving customers just-in-time parts without locking capital into machines. This transition lowers the cost of experimentation and spreads risk across diverse client pipelines.

In parallel, hardware vendors bundle software, maintenance, and training subscriptions, blurring lines between equipment sales and recurring services. Cloud dashboards aggregate fleet-wide data, enabling predictive maintenance and consumable replenishment. These integrated offers reinforce adoption, propelling the Europe 3D printing market toward outcome-based procurement norms.

FDM maintained the largest share in 2025 at 29.12% thanks to mature materials, low operating costs, and broad user familiarity. Yet DLP is registering an impressive 14.42% CAGR, propelled by sub-50-micron feature capability that suits dental aligners, hearing aids, and tissue-scaffold research. Advances in plant-based photopolymers reinforce sustainability credentials while widening the bio-compatibility palette. SLA and SLS cater to aerospace and automotive requirements for heat-resistant components, whereas electron-beam melting remains the go-to for titanium lattice structures in orthopedic implants.

Technology differentiation now hinges on automation and closed-loop control. AI-driven voxel-level correction trims support mass and eases depowdering, elevating utilization rates across the Europe 3D printing market. Multi-laser coordination in powder-bed systems balances productivity and surface finish, giving manufacturers confidence to qualify parts for serial production.

The Europe 3D Printing Market Report is Segmented by Component (Hardware and Services), Technology (Stereolithography, Fused Deposition Modeling, and More), Material (Polymers, Metals and Alloys, and More), End-User Industry (Automotive, Aerospace and Defense, Healthcare, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Stratasys Ltd.

- 3D Systems Corporation

- EOS GmbH

- General Electric Company (GE Additive)

- Hoganas AB (Digital Metal(R))

- Sisma S.p.A.

- ExOne Company

- SLM Solutions Group AG

- HP Inc.

- Ultimaker B.V.

- Materialise N.V.

- voxeljet AG

- Renishaw plc

- Prodways Group SA

- Arcam AB

- Carbon, Inc.

- Markforged Holding Corp.

- XJet Ltd.

- Photocentric Ltd.

- Desktop Metal, Inc.

- BEAMIT S.p.A.

- DWS Systems S.r.l.

- Farsoon Technologies Europe GmbH

- B9Creations, LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government initiatives and funding for Industry 4.0 and AM

- 4.2.2 Automotive OEM demand for lightweight prototyping and tooling

- 4.2.3 Healthcare adoption for patient-specific devices

- 4.2.4 Declining cost of metal printers and materials

- 4.2.5 EU carbon-border adjustment boosting localized production

- 4.2.6 On-demand spare-parts needs in rail and maritime sectors

- 4.3 Market Restraints

- 4.3.1 High capital investment and maintenance costs

- 4.3.2 Shortage of design-for-AM talent

- 4.3.3 Fragmented EU certification and standards landscape

- 4.3.4 Metal-powder supply volatility and recycling hurdles

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Services

- 5.2 By Technology

- 5.2.1 Stereolithography (SLA)

- 5.2.2 Fused Deposition Modeling (FDM)

- 5.2.3 Selective Laser Sintering (SLS)

- 5.2.4 Electron Beam Melting (EBM)

- 5.2.5 Digital Light Processing (DLP)

- 5.2.6 Other Technologies

- 5.3 By Material

- 5.3.1 Polymers

- 5.3.2 Metals and Alloys

- 5.3.3 Ceramics

- 5.3.4 Composites and Others

- 5.4 By End-user Industry

- 5.4.1 Automotive

- 5.4.2 Aerospace and Defense

- 5.4.3 Healthcare

- 5.4.4 Construction and Architecture

- 5.4.5 Energy and Utilities

- 5.4.6 Food and Beverage

- 5.4.7 Other Industries

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Netherlands

- 5.5.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Stratasys Ltd.

- 6.4.2 3D Systems Corporation

- 6.4.3 EOS GmbH

- 6.4.4 General Electric Company (GE Additive)

- 6.4.5 Hoganas AB (Digital Metal(R))

- 6.4.6 Sisma S.p.A.

- 6.4.7 ExOne Company

- 6.4.8 SLM Solutions Group AG

- 6.4.9 HP Inc.

- 6.4.10 Ultimaker B.V.

- 6.4.11 Materialise N.V.

- 6.4.12 voxeljet AG

- 6.4.13 Renishaw plc

- 6.4.14 Prodways Group SA

- 6.4.15 Arcam AB

- 6.4.16 Carbon, Inc.

- 6.4.17 Markforged Holding Corp.

- 6.4.18 XJet Ltd.

- 6.4.19 Photocentric Ltd.

- 6.4.20 Desktop Metal, Inc.

- 6.4.21 BEAMIT S.p.A.

- 6.4.22 DWS Systems S.r.l.

- 6.4.23 Farsoon Technologies Europe GmbH

- 6.4.24 B9Creations, LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment