|

市场调查报告书

商品编码

1910484

定向纤维板(OSB):市场占有率分析、产业趋势与统计、成长预测(2026-2031)Oriented Strand Board (OSB) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

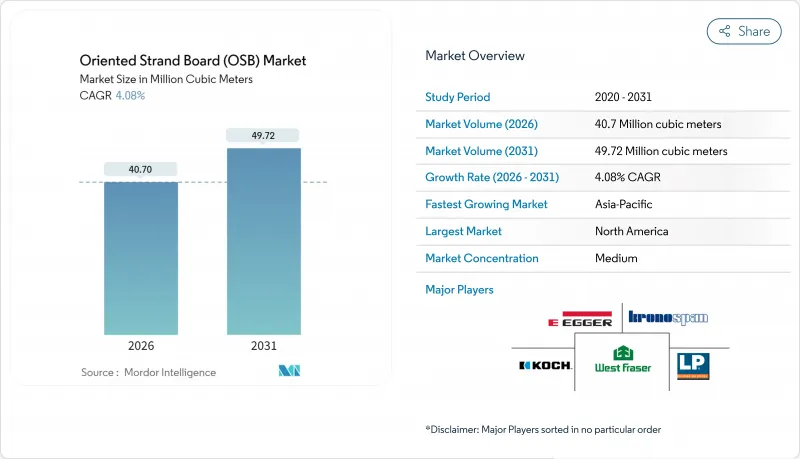

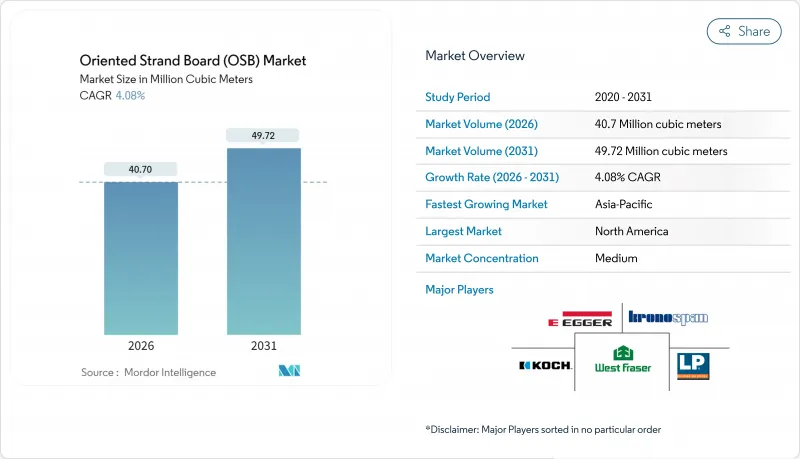

预计到 2026 年,定向纤维板(OSB) 市场规模将达到 4,070 万立方米,高于 2025 年的 3,910 万立方米。

预计到 2031 年将达到 4,972 万立方米,2026 年至 2031 年的复合年增长率为 4.08%。

这种稳定成长的趋势凸显了定向刨花板(OSB)相对于胶合板的成本优势、支援低碳材料的监管政策以及对製程自动化的投资如何共同推动了OSB市场需求的成长。成熟地区的建筑商正在追求营运效率的提升,而新兴经济体的政府则将基础设施建设资金投入工程木材领域,这些因素共同促进了OSB销售的健康成长。竞争的焦点集中在工厂自动化和等级创新上,威好公司(Weyerhaeuser)的AI赋能干燥优化技术便是数位化工具如何提高产量和下游板材品质的绝佳例证。

全球定向纤维板(OSB)市场趋势与洞察

比胶合板更经济实惠的替代品

製造商正透过利用刨花铺放软体和精准树脂计量技术来降低变动成本,从而不断缩小与软木胶合板的生产成本差距。路易斯安那太平洋公司2025年第一季定向刨花板(OSB)销售额达2.67亿美元,儘管现货价格下跌了11%,但出货量仍维持稳定。这表明,OSB市场正在消化因胶合板产能限製而导致的需求变化。可预测的板材价格有助于住宅确保预算的确定性,尤其是在木材价格每立方公尺波动超过100美元的情况下。因此,定向纤维板市场正在向传统上由胶合板主导的室内装饰和家具基材领域扩张。

全球建设活动不断扩大

亚太地区的基础建设仍是最大的需求转折点,该地区预计复合年增长率将达到6.34%。中国稳定的原木价格维持在每立方公尺110美元,支撑了板材买家的利润前景;而印度和印尼的公共管道建设则支撑了工程木材的长期需求成长。预计到2024年,北美单户住宅开工量将成长7%,这将推动对室外胶合板的需求,因为建筑商看重定向刨花板(OSB)稳定的钉子固定性能。在中东,沙乌地阿拉伯和阿联酋1,800亿美元的脱碳计画正推动木材进口量成长两倍,这为出口商开拓新的OSB市场创造了机会。预製构件工厂正在利用OSB的尺寸精度来缩短施工週期,进一步将建筑需求的成长动能与板材消费连结起来。

加强甲醛和挥发性有机化合物法规

欧盟将于2026年8月实施甲醛含量低于0.080 mg/m³的限值,这将迫使依赖脲醛树脂的製造商改变配方,否则将失去市场份额。虽然使用MDI黏合剂生产的定向刨花板(OSB)通常可以豁免,但化学成分的改变将使变动成本增加15-20%,从而挤压普通级OSB的利润空间。在美国,环保署(EPA)的风险评估草案列出了62种可能导致更严格的职场接触标准的用例,这将导致用于扩建通风和测试设施的资本支出。拥有规模和专业知识的垂直整合型企业在开发黏合剂方面具有优势,这进一步凸显了技术灵活性在OSB市场中的战略重要性。

细分市场分析

预计到2025年,OSB/3将占据OSB市场46.85%的份额,并在2031年之前以4.58%的复合年增长率持续成长,进一步扩大其在OSB市场中的地位。这主要得益于建筑规范对潮湿环境板材的推荐。製造商采用酚醛树脂或MDI树脂来增强防水性能,同时又不影响螺丝的固定力,因此OSB/3深受设计人员的青睐,尤其是在设计多用户住宅的墙体和屋顶板时。同时,OSB/4已在重型地板材料领域占据了一席之地,但其密度的不断增加限制了价格敏感型需求的成长。 OSB/2作为干燥室内衬垫材料仍然具有成本效益,但由于设计人员越来越多地选择批量采购单一等级的材料以进行高效的库存管理,OSB/2的市场份额正面临来自性能更优的OSB/3的蚕食。

表面处理技术的创新正在拓展OSB/3的应用范围,使其进入橱柜和装饰市场。由于OSB/3表面粗糙,这些市场以往难以进入。精细OSB产品线将塑合板面板与OSB芯材结合,可实现高压层压黏合,并拓展下游应用。这正在推动定向纤维板在家具行业的市场渗透。在监管方面,由于对更严格的甲醛法规的担忧,对OSB/1的需求有所下降。这促使工厂的资本投资转向改造传统生产线,以生产高价值的结构级OSB。

定向刨花板报告按等级(OSB/1、OSB/2、OSB/3、OSB/4)、最终用户应用(建筑、家具、包装)和地区(亚太、北美、欧洲、南美、中东和非洲)进行细分。市场预测以体积(立方米)为单位。

区域分析

预计到2025年,北美仍将保持60.05%的定向刨花板(OSB)市场份额,这得益于其庞大的现有工厂规模、一体化的软木供应链以及建筑商对该产品的高度认知。美国是全球最大的OSB进口国,市场规模达19亿美元,其OSB主要来自加拿大和巴西的工厂。儘管美国国内的工厂也透过采用人工智慧烘干机等现代化设备来提高产能运转率,但其OSB进口量仍居高不下。加拿大仍然是出口导向国家,但不断上涨的纤维原料成本迫使其选择性地调整生产,例如West Fraser关闭了位于弗雷泽湖的工厂。这导致区域供应紧张,并支撑了OSB价格。

亚太地区预计将成为成长的主要驱动力,到2031年将以6.23%的复合年增长率成长,这主要得益于中国、印度和东南亚国协加速城市轨道交通、资料中心和中高层住宅计划的建设。陆里集团运作中国首条精细定向刨花板(OSB)生产线,标誌着中国正从依赖进口转向国内一体化生产,从而缩短前置作业时间并可根据当地法规定制等级。印度的智慧城市计画正在推动工程板材的应用,工程板材在成本和施工速度方面均优于实木板材。在东南亚,旅游业主导的住宿设施建设正在推动需求成长,但当地产能已无法满足需求,这为来自北美和智利的供应商开闢了进口管道。

在欧洲,严格的气候法规巩固了有利于木材的政策,而成熟的住宅存量限制了需求成长,导致市场成长稳定但缓慢。将于2026年在欧盟范围内生效的甲醛法规将淘汰不合规的供应商,为已在使用MDI系统的工厂创造机会。由于南欧的维修税收优惠和北欧的预製产品出口,OSB市场仍能抵御CLT的衝击。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 比胶合板更经济实惠的替代品

- 全球建设活动不断扩大

- 对永续性工程木材的需求

- 模组化和预製住宅热潮

- 新型低VOC MDI黏合剂OSB级

- 市场限制

- 加强甲醛和挥发性有机化合物法规

- 木纤维价格波动

- CLT的采用会蚕食结构材料市场的份额

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 按年级

- OSB/1

- OSB/2

- OSB/3

- OSB/4

- 透过最终用户使用

- 建造

- 地板和屋顶

- 墙

- 门

- 柱和梁(模板)

- 楼梯

- 其他建筑

- 家具

- 住宅

- 商业的

- 包装

- 食品/饮料

- 产业

- 製药

- 化妆品

- 其他包装

- 建造

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 卡达

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- Arbec Forest Products Inc.

- Besgrade Plywood Sdn. Bhd.

- Coillte

- EGGER

- JM Huber Corporation

- Koch IP Holdings, LLC

- Koyuncuoglu Group of Companies

- Kronoplus Limited

- Louisiana-Pacific Corporation

- RoyOMartin

- Sonae Arauco

- STRANDPLYOSB

- Swiss Krono Group

- Tolko Industries Ltd.

- West Fraser

- Weyerhaeuser Company

- Yalong Wood

第七章 市场机会与未来展望

Oriented Strand Board (OSB) market size in 2026 is estimated at 40.7 Million cubic meters, growing from 2025 value of 39.10 Million cubic meters with 2031 projections showing 49.72 Million cubic meters, growing at 4.08% CAGR over 2026-2031.

This steady trajectory highlights how cost advantages over plywood, regulatory tailwinds favoring low-embodied-carbon materials, and process-automation investments are reinforcing demand across the oriented strand board market. Builders in mature regions seek operating efficiencies, while governments in emerging economies channel infrastructure funds toward engineered wood, collectively underpinning healthy volume growth. Competitive activity centers on mill automation and grade innovation; Weyerhaeuser's AI-guided dryer optimization exemplifies how digital tools are lifting throughput and down-line panel quality.

Global Oriented Strand Board (OSB) Market Trends and Insights

Cost-effective Substitution for Plywood

Manufacturers continue to narrow production spreads versus softwood plywood, leveraging strand-alignment software and precision resin dosing to cut variable costs. Louisiana-Pacific booked USD 267 million in OSB revenue in Q1-2025 and maintained shipment volumes despite an 11% spot-price slide, underscoring how the oriented strand board market absorbs demand displaced from constrained plywood capacity. Predictable panel pricing supports budget certainty for residential framers, especially when lumber volatility exceeds USD 100 per m3 swings. Consequently, the oriented strand board market now penetrates interior finish and furniture substrates once dominated by plywood.

Expansion of Global Construction Activity

Asia-Pacific's infrastructure drive remains the single largest demand inflection, reflected in the region's 6.34% CAGR outlook. China's stabilized log cost of USD 110 per m3 supports margin visibility for panel buyers, while public-works pipelines in India and Indonesia lift long-term engineered-wood offtake. North American single-family starts rose 7% in 2024, translating into incremental sheathing volume as builders favor OSB's uniform nail-holding capacity. the Middle East, Saudi and UAE decarbonization plans worth USD 180 billion triple timber imports, positioning exporters to tap fresh oriented strand board market pockets. Prefab factories leverage OSB's dimensional tolerance to shorten install cycles, further linking construction momentum with panel consumption.

Formaldehyde and VOC Regulations Tightening

The EU will enforce sub-0.080 mg/m3 formaldehyde ceilings from August 2026, compelling mills still reliant on UF-based resins to re-formulate or cede share. While OSB produced with MDI binders often qualifies for exemption, switching chemistry inflates variable cost 15-20%, squeezing commodity-grade margins. On the U.S. front, EPA's draft risk assessment flags 62 use-cases that might trigger tougher workplace exposure limits, creating capital spend for enhanced ventilation and test labs. Compliance pathways favor vertically integrated operators with adhesive research and development scale, adding strategic weight to technological agility in the oriented strand board market.

Other drivers and restraints analyzed in the detailed report include:

- Sustainability-driven Demand for Engineered Wood

- Modular and Prefab Housing Boom

- Wood-fiber Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

OSB/3 generated 46.85% of oriented strand board market share in 2025 and is slated to widen its role as the oriented strand board market size for this grade grows at 4.58% CAGR through 2031, buoyed by building-code preference for panels rated for humid conditions. Manufacturers rely on phenol-formaldehyde or MDI resins to deliver water resistance without sacrificing screw-holding, attracting specifiers in multifamily walls and roof decks. In parallel, OSB/4 captures niche heavy-load floors, but its higher density caps price-sensitive uptake. OSB/2 remains cost-effective in dry-interior sheathing, yet faces share leakage to enhanced OSB/3 as designers adopt one-grade fits-all procurement to streamline inventories.

Surface innovations are expanding OSB/3 utility into cabinetry and decorative markets previously closed due to rough finish. Fine-OSB lines that overlay particleboard faces onto OSB cores permit high-pressure laminate adhesion, enlarging downstream applications and supporting oriented strand board market penetration in furniture clusters. On the regulatory side, OSB/1 demand wanes amid looming formaldehyde scrutiny, steering mill capital toward converting legacy production to higher-value structural grades.

The Oriented Strand Board Report is Segmented by Grade (OSB/1, OSB/2, OSB/3, and OSB/4), End-User Application (Construction, Furniture, and Packaging), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Cubic Meters).

Geography Analysis

North America retained 60.05% oriented strand board market share in 2025 thanks to a deep installed mill base, integrated softwood supply, and builder familiarity with the product. The United States remains the world's largest importer at USD 1.9 billion, primarily sourcing from Canadian and Brazilian plants even while domestic mills modernize with AI-enabled dryers to lift uptime. Canada's export orientation continues, but high fiber costs have forced selective curtailments as illustrated by West Fraser's Fraser Lake shutdown, tightening regional supply, and underpinning pricing.

Asia-Pacific is the growth engine, expanding at a 6.23% CAGR through 2031 as China, India, and ASEAN economies fast-track urban rail, data-center, and mid-rise residential projects. Luli Group's commissioning of China's first Fine-OSB line marks a pivot from reliance on imports toward domestic integrated production that shortens lead times and customizes grades for local codes. India's Smart City program lifts engineered panel adoption, where cost and speed edge out solid timber. Southeast Asian demand rises on tourism-driven hospitality builds, though local capacity lags, opening import lanes for North American and Chilean suppliers.

Europe shows steady but lower growth as stringent climate regulations lock in wood-favoring policies yet mature housing stock tempers volume upside. The EU-wide 2026 formaldehyde limit will likely displace non-compliant suppliers, increasing opportunities for mills already using MDI systems. Southern Europe's renovation credits and Northern Europe's prefab exports provide incremental tailwinds, keeping the oriented strand board market defensible against CLT incursion.

- Arbec Forest Products Inc.

- Besgrade Plywood Sdn. Bhd.

- Coillte

- EGGER

- J.M. Huber Corporation

- Koch IP Holdings, LLC

- Koyuncuoglu Group of Companies

- Kronoplus Limited

- Louisiana-Pacific Corporation

- RoyOMartin

- Sonae Arauco

- STRANDPLYOSB

- Swiss Krono Group

- Tolko Industries Ltd.

- West Fraser

- Weyerhaeuser Company

- Yalong Wood

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cost-effective substitution for plywood

- 4.2.2 Expansion of global construction activity

- 4.2.3 Sustainability-driven demand for engineered wood

- 4.2.4 Modular and prefab housing boom

- 4.2.5 Emerging low-VOC MDI-bonded OSB grades

- 4.3 Market Restraints

- 4.3.1 Formaldehyde and VOC regulations tightening

- 4.3.2 Wood-fiber price volatility

- 4.3.3 CLT adoption stealing structural share

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Grade

- 5.1.1 OSB/1

- 5.1.2 OSB/2

- 5.1.3 OSB/3

- 5.1.4 OSB/4

- 5.2 By End-user Application

- 5.2.1 Construction

- 5.2.1.1 Floor and Roof

- 5.2.1.2 Wall

- 5.2.1.3 Door

- 5.2.1.4 Column and Beam (Shuttering)

- 5.2.1.5 Staircase

- 5.2.1.6 Other Constructions

- 5.2.2 Furniture

- 5.2.2.1 Residential

- 5.2.2.2 Commercial

- 5.2.3 Packaging

- 5.2.3.1 Food and Beverage

- 5.2.3.2 Industrial

- 5.2.3.3 Pharmaceutical

- 5.2.3.4 Cosmetics

- 5.2.3.5 Other Packaging

- 5.2.1 Construction

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.2.4 Rest of North America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global-level overview, Market-level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Arbec Forest Products Inc.

- 6.4.2 Besgrade Plywood Sdn. Bhd.

- 6.4.3 Coillte

- 6.4.4 EGGER

- 6.4.5 J.M. Huber Corporation

- 6.4.6 Koch IP Holdings, LLC

- 6.4.7 Koyuncuoglu Group of Companies

- 6.4.8 Kronoplus Limited

- 6.4.9 Louisiana-Pacific Corporation

- 6.4.10 RoyOMartin

- 6.4.11 Sonae Arauco

- 6.4.12 STRANDPLYOSB

- 6.4.13 Swiss Krono Group

- 6.4.14 Tolko Industries Ltd.

- 6.4.15 West Fraser

- 6.4.16 Weyerhaeuser Company

- 6.4.17 Yalong Wood

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment