|

市场调查报告书

商品编码

1910569

现场可程式闸阵列(FPGA)-市场占有率分析、产业趋势与统计、成长预测(2026-2031)Field Programmable Gate Array (FPGA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

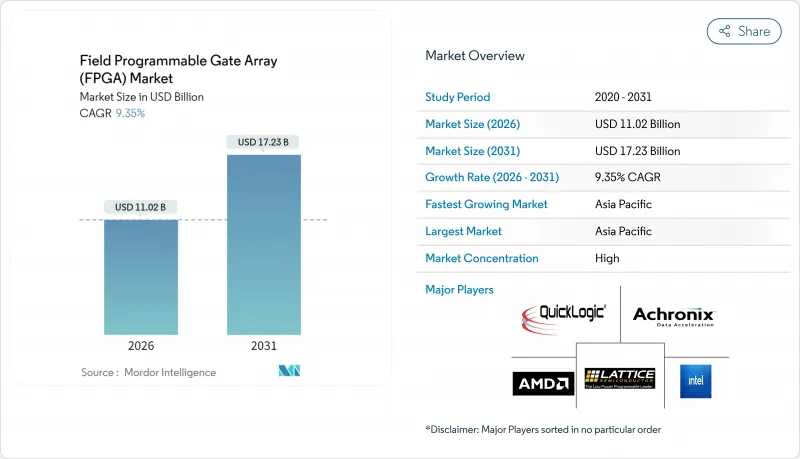

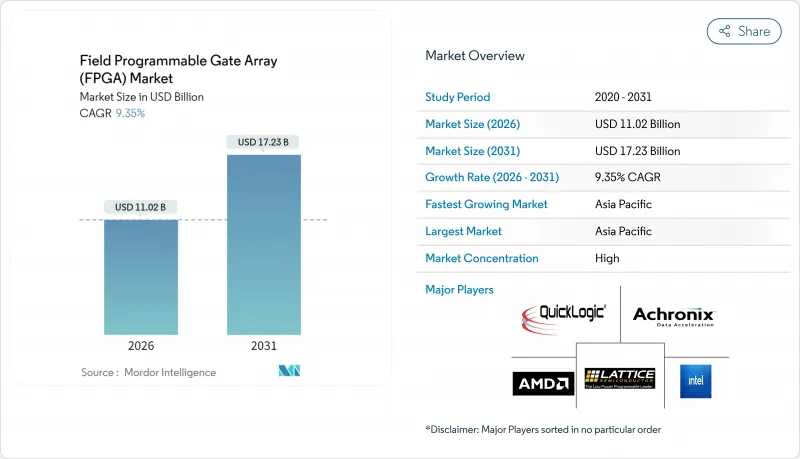

预计到 2025 年,现场可程式闸阵列(FPGA) 市值将达到 100.8 亿美元,从 2026 年的 110.2 亿美元成长到 2031 年的 172.3 亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 9.35%。

边缘人工智慧推理在超大规模资料中心的快速普及、向5G开放式无线架构的转型,以及汽车和航太电子产业对部署后可重构性日益增长的需求,都为市场提供了清晰的成长动力。高阶元件维持了其营收基础,而中低阶产品则随着设计团队在对成本敏感的工业、物联网和消费系统中部署FPGA技术而快速成长。亚太地区已成为最大的製造地和成长最快的需求中心,这主要得益于汽车动力系统和新型太空卫星群日益增长的需求。英特尔同意分拆Altera后,竞争加剧,供应商动态也跟着重整。同时,出口限制促使中国国内同步发展。 300毫米晶圆代工厂产能的限制以及向16奈米及以下製程节点的高成本转型,也迫使供应商优先考虑高收益应用,并与台积电和三星签订长期晶圆预订协议。

全球FPGA(现场可程式闸阵列)市场趋势与洞察

超大规模资料中心对边缘AI推理的需求

当延迟和功耗预算开始超过纯粹的处理容量要求时,超大规模营运商已采用 FPGA 来加速 AI 推理。 AMD 的第二代 Versal AI Edge 装置的 TOPS/W 能源效率比第一代产品提高了 3 倍,可在降低营运成本的同时实现即时影像分析。 Achronix 报告称,在运行大型语言模型时,FPGA 的成本和功耗比 GPU 方案低 200%,凸显了 FPGA 在记忆体受限工作负载中的效率。这种转变催生了一种分散式计算模型,该模型将推理处理更靠近资料来源,从而缓解了频宽限制和资料主权风险。将封装内 HBM 和强化型 AI 引擎整合到领先的 FPGA 系列中,巩固了它们在云端边缘拓扑结构中的地位。因此,现场可程式闸阵列)市场在超大规模资本支出计画中找到了永续成长的驱动力。

5G ORAN过渡需要无线电中的可程式设计逻辑。

开放式无线接取网路的愿景正迫使通讯业者采用与厂商无关的无线单元,这些单元可以透过软体升级而非全面更新设备来实现演进。英特尔的 Agilex 产品组合采用 10nm SuperFin 工艺,支援软体定义无线电,能够适应新的 5G 版本并降低整体拥有成本。莱迪思半导体 (Lattice Semiconductor) 为此硬体提供了参考协定栈,可为分散式网路提供零信任安全性和即时加密。 AMD 的 Zynq RFSoC DFE 的每瓦效能比之前的装置提高了一倍,从而能够在紧凑、功耗受限的射频单元内实现多频段运作。灵活的逻辑缩短了部署週期,成为通讯业者整合专用 5G、固定无线存取和毫米波服务的关键推动因素。这种柔软性为通讯基础设施领域的现场闸阵列 ( FPGA) 市场开闢了新的大规模应用机会。

对中国(美国/欧盟)高效能FPGA出口的限制

美国工业与安全局 (BIS) 的新规将于 2023 年底取消对中国出口的先进 FPGA 的民用豁免,限制适用于人工智慧和军事应用的装置出口。这项变更导致 AMD-Xilinx 和 Intel-Altera 暂停或授权大量订单,造成短期出货量下降。高文电子和盘古电子等中国供应商试图填补供应缺口,但由于在取得设计工具、智慧财产权和先进製程方面存在障碍,即时难以实现替代。跨国客户将敏感生产线迁出中国,或重新设计系统以适应非美国製造的装置,扰乱了传统的全球供应链。由此产生的不不确定性对现场闸阵列 ( FPGA) 市场造成了沉重打击,直到新的贸易规则稳定下来。

细分市场分析

截至2025年,高阶FPGA元件占据了FPGA市场份额的65.80%,这反映了它们在资料中心加速和5G基础设施中的核心作用。这些平台拥有超过100万个逻辑单元,儘管价格分布,却能提供GPU无法企及的确定性延迟,从而维持了对安全至关重要的航太和金融科技工作负载的需求。中低阶FPGA装置到2031年的复合年增长率(CAGR)为10.85%,这得益于像Lattice这样的製造商推出了成本优化的装置,这些装置配备了预硬体AI引擎,符合边缘运算的预算要求。设计工具也变得更加直观,使得不具备硬体专业知识的嵌入式工程师也能采用可配置逻辑。

AMD推出Spartan UltraScale+后,其价值提案发生了转变。 Spartan UltraScale+功耗降低30%,I/O数量更是无与伦比,并将产品线从高阶市场拓展到中阶市场。同时,模组厂商透过提供预先检验电路板、简化引脚规划和PCB布局,缩短了设计週期。这些变化有望缩小不同层级产品之间的价格差距,但随着新的AI和网路标准的出现,以及这些标准仅由最高节点的晶片支持,高阶元件仍将占据现场可编程闸阵列)市场的大部分份额。

凭藉无限次重编程循环和强大的软体生态系统,基于 SRAM 的解决方案预计到 2025 年将占据 54.85% 的市场份额,复合年增长率 (CAGR) 为 11.45%。同时,基于快闪记忆体的方案在穿戴式装置和车用通讯系统处理领域也日益受到认可,因为这些领域对即时启动的要求极高。 Microchip 的 RT PolarFire 达到了 MIL-STD-883 B 级标准,在提供 100 krad 抗辐射能力的同时,功耗比同类 SRAM 装置降低了 50%。耐熔熔丝平台在国防航空电子设备领域占有一席之地,其一次性可程式性消除了篡改风险。

软体可移植性的提升降低了传统壁垒,使设计人员能够根据功耗和安全性而非工具熟悉程度进行选择。新兴的异质架构将SRAM结构与片上非挥发性区域整合在一起,兼具两者的优势。虽然SRAM元件仍将继续推动FPGA市场收入成长,但快闪记忆体和耐熔熔丝产品将在低功耗、严苛环境应用中占据更大的份额。

现场可程式闸阵列依配置(高阶 FPGA、中阶/低阶 FPGA)、架构(基于 SRAM 的 FPGA、基于快闪记忆体的 FPGA 等)、技术节点(90nm 及以上、20-90nm、16nm 及以下)、南美洲市场(资料中心/云端运算、电信/5G 基础设施、汽车细分)及以下)、北美地区市场(资料中心/云端运算、电信/5G 基础设施、汽车细分)及

区域分析

预计亚太地区将在2025年引领FPGA市场,营收占比将达到39.10%,并在2031年之前维持16.20%的复合年增长率。中国在电动车驱动装置和卫星有效载荷等领域的创新推动了半导体自主化进程,从而带动了对FPGA的大规模需求。台湾和韩国拥有先进的製造技术,而日本则专注于汽车模组和工厂自动化子系统。莱迪思在印度浦那设立研发中心,促进了印度设计服务产业的发展,并扩大了工程人才储备。

北美在资料中心基础设施、高可靠性航太和EDA软体领域保持主导。超大规模资料中心业者资料中心营运商为自适应加速器投入巨额资本预算,以控制人工智慧服务成本,从而在该地区占据了强大的市场份额。出口许可证审查影响了出货模式,但也推动了国内对先进封装技术和OSAT(外包组装和测试)能力的投资,以支持FPGA市场。

欧洲依赖德国汽车供应链和北欧电信设备供应商。 ISO 26262合规性推动了汽车应用的发展,而能源转型计划则催生了对低损耗功率转换器的需求。欧盟「数位十年」政策鼓励发展自主边缘运算平台,并强调其可重构性。南美洲和中东及非洲目前市场份额较小,但5G基础设施和工业现代化带来的成长潜力预计将在预测期内提升其市场份额。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 超大规模资料中心对边缘AI推理的需求

- 随着我们向 5G ORAN 过渡,无线设备中对可程式设计逻辑的需求日益增长。

- ASIC/SoC 製程微缩週期(≤7 nm)中快速原型製作的需求

- 符合汽车产业功能安全标准(ISO 26262)

- 新型太空卫星群的抗辐射设计

- 中国电动车动力传动系统OEM厂商采用eFPGA进行马达控制

- 市场限制

- 美国和欧盟对高效能FPGA出口中国实施限制

- 300mm晶圆代工厂产能分配的波动性

- 与专用ASIC相比,静态功耗增加

- 价值链分析

- 监理展望

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济趋势对FPGA产业的影响

第五章 市场规模与成长预测

- 成分

- 高阶FPGA

- 中低阶FPGA

- 建筑设计

- 基于SRAM的FPGA

- 基于快闪记忆体的FPGA

- 反熔丝FPGA

- 依技术节点

- 90奈米或以上

- 20~90 nm

- 16奈米或更小

- 按终端市场

- 资料中心和云端运算

- 电讯和5G基础设施

- 汽车(ADAS、电气化)

- 工业自动化与机器人

- 航太与国防(航空电子设备、卫星通讯)

- 家用电子电器和穿戴式装置

- 测试、测量和医疗设备

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 北欧国家(瑞典、挪威、芬兰、丹麦)

- 其他欧洲

- 亚太地区

- 中国

- 台湾

- 日本

- 韩国

- 印度

- ASEAN

- 亚太其他地区

- 南美洲

- 墨西哥

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Advanced Micro Devices Inc.(Xilinx)

- Intel Corporation

- Lattice Semiconductor Corp.

- Microchip Technology Inc.(Microsemi)

- Achronix Semiconductor Corp.

- QuickLogic Corporation

- Efinix Inc.

- GOWIN Semiconductor Corp.

- Flex Logix Technologies Inc.

- NanoXplore SAS

- Anlogic Infotech Co. Ltd.

- Pango Microsystems Inc.

- Shenzhen S2C Ltd.

- BittWare(Molex Company)

- Digilent Inc.

- AlphaData Parallel Systems Ltd.

- Colfax International

- Reflex Ces SAS

- Aldec Inc.

- Beijing Tsinghua Tongfang Co. Ltd.

第七章 市场机会与未来展望

The field programmable gate array market was valued at USD 10.08 billion in 2025 and estimated to grow from USD 11.02 billion in 2026 to reach USD 17.23 billion by 2031, at a CAGR of 9.35% during the forecast period (2026-2031).

Rapid adoption of edge-AI inference in hyperscale data centers, the migration to 5G open radio architectures, and the rising need for post-deployment reconfigurability in automotive and aerospace electronics gave the market clear momentum. High-end devices continued to anchor revenues, yet mid-range and low-end products climbed quickly as design teams pushed FPGA technology into cost-sensitive industrial, IoT, and consumer systems. Asia-Pacific emerged as both the largest manufacturing base and the fastest-growing demand center, benefiting from electric-vehicle powertrains and new-space constellations. Competitive intensity increased after Intel agreed to carve out Altera, reshaping supplier dynamics while export controls spurred parallel domestic development in China. Tighter 300 mm foundry capacity and the costly transition to <=16 nm nodes also forced vendors to prioritize high-margin applications and long-term wafer reservations with TSMC and Samsung.

Global Field Programmable Gate Array (FPGA) Market Trends and Insights

Edge-AI inference demand in hyperscale data centers

Hyperscale operators deployed FPGAs to accelerate AI inference once latency and power budgets began outweighing raw throughput requirements. AMD's Versal AI Edge Gen 2 devices delivered up to 3 X higher TOPS-per-watt than first-generation parts, enabling real-time vision analytics while containing operating expenses. Achronix reported 200 % cost and power advantages versus GPU alternatives when running large language models, underscoring FPGA efficiency in memory-bound workloads. This shift unlocked a distributed compute model where inference processing moved closer to data sources, easing bandwidth constraints and data-sovereignty risks. Integration of on-package HBM and hardened AI engines within leading FPGA families strengthened their position in cloud-edge topologies. Consequently, the field programmable gate array market found a durable growth pillar in hyperscale capital expenditure plans.

5G ORAN shift requiring re-programmable logic in radios

Open radio access network initiatives pushed carriers to adopt vendor-agnostic radio units that could evolve with software upgrades rather than forklift replacements. Intel's Agilex portfolio used 10 nm SuperFin technology to deliver software-defined radios that adapt to new 5G releases at a lower total cost of ownership. Lattice Semiconductor complemented that hardware with a reference stack providing zero-trust security and real-time encryption for disaggregated networks. AMD's Zynq RFSoC DFE doubled performance per watt versus prior devices, letting operators support multi-band operation inside compact, power-constrained radio heads. Flexible logic shortened rollout cycles, a critical factor as carriers blended private-5G, fixed-wireless access, and mmWave services. That flexibility secured a new volume opportunity for the field programmable gate array market across telecom infrastructure.

US-EU export controls on high-performance FPGAs to China

New Bureau of Industry and Security rules removed civilian exemptions for advanced FPGA shipments to China in late 2023, restricting devices suited for AI or military use. The shift forced AMD-Xilinx and Intel-Altera to halt or license-screen many orders, reducing near-term unit volumes. Chinese suppliers such as GOWIN and Pango sought to close the gap, yet hurdles in design tools, IP, and advanced process access limited immediate substitution. Multinational customers moved sensitive production away from China or redesigned systems to qualify non-US devices, fracturing previously global supply chains. The resulting uncertainty weighed on the field programmable gate array market until new trade norms stabilized.

Other drivers and restraints analyzed in the detailed report include:

- Rapid prototyping needs for ASIC/SoC shrink cycles (<=7 nm)

- Functional safety compliance in automotive (ISO 26262)

- Volatility in 300 mm foundry capacity allocation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

High-end devices held 65.80% of the field programmable gate array market share in 2025, reflecting their central role in data-center acceleration and 5G infrastructure. These platforms, often exceeding 1 million logic cells, carried premium ASPs yet delivered deterministic latency unavailable in GPUs, preserving their appeal for safety-critical aerospace and fintech workloads. Mid-range and low-end devices exhibited an 10.85% CAGR to 2031 as manufacturers like Lattice shipped cost-optimized parts with hardened AI engines that met edge-compute budgets. Design tools have grown more intuitive, letting embedded engineers adopt configurable logic without hardware backgrounds.

The value proposition evolved as AMD introduced Spartan UltraScale+ with 30% lower power and unrivaled I/O count, attacking the mid-range from above. Simultaneously, module vendors supplied pre-validated boards that abstracted pin-planning and PCB layout, trimming design cycles. These shifts are expected to compress the pricing gap between tiers, although high-end devices still command a majority of the field programmable gate array market size when new AI or networking standards emerge that only top-node silicon can satisfy.

SRAM-based solutions owned 54.85% revenue in 2025 and posted an 11.45% CAGR outlook thanks to unlimited reprogram cycles and a deep software ecosystem. Yet flash-based variants gained mindshare in wearables and automotive telematics, where instant-on behavior is vital. Microchip's RT PolarFire achieved MIL-STD-883 Class B, offering 50% lower power than equivalent SRAM parts while tolerating 100 krad radiation. Anti-fuse platforms sustained a niche in defense avionics where one-time programmability eliminates tampering risk.

Software portability is shrinking historical barriers, so designers can now choose based on power and security rather than tool familiarity. Emerging heterogeneous architectures integrate SRAM fabric with on-die non-volatile domains, providing the best-of-both options. While SRAM devices will continue leading the field programmable gate array market revenue, flash and anti-fuse offerings should carve larger shares in low-power and harsh-environment deployments.

Field Programmable Gate Array is Segmented by Configuration (High-End FPGA, and Mid-range/Low-end FPGA), Architecture (SRAM-Based FPGA, Flash-Based FPGA, and More), Technology Node (>=90 Nm, 20-90 Nm, and <=16 Nm), End Market (Data Centre and Cloud Computing, Telecommunications and 5G Infrastructure, Automotive, and More), and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa).

Geography Analysis

Asia-Pacific dominated the field programmable gate array market with 39.10% revenue in 2025 and showed a 16.20% CAGR outlook to 2031. China's push for semiconductor self-reliance, highlighted by domestic innovators in electric vehicle drives and satellite payloads, pulled in significant FPGA volumes. Taiwan and South Korea supplied advanced fabrication, while Japan specialized in automotive modules and factory automation subsystems. India's design-service sector advanced after Lattice opened an R&D center in Pune, broadening engineering talent pools.

North America maintained leadership in data-center infrastructure, high-reliability aerospace, and EDA software. Hyperscalers directed large capital budgets toward adaptive accelerators to manage AI service costs, ensuring the region's strong purchase share. Export-license reviews shaped shipment patterns but also prompted domestic investment in advanced packaging and OSAT capacity that supports the field programmable gate array market.

Europe leaned on Germany's automotive supply chain and Nordic telecom equipment providers. ISO 26262 compliance spurred in-vehicle usage, while energy-transition projects created demand for low-loss power converters. EU Digital Decade policies encouraged sovereign edge computing platforms that favor reconfigurability. Although South America and the Middle East, and Africa hold smaller slices today, growth potential in 5G infrastructure and industrial modernization should boost their contribution over the forecast period.

- Advanced Micro Devices Inc. (Xilinx)

- Intel Corporation

- Lattice Semiconductor Corp.

- Microchip Technology Inc. (Microsemi)

- Achronix Semiconductor Corp.

- QuickLogic Corporation

- Efinix Inc.

- GOWIN Semiconductor Corp.

- Flex Logix Technologies Inc.

- NanoXplore SAS

- Anlogic Infotech Co. Ltd.

- Pango Microsystems Inc.

- Shenzhen S2C Ltd.

- BittWare (Molex Company)

- Digilent Inc.

- AlphaData Parallel Systems Ltd.

- Colfax International

- Reflex Ces SAS

- Aldec Inc.

- Beijing Tsinghua Tongfang Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Edge-AI Inference Demand in Hyperscale Data Centres

- 4.2.2 5G ORAN Shift Requiring Re-programmable Logic in Radios

- 4.2.3 Rapid Prototyping Needs for ASIC/SoC Shrink Cycles (<=7 nm)

- 4.2.4 Functional Safety Compliance in Automotive (ISO 26262)

- 4.2.5 Radiation-Tolerant Designs for New-Space Constellations

- 4.2.6 Chinese EV Power-train OEMs Adopting eFPGAs for Motor Control

- 4.3 Market Restraints

- 4.3.1 US-EU Export Controls on High-performance FPGAs to China

- 4.3.2 Volatility in 300 mm Foundry Capacity Allocation

- 4.3.3 Higher Static Power Consumption vs. Dedicated ASIC

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Trends on the FPGA Industry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Configuration

- 5.1.1 High-end FPGA

- 5.1.2 Mid-range/Low-end FPGA

- 5.2 By Architecture

- 5.2.1 SRAM-based FPGA

- 5.2.2 Flash-based FPGA

- 5.2.3 Anti-fuse FPGA

- 5.3 By Technology Node

- 5.3.1 >=90 nm

- 5.3.2 20-90 nm

- 5.3.3 <=16 nm

- 5.4 By End Market

- 5.4.1 Data Centre and Cloud Computing

- 5.4.2 Telecommunications and 5G Infrastructure

- 5.4.3 Automotive (ADAS, Electrification)

- 5.4.4 Industrial Automation and Robotics

- 5.4.5 Aerospace and Defense (Avionics, SATCOM)

- 5.4.6 Consumer Electronics and Wearables

- 5.4.7 Test, Measurement and Medical Devices

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Nordics (Sweden, Norway, Finland, Denmark)

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Taiwan

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 India

- 5.5.3.6 ASEAN

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Mexico

- 5.5.4.2 Brazil

- 5.5.4.3 Argentina

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global and Market Overview, Core Segments, Financials, Strategy, Rank/Share, Products, Recent Moves)

- 6.4.1 Advanced Micro Devices Inc. (Xilinx)

- 6.4.2 Intel Corporation

- 6.4.3 Lattice Semiconductor Corp.

- 6.4.4 Microchip Technology Inc. (Microsemi)

- 6.4.5 Achronix Semiconductor Corp.

- 6.4.6 QuickLogic Corporation

- 6.4.7 Efinix Inc.

- 6.4.8 GOWIN Semiconductor Corp.

- 6.4.9 Flex Logix Technologies Inc.

- 6.4.10 NanoXplore SAS

- 6.4.11 Anlogic Infotech Co. Ltd.

- 6.4.12 Pango Microsystems Inc.

- 6.4.13 Shenzhen S2C Ltd.

- 6.4.14 BittWare (Molex Company)

- 6.4.15 Digilent Inc.

- 6.4.16 AlphaData Parallel Systems Ltd.

- 6.4.17 Colfax International

- 6.4.18 Reflex Ces SAS

- 6.4.19 Aldec Inc.

- 6.4.20 Beijing Tsinghua Tongfang Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment