|

市场调查报告书

商品编码

1910460

液态防水卷材:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Liquid Applied Membrane - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

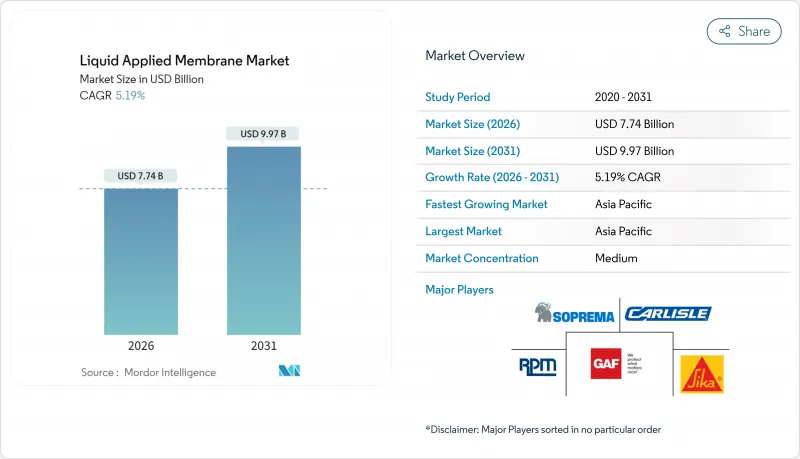

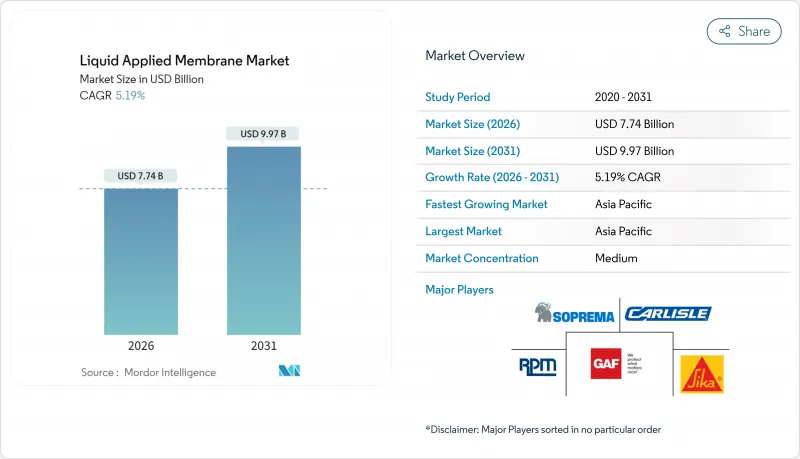

预计到 2025 年,液态防水捲材市场规模将达到 73.6 亿美元,到 2026 年将达到 77.4 亿美元,到 2031 年将达到 99.7 亿美元,预测期(2026-2031 年)复合年增长率为 5.19%。

终端用户正持续从捲材产品转向无缝涂料,无缝涂料能够修復裂缝、抵抗位移并延长使用寿命,从而降低生命週期成本。中国、印度和美国的基建更新项目支撑了市场需求,而加州、加拿大和欧盟更严格的低挥发性有机化合物(VOC)法规则推动了水性涂料的普及。鼓励采用冷屋顶、太阳能组装和绿色屋顶的建筑规范也进一步促进了无缝涂料的应用。为了应对利润率下降的局面,製造商推出了自修復、太阳能相容和快速固化系统,以减少繁忙施工现场的停工时间。

全球液体防水片材市场趋势及洞察

扩大防水膜的使用范围,以延长建筑物的使用寿命。

如今,业主们将先进的防水涂层视为可减少非计划性维修的资本资产。橡树岭国家实验室估计,商业屋顶使用寿命延长五年,每年可为美国减少25亿美元的废弃物成本,并减少掩埋的体积。像MAPEI的Mapelastic AquaDefense这样的液态防水系统,能够跨越3.2毫米的裂缝,并在热循环下保持柔软性,使其成为地震多发地区的理想选择。保险公司也开始为指定使用长效防水膜的业主提供保费折扣,这为推广使用长效防水膜提供了经济奖励。

成熟经济体中老旧屋顶的经济高效维修

在加拿大,SOPREMA公司对CF Champlain购物中心的屋顶进行了翻新,使其使用寿命延长了25年,同时与完全拆除相比,材料成本降低了45%,施工时间缩短了35%。这种涂层能够黏附在不规则的基材上,使承包商无需拆除屋顶板,从而避免了对购物中心、医院和学校等场所的干扰,保证了它们的正常运作。屋顶翻新还减少了废弃物处理和蕴藏量排放,帮助设施管理团队在无需大量资本投资的情况下实现ESG目标。

片材和预製篷布供应状况

热塑性捲材(例如TPO)在大型物流设施中保持速度优势,使安装人员每班可完成超过900平方公尺的铺设。为了因应涂料市场的成长,製造商推出了自黏片材,降低了使用明火的风险,从而消除了液体防水的一大优势。然而,在禁止明火的区域,例如复杂的穿透部位、垂直连接处以及生活空间的维修,液体防水仍然是首选。

细分市场分析

沥青基涂料凭藉数十年的现场经验和低廉的单位成本,在2025年占据了液态防水膜市场的30.10%。聚氨酯基涂料凭藉其弹性体特性,能够抵抗太阳能板、冷屋顶颜料和伸缩缝,推动了价值成长,复合年增长率达到6.24%。

丙烯酸分散体因其可使用滚筒涂刷且易于用水清洗,在维修工程中的应用日益广泛。聚甲基丙烯酸甲酯 (PMMA) 可在短短 30 分钟内固化,因此适用于对施工进度要求严格的区域,例如人流量大的阳台和体育场大厅。聚氨酯-沥青混合物和聚脲改性弹性体等混合化学产品满足了对超快速恢復使用和寒冷气候施工的特定需求,从而拓展了设计师的设计自由度。

液态防水捲材市场报告按类型(水泥基、沥青基、聚氨酯、聚脲、丙烯酸等)、应用(屋顶、墙面、地下/隧道、其他应用)、终端用户行业(住宅、商业、工业、公共设施/基础设施)和地区(亚太、北美、欧洲等)进行细分。市场预测以美元计价。

区域分析

预计到2025年,亚太地区将占全球营收的52.70%,并在2031年之前以6.65%的复合年增长率成长。中国的地铁扩建、印度的智慧城市走廊以及东协的防洪隧道,总需要数亿平方公尺的防水材料。当地开发商越来越要求产品符合EN 14891和GB 50108标准,这推动了用于更新测试证书的进口需求。

北美市场虽然成熟,但机会众多,其中屋顶维修占据主导地位。美国各市政当局正在扩大冷屋顶」补贴计画;在加拿大,2025年生效的联邦VOC法规正在加速水性技术的应用。墨西哥科阿察科阿尔科斯隧道采用了GCP公司的Integritank系统,实现了无缝防腐蚀保护,展现了该地区在复杂计划中的技术实力。

欧洲的维修热潮以脱碳为核心,德国的BEG补贴计画要求提高建筑的气密性,从而推动了流动性气密材料的广泛应用。乔治亚采纳欧盟的VOC排放上限规定,显示其监管与东方国家趋于一致。中东和非洲地区展现出巨大的成长潜力,但极端气候构成了一项挑战。杜拜世博城公园采用了脂肪族聚脲,使其能够承受45°C的夏季高温而不出现粉化(泛白)现象。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 扩大防水膜的使用范围,以延长建筑物的使用寿命。

- 成熟经济体中老旧屋顶的经济高效维修

- 亚太地区和非洲基础建设的快速扩张

- 法规要求使用不含挥发性有机化合物(VOC)的解决方案。

- 太阳能液态屋顶材料的快速普及

- 市场限制

- 片材和预製膜的供应情况

- 石化原料价格波动

- 新兴市场建筑工程师短缺

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 按类型

- 水泥基

- 沥青

- 聚氨酯

- 聚脲

- 丙烯酸(分散体)

- PMMA

- 混合型(聚氨酯/聚脲(PU/PUA)、改质聚氨酯/沥青等)

- 透过使用

- 屋顶材料

- 墙

- 地下和隧道

- 其他用途(地板、阳台、走道、平台、水箱、饮用水箱、种植箱等)

- 按最终用途面积

- 住宅

- 商业的

- 产业

- 公共设施和基础设施

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ASEAN

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- Alchimica

- ARDEX Group

- Bostik

- Carlisle Companies Incorporated

- Fosroc Inc.

- GAF Materials LLC

- HB Fuller

- Holcim

- Johns Manville

- MAPEI SpA

- RPM INTERNATIONAL INC.

- Saint-Gobain

- Sika AG

- SOPREMA Group

第七章 市场机会与未来展望

The Liquid Applied Membrane Market was valued at USD 7.36 billion in 2025 and estimated to grow from USD 7.74 billion in 2026 to reach USD 9.97 billion by 2031, at a CAGR of 5.19% during the forecast period (2026-2031).

End-users continue shifting from roll goods to seamless coatings because the latter bridge cracks, tolerate movement, and deliver longer service life, all of which lower lifecycle costs. Infrastructure renewal programs in China, India, and the United States keep demand resilient, while stringent low-VOC rules in California, Canada, and the European Union tilt specifications toward water-borne chemistries. Architectural codes that reward cool roofs, photovoltaic integration, and green-roof assemblies further accelerate uptake. Manufacturers counter margin pressure by launching self-healing, PV-ready, and rapid-cure systems that cut downtime on congested job sites.

Global Liquid Applied Membrane Market Trends and Insights

Growing Usage of Waterproofing Membranes for Building Longevity

Owners now treat advanced coatings as capital assets that curb unplanned repairs. Oak Ridge National Laboratory estimates that extending commercial roof life by just five years could trim United States disposal costs by USD 2.5 billion annually while cutting landfill volume. Liquid systems such as MAPEI's Mapelastic AquaDefense bridge cracks up to 3.2 mm and remain flexible under thermal cycling, making them attractive in seismic zones. Insurance carriers have begun offering premium discounts when owners specify long-life membranes, adding a financial incentive that reinforces adoption.

Cost-Effective Retrofitting for Aging Roofs in Mature Economies

In Canada, SOPREMA resurfaced the CF Champlain shopping center roof, slicing material spend 45% and shortening construction schedules 35% versus full tear-off, all while extending service life another 25 years. Because coatings conform to irregular substrates, contractors avoid disruptive deck removal, allowing malls, hospitals, and schools to stay open. Resurfacing also reduces waste disposal volume and embodied carbon, helping facilities teams achieve ESG goals without large cap-ex budgets.

Availability of Sheet and Prefabricated Membranes

Thermoplastic rolls such as TPO retain a labor-speed edge on wide-open logistics buildings, enabling contractors to install over 900 m2 per shift. Manufacturers responded to coating growth by launching self-adhered sheets that reduce torch risk, eroding one differentiator of liquids. Nonetheless, liquids hold strong in complex penetrations, vertical transitions, and occupied retrofits where flame-free work is mandatory.

Other drivers and restraints analyzed in the detailed report include:

- Infrastructure Boom in Asia-Pacific and Africa

- Regulations Mandating VOC-Free Solutions

- Applicator Skill Shortages in Emerging Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Bituminous coatings accounted for 30.10% of the liquid-applied membranes market share in 2025, reflecting decades of field data and low unit cost. Polyurethane led value growth at a 6.24% CAGR, supported by elastomeric performance that tolerates solar modules, cool-roof pigments, and movement joints without embrittlement.

Acrylic dispersions gain traction in refurbishments because crews can apply them with rollers and clean up using water. PMMA fills high-traffic balconies and stadium concourses where rapid 30-minute cure delivers schedule certainty. Hybrid chemistries such as polyurethane-bitumen blends and polyurea-modified elastomers address niche demands for ultra-fast return-to-service or cold-weather application, expanding design flexibility for specifiers.

The Liquid-Applied Membranes Report is Segmented by Type (Cementitious, Bituminous, Polyurethane, Polyurea, Acrylic, and More), Application (Roofing, Walls, Underground and Tunnels, and Other Applications), End-User Sector (Residential, Commercial, Industrial, and Institutional and Infrastructure), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 52.70% of 2025 global revenue and is expected to climb at a 6.65% CAGR through 2031. Chinese metro extensions, Indian smart-city corridors, and ASEAN flood-control tunnels collectively require hundreds of millions of square meters of waterproofing. Local developers increasingly demand EN 14891 and GB 50108 compliance, pushing imports to upgrade testing certificates.

North America represents a mature but opportunity-rich arena dominated by reroofing. U.S. municipalities expand cool-roof rebates, while Canada's federal VOC rule effective 2025 accelerates water-borne technology penetration. Mexico's Coatzacoalcos immersed-tube tunnel specified GCP's Integritank system for seamless corrosion protection, underscoring regional competence in complex projects.

Europe's renovation wave centers on decarbonization, with Germany's BEG subsidy requiring airtightness upgrades that often incorporate fluid air-barriers. Georgia's adoption of EU VOC caps signals regulatory harmonization eastward. Middle East and Africa present high growth but challenging climatic extremes; Dubai's Expo City parks selected aliphatic polyurea to survive 45 °C summers without chalking.

- Alchimica

- ARDEX Group

- Bostik

- Carlisle Companies Incorporated

- Fosroc Inc.

- GAF Materials LLC

- HB Fuller

- Holcim

- Johns Manville

- MAPEI SpA

- RPM INTERNATIONAL INC.

- Saint-Gobain

- Sika AG

- SOPREMA Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Usage of Waterproofing Membranes for Building Longevity

- 4.2.2 Cost-Effective Retrofitting for Aging Roofs in Mature Economies

- 4.2.3 Infrastructure Boom in APAC And Africa

- 4.2.4 Regulations Mandating VOC-Free Solutions

- 4.2.5 Rapid Adoption of PV-Ready Liquid Roof Skins

- 4.3 Market Restraints

- 4.3.1 Availability of Sheet and Prefabricated Membranes

- 4.3.2 Volatile Petrochemical Feedstock Prices

- 4.3.3 Applicator Skill Shortages in Emerging Markets

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Cementitious

- 5.1.2 Bituminous

- 5.1.3 Polyurethane

- 5.1.4 Polyurea

- 5.1.5 Acrylic (Dispersion)

- 5.1.6 PMMA

- 5.1.7 Hybrid (polyurethane/polyurea (PU/PUA), modified polyurethane-bituminous, etc.)

- 5.2 By Application

- 5.2.1 Roofing

- 5.2.2 Walls

- 5.2.3 Underground and Tunnels

- 5.2.4 Other Applications (Floors, Balconies, Walkways, Podiums, Tanks, Potable Water Tanks, Planter Boxes, etc.)

- 5.3 By End-use Sector

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial

- 5.3.4 Institutional and Infrastructure

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Alchimica

- 6.4.2 ARDEX Group

- 6.4.3 Bostik

- 6.4.4 Carlisle Companies Incorporated

- 6.4.5 Fosroc Inc.

- 6.4.6 GAF Materials LLC

- 6.4.7 HB Fuller

- 6.4.8 Holcim

- 6.4.9 Johns Manville

- 6.4.10 MAPEI SpA

- 6.4.11 RPM INTERNATIONAL INC.

- 6.4.12 Saint-Gobain

- 6.4.13 Sika AG

- 6.4.14 SOPREMA Group

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment