|

市场调查报告书

商品编码

1910634

剂量计:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Dosimeter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

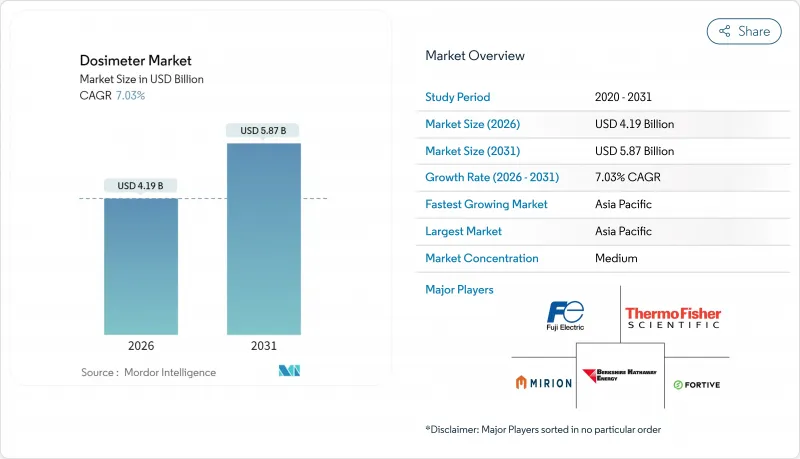

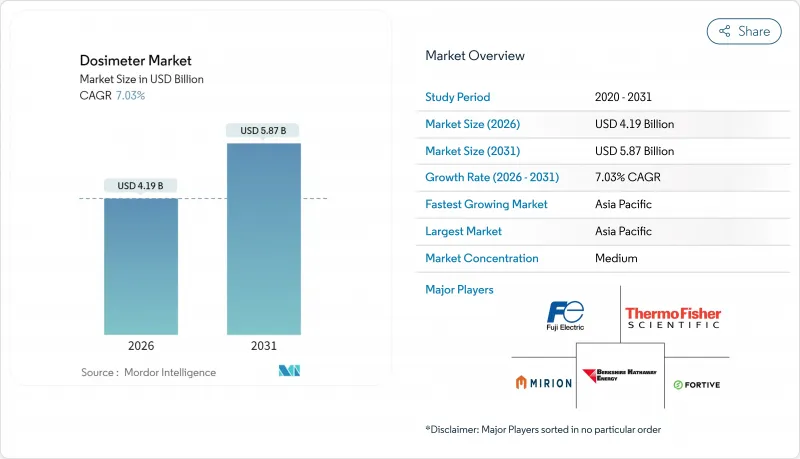

2025年剂量计市值为39.1亿美元,预计到2031年将达到58.7亿美元,而2026年为41.9亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 7.03%。

近期营收成长与辐射安全法规的加强、小型模组化反应器的引入以及可即时传输剂量资料的联网电子个人剂量计 (EPD) 技术的快速发展密切相关。在国际监管机构大幅降低年度允许辐射计量限值后,医疗机构增加了人工水晶体监测器的采购。同时,工业无损检测 (NDT) 团队正越来越多地采用无线剂量计,从而简化了跨多个地点的合规性文件记录。供应商还将人工智慧 (AI) 分析技术整合到现有硬体中,使安全团队能够预测累积暴露趋势并实现报告自动化。在亚太地区,核能发电厂建设的扩张以及诊断影像的快速发展,使该地区成为剂量解决方案需求量最大且成长最快的地区。同时,由于主要製造商不断收购利基技术公司、扩大其区域服务范围并提供基于订阅的数据平台以确保长期客户,市场仍然保持着一定的分散性。

全球剂量计市场趋势与洞察

对肿瘤影像和放射治疗的需求不断增长

对精准放射治疗和高通量诊断影像检查日益增长的需求,促使越来越多的放射工作人员需要持续监测。现代线性加速器会发射高能量散射中子,因此各医疗机构纷纷采用气泡检测器和半导体剂量计来监测混合辐射场。质子治疗中心率先采用多点微剂量计,用于绘製复杂辐射场内的剂量分布图。医院将剂量计数据与人工智慧仪表板结合,使管理人员能够预测累积辐射暴露量,甚至在达到限值之前轮换员工。最终,医院的辐射剂量监测方式发生了显着转变,从季度胶片剂量计监测转向与医院资讯系统整合的即时辐射计量估算(EPD),以确保符合更严格的职业暴露限值。

扩大核能发电能(小型模组化反应器和延寿计划)

亚太地区数十家电力公司已核准部署小型模组化反应器 (SMR)。与传统核子反应炉相比,SMR 需要更高的单位装置容量剂量计密度。老旧核子反应炉的延寿计画透过无线电子剂量计 (EPD) 取代传统的胶片剂量计,进一步刺激了对剂量计的需求,从而实现集中式剂量记录。像 Million 这样的供应商已经发布了专用于 SMR 的监测套件,并报告称该领域的收入实现了两位数的成长。业界奉行的「尽可能低辐射剂量 (ALARA)」原则要求更高的测量精度,促使电力公司为低水平伽马辐射环境采购高灵敏度的半导体检测器。

放射性校准材料短缺和同位素供应链中断

钼-99、铯-137和钴-60的长期短缺扰乱了校准计划,迫使服务实验室延长认证週期,并削弱了人们对辐照度计精度的信心。新兴市场受影响最为严重,因为它们依赖进口资源且国内辐照设施有限。儘管一些实验室正在尝试使用替代光子源,但监管机构核准新方法的速度缓慢,导致认证週期延长,辐照度计采购延迟。

细分市场分析

到2025年,电子个人剂量计将占剂量计市场38.72%的份额,年复合成长率(CAGR)为8.75%,主要得益于医疗机构向即时剂量回馈的过渡。无线连接、GPS定位以及人工智慧分析(可在累积剂量趋势加速时发出警报)是该细分市场的关键优势。萤光剂量计仍然受到对价格敏感且追求可靠精度的机构的青睐。同时,光激发萤光剂量计在快速读数至关重要的细分市场中越来越受欢迎。胶片剂量计在一些发展中地区仍然适用,但随着监管机构优先考虑支援快速审核週期的系统,其市场份额持续下降。混合型直接电离剂量计结合了被动式剂量计的长寿命和电子读数的便捷性,为那些对全面部署电子剂量计犹豫不决的运营商提供了一条平稳的过渡路径。

EPD供应商正在整合环境感测器,用于记录温度、湿度和气压,使安全负责人能够将辐射暴露与不断变化的工作环境关联。大规模工业设施部署了数千台设备,这些设备连接到云端仪表板,以可视化各部门的剂量分布。韧体更新增加了新的感测器功能,延长了设备的中期更换週期,而来自SaaS合约的经常性收入则强化了对供应商的锁定。

到2025年,被动式剂量计将占剂量计市场规模的52.10%,主要得益于监管机构的认可。然而,主动式剂量计系统的成长速度更快,复合年增长率(CAGR)达到8.52%。医院在实施高剂量介入性心臟病手术室时,需要配备声音警报和即时剂量仪錶盘,这推动了主动式剂量计的采购。核能发电厂在停机检修期间更倾向于使用主动式剂量计系统,因为此时工作时间缩短,辐射计量波动剧烈。服务供应商正在整合基于云端的分析功能,以实现限值追踪的自动化,从而减轻辐射安全负责人的行政负担。

由于成本低、重量轻且使用者培训要求低,被动式徽章在团体筛检计画中仍然很受欢迎。在低收入地区,政府卫生机构正在向诊所分发胶片式被动式徽章;而现在,由捐助方资助的先导计画正在部署光刺激发光(OSL)读取器以加快检测速度。能够提供涵盖被动式和主动式技术的兼容生态系统的供应商,更有能力为客户提供完整的升级生命週期服务。

区域分析

到2025年,亚太地区将占据剂量计市场28.45%的份额,年复合成长率将达到8.63%,主要得益于中国、印度和东南亚国家批准新建核子反应炉并扩大放射治疗能力。中国的核能建设计画和大规模同位素生产设施将确保电力和製药业对剂量计的稳定需求。日本在福岛第一核能发电厂事故后的维修工作中优先考虑数位化剂量跟踪,而马来西亚和菲律宾正在推进小型模组化反应器(SMR)的部署,这两种反应器都需要在模组化设施周围建立高密度个人剂量监测网络。

北美仍然拥有大量老旧核子反应炉和遍布全国的医疗影像设备。美国美国核能管理委员会强调对工作人员进行即时监控,这促使医院从季度性徽章发放计画转向即时EPD仪錶板。加拿大CANDU核子反应炉维修和铀矿开采作业正在采购中子检测器,而墨西哥工业射线照相承包商正在扩大其徽章发放订阅范围,以符合国家职业健康法规。

在欧洲,从核子反应炉延寿计划剂量计的更新到为拆除德国已关闭核子反应炉的技术人员配备去污团队,剂量计的应用正在逐步增加。英国先进反应器试点计画从计划开始就整合了新一代半导体检测器。 GDPR法规正在影响产品设计,促使供应商对资料加密模组进行认证并提供本地伺服器。在东欧,正在考虑建造小型模组化反应器(SMR)的国家正在建立本地化的剂量测定服务机构,以进一步促进区域销售。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 对肿瘤影像和放射治疗的需求不断增长

- 扩大核能发电能(小型模组化反应器和延寿计划)

- 强制执行眼科镜片剂量限制和即时合规性审核

- 工业辐射侦测数位化(管道焊接品管、5G基础设施建设)

- 整合了EPD硬体的AI驱动剂量分析平台

- 增加新兴市场的生物剂量实验室并加强紧急应变能力

- 市场限制

- 校准源短缺和同位素供应链中断

- 低能中子场中持续存在的精度差距

- 资料整合中的网路安全责任

- 徽章处理订阅成本给最终用户带来负担

- 产业价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依产品类型

- 电子个人剂量计(EPD)

- 热释光剂量计(TLD)

- 光刺激发光(OSL)

- 电影徽章

- 直接离子储存和DIS-OSL

- 透过使用

- 积极的

- 被动的

- 按最终用户行业划分

- 卫生保健

- 核能发电和燃料循环

- 石油和天然气

- 采矿和金属

- 工业无损检测/製造

- 国防/安全

- 透过检测技术

- 半导体(硅、碳化硅、PIN)

- 基于闪烁体的

- 充气式GM/比例

- 固体钝化元件(LiF、Al2O3、BeO)

- 气泡/过热液滴

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Mirion Technologies Inc.

- LANDAUER(Berkshire Hathaway Energy)

- Thermo Fisher Scientific Inc.

- Fuji Electric Co., Ltd.

- Fortive Corp.(Fluke Biomedical)

- ATOMTEX JSC

- Polimaster Ltd.

- Ludlum Measurements Inc.

- Panasonic Industrial Devices

- Arrow-Tech Inc.

- SE International Inc.

- Automess Automation & Measurement GmbH

- Radiation Detection Company Inc.

- Unfors RaySafe AB

- ECOTEST Group Ukraine

- Dosimetrics GmbH

- Kromek Group PLC

- Electronic & Engineering Co.(I)P. Ltd.

- Bubble Technology Industries Inc.

- Qingdao TLead International Co. Ltd.

第七章 市场机会与未来展望

The dosimeter market was valued at USD 3.91 billion in 2025 and estimated to grow from USD 4.19 billion in 2026 to reach USD 5.87 billion by 2031, at a CAGR of 7.03% during the forecast period (2026-2031).

Recent revenue expansion is closely tied to stricter radiation-safety regulations, the roll-out of small modular reactors, and rapid innovation in connected electronic personal dosimeters (EPDs) that stream dose data in real time. Health-care providers are purchasing higher volumes of eye-lens monitors after international regulators slashed permissible annual exposure limits, while industrial non-destructive-testing (NDT) crews are upgrading to wireless badges that simplify multi-site compliance documentation. Suppliers are also layering artificial-intelligence analytics onto existing hardware so safety teams can predict cumulative exposure trends and automate reporting. Asia-Pacific's nuclear build-out, coupled with its fast-growing diagnostic-imaging sector, positions the region as the largest and fastest-advancing demand center for dosimetry solutions. Meanwhile, moderate market fragmentation persists because leading manufacturers continue to acquire niche technology firms, expand regional service bureaus, and offer subscription-based data platforms that lock in long-term customers.

Global Dosimeter Market Trends and Insights

Heightened Oncology Imaging and Radiotherapy Volumes

Growing demand for precision radiotherapy and high-throughput diagnostic imaging is swelling the population of radiation workers who need continuous monitoring. Modern linear accelerators emit higher-energy stray neutrons, prompting facilities to add bubble detectors and semiconductor badges that capture mixed-field exposure. Proton-therapy centers are early adopters of multi-site microdosimeters that map dose distributions inside complex radiation fields. Hospitals are also layering AI dashboards onto badge data so managers can forecast cumulative exposure and rotate staff before limits are reached. The result is a clear shift from quarterly film badges to real-time EPDs that integrate with hospital information systems, ensuring compliance with tightened occupational limits.

Expansion of Nuclear-Power Capacity (SMRs and Life-Extension Projects)

Dozens of Asia-Pacific utilities have approved small modular reactors that require a denser network of dosimeters per installed megawatt than conventional units. Life-extension programs in aging fleets add further demand by replacing legacy film badges with wireless EPDs capable of centralized dose logging. Vendors such as Mirion have released SMR-specific monitoring suites and report double-digit revenue gains from the segment. The industry's ALARA culture calls for even finer measurement granularity, encouraging utilities to purchase high-sensitivity semiconductor detectors for low-level gamma fields.

Calibration-Source Shortages and Isotope Supply Chain Shocks

Chronic shortages of molybdenum-99, cesium-137, and cobalt-60 disrupt calibration schedules and force service bureaus to extend certification cycles, undermining confidence in badge accuracy. Emerging markets suffer most because they rely on imported sources and have limited domestic irradiation facilities. Some labs experiment with alternative photon sources, but regulatory bodies are slow to approve new methods, lengthening qualification timelines and slowing badge procurement.

Other drivers and restraints analyzed in the detailed report include:

- Tightening Eye-Lens Dose Limits and Real-Time Compliance Audits

- Industrial Radiography Digitization (Pipe-Weld QC, 5G Infra Build-Out)

- Persistent Accuracy Gaps for Low-Energy Neutron Fields

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Electronic Personal Dosimeters captured 38.72% dosimeter market share in 2025 and are forecast to expand at a 8.75% CAGR as facilities pivot toward instant exposure feedback. The segment benefits from wireless connectivity, GPS tagging, and AI analytics that warn users when cumulative dose trends accelerate. Thermoluminescent Dosimeters still appeal to price-sensitive programs seeking proven accuracy, while Optically Stimulated Luminescence gains niche traction where faster readout is critical. Film badges persist in some developing regions, but their share continues to shrink as regulatory bodies favor systems that support rapid audit cycles. Hybrid Direct Ion Storage devices now bridge passive longevity with electronic readout ease, smoothing migration paths for operators cautious of full-scale EPD deployment.

EPD vendors are integrating environmental sensors that record temperature, humidity, and air pressure so safety officers can correlate exposure with changing work conditions. Larger industrial sites deploy thousands of units tied into cloud dashboards that visualize dose distribution across departments. As firmware updates add new sensor modalities, mid-cycle replacement rates lengthen, but software-as-a-service contracts keep revenue recurring, reinforcing vendor lock-in.

Passive monitoring accounted for 52.10% of the dosimeter market size in 2025, thanks to entrenched regulatory acceptance, yet active systems are growing faster at an 8.52% CAGR. Hospitals rolling out high-dose interventional cardiology suites want audible alarms and real-time dose dashboards, pushing procurement toward active badges. Nuclear utilities favor active systems for outage work where job times are compressed and exposure rates fluctuate sharply. Service providers bundle cloud-based analytics that automate limit tracking, reducing administrative load on radiation-safety officers.

Passive badges remain popular in large-scale screening programs because they are inexpensive, lightweight, and require minimal user training. In lower-income regions, government health agencies still distribute passive film badges to clinics, though donor-funded pilot projects now introduce optically stimulated luminescence readers to accelerate result turnaround. Vendors that offer compatible ecosystems spanning both passive and active technologies position themselves well to capture the full lifecycle of customer upgrades.

The Dosimeter Market Report is Segmented by Product Type (Electronic Personal Dosimeter, Thermoluminescent Dosimeter, and More), Application (Active, and Passive), End-User Industry (Healthcare, Oil and Gas, Mining and Metals, and More), Detection Technology (Semiconductor, Scintillator-Based, and More), and Geography (North America, South America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led the dosimeter market with 28.45% share in 2025 and is accelerating at a 8.63% CAGR as China, India, and Southeast Asian countries greenlight new reactors and expand radiotherapy capacity. China's nuclear construction pipeline, coupled with large-scale isotope-production facilities, secures steady badge demand across utility and pharmaceutical segments. Japan's post-Fukushima retrofits prioritize digital dose tracking, while Malaysia and the Philippines embrace SMRs, each requiring dense personal-dosimetry networks around modular sites.

North America retains a substantial installed base of legacy reactors and nationwide medical imaging fleets. The U.S. Nuclear Regulatory Commission's focus on real-time worker monitoring drives hospitals to swap quarterly badge programs for live EPD dashboards. Canada's CANDU refurbishments and uranium mining operations procure neutron-capable detectors, whereas Mexico's industrial-radiography contractors expand their badge subscriptions to meet national occupational-health mandates.

Europe witnesses incremental uptake as reactor life-extension projects roll out dosimeter upgrades and decommissioning teams outfit technicians dismantling shuttered German plants. The United Kingdom's advanced-reactor pilots integrate next-generation semiconductor detectors from project inception. GDPR constraints influence product design, pushing suppliers to certify data-encryption modules and offer on-premises servers. Eastern European states exploring SMR options establish locally hosted dosimetry service bureaus, further propelling regional sales.

- Mirion Technologies Inc.

- LANDAUER (Berkshire Hathaway Energy)

- Thermo Fisher Scientific Inc.

- Fuji Electric Co., Ltd.

- Fortive Corp. (Fluke Biomedical)

- ATOMTEX JSC

- Polimaster Ltd.

- Ludlum Measurements Inc.

- Panasonic Industrial Devices

- Arrow-Tech Inc.

- SE International Inc.

- Automess Automation & Measurement GmbH

- Radiation Detection Company Inc.

- Unfors RaySafe AB

- ECOTEST Group Ukraine

- Dosimetrics GmbH

- Kromek Group PLC

- Electronic & Engineering Co. (I) P. Ltd.

- Bubble Technology Industries Inc.

- Qingdao TLead International Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Heightened oncology imaging and radiotherapy volumes

- 4.2.2 Expansion of nuclear-power capacity (SMRs and life-extension projects)

- 4.2.3 Tightening eye-lens dose limits and real-time compliance audits

- 4.2.4 Industrial radiography digitization (pipe-weld QC, 5-G infra build-out)

- 4.2.5 AI-enabled dose-analytics platforms bundled with EPD hardware

- 4.2.6 Rising emerging-market biodosimetry labs for emergency surge response

- 4.3 Market Restraints

- 4.3.1 Calibration-source shortages and isotope supply chain shocks

- 4.3.2 Persistent accuracy gaps for low-energy neutron fields

- 4.3.3 Data-integration cyber-security liabilities

- 4.3.4 End-user fatigue from badge-processing subscription costs

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Electronic Personal Dosimeter (EPD)

- 5.1.2 Thermoluminescent Dosimeter (TLD)

- 5.1.3 Optically Stimulated Luminescence (OSL)

- 5.1.4 Film Badge

- 5.1.5 Direct Ion Storage and DIS-OSL

- 5.2 By Application

- 5.2.1 Active

- 5.2.2 Passive

- 5.3 By End-user Industry

- 5.3.1 Healthcare

- 5.3.2 Nuclear Power and Fuel Cycle

- 5.3.3 Oil and Gas

- 5.3.4 Mining and Metals

- 5.3.5 Industrial NDT / Manufacturing

- 5.3.6 Defence and Security

- 5.4 By Detection Technology

- 5.4.1 Semiconductor (Si, SiC, PIN)

- 5.4.2 Scintillator-based

- 5.4.3 Gas-filled GM / Proportional

- 5.4.4 Solid-State Passive (LiF, Al2O3, BeO)

- 5.4.5 Bubble / Superheated-Drop

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 South-East Asia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Mirion Technologies Inc.

- 6.4.2 LANDAUER (Berkshire Hathaway Energy)

- 6.4.3 Thermo Fisher Scientific Inc.

- 6.4.4 Fuji Electric Co., Ltd.

- 6.4.5 Fortive Corp. (Fluke Biomedical)

- 6.4.6 ATOMTEX JSC

- 6.4.7 Polimaster Ltd.

- 6.4.8 Ludlum Measurements Inc.

- 6.4.9 Panasonic Industrial Devices

- 6.4.10 Arrow-Tech Inc.

- 6.4.11 SE International Inc.

- 6.4.12 Automess Automation & Measurement GmbH

- 6.4.13 Radiation Detection Company Inc.

- 6.4.14 Unfors RaySafe AB

- 6.4.15 ECOTEST Group Ukraine

- 6.4.16 Dosimetrics GmbH

- 6.4.17 Kromek Group PLC

- 6.4.18 Electronic & Engineering Co. (I) P. Ltd.

- 6.4.19 Bubble Technology Industries Inc.

- 6.4.20 Qingdao TLead International Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment