|

市场调查报告书

商品编码

1910455

涂料树脂:市场占有率分析、产业趋势与统计资料、成长预测(2026-2031)Resins In Paints And Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

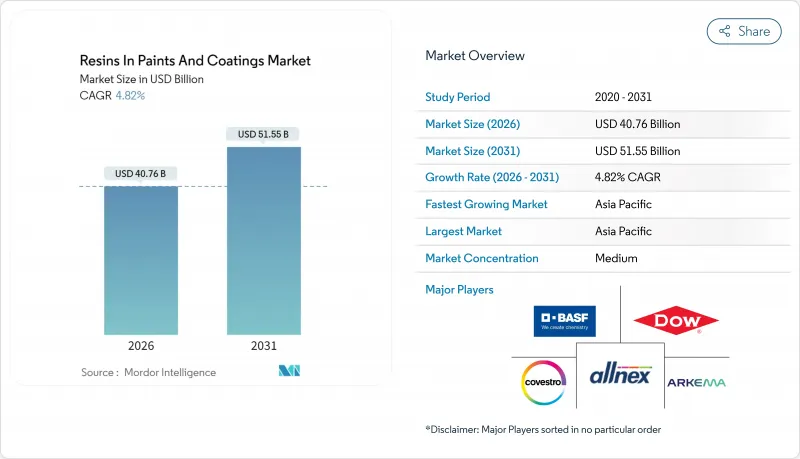

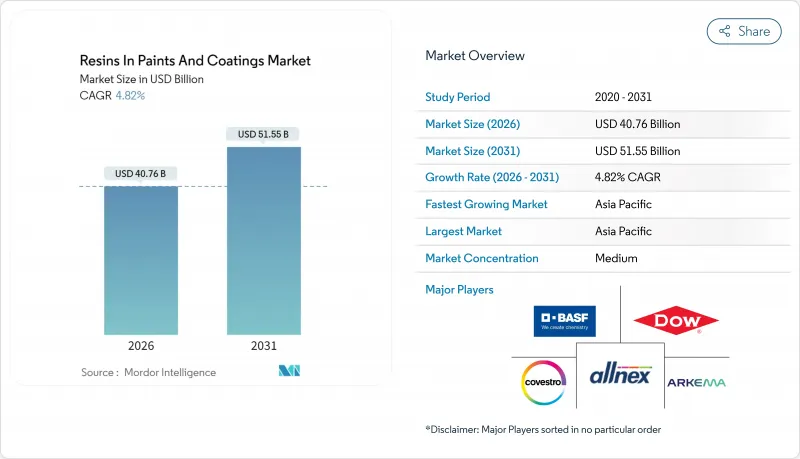

预计到 2026 年,油漆和涂料树脂市场价值将达到 407.6 亿美元,高于 2025 年的 388.9 亿美元。

预计到 2031 年,该产业规模将达到 515.5 亿美元,2026 年至 2031 年的复合年增长率为 4.82%。

儘管表面上成长率看似温和,但政策主导的溶剂型化学品减量趋势正迫使配方商围绕水性丙烯酸酯、聚氨酯分散体和其他生物循环技术重组产品系列。三大洲的政府已将挥发性有机化合物 (VOC) 的排放上限从 2024 年提前至 2025 年,并加快了转型进程。亚太地区在基础设施投资的主导继续引领价值创造。然而,北美和欧洲正在进行为期多年的维修计划,旨在推广优质低 VOC 树脂。随着现有企业整合可再生原料、建造区域分散式工厂并采用可缩短产品开发週期的数位化配方平台,竞争日益激烈。

全球油漆及涂料树脂市场趋势及洞察

亚太地区的建筑业蓬勃发展

公共部门基础设施项目仍然是建筑和防护涂料的最大需求来源。仅印度的国家基础设施计划就计划到2025年累计资本支出达1.4万亿美元,这将推动桥樑、港口和铁路涂料的多年需求,而这些涂料主要依赖环氧树脂和聚氨酯树脂。新加坡建设局强制要求所有新建公共住宅计划从2025年起达到绿建筑标誌铂金级标准,实际上要求工厂预涂面板必须使用水性丙烯酸或聚氨酯涂料。菲律宾已拨款1.1兆披索(约200亿美元)用于其2024年的「建设更美好、更繁荣」计划,该计划涵盖机场、道路和能源资产等大量使用工业涂料的设施。在全部区域,国有开发商越来越多地将低VOC(挥发性有机化合物)规范纳入竞标文件,从而推动了分散技术的应用。树脂製造商已宣布在印尼和越南安装分散反应器,以缩短前置作业时间并减少运输排放。这些倡议既能对冲全球公司的产量,又能使区域性化合物生产商实现在地化供应。

加强VOC排放法规

高溶剂树脂的合规窗口正在迅速缩小。 2025年1月,美国环保署(EPA)将气雾涂料的挥发性有机化合物(VOC)含量限制在25%(重量比)(先前的限值为45%),这迫使黏合剂的选择必须即时做出改变。乔治亚随后也采取了类似措施,在其法规391-3-1-.02(7)(c)中将建筑用平涂涂料的VOC含量限制在50克/公升,该法规于2025年7月生效。欧洲进一步收紧了标准,欧盟委员会于2024年10月发布的生态标章标准提案规定,室内涂料的VOC含量上限为30克/公升。只有高固态丙烯酸或混合系统才能达到此标准。中国在其GB 18582-2024标准中也采用了与欧盟相同的阈值,这表明全球最大的建筑市场不能再成为VOC法规宽鬆的避风港。随着配方师们应对日益严格的法规,拥有易于规模化的水性产品线(尤其是丙烯酸和聚氨酯分散体)的树脂供应商正在获得市场份额。

原物料价格波动

丙烯、苯和乙烯价格波动仍然是重要的不利因素。根据ICIS Chemical Business通报,受三家裂解装置意外停产的影响,2024年第二季亚洲丙烯合约价格较上季上涨25%。欧洲也面临类似的压力,导致乙烯衍生物利润率跌至负值,迫使规模较小的环氧树脂生产商关闭部分工厂。对于没有上游石化业务的树脂生产商而言,在价格敏感的建筑树脂领域,运作传导延迟通常为60至90天。一些局部解决方案正在涌现,例如科思创宣布推出一种源自废弃食用油的生物再生多元醇。该公司计划在2024年消除与化石原料的价格差异,并降低对石脑油价格波动的依赖。然而,在生物基原料广泛应用之前,大宗商品价格的相关性仍将继续限制利润率。

细分市场分析

由于丙烯酸树脂与低VOC水性体系的兼容性,预计到2025年,其在涂料市场树脂份额中将占30.02%。加上5.28%的复合年增长率,随着监管机构收紧排放上限,丙烯酸树脂的市场价值转型将由此展开。环氧树脂广泛应用于船舶和风力发电机等高应力应用领域,Hexion在其2024年报告中指出,涡轮机原始设备製造商(OEM)对其订单强劲。聚氨酯分散体在电动车电池应用领域的需求不断增长。作为粉末涂料主力军的聚酯树脂,由于低温固化聚酯-环氧树脂混合涂料的日益普及,其利润率正面临压缩。醇酸树脂长期以来一直是溶剂型建筑涂料的支柱,但由于其干燥时间长、VOC(挥发性有机化合物)含量高,在主流墙面涂料产品线中的应用正在减少。同时,醇酸树脂在高檔木器涂料领域仍占有一席之地。在斯堪地那维亚国家,基于 ISO 14040 的生命週期评估已成为公共采购的强制性要求,市场份额正逐渐转向具有经认证的环境声明的树脂。

丙烯酸树脂优异的分散性能也为模组化住宅的工厂预涂面板生产线奠定了基础。为了满足预製现场严格的生产週期,快干型单步骤涂料备受青睐,水性压克力树脂自然成为理想之选。环氧树脂供应商正透过奈米改质系统来缩短烘烤时间,而聚氨酯供应商则在推广无需强制通风烘箱的湿固化方法。在涂料市场,整体树脂供应商的创新方向正趋向于使用减少二氧化碳排放的原料。BASF承诺到2026年将可再生丙烯整合到其丙烯酸价值链中,便是这一趋势的有力证明。这项原物料策略符合欧洲公共采购法规,该法规要求对生物基含量达到20%或以上的材料给予溢价。

区域分析

到2025年,亚太地区将占据全球涂料树脂市场44.12%的份额,并以5.33%的复合年增长率成为成长最快的地区,这主要得益于中国建设业的復苏和印度的大型企划计画。在中国,随着地方政府放宽贷款监管,2024年住宅开工量将回升,贷款发放量也将随之增加。印度的国家基础设施计画将推动桥樑和铁路防护涂料树脂的消费,而印尼的IKN努沙登加拉首都地区发展计画和菲律宾的「建设更美好、更有效率」计画将提升以地区为基础需求。日本的抗震维修补贴计画和韩国的绿色新政政策均要求在公共采购中使用低VOC涂料,并透过当地加工商推广丙烯酸聚氨酯分散体的使用。

北美地区的成长主要得益于住宅维修支出,预计到2024年将达到4,850亿美元,其中节能型外墙覆层和墙板更换将引领这一趋势。美国环保署(EPA)将于2025年实施的VOC(挥发性有机化合物)法规将加速水性涂料的普及,剪切机表示,低气味乳胶漆的溢价将有助于提高利润率。预计到2024年,加拿大的碳价将达到每吨80美元,这将鼓励建筑业主提供包含高反射率屋顶涂料的维修方案,以降低冷气负荷。

受「维修」和「工业排放指令」(该指令优先考虑低溶剂和粉末涂料)的推动,欧洲涂料市场正经历着个位数的温和成长。北欧各市政当局在竞标中越来越要求提供产品特定的环境声明,这使得拥有全面审核且产品线多元化的供应商更具优势。南美洲、中东和非洲在耐腐蚀树脂市场规模中所占份额相对较小,但预计巴西、沙乌地阿拉伯和阿联酋等国的石油天然气、采矿和体育场建设等产业将带动局部成长。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 亚太地区的建筑业蓬勃发展

- 收紧(VOC)排放法规

- 汽车生产从2024年开始復苏

- 经合组织国家的住宅维修热潮

- 用于原位3D列印修復的树脂

- 市场限制

- 原物料价格波动

- 改用纯粉末系统

- 微塑胶淘汰法规

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 按类型

- 环氧树脂

- 丙烯酸纤维

- 聚氨酯

- 聚酯纤维

- 聚丙烯

- 醇酸树脂

- 其他类型

- 按最终用户行业划分

- 产业

- 建筑学

- 车

- 包装

- 其他最终用户

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 埃及

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率/排名分析

- 公司简介

- Allnex GmbH

- Arkema

- BASF SE

- Covestro AG

- Dow

- Evonik Industries AG

- Hexion

- Huntsman International LLC

- Kangnam Chemical

- KANSAI HELIOS

- Mitsubishi Shoji Chemical Corporation

- Mitsui Chemicals Inc.

- Olin Corporation.

- Reichhold LLC 2

- Solvay

- Synthomer plc

- Uniform Synthetics

- Vil Resins

- Wanhua

第七章 市场机会与未来展望

Resins In Paints And Coatings market size in 2026 is estimated at USD 40.76 billion, growing from 2025 value of USD 38.89 billion with 2031 projections showing USD 51.55 billion, growing at 4.82% CAGR over 2026-2031.

Although the headline growth rate appears measured, policy-driven shifts away from solvent-borne chemistries are forcing formulators to retool their portfolios around waterborne acrylic, polyurethane dispersion, and other biocircular technologies. Governments on three continents tightened volatile-organic-compound (VOC) ceilings in 2024-2025, accelerating the transition timeline. The Asia-Pacific region continues to dominate value creation, thanks to infrastructure spending. However, North America and Europe are staging multi-year renovation programs that favor premium, low-VOC resins. Competitive intensity is rising as incumbents integrate renewable feedstocks, build regional dispersion plants, and deploy digital formulation platforms to compress product-development cycles.

Global Resins In Paints And Coatings Market Trends and Insights

Construction Boom Across the Asia-Pacific

Public-sector infrastructure pipelines remain the single largest demand engine for architectural and protective coatings. India's National Infrastructure Pipeline alone targets USD 1.4 trillion in cumulative capital outlays through 2025, generating a multi-year pull-through for epoxy- and polyurethane-rich bridge, port, and rail coatings. Singapore's Building and Construction Authority now requires Green Mark Platinum performance on all new public housing projects from 2025, effectively mandating water-based acrylic or polyurethane chemistries for factory-applied panels. The Philippines allocated PHP 1.1 trillion (approximately USD 20 billion) to its Build Better More program in 2024, which includes industrial coating-intensive airports, roads, and energy assets. Across the region, state-owned developers are bundling low-VOC specifications into tender documents, accelerating the adoption of dispersion technology. Resin suppliers have responded by announcing the establishment of dispersion reactors in Indonesia and Vietnam, aiming to shorten lead times and reduce freight emissions. These moves provide global incumbents with a volume hedge while enabling regional formulators to localize their supply.

Tightening VOC-Emission Regulations

The compliance window for high-solvent resins is narrowing rapidly. In January 2025 the U.S. Environmental Protection Agency capped aerosol-coating VOC content at 25% by weight-down from prior category ceilings of 45%-forcing an immediate shift in binder selection. Georgia followed with Rule 391-3-1-.02(7)(c), effective July 2025, limiting flat architectural finishes to 50 grams per liter. Europe raised the bar again when the European Commission published draft Ecolabel criteria in October 2024 that impose a 30 grams-per-liter ceiling for interior paints, achievable only with high-solids acrylic or hybrid systems. China mirrored the EU thresholds in its GB 18582-2024 standard, signaling that the world's largest construction market can no longer serve as a VOC-light haven. Resin suppliers with ready-to-scale waterborne portfolios-especially acrylic- and polyurethane-based dispersions-are winning share as formulators scramble to meet the cliff.

Feedstock Price Volatility

Price swings for propylene, benzene, and ethylene remain a significant headwind. ICIS Chemical Business reported that Asian contract propylene prices increased by 25% quarter-on-quarter in Q2 2024, following three unplanned cracker outages. Similar squeezes in Europe turned ethylene-derivative margins negative, compelling smaller epoxy producers to idle plants. Resin makers without upstream petrochemical integration face 60- to 90-day pass-through lags in the price-sensitive architectural channel. Partial insulation is emerging; Covestro has disclosed bio-circular polyols derived from waste vegetable oils that reached price parity with fossil feedstock by 2024, thereby trimming exposure to naphtha volatility. Still, the commodity link will limit margins until bio-feedstock adoption scales.

Other drivers and restraints analyzed in the detailed report include:

- Automotive Output Revival Post-2024

- Refurbishment Wave in OECD Housing

- Shift Toward Powder-Only Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Acrylic resins commanded 30.02% of the 2025 resins in paints and coatings market share, supported by their superior fit in low-VOC waterborne systems. Coupled with a 5.28% CAGR, they anchor value migration as regulators tighten emission ceilings. Epoxy resins are used in high-stress applications, such as those in the marine and wind-turbine industries; Hexion noted robust orders from turbine OEMs in its 2024 report. Polyurethane dispersions benefit from EV battery use cases. Polyester, a workhorse for powder coatings, faces margin compression as buyers mix polyester-epoxy hybrids that cure at lower temperatures. Alkyds, long the backbone of solvent-borne architectural paints, retain a niche in premium wood finishes but fade in mainstream wall-coating lines due to their slower dry time and higher VOC. ISO 14040 life-cycle assessments are now mandatory in Scandinavian public tenders, funneling share toward resins with verified environmental declarations.

Acrylic's dispersion superiority also underpins factory-applied panel lines for modular housing. Prefabrication sites prefer quick-dry, single-pass coatings to meet tight takt times, making waterborne acrylic a natural choice. Epoxy suppliers are responding with nano-modified systems that cut bake curves, while polyurethane vendors push humidity-cure versions that eliminate forced-air ovens. Across the resins in paints and coatings market, supplier innovation is converging on CO2-reduced feedstocks, evidenced by BASF's pledge to integrate renewable propylene into its acrylic value chain by 2026. This feedstock strategy aligns with European public-procurement rules granting price premiums to materials with >=20% bio-content.

The Resins in Paints and Coatings Market Report is Segmented by Type (Epoxy, Acrylic, Polyurethane, Polyester, Polypropylene, Alkyd, Other Types), End-User Industry (Industrial, Architectural, Automotive, Packaging, Other End-Users), and Geography (North America, South America, Europe, Asia-Pacific, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific accounted for a 44.12% share of the resins in paints and coatings market in 2025 and is growing fastest at a 5.33% CAGR, propelled by China's construction recovery and India's megaproject pipelines. China's residential completions rebounded in 2024 as municipal authorities eased credit, translating into higher drawdowns. India's National Infrastructure Pipeline drives protective-coating resin consumption for bridges and railways, while the IKN Nusantara capital-city buildout in Indonesia and the Philippines' Build Better More program lift regional baseline volumes. Japan's seismic-retrofit subsidy and South Korea's Green New Deal mandate low-VOC coatings in public procurement, driving the use of acrylic and polyurethane dispersions through local converting channels.

North America's momentum rests on remodeling spending that hit USD 485 billion in 2024, with energy-efficient exteriors and siding replacements at the top of the wallet. The EPA's 2025 VOC rule accelerates waterborne adoption, and Sherwin-Williams has flagged premium pricing on low-odor emulsions as margin-accretive. Canada's carbon price reached CAD 80 per metric ton in 2024 and is nudging building owners toward retrofit packages that include high-albedo roof coatings to cut cooling loads.

Europe advances at a mid-single-digit pace led by the Renovation Wave and the Industrial Emission Directive, both of which prioritize low-solvent or powder chemistries. Nordic municipalities now require product-specific environmental product declarations in tenders, advantaging suppliers with fully audited dispersion lines. South America and the Middle East and Africa collectively account for a smaller share of coating resins market size but offer pocket-growth linked to oil-and-gas, mining, and stadium construction in Brazil, Saudi Arabia, and the United Arab Emirates.

- Allnex GmbH

- Arkema

- BASF SE

- Covestro AG

- Dow

- Evonik Industries AG

- Hexion

- Huntsman International LLC

- Kangnam Chemical

- KANSAI HELIOS

- Mitsubishi Shoji Chemical Corporation

- Mitsui Chemicals Inc.

- Olin Corporation.

- Reichhold LLC 2

- Solvay

- Synthomer plc

- Uniform Synthetics

- Vil Resins

- Wanhua

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Construction boom across Asia-Pacific

- 4.2.2 Tightening (VOC)-emission regulations

- 4.2.3 Automotive output revival post-2024

- 4.2.4 Refurbishment wave in OECD housing

- 4.2.5 On-site 3-D printing repair resins

- 4.3 Market Restraints

- 4.3.1 Feed-stock price volatility

- 4.3.2 Shift toward powder-only systems

- 4.3.3 Micro-plastic phase-out rules

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Epoxy

- 5.1.2 Acrylic

- 5.1.3 Polyurethane

- 5.1.4 Polyester

- 5.1.5 Polypropylene

- 5.1.6 Alkyd

- 5.1.7 Other Types

- 5.2 By End-user Industry

- 5.2.1 Industrial

- 5.2.2 Architectural

- 5.2.3 Automotive

- 5.2.4 Packaging

- 5.2.5 Other End-users

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Egypt

- 5.3.5.5 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Allnex GmbH

- 6.4.2 Arkema

- 6.4.3 BASF SE

- 6.4.4 Covestro AG

- 6.4.5 Dow

- 6.4.6 Evonik Industries AG

- 6.4.7 Hexion

- 6.4.8 Huntsman International LLC

- 6.4.9 Kangnam Chemical

- 6.4.10 KANSAI HELIOS

- 6.4.11 Mitsubishi Shoji Chemical Corporation

- 6.4.12 Mitsui Chemicals Inc.

- 6.4.13 Olin Corporation.

- 6.4.14 Reichhold LLC 2

- 6.4.15 Solvay

- 6.4.16 Synthomer plc

- 6.4.17 Uniform Synthetics

- 6.4.18 Vil Resins

- 6.4.19 Wanhua

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment