|

市场调查报告书

商品编码

1910554

石墨电极:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Graphite Electrode - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

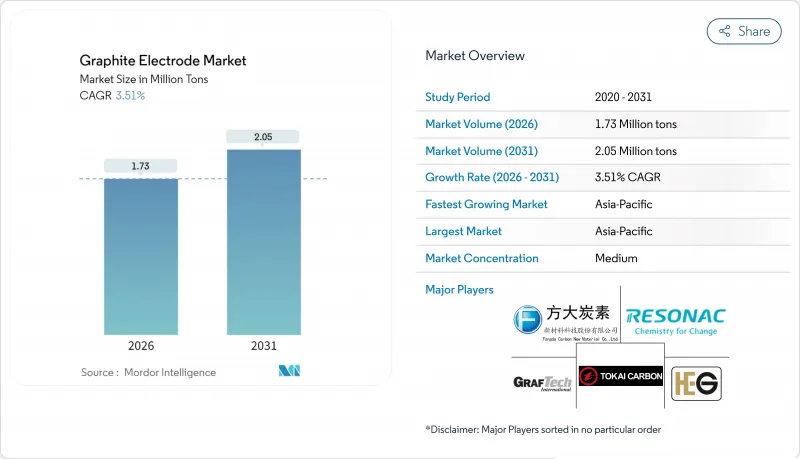

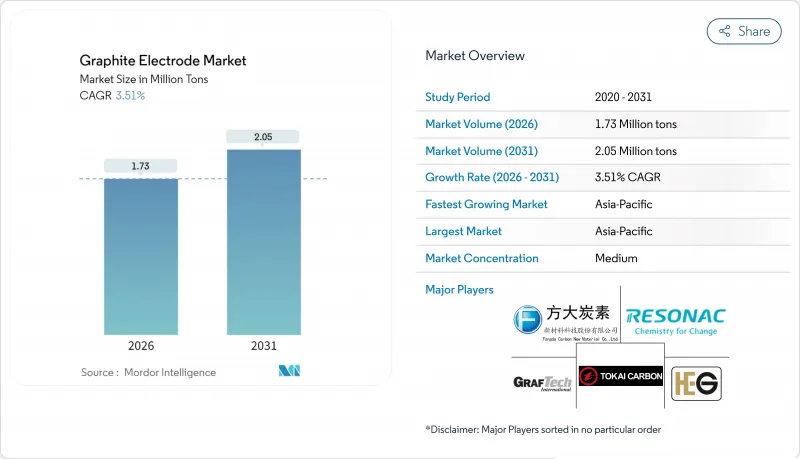

预计到 2026 年,石墨电极市场规模将达到 173 万吨,高于 2025 年的 167 万吨。

预计到 2031 年将达到 205 万吨,2026 年至 2031 年的复合年增长率为 3.51%。

需求成长主要受钢铁业转型为电弧炉(EAF)技术、日益严格的环保法规以及超高功率(UHP)焊条所带来的营运优势。不断增加的钢铁脱碳政策压力,尤其是在中国和欧盟,支持了以废钢为基础的长期生产模式,而更高品质的焊条则有助于钢厂降低每吨钢的电力消耗。针状焦供应风险和来自电池石墨的竞争限制了近期产能扩张,而垂直整合和回收技术的进步则在一定程度上抵消了原材料成本压力。亚太地区仍将是重要的需求中心,这主要得益于该地区大规模的钢铁产量、电弧炉的快速普及以及有利于非中国供应商的贸易结构调整。竞争策略日益围绕着原料安全、人工智慧驱动的炉窑优化以及废旧焊条闭合迴路回收的商业化。

全球石墨电极市场趋势与洞察

向电炉炼钢过渡

预计到2025年,电弧炉炼钢将占全球炼钢产量的30%,随着高炉排放法规的日益严格,到2030年这一比例将达到40%。与传统的氧气高炉相比,电弧炉炼钢可减少高达70%的二氧化碳排放,帮助欧洲和东亚的企业实现净零排放目标。儘管炼钢产能持续成长,但中国将于2024年上半年禁止新建燃煤炼钢计划,将进一步强化此一趋势。电弧炉的柔软性使其能够在电价飙升时调整产量,这使其在能源市场不稳定的地区具有优势。这种转型将维持对能够承受更高电流密度的高性能电极的长期需求,从而巩固石墨电极市场。

全球废钢供应量不断增加

随着使用了数十年的基础设施逐渐达到使用寿命终点,废钢回收池不断扩大,增加了北美和欧洲二次炼钢的原料供应。分类技术的进步提高了废钢的纯度,使钢厂无需使用原铁矿石即可满足严格的品质标准。亚太地区各国正加速投资建设现代化破碎设施和物流网络,以收集和处理生活垃圾和工业废弃物。每生产一吨电炉钢需要消耗1-2公斤石墨电极,废钢循环的扩张为石墨电极市场创造了可预测的需求和成长。这一趋势降低了对焦煤的依赖,并符合脱碳目标。

针焦价格波动与供应风险

针状焦占电极生产成本的60%之多,且依赖少数几家工厂集中的专业精炼产能。 2024年美国针状焦产量预计将下降3%,导致供应趋紧,而电池产业的需求进一步加剧了供应压力。硫含量和热膨胀係数等品质指标限制了可用原料的选择,也使得替代品难以找到。现货价格在过去12个月内波动超过40%,迫使电极製造商尽可能进行避险并签订长期合约。预计新的针状焦计划延期将使石墨电极市场供应紧张的局面持续到2027年。

细分市场分析

2025年,超高压石墨电极占石墨电极市场的69.88%,预计到2031年将以4.06%的复合年增长率成长。这一细分市场受惠于单炉产量超过400吨的大型电弧炉(EAF)的引进。这些电弧炉需要在保持结构完整性的同时,提供高电流密度。随着钢铁厂越来越重视整体拥有成本(TCO),延长电极寿命和减少更换停机时间使得其溢价合理。石墨电极市场正持续从高功率(SHP)和常规功率(RP)等级转变为超高压(UHP)等级,随着技术的成熟,平均售价(ASP)差距正在缩小。

超高功率电极的生产需要优质针状焦和多次石墨化循环,垂直整合的製造商依靠自有焦炉和远期合约来保障原料供应。新参与企业面临资金障碍和严格的品质检验,这维持了石墨电极市场当前的竞争格局。区域性高炉和氧气吹炼炉向电弧炉(EAF)的转型,尤其是在印度和东南亚地区,正在推动超高功率电极需求的逐步成长。与碳足迹相关的永续性认证正在促使采购审查更加严格,并青睐那些在其营运中展现闭合迴路回收和可再生能源使用的供应商。

本《石墨电极市场报告》按电极等级(超高功率 (UHP)、高功率 (SHP)、常规功率 (RP))、应用领域(电弧炉、碱性氧气转炉、非铁金属)和地区(亚太地区、北美地区、欧洲地区、南美地区、中东和非洲地区)分析石墨电极市场。市场预测以公吨为单位。

区域分析

预计到2025年,亚太地区将主导石墨电极市场,占据59.12%的市场份额,并在2031年之前保持4.58%的复合年增长率,成为成长最快的地区。中国对新建燃煤钢铁厂的政策限制以及印度雄心勃勃的基础设施建设计划,都为该地区的成长提供了支撑。日本对中国产电极征收95.2%的进口关税,该关税于2025年3月生效,迫使日本买家将采购来源多元化,转向国内和韩国供应商,从而改变了亚洲内部的贸易流量。韩国的高阶钢铁业依赖超高纯度电极进行汽车级生产,而不断扩展的电池材料生态系统正在推动闭合迴路回收合作。

在北美,受完善的废钢回收网路和电弧炉效率持续提升的推动,需求保持温和的个位数成长。中西部和东南部丰富的页岩气发电资源降低了营运成本,促进了大型小型钢厂的产能扩张。在加拿大,安大略省和魁北克省的水力发电电弧炉正在运作,以协助实现范围2的排放目标。这推动了对高等级焊条的需求。墨西哥毗邻美国废钢来源地,加上汽车生产的快速成长,推动了全部区域焊条进口量的成长。

儘管欧洲宏观经济持续疲软,但预计在经历了多年的萎缩之后,表观钢铁消费量将从2025年起回升2.20%。能源成本的上涨正促使钢铁厂转向数位化炉窑优化和灵活的生产调度,而这两者都需要可靠的超纯电极。欧盟电池法规2023/1542推动了人们对将废弃电极回收为阳极材料的兴趣日益浓厚,并透过整合钢铁和电池供应链来增强石墨电极市场。包括波兰和土耳其在内的东欧国家,由于劳动力成本低廉且建筑业蓬勃发展,正在吸引新的电弧炉投资,这将推动电极出货量在2020年代后期持续成长。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 过渡到电弧炉炼钢(EAF)

- 全球废钢供应量不断增加

- 对超高功率(UHP)电极的需求不断增长

- 将废弃电极封闭回路型回收製成电池级碳

- 炼油厂投资兴建高品质针状焦产能

- 市场限制

- 针焦价格波动与供应风险

- 全球钢铁生产的周期性

- 电池负极材料中高硅含量对石墨原料构成压力。

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章 市场规模和成长预测(价值和数量)

- 按电极等级

- 高功率(UHP)

- 高功率(SHP)

- 标准输出(RP)

- 透过使用

- 电弧炉

- 碱性氧气炉

- 有色金属

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 俄罗斯

- 西班牙

- 土耳其

- 北欧国家

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 卡达

- 阿拉伯聯合大公国

- 埃及

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- El 6 LLC

- Fangda Carbon New Material Technology Co. Ltd

- GrafTech International

- Graphite India Limited

- HEG Limited

- Jilin Carbon New Material Co., Ltd.

- Kaifeng Pingmei New Carbon Materials Technology Co. Ltd

- Liaoning Dantan Technology Group Co. Ltd(Dan Carbon)

- Nantong Yangzi Carbon Co. Ltd

- Nippon Carbon Co. Ltd

- Resonac Holdings Corporation

- Sangraf International Inc.

- SEC Carbon Limited

- Tokai Carbon Co. Ltd

- Zhongze Group

第七章 市场机会与未来展望

Graphite Electrode market size in 2026 is estimated at 1.73 million tons, growing from 2025 value of 1.67 million tons with 2031 projections showing 2.05 million tons, growing at 3.51% CAGR over 2026-2031.

Demand growth stems from the steel industry's pivot toward electric-arc-furnace (EAF) technology, stronger environmental regulations, and the operational advantages of ultra-high-power (UHP) electrodes. Intensifying policy pressure to decarbonize steelmaking, especially in China and the European Union, supports long-run uptake of scrap-based production, while premium electrode grades help mills cut electricity consumption per ton of steel. Needle coke supply risk and competition from battery-grade graphite constrain short-term capacity additions, yet vertical integration and recycling advances partially offset raw-material pressure. Asia-Pacific remains the principal demand hub, underpinned by large steel output, rapid EAF adoption, and trade realignments favoring non-Chinese suppliers. Competitive strategies increasingly revolve around securing feedstock, deploying AI-enabled furnace optimization, and commercializing closed-loop recycling for spent electrodes.

Global Graphite Electrode Market Trends and Insights

Shift to Electric-Arc-Furnace Steelmaking

EAF steelmaking represents 30% of global output in 2025 and is expected to reach 40% by 2030 as policy mandates tighten on blast furnace emissions. The route emits up to 70% less CO2 than the traditional blast-oxygen pathway, supporting corporate net-zero commitments in Europe and East Asia. China banned new coal-based steel projects in H1 2024, reinforcing the trend despite continued additions of ironmaking capacity. EAF flexibility lets mills modulate production when electricity prices spike, useful in regions with volatile energy markets. The shift sustains long-run demand for high-performance electrodes that tolerate higher current densities, strengthening the graphite electrode market.

Rising Global Steel-Scrap Availability

Scrap pools grow as infrastructure built decades earlier reaches end-of-life, boosting feedstock for secondary steelmaking in North America and Europe. Advances in sorting improve scrap purity, letting mills hit tight quality specifications without virgin iron ore. Asia-Pacific nations accelerate investment in modern shredding and logistics networks that collect and process household and industrial scrap. Each ton of EAF steel consumes 1-2 kg of graphite electrodes, so expanding scrap flows create predictable electrode demand and growth in the graphite electrode market. The trend also reduces reliance on coking coal, aligning with decarbonization goals.

Needle Coke Price Volatility & Supply Risk

Needle coke constitutes up to 60% of electrode production cost and relies on specialized petroleum refining capacity concentrated in a handful of plants. A 3% drop in U.S. coke output in 2024 tightened supply, while battery-sector demand compounds pressure on availability. Quality specifications involving sulfur and the coefficient of thermal expansion narrow the pool of acceptable material, limiting substitution. Spot prices fluctuated by more than 40% within twelve months, forcing electrode makers to hedge and lock in long-term contracts wherever possible. Delays in greenfield needle-coke projects keep the graphite electrode market tight through 2027.

Other drivers and restraints analyzed in the detailed report include:

- Accelerating Demand for Ultra-High-Power Electrodes

- Closed-Loop Recycling of Spent Electrodes into Battery-Grade Carbon

- Cyclicality of Global Steel Production

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

UHP electrodes accounted for a dominant 69.88% graphite electrode market share in 2025 and are estimated to grow at a 4.06% CAGR through 2031. The segment benefits from the rollout of mega-EAF units exceeding 400 tons per heat, which require elevated current densities while maintaining structural integrity. Mills' focus on total cost of ownership; consequently, longer electrode life and reduced change-out downtime justify premium pricing. The graphite electrode market continues shifting volume from high-power (SHP) and regular-power (RP) grades toward UHP, compressing ASP differentials over time as technology matures.

Production of UHP electrodes demands top-tier needle coke and multiple graphitization cycles, prompting vertically integrated players to secure feedstock via captive cokers and forward contracts. New entrants confront capital hurdles and stringent quality validation, preserving current competitive hierarchies in the graphite electrode market. Regional blast-oxygen furnace retrofits to EAF, especially in India and Southeast Asia, sustain incremental UHP demand. Sustainability certifications on carbon footprint intensify procurement scrutiny, favoring suppliers who demonstrate closed-loop recycling and renewable-energy usage in their operations.

The Graphite Electrode Market Report is Segmented by Electrode Grade (Ultra High Power (UHP), High Power (SHP), Regular Power (RP)), Application (Electric Arc Furnace, Basic Oxygen Furnace, Non-Steel), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific dominated the graphite electrode market in 2025, holding 59.12% share and registering the fastest 4.58% CAGR through 2031. China's policy curbs on new coal-based ironmaking combined with India's ambitious infrastructure pipeline underpin regional growth. Japanese import tariffs of 95.2% on Chinese electrodes, effective March 2025, prompt local buyers to diversify toward domestic and Korean suppliers, altering intra-Asian trade flows. South Korea's premium steel segment relies on UHP electrodes for automotive-grade outputs, while its expanding battery-material ecosystem fosters closed-loop recycling collaborations.

North America sustains mid-single-digit demand increases anchored by robust scrap collection networks and continuous efficiency upgrades at EAF mills. Abundant shale-gas electricity in the Midwest and Southeast supports low operating costs, encouraging capacity expansions by leading mini-mills. Canada leverages hydroelectric power to run EAFs in Ontario and Quebec, achieving low Scope 2 emissions targets that drive premium electrode procurement. Mexico's proximity to U.S. scrap and surging automotive production adds incremental tonnage to regional electrode imports.

Europe contends with lingering macro-economic softness; however, from 2025 the region anticipates a 2.20% recovery in apparent steel consumption after multi-year contraction. High energy costs propel mills toward digital furnace optimization and flexible production scheduling, both demanding reliable UHP electrodes. The EU Battery Regulation 2023/1542 boosts interest in recycling spent electrodes into anode material, integrating steel and battery supply chains reinforcing the graphite electrode market. Eastern European nations with lower labor costs and growing construction sectors, including Poland and Turkey, capture new EAF investments that lift electrode shipments into the late decade.

- El 6 LLC

- Fangda Carbon New Material Technology Co. Ltd

- GrafTech International

- Graphite India Limited

- HEG Limited

- Jilin Carbon New Material Co., Ltd.

- Kaifeng Pingmei New Carbon Materials Technology Co. Ltd

- Liaoning Dantan Technology Group Co. Ltd (Dan Carbon)

- Nantong Yangzi Carbon Co. Ltd

- Nippon Carbon Co. Ltd

- Resonac Holdings Corporation

- Sangraf International Inc.

- SEC Carbon Limited

- Tokai Carbon Co. Ltd

- Zhongze Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift to electric-arc-furnace (EAF) steelmaking

- 4.2.2 Rising global steel-scrap availability

- 4.2.3 Accelerating demand for ultra-high-power (UHP) electrodes

- 4.2.4 Closed-loop recycling of spent electrodes into battery-grade carbon

- 4.2.5 Refiners' investments in premium needle-coke capacity

- 4.3 Market Restraints

- 4.3.1 Needle-coke price volatility and supply risk

- 4.3.2 Cyclicality of global steel production

- 4.3.3 Silicon-rich battery anodes squeezing graphite feedstock

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Electrode Grade

- 5.1.1 Ultra High Power (UHP)

- 5.1.2 High Power (SHP)

- 5.1.3 Regular Power (RP)

- 5.2 By Application

- 5.2.1 Electric Arc Furnace

- 5.2.2 Basic Oxygen Furnace

- 5.2.3 Non-steel

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Spain

- 5.3.3.7 Turkey

- 5.3.3.8 NORDIC Countries

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Egypt

- 5.3.5.5 South Africa

- 5.3.5.6 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)**/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 El 6 LLC

- 6.4.2 Fangda Carbon New Material Technology Co. Ltd

- 6.4.3 GrafTech International

- 6.4.4 Graphite India Limited

- 6.4.5 HEG Limited

- 6.4.6 Jilin Carbon New Material Co., Ltd.

- 6.4.7 Kaifeng Pingmei New Carbon Materials Technology Co. Ltd

- 6.4.8 Liaoning Dantan Technology Group Co. Ltd (Dan Carbon)

- 6.4.9 Nantong Yangzi Carbon Co. Ltd

- 6.4.10 Nippon Carbon Co. Ltd

- 6.4.11 Resonac Holdings Corporation

- 6.4.12 Sangraf International Inc.

- 6.4.13 SEC Carbon Limited

- 6.4.14 Tokai Carbon Co. Ltd

- 6.4.15 Zhongze Group

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment