|

市场调查报告书

商品编码

1910670

专业视听系统:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Professional Audio Visual Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

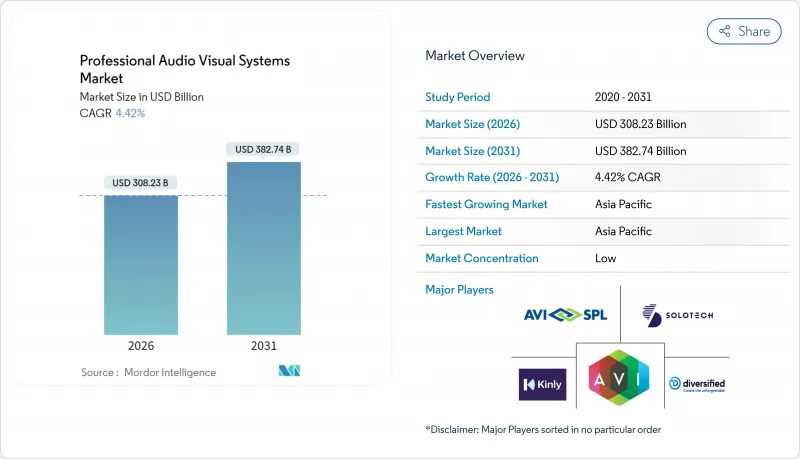

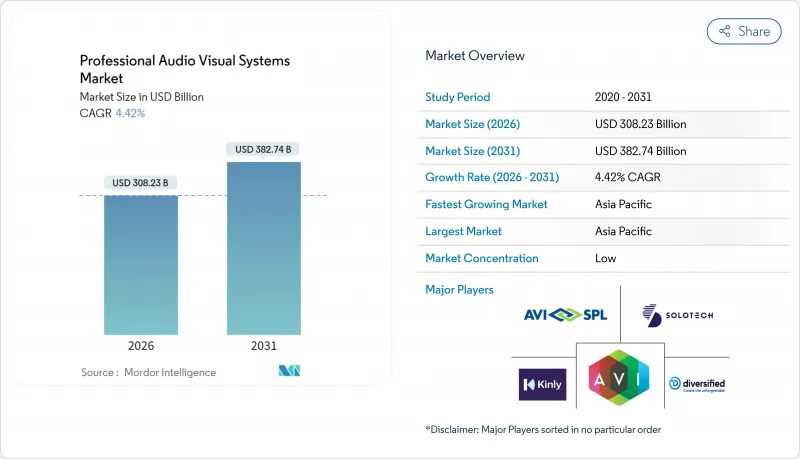

预计到 2025 年,专业视听系统市场规模将达到 2,951.8 亿美元,到 2031 年将达到 3,827.4 亿美元,高于 2026 年的 3,082.3 亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 4.42%。

对混合办公的需求、对数位电子看板的投资以及影音处理向云端和IP网路的迁移,都在支撑着市场需求的韧性。企业协作套件、大型LED显示器和支援包容性会议的AI音讯设备正迎来消费成长动能。随着以软体为中心的新兴参与企业凭藉订阅模式和远端设备管理挑战传统整合商,供应商之间的竞争日益激烈。半导体供应链的压力仍构成阻力,但对无障碍性和能源效率的监管要求,正为符合合规要求的平台创造新的商机。

全球专业影音系统市场趋势与洞察

混合式工作和学习模式迅速成长

企业支出已从升级孤立的会议室设备转向建造企业级生态系统,旨在为现场和远端员工提供公平的体验。投资范围涵盖空间音讯阵列、多摄影机追踪和自动内容取景等,这些技术均可与主流协作平台整合。教育产业对混合式教室支援解决方案的需求也在不断增长,包括讲座录製、校园直播和设备管理。专业视听系统市场受益于企业对可整合到现有IT策略中的认证、全託管解决方案的偏好。员工体验基准测试正在推动快速的更新周期和多年采购蓝图的发展。因此,跨平台互通性和云端仪表板正成为供应商之间关键的差异化因素。

在体验式零售和公共设施中引入LED技术

零售连锁店正将门市改造为身临其境型媒体空间,利用高清LED显示器即时传递品牌故事、指引方向并推广产品。 Scheels公司斥资1,100万美元在全美部署LED显示屏,充分展现了其雄厚的资金实力和规模。公共场所和交通枢纽也部署了类似的显示屏,用于客流管理和安全资讯发布。集中式内容管理系统使营运商能够跨区域同步推广宣传活动,同时客製化本地语言和优惠资讯。如今,显示硬体标配了可与零售商CRM工具整合的分析功能,从而推动了专业视听系统市场的发展。儘管零售支出存在週期性波动,但客流量成长的预期仍支撑着LED显示器的持续需求。

高成本结构和合遵循成本

无障碍存取、网路安全和能源法规的出现改变了采购决策。美国联邦通讯委员会 (FCC) 的规定将于 2027 年 1 月生效,要求视讯会议平台必须具备隐藏式字幕、手语支援和无障碍使用者介面。同时,能源标准也迫使製造商重新设计机壳和电源,采用更有效率的组件。合规性要求增加了测试、认证和频繁的软体更新,使得复杂部署的生命週期成本翻倍。企业往往低估了持续培训、监控和审核文件所需的工作量,导致预算超支,并限制了专业影音系统市场的短期订单。

细分市场分析

在专业视听系统市场,采集和製作设备将在2025年占据30.25%的领先份额,凸显了对高品质来源内容的重视。随着企业和教育机构的工作室复製广播工作流程,摄影系统、云台控制器和製作切换台等产品正向价格更低的细分市场转型。捆绑硬体、软体和远端支援的订阅模式正在提升供应商的年度经常性收入。串流媒体储存和分发领域预计将以5.33%的复合年增长率成长,这反映了市场对可扩展云端编码器和随选节目库的需求。边缘快取技术降低了全球分散式用户的观看延迟,使媒体伺服器成为讨论专业视听系统市场规模的关键节点。

传统视讯投影在礼堂和教堂等场所仍然十分重要,但在高亮度环境下,其市场份额正被直视式LED投影机蚕食。随着客户将生命週期管理外包,包括设计、监控和维修合约在内的服务需求日益增长。全像显示器和空间运算等新兴技术虽然仍处于小众市场,但正吸引高端场所的创新预算。每个细分领域都代表着价值创造模式的转变,即从孤立的硬体转向能够实现分析和内容工作流程货币化的整合生态系统。

区域分析

亚太地区以29.55%的市场份额和5.78%的复合年增长率保持最大份额,这主要得益于交通运输、酒店和智慧城市领域的大型企划。中国、印度和印尼的国家数位化政策正在推动校园网路和身临其境型教室的建设。本地製造群正在缩短前置作业时间并降低成本,加速下一代LED和人工智慧处理技术的应用。日本和韩国透过在microLEDLED构装和语音人工智慧领域的研发突破来提升产能,增强了出口竞争力。成熟的系统整合商正在组建合资企业,以克服区域采购和语言差异的挑战,这项策略正在扩大专业视听系统市场的版图。

在无障碍法规和混合办公模式兴起的推动下,北美正在稳步升级其係统。美国联邦通讯委员会(FCC)的字幕规则正在推动对人工智慧转录引擎和自适应用户介面元素的需求。各公司正在重新评估其三到五年的更新周期,以弥合办公室和远距办公环境之间的差距。加拿大幅员辽阔,透过对广播工作室和远端教育基础设施的投资,正在为市场注入活力。墨西哥的加工出口区正在实施基于IP的音视频传输技术,以协调跨境供应链,这有助于该地区保持其在专业影音系统市场的关键地位。

在欧洲,要求降低能耗和循环经济设计的永续性法规正在推动市场成长。德国和法国优先采用被动式冷却机壳和可自动切换至低功耗模式的韧体。英国正加速在交通枢纽应用人工智慧分析技术,以管理客流密度。东欧国家正利用重建资金升级社区剧院和当地大学。泛欧资料隐私法规正在影响专业视听系统市场的采购政策,并将安全的云端控制视为供应商之间的竞争优势。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 宏观经济因素的影响

- 市场驱动因素

- 混合办公和学习模式激增

- 体验式零售与公共设施的LED装置

- 疫情后现场及混合活动的復苏

- 向基于IP的音视频架构过渡

- 人工智慧驱动的即时无障碍解决方案

- 节能型影音设备的脱碳义务

- 市场限制

- 高昂的总拥有成本 (TCO) 和合规成本

- 半导体和显示器供应链波动

- 连网音影音设备的网路保险保费

- 技术纯熟劳工短缺和工资上涨

- 产业供应链分析

- 监管环境

- 技术展望

- 影响市场的宏观经济因素

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

第五章 市场规模与成长预测

- 按类型

- 拍摄和製作设备

- 视讯投影

- 串流媒体、储存和传输

- 服务

- 其他类型

- 按组件

- 音讯设备(麦克风、混音器、扩大器)

- 显示和投影系统

- 控制与处理

- 储存和分发硬体

- 按最终用户行业划分

- 对于企业

- 场地和活动

- 零售

- 媒体与娱乐

- 教育

- 政府

- 卫生保健

- 其他终端用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- AVI-SPL Inc.

- Diversified

- AVI Systems Inc.

- Ford Audio-Video LLC

- CCS Presentation Systems Inc.

- Solutionz Inc.

- Electrosonic Group

- Solotech Inc.

- Conference Technologies Inc.

- Vistacom Inc.

- Kinly BV

- Vega Global

- IDNS Ltd.

- Ricoh USA Inc.

- Midwich Group plc

- Wesco Anixter Inc.

- Audinate Group Ltd.

- NMK Electronics Enterprises

- Qvest Group

- ACTLD SA

- Almo Professional A/V(Exertis Almo)

- ClearOne Inc.

- Kramer Electronics Ltd.

第七章 市场机会与未来展望

The professional audio visual system market was valued at USD 295.18 billion in 2025 and estimated to grow from USD 308.23 billion in 2026 to reach USD 382.74 billion by 2031, at a CAGR of 4.42% during the forecast period (2026-2031).

Hybrid work requirements, investment in digital signage, and the migration of AV processing to cloud and IP networks drive demand resilience. Spending momentum is visible in enterprise collaboration suites, large-format LED displays, and AI-enabled audio that supports inclusive meetings. Vendor competition is intensifying as software-centric newcomers challenge traditional integrators with subscription models and remote device management. Supply-chain pressures related to semiconductors remain a headwind, yet regulatory mandates on accessibility and energy efficiency are opening new revenue avenues for compliance-ready platforms.

Global Professional Audio Visual Systems Market Trends and Insights

Hybrid Work and Learning Surge

Corporate spending shifted from isolated conference-room upgrades to enterprise-wide ecosystems that deliver equitable experiences for on-site and remote staff. Investments span spatial audio arrays, multi-camera tracking, and automated content framing that integrate with leading collaboration platforms. Education is mirroring this demand with lecture capture, campus streaming, and device management that support blended classrooms. The professional audio visual system market benefits because enterprises prefer certified, fully managed solutions that plug into existing IT policies. Rapid refresh cycles are fueled by employee experience benchmarks, leading to multiyear procurement roadmaps. As a result, platform interoperability and cloud dashboards have emerged as critical vendor differentiators.

Experiential Retail and Public-Venue LED Rollouts

Retail chains are turning stores into immersive media venues where fine-pitch LEDs deliver branded storytelling, wayfinding, and real-time promotions. Scheels' USD 11 million national signage rollout underscores capital intensity and scale. Public buildings and transport hubs are installing similar displays to manage passenger flow and safety messaging. Central content management lets operators synchronize campaigns across regions while tailoring local language and offers. The professional audio visual system market is bolstered because display hardware now ships with embedded analytics that feed retailers' CRM tools. Rising foot-traffic expectations keep LED demand elevated despite cyclical retail spending.

High TCO and Compliance Costs

Accessibility, cybersecurity, and energy mandates have transformed procurement math. The FCC rules, effective January 2027, require captioning, sign-language support, and accessible user interfaces within video-conferencing platforms. Parallel energy standards push manufacturers to redesign enclosures and power supplies with higher-efficiency components. Compliance adds testing, certification, and frequent software updates, doubling lifecycle spending for complex deployments. Organizations underestimate ongoing training, monitoring, and audit documentation, leading to budget overruns that temper near-term orders in the professional audio visual system market.

Other drivers and restraints analyzed in the detailed report include:

- Live and Hybrid Events Rebound Post-Pandemic

- Migration to AV-over-IP Architectures

- Skilled-Labor Shortages and Wage Inflation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The professional audio visual system market recorded Capture and Production Equipment at a leading 30.25% share in 2025, underscoring the premium placed on high-quality source content. Camera systems, PTZ controllers, and production switchers move down-market as corporate and educational studios replicate broadcast workflows. Bundled subscription models that wrap hardware, software, and remote support increase annual recurring revenue for vendors. Streaming Media, Storage, and Distribution, the fastest-growing slice at a 5.33% CAGR, reflects demand for scalable cloud encoders and on-demand content libraries. Edge caching reduces latency for globally dispersed viewers, turning media servers into strategic nodes in the professional audio visual system market size discussions.

Traditional Video Projection retains relevance for auditoriums and houses of worship but yields share to direct-view LED in high-brightness settings. Services, including design, monitoring, and break-fix contracts, climb as customers outsource lifecycle management. Emerging types such as holographic displays and spatial computing remain niche yet capture innovation budgets for premium venues. Every sub-segment illustrates a shift where value creation migrates from isolated hardware to integrated ecosystems that monetize analytics and content workflows.

The Professional Audio Visual System Market Report is Segmented by Type (Capture and Production Equipment, Video Projection, and More), Component (Audio Equipment, Display and Projection Systems, Control and Processing, and More), End-User Vertical (Corporate, Venues and Events, Retail, and More), and Geography (North America, South America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific holds the largest 29.55% share and a leading 5.78% CAGR, propelled by mega-projects in transportation, hospitality, and smart cities. National digitization policies funnel funds into campus networks and immersive classrooms in China, India, and Indonesia. Local manufacturing clusters compress lead times and cost structures, allowing rapid adoption of next-generation LED and AI processing. Japan and South Korea supplement volume with research and development breakthroughs in micro-LED packaging and voice AI, enhancing export competitiveness. Mature integrators forge joint ventures to navigate regional procurement and language diversity, a tactic that expands the professional audio visual system market footprint.

North America posts steady upgrades anchored by accessibility mandates and hybrid work normalization. The FCC captioning rule multiplies demand for AI transcription engines and adaptive UI elements. Enterprises revisit refresh cycles every three to five years to maintain parity between in-office and remote experiences. Canada boosts market momentum through investments in broadcast studios and distance-learning infrastructure across dispersed territories. Mexico's maquiladora centers adopt AV-over-IP to coordinate cross-border supply chains, keeping the region integral to the professional audio visual system market.

Europe advances on the back of sustainability legislation requiring lower energy consumption and circular-economy design. Germany and France prioritize passive cooling enclosures and firmware that schedules low-power modes. The United Kingdom accelerates the adoption of AI analytics in transport hubs to manage passenger density. Eastern European countries allocate recovery funds to upgrade civic theatres and regional universities. Pan-European data-privacy laws elevate secure cloud control as a competitive edge among vendors, shaping procurement policies across the professional audio visual system market.

- AVI-SPL Inc.

- Diversified

- AVI Systems Inc.

- Ford Audio-Video LLC

- CCS Presentation Systems Inc.

- Solutionz Inc.

- Electrosonic Group

- Solotech Inc.

- Conference Technologies Inc.

- Vistacom Inc.

- Kinly BV

- Vega Global

- IDNS Ltd.

- Ricoh USA Inc.

- Midwich Group plc

- Wesco Anixter Inc.

- Audinate Group Ltd.

- NMK Electronics Enterprises

- Qvest Group

- ACTLD SA

- Almo Professional A/V (Exertis Almo)

- ClearOne Inc.

- Kramer Electronics Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Impact of Macroeconomic Factors

- 4.3 Market Drivers

- 4.3.1 Hybrid work and learning surge

- 4.3.2 Experiential retail and public-venue LED roll-outs

- 4.3.3 Live and hybrid events rebound post-pandemic

- 4.3.4 Migration to AV-over-IP architectures

- 4.3.5 AI-driven real-time accessibility solutions

- 4.3.6 Decarbonization mandates for energy-efficient AV

- 4.4 Market Restraints

- 4.4.1 High TCO and compliance costs

- 4.4.2 Semiconductor and display supply-chain volatility

- 4.4.3 Cyber-insurance premiums on networked AV

- 4.4.4 Skilled-labor shortages and wage inflation

- 4.5 Industry Supply Chain Analysis

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Impact of Macroeconomic Factors on the Market

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Intensity of Competitive Rivalry

- 4.9.5 Threat of Substitute Products

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Capture and Production Equipment

- 5.1.2 Video Projection

- 5.1.3 Streaming Media, Storage and Distribution

- 5.1.4 Services

- 5.1.5 Other Types

- 5.2 By Component

- 5.2.1 Audio Equipment (mics, mixers, amps)

- 5.2.2 Display and Projection Systems

- 5.2.3 Control and Processing

- 5.2.4 Storage and Distribution Hardware

- 5.3 By End-user Vertical

- 5.3.1 Corporate

- 5.3.2 Venues and Events

- 5.3.3 Retail

- 5.3.4 Media and Entertainment

- 5.3.5 Education

- 5.3.6 Government

- 5.3.7 Healthcare

- 5.3.8 Other End-user Verticals

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 South-East Asia

- 5.4.4.6 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Saudi Arabia

- 5.4.5.1.2 United Arab Emirates

- 5.4.5.1.3 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Egypt

- 5.4.5.2.3 Rest of Africa

- 5.4.5.1 Middle East

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AVI-SPL Inc.

- 6.4.2 Diversified

- 6.4.3 AVI Systems Inc.

- 6.4.4 Ford Audio-Video LLC

- 6.4.5 CCS Presentation Systems Inc.

- 6.4.6 Solutionz Inc.

- 6.4.7 Electrosonic Group

- 6.4.8 Solotech Inc.

- 6.4.9 Conference Technologies Inc.

- 6.4.10 Vistacom Inc.

- 6.4.11 Kinly BV

- 6.4.12 Vega Global

- 6.4.13 IDNS Ltd.

- 6.4.14 Ricoh USA Inc.

- 6.4.15 Midwich Group plc

- 6.4.16 Wesco Anixter Inc.

- 6.4.17 Audinate Group Ltd.

- 6.4.18 NMK Electronics Enterprises

- 6.4.19 Qvest Group

- 6.4.20 ACTLD SA

- 6.4.21 Almo Professional A/V (Exertis Almo)

- 6.4.22 ClearOne Inc.

- 6.4.23 Kramer Electronics Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment