|

市场调查报告书

商品编码

1910644

柔版印刷:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Flexographic Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

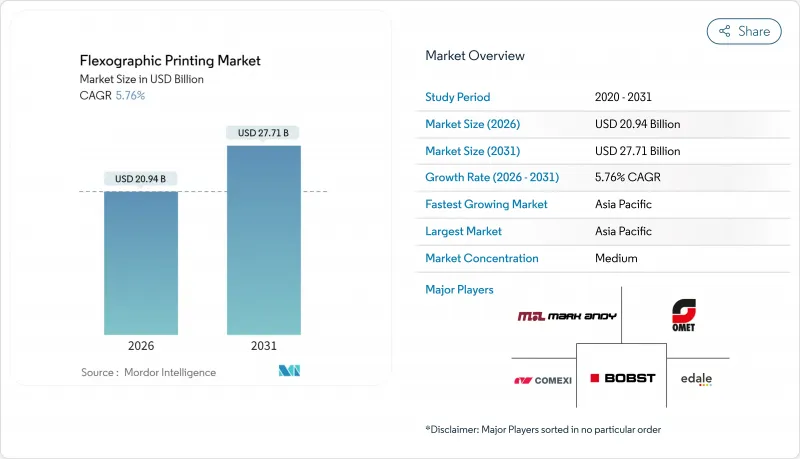

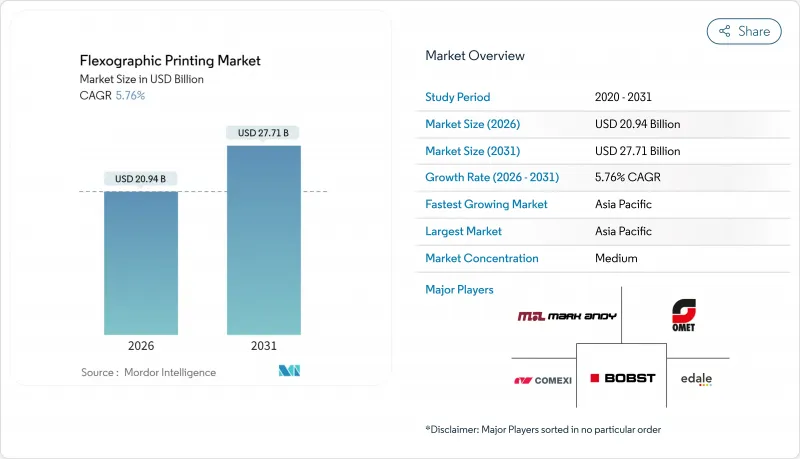

预计到 2025 年,柔版印刷市场规模将达到 198 亿美元,到 2026 年将达到 209.4 亿美元,到 2031 年将达到 277.1 亿美元,预测期(2026-2031 年)的复合年增长率为 5.76%。

电子商务交易量的成长、日益严格的食品接触法规以及人工智慧驱动的印刷自动化技术的不断进步,预计将继续推动柔版印刷市场的发展动能。供应商正在针对产品生命週期较短的品牌优化窄幅捲筒纸印刷机和数位混合印刷机,而加工商则越来越多地采用水性油墨以满足全球挥发性有机化合物(VOC)基准值。对永续瓦楞纸物流日益增长的需求,以及对快速装版和检测系统的投资,正帮助柔版印刷市场保持其相对于胶印和凹版印刷等竞争方式的优势。亚太地区的产能,加上政府对循环包装的激励措施,进一步巩固了该地区在柔版印刷市场的主导地位。

全球柔版印刷市场趋势与洞察

品牌拥有者要求缩短 SKU 更新週期

随着消费者偏好变化日新月异,品牌经理不得不更频繁地更新包装设计。印刷企业正积极应对这项挑战,采用窄幅轮转印刷机,实现几分钟内完成印版更换,从而减少停机时间和材料浪费。 Onyx GO 等解决方案透过主动套准控制,可将设定废料减少 30%。更快的周转时间使零售商能够试销季节性产品而无需大量库存,从而缓解柔版印刷市场的营运资金压力。同时,基于云端的工作流程软体加快了设计稿核准,确保新设计能够在短短几週内从概念转化为商店。

经济高效的长幅包装印刷

当印刷量超过百万份时,柔版印刷仍是单位成本最低的选择。光敏树脂版可承受数十万次循环,而节能烘干机则能降低营运成本。以杜邦Orion为例,从凹版印刷转向柔版印刷后,溶剂用量减少了30%,并提高了工作场所的安全性。这些经济效益帮助传统消费品企业在柔版印刷市场站稳脚跟,并维持了印刷机的运转率和OEM厂商的备件销售。亚洲的印刷加工商正充分利用这些成本优势,同时运作三班倒作业以满足出口主导的需求。

数位喷墨技术在缩短交货时间的替代效应

压电喷头和水性分散油墨技术的进步,使得可变资料印刷能够以极具竞争力的点击率实现接近胶印的影像品质。製药包装製造商正在将数位化生产线与ERP软体集成,以按需生产特定国家/地区的附加檔,从而将库存降至零。为此,柔版印刷市场正在向混合型印刷机转型,这种印刷机将传统单元与在线连续喷墨单元相结合,在保持现有印后加工流程的同时,增加了序列化功能。

细分市场分析

随着加工商寻求能够在批量生产模式和个人化批量生产模式之间切换的单条生产线,新型数位混合印刷机的安装份额不断增加。儘管窄幅印刷机在2025年仍占总营收的30.52%,但混合印刷机预计将以9.09%的复合年增长率成长,显着超过柔版印刷市场的整体成长速度。典型的配置是将用于品牌颜色的10色柔版印刷单元与位于复捲机之前的CMYK喷墨印刷单元结合。这种配置将作业切换时间缩短至五分钟以内,即使平均订单量低于5000米,也能确保生产线盈利。中幅印刷机仍然是卫生纸包装和零食包装纸的首选,而宽幅CI柔版印刷机则继续在立式袋领域占据主导地位。单张纸印刷机适用于折迭纸盒的印刷,而折迭纸盒的印刷则需要在下游进行精密模切。

模组化平台允许加工商根据客户产品组合的变化,随时添加电晕处理装置、冷却辊或第二个喷墨条。 Sapphire LUCE 正是这种模组化设计的体现,它将 1200 x 1200 dpi 的分辨率与每分钟 150 公尺的印刷速度完美结合。服务等级协定通常包含预测性维护分析功能,可将非计划性停机时间减少到可用时间的 2% 以下。即使整个柔版印刷市场面临来自新兴国家翻新印刷机兴起的竞争压力,这些功能也使原始设备製造商 (OEM) 能够运作定价权。

到2025年,水性油墨系统将占总收入的40.42%,这主要得益于其低气味和在大多数地区获得直接食品接触认证。这些油墨是瓦楞纸箱、折迭纸盒和纸质包装的关键化学品。同时,由于其印刷速度快,且在无孔薄膜上具有优异的耐刮擦性,预计到2031年,紫外光固化油墨的复合年增长率将达到8.28%。能量固化解决方案采用紧凑型LED灯,其电力消耗% ,有助于工厂降低电费。由于美国环保署(EPA)第59条法规对挥发性有机化合物(VOC)排放的限制日益严格,溶剂型油墨的市占率持续下降。电子束固化油墨仍处于小众市场,渗透率不到2%,但在乳製品包装和无菌纸盒领域展现出良好的应用前景。

油墨供应商透过颜料分散稳定性、流变控制和低迁移添加剂配方来区分产品。 INX International 的 GelFlex EB 墨水在某些零食应用中无需覆膜,从而可以减少油墨厚度和箔材用量。这些创新体现了席捲柔版印刷市场的永续性趋势。

区域分析

预计亚太地区将在2025年占据38.05%的最大市场份额,并在2031年之前以9.06%的复合年增长率持续成长。中国供应基材、油墨和机械设备,实现了成本协同效应;印度电子商务小包裹的两位数成长推动了国内包装需求。日本和韩国优先发展自动化,在开发具备协作式机器人换辊功能的印刷生产线方面处于领先地位。东南亚国协政府的回收目标推动了水性油墨和单组分包装袋设计的发展,从而扩大了柔版印刷市场的潜在机会。

北美在技术创新方面处于领先地位,主导人工智慧驱动的检测摄影机和云端连接黏度控制器的试验。品牌所有者正在评估能够提供符合FDA标准、低转移工作流程的加工商,以维持高价值的印刷。随着劳动力短缺的持续,诸如Ricoh的「高级职业教育计画」等措施正在製定中,旨在培训操作员进行印刷机旁的数据分析。近岸外包趋势正将消费品製造地从亚洲转移到墨西哥,推动了北美对连续柔版印刷生产线的新投资。

欧洲持续面临严格的监管审查,「零污染」框架要求迅速采用植物来源光引发剂和不含矿物油的油墨。德国正凭藉其卓越的工程技术不断进步,法国正在加速生质塑胶包装的发展,而义大利则在扩建窄幅捲筒纸印刷技术中心,例如博斯特位于佛罗伦萨的1200平方公尺的中心。东欧的印刷加工商正利用有利的工资结构来满足不断增长的订单,并巩固该地区在柔版印刷市场中的多元化地位。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 品牌拥有者要求缩短 SKU 更新週期

- 经济高效的长幅包装印刷

- 用于食品接触的水性油墨

- 向永续瓦楞纸物流转型

- 人工智慧驱动的印刷机自动化和减少废弃物

- 电子商务推动了对多层纸袋的需求

- 市场限制

- 以数位喷墨印表机取代内部产品进行小批量生产

- 光敏聚合物板价格波动

- 对溶剂型挥发性有机化合物(VOCs)的监管更加严格

- 熟练印刷操作员短缺

- 供应链分析

- 监理展望

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章 市场规模与成长预测

- 按印刷设备类型

- 窄幅网

- 中型网站

- 万维网

- 片材供应类型

- 数位混合

- 按墨水类型

- 水溶液

- 溶剂型

- 紫外线固化型

- 电子束

- 依基材类型

- 纸和纸板

- 柔软性塑胶薄膜

- 金属箔

- 其他基板类型

- 透过使用

- 瓦楞纸箱

- 折迭纸箱

- 软包装

- 标籤

- 印刷媒体

- 其他应用

- 按最终用户行业划分

- 食品/饮料

- 医疗和药品

- 个人护理和化妆品

- 产业

- 其他终端用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲和纽西兰

- 亚太其他地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 中东

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Bobst Group SA

- Heidelberger Druckmaschinen AG

- Mark Andy Inc.

- Comexi Group

- Koenig and Bauer AG

- Windmoller & Holscher KG

- Uteco Group

- OMET SRL

- Edale Ltd.

- Star Flex International

- InterFlex Group

- Flexopack SA

- Pepin Manufacturing Inc.

- Wolverine Flexographic LLC

- Siva Group

- Gallus Ferd. Ruesch AG

- Nilpeter A/S

- Soma Engineering

- PCMC(Barry-Wehmiller)

- Tresu Group

- MPS Systems BV

第七章 市场机会与未来展望

The flexographic printing market was valued at USD 19.80 billion in 2025 and estimated to grow from USD 20.94 billion in 2026 to reach USD 27.71 billion by 2031, at a CAGR of 5.76% during the forecast period (2026-2031).

Rising e-commerce volumes, stringent food-contact regulations, and continuous improvements in AI-enabled press automation are expected to uphold this momentum in the flexographic printing market. Equipment vendors are optimizing narrow-web and digital-hybrid presses to serve brands that juggle shorter SKU life cycles, while converters intensify water-based ink adoption to comply with global VOC thresholds. Growing demand for sustainable corrugated logistics, together with investments in rapid plate-mounting and inspection systems, keeps the flexographic printing market well placed against competing lithography and gravure methods. Asia-Pacific's manufacturing capacity, paired with government incentives for circular packaging, further cements the region's leadership role in the flexographic printing market.

Global Flexographic Printing Market Trends and Insights

Brand-owner Demand for Shorter SKU Cycles

Consumer preferences now turn over faster than ever, pushing brand managers to refresh packaging artwork frequently. Converters respond by leaning on narrow-web presses that complete plate changes in minutes, curbing downtime and material waste. Solutions such as the Onyx GO deliver active register control that lowers setup scrap by 30%. Shorter runs also let retailers pilot seasonal editions without carrying surplus inventory, reducing the working-capital burden throughout the flexographic printing market. In parallel, cloud-based workflow software accelerates artwork approvals, ensuring that new designs progress from concept to shelf within weeks.

Cost-Effective Long-Run Package Printing

Where volumes exceed millions of impressions, flexography still offers the lowest unit cost. Photopolymer plates last hundreds of thousands of cycles, while energy-efficient dryers reduce operating expenses. DuPont's Orion case illustrates 30% solvent savings after migrating from gravure to flexo, along with safer shop-floor conditions. Such economics keep legacy consumer-goods lines anchored in the flexographic printing market, preserving press utilization and spare-parts sales for OEMs. Asian converters, often running three shifts, maximize these cost advantages to meet export-driven demand.

Digital Inkjet Cannibalisation in Short Runs

Advances in piezo-electric heads and aqueous dispersion inks enable variable data and near-offset image quality at competitive click rates. Pharmaceutical packagers integrate digital lines with ERP software to produce country-specific leaflets on demand, cutting inventory to zero. In response, the flexographic printing market is pivoting to hybrid presses that merge in-line inkjet stations with conventional units, preserving established finishing workflows while adding serialization capability.

Other drivers and restraints analyzed in the detailed report include:

- Water-Based Ink Adoption for Food Contact Compliance

- Shift Toward Sustainable Corrugated Logistics

- Volatile Photopolymer Plate Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Digital-hybrid presses lifted their share of new installations as converters sought one line that could alternate between mass-production mode and personalized batches. Although narrow-web machines secured 30.52% of revenue in 2025, the hybrid cohort is on course for 9.09% CAGR, well above the overall flexographic printing market. Typical configurations combine 10-color flexo decks for brand colors with CMYK inkjet bars placed just before the rewinder. Such set-ups reduce job changeover time to under five minutes, keeping lines profitable even when average order quantities fall below 5,000 linear m. Medium-web lines remain favored in tissue overwraps and snack wrappers, while wide-web CI flexo retains dominance in stand-up pouches. Sheet-fed presses serve folding cartons that require precise die-cutting stations downstream.

Converters equipping themselves with modular platforms can later bolt on corona treaters, chill rolls, or second inkjet bars as client mixes evolve. The SapphireLUCE exemplifies this modular path, pairing 1200 X 1200 DPI resolution with speeds of 150 mpm. Service-level agreements often bundle predictive-maintenance analytics, shrinking unplanned downtime below 2% of available hours. These feature sets sustain pricing power for OEMs, even as the broader flexographic printing market experiences competitive pressure from refurbished presses in emerging economies.

Water-based systems commanded 40.42% revenue in 2025 thanks to low odour and direct-food-contact approval in most jurisdictions. They form the baseline chemistry for corrugated boxes, folding cartons, and paper wraps. UV-curable inks, however, are projected to register 8.28% CAGR through 2031 because they support higher line speeds and excellent scratch resistance on non-porous films. Energy-curable solutions require compact LED lamps that draw 65% less power than mercury arc units, reducing plant electricity bills. Solvent variants, constrained by tightening VOC caps under the US EPA Part 59 ruling, continue to cede share. Electron-beam curables remain a niche at under 2% penetration but show promise in dairy lidding and aseptic cartons.

Ink suppliers differentiate through pigment dispersion stability, rheology control, and low-migration additive packages. INX International's GelFlex EB ink removes lamination in certain snack applications, dropping gauge weight and cutting foil usage. Such innovations echo the broader sustainability narrative resonating throughout the flexographic printing market.

The Flexographic Printing Market Report is Segmented by Printing Equipment Type (Narrow Web, Medium Web, and More), Ink Type (Water-Based, Solvent-Based, and More), Substrate Type (Paper and Paperboard, Flexible Plastic Films, and More), Application (Corrugated Boxes, Folding Carton, and More), End-User Industry (Food and Beverage, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated the largest revenue slice at 38.05% in 2025 and is projected to compound at 9.06% CAGR to 2031. China supplies substrates, inks, and machinery, enabling integrated cost synergies, while India posts double-digit e-commerce parcel growth that fuels domestic packaging demand. Japan and South Korea emphasize automation, pioneering press lines equipped with cobot-assisted roll changes. Government recycling targets across ASEAN incentivize water-based inks and mono-material pouch designs, broadening addressable opportunities throughout the flexographic printing market.

North America remains the technology pione-er, hosting pilot runs for AI-driven inspection cameras and cloud-connected viscosity controllers. Brand owners reward converters that demonstrate FDA-compliant low-migration workflows, sustaining high value-added print per square meter. Labor shortages persist, prompting initiatives like Ricoh's Advanced Career Education program that trains operators in press-side data analytics. Nearshoring trends reroute consumer-goods manufacturing from Asia to Mexico, spurring fresh investments in CI flexo lines within North America.

Europe maintains keen regulatory oversight, compelling swift adoption of plant-based photoinitiators and mineral-oil-free ink sets under the Zero Pollution framework. Germany anchors engineering excellence, France accelerates bio-plastic packaging, and Italy scales narrow-web competence hubs such as Bobst's 1,200 sqm Florence center. Eastern European converters leverage favorable wage structures to absorb overflow orders, reinforcing the region's diverse role in the flexographic printing market.

- Bobst Group SA

- Heidelberger Druckmaschinen AG

- Mark Andy Inc.

- Comexi Group

- Koenig and Bauer AG

- Windmoller & Holscher KG

- Uteco Group

- OMET SRL

- Edale Ltd.

- Star Flex International

- InterFlex Group

- Flexopack SA

- Pepin Manufacturing Inc.

- Wolverine Flexographic LLC

- Siva Group

- Gallus Ferd. Ruesch AG

- Nilpeter A/S

- Soma Engineering

- PCMC (Barry-Wehmiller)

- Tresu Group

- MPS Systems B.V.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Brand - owner demand for shorter SKU cycles

- 4.2.2 Cost-effective long-run package printing

- 4.2.3 Water-based ink adoption for food contact compliance

- 4.2.4 Shift toward sustainable corrugated logistics

- 4.2.5 AI-driven press automation and waste reduction

- 4.2.6 E-commerce accelerates multi-wall mailers

- 4.3 Market Restraints

- 4.3.1 Digital inkjet cannibalisation in short runs

- 4.3.2 Volatile photopolymer plate prices

- 4.3.3 Solvent-based VOC regulations tightening

- 4.3.4 Skilled press-operator shortage

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Printing Equipment Type

- 5.1.1 Narrow Web

- 5.1.2 Medium Web

- 5.1.3 Wide Web

- 5.1.4 Sheet-Fed

- 5.1.5 Digital-Hybrid

- 5.2 By Ink Type

- 5.2.1 Water-Based

- 5.2.2 Solvent-Based

- 5.2.3 UV-Curable

- 5.2.4 Electron-Beam

- 5.3 By Substrate Type

- 5.3.1 Paper and Paperboard

- 5.3.2 Flexible Plastic Films

- 5.3.3 Metallic Foil

- 5.3.4 Other Substrate Type

- 5.4 By Application

- 5.4.1 Corrugated Boxes

- 5.4.2 Folding Carton

- 5.4.3 Flexible Packaging

- 5.4.4 Labels

- 5.4.5 Print Media

- 5.4.6 Other Application

- 5.5 By End-user Industry

- 5.5.1 Food and Beverage

- 5.5.2 Healthcare and Pharmaceuticals

- 5.5.3 Personal Care and Cosmetics

- 5.5.4 Industrial

- 5.5.5 Other End-user Industry

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Australia and New Zealand

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 United Arab Emirates

- 5.6.4.1.2 Saudi Arabia

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Nigeria

- 5.6.4.2.3 Egypt

- 5.6.4.2.4 Rest of Africa

- 5.6.4.1 Middle East

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Bobst Group SA

- 6.4.2 Heidelberger Druckmaschinen AG

- 6.4.3 Mark Andy Inc.

- 6.4.4 Comexi Group

- 6.4.5 Koenig and Bauer AG

- 6.4.6 Windmoller & Holscher KG

- 6.4.7 Uteco Group

- 6.4.8 OMET SRL

- 6.4.9 Edale Ltd.

- 6.4.10 Star Flex International

- 6.4.11 InterFlex Group

- 6.4.12 Flexopack SA

- 6.4.13 Pepin Manufacturing Inc.

- 6.4.14 Wolverine Flexographic LLC

- 6.4.15 Siva Group

- 6.4.16 Gallus Ferd. Ruesch AG

- 6.4.17 Nilpeter A/S

- 6.4.18 Soma Engineering

- 6.4.19 PCMC (Barry-Wehmiller)

- 6.4.20 Tresu Group

- 6.4.21 MPS Systems B.V.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment