|

市场调查报告书

商品编码

1910604

边缘人工智慧硬体:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Edge AI Hardware - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

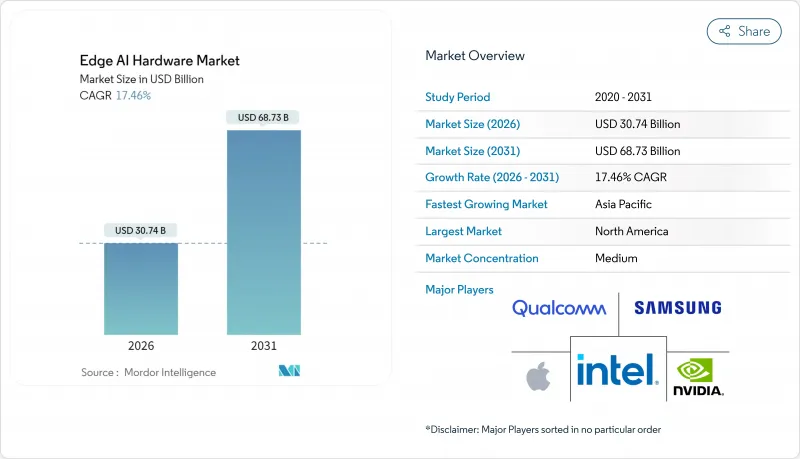

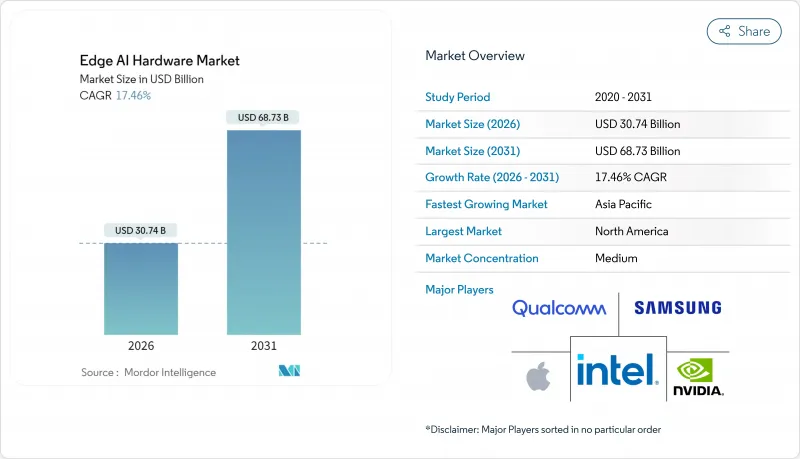

预计到 2025 年,边缘 AI 硬体市场规模将达到 261.7 亿美元,到 2026 年将成长至 307.4 亿美元,到 2031 年将成长至 687.3 亿美元,在预测期(2026-2031 年)内,复合年增长率为 17.46%。

这一成长动能主要得益于对设备端推理需求的不断增长,这种推理方式能够降低延迟、保护资料主权并减少能耗。高阶智慧型手机、人工智慧个人电脑以及关键的汽车安全系统正在支撑近期成长。诸如《晶片与科学法案》等政府激励措施正在推动国内製造业产能的提升,而支援5G的多接取边缘运算(MEC)则正在拓展可处理的工作负载范围。市场竞争较为温和,各半导体巨头都在努力捍卫市场份额,而应用专用晶片供应商则致力于优化每瓦性能。先进晶圆代工厂的供应链集中度以及不断扩大的出口限制加剧了区域市场的复杂性,同时也促进了本土替代技术的研发。

全球边缘人工智慧硬体市场趋势与洞察

人工智慧赋能的个人电脑的兴起将改变处理器架构。

最新笔记型电脑晶片中的专用神经处理单元 (NPU) 可提供 40-50 TOPS 的本地 AI 吞吐量,使大型语言模型和生成式工作负载能够离线运行并实现即时响应。微软 Copilot+PC 的新设计标准正在推动所有 OEM 厂商采用类似的加速整合方案,引导蓝图从通用核心转向异构运算。到 2030 年的半导体蓝图优先考虑推理最佳化型晶片,从而持续推动对边缘运算节点的需求。

智慧型手机人工智慧功能驱动的高阶市场更新週期

旗舰移动处理器将提供 45-50 TOPS 的推理性能,并透过将 AI 任务卸载到专用引擎来延长电池续航时间。设备内翻译、生成式影像处理和个人助理功能将为高阶产品带来明显的升级动力,从而缩短更换週期。中阶产品将保留上一年旗舰级的功能,并扩大专用 AI 晶片的出货量。

先进节点製造成本限制了市场进入

开发3奈米装置需要超过1亿美元的掩模费用,每片晶圆的成本超过2万美元,这限制了新进者的市场。随着小规模的公司寻求扩大规模并在细分领域脱颖而出,行业整合正在加速。节点优化设计和晶片分割在一定程度上抵消了成本,但也进一步巩固了拥有现有供应协议的现有企业的优势。

细分市场分析

到2025年,GPU设备将占据边缘AI硬体市场50.12%的份额,这主要得益于成熟的软体堆迭和高并行吞吐量。随着设计人员优先考虑每瓦性能,ASIC和NPU预计在预测期内将以18.74%的复合年增长率成长。随着汽车和工业领域的买家优先考虑确定性延迟和功能安全性,ASIC的边缘AI硬体市场规模预计将呈指数级增长。 CPU在需要通用资源的混合工作负载中仍将保持价值,而FPGA将在通讯和国防领域的可重构应用中继续蓬勃发展。

晶片封装将CPU、GPU和NPU模组整合到通用基板上,每个晶粒针对不同任务进行最佳化,共用记忆体介面。供应商在硅层整合安全区域和功能安全监控器,以满足医疗和汽车行业的监管要求。多代晶圆代工厂策略降低了地缘政治风险,而对先进製程节点的依赖则维持了与大型晶圆厂的议价能力。

到2025年,智慧型手机将占据边缘AI硬体市场39.25%的份额,这主要得益于其年度更新周期和大规模生产。然而,机器人和无人机领域,尤其是那些需要低延迟推理的自主导航和视觉分析领域,将以19.32%的复合年增长率成长。专用边缘闆卡整合了视觉处理器和深度感测器,可在毫秒级时间内实现避障。

摄影机整合边缘人工智慧技术,可在机柜内进行即时侦测,从而降低零售分析和智慧城市专案的影像回程传输成本。穿戴式装置采用超低功耗神经网路引擎,即使在电池电量有限的情况下也能持续撷取健康数据。智慧音箱将语音采集、波束成形和自然语言处理推理功能整合到单一晶片上,减少了组件数量,并透过本地音讯传输增强了隐私性。

区域分析

北美地区占总收入的38.92%,这主要得益于2025年高达520亿美元的CHIPS奖励计划,以及汽车、零售和医疗保健行业企业试点项目的领先部署。Start-Ups正利用创业投资推动特定产业加速器的商业化。出口管制政策限制了国际销售,而国内国防和航太需求仍然强劲。

亚太地区成长速度超过其他地区,复合年增长率达19.27%。中国正扶持国内GPU和NPU企业以规避进口限制;韩国正斥资70亿美元打造国家级人工智慧晶片生产线;日本的「社会5.0」计画正在推动智慧工厂转型,而这需要确定性边缘运算。

欧洲透过耗资430亿欧元的「晶片法案」在主权目标和预算现实之间寻求平衡。德国和法国的汽车产业中心优先发展边缘推理技术,并确保功能安全,而GDPR合规性则推动了本地分析的发展。以色列充满活力的Start-Ups生态系统瞄准国防和医疗成像应用领域,并向欧洲、中东和非洲地区出口电路板。

拉丁美洲在农业无人机和智慧城市监控系统方面已率先采用。中东正在加速投资建设主权资料中心,并结合边缘网关,以承载用于物流和能源基础设施的人工智慧。非洲虽然仍在发展中,但其技术平台正在超越传统模式,采用行动优先部署并结合卫星回程传输。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 人工智慧驱动的个人电脑(AI PC)的兴起

- 人工智慧智慧型手机升级週期

- MEC引入对5G和6G延迟的降低效果

- 对汽车L2-L4 ADAS边缘推理的需求

- 节能型模拟与PIM加速器

- 类似《CHIPS法案》的政府奖励

- 市场限制

- 先进节点初始开发成本(NRE)不断上升

- 工具链分散化和软体锁定

- 边缘运算与硅谷人才短缺

- 供应链中的地缘政治出口管制

- 产业价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济因素的影响

第五章 市场规模与成长预测

- 按处理器

- CPU

- GPU

- FPGA

- 专用积体电路与神经网路处理器

- 透过装置

- 智慧型手机

- 摄影机和智慧视觉感测器

- 机器人和无人机

- 穿戴式装置

- 智慧音箱与家庭中枢

- 其他边缘设备

- 按最终用户行业划分

- 家用电子电器

- 汽车/运输设备

- 製造和工业IoT

- 卫生保健

- 政府和公共

- 其他终端用户产业

- 按安装位置

- 设备边缘

- 近边缘伺服器

- 远边缘/MEC

- 云端辅助混合

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 新加坡

- 澳洲

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- NVIDIA Corporation

- Intel Corporation

- Qualcomm Incorporated

- Samsung Electronics Co., Ltd.

- Apple Inc.

- Advanced Micro Devices, Inc.

- Huawei Technologies Co., Ltd.

- Alphabet Inc.(Google LLC)

- Amazon.com, Inc.

- Alibaba Group Holding Limited

- Baidu, Inc.

- Continental AG

- DENSO Corporation

- Robert Bosch GmbH

- Kalray SA

- MediaTek Inc.

- Imagination Technologies Limited

- Hailo Technologies Ltd.

- SiMa.ai, Inc.

- BrainChip Holdings Ltd.

- Syntiant Corp.

- Mythic, Inc.

- Gyrfalcon Technology Inc.

第七章 市场机会与未来展望

The Edge AI hardware market was valued at USD 26.17 billion in 2025 and estimated to grow from USD 30.74 billion in 2026 to reach USD 68.73 billion by 2031, at a CAGR of 17.46% during the forecast period (2026-2031).

Momentum stems from rising demand for on-device inference that cuts latency, safeguards data sovereignty, and lowers energy consumption. Premium-tier smartphones, AI-enabled personal computers, and mandatory automotive safety systems anchor near-term growth. Government incentives such as the CHIPS and Science Act encourage domestic production capacity, while 5G-powered multi-access edge computing (MEC) broadens the addressable workload. Competitive intensity is moderate as diversified semiconductor leaders defend share against application-specific chip suppliers that optimize performance per watt. Supply-chain concentration at advanced foundries and widening export controls add regional complexity but also stimulate indigenous alternatives.

Global Edge AI Hardware Market Trends and Insights

Rise of AI-Enabled Personal Computing Transforms Processor Architecture

Dedicated neural processing units (NPUs) in the latest laptop chips achieve 40-50 TOPS of local AI throughput, allowing large language models and genera-tive workloads to run offline with instant response times. New design baselines from Microsoft Copilot+ PCs compel every OEM to integrate similar acceleration, steering roadmaps toward heterogeneous compute rather than general-purpose cores. Semiconductor roadmaps through 2030 now prioritize inference-optimized tiles, driving sustained demand for edge-centric nodes.

Smartphone AI Capabilities Drive Premium Segment Refresh Cycles

Flagship mobile processors deliver 45-50 TOPS inference and extend battery life by scheduling AI tasks to dedicated engines. On-device translation, generative imaging, and personal-assistant features create clear upgrade motives across premium tiers, shortening replacement intervals. Mid-range designs will inherit last year's flagship capabilities, expanding volume shipments of specialized AI silicon.

Advanced Node Manufacturing Costs Limit Market Entry

Developing a 3 nm device demands over USD 100 million in masks and USD 20,000 per wafer, constraining access for new entrants. Consolidation accelerates as smaller firms seek scale or niche differentiation. Design-for-node co-optimization and chiplet partitioning partially offset cost but reinforce the advantage for incumbents with existing supply contracts.

Other drivers and restraints analyzed in the detailed report include:

- 5G Infrastructure Enables Distributed Edge Computing Architectures

- Automotive Safety Regulations Mandate Advanced Driver Assistance Systems

- Export Control Restrictions Fragment Global Supply Chains

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

GPU devices captured 50.12% Edge AI hardware market share in 2025 owing to mature software stacks and high parallel throughput. Over the forecast horizon, ASICs and NPUs are projected to post a 18.74% CAGR as designers emphasize performance per watt. The Edge AI hardware market size for ASICs is expected to rise sharply as automotive and industrial buyers prioritize deterministic latency and functional safety. CPUs retain value where mixed workloads require general-purpose resources, and FPGAs grow in reconfigurable roles across telecom and defense.

Chiplet packaging combines CPU, GPU, and NPU tiles on common substrates, optimizing each die for distinct tasks while sharing memory interfaces. Vendors integrate security enclaves and functional-safety monitors at the silicon layer, satisfying regulatory mandates in healthcare and automotive deployments. Multi-foundry strategies mitigate geopolitical risk, yet advanced-node dependence keeps negotiating leverage with leading fabs.

Smartphones accounted for 39.25% of the Edge AI hardware market size in 2025, leveraging annual refresh cycles and large unit volumes. Robots and drones, however, represent the fastest trajectory, climbing at 19.32% CAGR as autonomous navigation and vision analytics demand low-latency inference. Specialized edge boards pair vision processors with depth sensors, enabling millisecond obstacle avoidance.

Cameras integrate edge AI to execute real-time detection within enclosures, reducing video backhaul costs for retail analytics and smart cities. Wearables adopt ultra-low-power neural engines that extract health insights continuously under limited battery budgets. Smart speakers consolidate voice capture, beamforming, and NLP inference on single chips, shrinking the bill of materials and enhancing privacy by keeping audio local.

The Edge AI Hardware Market Report is Segmented by Processor (CPU, GPU, and More), Device (Smartphones, Cameras and Smart Vision Sensors, and More), End-User Industry (Consumer Electronics, Automotive and Transportation, and More), Deployment Location (Device Edge, Near Edge Servers, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 38.92% revenue in 2025 on the back of USD 52 billion CHIPS incentives and early enterprise pilots in automotive, retail, and healthcare. Start-ups leverage venture capital density to commercialize domain-specific accelerators. Export-control policy constrains outbound sales, yet secures domestic defense and aerospace demand.

Asia-Pacific is advancing at a 19.27% CAGR, outpacing all other regions. China funds native GPU and NPU ventures to circumvent import restrictions, while South Korea allocates USD 7 billion for national AI chip lines. Japan's Society 5.0 agenda stimulates smart-factory retrofits that require deterministic edge compute.

Europe balances sovereignty aims with budget realities under its EUR 43 billion Chips Act. Automotive hubs in Germany and France prioritize functional-safe edge inference, while GDPR compliance encourages on-premise analytics. Israel's vibrant start-up ecosystem targets defense and medical imaging use cases, exporting boards across EMEA.

Latin America sees early adoption in agriculture drones and smart-city surveillance. The Middle East accelerates investment in sovereign data centers coupled with edge gateways to host AI for logistics and energy infrastructure. Africa remains nascent but leapfrogs legacy stacks through mobile-first deployments allied with satellite backhaul.

- NVIDIA Corporation

- Intel Corporation

- Qualcomm Incorporated

- Samsung Electronics Co., Ltd.

- Apple Inc.

- Advanced Micro Devices, Inc.

- Huawei Technologies Co., Ltd.

- Alphabet Inc. (Google LLC)

- Amazon.com, Inc.

- Alibaba Group Holding Limited

- Baidu, Inc.

- Continental AG

- DENSO Corporation

- Robert Bosch GmbH

- Kalray S.A.

- MediaTek Inc.

- Imagination Technologies Limited

- Hailo Technologies Ltd.

- SiMa.ai, Inc.

- BrainChip Holdings Ltd.

- Syntiant Corp.

- Mythic, Inc.

- Gyrfalcon Technology Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise of AI-enabled Personal Computing (AI PCs)

- 4.2.2 Smartphone upgrade cycle toward on-device AI

- 4.2.3 5G and 6G-driven MEC deployments lower latency

- 4.2.4 Automotive L2-L4 ADAS edge inference demand

- 4.2.5 Energy-efficient Analog and PIM accelerators

- 4.2.6 Government CHIPS ACT-style incentives

- 4.3 Market Restraints

- 4.3.1 High upfront NRE costs for advanced nodes

- 4.3.2 Fragmented toolchains and software lock-in

- 4.3.3 Talent shortage in edge-oriented ML and silicon

- 4.3.4 Supply-chain geopolitical export controls

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Processor

- 5.1.1 CPU

- 5.1.2 GPU

- 5.1.3 FPGA

- 5.1.4 ASIC and NPU

- 5.2 By Device

- 5.2.1 Smartphones

- 5.2.2 Cameras and Smart Vision Sensors

- 5.2.3 Robots and Drones

- 5.2.4 Wearables

- 5.2.5 Smart Speakers and Home Hubs

- 5.2.6 Other Edge Devices

- 5.3 By End-User Industry

- 5.3.1 Consumer Electronics

- 5.3.2 Automotive and Transportation

- 5.3.3 Manufacturing and Industrial IoT

- 5.3.4 Healthcare

- 5.3.5 Government and Public Safety

- 5.3.6 Other End-User Industries

- 5.4 By Deployment Location

- 5.4.1 Device Edge

- 5.4.2 Near Edge Servers

- 5.4.3 Far Edge / MEC

- 5.4.4 Cloud-Assisted Hybrid

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Singapore

- 5.5.4.6 Australia

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 NVIDIA Corporation

- 6.4.2 Intel Corporation

- 6.4.3 Qualcomm Incorporated

- 6.4.4 Samsung Electronics Co., Ltd.

- 6.4.5 Apple Inc.

- 6.4.6 Advanced Micro Devices, Inc.

- 6.4.7 Huawei Technologies Co., Ltd.

- 6.4.8 Alphabet Inc. (Google LLC)

- 6.4.9 Amazon.com, Inc.

- 6.4.10 Alibaba Group Holding Limited

- 6.4.11 Baidu, Inc.

- 6.4.12 Continental AG

- 6.4.13 DENSO Corporation

- 6.4.14 Robert Bosch GmbH

- 6.4.15 Kalray S.A.

- 6.4.16 MediaTek Inc.

- 6.4.17 Imagination Technologies Limited

- 6.4.18 Hailo Technologies Ltd.

- 6.4.19 SiMa.ai, Inc.

- 6.4.20 BrainChip Holdings Ltd.

- 6.4.21 Syntiant Corp.

- 6.4.22 Mythic, Inc.

- 6.4.23 Gyrfalcon Technology Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment