|

市场调查报告书

商品编码

1910600

北美合约物流:市场占有率分析、产业趋势与统计、成长预测(2026-2031)North America Contract Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

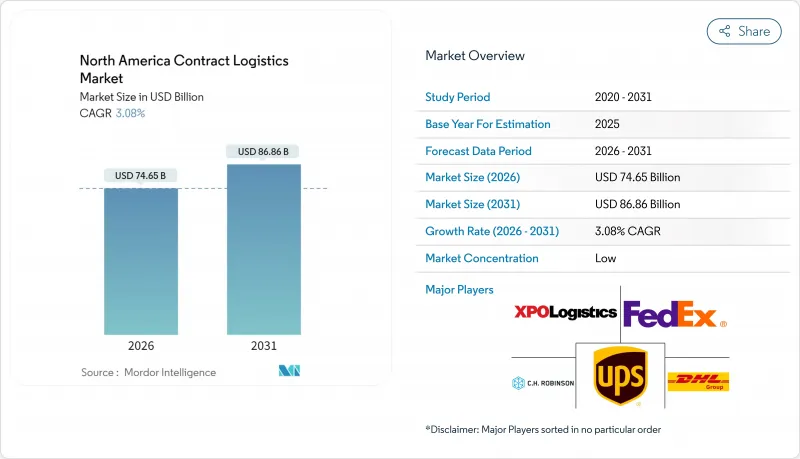

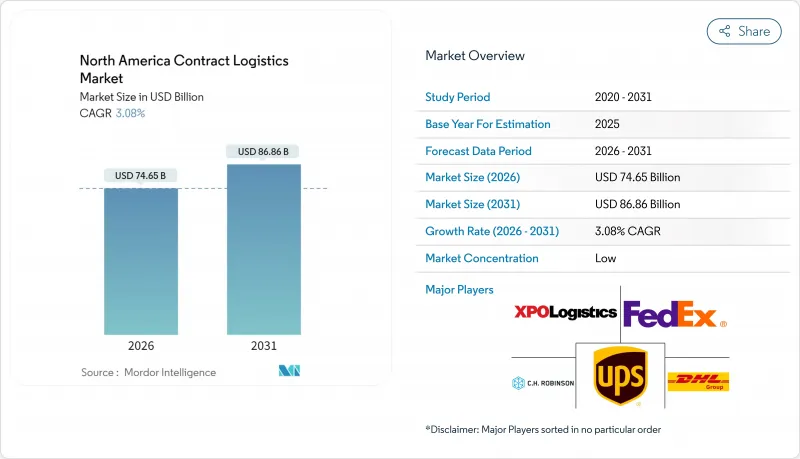

2025年北美合约物流市场价值为724.2亿美元,预计到2031年将达到868.6亿美元,高于2026年的746.5亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 3.08%。

非核心物流职能外包的增加、电子商务交易量的持续成长以及受《美国墨加协定》(USMCA)推动的跨境整合,持续支撑着市场扩张。儘管运输服务仍占据支出的大部分,但从组装到贴标等增值活动正经历着最快的增长,因为托运人寻求在更靠近终端市场的地方实现更具成本效益的客製化服务。稳定的长期合约为自动化和低温运输基础设施的投资提供了支持,而墨西哥的近岸外包则推动了一波新的物流中心建设浪潮。随着全球整合商扩大规模,以及本地专业公司开闢技术密集型细分市场,竞争日益激烈。

北美合约物流市场趋势与洞察

电子商务订单履约量快速成长

如今,零售商需要机器人仓库、即时视觉性和全通路整合。联邦快递已部署自主移动机器人和高速分类机来处理日益复杂的小包裹,从而缩短了周转时间并提高了吞吐量。物流供应商正在利用人工智慧预测需求并分配库存,以提高面向消费者和企业对企业 (B2B) 业务的最后一公里配送准确率。中型第三方物流 (3PL) 公司透过提供分散式节点网路来大幅缩小配送区域,从而增加了合约中标率。曾经无法负担复杂解决方案的中小型托运人,现在正接入基于云端的 3PL 入口网站,这些网站以订阅价格提供仓库管理系统 (WMS)、运输管理系统 (TMS) 和费率比较功能。这些变化正在推动外包合作伙伴收入的成长,并进一步提升附加价值服务在北美合约物流市场的重要性。

推动外包迈向成本效益高、资产轻型模式转型

托运人正透过清算物流资产来重组财务状况,而第三方物流公司则在收购仓库、车辆和人才。根据《2024年物流状况报告》,合约物流收入呈现稳健成长,在市场波动加剧、运力保障变得愈发重要的背景下,其成长速度已超过传统的整车运输业务。长期合约使供应商能够摊销自动化投资并部署专属劳动力,从而提升托运人服务关键绩效指标 (KPI) 并稳定供应商现金流。这一趋势与北美合约物流市场向混合模式的稳定转型相一致,该混合模式将专属资产与经纪业务的柔软性相结合。

仓库劳动力短缺和工资上涨

2024年,失业率下降和电子商务劳动力需求激增,促使物流供应商报告拣货员和堆高机驾驶人的薪资实现了两位数成长。机器人采用率成长了23%,部分填补了劳动力缺口,同时也推动了资本投资需求。招募奖励,包括2500美元的签约奖金,推高了营运成本,而人员配备不足则可能面临服务处罚。小型托运人往往依赖北美合约物流市场来间接获得可靠的劳动力。

细分市场分析

2025年,运输业务将占总收入的64.35%,这凸显了货运在北美合约物流市场中不可取代的地位。卡车运输仍是核心业务,承担美国墨西哥货运量的72.2%和美国加拿大货运量的60.1%。铁路运输支持大宗货物和长途消费品的运输,航空运输支持高价值商品的运输,海运则支持沿海配送中心的运作。儘管该业务板块规模保持稳定,但其成长速度与辅助服务相比仍然较为缓慢。

附加价值服务(丛集组装、套件组装和贴标)的成长速度将超过其他类别,到2031年将以3.53%的复合年增长率成长。製造商正将最后时刻的客製化工作外包给第三方物流公司,以减少成品库存并提高市场应对力。 Ryder公司的热缩包装和泡壳包装生产线展示了整合服务如何提高客户留存率。 Basket 物流的套件组装方案可以节省工厂空间并提高生产效率。随着这些解决方案的成熟,供应商正将其与传统仓储服务相结合,以提高合约份额,这使得北美合约物流市场对希望精简供应商名单的托运人来说具有重要的战略价值。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电子商务订单履约量快速成长

- 外包推动成本降低与轻资产模式

- 美墨加协定主导跨境物流流量成长

- 将生产外包到墨西哥推动了新的配送中心建设。

- 中小企业对人工智慧驱动的第三方物流平台的采用现状

- 与环境、社会和治理(ESG)相关的物流合约正变得越来越受欢迎。

- 市场限制

- 仓库劳动力短缺和工资上涨

- 各州卡车运输法规不一致

- 第三方物流供应商的网路保险保费正在上涨

- 电动车卡车充电基础设施的缺乏阻碍了绿色车队的普及。

- 价值/供应链分析

- 监管环境(包括美墨加协定的影响)

- 科技展望(自动化、人工智慧、物联网)

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 电子商务洞察(国内和跨境)

- 逆向物流的考量

- 新冠疫情与地缘政治事件的影响

第五章 市场规模与成长预测

- 按服务类型

- 运输

- 路

- 铁路

- 航空

- 海上运输

- 仓库/配送

- 附加价值服务(组装、贴标、套件包装)

- 运输

- 按合约期限

- 1-3年

- 3年或以上

- 按最终用户行业划分

- 製造业和汽车业

- 食品/饮料

- 零售与电子商务

- 医疗/製药

- 化学品

- 其他行业

- 按国家/地区

- 美国

- 加拿大

- 墨西哥

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Deutsche Post DHL Group

- United Parcel Service Inc.

- FedEx Corp.

- CH Robinson Worldwide

- XPO Logistics Inc.

- Kuehne+Nagel International AG

- Ryder System Inc.

- JB Hunt Transport Services Inc.

- DSV

- CEVA Logistics

- Geodis

- Penske Logistics Inc.

- Hellmann Worldwide Logistics

- GXO Logistics

- NFI Industries

- Neovia Logistics Services LLC

- Yusen Logistics

- Werner Enterprises

- PiVAL International

- Metro Supply Chain

第七章 市场机会与未来展望

第八章附录

- 按活动分類的GDP分布

- 资金流分析

- 外贸统计

The North America Contract Logistics Market was valued at USD 72.42 billion in 2025 and estimated to grow from USD 74.65 billion in 2026 to reach USD 86.86 billion by 2031, at a CAGR of 3.08% during the forecast period (2026-2031).

Growing outsourcing of non-core logistics functions, persistent e-commerce volume spikes, and cross-border integration enabled by the USMCA continue to anchor expansion. Transportation services still dominate spend, but value-added activities-ranging from assembly to labeling-record the briskest growth as shippers search for cost-effective customization near end markets. Stable long-term contracts underpin investment in automation and cold-chain infrastructure, while near-shoring to Mexico drives a fresh wave of distribution-center construction. Competitive intensity is heightening as global integrators consolidate scale and regional specialists carve out technology-rich niches.

North America Contract Logistics Market Trends and Insights

Surging E-commerce Fulfillment Volumes

Retailers now demand robotics-equipped warehouses, real-time visibility, and omnichannel orchestration. FedEx has deployed autonomous mobile robots and high-speed sorters to cope with package complexity, cutting cycle times and lifting throughput. Logistics providers use AI for demand forecasting and inventory positioning, improving last-mile accuracy for direct-to-consumer and B2B flows. Mid-tier 3PLs increasingly win contracts by offering distributed node networks that slash shipping zones. SME shippers, once priced out of complex solutions, plug into cloud-based 3PL portals that bundle WMS, TMS, and rate shopping features at subscription pricing. These shifts direct more revenue toward outsourced partners and reinforce the importance of value-added services within the North America contract logistics market.

Outsourcing Push for Cost-Efficient Asset-Light Models

Shippers restructure balance sheets by monetizing captive logistics assets while 3PLs pick up warehouses, fleets, and talent. The 2024 State of Logistics report noted a robust uptick in contract logistics revenues, eclipsing traditional trucking segments as volatility made guaranteed capacity critical. Longer contracts enable providers to amortize automation investments and devote dedicated labor, producing higher service KPIs for shippers while stabilizing provider cash flows. The trend harmonizes with the North America contract logistics market's steady shift toward hybrid models that blend dedicated assets with brokerage flexibility.

Warehouse Labor Scarcity & Wage Inflation

Providers reported double-digit pay increases for pickers and forklift drivers in 2024 as unemployment dipped and e-commerce labor demand soared. Robotics deployments rose 23%, partially offsetting shortages while raising capex needs. Recruitment incentives, including USD 2,500 signing bonuses, inflate operating costs, but failing to staff facilities risks service penalties. Shippers lacking scale turn to the North America contract logistics market to secure reliable staffing indirectly.

Other drivers and restraints analyzed in the detailed report include:

- USMCA-Led Cross-Border Flow Growth

- Near-Shoring to Mexico Spurring New DC Builds

- Rising Cyber-Insurance Premiums for 3PLs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Transportation contributed 64.35% of 2025 revenue, illustrating freight's irreplaceable role in the North America contract logistics market. Trucking remains the backbone, carrying 72.2% of U.S.-Mexico and 60.1% of U.S.-Canada flows. Rail supports bulk freight and long-haul consumer goods; air caters to high-value SKUs; ocean feeds coastal DCs. The segment's scale endures, yet its growth pace remains modest compared with ancillary offerings.

The value-added cluster-assembly, kitting, labeling-posts a 3.53% CAGR through 2031, outpacing every other category. Manufacturers delegate late-stage customization to 3PLs to shrink finished-goods inventory and sharpen market responsiveness. Ryder's heat-shrinking and blister-sealing lines illustrate how integrated services deepen customer stickiness. Buske Logistics' kitting programs reclaim plant floor space and elevate throughput. As these solutions mature, providers bundle them with conventional warehousing to lift contractual share of wallet, raising the strategic value of the North America contract logistics market size for shippers looking to rationalize vendor rosters.

The North America Contract Logistics Market Report is Segmented by Service Type (Transportation, Warehousing & Distribution, and Value-Added Services), Contract Duration (1-3 Years and Above 3 Years), End-User Industry (Manufacturing & Automotive, Food & Beverage, Retail & E-Commerce, Healthcare & Pharmaceuticals, and More), Country (United States, Canada, and Mexico). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Deutsche Post DHL Group

- United Parcel Service Inc.

- FedEx Corp.

- C.H. Robinson Worldwide

- XPO Logistics Inc.

- Kuehne + Nagel International AG

- Ryder System Inc.

- J.B. Hunt Transport Services Inc.

- DSV

- CEVA Logistics

- Geodis

- Penske Logistics Inc.

- Hellmann Worldwide Logistics

- GXO Logistics

- NFI Industries

- Neovia Logistics Services LLC

- Yusen Logistics

- Werner Enterprises

- PiVAL International

- Metro Supply Chain

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging e-commerce fulfilment volumes

- 4.2.2 Outsourcing push for cost & asset-light models

- 4.2.3 USMCA-led cross-border flow growth

- 4.2.4 Near-shoring to Mexico spurring new DC builds

- 4.2.5 SME adoption of AI-enabled 3PL platforms

- 4.2.6 ESG-linked logistics contracts gaining traction

- 4.3 Market Restraints

- 4.3.1 Warehouse labour scarcity & wage inflation

- 4.3.2 Patchy state-level trucking regulations

- 4.3.3 Rising cyber-insurance premiums for 3PLs

- 4.3.4 EV-truck charging gaps limiting green fleets

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape (incl. USMCA impact)

- 4.6 Technological Outlook (automation, AI, IoT)

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Insights on E-commerce (domestic & cross-border)

- 4.9 Insights on Reverse Logistics

- 4.10 Impact of COVID-19 and Geo-Political Events

5 Market Size & Growth Forecasts

- 5.1 By Service Type

- 5.1.1 Transportation

- 5.1.1.1 Road

- 5.1.1.2 Rail

- 5.1.1.3 Air

- 5.1.1.4 Sea

- 5.1.2 Warehousing & Distribution

- 5.1.3 Value-added Services (Assembly, Labelling, Kitting)

- 5.1.1 Transportation

- 5.2 By Contract Duration

- 5.2.1 1 - 3 Years

- 5.2.2 Above 3 years

- 5.3 By End-user Industry

- 5.3.1 Manufacturing & Automotive

- 5.3.2 Food & Beverage

- 5.3.3 Retail & E-commerce

- 5.3.4 Healthcare & Pharmaceuticals

- 5.3.5 Chemicals

- 5.3.6 Other Industries

- 5.4 By Country

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Deutsche Post DHL Group

- 6.4.2 United Parcel Service Inc.

- 6.4.3 FedEx Corp.

- 6.4.4 C.H. Robinson Worldwide

- 6.4.5 XPO Logistics Inc.

- 6.4.6 Kuehne + Nagel International AG

- 6.4.7 Ryder System Inc.

- 6.4.8 J.B. Hunt Transport Services Inc.

- 6.4.9 DSV

- 6.4.10 CEVA Logistics

- 6.4.11 Geodis

- 6.4.12 Penske Logistics Inc.

- 6.4.13 Hellmann Worldwide Logistics

- 6.4.14 GXO Logistics

- 6.4.15 NFI Industries

- 6.4.16 Neovia Logistics Services LLC

- 6.4.17 Yusen Logistics

- 6.4.18 Werner Enterprises

- 6.4.19 PiVAL International

- 6.4.20 Metro Supply Chain

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment

8 Appendix

- 8.1 GDP Distribution by Activity

- 8.2 Capital Flows Insights

- 8.3 External Trade Statistics