|

市场调查报告书

商品编码

1910642

全球热泵市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031年)Global Heat Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

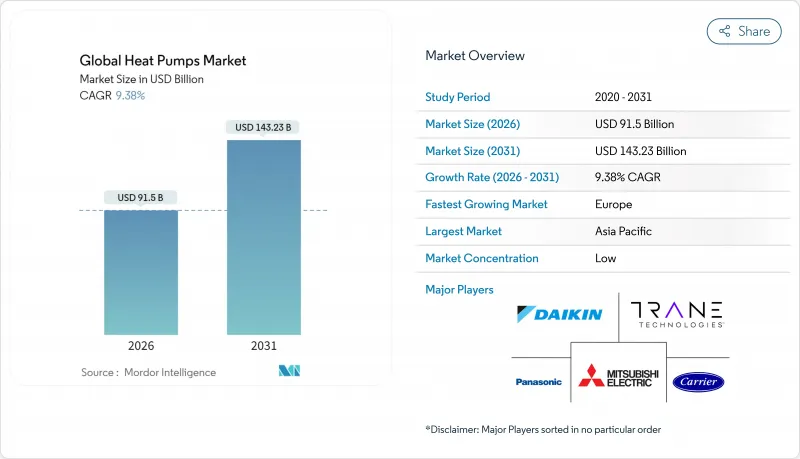

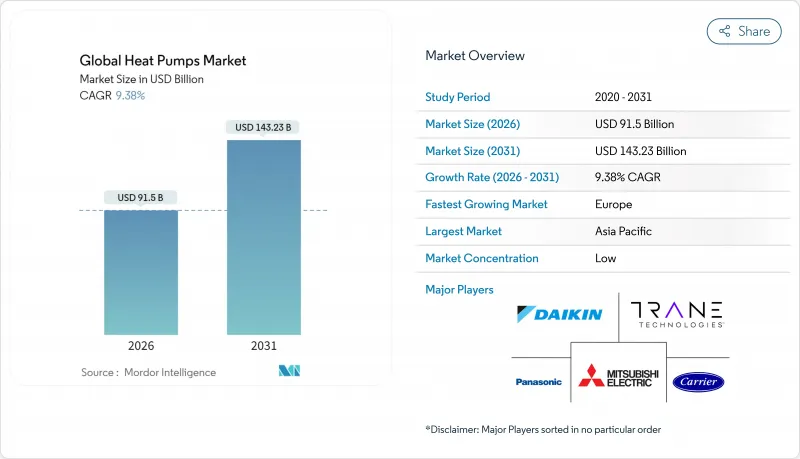

2025年热泵市值为836.6亿美元,预计从2026年的915亿美元成长到2031年的1432.3亿美元,在预测期(2026-2031年)内复合年增长率为9.38%。

欧洲和北美地区的脱碳政策、联邦和州政府的大规模奖励以及日益大规模的公用事业计划,已使热泵市场成为石化燃料空间和热水解决方案的主要替代方案。中国一体化的製造地有助于控製成本,而变频压缩机技术的进步缩小了零下温度下的性能差距,为在寒冷气候地区快速推广应用奠定了基础。美国和波兰的供应链在地化措施降低了关税和运输风险,而不断发展的「供热即服务」融资模式则解决了高昂的初始安装成本问题,此前这一成本曾阻碍了现有建筑的普及。

全球热泵市场趋势与洞察

政府脱碳奖励和强制规定

积极的政策框架透过将建筑规范和补贴水准与可再生热能的性能直接挂钩,从而创造了对热泵的强劲需求。美国的《通货膨胀控制法案》结合了联邦税额扣抵和州补贴计划,为每个家庭提供高达14,000美元的补贴;德国则强制规定,从2024年起,新建供暖系统必须至少使用65%的可再生热能。加拿大的「油泵转型计画」为低收入家庭提供高达15,000加元(约11,100美元)的补贴;英国的「锅炉更新计画」则提供高达7,500英镑(约9,400美元)的津贴。这些措施人为地设定了需求下限,保护製造商免受宏观经济放缓的影响,并加速了市场渗透。

电气化推广导致空调设备更换週期延长

主要城市实施的区域温室气体排放上限政策,缩短了暖通空调系统的更换週期(从传统的15-20年缩短),并加速了老旧锅炉的维修,以高效热泵取而代之。纽约市第97号地方法律促成了诸如Hudson街345号维修项目等计划,该项目结合了热泵和余热回收技术,力争在2030年前实现排放70%的目标。麻州一家公共产业在弗雷明汉推出了美国首个地热网络,于2024年为135户用户提供服务,展现了社区电气化的潜力。

现有建筑物的安装和维修成本很高

总安装成本因地区而异。在德国,维修一栋典型的联排住宅需要花费超过 3 万欧元(约 3.24 万美元),是法国的两倍,即使享受了补贴,由于人事费用高昂和审批流程严格,实际成本仍然如此。在纽约的一个多用户住宅案例研究中,仅配电盘升级一项就占了计划总成本的 40%,这凸显了基础设施方面的障碍,而这些障碍无法透过奖励完全消除。

细分市场分析

由于安装成本低且产品认知度高,空气源热泵预计2025年将占据热泵市场73.12%的份额。然而,地源/地热能预计将成为该领域成长最快的细分市场,年复合成长率将达到12.35%,这主要得益于公共产业试点建设联网迴路,例如耗资1400万美元的弗雷明汉计划,该项目计划于2024年连接135户家庭。直接膨胀式钻孔技术和共用地下迴路的进步已将能源效率比(COP)稳定性提升至4.0以上,从而推动了高密度都市区改造区域的需求。

空气源热泵製造商不断改进其低温演算法,有效控制了-20°F(约-29 度C)时的性能下降,从而促进了北方地区的成长。同时,公用事业公司和大型开发商正将地热系统定位为应对电网尖峰负载的保障,因为其输出功率不受高温骤降的影响。这些发展预示着市场结构正在逐步重新平衡,儘管预计在整个预测期内,空气源热泵仍将继续在热泵市场中主导地位。

2025年,10kW以下的住宅系统将占总出货量的45.92%,反映出在消费者补贴的支持下,单户住宅的广泛应用。然而,30kW以上的系统将占据主导地位,年复合成长率将达到12.18%,这主要得益于区域供热製冷和工业流程计划的成长。例如,丹麦埃斯比约海水淡化厂(70MW)和汉堡污水利用计划(60MW)等项目,都展现了大型集中式设施的发展动能。

标准化的安装和简化的审批程序将确保小容量太阳能发电系统维持较高的普及率。而仓库、食品加工和旨在实现碳中和供暖的市政管网等应用领域的不断拓展,则为大容量太阳能发电系统的发展提供了支撑。

热泵市场按热源类型(空气源、水源、地热源)、额定容量(<10kW、10-20kW、>20kW)、系统设计(分体式、一体式、混合式热泵)、最终用户(住宅、商业、其他)、应用(空间供暖/制冷、热水等)和地区进行细分。市场预测以美元以金额为准。

区域分析

亚太地区预计在2025年仍将占据全球热泵市场38.05%的主导地位,这主要得益于中国国内销售额13%的增长、中国在全球40%的产能占比,以及工厂自动化程度提高带来的单位成本下降12%。日本1%的谨慎销售成长和韩国在压缩机技术上的领先地位稳定了区域出货量,而印度由于其热带气候限制了传统设计的效率优势,仍处于发展阶段。

欧洲正在復苏,预计年复合成长率将达到10.92%。此前,德国一项暖气法案的辩论打击了消费者信心,导致2024年初销售量下降了50%。法国承诺每年在国内生产100万台空调,而丹麦则公布了包括埃斯比约海水淡化厂在内的区域旗舰计划,作为其2030年实现石化燃料燃料目标的一部分。儘管英国获得了高达7,500英镑的补贴,但其空调安装目标仍落后于预期,这凸显了基础设施和技能方面的障碍远比纯粹的经济因素更为重要。

在经历了最初的放缓之后,北美已进入政策支持下的成长週期。在美国,《通膨控制法案》的奖励措施已促使销售额在2024年11月前年增15%。在加拿大,已处理超过13,000份拨款申请,主要集中在大西洋省份。供应链回流倡议,例如三菱电机压缩机厂和Daikin-Copeland合资企业,旨在透过关键零件的在地化生产来抵消预计2.5亿至2.75亿美元的关税负担。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 政府脱碳奖励和强制规定

- 电气化导致空调设备更换週期延长

- 变频压缩机的成本迅速下降

- 併网热泵能够实现需量反应收益

- 寒冷地区热泵技术的创新

- 透过「供热即服务」经营模式进行资金筹措的潜力

- 市场限制

- 现有建筑物的安装和维修成本很高

- 熟练安装人员短缺

- 现有住宅存量的配电盘和电网容量有限制。

- 在某些国家,与混合氢锅炉竞争的风险

- 价值/供应链分析

- 监管环境

- 技术展望

- 宏观经济因素的影响

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 按来源

- 空气源

- 空对空

- 空气-水热交换

- 水源

- 地表水

- 开放回路

- 地下/地热源

- 闭合迴路垂直型

- 闭合迴路水平型

- 直接通货膨胀

- 空气源

- 按额定容量

- 最大功率 10kW

- 10-20 kW

- 20-30 kW

- 30千瓦或以上

- 透过系统设计

- 分离式系统

- 单体块

- 混合热泵

- 最终用户

- 住宅

- 商业的

- 产业

- 对机构而言

- 透过使用

- 暖气和冷气设备

- 热水供应

- 区域供热

- 製程和工业加热

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- ASEAN

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Daikin Industries, Ltd.

- Mitsubishi Electric Corporation

- Panasonic Holdings Corporation

- Trane Technologies plc

- Carrier Global Corporation

- NIBE Industrier AB

- Glen Dimplex Group

- Viessmann Climate Solutions SE

- Stiebel Eltron GmbH & Co. KG

- Midea Group Co., Ltd.

- Guangdong Gree Electric Appliances Inc. of Zhuhai

- Haier Smart Home Co., Ltd.

- Bosch Thermotechnology GmbH(Robert Bosch GmbH)

- LG Electronics Inc.

- Lennox International Inc.

- Ariston Holding NV(Ariston Group)

- Samsung Electronics Co., Ltd.

- Rheem Manufacturing Company

- Johnson Controls International plc

- Viomi Technology Co., Ltd.

- AO Smith Corporation

- Ecoforest Geotermia SL

- WaterFurnace International, Inc.(NIBE Group)

- Danfoss A/S

- Vaillant GmbH

第七章 市场机会与未来趋势

- 评估差距和未满足的需求

The heat pump market was valued at USD 83.66 billion in 2025 and estimated to grow from USD 91.5 billion in 2026 to reach USD 143.23 billion by 2031, at a CAGR of 9.38% during the forecast period (2026-2031).

Decarbonization mandates in Europe and North America, large federal and provincial incentive packages, and ever-larger utility-scale projects positioned the heat pump market as the leading replacement pathway for fossil-fuel-based space and water heating solutions. China's integrated manufacturing base held costs down while inverter-driven compressor advances narrowed performance gaps in sub-zero environments, setting the stage for rapid uptake in colder regions. Supply-chain localization efforts in the United States and Poland mitigated tariff and freight risks while growing "Heat-as-a-Service" finance models addressed steep upfront installation costs that had slowed adoption in existing buildings.

Global Heat Pumps Market Trends and Insights

Government decarbonization incentives and mandates

Aggressive policy frameworks created binding demand for heat pumps by tying building codes and subsidy levels directly to renewable heat outcomes. The US Inflation Reduction Act offered combined federal tax credits and state rebates as high as USD 14,000 per household, while Germany enforced its 65% renewable-heat requirement for all new heating systems starting in 2024. Canada's Oil to Heat Pump Affordability Program provided up to CAD 15,000 (USD 11,100) to lower-income homes, and the UK's Boiler Upgrade Scheme paid grants of up to GBP 7,500 (USD 9,400). These measures set artificial demand floors that shielded manufacturers from macroeconomic slowdowns and accelerated market penetration.

Electrification-driven HVAC replacement cycles

Local greenhouse gas caps in large cities condensed typical 15-20 year HVAC replacement intervals into fast-tracked retrofits that replace failing boilers with high-efficiency heat pumps. New York City's Local Law 97 triggered projects such as the retrofit of 345 Hudson Street, combining heat pumps and waste-heat recovery to hit a 70% emissions-cut target by 2030. Massachusetts Utilities launched the first US geothermal network in Framingham, connecting 135 customers in 2024 and demonstrating district-level electrification potential.

High installation and retrofitting costs in existing buildings

Total installed pricing diverged sharply by geography. Typical German row-house retrofits exceeded EUR 30,000 (USD 32,400), double France's post-subsidy cost because of higher labor expenses and stricter permitting rules. A New York multifamily case study showed that electrical panel upgrades alone amounted to 40% of the project cost, highlighting infrastructure hurdles that incentives cannot fully offset.

Other drivers and restraints analyzed in the detailed report include:

- Rapid cost declines in inverter-driven compressors

- Cold-climate heat pump technology breakthroughs

- Skilled installer shortage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Air-source units held 73.12% heat pump market share in 2025 because of lower installation costs and product familiarity. However, the ground/geothermal category is forecast to post a 12.35% CAGR, the fastest within the spectrum, as utilities pilot networked loops such as the USD 14 million Framingham project that connected 135 customers in 2024. Advances in direct-expansion boreholes and shared ground loops improved COP stability above 4.0, increasing appeal in dense urban infill.

Air-source manufacturers continued to refine low-ambient algorithms, cutting performance drop-off at -20°F and unlocking northern growth. Meanwhile, utilities and large developers viewed geothermal systems as a hedge against grid-peak constraints because output is decoupled from outdoor temperature swings. These dynamics suggest gradual rebalancing, yet the heat pump market will still see air-source units dominate unit volumes through the forecast horizon.

Residential-scale systems up to 10 kW contributed 45.92% of 2025 shipments, reflecting the breadth of single-family adoption supported by consumer rebates. The above-30 kW class, however, is projected to outpace all others at a 12.18% CAGR as district heating and industrial process projects proliferate. Denmark's 70 MW Esbjerg seawater plant and Hamburg's 60 MW wastewater initiative highlight the momentum toward centralized mega-scale assets.

Small-capacity uptake will remain elevated because of standardized equipment and simplified permitting. Large-capacity momentum underscores the widening application perimeter that includes warehouses, food processing, and municipal networks aiming for carbon-neutral heat.

Heat Pump Market is Segmented by Source Type (Air-Source, Water-Source, and Ground/Geothermal Source), Rated Capacity (Up To 10 KW, 10-20 KW, and More), System Design (Split System, Monobloc, and Hybrid Heat Pump), End-User (Residential, Commercial, and More), Application (Space Heating and Cooling, Water Heating, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained a commanding 38.05% portion of the heat pump market in 2025, underpinned by China's 13% domestic sales growth and its 40% share of global production capacity, which yielded 12% unit-cost declines from factory automation gains. Japan's cautious 1% volume uptick and South Korea's compressor technology leadership stabilized regional shipments, while India remained nascent because tropical ambient conditions limited efficiency advantages for traditional designs.

Europe is on a rebound path, with an 10.92% CAGR projected after a 50% sales dip in early 2024 when Germany's heating-law debate dampened consumer confidence. France committed to producing 1 million units per year domestically, and Denmark showcased flagship district-scale projects, including the Esbjerg seawater plant, as part of its fossil-free-by-2030 pledge. The United Kingdom trailed installation targets despite rich GBP 7,500 grants, underscoring the role of infrastructure and skills barriers over pure economics.

North America entered a policy-assisted growth cycle after initial softness: US year-over-year sales climbed 15% by November 2024 following the Inflation Reduction Act incentives, while Canada processed more than 13,000 subsidy applications concentrated in Atlantic provinces. Supply-chain reshoring efforts, including Mitsubishi Electric's compressor factory and the Daikin-Copeland joint venture, aim to offset projected USD 250-275 million tariff exposure by localizing critical components.

- Daikin Industries, Ltd.

- Mitsubishi Electric Corporation

- Panasonic Holdings Corporation

- Trane Technologies plc

- Carrier Global Corporation

- NIBE Industrier AB

- Glen Dimplex Group

- Viessmann Climate Solutions SE

- Stiebel Eltron GmbH & Co. KG

- Midea Group Co., Ltd.

- Guangdong Gree Electric Appliances Inc. of Zhuhai

- Haier Smart Home Co., Ltd.

- Bosch Thermotechnology GmbH (Robert Bosch GmbH)

- LG Electronics Inc.

- Lennox International Inc.

- Ariston Holding N.V. (Ariston Group)

- Samsung Electronics Co., Ltd.

- Rheem Manufacturing Company

- Johnson Controls International plc

- Viomi Technology Co., Ltd.

- A. O. Smith Corporation

- Ecoforest Geotermia S.L.

- WaterFurnace International, Inc. (NIBE Group)

- Danfoss A/S

- Vaillant GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government decarbonization incentives and mandates

- 4.2.2 Electrification-driven HVAC replacement cycles

- 4.2.3 Rapid cost declines in inverter-driven compressors

- 4.2.4 Grid-interactive heat pumps enabling demand-response revenue

- 4.2.5 Cold-climate heat pump technology breakthroughs

- 4.2.6 Heat-as-a-Service business models unlocking financing

- 4.3 Market Restraints

- 4.3.1 High installation and retrofitting costs in existing buildings

- 4.3.2 Skilled installer shortage

- 4.3.3 Electrical-panel and grid-capacity constraints in older housing stock

- 4.3.4 Competitive risk from hybrid hydrogen boilers in specific countries

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors

- 4.8 Porter's Five Forces

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products

- 4.8.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Source Type

- 5.1.1 Air-Source

- 5.1.1.1 Air-to-Air

- 5.1.1.2 Air-to-Water

- 5.1.2 Water-Source

- 5.1.2.1 Surface Water

- 5.1.2.2 Open Loop

- 5.1.3 Ground / Geothermal Source

- 5.1.3.1 Closed Loop Vertical

- 5.1.3.2 Closed Loop Horizontal

- 5.1.3.3 Direct Expansion

- 5.1.1 Air-Source

- 5.2 By Rated Capacity

- 5.2.1 Up to 10 kW

- 5.2.2 10-20 kW

- 5.2.3 20-30 kW

- 5.2.4 Above 30 kW

- 5.3 By System Design

- 5.3.1 Split System

- 5.3.2 Monobloc

- 5.3.3 Hybrid Heat Pump

- 5.4 By End-User

- 5.4.1 Residential

- 5.4.2 Commercial

- 5.4.3 Industrial

- 5.4.4 Institutional

- 5.5 By Application

- 5.5.1 Space Heating and Cooling

- 5.5.2 Water Heating

- 5.5.3 District Heating

- 5.5.4 Process and Industrial Heating

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Russia

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 ASEAN

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.5.1 Middle East

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Daikin Industries, Ltd.

- 6.4.2 Mitsubishi Electric Corporation

- 6.4.3 Panasonic Holdings Corporation

- 6.4.4 Trane Technologies plc

- 6.4.5 Carrier Global Corporation

- 6.4.6 NIBE Industrier AB

- 6.4.7 Glen Dimplex Group

- 6.4.8 Viessmann Climate Solutions SE

- 6.4.9 Stiebel Eltron GmbH & Co. KG

- 6.4.10 Midea Group Co., Ltd.

- 6.4.11 Guangdong Gree Electric Appliances Inc. of Zhuhai

- 6.4.12 Haier Smart Home Co., Ltd.

- 6.4.13 Bosch Thermotechnology GmbH (Robert Bosch GmbH)

- 6.4.14 LG Electronics Inc.

- 6.4.15 Lennox International Inc.

- 6.4.16 Ariston Holding N.V. (Ariston Group)

- 6.4.17 Samsung Electronics Co., Ltd.

- 6.4.18 Rheem Manufacturing Company

- 6.4.19 Johnson Controls International plc

- 6.4.20 Viomi Technology Co., Ltd.

- 6.4.21 A. O. Smith Corporation

- 6.4.22 Ecoforest Geotermia S.L.

- 6.4.23 WaterFurnace International, Inc. (NIBE Group)

- 6.4.24 Danfoss A/S

- 6.4.25 Vaillant GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-space and Unmet-need Assessment