|

市场调查报告书

商品编码

1910467

雷射:市场份额分析、行业趋势和统计数据、成长预测(2026-2031)Lasers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

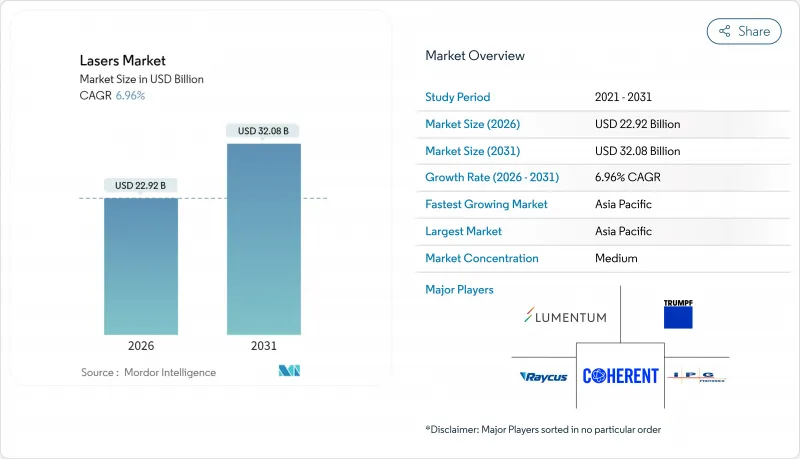

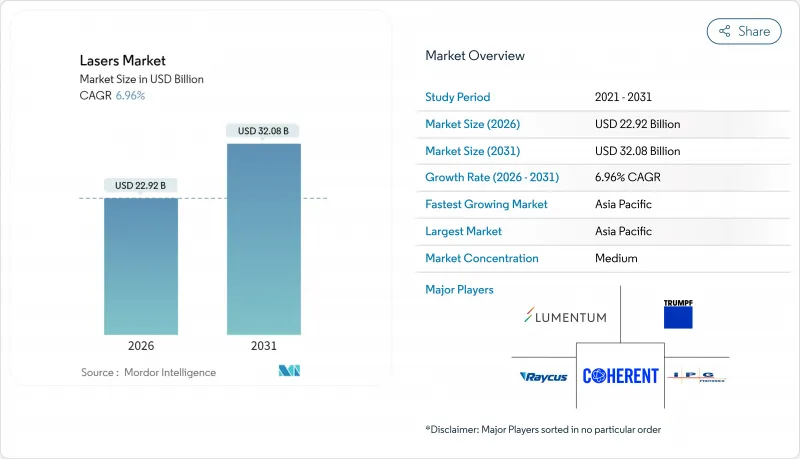

预计雷射市场将从 2025 年的 214.3 亿美元成长到 2026 年的 229.2 亿美元,预计到 2031 年将达到 320.8 亿美元,2026 年至 2031 年的复合年增长率为 6.96%。

这一增长反映了雷射技术在精密微加工、积层製造、自动驾驶和下一代显示器生产等领域的日益普及。用于加工10奈米以下半导体微结构的超快脉衝光源和用于切割厚金属板的千瓦级光纤系统,如今已成为大批量生产工厂的主流设备。政府资助的光电丛集正在加速亚太地区的生态系统发展,而用于积层製造的雷射则正在减少航太零件的材料浪费并缩短生产週期。儘管镓、锗和磷化铟基板的供应链风险仍然是一大阻力,但温度控管和光束合成架构的创新不断提高可实现功率输出的上限。

全球雷射市场趋势与洞察

半导体后端封装领域对高精度微加工的需求激增

扇出型晶圆级封装和玻璃通孔製程要求使用飞秒准分子雷射器,其特征尺寸小于10微米,脉衝间能量偏差小于1%,从而确保在300毫米晶圆上形成均匀的通孔。以雷射成型的微凸点取代焊线可将互连电阻降低40%,为3D晶片堆迭铺路。光束整形模组的同步和原位监测可提高产量比率并减少大批量晶圆厂的废品率。亚太地区的晶圆代工厂持续采购承包雷射工作站,显着推动了对超快光源供应商的需求。随着封装生产线节拍时间的缩短,对更高重复频率的需求预计将会增加,从而推高高阶超快雷射的平均售价。

雷射增材製造技术在航太高温合金零件的应用日益广泛

目前,领先的航太製造商正在对粉末层熔融光纤雷射进行认证,用于加工钛铝合金和镍基高温合金,材料利用率超过95%,远超切割製程。动态光束整形技术可将成型週期缩短40%,能耗降低60%,同时维持对飞机设备至关重要的微观结构完整性。修订后的AS9100标准明确提及雷射列印零件,简化了认证流程。美国和欧洲的引擎计画越来越多地采用「列印优先」的外形设计,这些外形无法透过机械加工经济地实现。这种转变正在推动雷射技术的需求,同时,宽体机队更新和计划于2020年代末投入使用的超音速推进计划也推动了这项需求的成长。

高品质砷化镓/磷化铟外延晶片持续短缺

镓和锗出口限制的收紧加剧了化合物半导体基板的短缺,而这些基板对于高功率雷射二极体至关重要。不同批次基板导热係数的差异迫使雷射製造商延长重新认证週期,导致出货延迟和库存积压增加。儘管北美和欧洲的新兴企业正在规划建造新的晶体生长工厂,但设备前置作业时间和製程技术取得意味着实际的大规模生产不太可能在2027年或之后开始。高昂的基板价格正以两位数的速度推高元件成本,尤其是对于工作在高结温下的雷射雷达和通讯雷射而言。製造商正在尝试使用硅基中间基板来补充现有的外延晶圆供应,但性能损失仍然十分显着。

细分市场分析

光纤雷射器凭藉其卓越的光束品质、全光纤结构和极低的维护成本,预计到2025年将占据全球雷射市场41.40%的份额。然而,由于定向能量武器和核融合实验需要兆瓦级的光链路,固体雷射平台预计将在2031年之前以9.18%的复合年增长率实现最快成长。受国防资金投入趋势的影响,预计2031年,全球固体雷射元件市场规模将超过56.2亿美元。将板状增益介质连接到铠装光纤传输线的混合配置有助于克服单根光纤的功率限制,同时保持亮度。二氧化碳光源在厚板切割领域仍占有一席之地,而二极体雷射则在泵浦阵列和直写应用中不断扩展。准分子雷射和紫外线雷射对于100奈米以下的半导体微影术至关重要,即使在代工厂资本支出週期性波动的情况下,也能维持稳定的需求。

对分散式增益架构的持续研究有望在不引起热致模式不稳定性的情况下实现功率扩展。虽然自由电子雷射和量子级联技术目前仍占据小众光谱区域,但紧凑型加速器架构的突破最终可能使中红外线波段惠及大众。基于IEC 60825-1的安全标准规定了机壳设计,并影响高度自动化工厂的总安装成本。随着应用边界的日益模糊,能够将光纤的可靠性与固体雷射器的优势相结合的供应商有望占据主导地位。

至2025年,材料加工领域将占全球雷射市场的30.10%,涵盖汽车、航太和一般工业领域的切割、焊接、钻孔和积层製造流程。然而,感测器(尤其是光达和光谱模组)的普及预计将在未来十年内缩小这一差距,复合年增长率将达到8.58%。重工业订单仍有週期性波动,但现有工厂的维修项目支撑着基准需求。同时,受门诊手术兴起的推动,医疗和美容雷射市场正经历稳定成长。门诊手术的特点是微创和恢復快。

光刻技术的支出依赖大型代工厂先进製程节点的量产,每台极紫外线(EUV)扫描仪都整合了多个高重复频率准分子光源。下一代显示器依靠超快速修復技术来维持产量比率,预计将提高面板的利润率。军方采购用于反无人机系统的高能係统正在推动需求波动,同时,公共部门也正在增加对基础光学研究的投入。边缘和云端资料中心的激增正在推动光连接模组需求,从而促进通讯雷射的出货量成长,并增强全球雷射市场的应用多样性。

区域分析

预计到2025年,亚太地区将占全球雷射市场46.40%的份额,并在2031年之前以8.17%的复合年增长率成长。这主要得益于高密度半导体晶圆厂、快速成长的显示器生产线以及政府支持的光电园区。中国在先进光刻节点准分子雷射和超快雷射的采购方面主导,而日本正在升级对光束品质要求更高的精密加工应用。韩国的OLED和microLED生产线保持着高运转率,支撑了持续的雷射维护合约。印度的生产挂钩激励措施鼓励工具机製造商实现雷射切割和焊接能力的本地化,从而扩大了潜在需求。台湾和新加坡分别以其化合物丛集和精密工程产业丛集贡献了细分市场需求。

北美保持第二的位置,这得益于航太生产和兆瓦级定向能係统国防合约的快速成长。在美国,美国製造计画(Manufacturing USA)下属的光电中心正在扶持整合光电和量子级联设计领域的Start-Ups。加拿大材料科学实验室正与当地加工中心合作,展示雷射覆层和硬化工艺。墨西哥的电动车走廊正在推进电池托盘光纤雷射焊接的大规模生产。儘管美墨加协定(USMCA)的协调有望改善跨境供应链,但出口管制限制了高功率设备向某些地区的出口。环境监测法规也刺激了国内对中红外线气体检测模组的需求。

在欧洲,德国机械巨头和法国国防整合商在推进高能量研究雷射方面发挥重要作用。英国正致力于利用雷射消熔进行航太复合材料加工,以最大限度地减少分层缺陷;一家义大利超级跑车製造商则采用多千瓦级碟片雷射高效焊接铝製底盘。欧盟范围内的法规,包括机械指令和IEC 60825-1标准,都对出口系统的安全性提出了要求。像DioHELIOS这样的合作项目,透过汇集二极体雷射专业知识并推动经济高效规模化生产的联盟,展现了欧洲对核融合能源实行技术的承诺。不断扩展的绿色氢能倡议也推动了全部区域对雷射切割和管道焊接技术的兴趣。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 半导体后端封装领域对高精度微加工的需求激增

- 雷射增材製造技术在航太高温合金零件製造的应用日益广泛

- 自动驾驶系统中雷射雷达雷射的应用日益广泛

- 超快雷射在下一代OLED和MicroLED显示器修復的应用拓展

- 政府资助的光电丛集推动区域製造业生态系发展

- 用于钣金切割的千瓦级光纤雷射的性价比迅速提高

- 市场限制

- 高品质砷化镓/磷化铟外延晶片持续供不应求

- 出口管制制度限制向某些国家出口高功率雷射。

- 30kW以上功率的温度控管挑战限制了切割厚度蓝图

- 分散的安全标准增加了原始设备製造商的认证成本。

- 价值链分析

- 技术展望

- 监管环境

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 依雷射类型

- 光纤雷射

- 二极体雷射

- 二氧化碳雷射

- 固体雷射

- 准分子雷射与紫外线雷射器

- 其他类型(量子级联、自由电子)

- 透过使用

- 材料加工(切割、焊接、钻孔)

- 通讯和光连接模组

- 医疗美容领域

- 光刻和半导体计量

- 军事/国防

- 显示器(有机发光二极体、微型发光二极体、投影式)

- 感测器(光达、光谱仪)

- 印刷和标记

- 透过输出

- 低功率(小于1千瓦)

- 中功率(1-3千瓦)

- 高功率(3kW 或以上)

- 按操作模式

- 连续波(CW)

- 脉衝(奈秒、皮秒、飞秒)

- 按最终用户行业划分

- 电子和半导体

- 车

- 工业机械

- 卫生保健

- 航太/国防

- 研究和学术机构

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 亚太其他地区

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

- 非洲

- 南非

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Coherent Corp.

- IPG Photonics Corporation

- TRUMPF SE+Co. KG

- nLIGHT, Inc.

- Lumentum Holdings Inc.

- Jenoptik AG

- Novanta, Inc.

- Lumibird SA

- Wuhan Raycus Fiber Laser Technologies Co. Ltd

- Hans Laser Technology Industry Group Co., Ltd.

- Maxphotonics Co., Ltd.

- Keyence Corporation

- EKSPLA UAB

- MKS Instruments, Inc.(Spectra-Physics)

- Panasonic Corporation

- EdgeWave GmbH

- Civan Lasers Ltd.

- Synrad Laser Division

- Amonics Ltd.

- TOPTICA Photonics AG

第七章 市场机会与未来展望

The lasers market is expected to grow from USD 21.43 billion in 2025 to USD 22.92 billion in 2026 and is forecast to reach USD 32.08 billion by 2031 at 6.96% CAGR over 2026-2031.

This expansion reflects rising deployment across precision micromachining, additive manufacturing, autonomous mobility, and next-generation display production. Ultrafast pulse sources that machine sub-10 nm semiconductor features and kW-class fiber systems that cut thicker metal sheets are now mainstream in high-volume factories. Government-funded photonics clusters accelerate ecosystem development in Asia-Pacific, while additive manufacturing lasers lower material waste in aerospace components and shorten production cycles. Supply chain risks around gallium, germanium, and indium phosphide substrates remain a headwind, yet innovations in thermal management and beam-combining architectures continue to raise attainable power ceilings.

Global Lasers Market Trends and Insights

Surging Demand for High-Precision Micromachining in Semiconductor Back-End Packaging

Fan-Out Wafer Level Packaging and Through-Glass Via processes specify femtosecond and excimer sources that deliver sub-10 µm features with under-1% pulse-to-pulse energy deviation, ensuring uniform via formation across full 300 mm wafers. Replacing wire bonding with laser-formed micro-bumps reduces interconnect resistance by 40% and opens the path to three-dimensional chip stacks. Beam-shaping modules synchronized with in-situ monitoring raise yield and lower scrap rates in high-volume fabs. Asia-Pacific foundries continue to procure turnkey laser stations, creating a substantial pull on ultrafast source suppliers. As packaging line takt times tighten, demand for even higher repetition rates is expected to lift average selling prices in the premium ultrafast tier.

Growing Adoption of Additive Manufacturing Lasers for Aerospace Super-Alloy Parts

Aerospace primes now qualify powder-bed-fusion fiber lasers that process titanium aluminide and nickel super-alloys at material utilization rates above 95%, sharply outperforming subtractive machining. Dynamic beam shaping shortens build cycles by 40% and lowers energy consumption by 60%, while maintaining microstructure integrity critical for flight hardware. AS9100 revisions explicitly reference laser-printed parts, simplifying certification workflows. U.S. and European engine programs increasingly design for "print-first" geometries that cannot be machined economically. The shift ties laser demand to wide-body fleet renewal and hypersonic propulsion projects scheduled for late-decade entry into service.

Persistent Shortages of High-Grade Gallium Arsenide/Indium Phosphide Epi-Wafers

Export curbs on gallium and germanium intensify the scarcity of compound semiconductor substrates vital for high-power laser diodes. Variability in thermal conductivity across lots forces laser makers into lengthy re-qualification cycles, delaying shipments and elevating inventory buffers. Start-ups in North America and Europe plan new crystal-growth fabs, but tooling lead times and process know-how push meaningful volumes past 2027. Premium substrate pricing inflates the bill of materials by double digits, particularly for LiDAR and telecom lasers operating at elevated junction temperatures. Manufacturers are experimenting with silicon-based interposers to stretch the existing epi-wafer supply, yet performance penalties remain non-trivial.

Other drivers and restraints analyzed in the detailed report include:

- Rising Installation of LiDAR Lasers in Autonomous Mobility Stacks

- Expanding Use of Ultrafast Lasers for Next-Gen OLED and Micro-LED Display Repair

- Export-Control Regimes Limiting High-Power Laser Shipments to Certain Countries

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fiber lasers held 41.40% of the global lasers market in 2025 thanks to robust beam quality, all-fiber architectures, and minimal service needs. Solid-state platforms, however, register the swiftest 9.18% CAGR to 2031 as directed-energy weapons and fusion experiments demand multi-megawatt optical chains. The global lasers market size for solid-state devices is projected to cross USD 5.62 billion by 2031, reflecting defense funding pipelines. Hybrid configurations that splice slab gain media into armored fiber delivery lines help transcend single-fiber power ceilings while preserving brightness. CO2 sources persist in thick-section cutting, whereas diode lasers expand in pump arrays and direct-write applications. Excimer and UV variants remain indispensable in sub-100 nm semiconductor lithography, anchoring steady demand despite cyclical foundry capex.

Ongoing research into distributed-gain architectures promises power scaling without thermally induced mode instabilities. Free-electron and quantum cascade technologies still occupy niche spectroscopy realms, but breakthroughs in compact accelerator structures could eventually democratize mid-infrared access. Safety compliance under IEC 60825-1 shapes enclosure designs, influencing total landed cost in high-automation factories. Vendors that fuse fiber reliability with solid-state punch position themselves to capture outsized share as application boundaries blur.

Materials processing retained a 30.10% share of the global lasers market in 2025, spanning cutting, welding, drilling, and additive build processes across automotive, aerospace, and general industry. Yet sensor deployments, notably LiDAR and spectroscopy modules, post an 8.58% CAGR, poised to narrow the gap by decade-end. Heavy-industry orders remain cyclical, but retrofit programs in brownfield plants sustain baseline volume. In parallel, medical and aesthetic lasers harvest incremental growth from outpatient procedures that favor low invasiveness and quick recovery.

Lithography expenditures hinge on advanced-node ramps at the top foundries, with each EUV scanner embedding multiple high-repetition excimer sources. Next-generation displays rely on ultrafast repair to maintain yield, unlocking higher panel profit margins. Military procurement of high-energy systems for counter-UAS duties injects lumpiness but also elevates public-sector funding for fundamental optics research. As edge and cloud data centers mushroom, optical interconnect demand boosts telecom laser volumes, reinforcing the application mix diversity within the global lasers market.

The Lasers Market Report is Segmented by Laser Type (Fiber Lasers, Diode Lasers, and More), Application (Materials Processing, and More), Power Output (Low-Power, Medium-Power, High-Power), Mode of Operation (Continuous-Wave, Pulsed), End-User Industry (Electronics and Semiconductor, and More), and Geography (North America, South America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific controlled 46.40% of the global lasers market in 2025 and is projected to compound at 8.17% CAGR to 2031, propelled by dense semiconductor fabs, burgeoning display lines, and state-backed photonics parks. China leads excimer and ultrafast procurement for advanced lithography nodes, while Japan refines precision machining applications that demand superior beam quality. South Korea's OLED and micro-LED lines maintain high utilization, feeding sustained laser service contracts. India's Production-Linked Incentive schemes entice machine-tool makers to localize laser cutting and welding capacities, widening addressable demand. Taiwan and Singapore contribute niche volumes from compound semiconductor and precision engineering clusters, respectively.

North America ranks second, buoyed by aerospace build rates and defense contracts for megawatt-class directed-energy systems. U.S. photonics hubs under the Manufacturing USA umbrella foster start-up formation in integrated photonics and quantum cascade designs. Canada's materials-science institutes partner with local machine shops to trial laser cladding and hardening, while Mexico's electric-vehicle corridor scales fiber-laser welding for battery trays. Cross-border supply chains benefit from USMCA harmonization, though export controls constrain outbound shipments of high-power units to certain destinations. Environmental-monitoring mandates also spur domestic demand for mid-infrared gas-sensing modules.

Europe holds notable share through Germany's machinery giants and France's defense integrators that champion high-energy research lasers. The United Kingdom pursues aerospace composites processing with laser ablation to minimize delamination defects, and Italy's super-car makers adopt multi-kW disk lasers to weld aluminum chassis efficiently. EU-wide regulations, including the Machinery Directive and IEC 60825-1 alignment, shape safety features embedded in export-grade systems. Collaborative programs like DioHELIOS illustrate Europe's focus on fusion-energy enablers, with consortiums pooling diode-laser expertise to drive cost-effective scaling. Growing green-hydrogen initiatives further elevate interest in laser-based plate cutting and pipe welding across the region.

- Coherent Corp.

- IPG Photonics Corporation

- TRUMPF SE + Co. KG

- nLIGHT, Inc.

- Lumentum Holdings Inc.

- Jenoptik AG

- Novanta, Inc.

- Lumibird SA

- Wuhan Raycus Fiber Laser Technologies Co. Ltd

- Hans Laser Technology Industry Group Co., Ltd.

- Maxphotonics Co., Ltd.

- Keyence Corporation

- EKSPLA UAB

- MKS Instruments, Inc. (Spectra-Physics)

- Panasonic Corporation

- EdgeWave GmbH

- Civan Lasers Ltd.

- Synrad Laser Division

- Amonics Ltd.

- TOPTICA Photonics AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging demand for high-precision micromachining in semiconductor back-end packaging

- 4.2.2 Growing adoption of additive manufacturing lasers for aerospace super-alloy parts

- 4.2.3 Rising installation of LiDAR lasers in autonomous mobility stacks

- 4.2.4 Expanding use of ultrafast lasers for next-gen OLED and micro-LED display repair

- 4.2.5 Government-funded photonics clusters driving regional manufacturing ecosystems

- 4.2.6 Rapid price/performance improvements in kW-class fiber lasers for sheet-metal cutting

- 4.3 Market Restraints

- 4.3.1 Persistent shortages of high-grade gallium arsenide/indium phosphide epi-wafers

- 4.3.2 Export-control regimes limiting high-power laser shipments to certain countries

- 4.3.3 Thermal-management challenges above 30 kW limiting cutting-thickness roadmap

- 4.3.4 Fragmented safety standards increasing certification costs for OEMs

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Laser Type

- 5.1.1 Fiber Lasers

- 5.1.2 Diode Lasers

- 5.1.3 CO2 Lasers

- 5.1.4 Solid-State Lasers

- 5.1.5 Excimer and Ultraviolet Lasers

- 5.1.6 Other Types (Quantum Cascade, Free-Electron)

- 5.2 By Application

- 5.2.1 Materials Processing (Cutting, Welding, Drilling)

- 5.2.2 Communications and Optical Interconnects

- 5.2.3 Medical and Aesthetic

- 5.2.4 Lithography and Semiconductor Metrology

- 5.2.5 Military and Defense

- 5.2.6 Displays (OLED, Micro-LED, Projection)

- 5.2.7 Sensors (LiDAR, Spectroscopy)

- 5.2.8 Printing and Marking

- 5.3 By Power Output

- 5.3.1 Low-Power (Less than 1 kW)

- 5.3.2 Medium-Power (1-3 kW)

- 5.3.3 High-Power (More than 3 kW)

- 5.4 By Mode of Operation

- 5.4.1 Continuous-Wave (CW)

- 5.4.2 Pulsed (ns, ps, fs)

- 5.5 By End-User Industry

- 5.5.1 Electronics and Semiconductor

- 5.5.2 Automotive

- 5.5.3 Industrial Machinery

- 5.5.4 Healthcare

- 5.5.5 Aerospace and Defense

- 5.5.6 Research and Academia

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Coherent Corp.

- 6.4.2 IPG Photonics Corporation

- 6.4.3 TRUMPF SE + Co. KG

- 6.4.4 nLIGHT, Inc.

- 6.4.5 Lumentum Holdings Inc.

- 6.4.6 Jenoptik AG

- 6.4.7 Novanta, Inc.

- 6.4.8 Lumibird SA

- 6.4.9 Wuhan Raycus Fiber Laser Technologies Co. Ltd

- 6.4.10 Hans Laser Technology Industry Group Co., Ltd.

- 6.4.11 Maxphotonics Co., Ltd.

- 6.4.12 Keyence Corporation

- 6.4.13 EKSPLA UAB

- 6.4.14 MKS Instruments, Inc. (Spectra-Physics)

- 6.4.15 Panasonic Corporation

- 6.4.16 EdgeWave GmbH

- 6.4.17 Civan Lasers Ltd.

- 6.4.18 Synrad Laser Division

- 6.4.19 Amonics Ltd.

- 6.4.20 TOPTICA Photonics AG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment