|

市场调查报告书

商品编码

1910671

油压设备:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Hydraulic Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

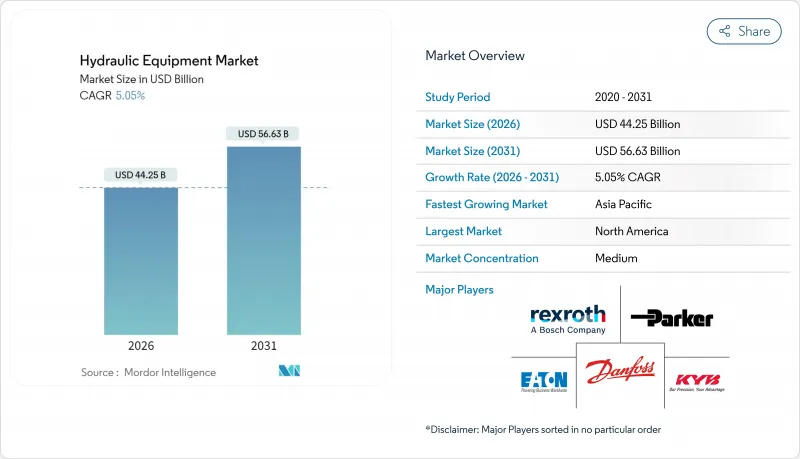

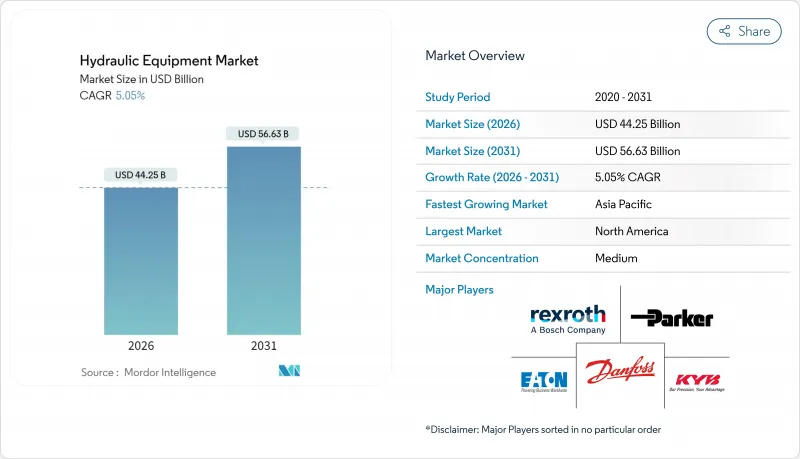

2025年油压设备市场价值为421.1亿美元,预计到2031年将达到566.3亿美元,高于2026年的442.5亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 5.05%。

这一稳定成长展现了该产业在面对週期性放缓、原物料价格波动以及电气化压力日益增大等挑战时的韧性。美国和中国强劲的公共基础设施投资、全球电子商务中仓库自动化程度的提高以及精密农业的扩张都支撑了市场需求。同时,设备製造商正在加速转型为节能型电油压混合动力技术。以应用工业技术公司(Applied Industrial Technologies)收购海德拉迪恩公司(Hydradyne)为例,产业整合加速,显示供应商正在积极应对利润率下降以及对数位化、高功率密度解决方案的需求。北美仍然是最大的区域市场,这得益于前所未有的水利基础设施预算;而亚太地区则经历了最快的增长,这主要得益于中国和印度向交通和城市服务奖励策略注入了数万亿美元。

全球油压设备市场趋势及展望

加速电子商务物流仓储履约

为了因应电商订单量的爆炸性成长,配销中心正越来越多地部署自动堆高机、穿梭车系统和产品搬运机器人。这些机器依靠微型伺服油压缸来实现毫米级的精度。亚马逊的移动机器人网路表明,全天候运作需要配备感测器且无洩漏的液压系统,同时还需要预测性维护来预先发现故障并最大限度地减少停机时间。仓库营运商通常报告生产效率提高了 40%,这使得零件供应商能够为超可靠、受污染控制的组件收取更高的价格。

政府主导的大型基础建设项目

从1.2兆美元的美国基础设施投资和就业创造法案到1.4兆美元的中国地方政府债务计划,这些多年期公共工程项目对挖掘机、混凝土泵和大口径油缸的需求预测不断增长。长期计划计划使原始设备製造商(OEM)能够获得长期合同,扩大区域服务基地,并就桥樑、港口和可再生能源建设等特定应用领域的液压系统展开合作。

钢铁和稀土等原物料价格波动加剧

预计到2024年,钢铁价格将出现40%的波动,而中国在稀土元素加工领域的主导地位将使磁铁和电机供应链面临地缘政治风险。对中国製造的液压元件征收44%至54%的关税进一步挤压了利润空间,迫使供应商进行大宗商品套期保值、改变设计以减少材料用量,或透过併购扩张。

细分市场分析

2025年,泵浦作为建筑、农业和工业机械的重要动力来源,将占油压设备市场27.85%的份额。可变排气量和负载感应式泵浦可降低油耗,帮助原始设备製造商(OEM)实现效率目标,并促进售后市场改造销售。预计到2031年,泵浦的油压设备市场规模将随着基础设施投资週期的推进而成长。过滤器和蓄能器预计将以6.18%的复合年增长率实现最快成长,因为更严格的ISO 4406清洁度标准使得污染控製成为保固谈判中的决定性因素。对高流量、低压差过滤介质的需求提高了利润率,而充氮囊可在混合动力迴路中储存再生能源,从而扩大了该细分市场在行动应用领域的油压设备市场份额。

阀门供应商将满足远端和自主任务对精确流量控制的需求。随着电子商务仓储机器人的普及,气缸将受益于其对可重复、高循环线性运动的需求。马达和变速器将服务于扭矩密度和过载能力至关重要的专用移动设备。由于整合式动力单元的普及简化了OEM组装并缩短了产品上市时间,辅助组件(储液罐、歧管、冷却器)的需求也将增加。

2025年,受全球公共工程项目和商业房地产建设项目开工量的推动,建筑业将占油压设备市场收入的31.05%。车队营运商正在采用电液油压混合动力,以满足日益严格的现场排放法规,同时维持较高的运转率和零件消耗量。由于桥樑、港口和铁路计划在未来几年内需要大量长行程致动器和重型泵,预计建筑油压设备市场规模将以中等个位数的成长率稳步增长。同时,受民用窄体飞机产量扩张和国防机构机身现代化改造的推动,航太和国防领域将呈现最快的成长轨迹,复合年增长率将达到6.35%。用于飞行控制和起落架的轻量化高压致动器价格分布,这使得航太供应商能够占据更大的油压设备市场份额。

得益于精密农业中采用GPS引导液压系统实现厘米级播种技术的应用,农业部门维持稳定成长。物料输送产业因全通路零售物流的扩张而蓬勃发展,石油和天然气产业的需求保持稳定,尤其是在海上结构物建造和管道维护方面。工具机、塑胶和汽车产业的趋势虽然与全球製造业週期密切相关,但它们仍然是密封件、阀门和小直径汽缸的重要批量生产基地。

区域分析

到2025年,北美将占全球收入的37.65%,这得益于688亿美元的水利基础建设资金和8.5亿美元的土地復垦计划资金。强劲的仓储自动化投资和老旧设备更新换代的需求将推动气缸、比例阀和过滤套件的销售。然而,运输设备产业需求疲软构成不利因素,供应商正专注于售后服务合约数位化维护服务。

预计到2031年,亚太地区将以8.07%的复合年增长率实现最高增速,其中中国1.4兆美元的信贷计划以及印度的城市轨道交通和供水计划将推动国内需求在经济週期之外持续保持高峰。本地整车製造商正与零件专家合作以满足Tier 4f排放标准,而关税争端则促使跨国供应商将其组装基地多元化转移至东南亚。高压微型帮浦和防污阀在韩国和日本的精密製造群中得到越来越广泛的应用。

欧洲前景喜忧参半。预计到2024年,德国流体动力订单将下降8%,但法国的「大巴黎快线」项目和义大利的风电场建设计划正在推动高压油缸这一细分市场的需求。更严格的PFAS法规正在加速向生物基密封件的转型,并推动油压设备市场进行大规模的研发投资。欧盟再生能源计画(REPowerEU)为可再生能源基础设施拨款3,000亿欧元(3,390亿美元),预计提振离岸风力发电船舶用伸缩油缸的需求,从而缓解宏观经济疲软的影响。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 产业供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 市场驱动因素

- 加速电子商务物流仓储履约

- 大型政府资助的基础建设项目

- 转向节能型电油压混合动力

- 非公路领域电气化程度的提高推动了紧凑型、高功率密度油压设备的发展。

- 扩大精密农业机械的引进

- 经合组织国家老旧工业机械的更新週期

- 市场限制

- 在轻载范围内,其总拥有成本(TCO)高于电动驱动系统。

- 钢铁和稀土元素等原物料价格波动加剧

- 增强型ESG监测液压油洩漏

- 维修维修工作缺乏技术纯熟劳工

- 宏观经济因素的影响

第五章 市场规模与成长预测

- 透过装置

- 泵浦

- 阀门

- 圆柱

- 马达

- 过滤器和蓄能器

- 传播

- 其他的

- 按最终用户行业划分

- 建造

- 农业

- 物料输送

- 航太/国防

- 工具机

- 石油和天然气

- 油压机

- 塑胶

- 车

- 其他最终用户

- 透过使用

- 移动液压

- 工业固定式液压系统

- 按工作压力范围

- 低压(低于150巴)

- 中压(150-350 巴)

- 高压(高于 350 巴)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 其他南美洲

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Bosch Rexroth AG

- Parker Hannifin Corporation

- HYDAC International GmbH

- Danfoss A/S

- SMC Corporation

- Festo SE and Co. KG

- Norgren Limited(IMI plc)

- Bucher Hydraulics GmbH(Bucher Industries AG)

- HAWE Hydraulik SE

- Linde Hydraulics GmbH and Co. KG

- Caterpillar Inc.

- KYB Corporation

- Eaton Corporation plc

- Kawasaki Heavy Industries Ltd.

- Yuken Kogyo Co., Ltd.

- Daikin Industries, Ltd.

- Komatsu Ltd.

- Sun Hydraulics LLC(Helios Technologies, Inc.)

- Moog Inc.

- Argo-Hytos Group AG

第七章 市场机会与未来展望

The hydraulic equipment market was valued at USD 42.11 billion in 2025 and estimated to grow from USD 44.25 billion in 2026 to reach USD 56.63 billion by 2031, at a CAGR of 5.05% during the forecast period (2026-2031).

This steady momentum underscores the sector's resilience in the face of cyclical slowdowns, raw material volatility, and intensifying pressures from electrification. Robust public infrastructure spending in the United States and China, rising warehouse automation in global e-commerce, and expanding precision agriculture underpin demand, even as equipment makers accelerate the shift toward energy-efficient electro-hydraulic hybrids. Heightened consolidation, exemplified by Applied Industrial Technologies' acquisition of Hydradyne, signals how suppliers are responding to margin compression and the need for digital, power-dense solutions. North America remains the largest regional base, supported by unprecedented water infrastructure appropriations, while the Asia-Pacific records the fastest gains as China and India commit multi-trillion-dollar stimulus to transport and urban services.

Global Hydraulic Equipment Market Trends and Insights

Accelerated Warehouse Automation in E-commerce Fulfillment

Explosive e-commerce order volumes compel distribution centers to deploy autonomous forklifts, shuttle systems, and goods-to-person robots that rely on compact servo-hydraulic cylinders for milli-meter accuracy. Amazon's network of mobile robots illustrates how 24/7 operation requires leak-free, sensor-equipped hydraulics offering predictive failure alerts to minimize downtime. Warehouse operators typically report 40% productivity gains, enabling component suppliers to charge premium prices for ultra-reliable, contamination-controlled assemblies.

Government-Funded Mega-Infrastructure Programmes

Multi-year public works-from the USD 1.2 trillion U.S. Infrastructure Investment and Jobs Act to China's USD 1.4 trillion local-government debt plan-create demand visibility for excavators, concrete pumps, and large-bore cylinders. Extended project pipelines allow OEMs to lock-in long-term contracts, expand regional service hubs, and co-develop application-specific hydraulics for bridge, port, and renewable-energy construction.

Intensifying Raw-Material Price Volatility for Steel and Rare Earths

Steel prices swung 40% in 2024, while China's dominance of rare-earth processing exposes magnet-motor supply chains to geopolitical risk. Tariffs of 44-54% on Chinese hydraulic components further compress margins, forcing suppliers to hedge commodities, redesign to reduce material intensity, or pursue scale through mergers.

Other drivers and restraints analyzed in the detailed report include:

- Shift to Energy-Efficient Electro-Hydraulic Hybrids

- Increasing Off-Highway Electrification

- Skilled-Labor Shortage for Maintenance and Retrofits

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Pumps anchored 27.85% of the hydraulic equipment market in 2025 as the indispensable power-source across construction, agriculture, and industrial machinery. Variable-displacement and load-sensing models cut fuel draw, satisfying OEM efficiency targets and boosting aftermarket retrofit sales. The hydraulic equipment market size for pumps is positioned to advance with infrastructure investment cycles through 2031. Filters and accumulators log the quickest gains at a 6.18% CAGR as stricter ISO 4406 cleanliness codes make contamination control decisive during warranty negotiations. Demand for high-flow, low-delta-pressure filter media elevates margins, while nitrogen-charged bladders store regenerative energy in hybrid circuits, extending the hydraulic equipment market share of this sub-segment across mobile applications.

Valve suppliers capitalize on precision flow control required by tele-operation and autonomous tasks. Cylinders benefit from e-commerce warehouse robotics that necessitate repeatable, high-cycle linear motion. Motors and transmissions cater to specialty mobile equipment where torque density and overload capacity remain critical. Ancillary components-reservoirs, manifolds, coolers-gain from integrated power-packs that simplify OEM assembly lines and shorten time-to-market.

Construction contributed 31.05% of hydraulic equipment market revenue in 2025, buoyed by global public-works pipelines and commercial real-estate starts. Fleet operators adopt electro-hydraulic hybrids to meet stricter job-site emissions caps, sustaining high utilization and parts consumption. The hydraulic equipment market size for construction is poised for stable mid-single-digit growth as bridge, port, and rail projects consume long-stroke actuators and heavy-duty pumps over multi-year timelines. Aerospace and defense, however, posts the sharpest trajectory at 6.35% CAGR as commercial narrow-body production ramps and defense agencies modernize airframes. High-pressure, weight-optimized actuation for flight-control and landing-gear commands premium pricing, increasing the hydraulic equipment market share captured by aerospace suppliers.

Agriculture maintains steady gains as precision farming embeds GPS-guided hydraulics for centimeter-level seed placement. Material-handling thrives on omnichannel retail logistics, while oil and gas demand stabilizes around offshore construction and pipeline maintenance. Machine-tool, plastics, and automotive segments experience mixed trends tied to global manufacturing cycles yet remain indispensable volume anchors for seal, valve, and small-bore cylinder demand.

The Hydraulic Equipment Market Report is Segmented by Equipment Type (Pumps, Valves, Cylinders, Motors, Filters and Accumulators, Transmissions, and Others), End-User Industry (Construction, Agriculture, Material Handling, and More), Application (Mobile Hydraulics and Industrial Stationary Hydraulics), Operating-Pressure Range (Low, Medium, and High), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 37.65% of global revenue in 2025, supported by USD 68.8 billion in obligated water-infrastructure funds and USD 850 million dedicated to reclamation projects. Robust warehouse-automation investments and aging fleet replacements underpin sales of cylinders, proportional valves, and filtration kits. Nevertheless, the softness of transport equipment presents a headwind, prompting suppliers to emphasize aftermarket service contracts and digitalized maintenance offers.

The Asia-Pacific region registers the fastest growth, with an 8.07% CAGR through 2031, as China's USD 1.4 trillion credit package and India's urban-rail and water-supply programs sustain demand peaks beyond domestic cycles. Local OEMs partner with component specialists to meet Tier 4f standards, while tariff disputes prompt multinational suppliers to diversify assembly footprints into Southeast Asia. High-pressure micro-pumps and contamination-resistant valves are seeing a rising take-up in Korean and Japanese precision-manufacturing clusters.

Europe presents a mixed outlook: German fluid-power orders fell 8% in 2024, yet projects such as France's Grand Paris Express and Italy's wind-farm builds drive niche high-pressure requirements. PFAS restrictions are accelerating the shift to bio-based seals, prompting significant R&D investment across the hydraulic equipment market. The REPowerEU plan's EUR 300 billion (USD 339 billion) allocation for renewable energy infrastructure multiplies demand for telescopic cylinders in offshore wind installation vessels, cushioning macroeconomic softness.

- Bosch Rexroth AG

- Parker Hannifin Corporation

- HYDAC International GmbH

- Danfoss A/S

- SMC Corporation

- Festo SE and Co. KG

- Norgren Limited (IMI plc)

- Bucher Hydraulics GmbH (Bucher Industries AG)

- HAWE Hydraulik SE

- Linde Hydraulics GmbH and Co. KG

- Caterpillar Inc.

- KYB Corporation

- Eaton Corporation plc

- Kawasaki Heavy Industries Ltd.

- Yuken Kogyo Co., Ltd.

- Daikin Industries, Ltd.

- Komatsu Ltd.

- Sun Hydraulics LLC (Helios Technologies, Inc.)

- Moog Inc.

- Argo-Hytos Group AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Industry Supply-Chain Analysis

- 4.3 Regulatory Landscape

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Market Drivers

- 4.6.1 Accelerated warehouse automation in e-commerce fulfilment

- 4.6.2 Government-funded mega infrastructure programmes

- 4.6.3 Shift to energy-efficient electro-hydraulic hybrids

- 4.6.4 Increasing off-highway electrification driving compact power-dense hydraulics

- 4.6.5 Growing adoption of precision agriculture machinery

- 4.6.6 Ageing industrial machinery replacement cycle in OECD

- 4.7 Market Restraints

- 4.7.1 Total cost of ownership (TCO) higher than electric drives in light-duty ranges

- 4.7.2 Intensifying raw-material price volatility for steel and rare earths

- 4.7.3 Rising ESG scrutiny over hydraulic-fluid leakage

- 4.7.4 Skilled-labour shortage for maintenance and retrofits

- 4.8 Impact of Macroeconomic Factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Equipment Type

- 5.1.1 Pumps

- 5.1.2 Valves

- 5.1.3 Cylinders

- 5.1.4 Motors

- 5.1.5 Filters and Accumulators

- 5.1.6 Transmissions

- 5.1.7 Others

- 5.2 By End-user Industry

- 5.2.1 Construction

- 5.2.2 Agriculture

- 5.2.3 Material Handling

- 5.2.4 Aerospace and Defence

- 5.2.5 Machine Tools

- 5.2.6 Oil and Gas

- 5.2.7 Hydraulic Press

- 5.2.8 Plastics

- 5.2.9 Automotive

- 5.2.10 Other End-users

- 5.3 By Application

- 5.3.1 Mobile Hydraulics

- 5.3.2 Industrial Stationary Hydraulics

- 5.4 By Operating-Pressure Range

- 5.4.1 Low (Less than 150 bar)

- 5.4.2 Medium (150-350 bar)

- 5.4.3 High (Greater than 350 bar)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Colombia

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Bosch Rexroth AG

- 6.4.2 Parker Hannifin Corporation

- 6.4.3 HYDAC International GmbH

- 6.4.4 Danfoss A/S

- 6.4.5 SMC Corporation

- 6.4.6 Festo SE and Co. KG

- 6.4.7 Norgren Limited (IMI plc)

- 6.4.8 Bucher Hydraulics GmbH (Bucher Industries AG)

- 6.4.9 HAWE Hydraulik SE

- 6.4.10 Linde Hydraulics GmbH and Co. KG

- 6.4.11 Caterpillar Inc.

- 6.4.12 KYB Corporation

- 6.4.13 Eaton Corporation plc

- 6.4.14 Kawasaki Heavy Industries Ltd.

- 6.4.15 Yuken Kogyo Co., Ltd.

- 6.4.16 Daikin Industries, Ltd.

- 6.4.17 Komatsu Ltd.

- 6.4.18 Sun Hydraulics LLC (Helios Technologies, Inc.)

- 6.4.19 Moog Inc.

- 6.4.20 Argo-Hytos Group AG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment