|

市场调查报告书

商品编码

1910633

硬质塑胶包装:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Rigid Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

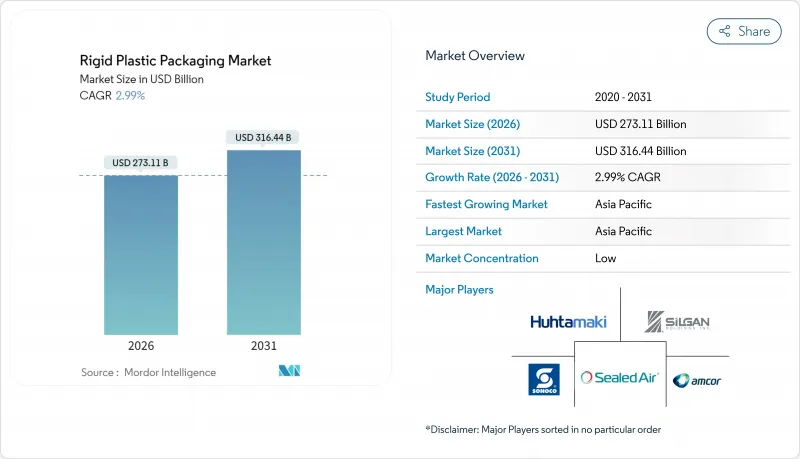

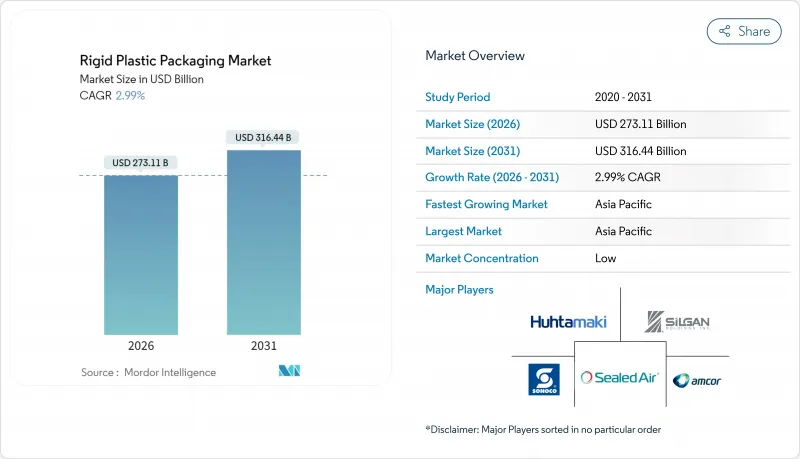

预计硬质塑胶包装市场将从 2025 年的 2,651.8 亿美元成长到 2026 年的 2,731.1 亿美元,到 2031 年将达到 3,164.4 亿美元,2026 年至 2031 年的复合年增长率为 2.99%。

在永续性势在必行以及对供应链韧性的需求驱动下,硬质塑胶包装市场正处于稳步扩张阶段,力求在销售和价值创造之间取得平衡。电子商务的成长推动了抗衝击包装的需求,监管压力促使企业采用单一材料设计,而人口结构变化也带动了食品和医疗保健行业对一次性包装的需求,这些因素共同促进了硬质塑胶包装市场的发展。生产商正在提高再生材料的使用比例,以应对生产者延伸责任制(EPR)带来的成本上涨,而对再生资产的垂直整合则提高了原材料的透明度,并有助于抵御聚合物价格的波动。亚太地区凭藉其规模优势、政策奖励和快速增长的都市区消费主导市场;欧洲正利用严格的循环经济法规加速高端解决方案的发展;而北美则在推动低温运输物流的发展,这需要坚固耐用的包装容器。随着大型加工商寻求併购以增强其采购能力、创新广度和合规应对力,日益激烈的竞争正在改变小型企业的进入门槛。

全球硬质塑胶包装市场趋势与洞察

循环经济政策推动了对再生包装的需求

目前已有63个国家实施生产者延伸责任制(EPR),其费用随可回收性呈指数级增长,从而推动成本结构向消费后回收(PCR)原料和整体式设计倾斜。 PCR PET的价格比原生树脂高出10-15%,颠覆了传统的定价模式,促使加工商透过收购和长期合约来确保再生原料的供应。随着丹麦2025年数据报告法规的实施,数位化可追溯系统正在兴起,端到端透明度也正在加速提升。随着欧盟回收义务期限的临近,大量资金正涌入食品级认证的清洁、挤出和化学回收设施。这一因素正在推动规模化投资,并加速硬质塑胶包装市场从以销售量衡量标准转变为循环价值的标准。

电子商务的蓬勃发展推动了对防震、便于运输的包装形式的需求。

在直接面向消费者 (D2C) 的物流模式中,初级包装容器承受的搬运力比传统零售通路高出 40%,这增加了品牌所有者的破损成本风险。刚性设计,特别是射出成型成型和热成型的托盘,无需二次包装即可吸收衝击力,从而降低体积重量费用和损坏退货率。零售商正在强制推行「自营发货」通讯协定,该流程建议采用能够承受自动化仓库中 50 公斤以上载重的坚固结构。目前的创新重点在于边角加固结构和内建缓衝肋,这些设计在保护内容物的同时,也能减少树脂的使用。这种结构要求也符合永续性的概念,因为厚实的、可重复使用的刚性包装容器可以减少末端配送中一次性纸板的废弃物。这些趋势正在推动硬质塑胶包装市场的成长和创新。

聚合物价格波动加剧,对加工商的利润率带来压力。

原料供应中断导致聚乙烯价格在2024年六个月内波动幅度高达35%,给受固定价格合约约束的加工商带来压力。规模较小、避险能力有限的公司产运转率不到70%,面临营运资金透支的风险。亚洲烯烃裂解装置正在降低运转率以应对负价差,这限制了树脂供应并推高了现货溢价。硬质塑胶包装市场对成本衝击的吸收并不均衡,全球巨头利用规模经济效应签订的合约获利,而区域性公司则延后投资和产能现代化改造。

细分市场分析

到2025年,瓶罐将占硬质塑胶包装市场规模的42.83%,反映了饮料、个人护理和非处方药品行业的稳定需求。卓越的透明度、防篡改功能和标籤相容性将支撑其稳定的需求,即使轻量化趋势导致单位树脂用量减少。创新产品包括繫绳式瓶盖,这种瓶盖符合一次性塑胶法规并提高了可回收性。该领域的成长主要依赖饮料产量而非颠覆性创新,因此对于大型加工商而言,这是一个稳定的收入来源。

儘管托盘市场占有率较小,但其复合年增长率高达4.43%,是成长最快的产品,这主要得益于电子商务自动化,尤其是嵌入式RFID和物联网赋能的装载容器的应用。可重复使用的塑胶托盘在耐用性和卫生性方面优于木质托盘,使其成为药品和生鲜食品低温运输的关键环节。标准化的形状有助于高层仓库的自动化,而序列化则支援资产追踪资讯服务,从而创造额外收入。随着零售商采用闭合迴路共享系统,托盘供应商正在将追踪软体和硬体捆绑销售,从而在硬质塑胶包装市场打造以服务主导的差异化优势。

2025年,PET凭藉其优异的阻隔性能和完善的瓶到瓶回收循环体系,仍将占据硬质塑胶包装市场31.05%的份额。欧洲押金制度实现了76.7%的PET回收率,由于其较高的消费后生质塑胶的复合年增长率(CAGR)达到4.98%。中国每年新增70万吨PBAT和10万吨PLA产能,正稳定供应并逐步降低价格溢价。

排碳权计画正在将生物基树脂的温室气体减排量货币化,从而改变生命週期经济模式。主要饮料品牌正在试验使用100%生物基宝特瓶,瓶盖製造商也正在向植物来源HDPE过渡。因此,硬质塑胶包装市场正在努力平衡传统石化产业链的成本效益与向低碳聚合物的策略性多元化发展,以确保产品组合能够应对未来日益严格的监管。

这份《硬质塑胶包装报告》依产品类型(瓶罐、托盘容器等)、材料(聚乙烯、聚对苯二甲酸乙二醇酯、聚丙烯等)、终端用户产业(食品、医疗保健、化妆品及个人护理、工业等)、製造流程(射出成型、挤出吹塑成型成型等)和地区对市场进行分析。市场预测以美元以金额为准。

区域分析

预计到2025年,亚太地区将占全球硬质塑胶包装收入的38.85%,复合年增长率(CAGR)为5.62%。这主要得益于印度吸引了14.6亿美元的生产关联投资(PLI),以及中国生物分解性塑胶的扩张,从而支撑了区域供应链。为了减少运输排放,本地加工商正与全球品牌保持同步,在更靠近消费者的地方建立生产设施并扩大产能。监管政策向可回收或生物基包装材料的转变,为那些开展技术转移合作的企业提供了先发优势。

在北美,电子商务和低温运输药品运输的扩张持续推动着对能够确保产品在长途物流运输过程中保持品质的坚固包装的需求。各州提出的生产者延伸责任制(EPR)提案正在推动包装设计的重新调整,但实施时间的不均衡缓解了监管措施的突发影响。较高的平均收入水准支撑着高端一次性包装的需求,从而推动了高利润率硬质塑胶包装市场的成长。

欧洲市场需求成熟,但由于积极的循环经济政策,其产品附加价值密度极高。 《包装及包装废弃物法规》(PPWR) 正在推动单一材料解决方案的普及,刺激资本流入回收基础设施,并催生了一个价值150亿美元的合规市场。德国、荷兰和法国的创新丛集正在领先化学回收试点项目,确保该地区的消费后回收 (PCR) 供应,并建立通往亚洲的出口管道。

在南美洲和中东及非洲,新兴机会正因回收不足和政策执行缓慢而受阻。跨国公司正在部署模组化回收工厂,以确保当地再生塑胶(PCR)的供应,并力求达到全球含量目标。南非的《生产者责任延伸法》和肯亚的《生产者责任法案》体现了政策的趋同,这正在推动更严格的设计标准和对符合规范的硬质塑胶解决方案日益增长的需求。投资激励措施和低廉的劳动力成本正在吸引挤出和射出成型线的迁入,使这些地区成为未来硬质塑胶包装市场的出口中心。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 循环经济政策推动了对再生材料包装的需求。

- 电子商务的蓬勃发展推动了对防震、适于运输的包装形式的需求。

- 家庭规模缩小推动了对单一硬质容器的需求。

- 推出高阻隔性、单一材料解决方案,以符合欧盟2027年回收目标

- 低温运输物流的快速成长对超强刚性容器的需求日益增长。

- 市场限制

- 聚合物价格波动加剧,对加工商的利润率带来压力。

- 消费者越来越多地转向柔软性的纸质替代品

- 生产者延伸责任制(EPR)成本增加总拥有成本

- 新兴经济体缺乏回收基础设施,限制了消费后消费品的供应。

- 产业价值链分析

- 监管环境

- 技术展望

- 宏观经济因素如何影响市场

- 波特五力分析

- 供应商的议价能力

- 买方和消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依产品类型

- 瓶子和罐子

- 托盘和容器

- 中型散货箱(IBC)

- 调色盘

- 其他产品类型

- 材料

- 聚乙烯(PE)

- 聚对苯二甲酸乙二醇酯(PET)

- 聚丙烯(PP)

- 聚苯乙烯(PS)和发泡聚苯乙烯(EPS)

- 生质塑胶

- 其他材料

- 按最终用户行业划分

- 食物

- 饮料

- 卫生保健

- 化妆品和个人护理

- 产业

- 建筑/施工

- 车

- 其他终端用户产业

- 透过製造工艺

- 射出成型

- 挤出吹塑成型

- 注塑吹塑成型

- 拉伸吹塑成型

- 热成型

- 旋转成型

- 压缩成型

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 墨西哥

- 南美洲其他地区

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 波兰

- 其他欧洲

- 亚太地区

- 中国

- 印度

- 日本

- 泰国

- 澳洲

- 韩国

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Amcor plc

- Alpha Packaging Holdings, Inc.

- ALPLA Werke Alwin Lehner GmbH & Co KG

- Silgan Holdings Inc.

- Sealed Air Corporation

- Plastipak Holdings, Inc.

- Sonoco Products Company

- Resilux NV

- Graham Packaging Company, LP

- Greif, Inc.

- Mauser Packaging Solutions Holding Company

- Pact Group Holdings Ltd

- Gerresheimer AG

- Huhtamaki Oyj

- Coveris Management GmbH

- Logoplaste Consultores Tecnicos SA

- International Paper Company(DS Smith Plc)

- Weener Plastics Group BV

- Anchor Packaging LLC

- Visy Industries Holdings Pty Ltd

- Altium Packaging LLC

- Serioplast Group SpA

- Mpact Limited

第七章 市场机会与未来展望

The Rigid Plastic Packaging Market is expected to grow from USD 265.18 billion in 2025 to USD 273.11 billion in 2026 and is forecast to reach USD 316.44 billion by 2031 at 2.99% CAGR over 2026-2031.

Underscoring a steady expansion phase that balances volume with value creation driven by sustainability mandates and supply-chain resilience needs. The rigid plastic packaging market benefits from e-commerce growth that favors impact-resistant formats, regulatory pressure that rewards monomaterial design, and demographic trends that lift single-serve demand across food and healthcare channels. Producers elevate recycled-content integration to meet Extended Producer Responsibility (EPR) cost curves, while vertical integration into recycling assets secures feedstock visibility and buffers polymer price swings. Asia-Pacific leads with scale, policy incentives, and rapid urban consumption, Europe leverages stringent circular-economy rules to accelerate premium solutions, and North America advances cold-chain logistics that require robust containers. Competitive intensity rises as top converters merge to gain procurement muscle, innovation breadth, and compliance readiness, resetting entry barriers for smaller firms.

Global Rigid Plastic Packaging Market Trends and Insights

Circular-economy mandates driving recycled-content packaging demand

Sixty-three countries now levy EPR fees that scale sharply with recyclability, shifting cost structures in favor of post-consumer recycled (PCR) feedstock and monomaterial design. Premiums of 10-15% for PCR PET over virgin resin invert traditional price hierarchies, prompting converters to lock in recycled supply through acquisitions and long-term contracts. Digital traceability systems emerge as firms comply with Denmark's 2025 data-reporting rules, accelerating end-to-end transparency. As EU recyclability deadlines approach, capital flows toward washing, extrusion, and chemical recycling facilities that can certify food-grade output. This driver underpins scale investment rationales and reinforces the rigid plastic packaging market's pivot from volume metrics to circular-value metrics.

Surge in e-commerce accelerating demand for impact-resistant ship-ready formats

Direct-to-consumer fulfillment exposes primary containers to handling forces 40% higher than traditional retail routes, elevating failure-cost risk for brand owners. Rigid designs- especially injection-molded tubs and thermoformed trays- absorb shock without secondary packaging, reducing dimensional weight fees and damage returns. Retailers mandate "ship-in-own-container" protocols that favor sturdy formats capable of stack loads exceeding 50 kg during automated warehousing. Innovation now focuses on corner-reinforcement geometry and built-in cushioning ribs that protect contents while trimming resin use. This structural requirement aligns with sustainability imperatives because thicker, reusable rigid containers offset single-use corrugated waste in last-mile delivery. These trends are driving growth and innovation in the rigid plastic packaging market.

Escalating polymer price volatility compressing converter margins

Feedstock disruptions lifted polyethylene price swings to 35% within six months during 2024, squeezing converters locked into fixed-price contracts. Smaller firms with limited hedging capability operate at sub-70% plant utilization, risking covenant breaches on working-capital lines. Asian olefin crackers cut run rates to manage negative spreads, constraining resin availability and inflating spot premiums. The rigid plastic packaging market absorbs cost shocks unevenly; global majors leverage scale contracts, whereas regional players delay investments, slowing capacity modernization.

Other drivers and restraints analyzed in the detailed report include:

- Demographic shift toward smaller households fueling single-serve rigid packs

- Adoption of high-barrier monomaterial solutions to meet 2027 EU recyclability targets

- Increasing consumer shift to flexible and paper-based alternatives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Bottles and jars accounted for 42.83% of the rigid plastic packaging market size in 2025, reflecting entrenched usage in beverages, personal care, and over-the-counter medicines. Superior clarity, tamper evidence, and label compatibility keep demand steady even as lightweight initiatives trim resin per unit. Innovations include tethered caps that satisfy single-use plastics directives and improve recyclability. Growth remains volume-linked to beverage output rather than disruptive technology shifts, positioning the segment as a stable revenue base for large converters.

Pallets, though a smaller share, are the fastest-rising product at a 4.43% CAGR, powered by e-commerce automation that values RFID-embedded, IoT-ready load carriers. Reusable plastic pallets outperform wood on durability and hygiene, which is critical for cold-chain pharmaceuticals and fresh produce. Standardized footprints facilitate high-bay warehouse robotics, and serialization unlocks asset-tracking data services that generate ancillary revenue. As retailers adopt closed-loop pooling systems, pallet suppliers bundle tracking software with hardware, creating service-driven differentiation within the rigid plastic packaging market.

PET retained 31.05% of the rigid plastic packaging market share in 2025, owing to its strong barrier profile and established bottle-to-bottle recycling loops. Deposit schemes in Europe achieve 76.7% PET recovery, enabling high PCR content that lowers EPR liabilities. Yet bioplastics show a 4.98% CAGR as policy and brand commitments prioritize bio-based feedstocks. Chinese capacity expansions to 700,000 t/y PBAT and 100,000 t/y PLA stabilize supply and chip away at price premiums.

Lifecycle economics shift as carbon-credit schemes monetize greenhouse-gas savings from bio-based resins. Major beverage brands test 100% bio-PET bottles, and cap manufacturer programs move toward plant-derived HDPE. The rigid plastic packaging market, therefore, balances cost efficiencies in legacy petrochemical chains with strategic diversification into low-carbon polymers that future-proof portfolios against regulatory escalation.

The Rigid Plastic Packaging Report is Segmented by Product Type (Bottles and Jars, Trays and Containers, and More), Material (Polyethylene, Polyethylene Terephthalate, Polypropylene, and More), End User Industry (Food, Healthcare, Cosmetics and Personal Care, Industrial, and More), Manufacturing Process (Injection Molding, Extrusion Blow Molding, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 38.85% of 2025 sales in rigid plastic packaging and is forecast to expand at 5.62% CAGR, buoyed by India's USD 1.46 billion PLI-attracted investments and China's biodegradable-plastic build-out that anchors regional supply chains. Local converters scale capacity alongside global brands, locating production near consumers to cut freight emissions. Regulatory pivots toward recyclable or bio-based packaging create first-mover advantages for firms with technology transfer alliances.

North America enjoys steady growth as e-commerce and cold-chain pharmaceuticals escalate demand for robust containers that preserve product integrity across extended logistics routes. State-level EPR proposals prompt design re-evaluation, yet fragmented timelines moderate compliance shocks. High average incomes support premium single-serve formats, reinforcing volume for high-margin rigid segments.

Europe exhibits mature volume but high value density because of aggressive circular-economy directives. The Packaging and Packaging Waste Regulation drives adoption of monomaterial solutions and propels capital into recycling infrastructure, creating a USD 15 billion compliance market. Innovation clusters in Germany, the Netherlands, and France pioneer chemical recycling pilots that secure local PCR supplies and feed export channels into Asia.

South America and the Middle East and Africa present emerging opportunities tempered by collection shortfalls and policy lag. Multinationals deploy modular recycling plants to capture local PCR and fulfill global content pledges. South Africa's EPR law and Kenya's producer-responsibility draft demonstrate policy convergence that will tighten design standards and escalate demand for compliant rigid solutions. Investment incentives and lower labor costs attract extruder and injection-molding line relocations, positioning these regions as future export hubs within the rigid plastic packaging market.

- Amcor plc

- Alpha Packaging Holdings, Inc.

- ALPLA Werke Alwin Lehner GmbH & Co KG

- Silgan Holdings Inc.

- Sealed Air Corporation

- Plastipak Holdings, Inc.

- Sonoco Products Company

- Resilux NV

- Graham Packaging Company, L.P.

- Greif, Inc.

- Mauser Packaging Solutions Holding Company

- Pact Group Holdings Ltd

- Gerresheimer AG

- Huhtamaki Oyj

- Coveris Management GmbH

- Logoplaste Consultores Tecnicos SA

- International Paper Company (DS Smith Plc)

- Weener Plastics Group BV

- Anchor Packaging LLC

- Visy Industries Holdings Pty Ltd

- Altium Packaging LLC

- Serioplast Group SpA

- Mpact Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Circular-economy mandates driving recycled-content packaging demand

- 4.2.2 Surge in e-commerce accelerating demand for impact-resistant ship-ready formats

- 4.2.3 Demographic shift toward smaller households fueling single-serve rigid packs

- 4.2.4 Adoption of high-barrier monomaterial solutions to meet 2027 EU recyclability targets

- 4.2.5 Rapid growth of cold-chain logistics requiring ultra-robust rigid containers

- 4.3 Market Restraints

- 4.3.1 Escalating polymer price volatility compressing converter margins

- 4.3.2 Increasing consumer shift to flexible and paper-based alternatives

- 4.3.3 Extended Producer Responsibility (EPR) fees raising total cost of ownership

- 4.3.4 Recycling-infrastructure gaps in emerging economies limiting PCR supply

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors on the Market

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers/Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Bottles and Jars

- 5.1.2 Trays and Containers

- 5.1.3 Intermediate Bulk Containers (IBCs)

- 5.1.4 Pallets

- 5.1.5 Other Product Types

- 5.2 By Material

- 5.2.1 Polyethylene (PE)

- 5.2.2 Polyethylene Terephthalate (PET)

- 5.2.3 Polypropylene (PP)

- 5.2.4 Polystyrene (PS) and Expanded Polystyrene (EPS)

- 5.2.5 Bioplastics

- 5.2.6 Other Materials

- 5.3 By End User Industry

- 5.3.1 Food

- 5.3.2 Beverage

- 5.3.3 Healthcare

- 5.3.4 Cosmetics and Personal Care

- 5.3.5 Industrial

- 5.3.6 Building and Construction

- 5.3.7 Automotive

- 5.3.8 Other End-user Industries

- 5.4 By Manufacturing Process

- 5.4.1 Injection Molding

- 5.4.2 Extrusion Blow Molding

- 5.4.3 Injection Blow Molding

- 5.4.4 Stretch Blow Molding

- 5.4.5 Thermoforming

- 5.4.6 Rotational Molding

- 5.4.7 Compression Molding

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Mexico

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 France

- 5.5.3.3 United Kingdom

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Poland

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 Thailand

- 5.5.4.5 Australia

- 5.5.4.6 South Korea

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 Alpha Packaging Holdings, Inc.

- 6.4.3 ALPLA Werke Alwin Lehner GmbH & Co KG

- 6.4.4 Silgan Holdings Inc.

- 6.4.5 Sealed Air Corporation

- 6.4.6 Plastipak Holdings, Inc.

- 6.4.7 Sonoco Products Company

- 6.4.8 Resilux NV

- 6.4.9 Graham Packaging Company, L.P.

- 6.4.10 Greif, Inc.

- 6.4.11 Mauser Packaging Solutions Holding Company

- 6.4.12 Pact Group Holdings Ltd

- 6.4.13 Gerresheimer AG

- 6.4.14 Huhtamaki Oyj

- 6.4.15 Coveris Management GmbH

- 6.4.16 Logoplaste Consultores Tecnicos SA

- 6.4.17 International Paper Company (DS Smith Plc)

- 6.4.18 Weener Plastics Group BV

- 6.4.19 Anchor Packaging LLC

- 6.4.20 Visy Industries Holdings Pty Ltd

- 6.4.21 Altium Packaging LLC

- 6.4.22 Serioplast Group SpA

- 6.4.23 Mpact Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment