|

市场调查报告书

商品编码

1910900

印度雷射市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031)India Laser - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

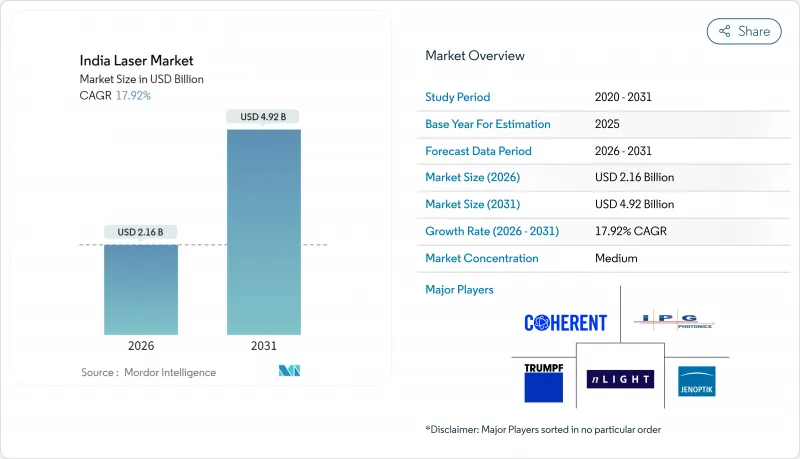

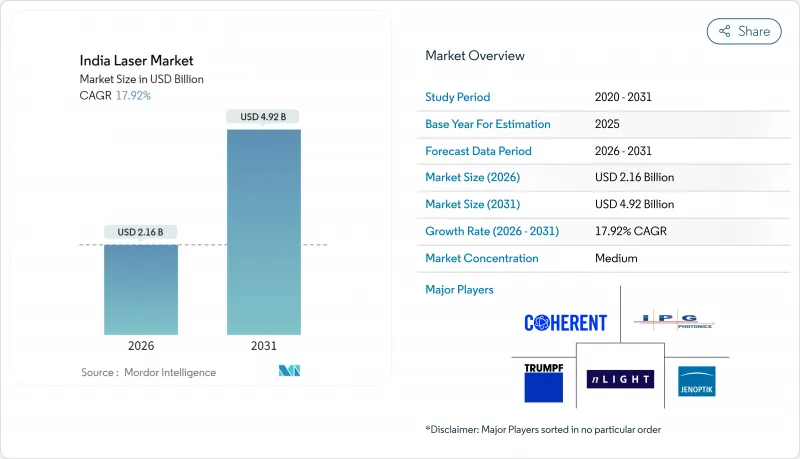

印度雷射市场规模预计到 2026 年将达到 21.6 亿美元,高于 2025 年的 18.3 亿美元。

预计到 2031 年将达到 49.2 亿美元,2026 年至 2031 年的复合年增长率为 17.92%。

政府的生产关联激励计划(PLI)、对半导体代工厂的财政支持以及不断扩大的工业自动化生产线装机量支撑了这一增长前景。丛集式电子製造业的蓬勃发展、电动车电池焊接需求的激增以及政策主导的进口雷射设备税收优惠,都有助于扩大客户群。大型终端用户正从传统的CO2和Nd:YAG系统转向高功率光纤平台以提高产能,而中小型製造商则利用雷射加工服务供应商来克服资金障碍。国际供应商正在深化售后支援的本地化,而国内製造商则正在引进垂直整合的设备,从而加强技术在工程中心的扩散。

印度雷射市场趋势与洞察

国内电子製造群快速发展

预计到2025年,电子产品生产规模将达到11兆印度卢比(约1320亿美元),比过去十年增长五倍。元件级支援措施正在助力本地电阻器和电容器生产线的发展。位于古吉拉突邦和泰米尔纳德邦霍苏尔-奥拉加达姆的丛集缩短了物流週期,实现了雷射切割和打标的即时服务。中小企业透过合作车间获得了经济机会,大型原始设备製造商(OEM)则正在整合多千瓦光纤工作台,用于底盘修整和机壳焊接。服务密度的提高减少了停机时间,并推动了高功率的升级。因此,各市场对中高功率光纤光源的需求正稳定成长。

电动车和电池生产线的快速普及

预计到2030年,锂离子电池的需求量将超过500GWh,因此,原始设备製造商(OEM)正在采用微秒脉衝光纤焊接机进行铜铝连接。像Light Mechanics这样的国内整合商正在引进用于连接圆柱形、棱柱形和软包电池的承包焊接设备,从而有助于加强本地供应链。一级汽车供应商正在采用雷射汇流排焊接技术来减少气孔并提高电气完整性。合约电池组装正在增加对3-6kW扫描器的资本投资,从而形成培训和服务基础设施的良性循环,并扩大印度雷射市场的基本客群。

高功率光纤雷射需要高额资本投入

入门级1-6kW切割机的起价为400万印度卢比(约480万日圆),而30kW一体化生产线的价格可高达4,000万印度卢比(约4,800万日圆)。印度6,300万家微型、小型和微企业(MSME)往往缺乏足够的抵押品来支付这些费用,并且由于冷却和排烟设备的额外成本,它们还面临着整体支出增加高达50%的挑战。虽然租赁和共用产能模式正在促进技术的普及,但农村地区的普及速度落后于大城市,这限制了印度雷射市场近期的扩张。

细分市场分析

预计到2025年,光纤平台将占据印度雷射市场40.95%的份额,凭藉其即插即用、高效节能和低维护成本的优势,进一步扩大领先地位。超高速光纤雷射预计将以18.45%的复合年增长率快速成长,加速其在玻璃穿孔和医用支架加工领域的应用。二氧化碳雷射在包装和皮革行业仍然占据重要地位,而固体DPSS雷射头则满足了对特定波长的需求。准分子雷射和紫外线雷射被用于晶圆切割,但成本仍然是一大挑战。本地原始设备製造商(OEM)正利用技术发展委员会(TDB)的津贴在国内生产机架,同时从IPG和TRUMPF采购雷射引擎,从而建造混合价值链。这种机制加速了技术转移,并提高了印度雷射市场每台安装设备的光纤含量。

二次整合商正将二极体和直接半导体发光二极体整合到紧凑型编码器中,用于快速消费品生产线,从而降低了中小企业的进入门槛。光束品质的提升拓宽了薄合金切割的应用范围,进一步巩固了光纤雷射的成长动能。销售时提供的年度维护合约日益普及,确保了客户的设备运作,进一步强化了光纤雷射的优势。

到2025年,功率超过100瓦的系统将占总收入的51.15%,这主要得益于汽车和铁路车辆製造商对厚板加工的需求。预计随着基础设施建设的推进,印度此类雷射的市场规模将呈现复合成长。功率低于1瓦的低功率雷射正以18.87%的复合年增长率增长,这主要得益于医疗保健生产责任保险政策,该政策支持用于心血管植入的微切割工作台。功率在1-100瓦中功率雷射仍然是珠宝饰品、行动电话机壳和铭牌雕刻领域的主力。

SLTL集团提供从20W打标机到60kW龙门焊接机的丰富产品线,实现了单一品牌下的可扩展性。功率高达2kW的手持式焊接机将进入钣金加工领域,使以往需要氩弧焊接机才能完成的现场维修成为可能。这种功率等级的普及将鼓励用户根据自身规模逐步采用,从而深化市场。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 国内电子製造群快速发展

- 电动车和电池生产线的快速普及

- 降低雷射设备进口商品及服务税(GST)(自2024财年起)

- 政府对半导体製造厂的奖励措施

- 印度南部航太MRO走廊

- 医疗设备出口关联生产关联激励计画 (PLI)

- 市场限制

- 高功率光纤雷射的高资本投资成本

- 卢比兑美元/人民币汇率波动

- 熟练雷射操作人员短缺

- 光电元件清关延误

- 产业价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依雷射类型

- 光纤雷射

- 固体雷射(Nd:YAG、DPSS 等)

- 二氧化碳雷射

- 二极体/直接半导体雷射器

- 准分子/紫外线雷射

- 超快光纤雷射

- 其他雷射类型

- 透过输出

- 低功率(小于1瓦)

- 中功率(1-100瓦)

- 高功率(超过100瓦)

- 透过使用

- 材料加工(切割、焊接、打标)

- 通讯和光学储存

- 医疗美容

- 测量

- 国防与安全

- 研究与开发

- 家用电子电器

- 其他用途

- 按最终用户行业划分

- 车

- 航太与国防

- 电子和半导体行业

- 卫生保健

- 电讯

- 研究所

- 其他终端用户产业

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- IPG Photonics Corporation

- Coherent Corp.

- TRUMPF SE+Co. KG

- nLIGHT, Inc.

- Jenoptik AG

- Lumentum Holdings Inc.

- MKS Instruments, Inc.(Spectra-Physics)

- Han's Laser Technology Industry Group Co., Ltd.

- Wuhan Raycus Fiber Laser Technologies Co., Ltd.

- Synrad Inc.(Novanta Inc.)

- SPI Lasers UK Ltd.

- Laserline GmbH

- Maxphotonics Co., Ltd.

- EKSPLA UAB

- EdgeWave GmbH

- Toptica Photonics AG

- Amplitude Laser Group(Amplitude SAS)

- Light Conversion UAB

- Bystronic Laser AG

- Litron Lasers Ltd.

- HUBNER Photonics GmbH

- Epilog Corporation

- Universal Laser Systems, Inc.

- JPT Opto-electronics Co., Ltd.

- IPG Laser India Pvt. Ltd.

- Sahajanand Laser Technology Ltd.(SLTL Group)

第七章 市场机会与未来展望

India Laser Market size in 2026 is estimated at USD 2.16 billion, growing from 2025 value of USD 1.83 billion with 2031 projections showing USD 4.92 billion, growing at 17.92% CAGR over 2026-2031.

The growth outlook is sustained by government production-linked incentive (PLI) schemes, fiscal support for semiconductor fabs, and a widening installed base of industrial automation lines. Surging cluster-based electronics manufacturing, fast-rising demand for electric-vehicle battery welding, and policy-driven tax relief on imported laser machines are expanding the total addressable customer pool. Large end users are upgrading from legacy CO2 and Nd: YAG systems to high-power fiber platforms to improve throughput, while small manufacturers tap contract laser service providers to overcome capital barriers. International vendors deepen localization for after-sales support, and domestic builders introduce vertically integrated machines, together reinforcing technology diffusion across engineering hubs.

India Laser Market Trends and Insights

Surge in Domestic Electronics Manufacturing Clusters

Electronics output reached INR 11 lakh crore (USD 132 billion) in 2025 after a fivefold decade jump, and component-level schemes now underpin localized resistor and capacitor lines. Cluster concentration in Dholera (Gujarat) and the Hosur-Oragadam belt (Tamil Nadu) shortens logistics cycles, allowing just-in-time laser cutting and marking services. Small firms gain economical access through shared job-shops, while large OEMs integrate multi-kilowatt fiber benches for chassis trimming and enclosure welding. Service density lowers downtime, thus incentivizing higher-power upgrades. The outcome is steady demand acceleration for mid- and high-power fiber sources across the market.

Rapid Adoption of EV and Battery Fabrication Lines

Lithium-ion cell demand above 500 GWh by 2030 pushes OEMs to specify micro-second pulsed fiber welders for copper and aluminum joints. Domestic integrators such as Light Mechanics deploy turnkey benches that join cylindrical, prismatic, and pouch cells, fostering local supply resilience. Automotive tier-1 vendors embrace laser-based busbar welding to cut porosity and raise electrical integrity. Contract battery assemblers expand capex on 3-6 kW scanners, feeding a virtuous loop of training and service infrastructure that broadens the India Laser Market customer base.

High Capex of High-Power Fiber Lasers

Entry-level 1-6 kW cutters start near INR 40 lakh (USD 480,000) and integrated 30 kW lines top INR 4 crore (USD 4.8 million). MSMEs, 63 million strong, often lack collateral for such outlays and face added costs for chillers and fume extractors that raise total spend by as much as 50%. Leasing and shared-capacity models ease adoption, but penetration in tier-2 hubs lags metro centers, tempering short-term expansion of the India Laser Market.

Other drivers and restraints analyzed in the detailed report include:

- Lower GST on Laser Machine Imports from FY-2024

- Government Incentives for Semiconductor Fabs

- Rupee Volatility vs. USD / CNY

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fiber platforms held 40.95% of the India Laser Market share in 2025, with the subsegment expected to widen its lead on the strength of wall-plug efficiency and low maintenance. Ultrafast fiber varieties post the fastest 18.45% CAGR, finding uptake in through-glass vias and medical stent machining. CO2 units stay relevant in packaging and leather, while solid-state DPSS heads meet niche wavelength needs. Excimer and UV lines serve wafer dicing but remain cost-sensitive. Domestic OEMs utilize Technology Development Board grants to indigenize gantries while sourcing IPG or TRUMPF engines, illustrating hybrid value chains. This arrangement accelerates knowledge transfer and elevates fiber content per installation within the India Laser Market.

Second-tier integrators bundle diode and direct semiconductor emitters into compact coders for FMCG lines, lowering entry barriers for SMEs. Improved beam quality widens application to thin-sheet alloy cutting, reinforcing fiber's trajectory. With annual service contracts increasingly bundled at sale, buyers secure uptime, further entrenching fiber dominance.

Systems above 100 W captured 51.15% of 2025 revenue as automotive and rail car builders demand thick-plate throughput. The India Laser Market size for this tier will compound inline with infrastructure buildouts. Low-power machines under 1 W surge at 18.87% CAGR on medical PLI tailwinds that favor micro-cutting benches for cardiovascular implants. Mid-power 1-100 W tools remain workhorses in jewelry, mobile handset casing, and nameplate engraving.

SLTL Group offers a spectrum from 20 W markers to 60 kW gantries, ensuring buyers scale within a single brand. Handheld welders up to 2 kW enter sheet-metal fabrication, enabling point-of-use repairs that previously required TIG setups. This democratization of power categories fosters layered adoption across user sizes, deepening the market.

The India Laser Market Report is Segmented by Laser Type (Fiber, Solid-State, CO2, Diode, Excimer/UV, Ultrafast Fiber, and More), Power Output (Low, Medium, and High), Application (Material Processing, Medical, Communication, Defense, R&D, Electronics, and More), End-User (Automotive, Healthcare, Electronics, Aerospace and Defense, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- IPG Photonics Corporation

- Coherent Corp.

- TRUMPF SE + Co. KG

- nLIGHT, Inc.

- Jenoptik AG

- Lumentum Holdings Inc.

- MKS Instruments, Inc. (Spectra-Physics)

- Han's Laser Technology Industry Group Co., Ltd.

- Wuhan Raycus Fiber Laser Technologies Co., Ltd.

- Synrad Inc. (Novanta Inc.)

- SPI Lasers UK Ltd.

- Laserline GmbH

- Maxphotonics Co., Ltd.

- EKSPLA UAB

- EdgeWave GmbH

- Toptica Photonics AG

- Amplitude Laser Group (Amplitude SAS)

- Light Conversion UAB

- Bystronic Laser AG

- Litron Lasers Ltd.

- HUBNER Photonics GmbH

- Epilog Corporation

- Universal Laser Systems, Inc.

- JPT Opto-electronics Co., Ltd.

- IPG Laser India Pvt. Ltd.

- Sahajanand Laser Technology Ltd. (SLTL Group)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in domestic electronics-manufacturing clusters

- 4.2.2 Rapid adoption of EV and battery fabrication lines

- 4.2.3 Lower GST on laser machine imports from FY-2024

- 4.2.4 Government incentives for semiconductor fabs

- 4.2.5 Aerospace MRO corridor in South India

- 4.2.6 Export-linked PLI for medical devices

- 4.3 Market Restraints

- 4.3.1 High capex of high-power fiber lasers

- 4.3.2 Rupee volatility vs. USD / CNY

- 4.3.3 Shortage of skilled laser operators

- 4.3.4 Delays in customs clearance of photonics components

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Laser Type

- 5.1.1 Fiber Laser

- 5.1.2 Solid-State Laser (Nd:YAG, DPSS etc.)

- 5.1.3 CO2 Laser

- 5.1.4 Diode / Direct Semiconductor Laser

- 5.1.5 Excimer / UV Laser

- 5.1.6 Ultrafast Fiber Laser

- 5.1.7 Other Laser Types

- 5.2 By Power Output

- 5.2.1 Low-Power (less than 1 W)

- 5.2.2 Medium-Power (1-100 W)

- 5.2.3 High-Power (above 100 W)

- 5.3 By Application

- 5.3.1 Material Processing (Cutting, Welding, Marking)

- 5.3.2 Communication and Optical Storage

- 5.3.3 Medical and Aesthetic

- 5.3.4 Instrumentation and Measurement

- 5.3.5 Defense and Security

- 5.3.6 Research and Development

- 5.3.7 Consumer Electronics

- 5.3.8 Other Applications

- 5.4 By End-User Industry

- 5.4.1 Automotive

- 5.4.2 Aerospace and Defense

- 5.4.3 Electronics and Semiconductors

- 5.4.4 Healthcare

- 5.4.5 Telecommunications

- 5.4.6 Research Institutions

- 5.4.7 Other End-User Industries

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 IPG Photonics Corporation

- 6.4.2 Coherent Corp.

- 6.4.3 TRUMPF SE + Co. KG

- 6.4.4 nLIGHT, Inc.

- 6.4.5 Jenoptik AG

- 6.4.6 Lumentum Holdings Inc.

- 6.4.7 MKS Instruments, Inc. (Spectra-Physics)

- 6.4.8 Han's Laser Technology Industry Group Co., Ltd.

- 6.4.9 Wuhan Raycus Fiber Laser Technologies Co., Ltd.

- 6.4.10 Synrad Inc. (Novanta Inc.)

- 6.4.11 SPI Lasers UK Ltd.

- 6.4.12 Laserline GmbH

- 6.4.13 Maxphotonics Co., Ltd.

- 6.4.14 EKSPLA UAB

- 6.4.15 EdgeWave GmbH

- 6.4.16 Toptica Photonics AG

- 6.4.17 Amplitude Laser Group (Amplitude SAS)

- 6.4.18 Light Conversion UAB

- 6.4.19 Bystronic Laser AG

- 6.4.20 Litron Lasers Ltd.

- 6.4.21 HUBNER Photonics GmbH

- 6.4.22 Epilog Corporation

- 6.4.23 Universal Laser Systems, Inc.

- 6.4.24 JPT Opto-electronics Co., Ltd.

- 6.4.25 IPG Laser India Pvt. Ltd.

- 6.4.26 Sahajanand Laser Technology Ltd. (SLTL Group)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment