|

市场调查报告书

商品编码

1910555

冶金焦:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Metallurgical Coke - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

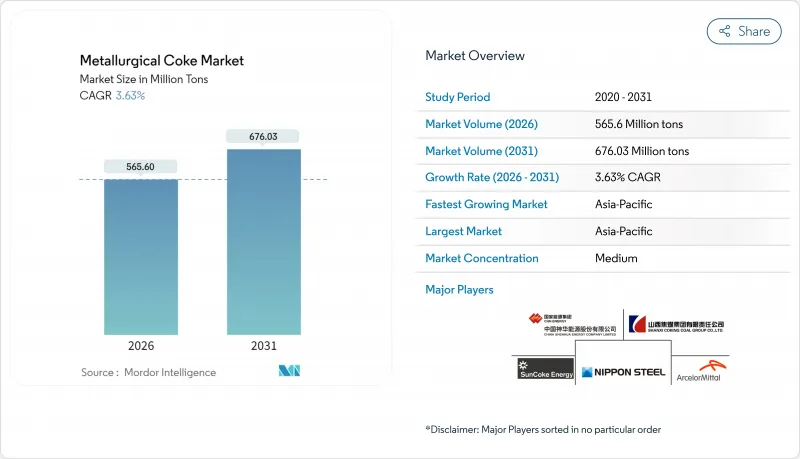

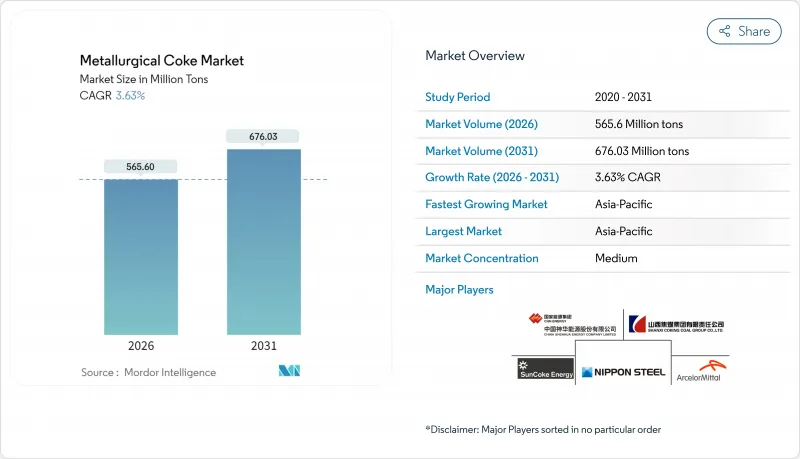

2025年冶金焦市场价值为5.4578亿吨,预计从2026年的5.656亿吨增长到2031年的6.7603亿吨,在预测期(2026-2031年)内复合年增长率为3.63%。

亚太地区钢铁产量的增长、北美稳定的公共基础设施投资以及保护综合钢铁美国。供应链韧性正变得日益重要,垂直整合的钢铁企业正努力确保专属焦炭产能,并优先选择拥有地理分散资产的供应商。

全球冶金焦市场趋势及展望

公共基础设施对钢铁的需求不断增长

大规模公共工程项目确保了多年期钢铁承购协议的签订,直接转化为冶金焦市场稳定的需求。政府合约保证了订单的可预测性,帮助焦炭生产商优化炉窑运转率和物流规划。即使在景气衰退时期,公共工程项目通常也会持续进行,从而缓解需求波动,保障供应商的长期收益。像美国和印度这样基础建设与国内钢铁政策紧密结合的地区,供应链韧性更强。这种契合度促使钢铁厂续签长期采购协议,从而确保优质低灰焦的供应。

扩大汽车产能

汽车产量的成长,主要集中在中国、印度、墨西哥和东南亚地区,推动了精密铸造用焦炭的需求,并促进了先进高强度钢种的高温加工。电动车平台需要轻量化且坚固的电池外壳,这对焦炭原料的碳含量稳定性提出了更高的品质要求。汽车工厂的地理集中催生了区域性焦炭供应基地,为拥有多式联运网路的本地生产商带来了成本优势。随着汽车製造商越来越多地将零件生产在地化以降低供应链风险,附近焦炭厂的需求模式也变得更加可预测。然而,汽车需求的周期性仍然要求焦炭供应商在月度合约配额和现货市场之间保持灵活的产能。

焦化厂需遵守严格的环境法规

在美国,国家有害空气污染物排放标准(NEPS)最终确定了更低的洩漏限值,并强制要求对厂区进行连续的苯监测,以及采用先进的洩漏检测通讯协定。欧盟强制要求在整个煤炭价值链中进行甲烷测量和报告,并为焦化设施增加了新的合规要求。脱硫装置、苯萃取装置和除尘器的资本投资可能超过每吨产能100美元,使得小规模独立生产商难以资金筹措。因此,监管负担正在加速产业整合,并提高进入门槛,从而限制了冶金焦市场的成长。

细分市场分析

高炉焦占冶金焦市场的63.74%。稳定的生铁产量目标带来了稳定的年订单量,而更先进的製程控制则提高了钢铁厂所需的冷强度和碳含量(CSR)指标。儘管块状焦产量较低,但其复合年增长率(CAGR)为4.05%,高于整体市场成长率,这主要得益于其在铸造和非铁金属的应用,这些行业对10-25毫米的精确尺寸要求较高。

一体化生产商透过多年合约锁定产量,以确保炉窑效率;而运作余热回收炉的供应商则因其可预测的品质而获得溢价。儘管环保法规日益严格,但该领域的持续成长仍支撑着冶金焦市场的整体发展,确保产能扩张仍将围绕传统的滚筒式冲压炉。

预计到 2025 年,低灰分(8-12% 灰分)产品将占冶金焦市场的 70.25%,到 2031 年将以 4.38% 的复合年增长率增长,这反映了炉渣法规和排放上限的收紧。

印度对低灰焦的进口限制(每半年进口量上限为140万吨)凸显了此等级焦炭对供应安全的战略重要性。投资于先进洗煤和配煤技术的生产商能够更好地掌握这一高端市场,并与大型钢铁厂签订长期供应合同,从而加深其在冶金焦行业的渗透率。

冶金焦炭报告按焦炭类型(高炉焦炭、铸造焦炭等)、等级(低灰分 8-12%,高灰分 15% 及以上)、应用(钢铁製造、铸造、製糖等)、最终用户行业(综合钢铁製造商、小型钢厂/电弧炉 (EAF) 运营商等)和北美地区(欧洲亚省)、中东地区和中东地区进行细分、中东地区和中东地区。

区域分析

到2025年,亚太地区将占全球整体的69.10%,并在2031年之前保持3.98%的复合年增长率,这主要得益于印度产能的积极扩张以及东南亚基础设施计划的持续需求。中国暂停审批新建燃煤钢铁厂的政策抑制了新计画的推进,但由于检修停产和效率维修,现有钢铁厂仍在消耗高品质焦炭。

在北美,长期基础设施投资正在稳定钢铁订单。墨西哥的汽车产业丛集和加拿大的自然资源管道正在增加需求,并支持北美大陆的焦炭分销。

欧洲仍然是一个重要的市场,在氢气直接还原铁产能普及之前,瑞典、德国和法国对优质焦炭的需求仍然至关重要。欧盟甲烷法规2024/1787将增加新的监测成本,并可能导致一些获利能力的焦炉关闭。这将加剧区域供应紧张,并维持进口依赖。以巴西一体化钢铁厂为基础的南美洲,以及以新兴绿色钢铁中心为支撑的中东和非洲,为那些寻求企业发展传统高炉炼钢核心业务的生产商提供了新的多元化发展前景。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 公共基础设施对钢铁的需求不断增长

- 扩大汽车产能

- 提高亚太地区综合钢铁厂产能

- 新兴经济体的都市建设热潮

- 扩大余热回收焦炉的商业化应用

- 市场限制

- 冶金焦价格波动

- 焦化厂需遵守严格的环境法规

- 转向氢基直接还原铁?

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模及成长预测(销售)

- 按可乐类型

- 高炉焦炭

- 铸造焦炭

- 坚果可乐

- 可口可乐的微风

- 按年级

- 灰分含量低(灰分含量8-12%)

- 高灰分含量(灰分含量15%或以上)

- 透过使用

- 钢铁製造

- 铸件

- 糖加工

- 玻璃製造

- 其他方法(化学还原法及其他方法)

- 按最终用户行业划分

- 综合钢铁製造商

- 小型轧机/电弧炉 (EAF) 操作员

- 铸造厂

- 非铁金属产业

- 其他的

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 俄罗斯

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- ArcelorMittal

- BlueScope Steel Ltd.

- China Baowu Steel Group

- China Shenhua Energy Co. Ltd.

- Drummond Company Inc.

- Gujarat NRE Coke Ltd.(GNCL)

- Hickman-Williams & Company

- Jiangsu Surung High-Carbon Co. Ltd.

- JSW Steel Ltd.

- Mahalaxmi Ennore Coke Pvt Ltd

- Mechel PAO

- Nippon Steel Corporation

- OKK Koksovny as

- POSCO

- Shanxi Coking Coal Group

- SunCoke Energy Inc.

- Tata Steel Ltd.

- United States Steel Corporation

第七章 市场机会与未来展望

The Metallurgical Coke Market was valued at 545.78 Million tons in 2025 and estimated to grow from 565.6 Million tons in 2026 to reach 676.03 Million tons by 2031, at a CAGR of 3.63% during the forecast period (2026-2031).

Escalating steel production in Asia Pacific, steady public-infrastructure investment in North America, and long-term contracts that shield integrated mills from short-term price swings underpin this expansion. Blast-furnace operations retain economic advantages over alternative ironmaking routes, so demand for premium low-ash coke remains firm despite decarbonization headwinds. Environmental regulation is tightening across the United States and the European Union, yet heat-recovery coke ovens help large operators contain compliance costs and safeguard margins. Supply-chain resilience is rising in strategic importance, pushing vertically integrated steel producers to secure captive coke capacity and favor suppliers with geographically diversified assets.

Global Metallurgical Coke Market Trends and Insights

Rising Demand for Steel in Public Infrastructure

Large public-works programs have locked in multi-year steel offtake commitments that translate directly into steady metallurgical coke market demand. Government contracts provide predictable order books, helping coke producers optimize oven utilization rates and logistics planning. Because public projects often proceed even in downturns, they soften demand volatility and protect long-term supplier revenues. Regions with synchronized infrastructure and domestic steel policy, such as the United States and India, enjoy superior supply-chain resilience. This alignment encourages mills to renew long-term offtake agreements that secure premium low-ash coke supplies.

Expanding Automotive Production Capacity

Vehicle output growth, particularly in China, India, Mexico, and Southeast Asia, lifts foundry coke requirements for precision castings and heats advanced high-strength steel grades. Electric-vehicle platforms demand lightweight yet rigid battery housings that intensify quality requirements for consistent carbon levels in coke feedstock. Geographic clustering of automotive plants fosters localized coke-supply hubs, giving regional producers with multimodal transport access a cost edge. As automakers localize components to mitigate supply-chain risk, demand patterns become more predictable for nearby coke plants. Nevertheless, cyclical vehicle demand still obliges coke suppliers to keep flexible capacity that can swing between monthly contract allocations and spot markets.

Stringent Environmental Regulations on Coking Plants

The United States finalized lower leak limits under the National Emission Standards for Hazardous Air Pollutants, mandating continuous benzene monitoring at fencelines and advanced leak-detection protocols. The European Union now requires methane measurement and reporting across the coal value chain, adding compliance layers for coke facilities. Capital expenditure for desulfurization, benzene extraction, and dust-capture equipment can exceed USD 100 per-ton of capacity, costs that smaller independent producers struggle to finance. Consequently, the regulatory burden accelerates industry consolidation and raises barriers to entry, moderating metallurgical coke market growth.

Other drivers and restraints analyzed in the detailed report include:

- Urban Construction Boom in Emerging Economies

- Increasing Commercialization of Heat-Recovery Coke Ovens

- Shift Toward Hydrogen-Based Direct Reduced Iron

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Blast-furnace varieties hold a 63.74% slice of the metallurgical coke market. Stable hot-metal production targets keep annual call-offs steady, while process-control upgrades raise the cold-strength and CSR specifications mills expect. Nut coke, though a lower-volume grade, is eclipsing aggregate growth at a 4.05% CAGR due to foundry and non-ferrous use cases that require precise 10-25 mm sizing.

Integrated producers contract multi-year volumes to safeguard furnace efficiency, so suppliers running heat-recovery ovens capture premiums for predictable quality. The segment's incremental growth continues to anchor the broader metallurgical coke market, ensuring that capacity expansions still centre on traditional drum-stamp batteries despite mounting environmental scrutiny.

Low-ash (8-12% ash) product occupied 70.25% of the metallurgical coke market in 2025 and is forecast to record a 4.38% CAGR through 2031, reflecting tighter furnace slag limits and emission caps.

Import restrictions in India that cap low-ash cargoes at 1.4 million tons per half-year underscore the grade's strategic importance for supply security. Producers investing in advanced coal washing and blending technology are best positioned to seize this premium segment and secure long-term supply agreements with large mills, thereby deepening penetration within the metallurgical coke industry.

The Metallurgical Coke Report is Segmented by Coke Type (Blast-Furnace Coke, Foundry Coke, and More), Grade (Low Ash 8 To 12% Ash and High Ash More Than 15% Ash), Application (Iron and Steel Making, Foundry Castings, Sugar Processing, and More), End-User Industry (Integrated Steel Producers, Mini-mills/EAF Operators, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia Pacific delivered 69.10% of global volume in 2025 and will maintain a 3.98% CAGR through 2031 owing to India's vigorous capacity build-out and ongoing demand from Southeast Asian infrastructure projects. China's moratorium on new coal-based steel permits curbs greenfield projects, yet existing furnaces still consume high-quality coke for maintenance outages and efficiency upgrades.

North America is driven by long-life infrastructure spending that stabilized steel orders. Mexico's automotive clusters and Canada's natural-resource pipelines add incremental volume and sustain intracontinental coke flows.

Europe remains significant because high-grade coke is indispensable for Sweden, Germany, and France until hydrogen DRI facilities scale. The EU Methane Regulation 2024/1787 ushers in new monitoring costs that could shutter sub-economic batteries, tightening internal supply and sustaining import dependence. South America, underpinned by Brazilian integrated mills, and the Middle-East and Africa, buoyed by emerging green-steel hubs, collectively form a diversification frontier for producers seeking exposure beyond traditional blast-furnace heartlands.

- ArcelorMittal

- BlueScope Steel Ltd.

- China Baowu Steel Group

- China Shenhua Energy Co. Ltd.

- Drummond Company Inc.

- Gujarat NRE Coke Ltd. (GNCL)

- Hickman-Williams & Company

- Jiangsu Surung High-Carbon Co. Ltd.

- JSW Steel Ltd.

- Mahalaxmi Ennore Coke Pvt Ltd

- Mechel PAO

- Nippon Steel Corporation

- OKK Koksovny a.s.

- POSCO

- Shanxi Coking Coal Group

- SunCoke Energy Inc.

- Tata Steel Ltd.

- United States Steel Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Steel in Public Infrastructure

- 4.2.2 Expanding Automotive Production Capacity

- 4.2.3 Increasing Capacity Additions in Integrated Steel Mills in Asia Pacific

- 4.2.4 Urban Construction Boom in Emerging Economies

- 4.2.5 Increasing Commercialisation of Heat-Recovery Coke Ovens

- 4.3 Market Restraints

- 4.3.1 Metallurgical Coke Price Volatility

- 4.3.2 Stringent Environmental Regulations on Coking Plants

- 4.3.3 Shift Toward Hydrogen?Based Direct Reduced Iron

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts ( Volume)

- 5.1 By Coke Type

- 5.1.1 Blast-Furnace Coke

- 5.1.2 Foundry Coke

- 5.1.3 Nut Coke

- 5.1.4 Coke Breeze

- 5.2 By Grade

- 5.2.1 Low Ash (8 to 12% Ash)

- 5.2.2 High Ash (more than 15% Ash)

- 5.3 By Application

- 5.3.1 Iron and Steel Making

- 5.3.2 Foundry Castings

- 5.3.3 Sugar Processing

- 5.3.4 Glass Manufacturing

- 5.3.5 Others (Chemical Reduction and Others)

- 5.4 By End-User Industry

- 5.4.1 Integrated Steel Producers

- 5.4.2 Mini-mills/EAF Operators

- 5.4.3 Foundries

- 5.4.4 Non-ferrous Metallurgy

- 5.4.5 Others

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN Countries

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ArcelorMittal

- 6.4.2 BlueScope Steel Ltd.

- 6.4.3 China Baowu Steel Group

- 6.4.4 China Shenhua Energy Co. Ltd.

- 6.4.5 Drummond Company Inc.

- 6.4.6 Gujarat NRE Coke Ltd. (GNCL)

- 6.4.7 Hickman-Williams & Company

- 6.4.8 Jiangsu Surung High-Carbon Co. Ltd.

- 6.4.9 JSW Steel Ltd.

- 6.4.10 Mahalaxmi Ennore Coke Pvt Ltd

- 6.4.11 Mechel PAO

- 6.4.12 Nippon Steel Corporation

- 6.4.13 OKK Koksovny a.s.

- 6.4.14 POSCO

- 6.4.15 Shanxi Coking Coal Group

- 6.4.16 SunCoke Energy Inc.

- 6.4.17 Tata Steel Ltd.

- 6.4.18 United States Steel Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment